Aircraft Interface Device Market Size, Share, Industry Trends and Forecast to 2033

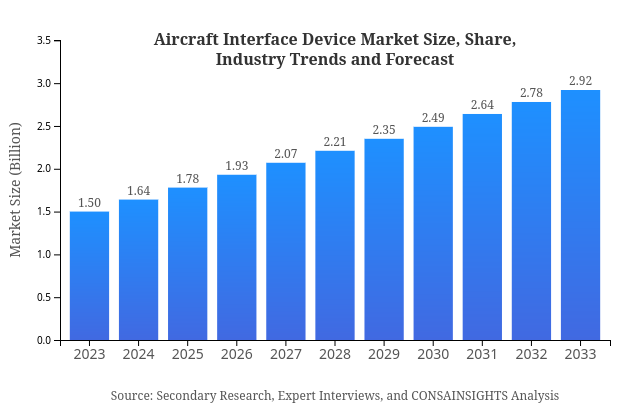

This report provides an in-depth analysis of the Aircraft Interface Device market, covering key insights from 2023 to 2033, including market size, industry trends, regional analyses, and the influence of emerging technologies.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $2.92 Billion |

| Top Companies | Honeywell Aerospace, Rockwell Collins, Garmin, Zodiac Aerospace |

| Last Modified Date | 27 February 2025 |

Aircraft Interface Device Market Overview

What is the Market Size & CAGR of Aircraft Interface Device market in 2023?

Aircraft Interface Device Industry Analysis

Aircraft Interface Device Market Segmentation and Scope

Request a custom research report for industry.

Aircraft Interface Device Market Analysis Report by Region

Europe Aircraft Interface Device Market Report:

Europe's market is anticipated to grow from USD 0.43 billion in 2023 to USD 0.84 billion by 2033. The focus on safety and environmental impact in aviation supports innovation in interface devices.Asia Pacific Aircraft Interface Device Market Report:

In the Asia Pacific region, the Aircraft Interface Device market is projected to grow from USD 0.29 billion in 2023 to USD 0.57 billion by 2033, driven by increasing air travel demand and expansion of local airlines.North America Aircraft Interface Device Market Report:

North America holds a dominant position in the market, with an estimated value of USD 0.54 billion in 2023, projected to rise to USD 1.05 billion by 2033. The region benefits from a robust aerospace sector and strong investments in aviation technology.South America Aircraft Interface Device Market Report:

The South American market is expected to increase from USD 0.13 billion in 2023 to USD 0.25 billion by 2033. Factors such as regional tourism growth and a rise in aircraft modernization initiatives are significant contributors.Middle East & Africa Aircraft Interface Device Market Report:

In the Middle East and Africa, growth is slower, moving from USD 0.10 billion in 2023 to USD 0.20 billion by 2033, influenced by infrastructural developments and the increasing significance of air travel in regional connectivity.Request a custom research report for industry.

Aircraft Interface Device Market Analysis By Product

Global Aircraft Interface Device Market, By Product Market Analysis (2024 - 2033)

The product segment of the Aircraft Interface Device market includes adapters, controllers, and software, with adapters leading the market share due to their critical role in enabling connectivity across systems. In 2023, the adapters market is valued at USD 0.95 billion, expected to reach USD 1.84 billion by 2033. Controllers represent a significant component of this segment, valued at USD 0.38 billion in 2023, projected to grow to USD 0.74 billion by 2033.

Aircraft Interface Device Market Analysis By Application

Global Aircraft Interface Device Market, By Application Market Analysis (2024 - 2033)

Applications of Aircraft Interface Devices are prevalent across commercial, military, and business aviation sectors. The commercial aviation segment dominates the market, valued at USD 0.95 billion in 2023, forecasted to achieve USD 1.84 billion by 2033. Military aviation applications are also noteworthy, growing from USD 0.38 billion to USD 0.74 billion during the same period.

Aircraft Interface Device Market Analysis By Technology

Global Aircraft Interface Device Market, By Technology Market Analysis (2024 - 2033)

The technology segment of the Aircraft Interface Device market includes both wired and wireless technologies. Wired technology holds a substantial share at 87.38% in 2023, valued at USD 1.31 billion, predicted to reach USD 2.55 billion by 2033. Wireless technology represents a growing niche, moving from USD 0.19 billion to USD 0.37 billion in the same timeframe.

Aircraft Interface Device Market Analysis By End User

Global Aircraft Interface Device Market, By End-User Market Analysis (2024 - 2033)

End-user segments include airlines, fleet operators, and maintenance, repair, and overhaul (MRO) organizations. Airlines represent the largest share at 63.09% in 2023, with market growth from USD 0.95 billion to USD 1.84 billion by 2033. Fleet operators and MRO organizations are also significant players, expected to expand in line with growing fleet sizes and operational complexities.

Aircraft Interface Device Market Analysis By Distribution Channel

Global Aircraft Interface Device Market, By Distribution Channel Market Analysis (2024 - 2033)

Distribution channels in the Aircraft Interface Device market comprise direct sales, distributors, and e-commerce. Direct sales capture the largest segment, with a share of 63.09% in 2023, forecasted to persist in dominance through 2033. E-commerce is emerging as a vital distribution avenue, growing moderately alongside the trend towards digitization in procurement.

Aircraft Interface Device Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in Aircraft Interface Device Industry

Honeywell Aerospace:

A key player in aviation technology, providing advanced aircraft interface solutions that enhance operational efficiency and safety features.Rockwell Collins:

A leading manufacturer of aviation electronics, specializing in interface devices that ensure seamless data transfer and communication across systems.Garmin:

Renowned for innovative navigation technologies, Garmin also develops interface devices that improve connectivity and pilot control.Zodiac Aerospace:

A major contributor to aircraft systems, providing solutions for interfacing devices that integrate seamlessly with complex aviation technologies.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of aircraft Interface Device?

The global aircraft interface device market is valued at approximately $1.5 billion in 2023 and is projected to reach $2.81 billion by 2033, growing at a CAGR of 6.7% over the period.

What are the key market players or companies in this aircraft Interface Device industry?

Notable players in the aircraft interface device market include major aerospace and technology firms like Honeywell, Rockwell Collins, and Thales. Their innovations and competitive strategies significantly impact industry dynamics.

What are the primary factors driving the growth in the aircraft interface device industry?

Key growth drivers include the increasing demand for efficient flight operations, regulatory requirements for improved safety and performance, and advancements in smart technologies and connectivity in aviation.

Which region is the fastest Growing in the aircraft interface device?

Asia Pacific is the fastest-growing region for aircraft interface devices, with market size expected to grow from $0.29 billion in 2023 to $0.57 billion by 2033, showcasing a significant CAGR.

Does ConsaInsights provide customized market report data for the aircraft interface device industry?

Yes, ConsaInsights offers tailored market reports to meet specific client needs in the aircraft interface device industry, providing accurate data and insights for informed decision-making.

What deliverables can I expect from this aircraft interface device market research project?

Deliverables from the research project include comprehensive reports, detailed segment analyses, market forecasts, competitive landscape assessments, and actionable insights tailored to client's strategic goals.

What are the market trends of aircraft interface device?

Current trends include increased adoption of digital technologies, a shift towards wireless communication in aviation, and emerging applications in military and commercial sectors, driving innovation in aircraft interface devices.