Aircraft Floor Panel Market Report

Published Date: 03 February 2026 | Report Code: aircraft-floor-panel

Aircraft Floor Panel Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Floor Panel market, focusing on current trends, market size, growth forecasts from 2023 to 2033, and competitive dynamics shaping the industry landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

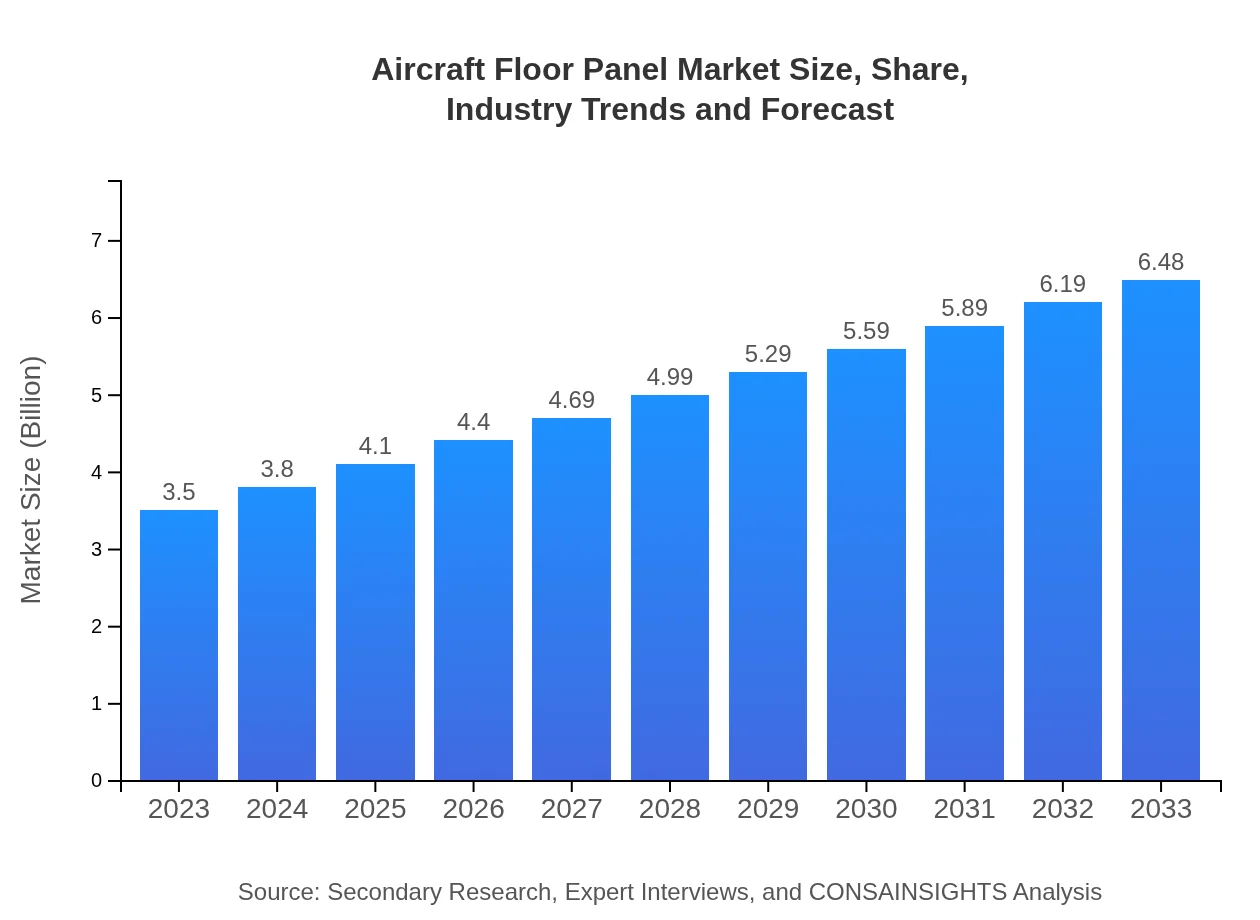

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | Boeing , Airbus, Safran |

| Last Modified Date | 03 February 2026 |

Aircraft Floor Panel Market Overview

Customize Aircraft Floor Panel Market Report market research report

- ✔ Get in-depth analysis of Aircraft Floor Panel market size, growth, and forecasts.

- ✔ Understand Aircraft Floor Panel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Floor Panel

What is the Market Size & CAGR of Aircraft Floor Panel market in 2023?

Aircraft Floor Panel Industry Analysis

Aircraft Floor Panel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Floor Panel Market Analysis Report by Region

Europe Aircraft Floor Panel Market Report:

In Europe, the market is positioned at $1.17 billion in 2023 and expected to reach $2.17 billion by 2033, driven by a strong focus on eco-friendly materials and compliance with stringent aviation regulations, which enhance safety and performance.Asia Pacific Aircraft Floor Panel Market Report:

The Asia Pacific region is witnessing rapid growth, with the market projected to reach $1.20 billion by 2033, up from $0.65 billion in 2023. This growth is fueled by a robust increase in air traffic and significant investments in aircraft manufacturing in countries like China and India.North America Aircraft Floor Panel Market Report:

North America holds the largest market share for aircraft floor panels, estimated at $1.20 billion in 2023, projected to grow to $2.22 billion by 2033. The region benefits from advanced manufacturing technologies and a strong presence of major aircraft manufacturers.South America Aircraft Floor Panel Market Report:

The South American aircraft floor panel market is expected to grow from $0.32 billion in 2023 to $0.59 billion by 2033, owing to improvements in aviation infrastructure and increasing regional air travel demand, although it remains slower compared to other regions.Middle East & Africa Aircraft Floor Panel Market Report:

The Middle East and Africa show a growing market with a valuation of $0.17 billion in 2023, expanding to $0.31 billion by 2033, fueled by an increase in airline operations, infrastructure investments, and a rise in tourism.Tell us your focus area and get a customized research report.

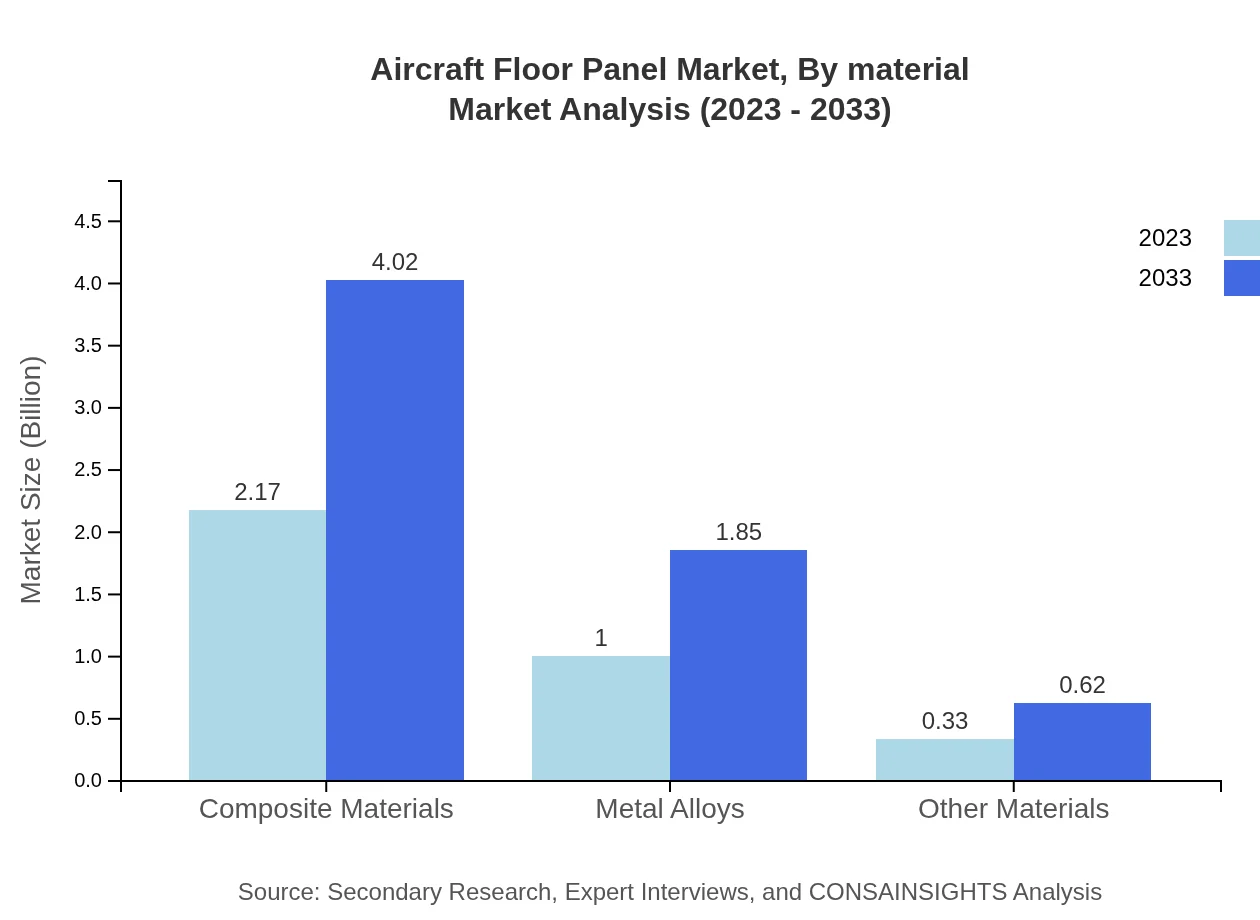

Aircraft Floor Panel Market Analysis By Material

The Aircraft Floor Panel Market is segmented by material type into composite materials, metal alloys, and other materials. Composite materials dominate with a market size of $2.17 billion in 2023 and expected to rise to $4.02 billion by 2033, with a market share of 61.94%. Metal alloys follow with a market size of $1.00 billion in 2023, growing to $1.85 billion by 2033, holding 28.54% share.

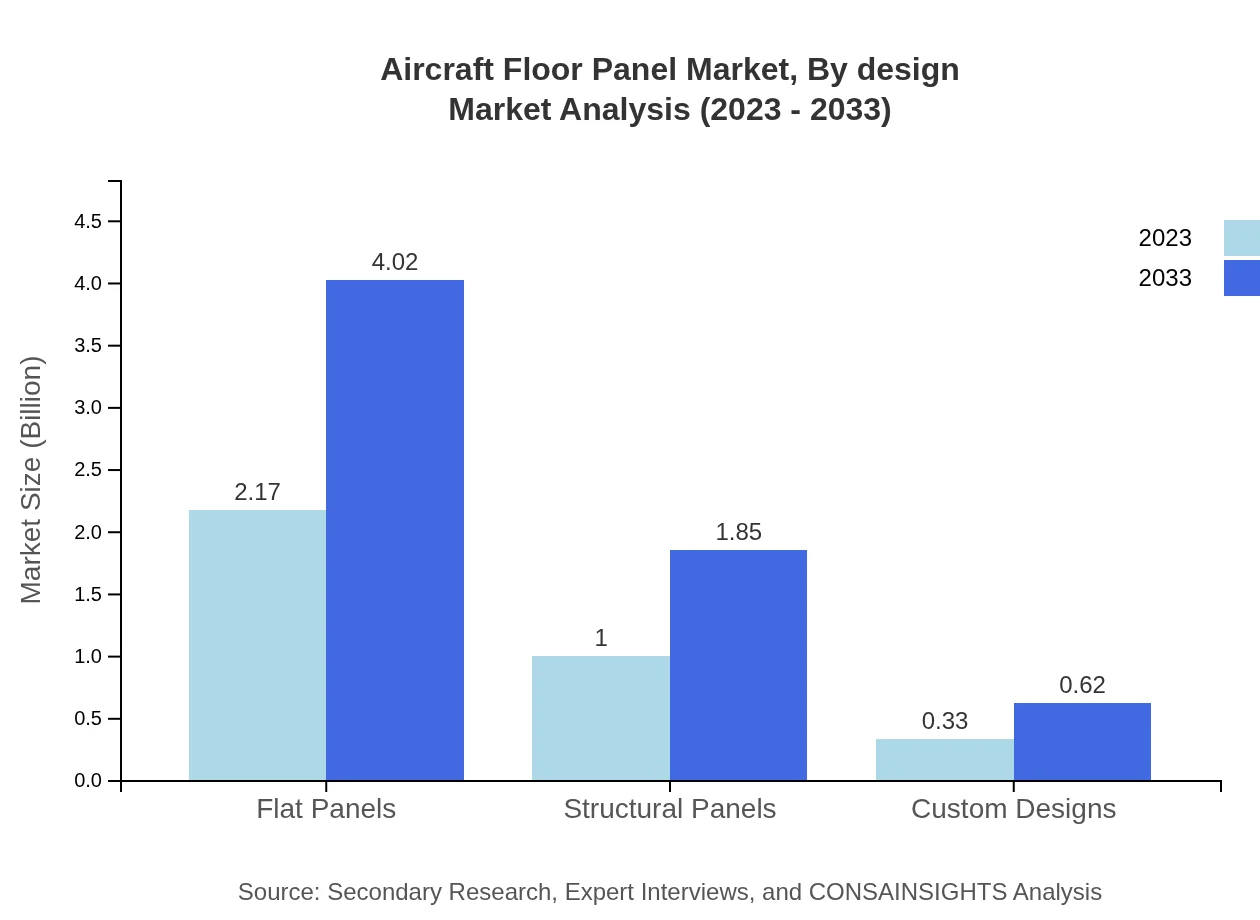

Aircraft Floor Panel Market Analysis By Design

The Aircraft Floor Panel Market also segments by design featuring flat panels, structural panels, and custom designs. Flat panels lead the way with a market size of $2.17 billion in 2023 and projected to hit $4.02 billion by 2033, maintaining a 61.94% market share.

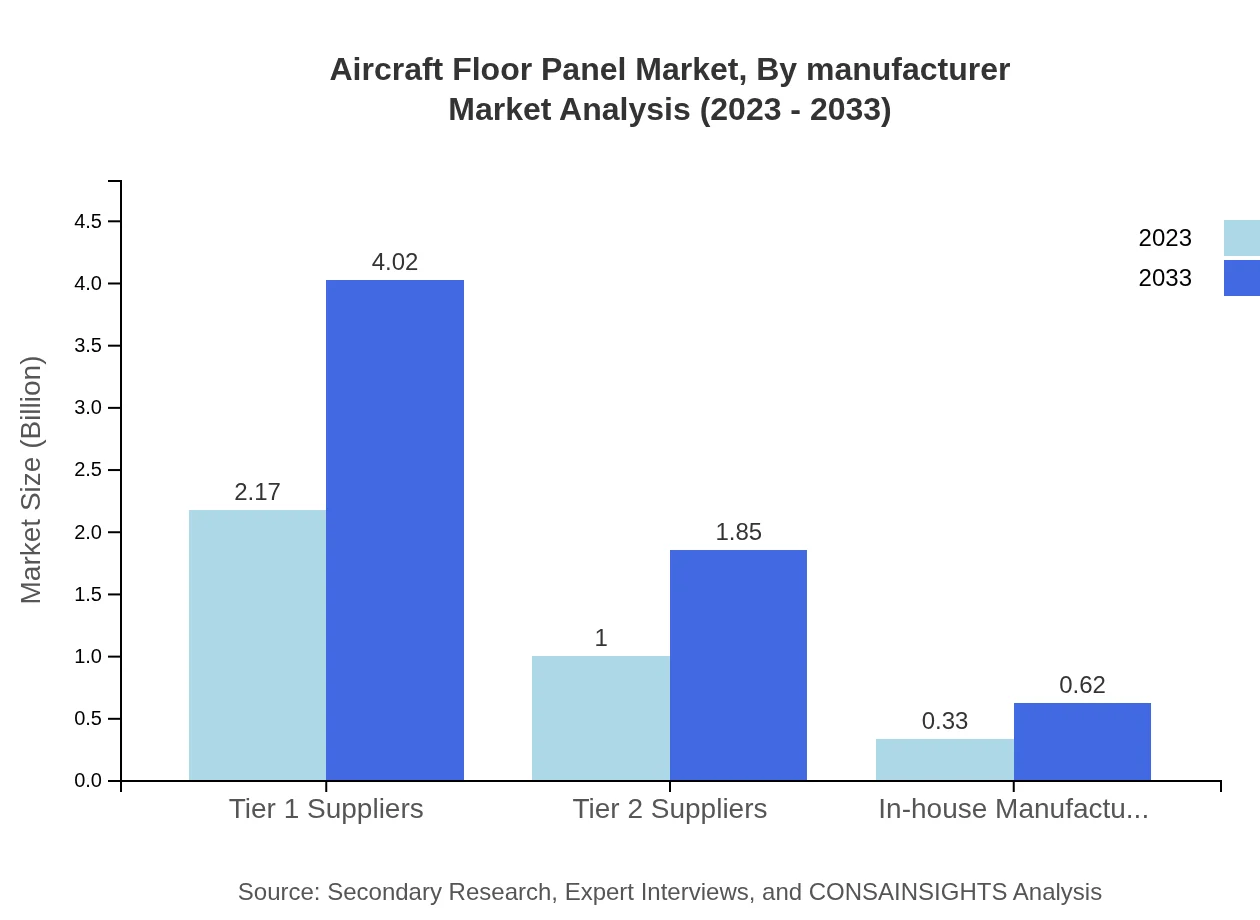

Aircraft Floor Panel Market Analysis By Manufacturer

In terms of manufacturers, tier 1 suppliers dominate the market with an estimated size of $2.17 billion in 2023, expected to increase to $4.02 billion by 2033, sustaining a 61.94% share. Meanwhile, tier 2 suppliers and in-house manufacturers hold considerable shares within the market.

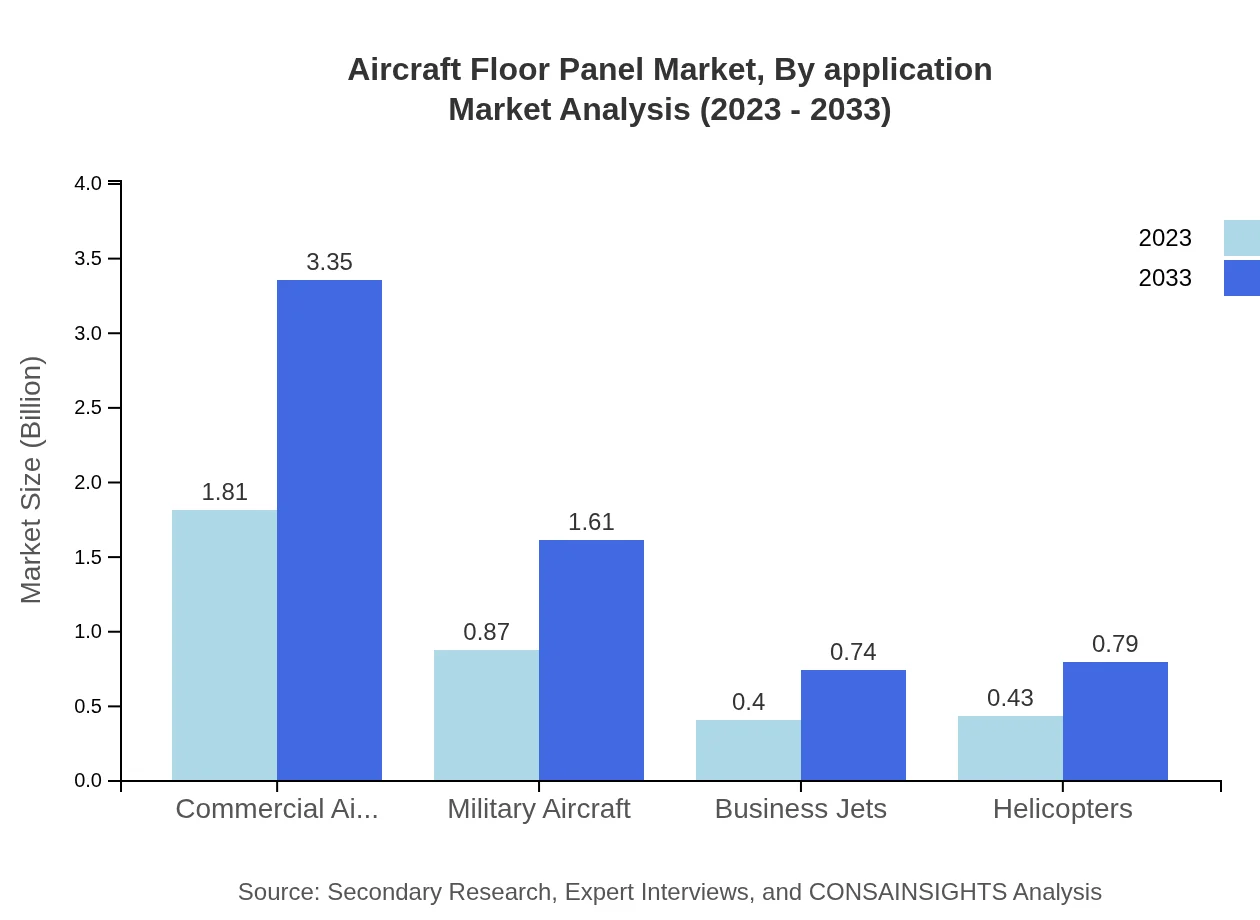

Aircraft Floor Panel Market Analysis By Application

The application segment includes commercial aircraft, military aircraft, business jets, and helicopters. Commercial aircraft lead with $1.81 billion in 2023, forecasted to grow to $3.35 billion by 2033. Military aircraft also show a solid position, expanding from $0.87 billion to $1.61 billion in the same period.

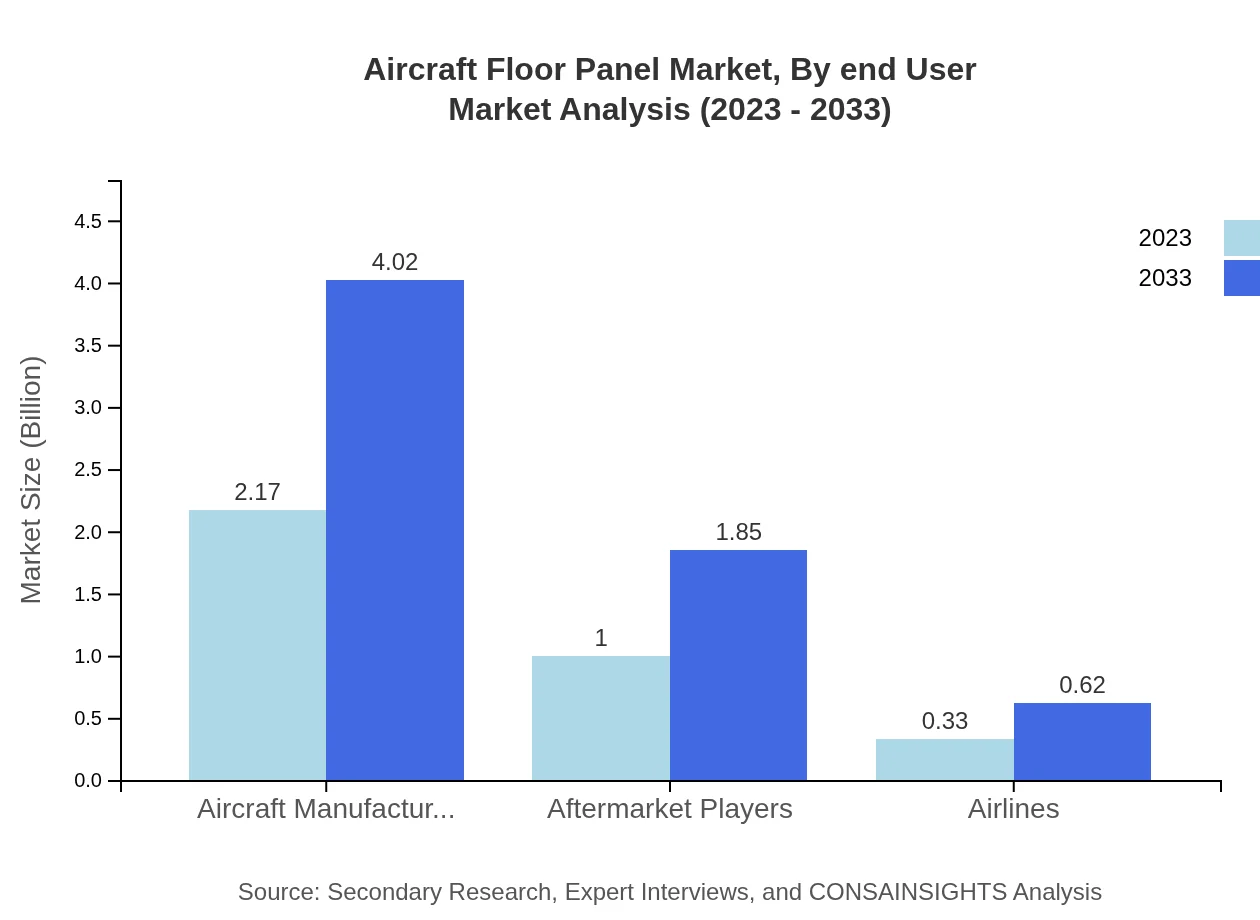

Aircraft Floor Panel Market Analysis By End User

The end-user analysis indicates a significant share captured by airlines, predicted to grow from $0.33 billion to $0.62 billion by 2033. Moreover, aftermarket players also expand their market presence, slating from $1.00 billion in 2023 to $1.85 billion by 2033.

Aircraft Floor Panel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Floor Panel Industry

Boeing :

A leader in aerospace, Boeing is known for its innovation in aircraft design and manufacturing, including advanced floor panel technologies.Airbus:

Airbus, a key player, focuses on eco-efficient solutions in aviation, driving advancements in the development of lightweight materials for aircraft interiors.Safran:

Safran specializes in aircraft equipment and interiors, offering high-quality floor panels that enhance safety and comfort in the passenger environment.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Floor Panel?

The global aircraft floor panel market is valued at approximately $3.5 billion in 2023, with an expected CAGR of 6.2% through 2033. This substantial growth indicates increasing demand in the aviation sector, fueled by the expansion of air travel.

What are the key market players or companies in this aircraft Floor Panel industry?

Key players in the aircraft floor panel market include leading aircraft manufacturers and suppliers specializing in composite materials and panel technologies. These companies drive innovation and market share, helping shape the future of aviation design and safety.

What are the primary factors driving the growth in the aircraft Floor Panel industry?

Growth factors include the rising demand for lightweight materials, advancements in manufacturing technologies, and increasing air traffic, particularly in commercial aviation. These elements collectively enhance the efficiency and performance of aircraft flooring.

Which region is the fastest Growing in the aircraft Floor Panel?

The Asia Pacific region is the fastest-growing market for aircraft floor panels, with projected growth from $0.65 billion in 2023 to $1.20 billion by 2033, as emerging economies invest in expanding their aviation infrastructures.

Does ConsaInsights provide customized market report data for the aircraft Floor Panel industry?

Yes, ConsaInsights offers customized market reports tailored to meet specific client needs in the aircraft floor panel industry. This enables businesses to gain insights relevant to their operational and strategic objectives.

What deliverables can I expect from this aircraft Floor Panel market research project?

Deliverables from the research project typically include comprehensive market analysis, forecasts, competitive landscape, segment insights, and actionable recommendations, assisting stakeholders in making informed decisions in the aircraft floor panel sector.

What are the market trends of aircraft Floor Panel?

Current trends include a shift towards the use of advanced composite materials for efficiency, increased customization in designs, and a focus on sustainability in aircraft manufacturing, indicating a transformative phase in the aircraft flooring market.