Aircraft Line Maintenance Market Report

Published Date: 03 February 2026 | Report Code: aircraft-line-maintenance

Aircraft Line Maintenance Market Size, Share, Industry Trends and Forecast to 2033

This report covers the Aircraft Line Maintenance market analysis from 2023 to 2033, providing insights into market size, growth, segmentation, regional performance, technology trends, and leading companies within the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

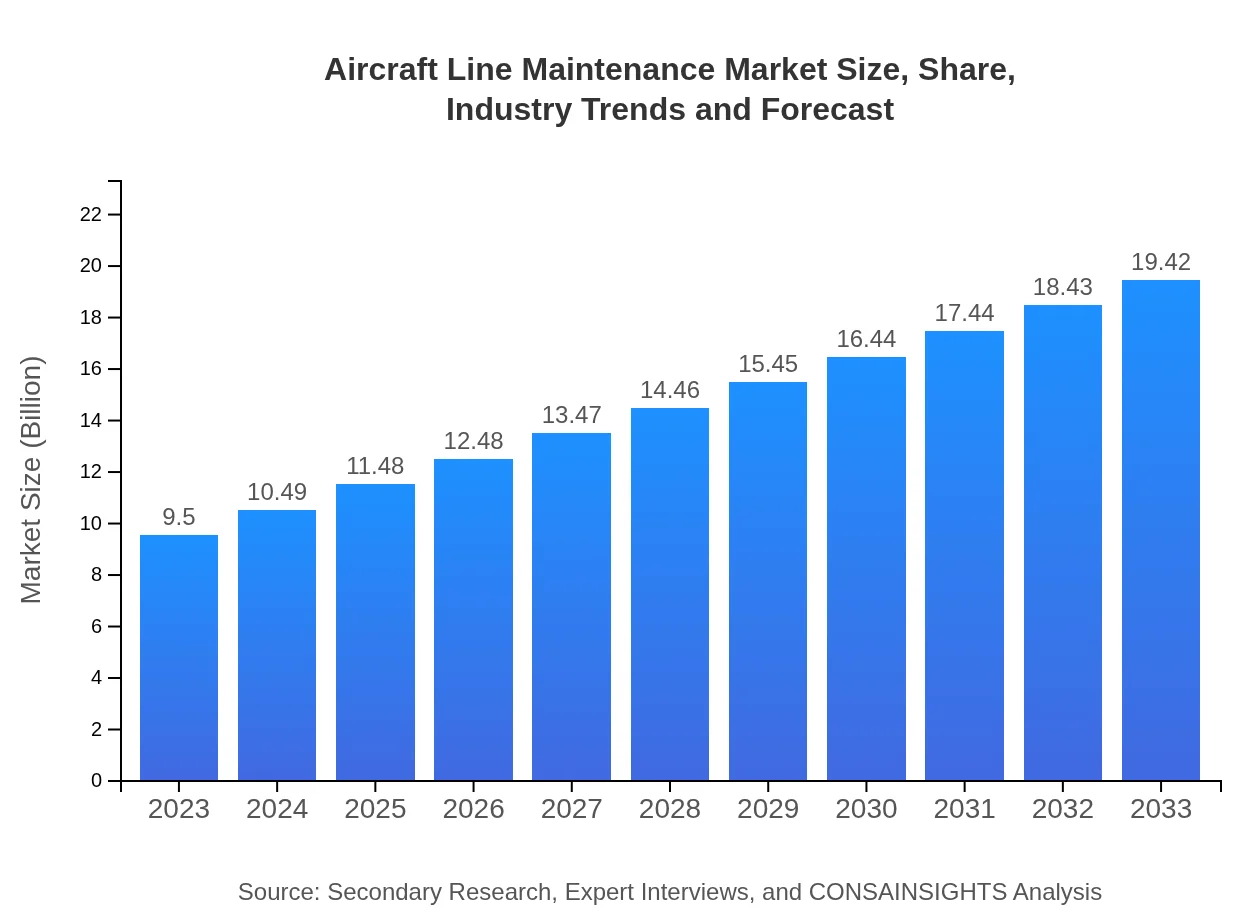

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $19.42 Billion |

| Top Companies | Honeywell Aerospace, Lufthansa Technik AG, Air France Industries KLM Engineering & Maintenance, United Technologies Corporation |

| Last Modified Date | 03 February 2026 |

Aircraft Line Maintenance Market Overview

Customize Aircraft Line Maintenance Market Report market research report

- ✔ Get in-depth analysis of Aircraft Line Maintenance market size, growth, and forecasts.

- ✔ Understand Aircraft Line Maintenance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Line Maintenance

What is the Market Size & CAGR of Aircraft Line Maintenance market in 2023?

Aircraft Line Maintenance Industry Analysis

Aircraft Line Maintenance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Line Maintenance Market Analysis Report by Region

Europe Aircraft Line Maintenance Market Report:

Europe is estimated to grow from $3.10 billion in 2023 to $6.33 billion by 2033. The region's strict regulatory framework and emphasis on safety and service quality drive investments in maintenance operations, paving the way for market expansion.Asia Pacific Aircraft Line Maintenance Market Report:

The Aircraft Line Maintenance market in Asia Pacific is projected to grow from $1.67 billion in 2023 to $3.42 billion by 2033, driven by the region's expanding aviation sector. Increased air travel demand and the proliferation of low-cost carriers fuel this growth, necessitating robust line maintenance services.North America Aircraft Line Maintenance Market Report:

North America holds a significant portion of the market, with projections indicating growth from $3.33 billion in 2023 to $6.80 billion by 2033. The region's strong airline industry and focus on safety standards enhance the demand for comprehensive line maintenance solutions.South America Aircraft Line Maintenance Market Report:

In South America, the market value is expected to increase from $0.46 billion in 2023 to $0.94 billion by 2033. The growth is attributed to the increasing number of airlines and aircraft operating within the region, alongside greater investments in maintenance infrastructure.Middle East & Africa Aircraft Line Maintenance Market Report:

In the Middle East and Africa, the market is expected to rise from $0.95 billion in 2023 to $1.93 billion by 2033. The growth is supported by increasing air traffic and a quest for modernization in aircraft maintenance practices.Tell us your focus area and get a customized research report.

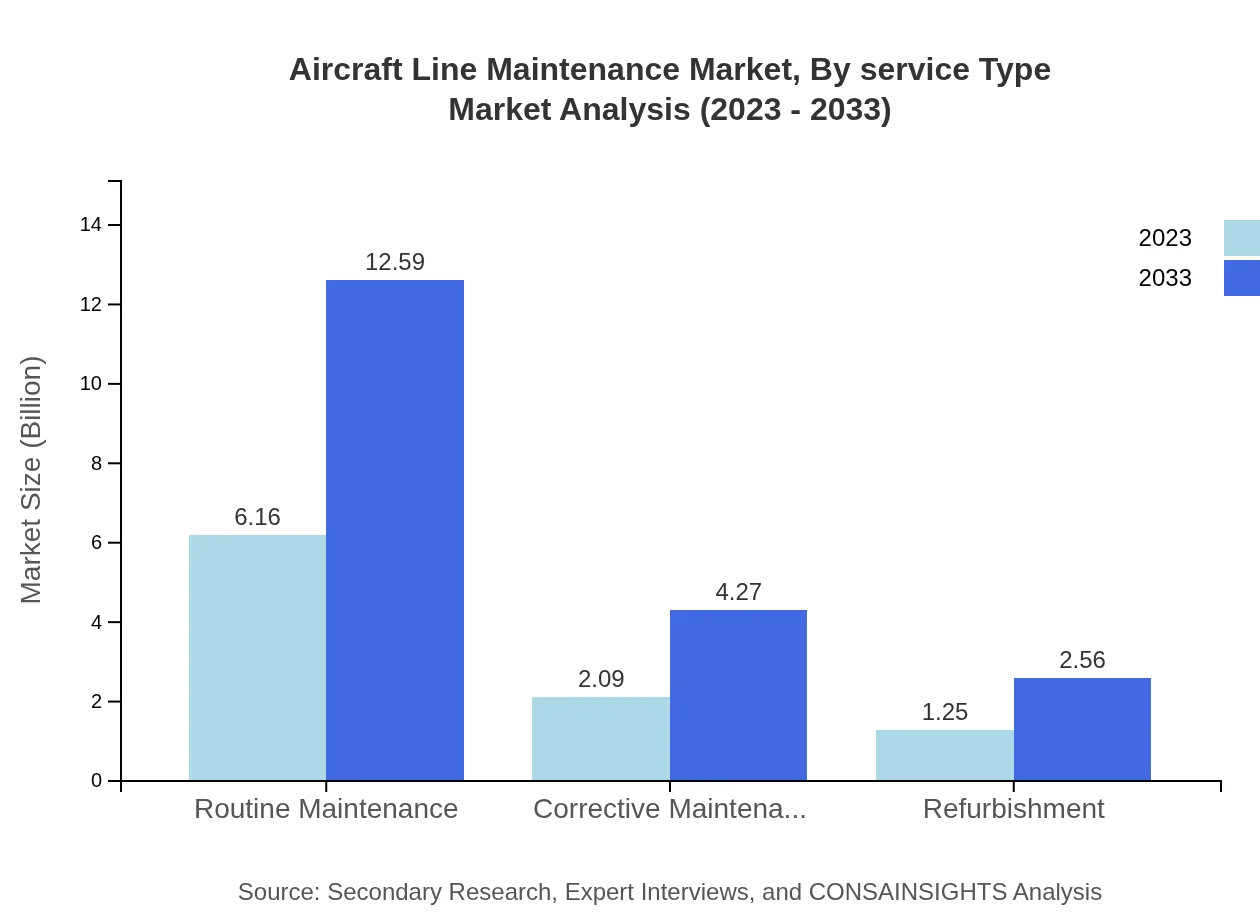

Aircraft Line Maintenance Market Analysis By Service Type

The market is significantly shaped by service type, with routine maintenance dominating, valued at $6.16 billion in 2023 with a forecasted increase to $12.59 billion by 2033. Corrective and refurbishment maintenance segments also display steady growth, indicating a balanced demand for both proactive and reactive maintenance solutions.

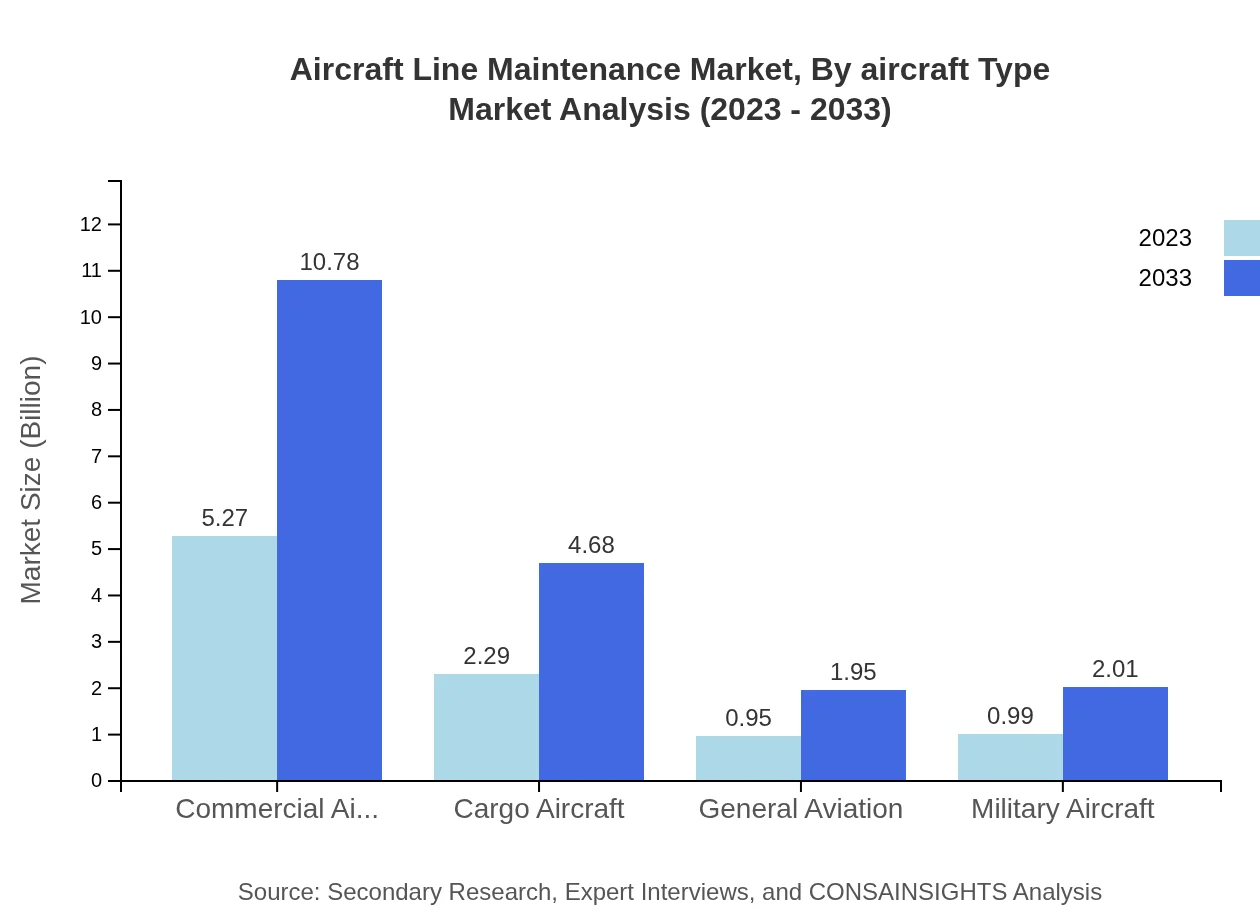

Aircraft Line Maintenance Market Analysis By Aircraft Type

Commercial aircraft maintenance comprises the largest segment at $5.27 billion in 2023, projected to reach $10.78 billion by 2033. Conversely, cargo and military aircraft segments are also expanding, signaling a diversified growth pattern across different aircraft types.

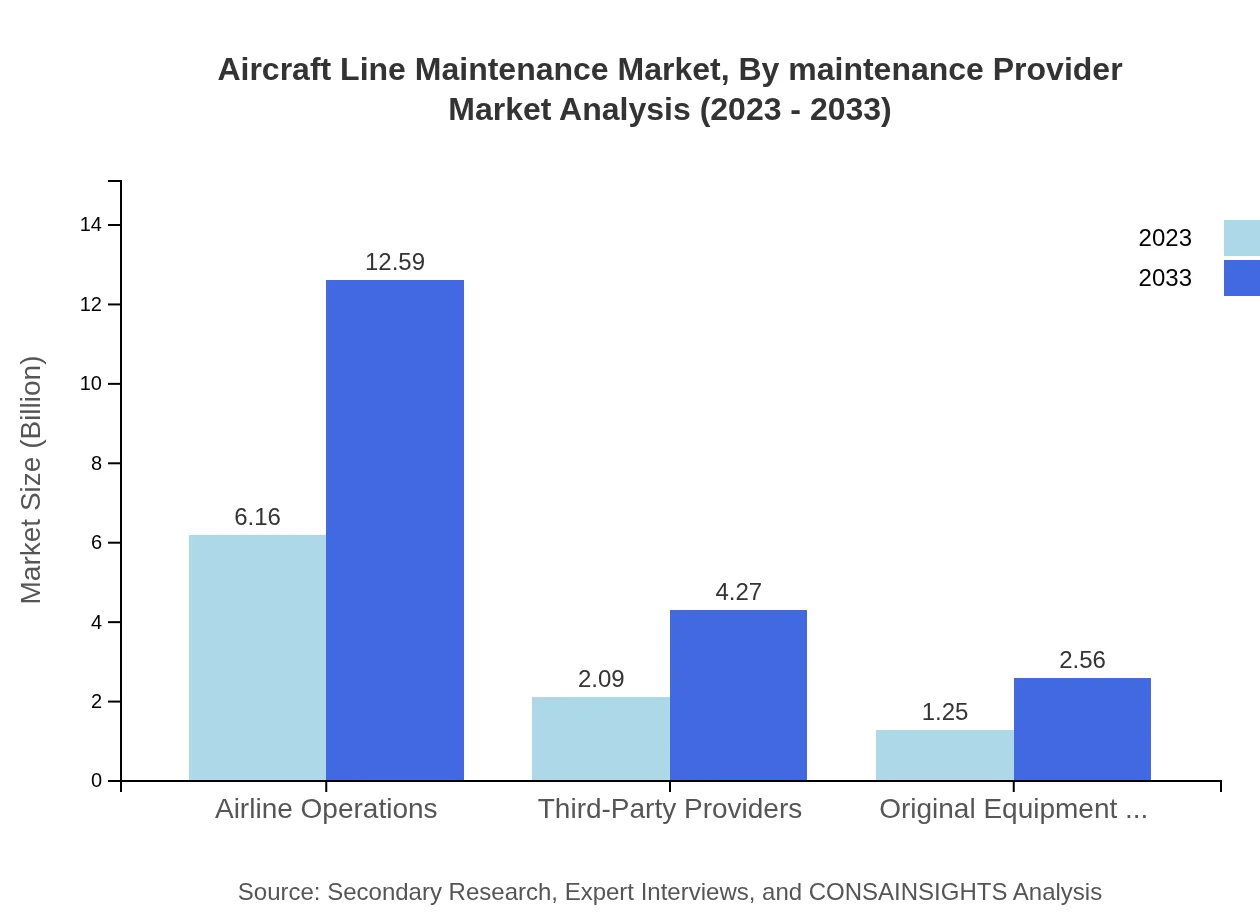

Aircraft Line Maintenance Market Analysis By Maintenance Provider

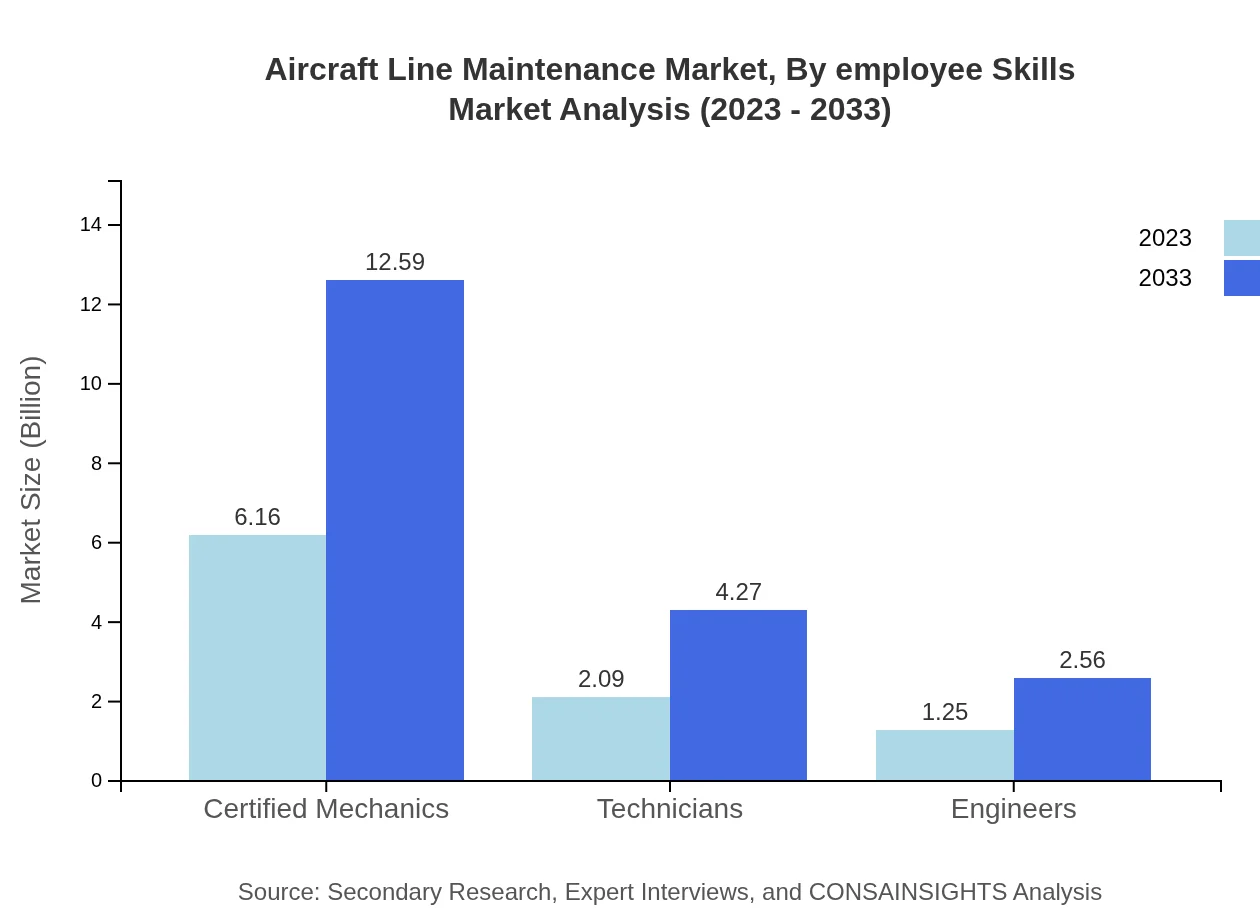

The market showcases robust activity among certified mechanics and technicians, with certified mechanics expected to grow from $6.16 billion in 2023 to $12.59 billion by 2033. This segment underscores the demand for skilled labor that adheres to industry standards.

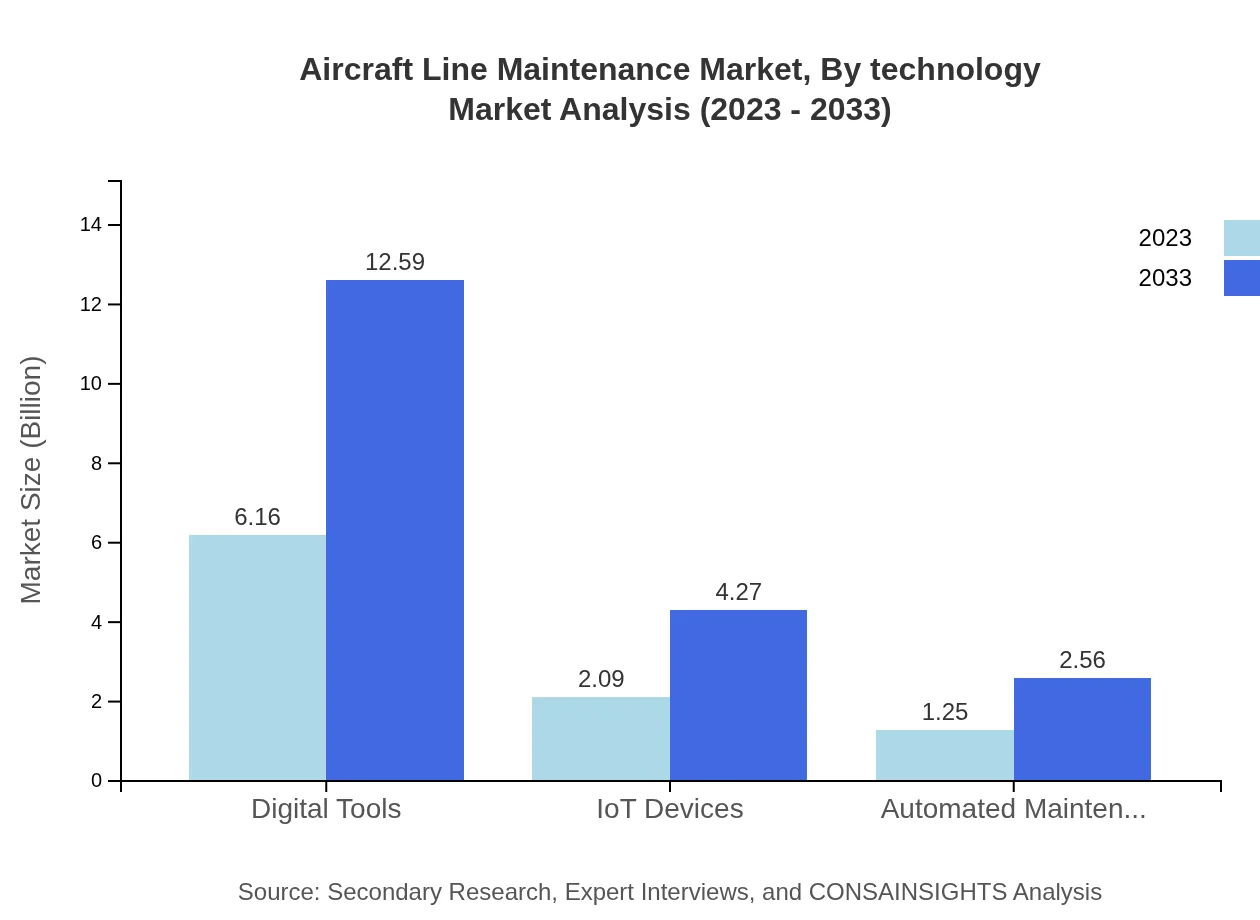

Aircraft Line Maintenance Market Analysis By Technology

Technological integration is redefining maintenance practices, with digital tools driving efficiency. The market for digital tools is set to expand from $6.16 billion in 2023 to $12.59 billion by 2033, emphasizing the increasing reliance on innovative solutions to enhance maintenance services.

Aircraft Line Maintenance Market Analysis By Employee Skills

A strong focus on employee skills, particularly certified mechanics, continues to dominate the market, reflecting the industry's need for qualified personnel capable of utilizing modern maintenance technologies effectively. This segment's growth aligns with the rising complexity of aircraft systems.

Aircraft Line Maintenance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Line Maintenance Industry

Honeywell Aerospace:

Honeywell is a key player in the aviation industry, providing efficiency-enhancing solutions in line maintenance and safety systems.Lufthansa Technik AG:

Lufthansa Technik AG is a leading aircraft maintenance company known for its extensive range of maintenance services and innovative technologies that enhance operational safety.Air France Industries KLM Engineering & Maintenance:

This entity offers comprehensive maintenance services for a variety of aircraft, emphasizing quality and efficiency to ensure high operational standards.United Technologies Corporation:

UTC provides advanced maintenance, repair, and overhaul (MRO) solutions across the aviation sector, leveraging technology to improve service efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Line Maintenance?

The global Aircraft Line Maintenance market was valued at approximately $9.5 billion in 2023 and is projected to grow at a CAGR of 7.2%, reaching around $18.2 billion by 2033.

What are the key market players or companies in the aircraft Line Maintenance industry?

Key players in the Aircraft Line Maintenance market include major airlines, third-party maintenance providers, and Original Equipment Manufacturers (OEMs). These entities compete based on service quality, technological advancements, and operational efficiency.

What are the primary factors driving the growth in the aircraft Line Maintenance industry?

Growth drivers include increasing air traffic, a growing fleet of aircraft, technological advancements in maintenance solutions, and rising demand for efficient, reliable maintenance services in the aviation sector.

Which region is the fastest Growing in the aircraft Line Maintenance?

Among regions, Europe is expected to witness significant growth, expanding from $3.10 billion in 2023 to $6.33 billion by 2033. The Asia-Pacific region is also experiencing robust growth, with the market size projected to increase from $1.67 billion to $3.42 billion.

Does ConsaInsights provide customized market report data for the aircraft Line Maintenance industry?

Yes, ConsaInsights offers tailored market report data for the Aircraft Line Maintenance industry. This can cater to specific research needs, helping businesses gain insightful, actionable data tailored to their interests.

What deliverables can I expect from this aircraft Line Maintenance market research project?

Expect comprehensive reports detailing market size, growth forecasts, competitive analysis, regional insights, and segment breakdowns. Deliverables include data visualizations, executive summaries, and strategic recommendations.

What are the market trends of aircraft Line Maintenance?

Current trends include the adoption of digital tools, IoT devices for predictive maintenance, and automated maintenance solutions. Additionally, there's an increasing focus on sustainability and operational efficiency within the industry.