Aircraft Exhaust Systems Market Report

Published Date: 03 February 2026 | Report Code: aircraft-exhaust-systems

Aircraft Exhaust Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Aircraft Exhaust Systems market, covering market size, trends, technological advancements, and forecasts for the period 2023-2033. It includes regional analysis and competitive landscape to aid stakeholders in strategic decision-making.

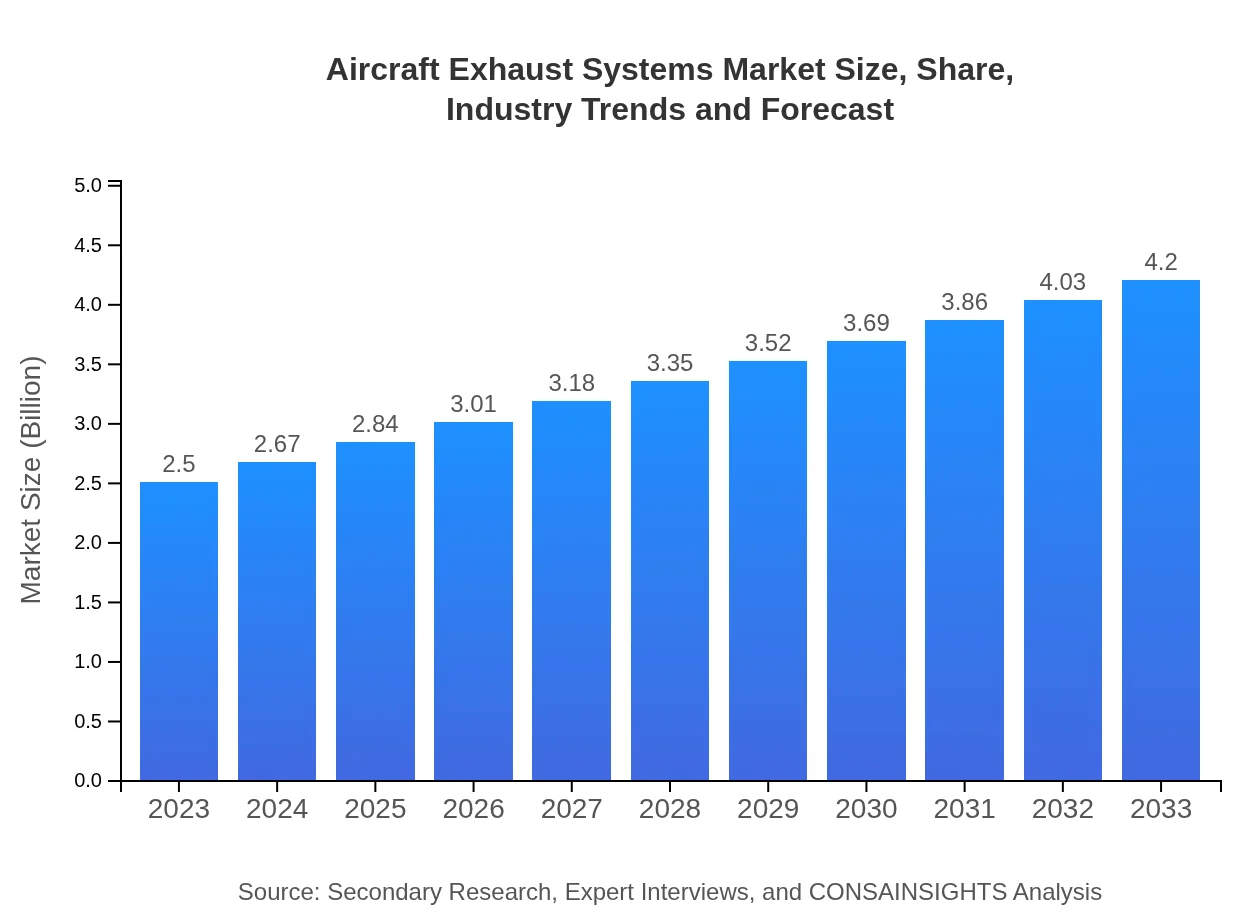

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $4.20 Billion |

| Top Companies | Honeywell Aerospace, General Electric Aviation, Rolls-Royce, MTU Aero Engines, Safran |

| Last Modified Date | 03 February 2026 |

Aircraft Exhaust Systems Market Overview

Customize Aircraft Exhaust Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Exhaust Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Exhaust Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Exhaust Systems

What is the Market Size & CAGR of Aircraft Exhaust Systems market in 2023-2033?

Aircraft Exhaust Systems Industry Analysis

Aircraft Exhaust Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Exhaust Systems Market Analysis Report by Region

Europe Aircraft Exhaust Systems Market Report:

The European market for Aircraft Exhaust Systems is slated to grow from USD 0.62 billion in 2023 to USD 1.05 billion by 2033. Factors such as stringent regulatory frameworks regarding emissions and a strong push towards sustainable aviation are propelling market advancements. Major players in Europe are investing in R&D to comply with these regulations and develop more eco-friendly solutions.Asia Pacific Aircraft Exhaust Systems Market Report:

In the Asia Pacific region, the Aircraft Exhaust Systems market is expected to grow from USD 0.53 billion in 2023 to USD 0.89 billion by 2033. This growth is fueled by increasing air travel demand, expanding airline fleets, and rising investments in aviation infrastructure. Countries like China and India are leading this growth, supported by government initiatives to enhance local manufacturing capacities.North America Aircraft Exhaust Systems Market Report:

North America remains a key player in the global Aircraft Exhaust Systems market, with a forecasted growth from USD 0.83 billion in 2023 to USD 1.39 billion by 2033. The United States, with its advanced aerospace technologies and significant defense sector, is at the forefront of this growth. Additionally, the focus on reducing carbon emissions and enhancing fuel efficiency is expected to drive investment in newer technologies.South America Aircraft Exhaust Systems Market Report:

The South American market is projected to rise from USD 0.20 billion in 2023 to USD 0.33 billion by 2033. The growth is primarily driven by an increase in regional air traffic and efforts to modernize existing fleets. However, economic constraints and regulatory challenges may hinder faster growth in this region.Middle East & Africa Aircraft Exhaust Systems Market Report:

The Middle East and Africa market is expected to expand from USD 0.31 billion in 2023 to USD 0.53 billion by 2033, driven by growth in air travel, tourism, and infrastructural developments in the aviation sector. The rise in low-cost carriers in this region is attracting significant investments, further boosting the demand for aircraft exhaust systems.Tell us your focus area and get a customized research report.

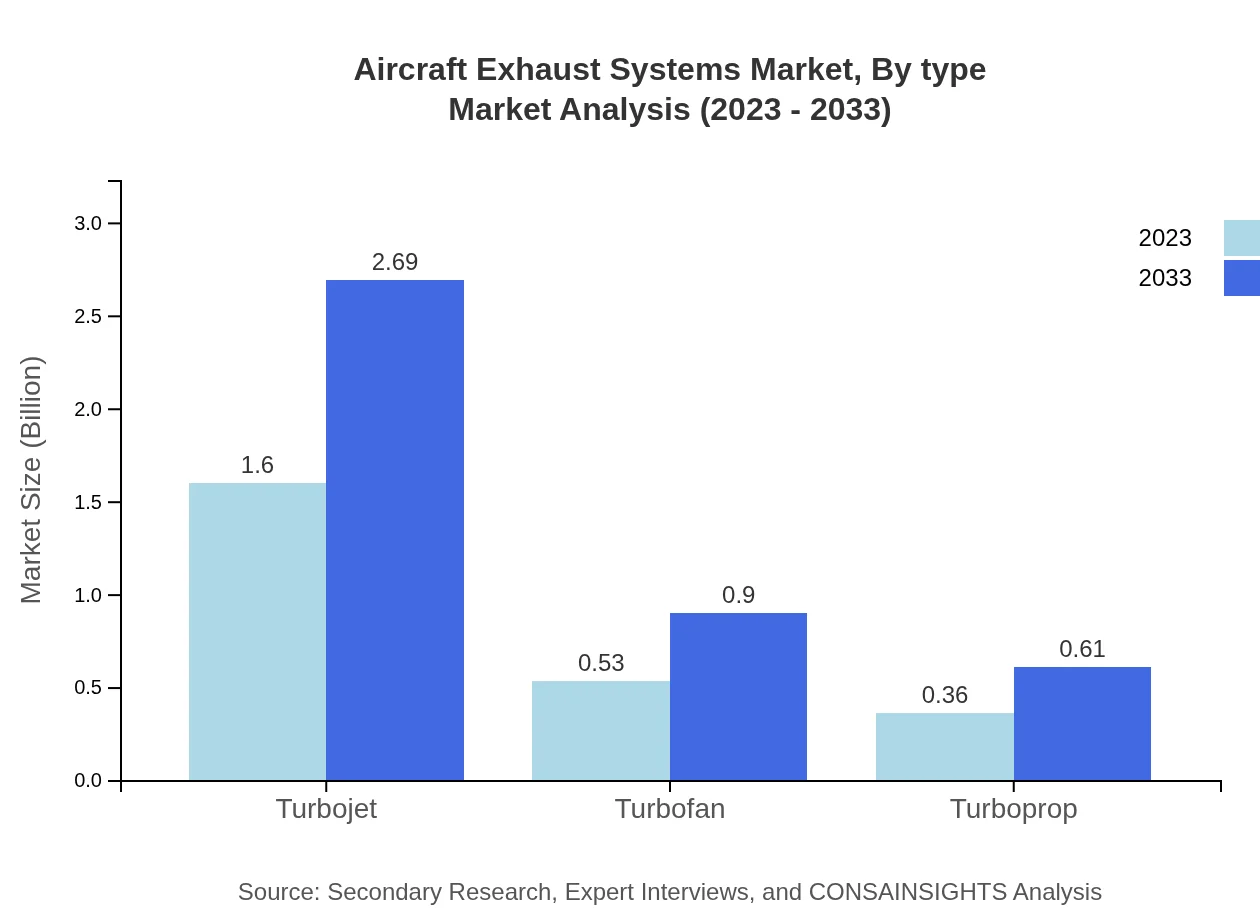

Aircraft Exhaust Systems Market Analysis By Type

In terms of type, Turbojet systems dominate the market, expected to grow from USD 1.60 billion in 2023 to USD 2.69 billion by 2033, maintaining a market share of 64.12%. Turbofan systems are projected to grow from USD 0.53 billion to USD 0.90 billion, capturing a 21.36% market share. Turboprop systems, currently valued at USD 0.36 billion, are estimated to grow to USD 0.61 billion, holding a 14.52% share.

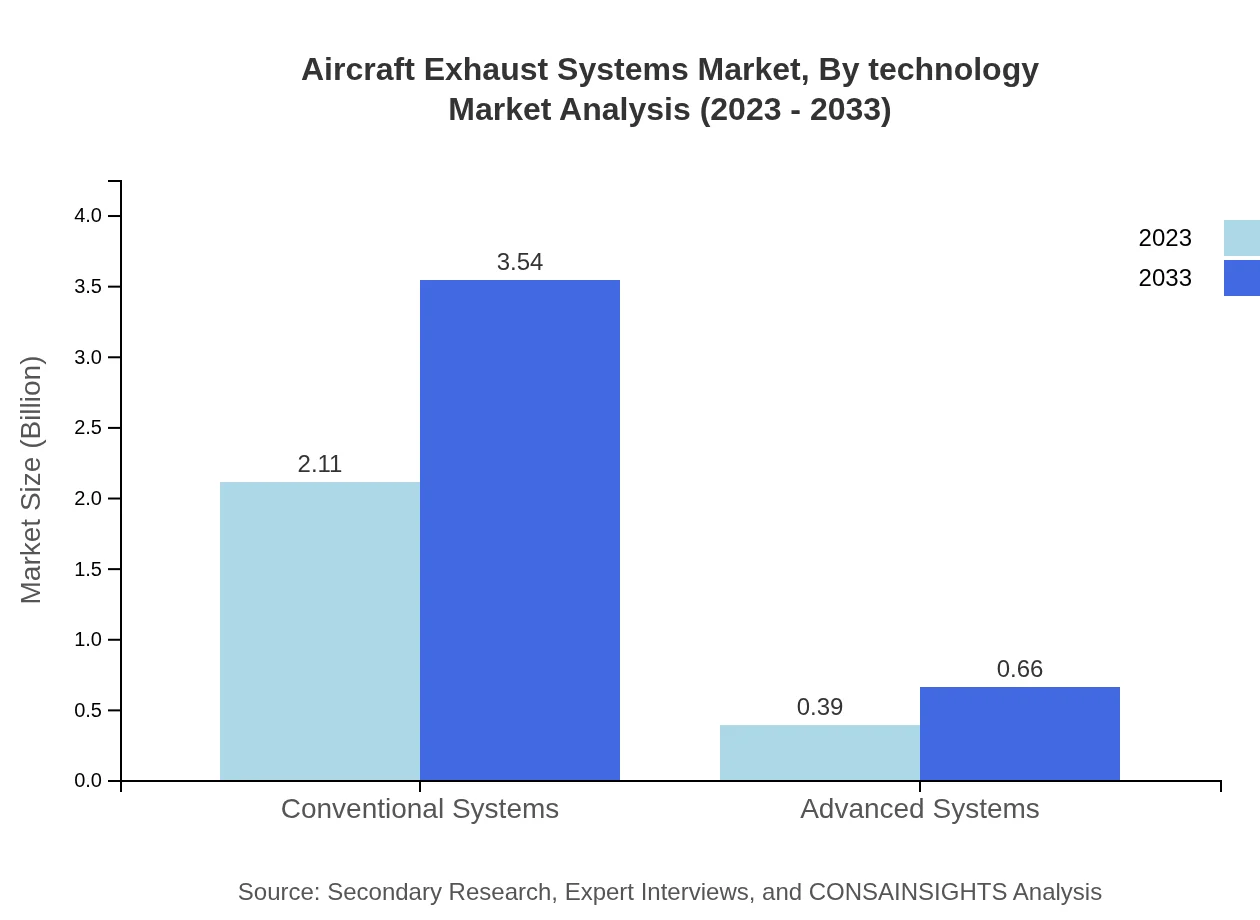

Aircraft Exhaust Systems Market Analysis By Technology

The market is also segmented by technology, with conventional systems comprising the majority share of 84.28% in 2023, valued at USD 2.11 billion. Advanced systems, expected to reach USD 0.66 billion from a size of USD 0.39 billion, account for a growing market segment focused on innovative designs that enhance performance.

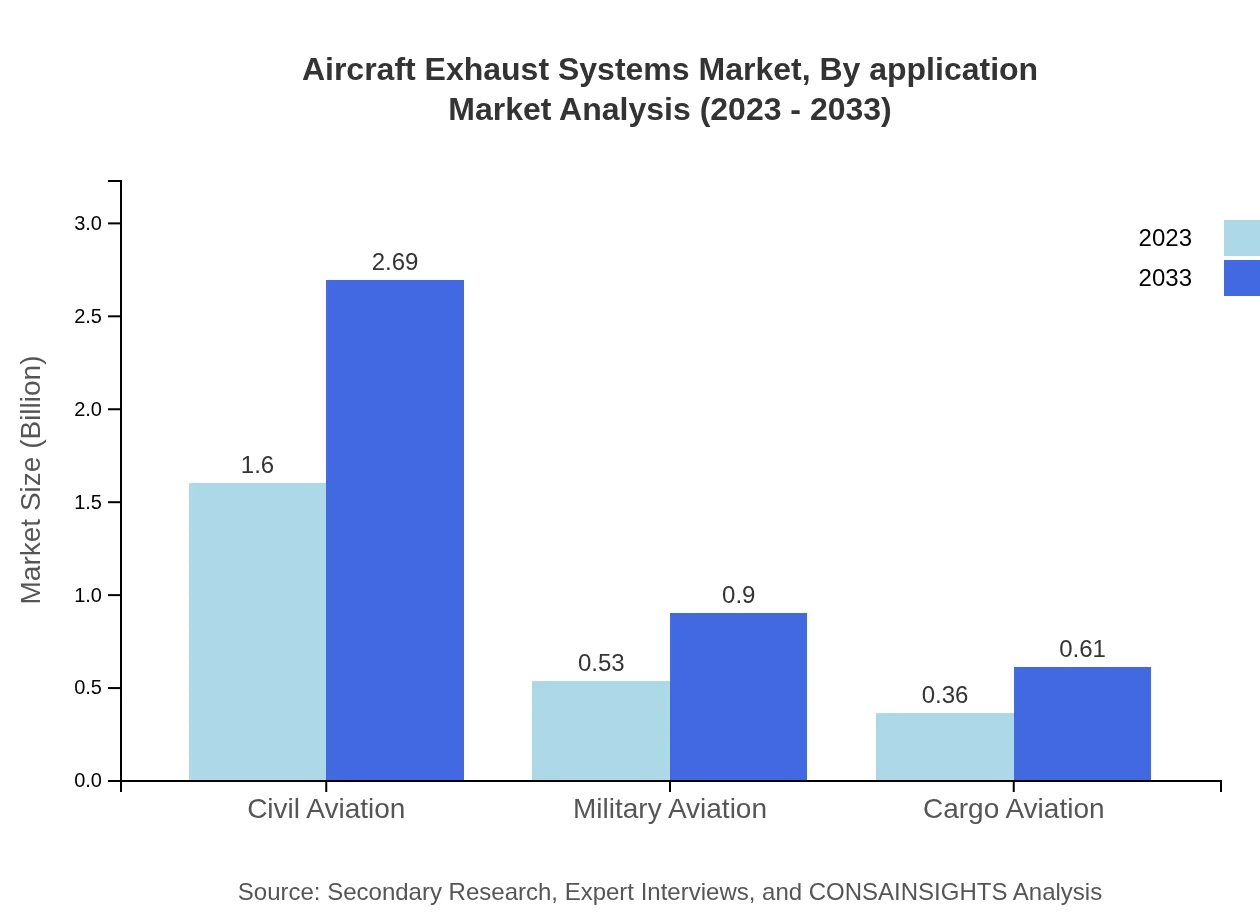

Aircraft Exhaust Systems Market Analysis By Application

The Aircraft Exhaust Systems market can be segmented by application into Civil Aviation, Military Aviation, and Cargo Aviation. The Civil Aviation segment is projected to grow from USD 1.60 billion in 2023 to USD 2.69 billion in 2033. The Military Aviation segment is expected to increase from USD 0.53 billion to USD 0.90 billion, while Cargo Aviation, currently at USD 0.36 billion, is forecasted to reach USD 0.61 billion.

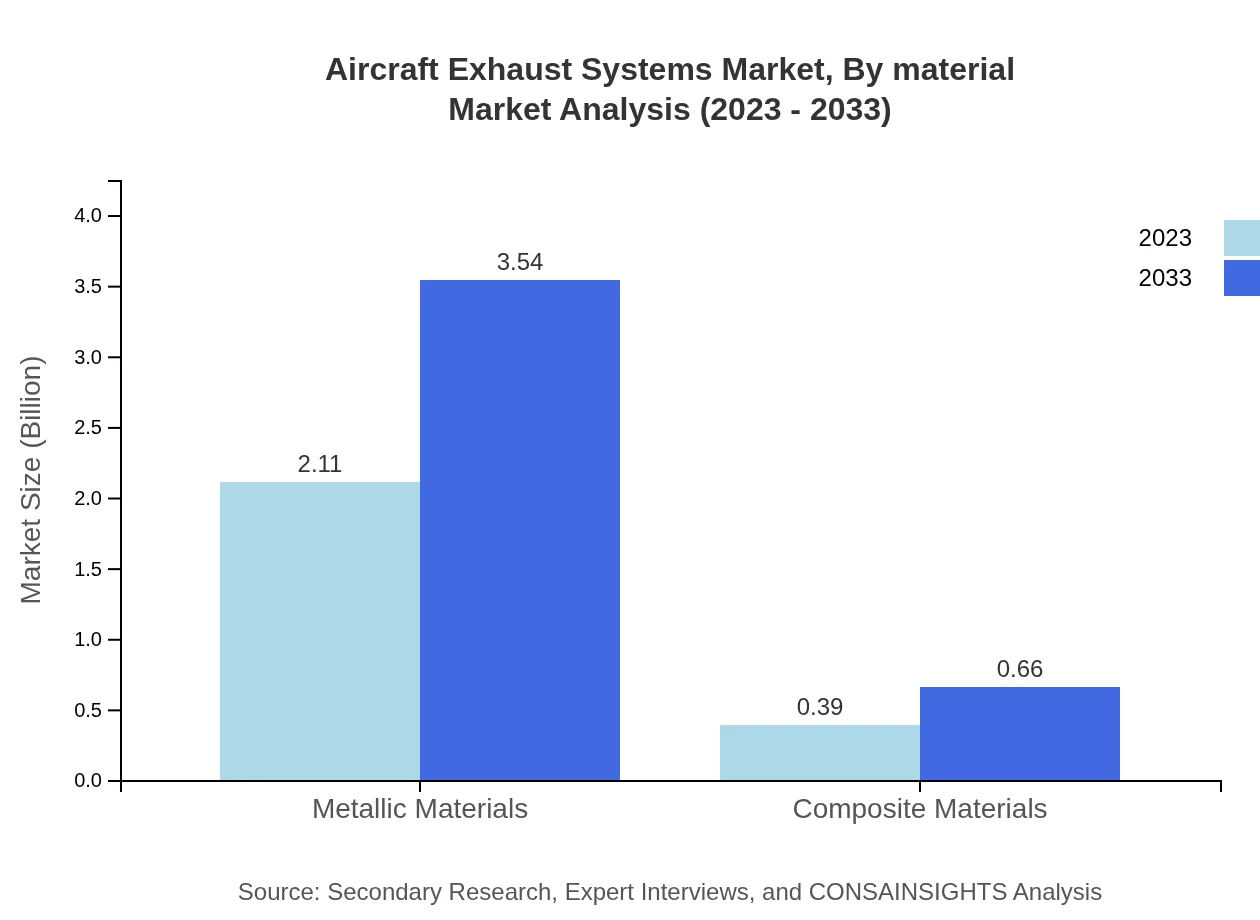

Aircraft Exhaust Systems Market Analysis By Material

The market segments by material include Metallic Materials and Composite Materials. The preference for metallic materials remains firm, with a market share of 84.28%, growing from USD 2.11 billion to USD 3.54 billion by 2033. Composite materials, although smaller, are seeing a positive trend with values rising from USD 0.39 billion to USD 0.66 billion.

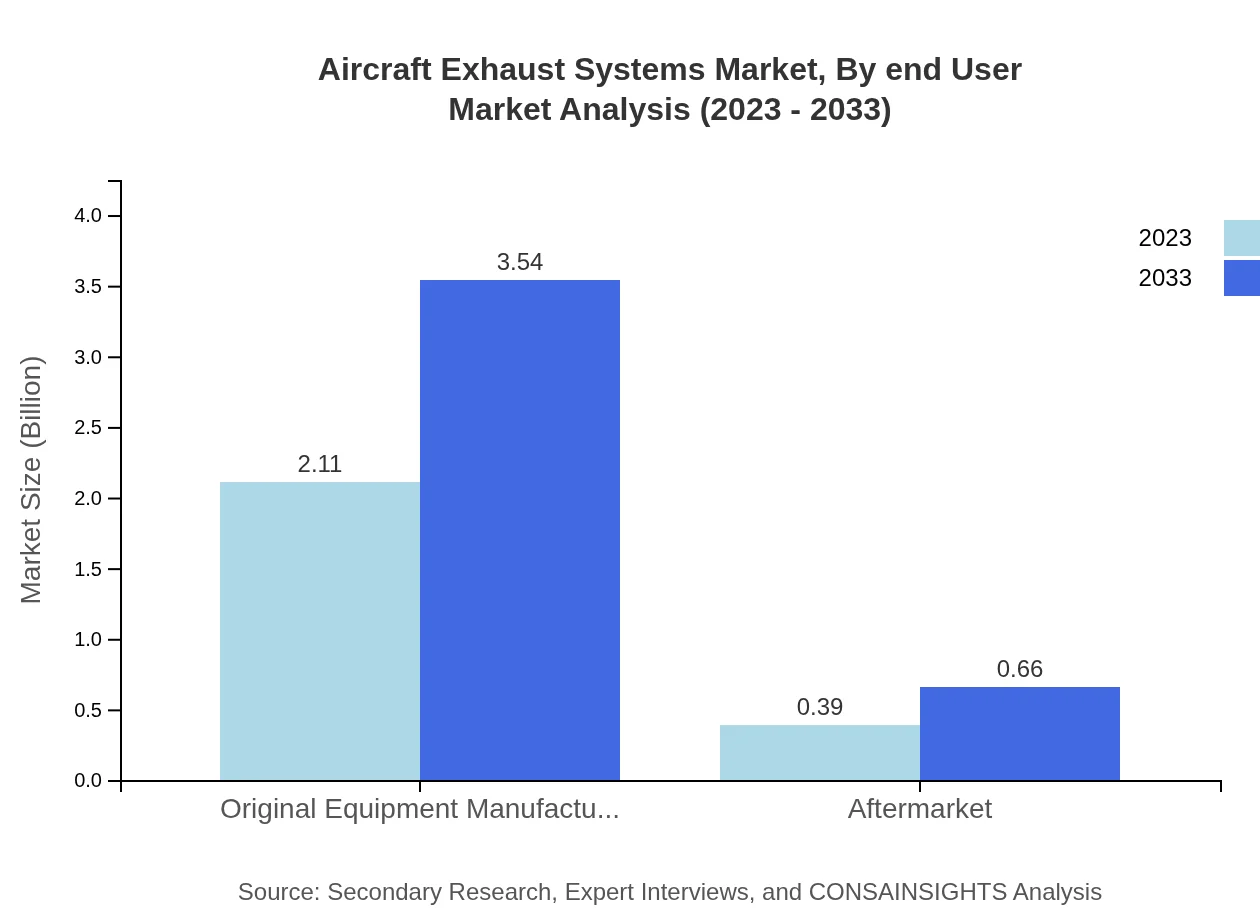

Aircraft Exhaust Systems Market Analysis By End User

Market segmentation by end-user reveals that OEMs currently capture a substantial 84.28% share, expected to grow from USD 2.11 billion to USD 3.54 billion. The aftermarket segment, representing a significant niche, is anticipated to see growth from USD 0.39 billion to USD 0.66 billion.

Aircraft Exhaust Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Exhaust Systems Industry

Honeywell Aerospace:

A leading provider of aircraft engines, avionics, and innovative exhaust solutions, Honeywell focuses on enhancing aircraft safety and reliability.General Electric Aviation:

General Electric Aviation offers advanced jet engines and exhaust systems, applying cutting-edge technologies to improve operational efficiency.Rolls-Royce:

Renowned for its high-performance aircraft engines, Rolls-Royce invests heavily in R&D for exhaust technologies that support sustainable aviation.MTU Aero Engines:

A key player in the aero engine market, MTU specializes in aerospace propulsion and products including efficient exhaust systems.Safran:

Safran is a major French multinational focusing on aircraft propulsion and equipment, including innovative exhaust management systems.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Exhaust Systems?

The global Aircraft Exhaust Systems market is projected to reach approximately $2.5 billion by 2033, growing at a CAGR of 5.2% from its current valuation.

What are the key market players or companies in the aircraft Exhaust Systems industry?

Key players in the aircraft exhaust systems market include companies like Safran S.A., Honeywell International Inc., Woodward, Inc., and UTC Aerospace Systems, which significantly contribute to innovation and market growth.

What are the primary factors driving the growth in the aircraft Exhaust Systems industry?

Growth is driven by increasing air traffic, advancements in aviation technology, and environmental regulations. Additionally, demand for more efficient and durable exhaust systems contributes to the market expansion.

Which region is the fastest Growing in the aircraft Exhaust Systems?

The Asia Pacific region is the fastest-growing market for aircraft exhaust systems, expected to increase from $0.53 billion in 2023 to $0.89 billion by 2033, reflecting a strong CAGR.

Does ConsaInsights provide customized market report data for the aircraft Exhaust Systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to obtain detailed insights and data relevant to their strategic objectives in the aircraft exhaust systems sector.

What deliverables can I expect from this aircraft Exhaust Systems market research project?

Deliverables include comprehensive reports, detailed market analyses, forecasts, and regional insights, along with segmentation data and competitive landscape evaluations tailored to the aircraft exhaust systems industry.

What are the market trends of aircraft Exhaust Systems?

Current trends include a shift towards lightweight materials, increased integration of advanced technology for emissions reduction, and a growing preference for eco-friendly exhaust systems in response to regulatory pressures.