Aircraft Fuel Systems Market Report

Published Date: 22 January 2026 | Report Code: aircraft-fuel-systems

Aircraft Fuel Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Fuel Systems market, covering essential insights on market size, trends, segmentation, and technological advancements. It spans the forecast period from 2023 to 2033, aiming to offer strategic guidance for stakeholders in the aviation industry.

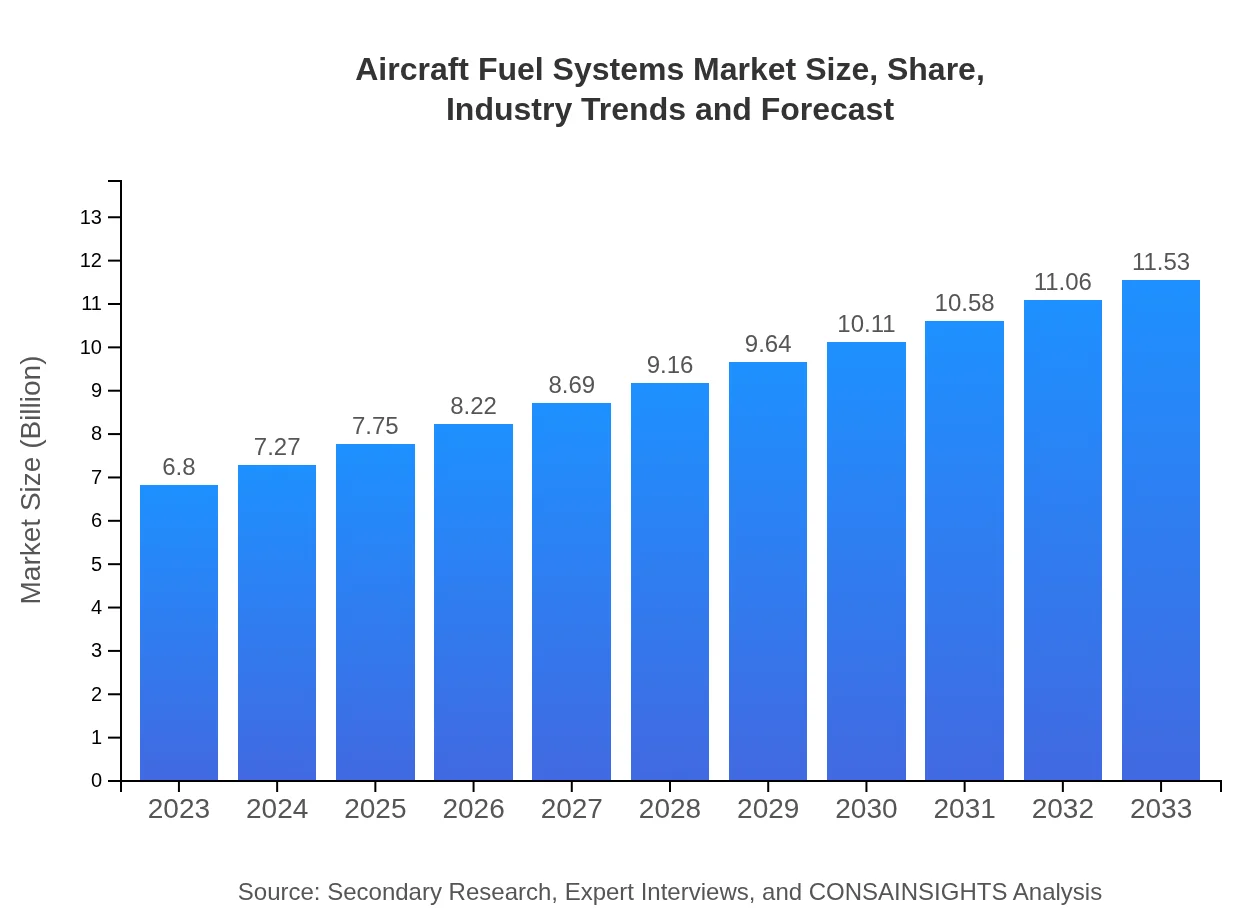

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $11.53 Billion |

| Top Companies | Boeing , Airbus, Honeywell International Inc., General Electric, Safran |

| Last Modified Date | 22 January 2026 |

Aircraft Fuel Systems Market Overview

Customize Aircraft Fuel Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Fuel Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Fuel Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Fuel Systems

What is the Market Size & CAGR of the Aircraft Fuel Systems market in 2023?

Aircraft Fuel Systems Industry Analysis

Aircraft Fuel Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Fuel Systems Market Analysis Report by Region

Europe Aircraft Fuel Systems Market Report:

The European market is expected to grow from $2.00 billion in 2023 to $3.39 billion by 2033. The emphasis on sustainable aviation fuels and strong regulatory frameworks promoting low-carbon technologies significantly influence this growth.Asia Pacific Aircraft Fuel Systems Market Report:

In the Asia Pacific region, the Aircraft Fuel Systems market size in 2023 is estimated at $1.39 billion, projected to grow to $2.35 billion by 2033. Rapid urbanization, increasing air travel, and investments in aircraft fleets boost this growth, as countries like China and India expand their aviation sectors significantly.North America Aircraft Fuel Systems Market Report:

North America represents a substantial market, valued at $2.39 billion in 2023, expected to expand to $4.04 billion by 2033. Fuel efficiency regulations and a strong presence of key players in the aviation industry push innovation and enhancements in fuel systems.South America Aircraft Fuel Systems Market Report:

The South American market is relatively smaller, starting at $0.59 billion in 2023 and expected to reach $1.01 billion by 2033. This growth is primarily driven by the rise in domestic flights and the enhancement of regional air connectivity amidst economic development.Middle East & Africa Aircraft Fuel Systems Market Report:

In the Middle East and Africa, the market is projected to grow from $0.43 billion in 2023 to $0.74 billion in 2033, driven by increasing investments in aviation infrastructure and a high volume of international flights traversing the region.Tell us your focus area and get a customized research report.

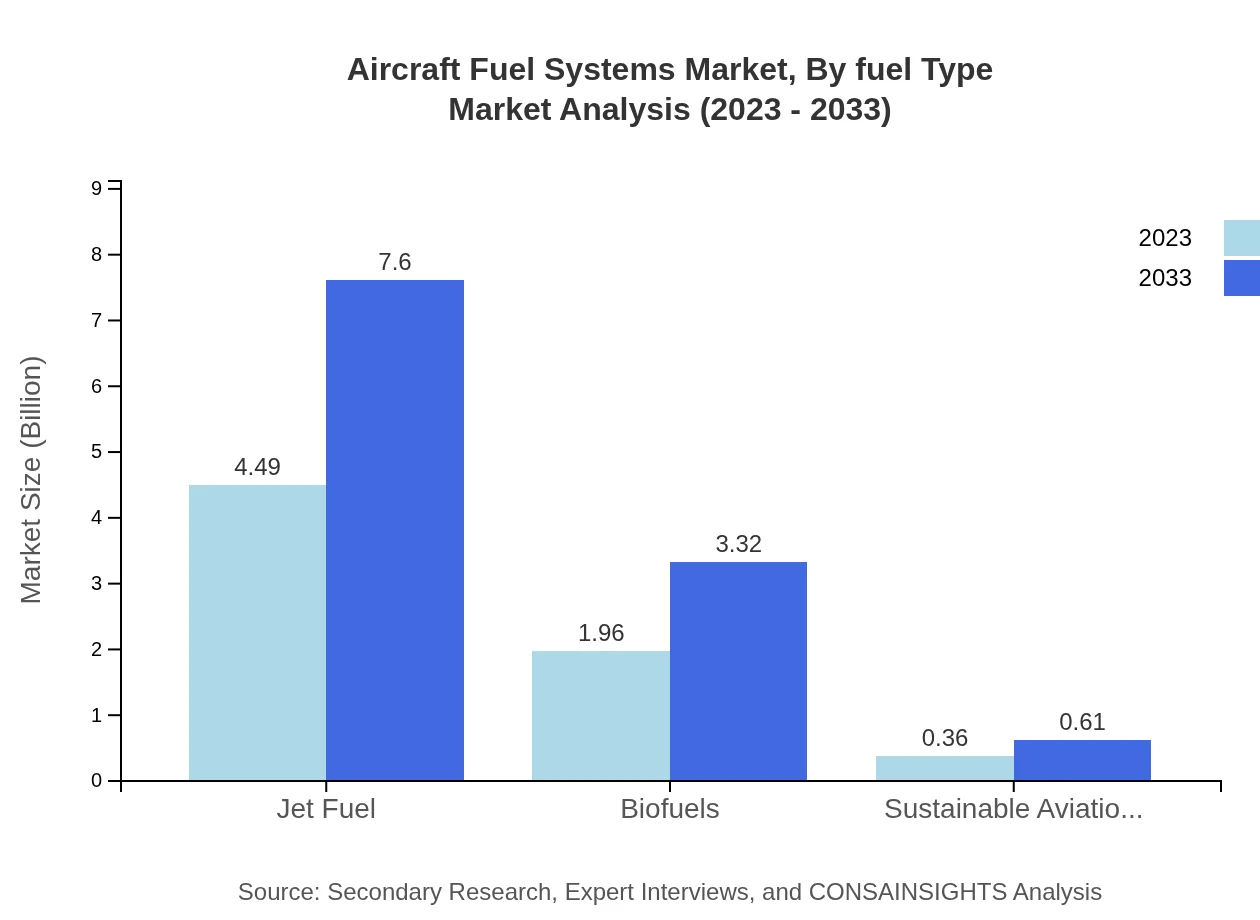

Aircraft Fuel Systems Market Analysis By Fuel Type

The market for Jet Fuel is projected to grow from $4.49 billion in 2023 to $7.60 billion by 2033, maintaining a dominant market share of 65.96%. Biofuels are also seeing increasing adoption, with market values growing from $1.96 billion to $3.32 billion, representing 28.79% share. Meanwhile, Sustainable Aviation Fuel (SAF), although currently smaller at $0.36 billion, is anticipated to grow to $0.61 billion.

Aircraft Fuel Systems Market Analysis By System Type

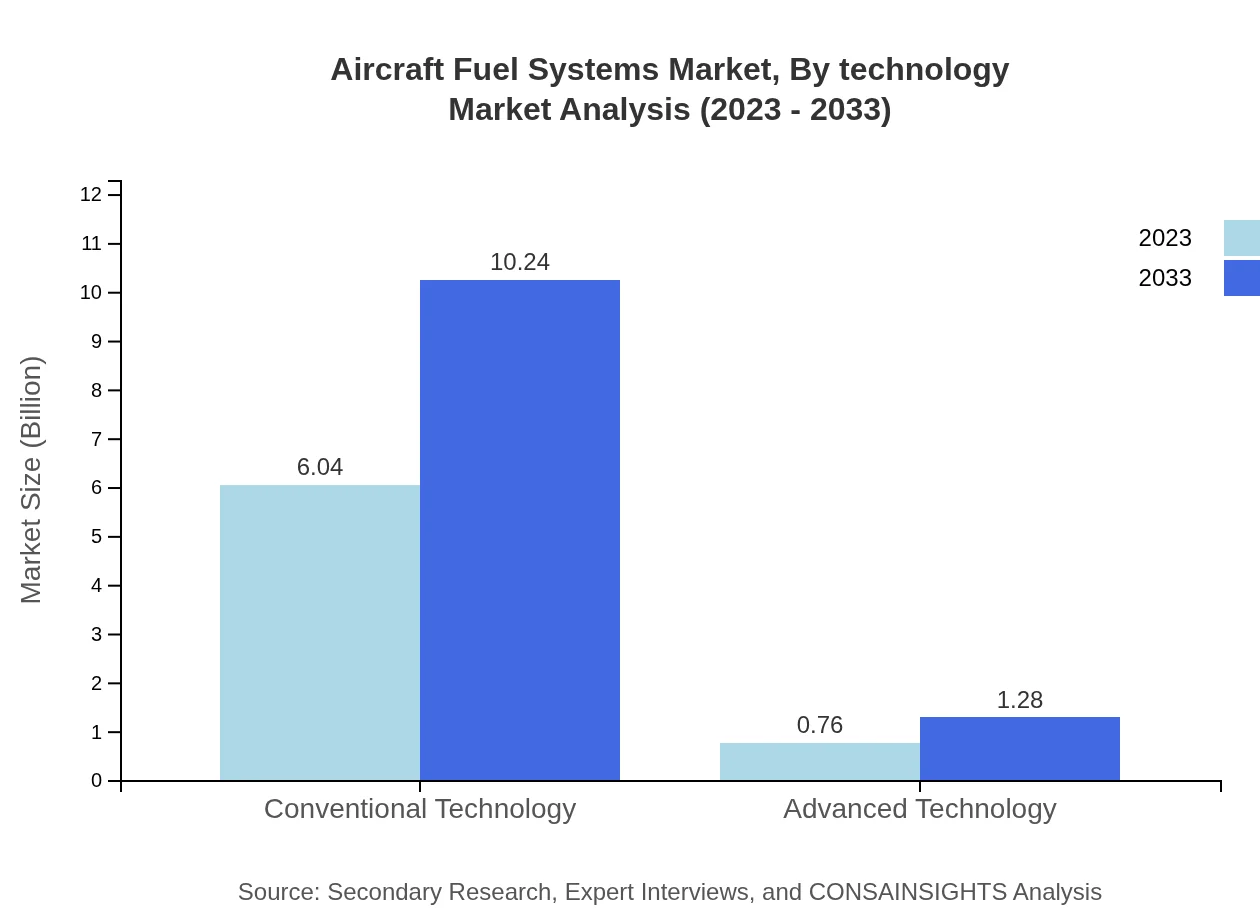

Conventional Technology in fuel systems is expected to grow from $6.04 billion in 2023 to $10.24 billion by 2033 with an 88.86% share, indicating its continued dominance. Advanced Technology, while smaller, will expand from $0.76 billion to $1.28 billion, capturing 11.14% share as innovations come into play.

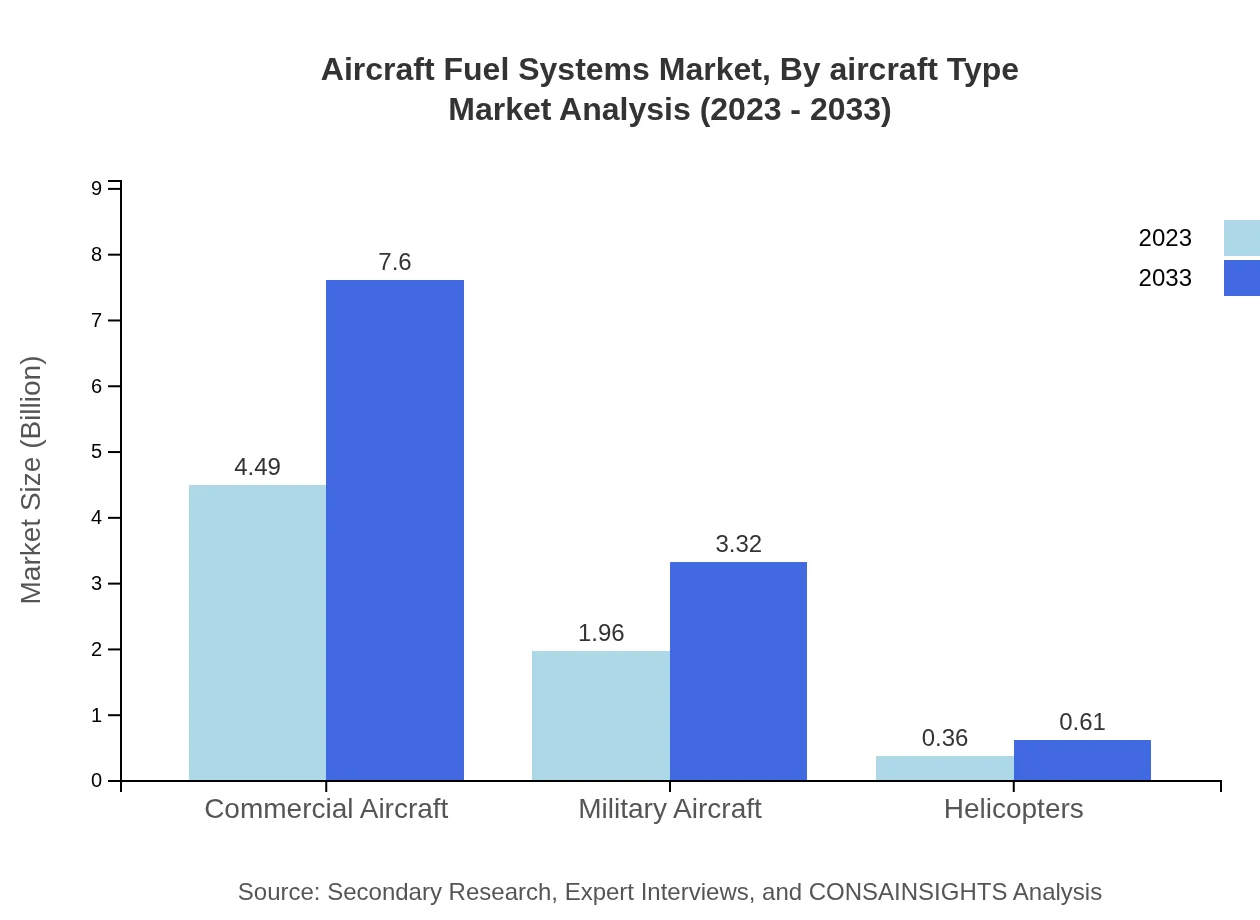

Aircraft Fuel Systems Market Analysis By Aircraft Type

The Commercial Aircraft segment shows strong growth, expected to rise from $4.49 billion to $7.60 billion, sustaining a 65.96% market share. Military Aircraft fuel systems are also anticipated to grow from $1.96 billion to $3.32 billion. Helicopters represent a smaller segment with values growing from $0.36 billion to $0.61 billion.

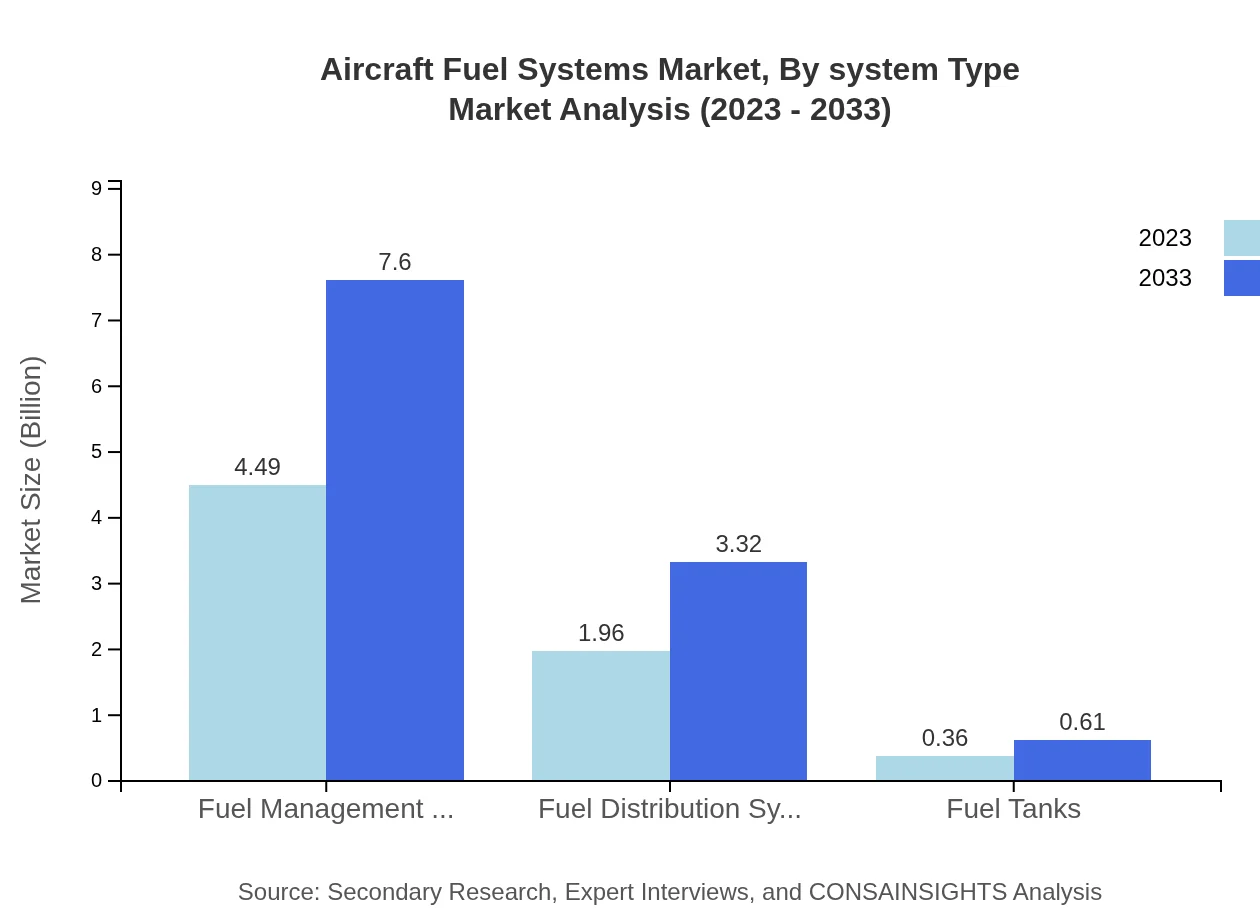

Aircraft Fuel Systems Market Analysis By Technology

Fuel Management Systems are set to maintain a market size of $4.49 billion in 2023 and grow to $7.60 billion by 2033. The Fuel Distribution System segment is expected to grow from $1.96 billion to $3.32 billion, correlating to 28.79% market share, while Fuel Tanks, currently at $0.36 billion, will rise to $0.61 billion.

Aircraft Fuel Systems Market Analysis By Distribution Channel

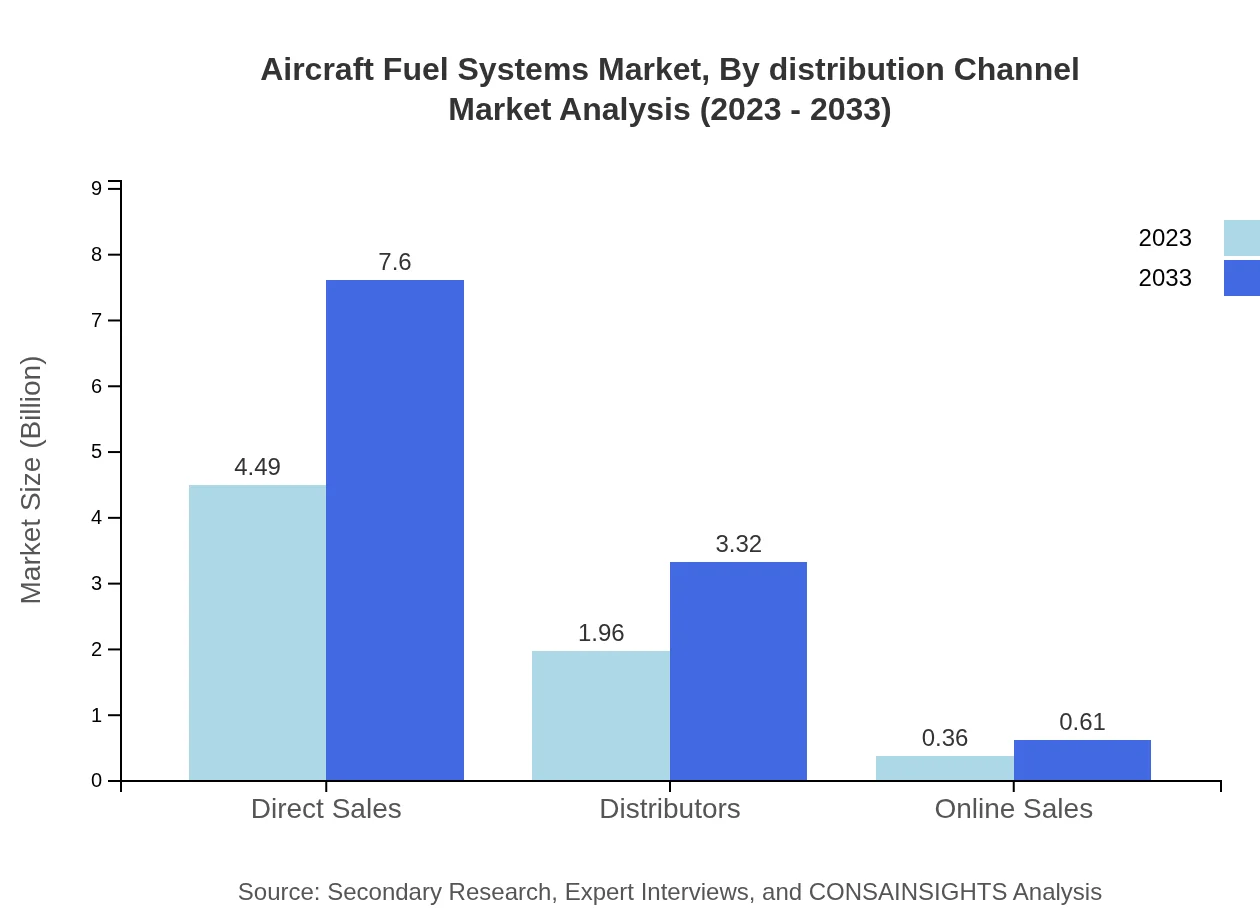

Direct Sales shows robust performance from $4.49 billion to $7.60 billion, with 65.96% market share. Meanwhile, Distributors will see growth from $1.96 billion to $3.32 billion, along with Online Sales rising from $0.36 billion to $0.61 billion.

Aircraft Fuel Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Fuel Systems Industry

Boeing :

A leading global aerospace company known for manufacturing commercial jetliners, defense aircraft, and advanced fuel systems technology.Airbus:

One of the world’s largest aircraft manufacturers, Airbus specializes in fuel-efficient aircraft designs and innovative fuel system solutions.Honeywell International Inc.:

A technology and manufacturing company that provides cutting-edge fuel management systems and solutions for aircraft.General Electric:

Known for its advanced fuel systems and aerospace technologies that improve fuel efficiency and support sustainable aviation.Safran:

A major player in aerospace propulsion and equipment, focusing on high-performance fuel systems for commercial and military aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft fuel systems?

The aircraft fuel systems market is valued at $6.8 billion in 2023 and is projected to grow at a CAGR of 5.3% through 2033, reflecting advancements and rising demand in aviation industries.

What are the key market players or companies in the aircraft fuel systems industry?

Key players in the aircraft fuel systems market include major aerospace manufacturers and fuel supply companies who invest in advanced technologies and innovation, ensuring efficiency and safety in fuel management and distribution.

What are the primary factors driving the growth in the aircraft fuel systems industry?

Growth in the aircraft fuel systems sector is driven by increasing air travel demand, regulatory pressures for fuel efficiency, and advancements in fuel technology, including biofuels and sustainable aviation fuel.

Which region is the fastest Growing in the aircraft fuel systems?

North America is the fastest-growing region in the aircraft fuel systems market, expected to rise from $2.39 billion in 2023 to $4.04 billion by 2033, showcasing a significant growth trajectory in the aerospace sector.

Does ConsaInsights provide customized market report data for the aircraft fuel systems industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the aircraft fuel systems industry, providing detailed insights and data necessary for informed decision-making.

What deliverables can I expect from this aircraft fuel systems market research project?

Project deliverables from the aircraft fuel systems research will include comprehensive reports, market analysis, segment data, regional insights, and expert recommendations to inform strategic planning and investment.

What are the market trends of aircraft fuel systems?

Current trends in the aircraft fuel systems market prioritize fuel efficiency, the integration of sustainable aviation fuels, advancements in fuel management systems, and innovations in fuel tank technologies for enhanced performance.