Aircraft Fairings Market Report

Published Date: 03 February 2026 | Report Code: aircraft-fairings

Aircraft Fairings Market Size, Share, Industry Trends and Forecast to 2033

This market report provides comprehensive insights into the Aircraft Fairings industry, covering market size forecasts from 2023 to 2033, trends, segmentation, and regional analyses. It aims to equip stakeholders with crucial data for informed decision-making in this evolving market landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.67 Billion |

| Top Companies | Spirit AeroSystems, GKN Aerospace, UTC Aerospace Systems, HEICO Corporation |

| Last Modified Date | 03 February 2026 |

Aircraft Fairings Market Overview

Customize Aircraft Fairings Market Report market research report

- ✔ Get in-depth analysis of Aircraft Fairings market size, growth, and forecasts.

- ✔ Understand Aircraft Fairings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Fairings

What is the Market Size & CAGR of Aircraft Fairings market in 2023?

Aircraft Fairings Industry Analysis

Aircraft Fairings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Fairings Market Analysis Report by Region

Europe Aircraft Fairings Market Report:

Europe's Aircraft Fairings market is valued at $0.36 billion in 2023 and expected to grow to $0.65 billion by 2033. The heightened focus on fuel efficiency and sustainability in aviation is driving the demand for advanced fairing technologies. Collaborative programs among manufacturers also enhance innovation in materials and design.Asia Pacific Aircraft Fairings Market Report:

The Asia Pacific region, with a market value of $0.30 billion in 2023, is expected to grow to $0.53 billion by 2033. Rapid growth in air travel and the expansion of aircraft manufacturing in countries like China and India are significant contributors to this growth. Increasing investments in airport infrastructure and modernization of existing fleets are boosting the demand for aircraft fairings.North America Aircraft Fairings Market Report:

North America, a major contributor to the global market, is valued at $0.58 billion in 2023, with a projected growth to $1.04 billion by 2033. The presence of leading aircraft manufacturers and a mature aerospace market drive demand for innovative fairing solutions, catering to the increasing production rates of commercial and military aircraft.South America Aircraft Fairings Market Report:

In South America, the market is valued at $0.08 billion in 2023 and is projected to reach $0.14 billion by 2033. The increasing demand for regional aircraft and growth in domestic air travel are fueling market expansion. Additionally, government initiatives aimed at enhancing aviation capabilities are expected to impact positively.Middle East & Africa Aircraft Fairings Market Report:

In the Middle East and Africa, the market size is $0.17 billion in 2023, expected to grow to $0.31 billion by 2033. The region's expanding airline sector and substantial investments in aviation infrastructure support market growth. As more airlines enter the market, the demand for both commercial and cargo aircraft increases, thereby accelerating the need for fairings.Tell us your focus area and get a customized research report.

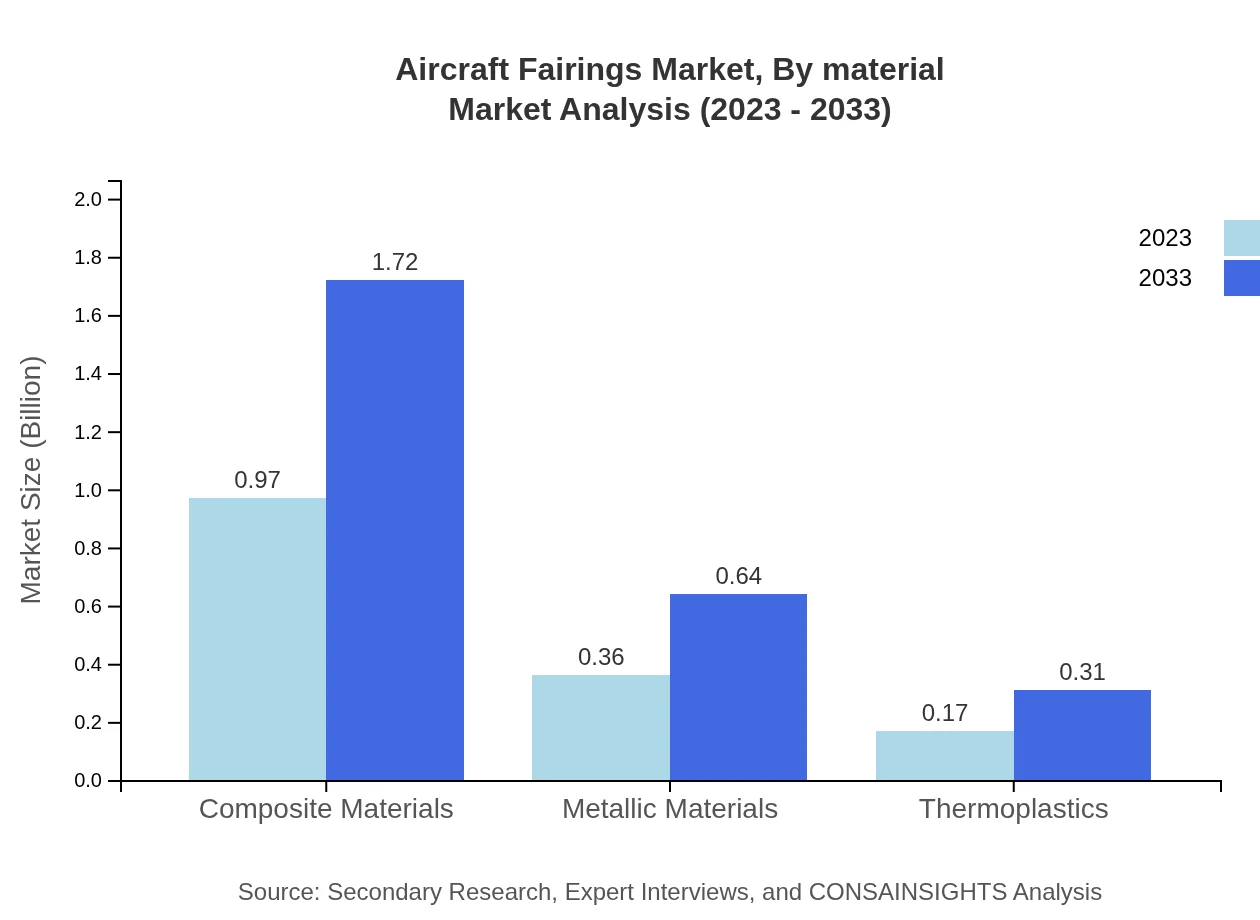

Aircraft Fairings Market Analysis By Material

The material segment of the Aircraft Fairings market demonstrates significant variation in performance and application. Composite materials, which dominate the market with a share of 64.53% in 2023, feature lightweight properties that enhance fuel efficiency. Metallic materials, accounting for 24%, remain crucial for structural applications, while thermoplastics, at 11.47%, are gaining traction for specific applications owing to their flexibility and heat resistance.

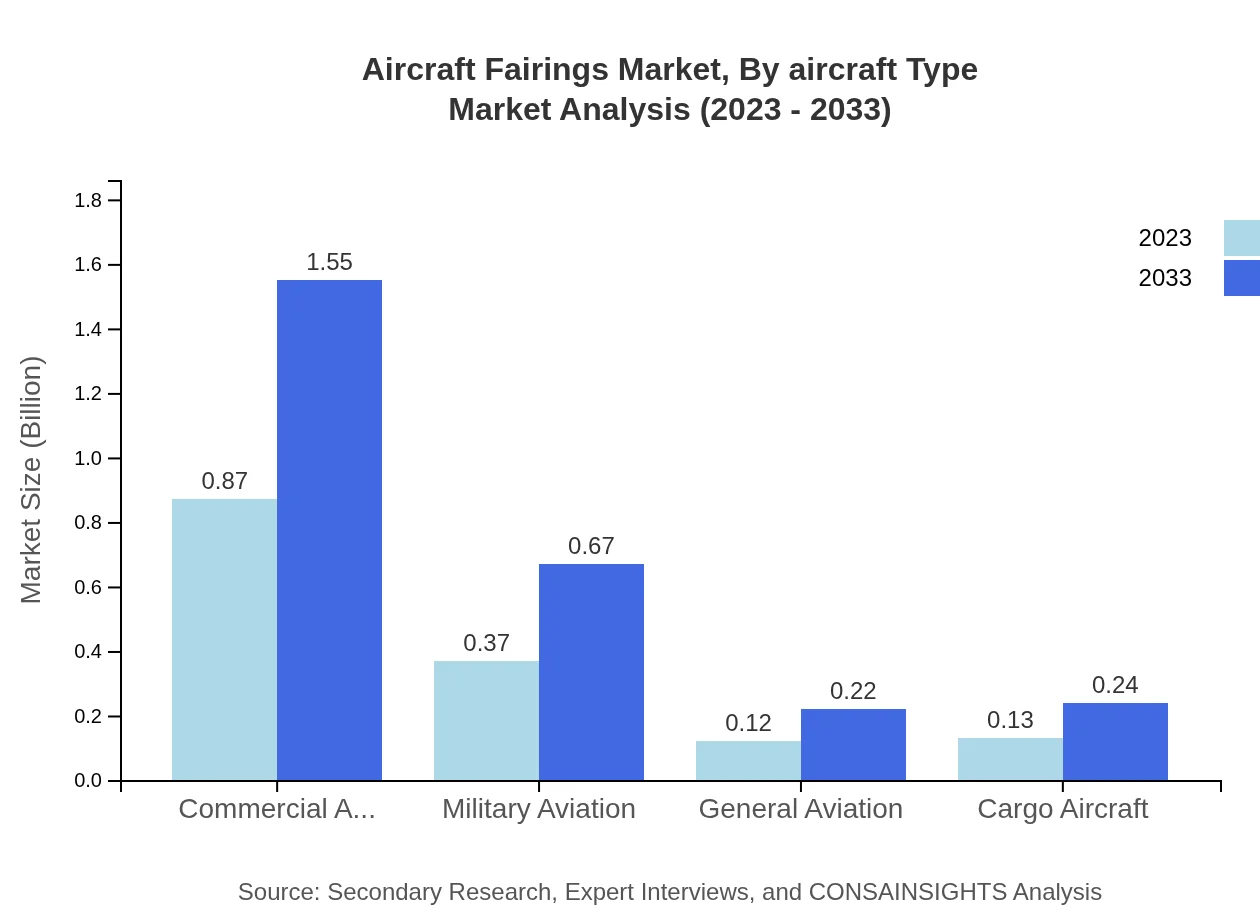

Aircraft Fairings Market Analysis By Aircraft Type

The segment analysis by aircraft type reveals that commercial aviation holds the largest market share at 57.85% in 2023, driven by the rising global air travel demand. Military aviation follows close behind at 24.96%, spurred by increased defense expenditures. The general aviation segment, albeit smaller, is emerging with steady growth as more private and small aircraft manufacturers enter the market.

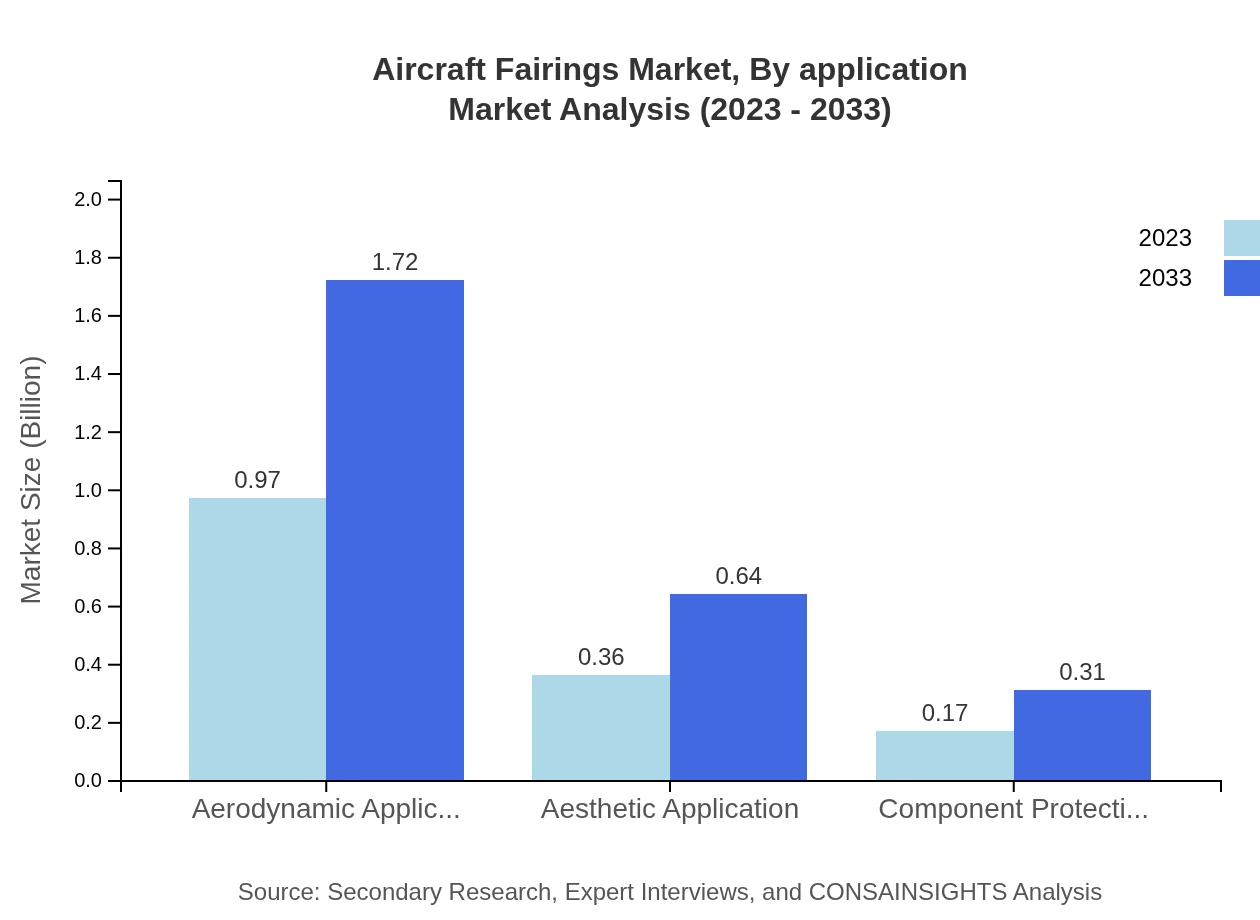

Aircraft Fairings Market Analysis By Application

Aerodynamic applications account for the dominant share in the market, as optimized fairings significantly reduce drag and improve fuel efficiency. Aesthetic applications are vital for enhancing the visual appeal of aircraft, while component protection applications also hold important roles, particularly in safeguarding sensitive aircraft systems from environmental damage.

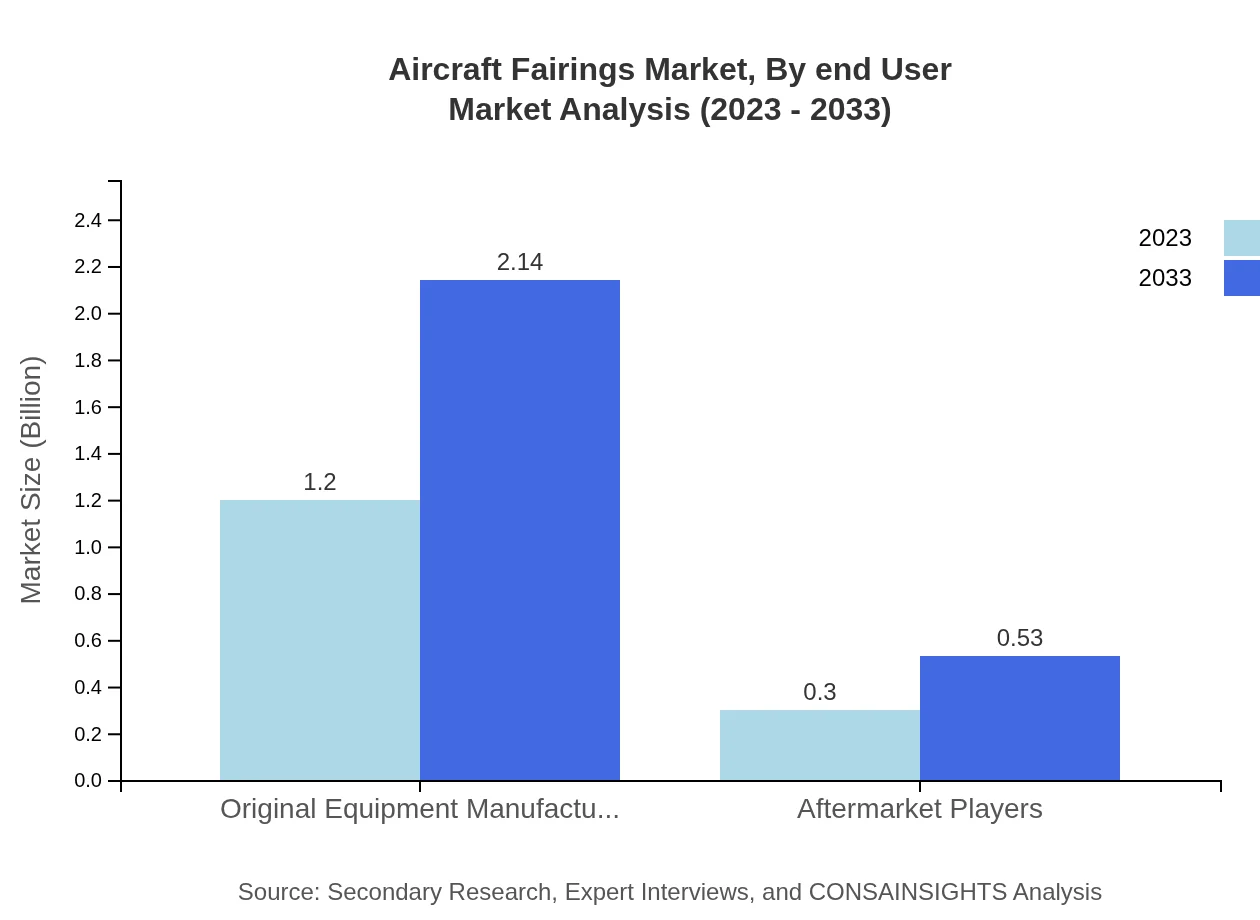

Aircraft Fairings Market Analysis By End User

The market analysis by end-user highlights the significant role of Original Equipment Manufacturers (OEMs), which hold an 80.02% share in 2023. This dominance is attributed to the consistent requirement for fairings in new aircraft production. Meanwhile, aftermarket players, while constituting 19.98%, are experiencing growth as the demand for replacement parts and retrofitting increases.

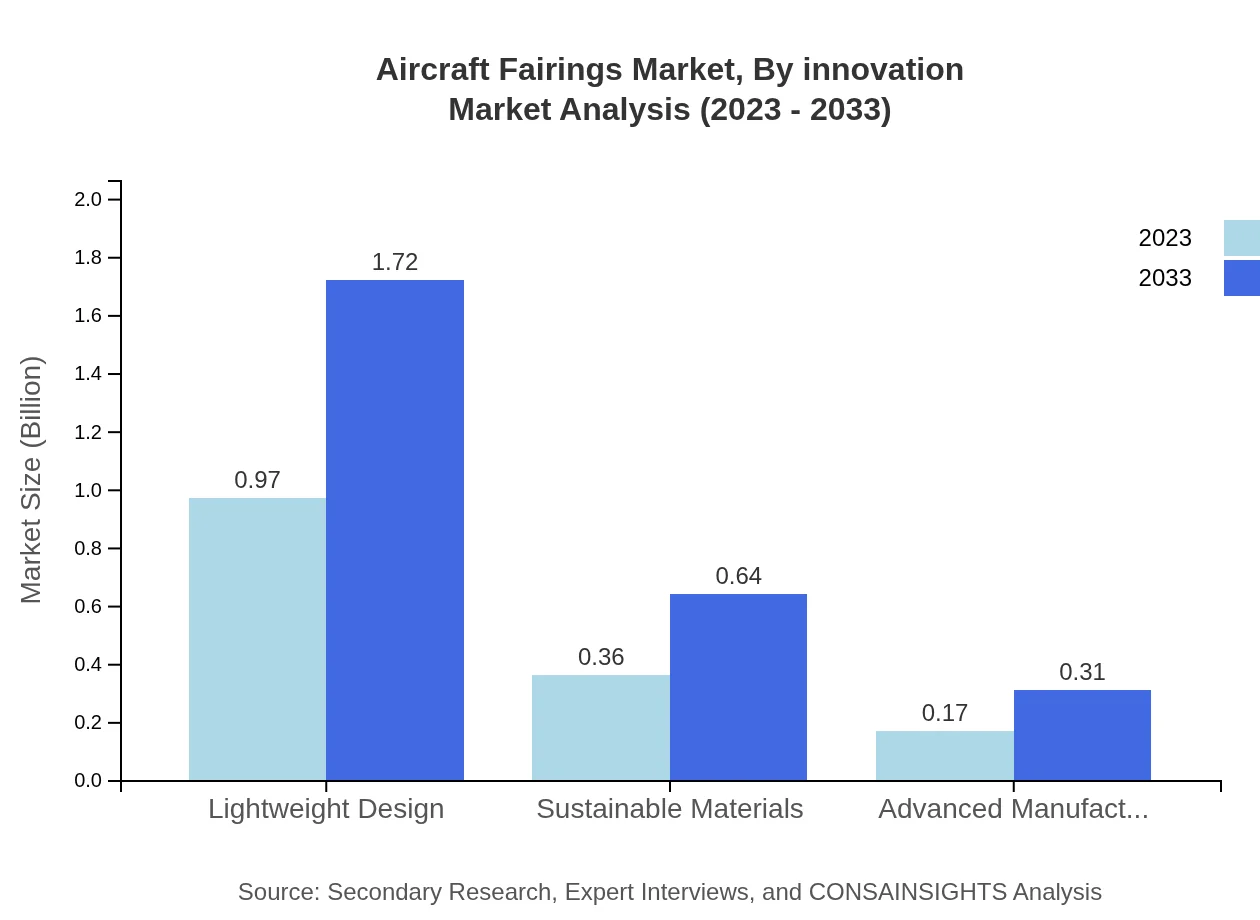

Aircraft Fairings Market Analysis By Innovation

Innovation is transforming the Aircraft Fairings market, with advanced manufacturing techniques constituting a crucial segment. The adoption of automation and 3D printing is optimizing production capabilities. The development of sustainable and lightweight materials also characterizes this segment, representing a paradigm shift in how fairings are engineered and produced for global aerospace applications.

Aircraft Fairings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Fairings Industry

Spirit AeroSystems:

A leading player specializing in aerostructures and components, Spirit AeroSystems designs and manufactures fairings for both commercial and military aircraft, focusing on innovation and efficiency.GKN Aerospace:

With a robust portfolio in aerospace manufacturing, GKN Aerospace is known for its advanced composite materials and structural components used in various aircraft fairings worldwide.UTC Aerospace Systems:

Part of Collins Aerospace, UTC Aerospace Systems is renowned for providing technologically advanced fairing solutions, optimizing both performance and safety in aviation.HEICO Corporation:

Specializing in aerospace and electronics, HEICO offers a range of solutions that include repair and replacement parts for fairings, catering to both commercial and military markets.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Fairings?

The aircraft fairings market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 5.8%, indicating robust growth opportunities and potential to reach significant milestones by 2033.

What are the key market players or companies in this aircraft Fairings industry?

Key players in the aircraft fairings industry include prominent aerospace manufacturers and suppliers, which focus on innovation and high-quality production to fulfill the growing demands of commercial and military aviation.

What are the primary factors driving the growth in the aircraft Fairings industry?

Growth in the aircraft fairings industry is fueled by increased air traffic, demand for fuel-efficient aircraft, advancements in materials technology, and the ongoing expansion of both commercial and military aviation sectors.

Which region is the fastest Growing in the aircraft Fairings?

North America is the fastest-growing region in the aircraft fairings market, with growth expectations to rise from $0.58 billion in 2023 to $1.04 billion in 2033, spawning significant investment and development opportunities.

Does ConsaInsights provide customized market report data for the aircraft Fairings industry?

Yes, Consainsights offers customized market report data tailored to specific inquiries within the aircraft fairings industry, helping stakeholders gain deeper insights and competitive advantages.

What deliverables can I expect from this aircraft Fairings market research project?

Deliverables from the aircraft fairings market research project include detailed market analysis, forecasts, competitive landscape summaries, and insights into consumer trends and regional dynamics.

What are the market trends of aircraft Fairings?

Trends in the aircraft fairings market indicate a shift towards lightweight and sustainable materials, with increasing investments in advanced manufacturing techniques and a growing focus on aerodynamic efficiency in design.