Aircraft Gearbox Market Report

Published Date: 03 February 2026 | Report Code: aircraft-gearbox

Aircraft Gearbox Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Gearbox market, including insights into market trends, growth factors, and regional dynamics for the forecast period from 2023 to 2033.

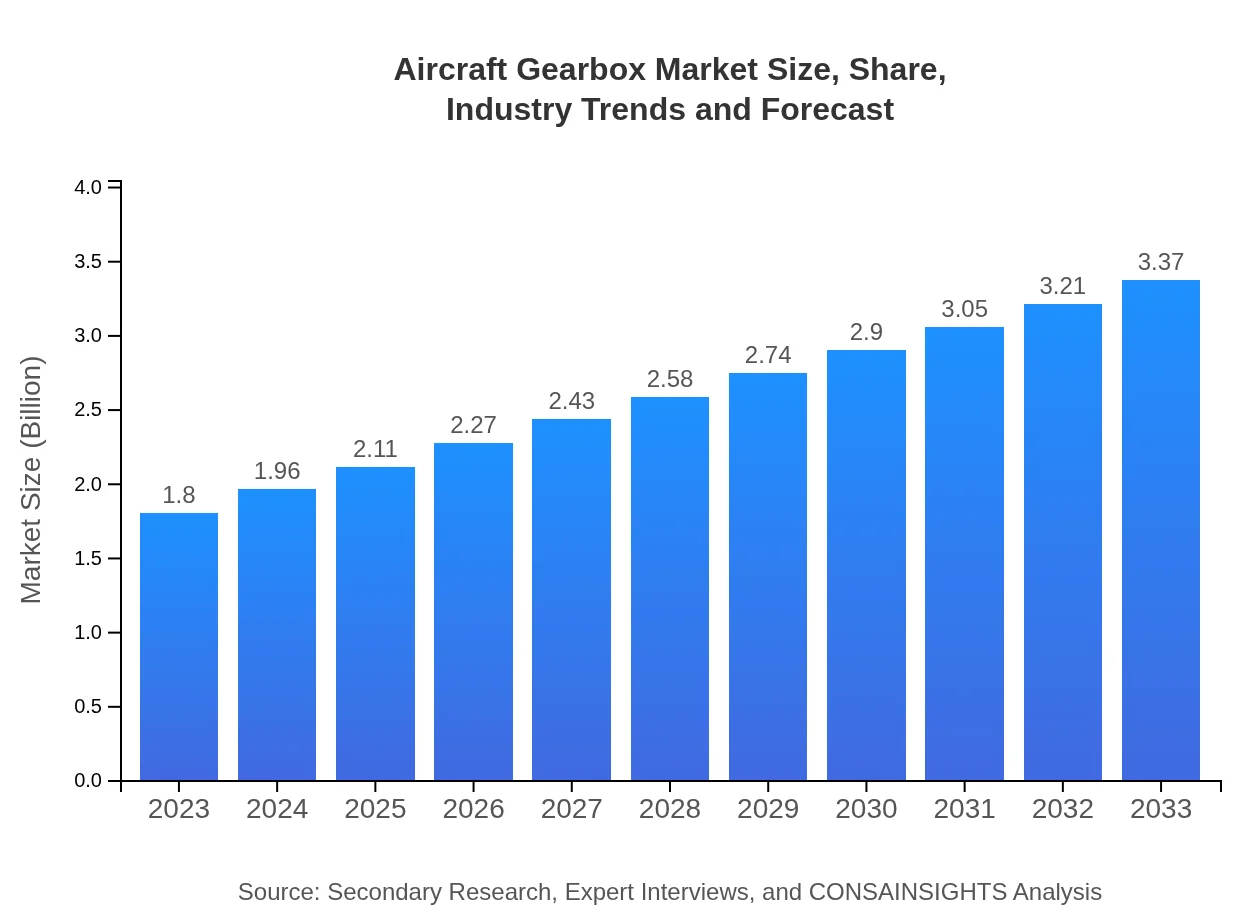

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $3.37 Billion |

| Top Companies | General Electric Company (GE), Honeywell International Inc., Rolls-Royce Holdings plc, SAFRAN, United Technologies Corporation |

| Last Modified Date | 03 February 2026 |

Aircraft Gearbox Market Overview

Customize Aircraft Gearbox Market Report market research report

- ✔ Get in-depth analysis of Aircraft Gearbox market size, growth, and forecasts.

- ✔ Understand Aircraft Gearbox's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Gearbox

What is the Market Size & CAGR of Aircraft Gearbox market in 2023?

Aircraft Gearbox Industry Analysis

Aircraft Gearbox Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Gearbox Market Analysis Report by Region

Europe Aircraft Gearbox Market Report:

In Europe, the aircraft gearbox market is anticipated to increase from $0.45 billion in 2023 to $0.84 billion by 2033. The region is focusing on sustainability and reducing emissions, which are influencing the development of next-generation gear systems.Asia Pacific Aircraft Gearbox Market Report:

The Asia Pacific region is witnessing rapid growth, with the market size projected to rise from $0.38 billion in 2023 to $0.71 billion by 2033. Countries like China and India are significantly investing in expanding their aircraft manufacturing capabilities, which in turn stimulates the demand for aircraft gearboxes.North America Aircraft Gearbox Market Report:

North America represents the largest market for aircraft gearboxes, from $0.70 billion in 2023 to $1.31 billion by 2033. The presence of major aircraft manufacturers and a high demand for both commercial and military aircraft support this growth.South America Aircraft Gearbox Market Report:

In South America, the market is expected to grow from $0.15 billion in 2023 to $0.28 billion by 2033. The growth is largely driven by increasing investments in regional airlines and upgrades to existing fleets to meet modern standards.Middle East & Africa Aircraft Gearbox Market Report:

The Middle East and Africa market is projected to grow from $0.13 billion in 2023 to $0.24 billion by 2033, driven by the expansion of the aviation sector and increasing aircraft fleet size in the region.Tell us your focus area and get a customized research report.

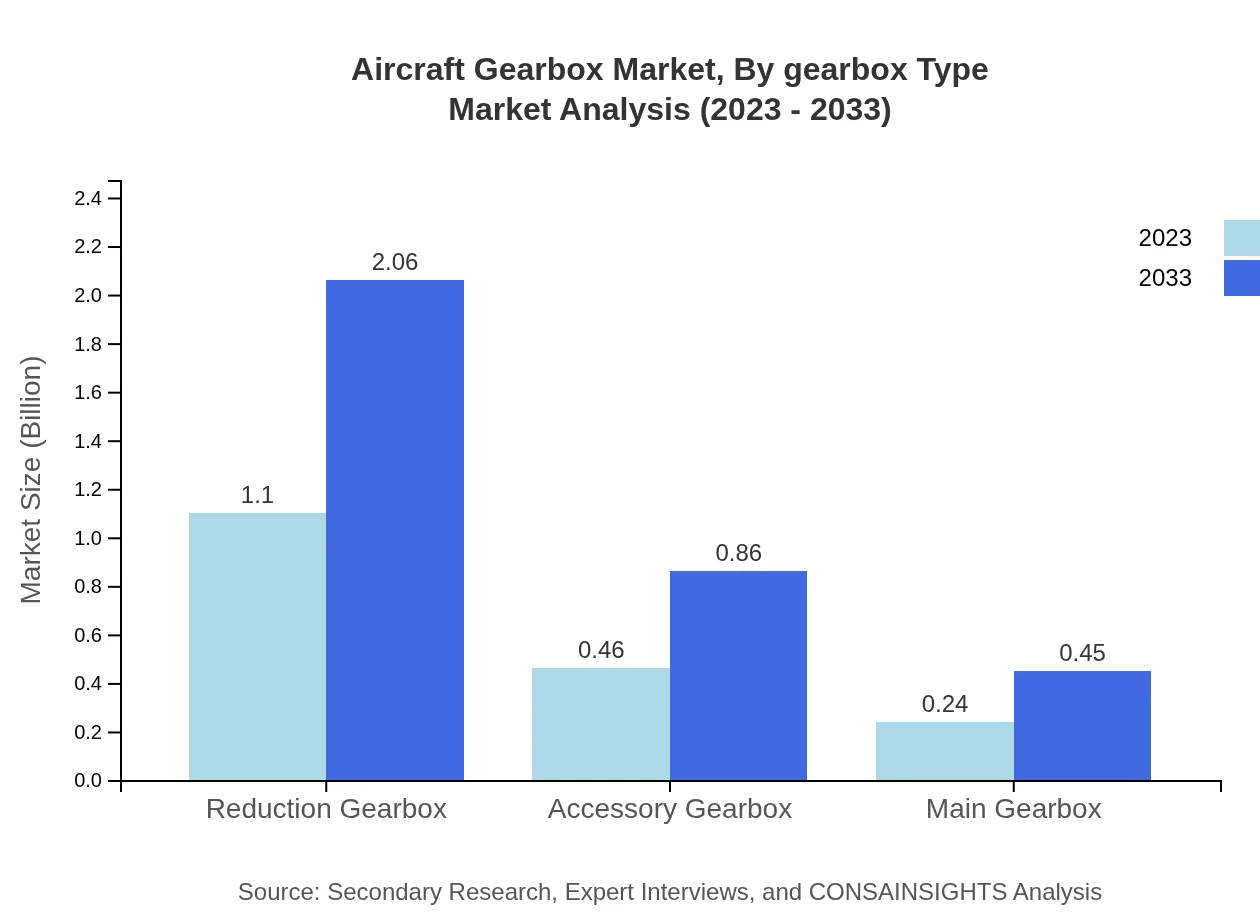

Aircraft Gearbox Market Analysis By Gearbox Type

The Aircraft Gearbox market, by gearbox type, reflects a diverse landscape characterized by Mechanical Gearboxes holding a significant market share of 61.05% in 2023. The rise of Electronic Gearboxes, representing 25.62% of the market, is gaining traction with technological advancements in automation and control systems. Hybrid Gearboxes, accounting for 13.33%, indicate the industry's transition towards more adaptable systems that can cater to various applications.

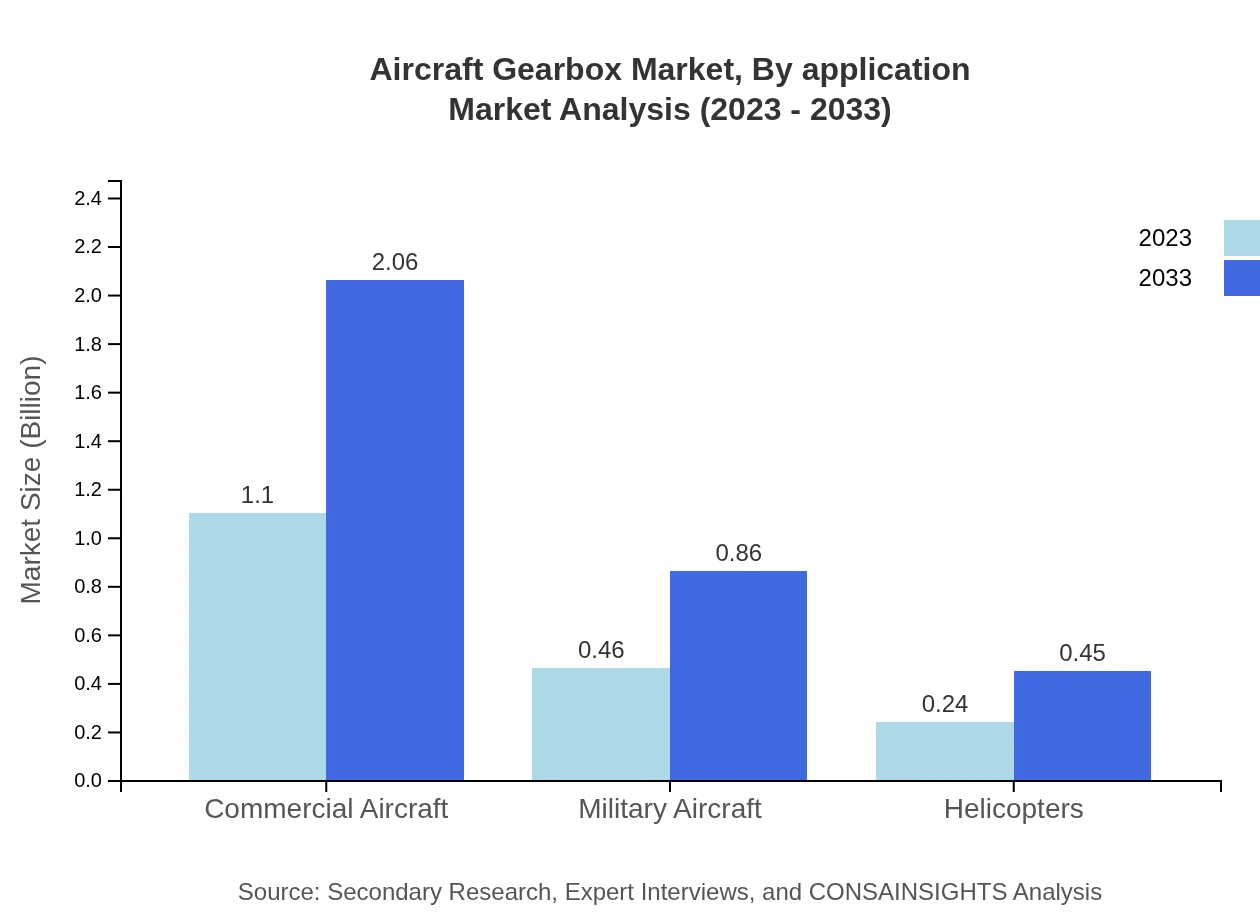

Aircraft Gearbox Market Analysis By Application

In terms of application, the Commercial Aircraft segment dominates the market with 61.05% share, reflecting the robust demand in passenger transport. Military Aircraft follows with a 25.62% share, focusing on advanced gear systems capable of meeting defense requirements. Helicopters, with a 13.33% share, represent a niche but growing segment driven by the demand for multi-role capabilities.

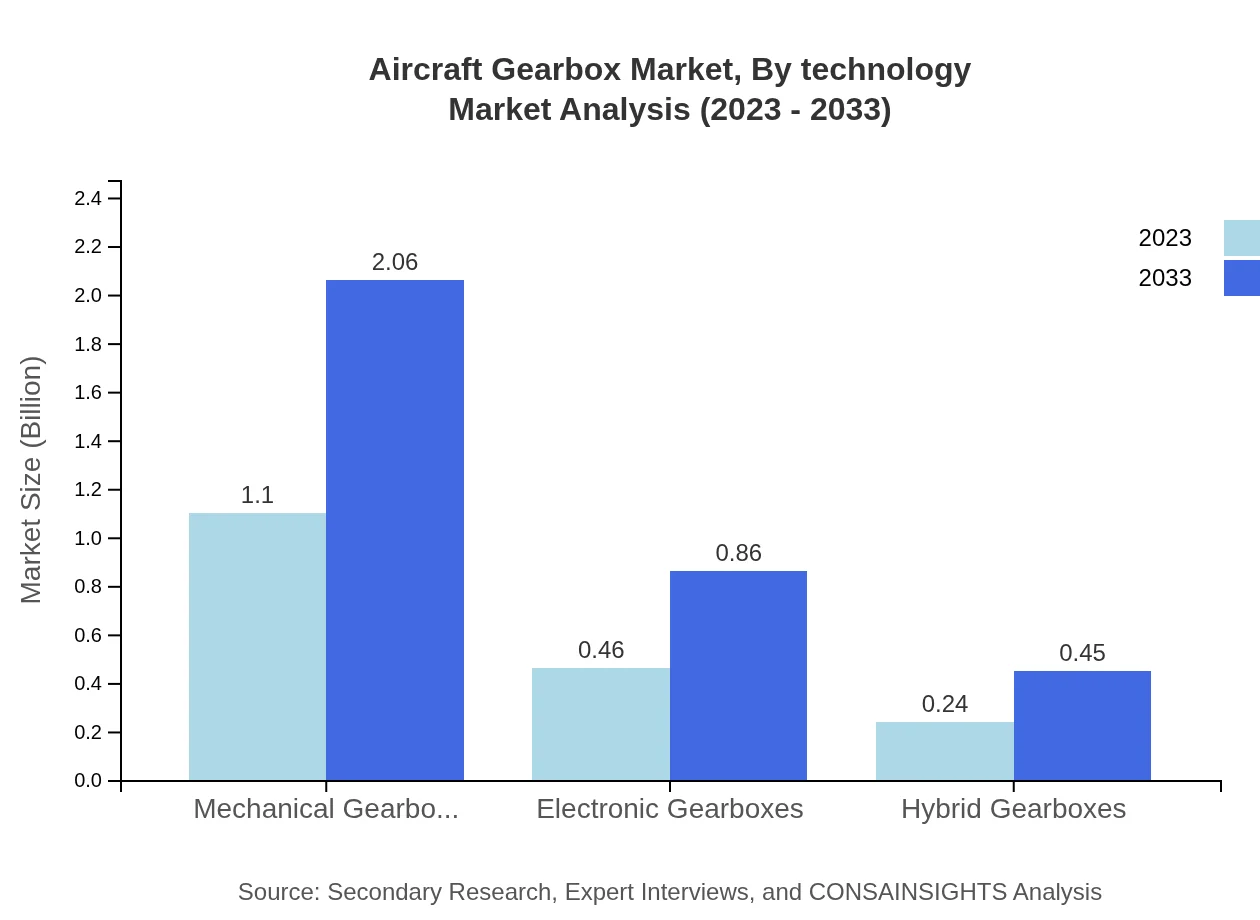

Aircraft Gearbox Market Analysis By Technology

The technology segment of the Aircraft Gearbox market reveals a trend towards improvements in gearbox performance and reliability. Innovations such as centrifugal gear technology and advancements in lubricants are enhancing efficiency. Companies are also increasingly integrating IoT technologies to monitor gearbox health in real-time, helping to mitigate failures and reduce maintenance costs.

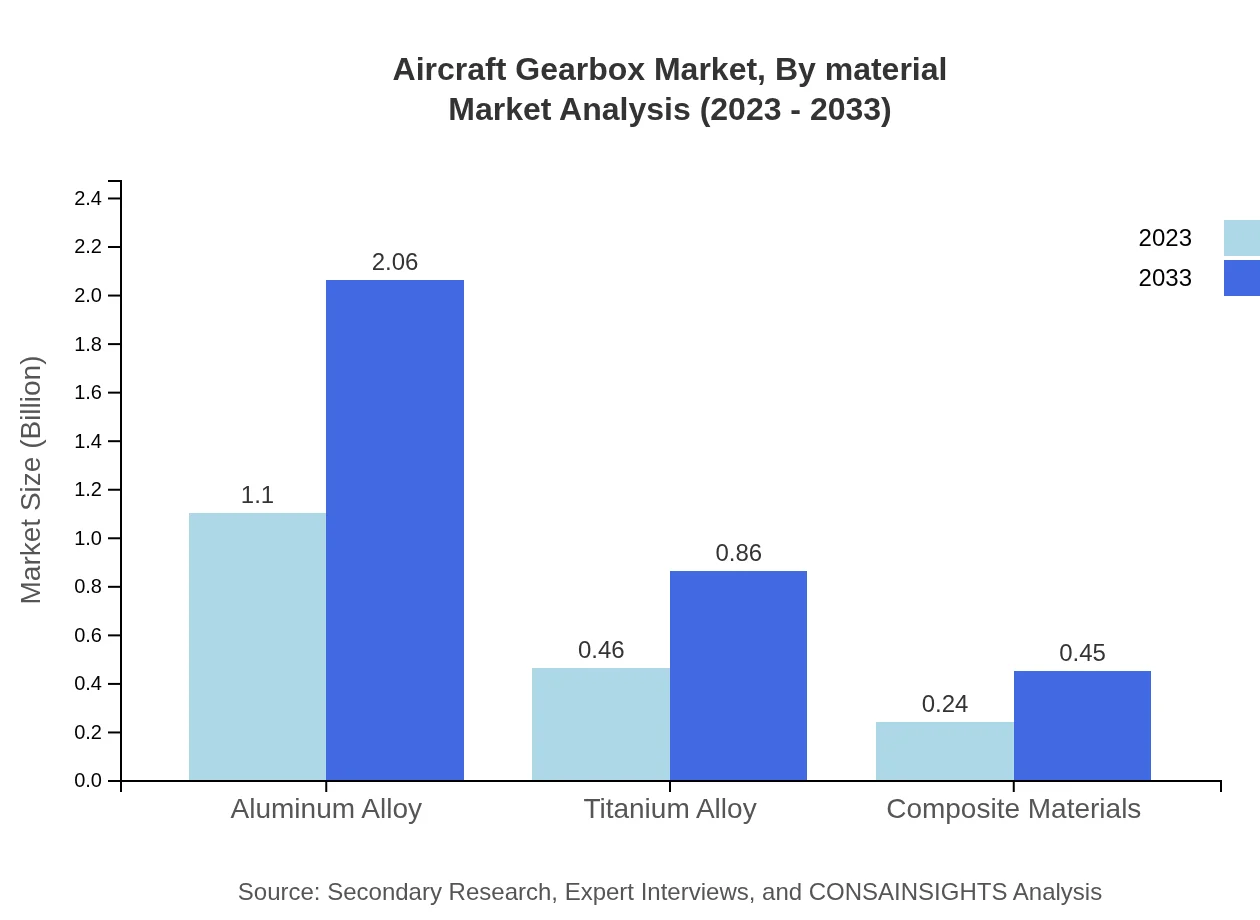

Aircraft Gearbox Market Analysis By Material

Materials used in the Aircraft Gearbox market are evolving, with lightweight materials such as Aluminum alloys prevalent, holding a 61.05% market share. Titanium alloys (25.62%) and composite materials (13.33%) are critical for enhancing performance while reducing weight, catering to the trend of developing fuel-efficient aircraft.

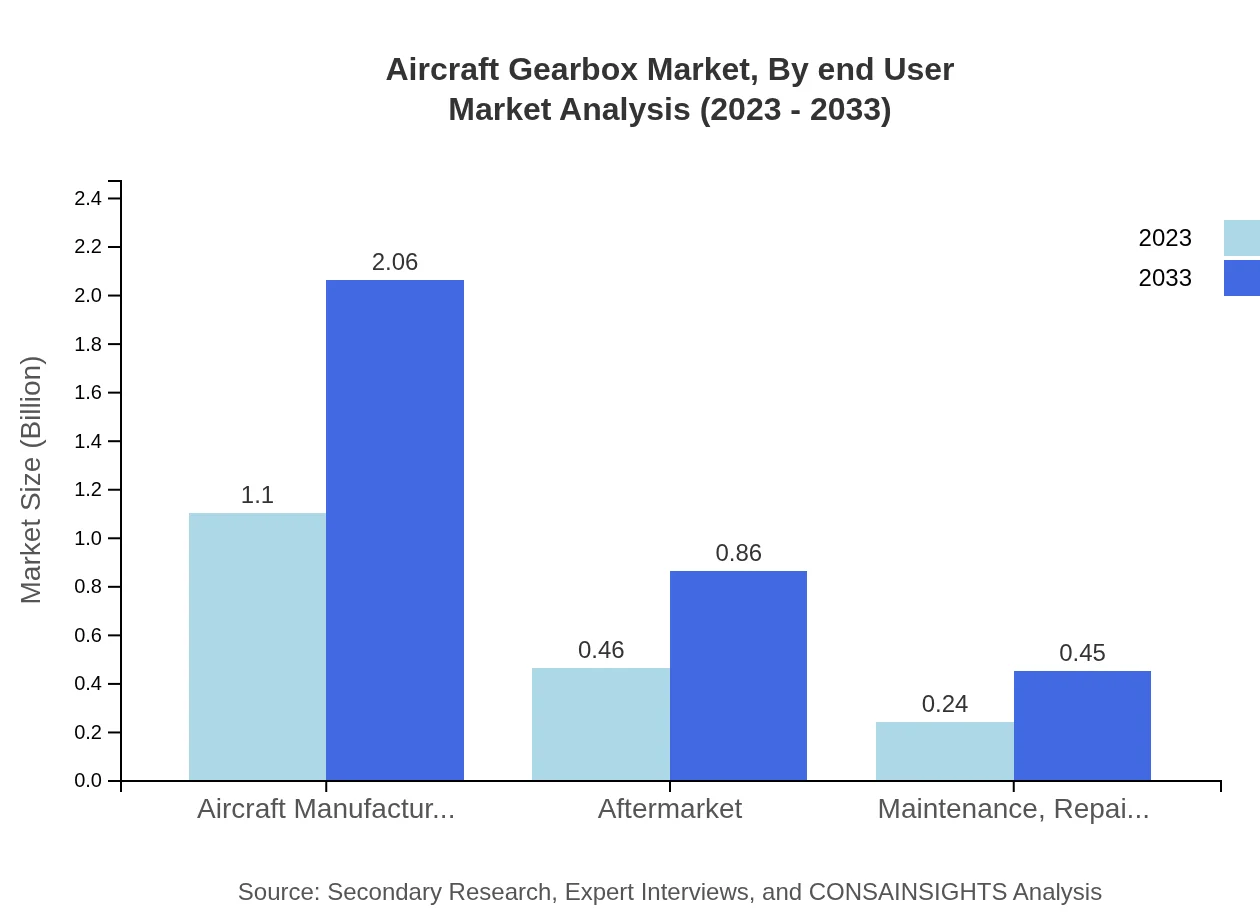

Aircraft Gearbox Market Analysis By End User

The Aircraft Gearbox market's end-user segmentation highlights the role of manufacturers as primary consumers, accounting for 61.05%. The aftermarket segment, representing a 25.62% share, includes repairs and replacements which are crucial for maintaining aircraft safety over time. The Maintenance, Repair, and Overhaul (MRO) segment is equally vital, reflecting the importance of ongoing support in aviation operations.

Aircraft Gearbox Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Gearbox Industry

General Electric Company (GE):

A leading player in the Aircraft Gearbox market known for its cutting-edge technology and comprehensive solutions for commercial and military aircraft.Honeywell International Inc.:

Honeywell specializes in producing advanced gearbox systems for aerospace applications, contributing significantly to innovations in efficiency and performance.Rolls-Royce Holdings plc:

Rolls-Royce is recognized for its high-performance power systems and gearboxes tailored for aviation applications, emphasizing reliability and durability.SAFRAN:

SAFRAN is known for its Aerospace division, providing innovative gearbox solutions that meet the demands of modern aircraft.United Technologies Corporation:

UTC has a strong presence in the aircraft propulsion systems market, focusing on producing high-quality gear systems for various aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft gearbox?

The global aircraft gearbox market is valued at approximately $1.8 billion in 2023 and is projected to reach significant growth with a CAGR of 6.3%, highlighting the increasing demand in the aerospace sector.

What are the key market players or companies in the aircraft gearbox industry?

Key players in the aircraft gearbox industry include major manufacturers like Honeywell Aerospace, Collins Aerospace, and GE Aviation, which are recognized for their technological advancements and market presence across various segments.

What are the primary factors driving the growth in the aircraft gearbox industry?

Growth in the aircraft gearbox industry is primarily driven by rising aircraft production rates, advancements in technology, increased demand for fuel-efficient aircraft, and the expanding aftermarket services sector.

Which region is the fastest Growing in the aircraft gearbox market?

The North American region is the fastest-growing market, projected to grow from $0.70 billion in 2023 to $1.31 billion by 2033, fueled by high aircraft manufacturing and defense spending.

Does ConsaInsights provide customized market report data for the aircraft gearbox industry?

Yes, ConsaInsights offers customized market report data, allowing clients to access tailored insights that reflect specific needs, trends, and competitive landscapes in the aircraft gearbox industry.

What deliverables can I expect from this aircraft gearbox market research project?

Expect deliverables such as comprehensive market analysis, trend assessments, competitive landscapes, forecasts, and segmentation data that provide deep insights into the aircraft gearbox market.

What are the market trends of aircraft gearbox?

Notable trends in the aircraft gearbox market include a growing preference for lightweight materials such as aluminum and composite, developments in electronic gearbox technologies, and increased focus on sustainability and efficiency.