Aircraft Heat Exchanger Market Report

Published Date: 03 February 2026 | Report Code: aircraft-heat-exchanger

Aircraft Heat Exchanger Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Heat Exchanger market, including market size, segmentation, industry trends, and regional insights from 2023 to 2033.

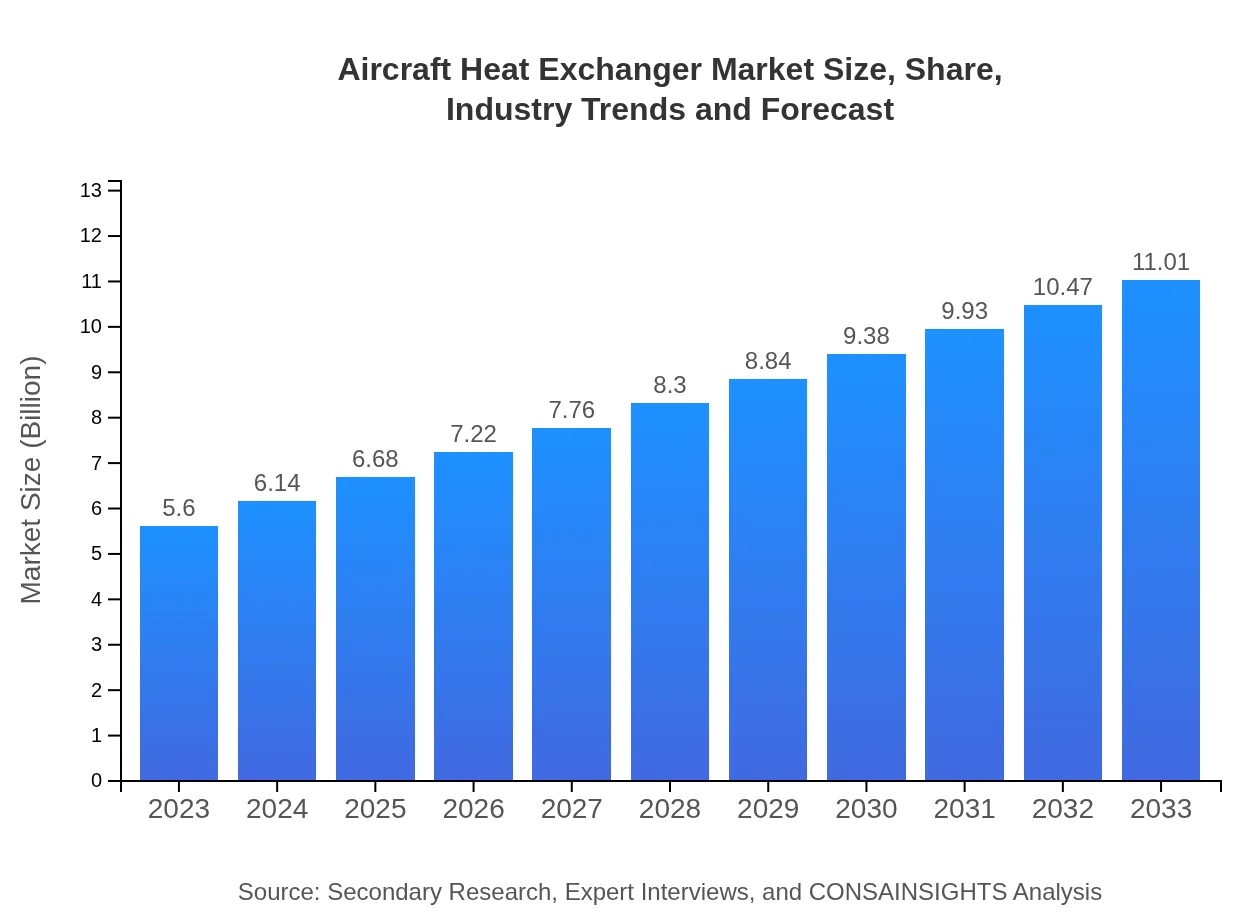

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Eaton Corporation, Northrop Grumman, Honeywell International, Inc., Parker Hannifin Corporation, Airbus |

| Last Modified Date | 03 February 2026 |

Aircraft Heat Exchanger Market Overview

Customize Aircraft Heat Exchanger Market Report market research report

- ✔ Get in-depth analysis of Aircraft Heat Exchanger market size, growth, and forecasts.

- ✔ Understand Aircraft Heat Exchanger's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Heat Exchanger

What is the Market Size & CAGR of Aircraft Heat Exchanger market in 2023 and 2033?

Aircraft Heat Exchanger Industry Analysis

Aircraft Heat Exchanger Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Heat Exchanger Market Analysis Report by Region

Europe Aircraft Heat Exchanger Market Report:

Europe's market is forecasted to grow from $1.82 billion in 2023 to $3.58 billion in 2033, bolstered by stringent environmental regulations and a shift toward sustainable aviation technologies among leading manufacturers.Asia Pacific Aircraft Heat Exchanger Market Report:

The Aircraft Heat Exchanger market in the Asia Pacific is projected to grow from $1.09 billion in 2023 to $2.14 billion in 2033, driven by increasing air travel and investment in aircraft modernization across countries like China and India. Additionally, the region is a hub for manufacturing and assembly.North America Aircraft Heat Exchanger Market Report:

North America is anticipated to maintain a strong market presence, increasing from $1.85 billion in 2023 to $3.64 billion in 2033. The demand is heavily influenced by advancements in military and commercial aviation sectors supported by substantial governmental and private funding.South America Aircraft Heat Exchanger Market Report:

In South America, the market size is expected to rise from $0.53 billion in 2023 to $1.03 billion by 2033, fueled by the growing aviation sector and heightened interest in regional connectivity and tourism development.Middle East & Africa Aircraft Heat Exchanger Market Report:

The Middle East and Africa region is expected to expand from $0.31 billion in 2023 to $0.62 billion by 2033, driven by increased regional investments in aviation infrastructure and the rise of air travel demand.Tell us your focus area and get a customized research report.

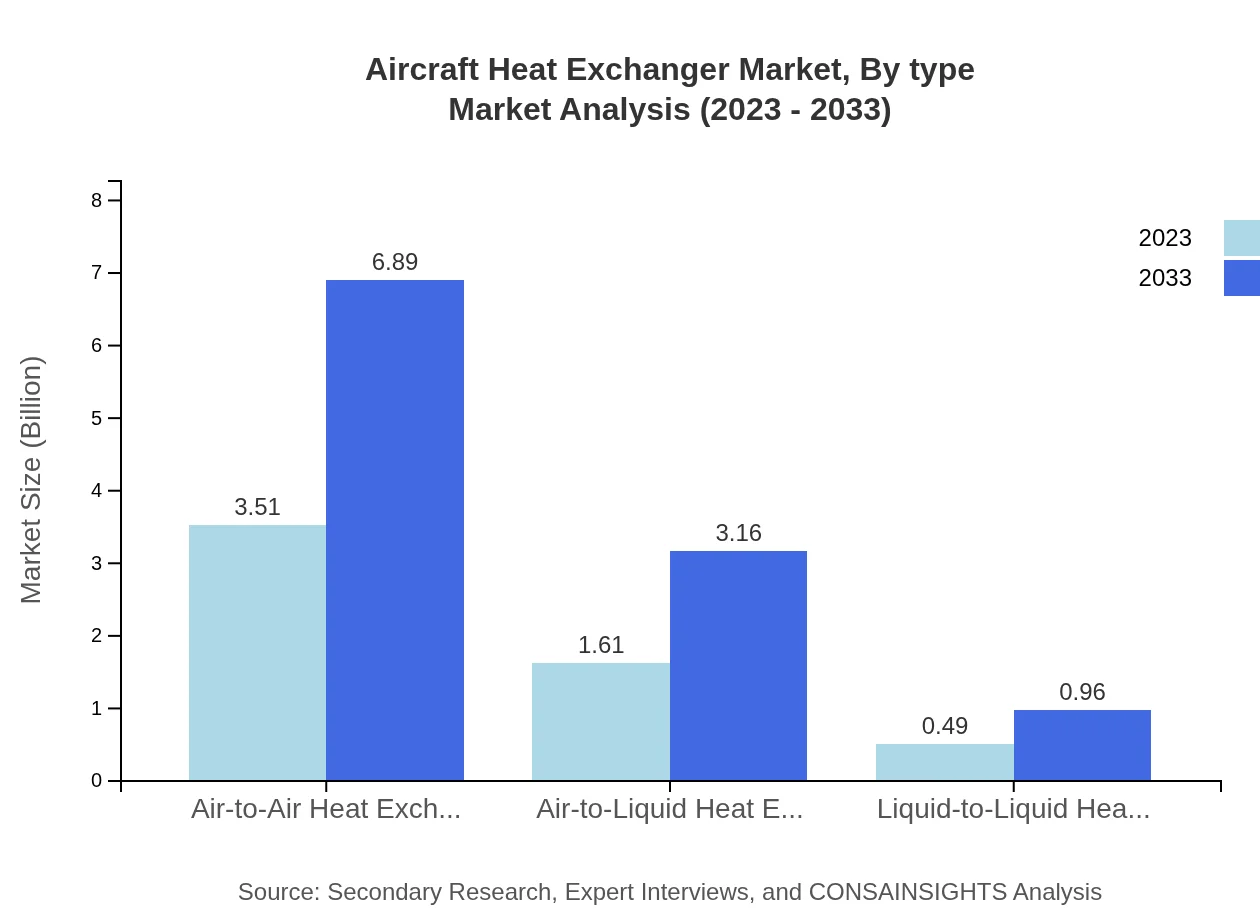

Aircraft Heat Exchanger Market Analysis By Type

Air-to-Air Heat Exchangers dominate the market, with a size of $3.51 billion in 2023 and projected growth to $6.89 billion by 2033, capturing a market share of about 62.63%. Air-to-Liquid Heat Exchangers follow with market sizes of $1.61 billion in 2023 to $3.16 billion in 2033, holding 28.69% share. Liquid-to-Liquid Heat Exchangers remain smaller but steadily growing, with $0.49 billion in 2023 increasing to $0.96 billion in 2033, representing 8.68%.

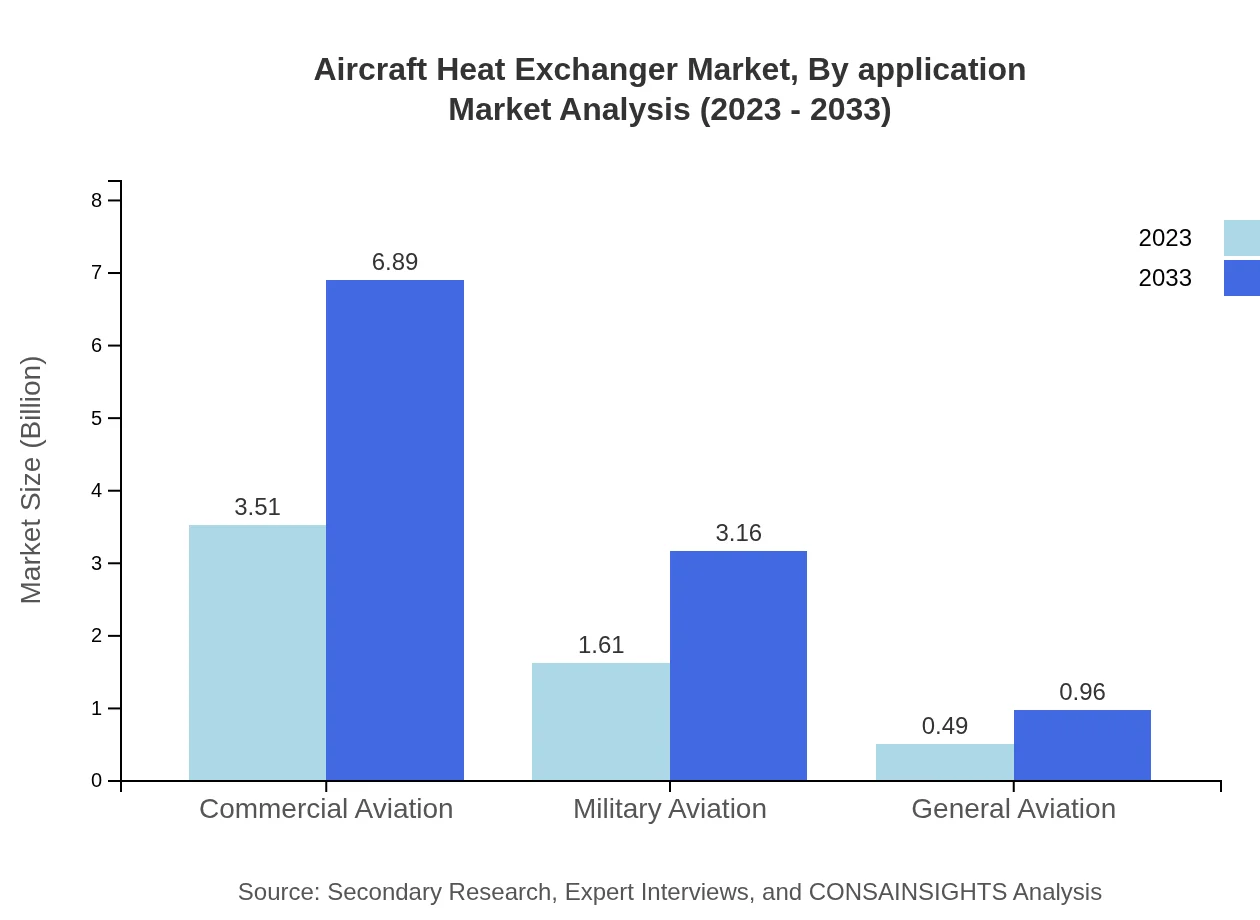

Aircraft Heat Exchanger Market Analysis By Application

The Commercial Aviation segment leads with $3.51 billion in size for 2023, expanding to $6.89 billion by 2033. Military Aviation also shows promising growth, from $1.61 billion to $3.16 billion during the same period, while General Aviation's smaller footprint grows from $0.49 billion to $0.96 billion, reflecting the overall trends in air travel behaviors.

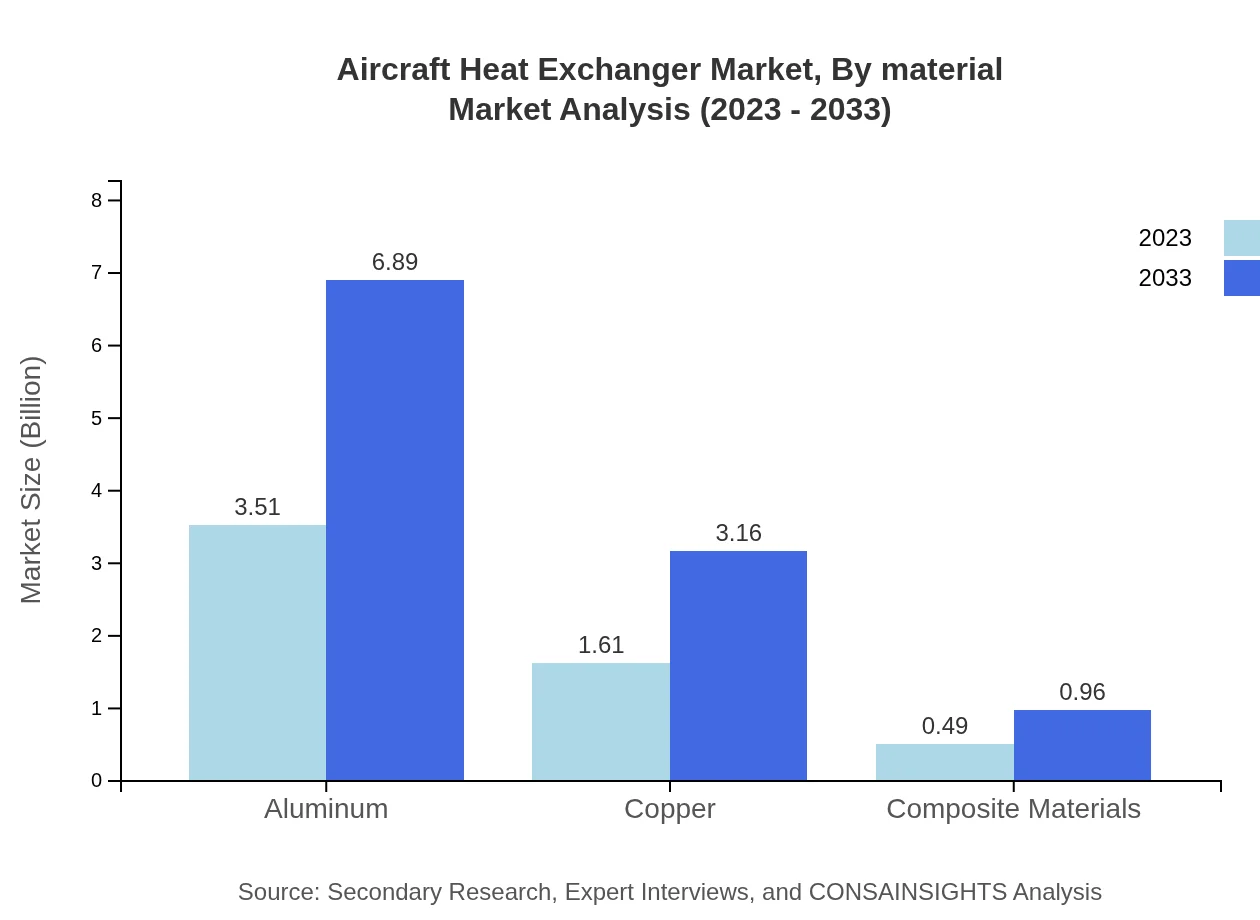

Aircraft Heat Exchanger Market Analysis By Material

Aluminum currently dominates the material segment, with a notable $3.51 billion market size in 2023, set to double by 2033. Copper and Composite Materials follow, with sizes projected to move from $1.61 billion to $3.16 billion and $0.49 billion to $0.96 billion, respectively, indicating a growing interest in weight-saving materials in aerospace applications.

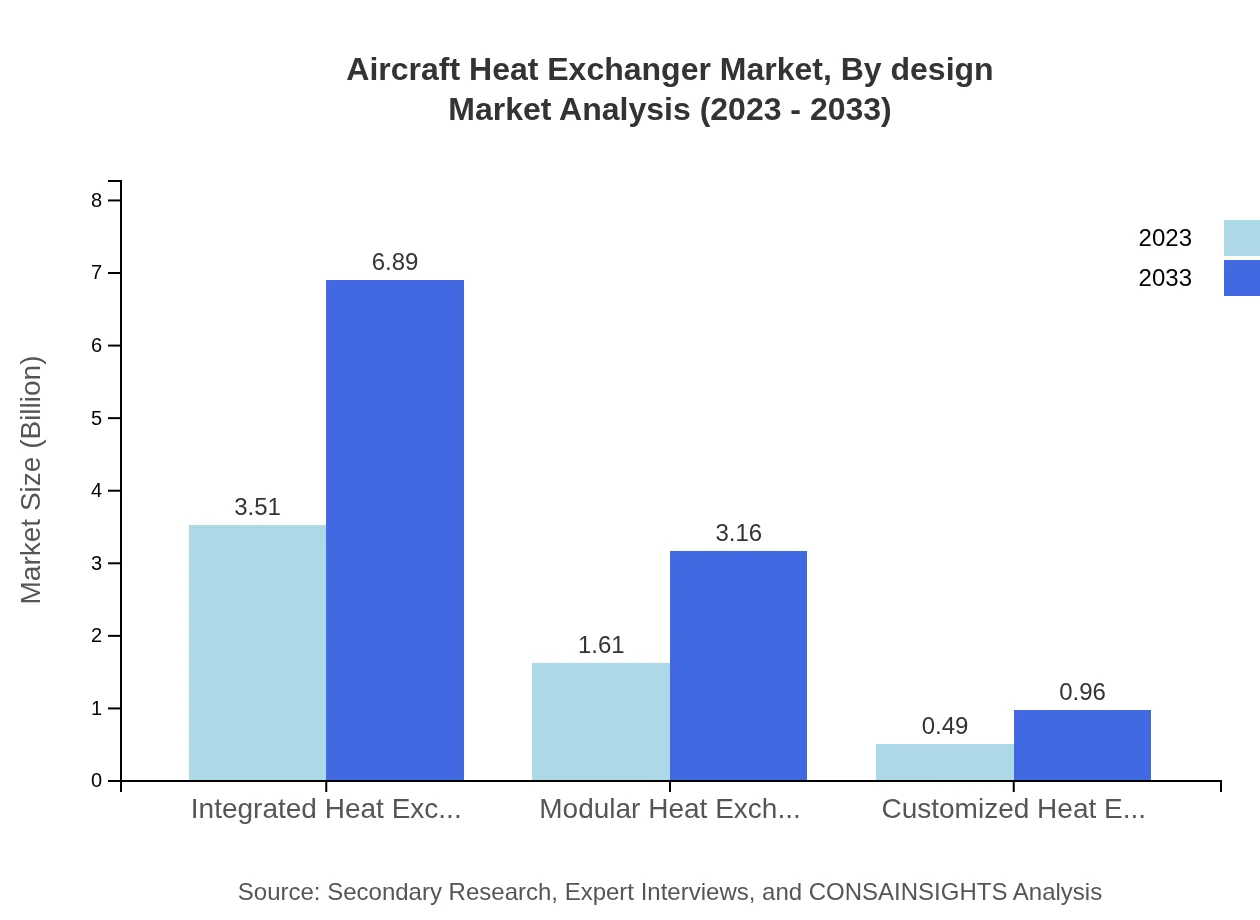

Aircraft Heat Exchanger Market Analysis By Design

Integrated and Modular Heat Exchangers lead the design segment with significant sizes expected to reach $6.89 billion by 2033, indicating efficient, adaptable solutions for thermal management. Customized designs, though smaller, are on the rise, forecasted to grow alongside industry-specific applications.

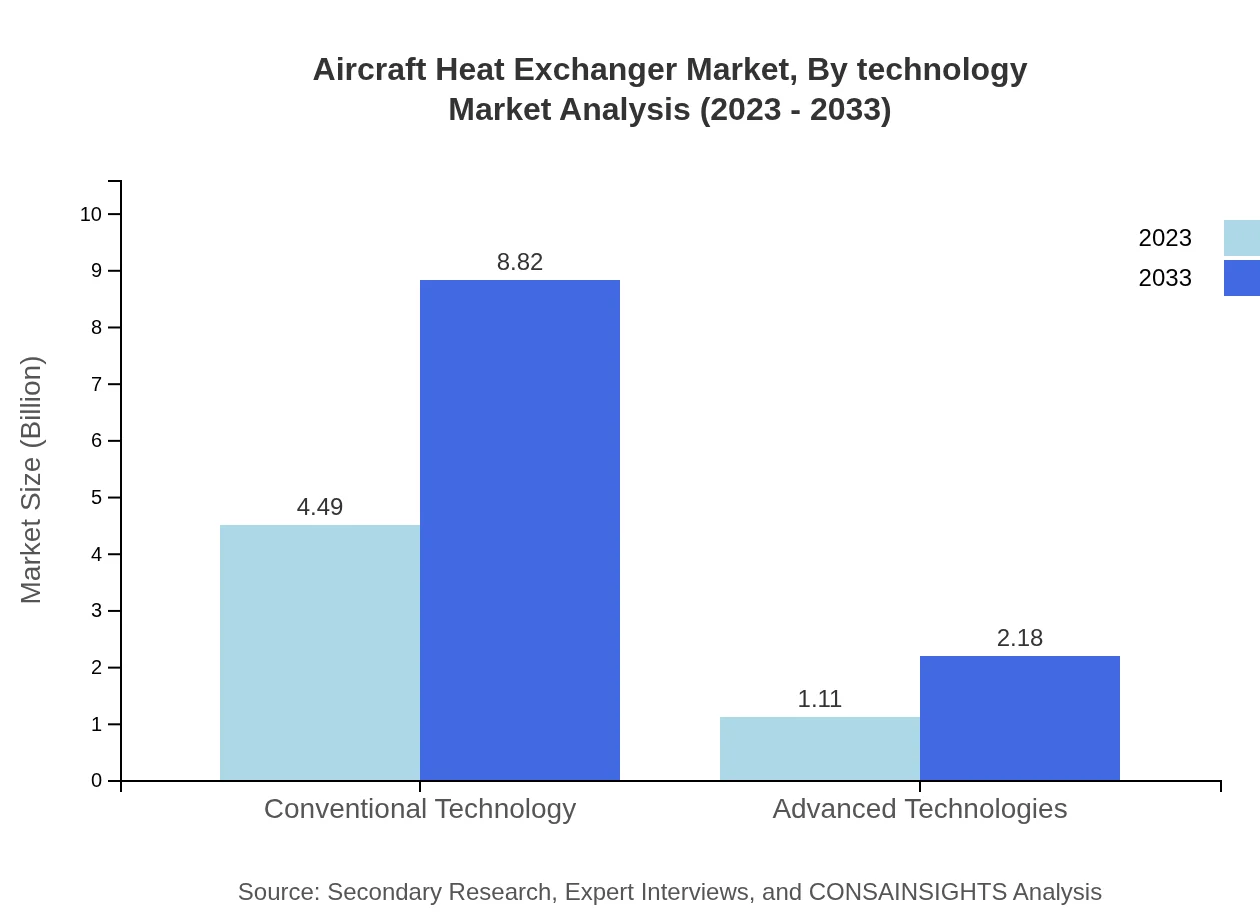

Aircraft Heat Exchanger Market Analysis By Technology

Conventional Technologies dominate significantly with a market size of $4.49 billion in 2023, projected to reach $8.82 billion in 2033. Advanced Technologies are gaining momentum with growth from $1.11 billion to $2.18 billion, driven by the need for efficiency and smarter energy management within aircraft systems.

Aircraft Heat Exchanger Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Heat Exchanger Industry

Eaton Corporation:

Eaton Corporation specializes in aircraft thermal management systems and provides innovative heat exchanger solutions that are highly regarded for reliability and performance.Northrop Grumman:

Northrop Grumman delivers advanced technologies in aerospace, including highly efficient heat exchangers suitable for military and commercial aviation applications.Honeywell International, Inc.:

Honeywell is known for its robust aviation solutions that incorporate cutting-edge heat exchanger designs aimed at enhancing aircraft efficiency and safety.Parker Hannifin Corporation:

Parker Hannifin offers an array of heat exchanger products, focusing on lightweight materials and innovative technologies to meet the demands of modern aircraft.Airbus:

Airbus, as a leading aircraft manufacturer, integrates advanced heat exchanger technologies to support their aircraft systems and sustainability goals.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Heat Exchanger?

The global aircraft heat exchanger market is valued at approximately $5.6 billion in 2023 and is expected to grow at a CAGR of 6.8%, reaching significantly higher figures by 2033. This growth reflects increased demand in aviation and advancements in technology.

What are the key market players or companies in this aircraft Heat Exchanger industry?

Key players in the aircraft heat exchanger market include major aerospace manufacturers and specialized heat exchanger production companies. These entities focus on innovation and efficiency in designing heat exchangers to improve performance in aircraft systems.

What are the primary factors driving the growth in the aircraft Heat Exchanger industry?

The growth of the aircraft heat exchanger market is driven by factors such as rising air travel demand, technological advancements in aircraft design, and the need for efficient thermal management systems to enhance aircraft performance and safety.

Which region is the fastest Growing in the aircraft Heat Exchanger?

The Asia Pacific region is projected to be the fastest-growing market for aircraft heat exchangers, expanding from $1.09 billion in 2023 to $2.14 billion by 2033, driven by increasing aircraft production and maintenance activities in emerging economies.

Does ConsaInsights provide customized market report data for the aircraft Heat Exchanger industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the aircraft heat exchanger industry, ensuring relevant insights and detailed analysis to support business decisions.

What deliverables can I expect from this aircraft Heat Exchanger market research project?

Deliverables from the aircraft heat exchanger market research project include comprehensive reports, market forecasts, competitive analysis, and detailed insights on regional and segment trends over the specified time frame.

What are the market trends of aircraft Heat Exchanger?

Current market trends in the aircraft heat exchanger industry include a shift towards lightweight materials, increased adoption of advanced technologies, and a growing focus on environmental sustainability in the design and operation of aircraft systems.