Aircraft Lighting Systems Market Report

Published Date: 03 February 2026 | Report Code: aircraft-lighting-systems

Aircraft Lighting Systems Market Size, Share, Industry Trends and Forecast to 2033

This market report provides comprehensive insights into the Aircraft Lighting Systems sector, covering market trends, size forecasts, regional analyses, and technological advancements from 2023 to 2033.

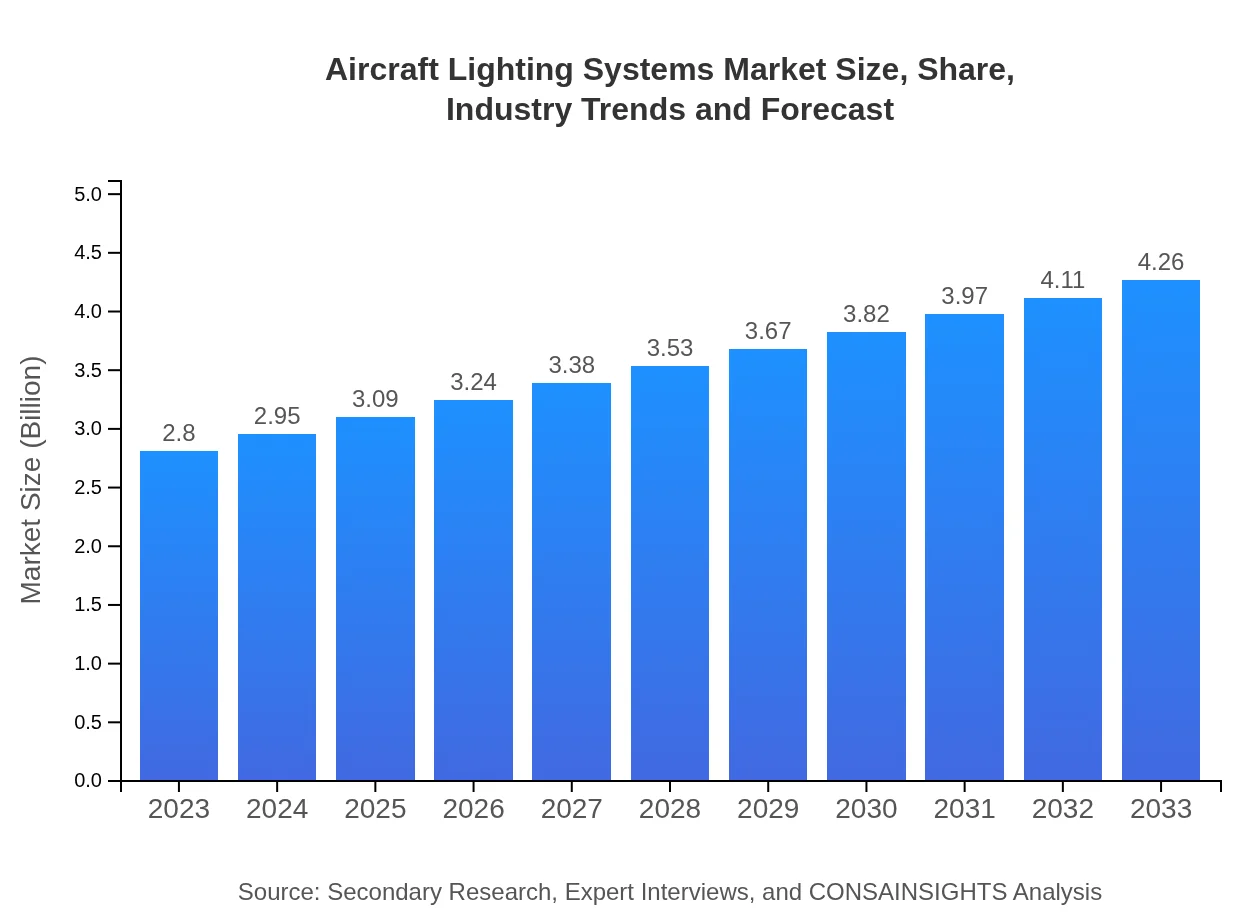

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $4.26 Billion |

| Top Companies | Honeywell International Inc., Diehl Aerospace, Rockwell Collins, Cobham plc, L-3 Communications |

| Last Modified Date | 03 February 2026 |

Aircraft Lighting Systems Market Overview

Customize Aircraft Lighting Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Lighting Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Lighting Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Lighting Systems

What is the Market Size & CAGR of Aircraft Lighting Systems market in 2023 and 2033?

Aircraft Lighting Systems Industry Analysis

Aircraft Lighting Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Lighting Systems Market Analysis Report by Region

Europe Aircraft Lighting Systems Market Report:

The European market stands at $0.71 billion in 2023, with forecasts indicating a rise to $1.08 billion by 2033. Growth drivers include stringent safety regulations, modernized fleet requirements, and an increase in passenger traffic.Asia Pacific Aircraft Lighting Systems Market Report:

As of 2023, the Asia Pacific region holds a market share of approximately $0.56 billion, expected to grow to $0.85 billion by 2033. The growth is propelled by rising air travel demand, increased government expenditure on aviation infrastructure, and a growing number of aircraft deliveries.North America Aircraft Lighting Systems Market Report:

North America leads the market with an estimated size of $1.09 billion in 2023, expanding to $1.65 billion by 2033. The region's dominance is attributed to the high volume of aircraft operations and significant investments in safety and comfort enhancements.South America Aircraft Lighting Systems Market Report:

In South America, the market is currently valued at $0.05 billion in 2023, projected to reach $0.08 billion by 2033. Factors fueling this trend include growing regional airlines and an increase in the number of commercial flights.Middle East & Africa Aircraft Lighting Systems Market Report:

The Middle East and Africa market is currently valued at $0.39 billion in 2023, expected to grow to $0.59 billion by 2033. Rapid aviation sector growth, driven by tourism and business travel, significantly contributes to this increase.Tell us your focus area and get a customized research report.

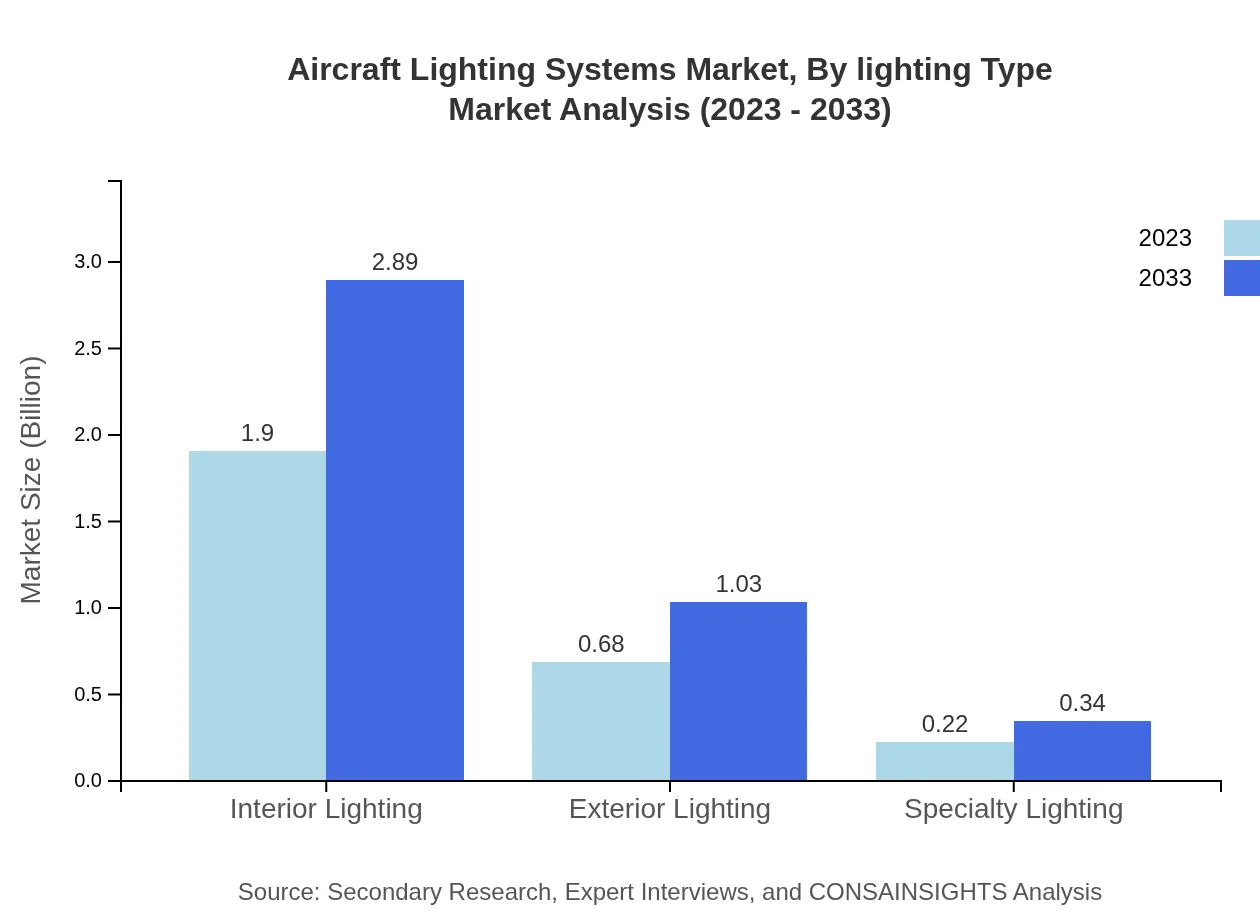

Aircraft Lighting Systems Market Analysis By Lighting Type

The Aircraft Lighting Systems market can be categorized into interior lighting, exterior lighting, and specialty lighting. - **Interior Lighting**: Valued at $1.90 billion in 2023, growing to $2.89 billion by 2033. - **Exterior Lighting**: Starting from $0.68 billion in 2023, expected to rise to $1.03 billion by 2033. - **Specialty Lighting**: Holding a market value of $0.22 billion in 2023, predicted to increase to $0.34 billion by 2033. Indoor lighting remains dominant, driven by the focus on enhancing passenger experience.

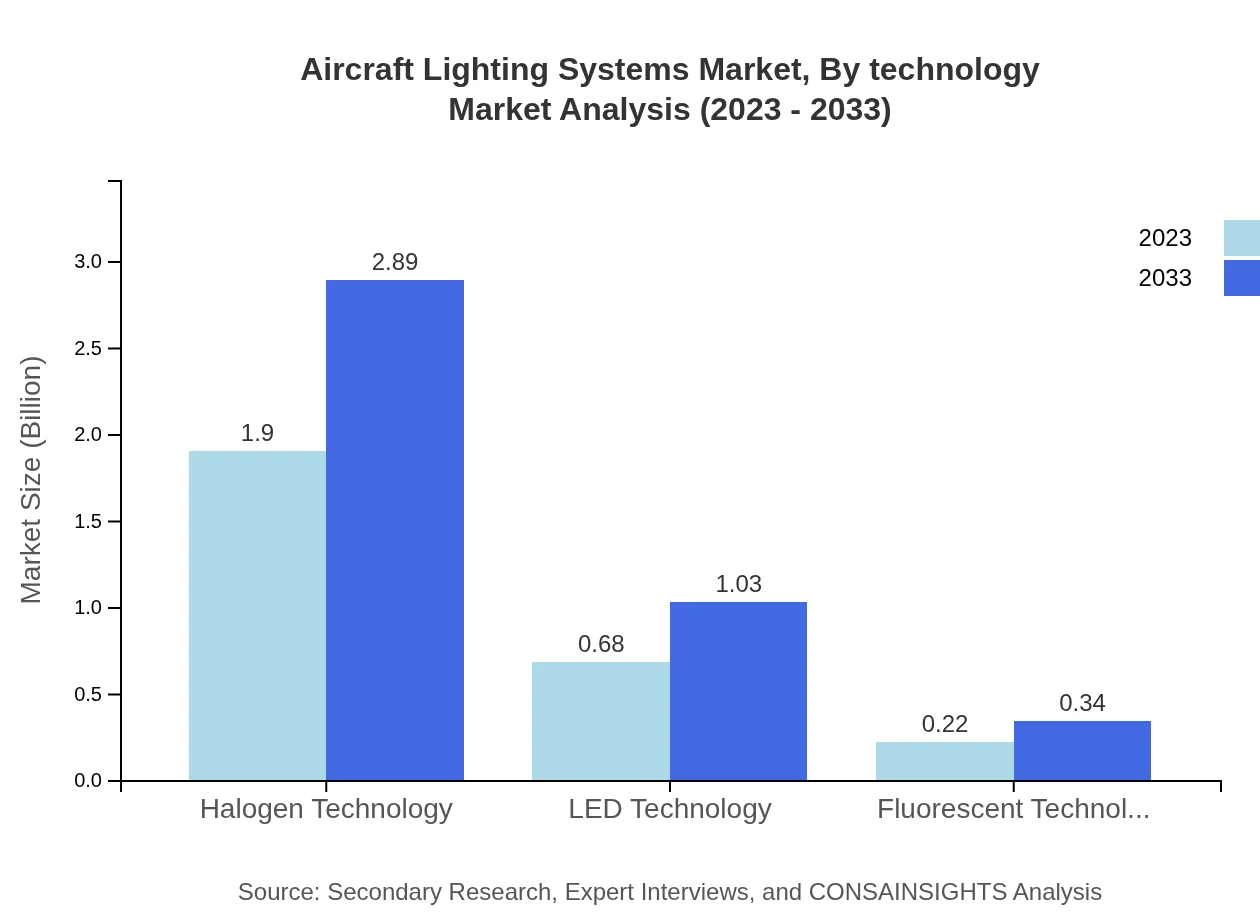

Aircraft Lighting Systems Market Analysis By Technology

The market is segmented into halogen, LED, and fluorescent technologies. - **Halogen Technology**: Commands a market size of $1.90 billion in 2023, expected to remain at 67.83% market share. - **LED Technology**: Growing from $0.68 billion in 2023 to $1.03 billion by 2033, capturing 24.27% market share. - **Fluorescent Technology**: Registered at $0.22 billion in 2023, anticipated to hold a 7.9% share. The shift towards LED technology is prominent due to efficiency and lifespans.

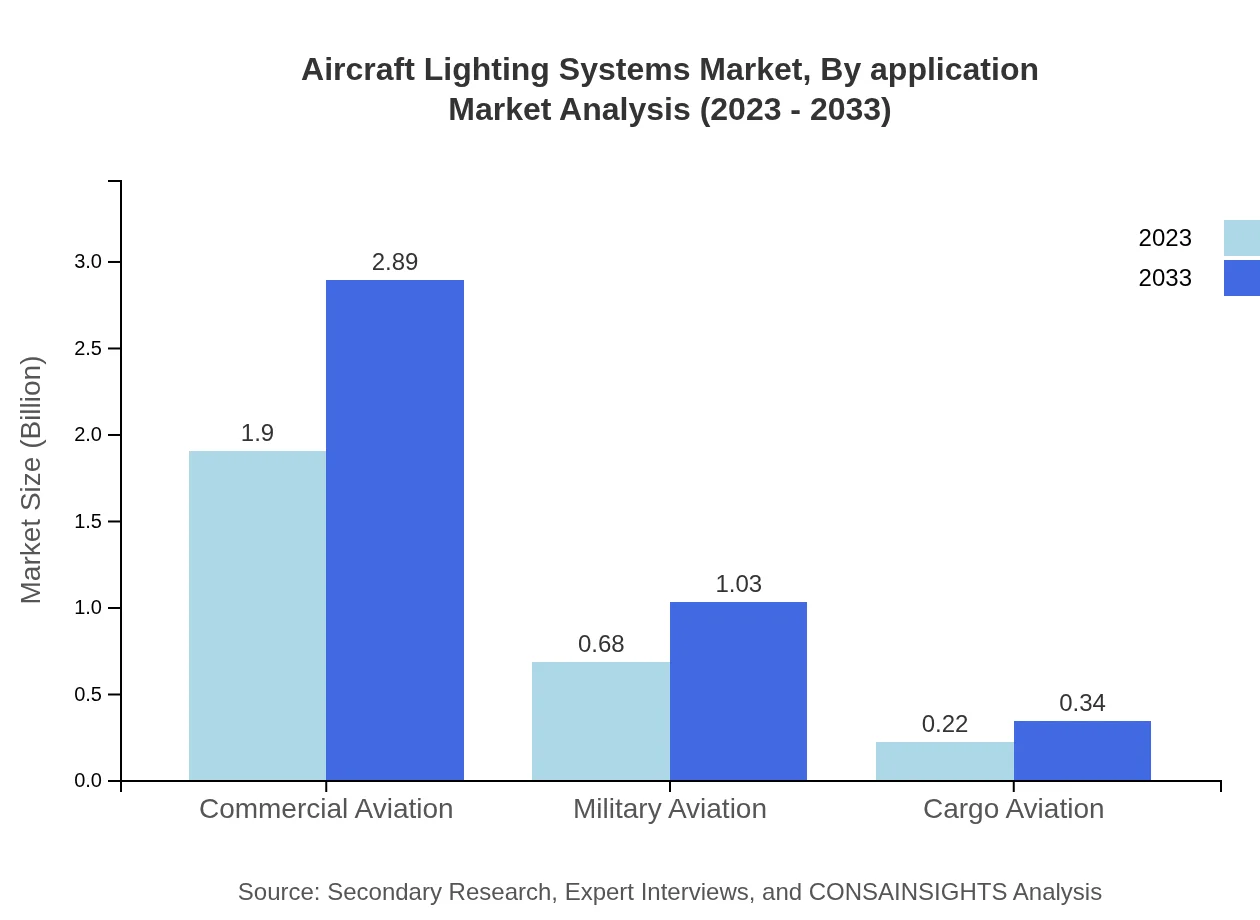

Aircraft Lighting Systems Market Analysis By Application

Two main segments: commercial aviation and military aviation. - **Commercial Aviation**: Valued at $1.90 billion in 2023, on track to reach $2.89 billion by 2033. - **Military Aviation**: Currently valued at $0.68 billion, growing to $1.03 billion by 2033. The need for enhanced operational capabilities drives the military sector.

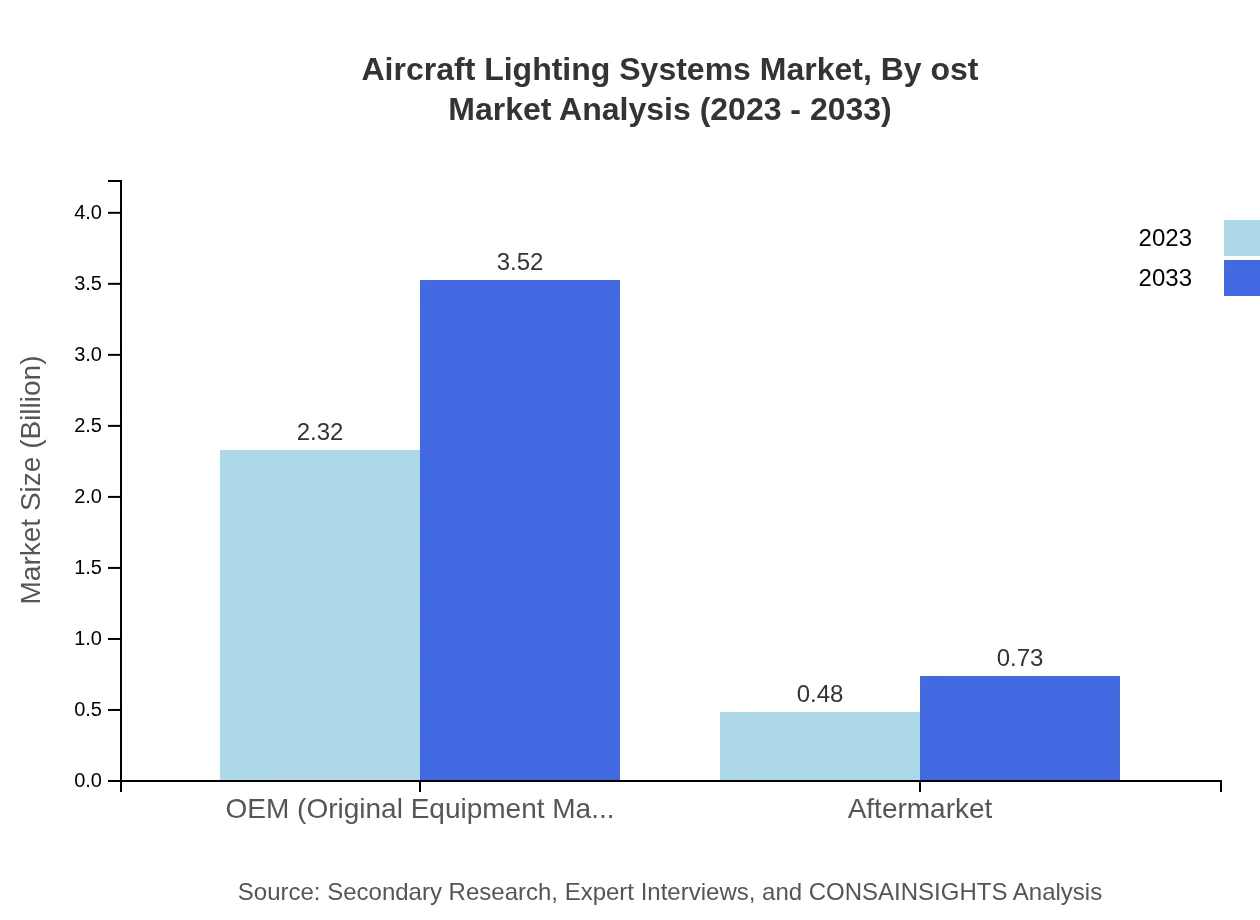

Aircraft Lighting Systems Market Analysis By Ost

The market is segmented into OEM and aftermarket segments. - **OEM**: This segment holds a significant market size of $2.32 billion in 2023, projected to reach $3.52 billion by 2033, maintaining an 82.8% share. - **Aftermarket**: These systems, valued at $0.48 billion in 2023, are expected to rise to $0.73 billion by 2033, with a share of 17.2%. Interest in upgrading existing aircraft fleets significantly benefits this segment.

Aircraft Lighting Systems Market Analysis By End User

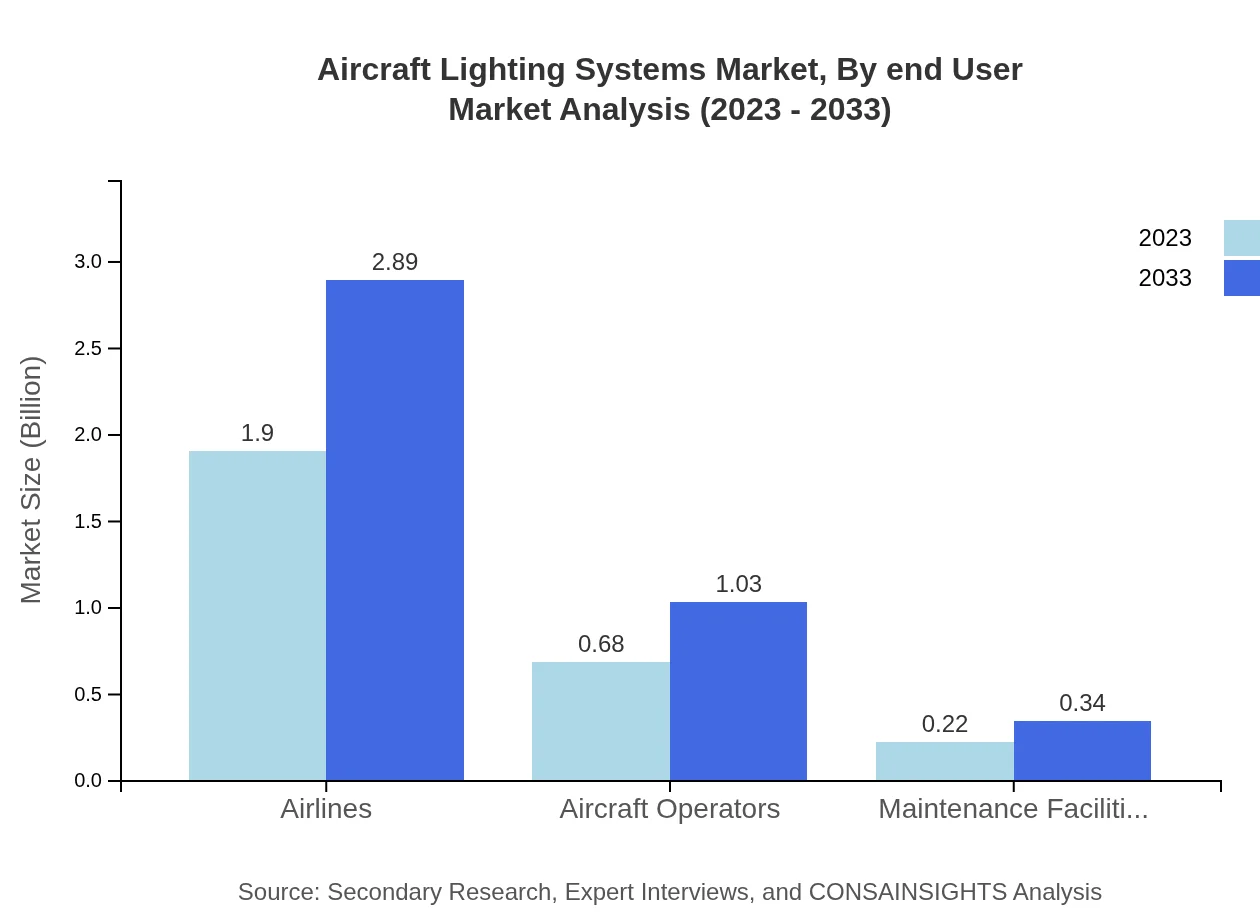

This segment includes airlines, aircraft operators, and maintenance facilities. - **Airlines**: Capturing a substantial market size of $1.90 billion in 2023, expected to rise to $2.89 billion by 2033, reflecting a 67.83% market share. - **Aircraft Operators**: Valued at $0.68 billion, projected to reach $1.03 billion by 2033 with a share of 24.27%. - **Maintenance Facilities**: Currently valued at $0.22 billion, expected to grow to $0.34 billion, contributing a 7.9% share.

Aircraft Lighting Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Lighting Systems Industry

Honeywell International Inc.:

A leading player in manufacturing and integrating aircraft lighting solutions across various platforms, known for innovation and quality.Diehl Aerospace:

Renowned for providing advanced aircraft lighting systems, Diehl Aerospace focuses on sustainability and customer-specific solutions.Rockwell Collins:

A key provider of aircraft communication and lighting systems, Rockwell Collins integrates cutting-edge technology in aviation solutions.Cobham plc:

Cobham specializes in high-performance aerospace technologies, delivering lighting solutions tailored to both commercial and military applications.L-3 Communications:

Known for its defense and commercial aircraft systems, L-3 Communications develops reliable lighting mechanisms improving operational safety.We're grateful to work with incredible clients.

FAQs

What is the market size of Aircraft Lighting Systems?

The global Aircraft Lighting Systems market is valued at approximately $2.8 billion in 2023, with an expected CAGR of 4.2% through 2033, reaching substantial growth driven by technological advancements and rising air travel demand.

What are the key market players or companies in the Aircraft Lighting Systems industry?

Key players in the Aircraft Lighting Systems market include Honeywell, Zodiac Aerospace, Rockwell Collins, and Cobham. These companies are pivotal in driving innovation and cater to both OEMs and aftermarket segments.

What are the primary factors driving the growth in the Aircraft Lighting Systems industry?

Key growth drivers in the Aircraft Lighting Systems industry encompass increasing aircraft production rates, technological advancements such as LED lighting, and the rise in demand for upgraded passenger experiences enhancing flight safety and comfort.

Which region is the fastest Growing in the Aircraft Lighting Systems?

The North American region leads in growth, expected to expand from $1.09 billion in 2023 to $1.65 billion by 2033. Europe and Asia Pacific are also notable due to increased aviation activities and modernization efforts.

Does ConsaInsights provide customized market report data for the Aircraft Lighting Systems industry?

Yes, ConsaInsights offers tailored market report data for the Aircraft Lighting Systems industry, allowing clients to receive insights specific to their needs, covering various parameters like trends, growth rates, and competitive landscapes.

What deliverables can I expect from this Aircraft Lighting Systems market research project?

The deliverables from the Aircraft Lighting Systems market research project will include comprehensive reports, segment analysis, regional insights, competitive analysis, and actionable recommendations focused on market trends and opportunities.

What are the market trends of Aircraft Lighting Systems?

Current market trends in Aircraft Lighting Systems highlight the transition to LED technology, increasing demand for energy-efficient solutions, growing emphasis on passenger comfort, and evolving regulations driving enhanced safety features.