Aircraft Hydraulic System Market Report

Published Date: 22 January 2026 | Report Code: aircraft-hydraulic-system

Aircraft Hydraulic System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Aircraft Hydraulic System market, covering market dynamics, trends, size, and growth forecasts for the period from 2023 to 2033. It aims to deliver insights on market segmentation, regional analysis, key players, and technological advancements shaping the industry.

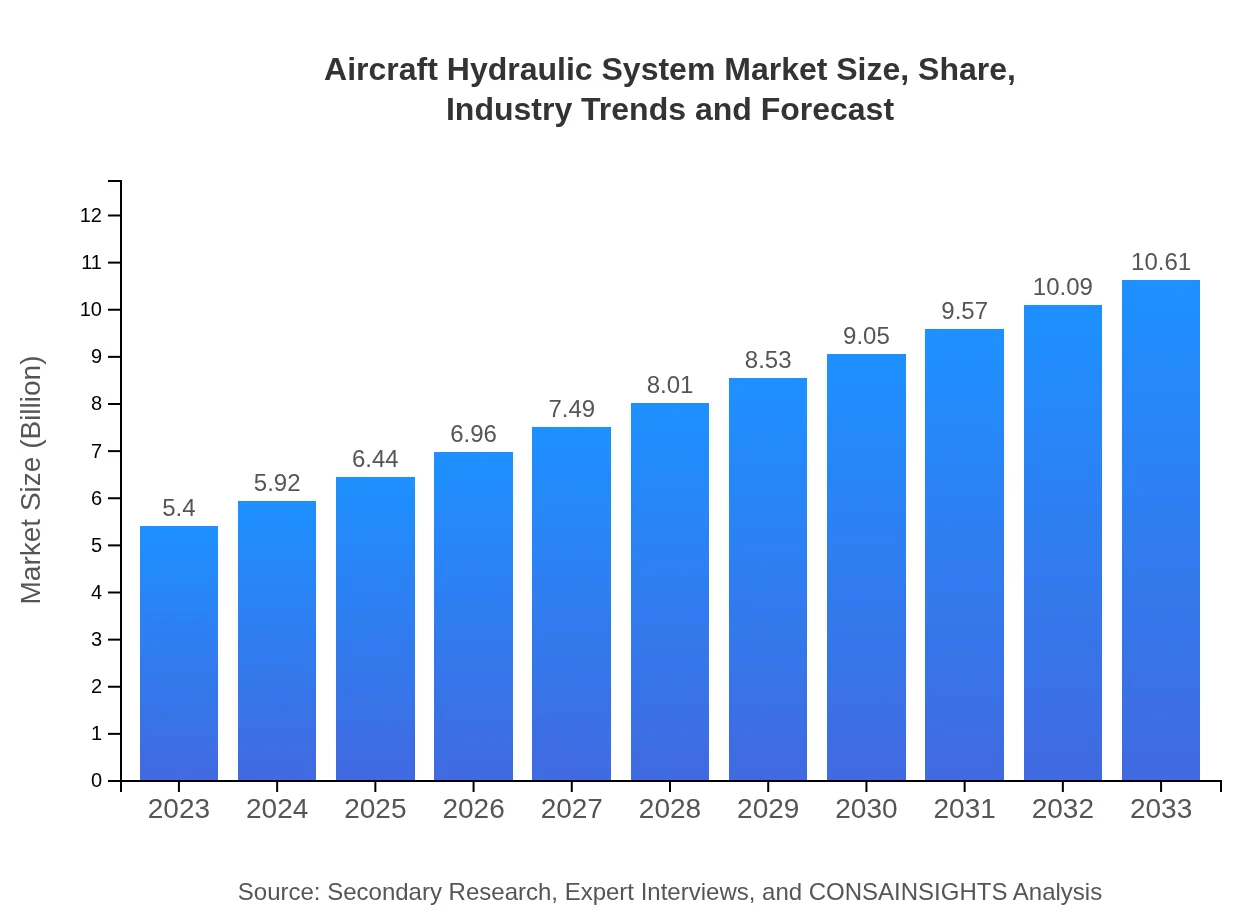

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.61 Billion |

| Top Companies | Boeing , Airbus, Parker Hannifin, Honeywell , Moog Inc. |

| Last Modified Date | 22 January 2026 |

Aircraft Hydraulic System Market Overview

Customize Aircraft Hydraulic System Market Report market research report

- ✔ Get in-depth analysis of Aircraft Hydraulic System market size, growth, and forecasts.

- ✔ Understand Aircraft Hydraulic System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Hydraulic System

What is the Market Size & CAGR of Aircraft Hydraulic System market in 2023?

Aircraft Hydraulic System Industry Analysis

Aircraft Hydraulic System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Hydraulic System Market Analysis Report by Region

Europe Aircraft Hydraulic System Market Report:

Europe reported a market size of $1.47 billion in 2023, forecasted to grow to $2.89 billion by 2033. Growth is propelled by stringent safety regulations and increasing airline efficiency demands. Further investments in R&D by European aerospace companies are fostering innovations in hydraulic technologies.Asia Pacific Aircraft Hydraulic System Market Report:

In the Asia Pacific region, the Aircraft Hydraulic System market was valued at $1.02 billion in 2023 and is expected to reach $2.01 billion by 2033. This rapid growth is driven by increasing air travel demand and rising investments in the aerospace industry, particularly from countries like China and India. Regional initiatives to enhance manufacturing capabilities and establish MRO facilities also contribute significantly to market growth.North America Aircraft Hydraulic System Market Report:

In North America, the market was valued at $2.10 billion in 2023, with an expected increase to $4.12 billion by 2033. The region represents a significant share of the global market due to its mature aerospace industry, high aircraft production levels, and advanced technology adoption driven by leading aircraft manufacturers and a robust MRO framework.South America Aircraft Hydraulic System Market Report:

The South American Aircraft Hydraulic System market is relatively smaller, valued at $0.18 billion in 2023, projected to reach $0.35 billion by 2033. The regional market growth is primarily influenced by increasing air traffic, yet it faces challenges such as economic fluctuations and limited investments compared to more developed regions.Middle East & Africa Aircraft Hydraulic System Market Report:

The market in the Middle East and Africa, valued at $0.63 billion in 2023, is expected to reach $1.24 billion by 2033. A growing focus on increasing passenger air travel and investments in airport infrastructure in the Middle East is driving the market, alongside the need for modernizing military fleets in various African nations.Tell us your focus area and get a customized research report.

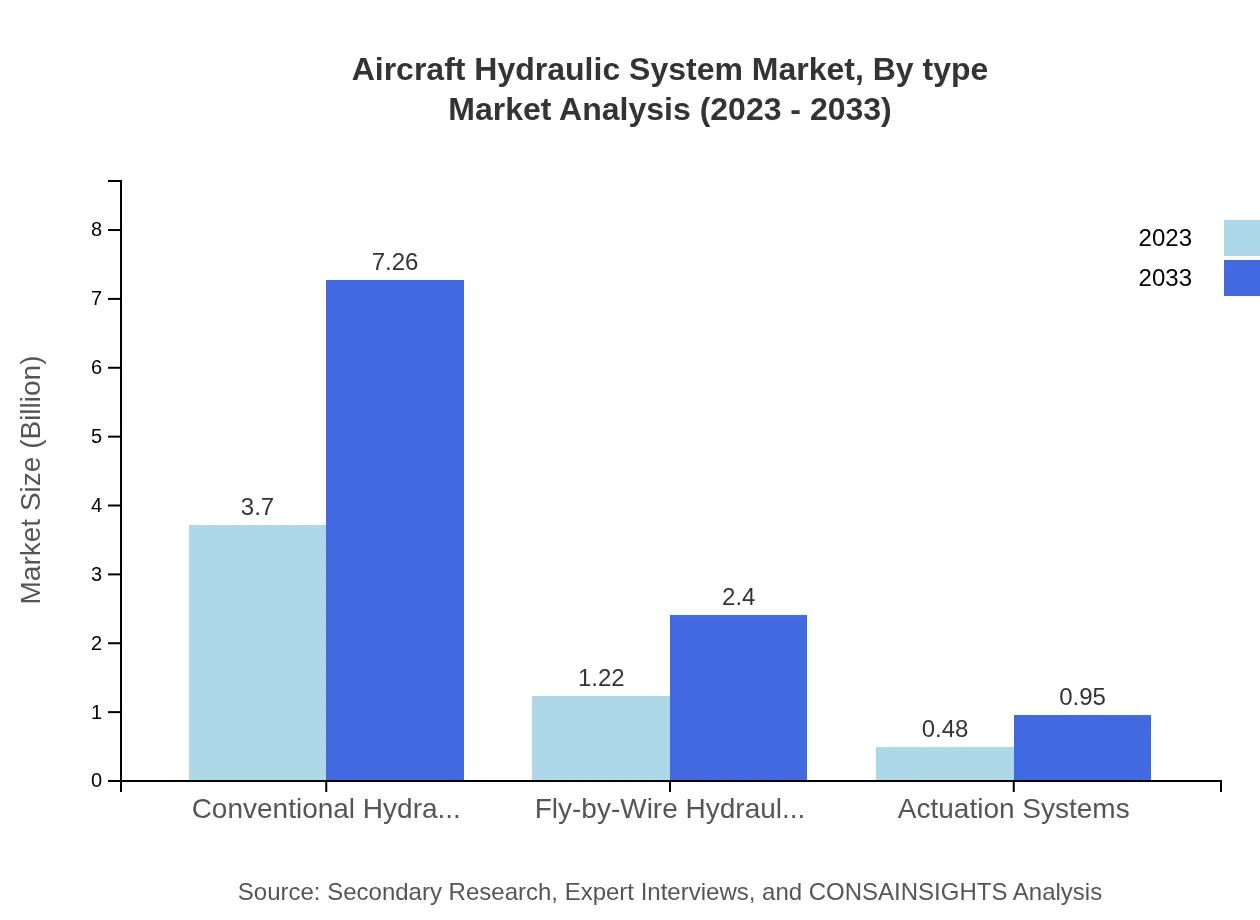

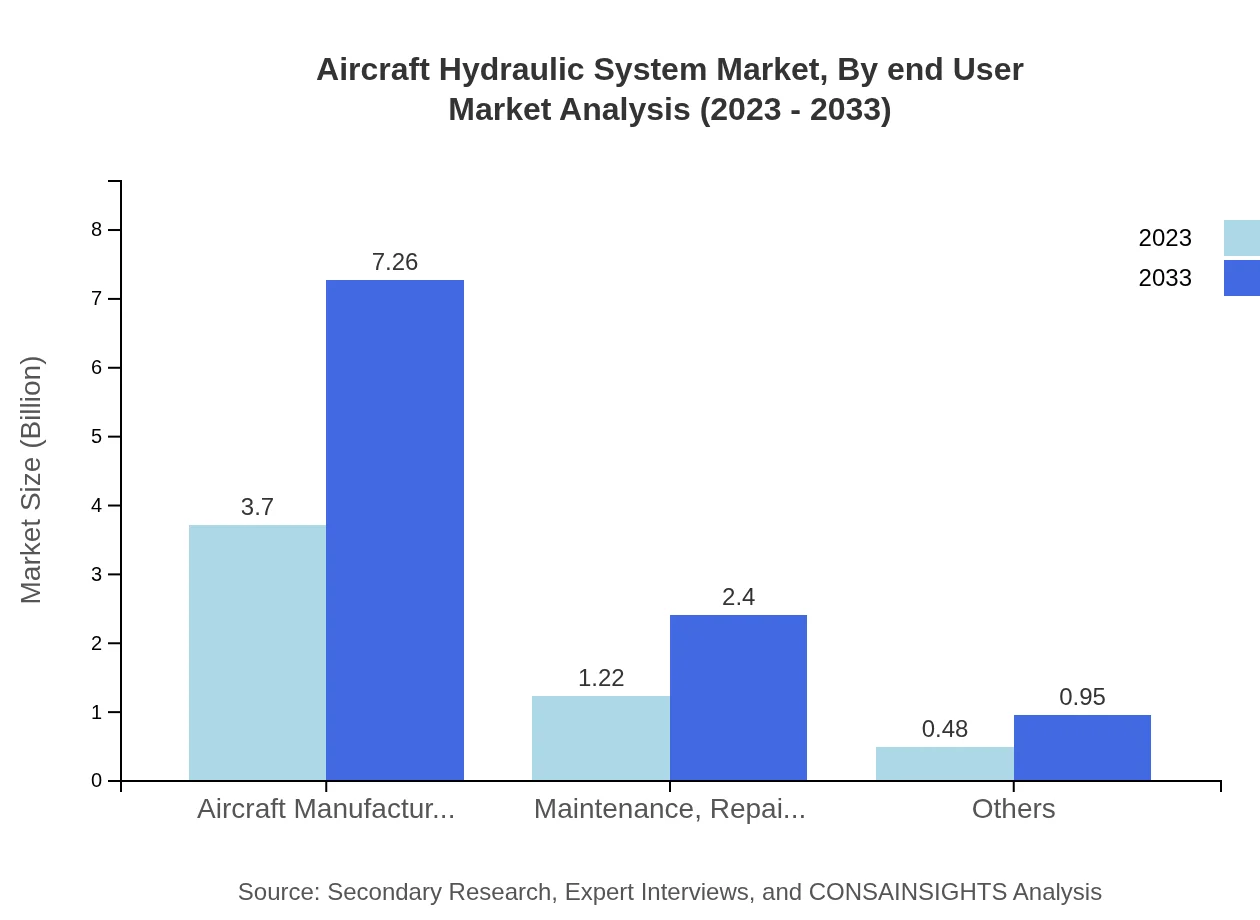

Aircraft Hydraulic System Market Analysis By Type

In terms of type, the Conventional Hydraulic Systems segment dominated the market with a size of $3.70 billion in 2023 and projected to reach $7.26 billion by 2033. Fly-by-Wire Hydraulic Systems, valued at $1.22 billion in 2023, are anticipated to grow to $2.40 billion. Actuation Systems accounted for $0.48 billion, expected to reach $0.95 billion in the same period. Overall, Conventional Systems hold a substantial market share due to their widespread adoption across various aircraft types.

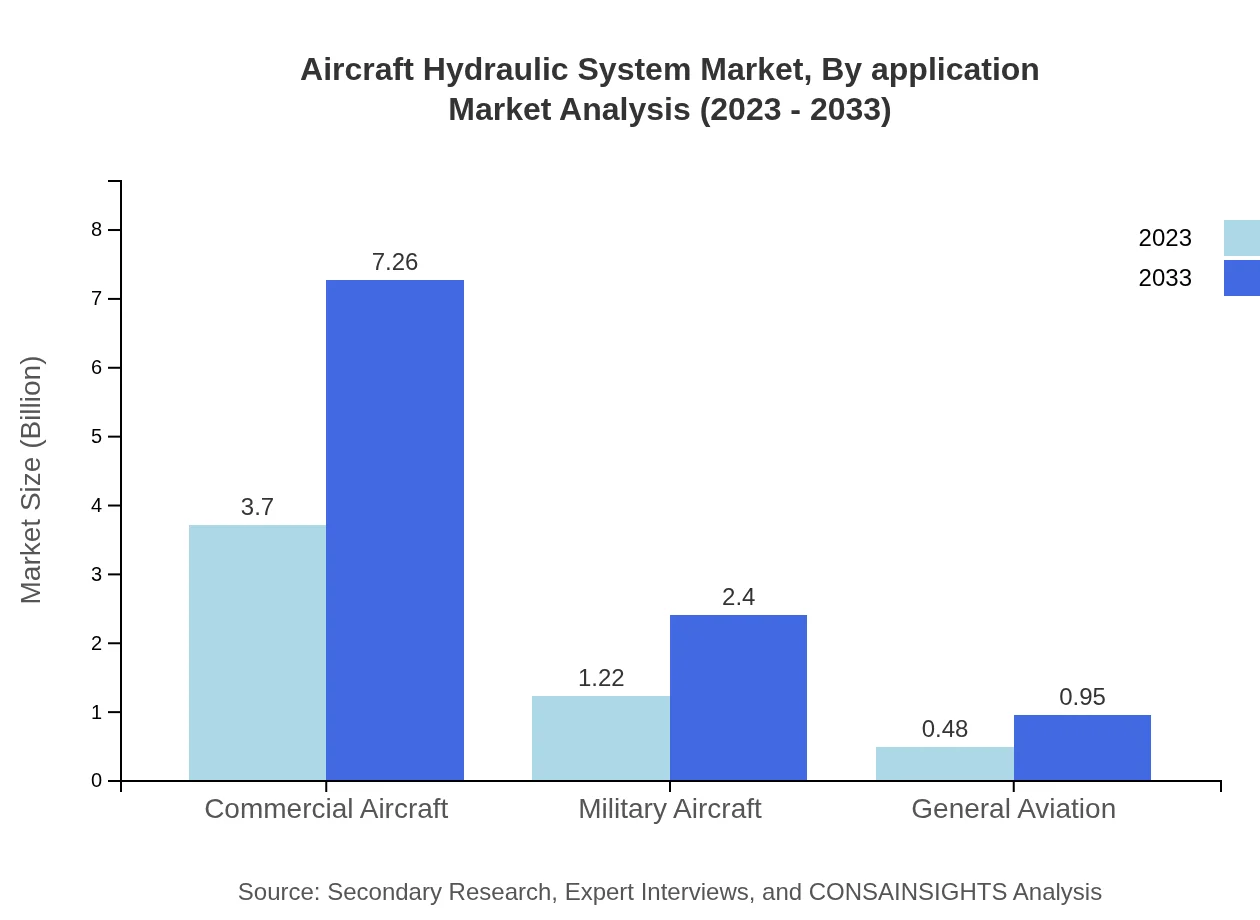

Aircraft Hydraulic System Market Analysis By Application

The application segmentation highlights the emphasis on Commercial Aircraft, which represented $3.70 billion in 2023, growing to $7.26 billion by 2033. Military Aircraft holds a significant share at $1.22 billion, expected to increase to $2.40 billion, highlighting the ongoing investment in military infrastructure. General Aviation contributes with a market size of $0.48 billion, projected to reach $0.95 billion. The consistent demand in commercial applications remains the key driver for innovation in product offerings.

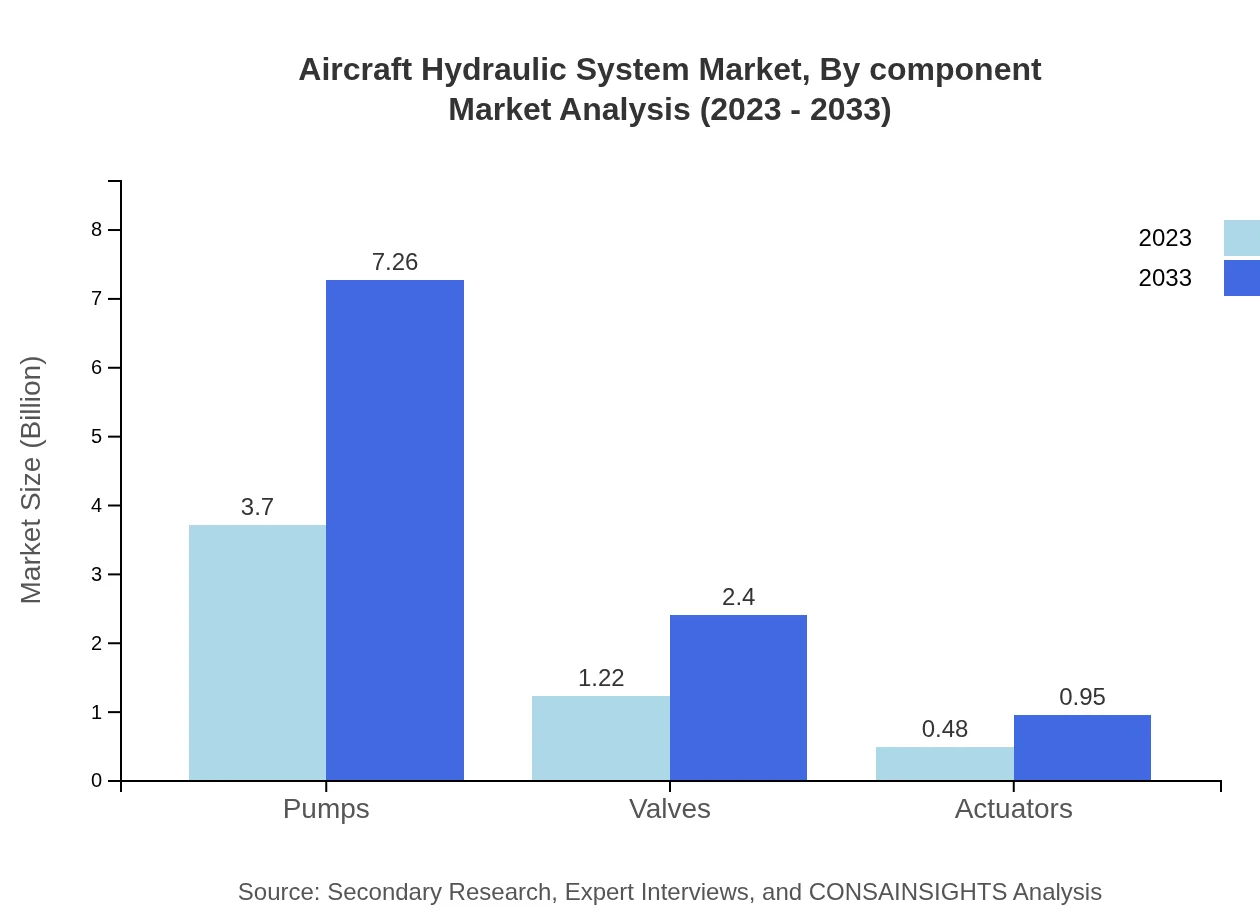

Aircraft Hydraulic System Market Analysis By Component

Components include Pumps, valued at $3.70 billion, expected to maintain a share of 68.45% through 2033, and Valves at $1.22 billion aiming for continuous growth. Actuators represent a smaller yet crucial group with $0.48 billion in 2023, important for specific applications. All components are vital for system efficiency and reliability, driving continuous improvements and innovations.

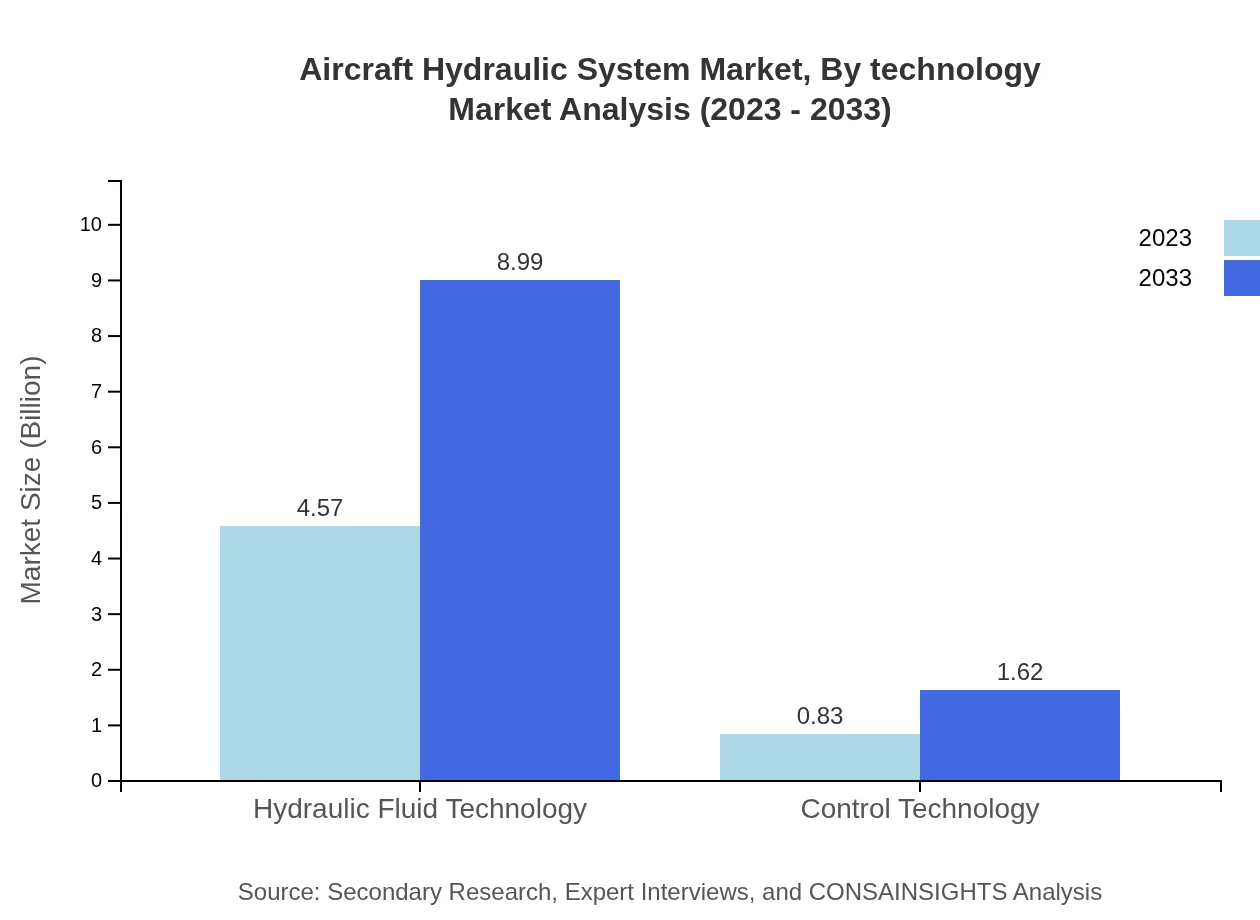

Aircraft Hydraulic System Market Analysis By Technology

Technological advancements play a significant role, with Hydraulic Fluid Technology valued at $4.57 billion and expected to rise, indicating the push for advanced lubricants to enhance system performance and longevity. Control Technology is estimated at $0.83 billion, focusing on integrating semi-autonomous and autonomous systems for improved safety and efficiency. Continuous technological improvements are crucial for sustaining competitiveness.

Aircraft Hydraulic System Market Analysis By End User

End-users primarily include aircraft manufacturers and MRO operators, with manufacturers consuming significant hydraulic systems due to their integration in new aircraft designs, thereby maintaining a significant market share. MRO operations are expected to grow as aging aircraft fleets require modern system upgrades and retrofits to improve operational effectiveness.

Aircraft Hydraulic System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Hydraulic System Industry

Boeing :

Boeing is a leading aerospace company that significantly invests in hydraulic system technologies to enhance aircraft functionality and safety while maintaining a competitive edge in the aviation industry.Airbus:

Airbus, a global leader in aeronautics, develops state-of-the-art hydraulic systems integrated with its aircraft designs, focusing on innovation and efficiency.Parker Hannifin:

Parker Hannifin provides advanced hydraulic solutions for aviation, focusing on system integration and reliability, catering to both commercial and military aircraft markets.Honeywell :

Honeywell is known for its expertise in flight control systems, including hydraulic systems that offer cutting-edge technological solutions to various aircraft manufacturers.Moog Inc.:

Moog Inc., a premium designer and manufacturer of motion control products, supplies hydraulic systems and components critical for high-performance aircraft applications.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Hydraulic System?

The aircraft hydraulic system market is projected to reach approximately $5.4 billion by 2033, growing from a current value of $3.70 billion, with a CAGR of 6.8% during the period.

What are the key market players or companies in this aircraft Hydraulic System industry?

Key players in the aircraft hydraulic system market include major manufacturers, suppliers, and OEMs. They play vital roles in driving innovation and market stability through advanced systems and components.

What are the primary factors driving the growth in the aircraft Hydraulic System industry?

The growth is driven by the increasing demand for commercial and military aircraft, advancements in hydraulic technology, and the growing focus on reducing aircraft weight and enhancing efficiency.

Which region is the fastest Growing in the aircraft Hydraulic System?

North America is the fastest-growing region, with the market growing from $2.10 billion in 2023 to $4.12 billion by 2033, driven by significant investments in aerospace technologies and infrastructure.

Does ConsaInsights provide customized market report data for the aircraft Hydraulic System industry?

Yes, ConsaInsights offers customized market report data that caters to specific needs in the aircraft hydraulic system industry, providing tailored insights and analysis.

What deliverables can I expect from this aircraft Hydraulic System market research project?

You can expect comprehensive market analysis reports, including market size, growth forecasts, competitive analysis, and detailed segmentation across various factors in the aircraft hydraulic system industry.

What are the market trends of aircraft Hydraulic System?

Current trends include increased adoption of fly-by-wire technology, advancements in hydraulic fluid technology, and a push towards more environmentally friendly hydraulic solutions to enhance aircraft performance.