Aircraft Nacelle Systems Market Report

Published Date: 03 February 2026 | Report Code: aircraft-nacelle-systems

Aircraft Nacelle Systems Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Aircraft Nacelle Systems market from 2023 to 2033, providing in-depth insights into market trends, growth prospects, segmentation, and key regional performance metrics.

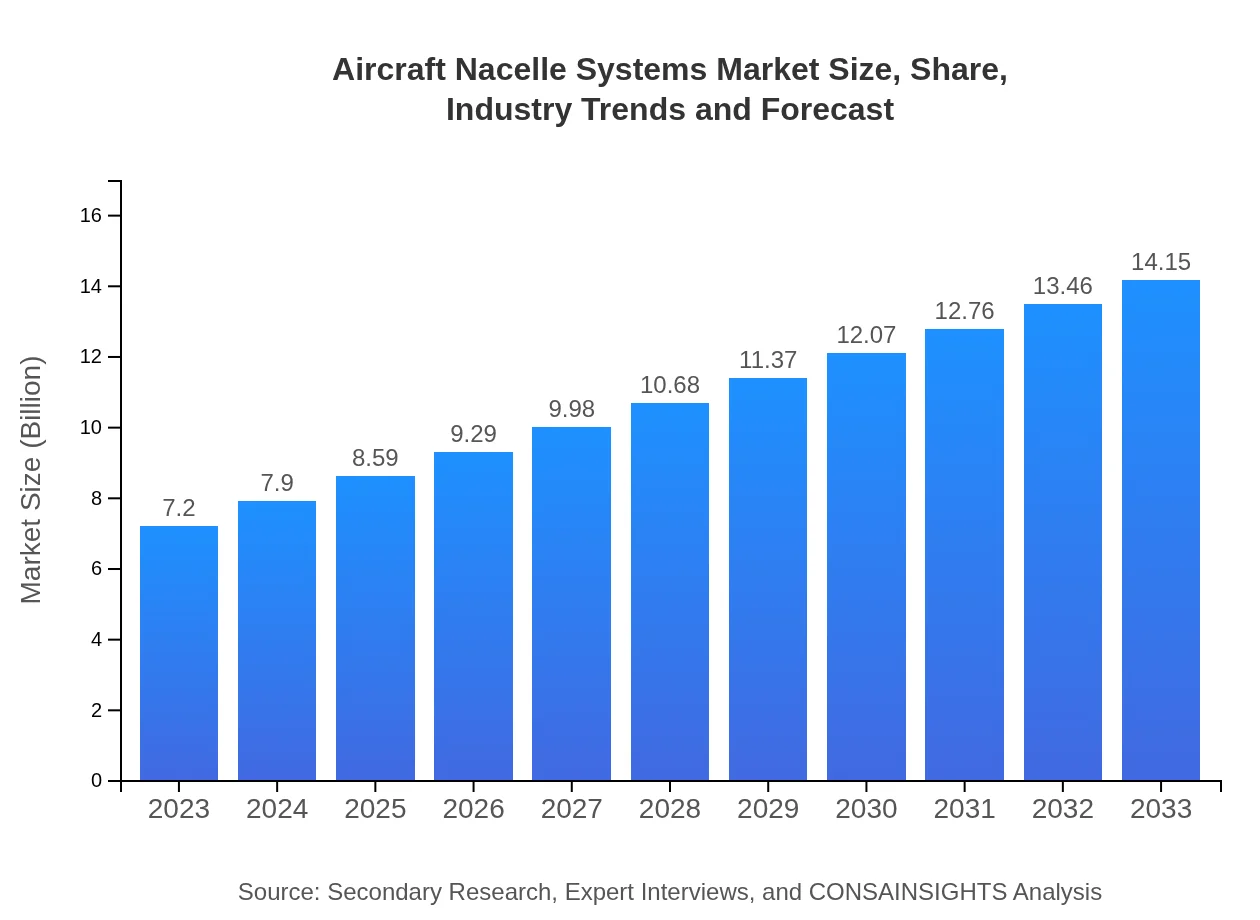

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.15 Billion |

| Top Companies | Safran S.A., General Electric Company, Honeywell International Inc., Meggitt PLC, Collins Aerospace |

| Last Modified Date | 03 February 2026 |

Aircraft Nacelle Systems Market Overview

Customize Aircraft Nacelle Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Nacelle Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Nacelle Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Nacelle Systems

What is the Market Size & CAGR of Aircraft Nacelle Systems market in 2023?

Aircraft Nacelle Systems Industry Analysis

Aircraft Nacelle Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Nacelle Systems Market Analysis Report by Region

Europe Aircraft Nacelle Systems Market Report:

The European market holds a significant share, starting at $1.86 billion in 2023 and anticipated to grow to $3.65 billion by 2033. Innovative advances in aerodynamics and fuel efficiency are key growth drivers.Asia Pacific Aircraft Nacelle Systems Market Report:

In 2023, the Asia Pacific market is valued at $1.51 billion, expected to grow to $2.97 billion by 2033. Emerging economies are increasing their fleet sizes and enhancing local manufacturing capabilities, driving growth in this region.North America Aircraft Nacelle Systems Market Report:

North America leads the market with a valuation of $2.61 billion in 2023, projected to expand to $5.14 billion by 2033. The presence of major manufacturers and a high demand for modern aircraft technology power this growth.South America Aircraft Nacelle Systems Market Report:

The South American market is relatively smaller, valued at $0.29 billion in 2023, with a forecast to reach $0.56 billion by 2033. Increased investments in aviation infrastructure and regional airlines will motivate growth.Middle East & Africa Aircraft Nacelle Systems Market Report:

The Middle East and Africa market is expected to increase from $0.94 billion in 2023 to $1.84 billion by 2033. Expanding air travel and rising cargo demands in the region will play vital roles.Tell us your focus area and get a customized research report.

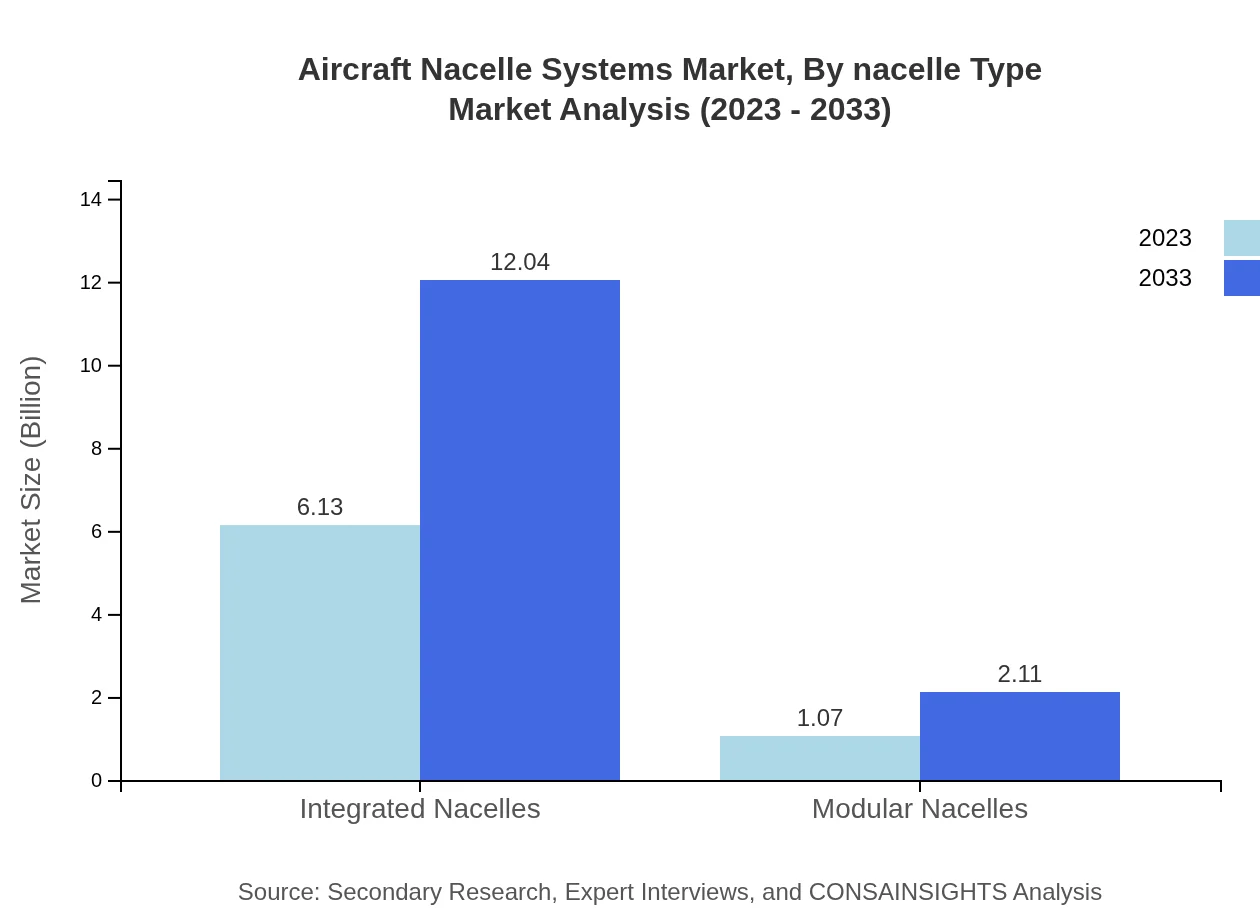

Aircraft Nacelle Systems Market Analysis By Nacelle Type

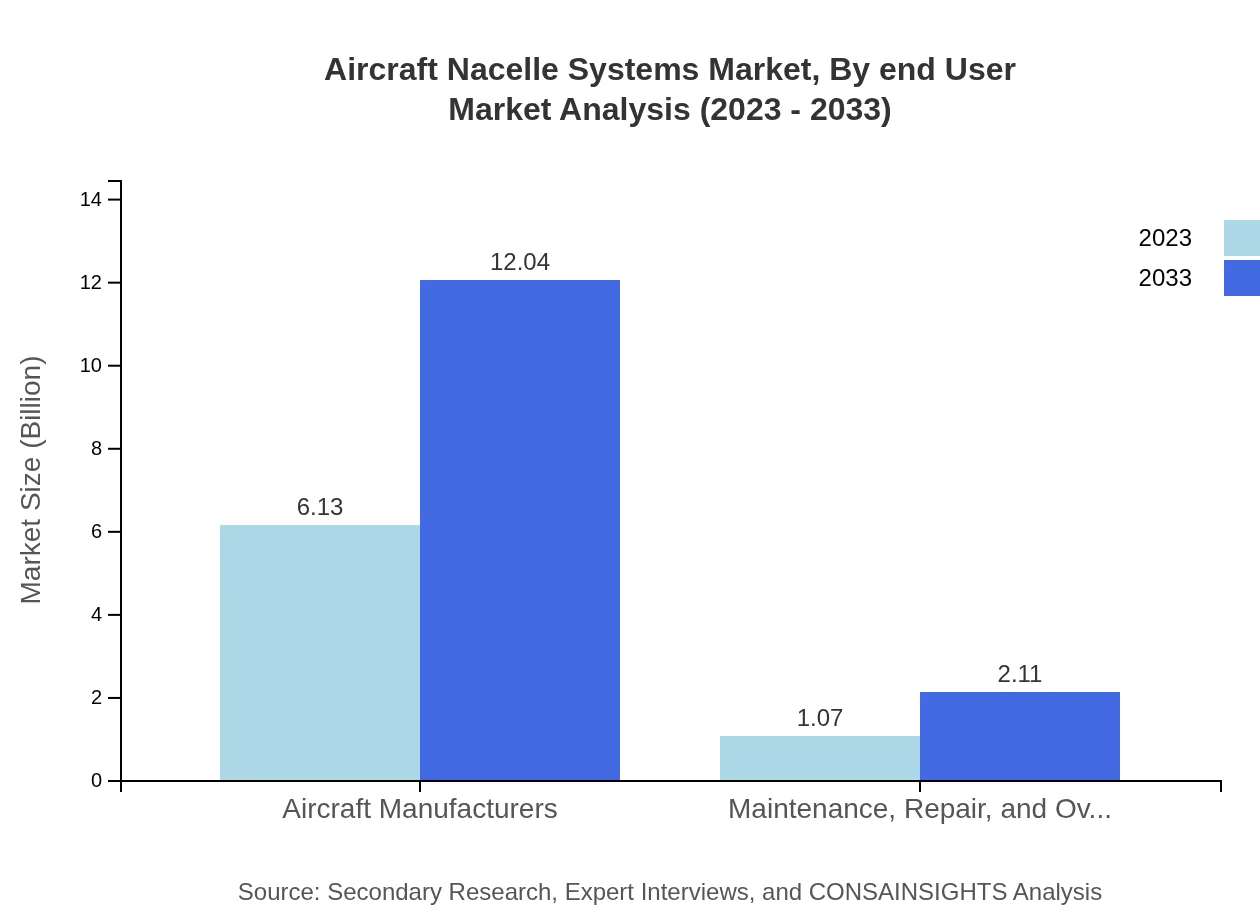

The Integrated Nacelles segment is leading, expected to grow from $6.13 billion in 2023 to $12.04 billion by 2033, holding 85.08% of the market share, driven by efficiency and performance. The Modular Nacelles segment, while smaller, will increase from $1.07 billion to $2.11 billion, achieving 14.92% market share as modularization trends in design take hold.

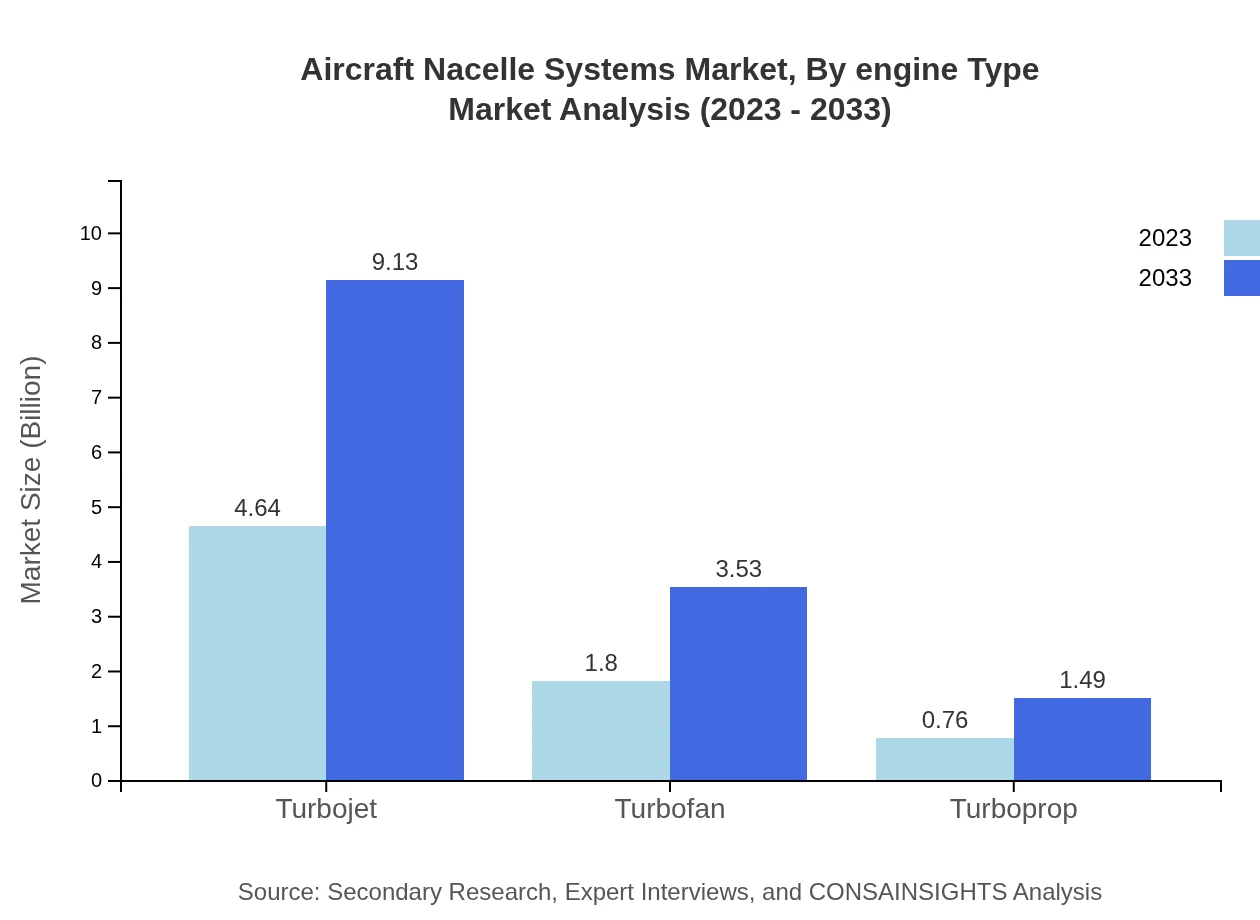

Aircraft Nacelle Systems Market Analysis By Engine Type

The market for Turbojet engines is projected to mirror commercial demand, reaching $4.64 billion by 2033, maintaining a 64.51% market share. Turbofan and Turboprop segments, meanwhile, will see their markets grow significantly from $1.80 billion to $3.53 billion and $0.76 billion to $1.49 billion, respectively, reflecting broader diversification in aviation technologies.

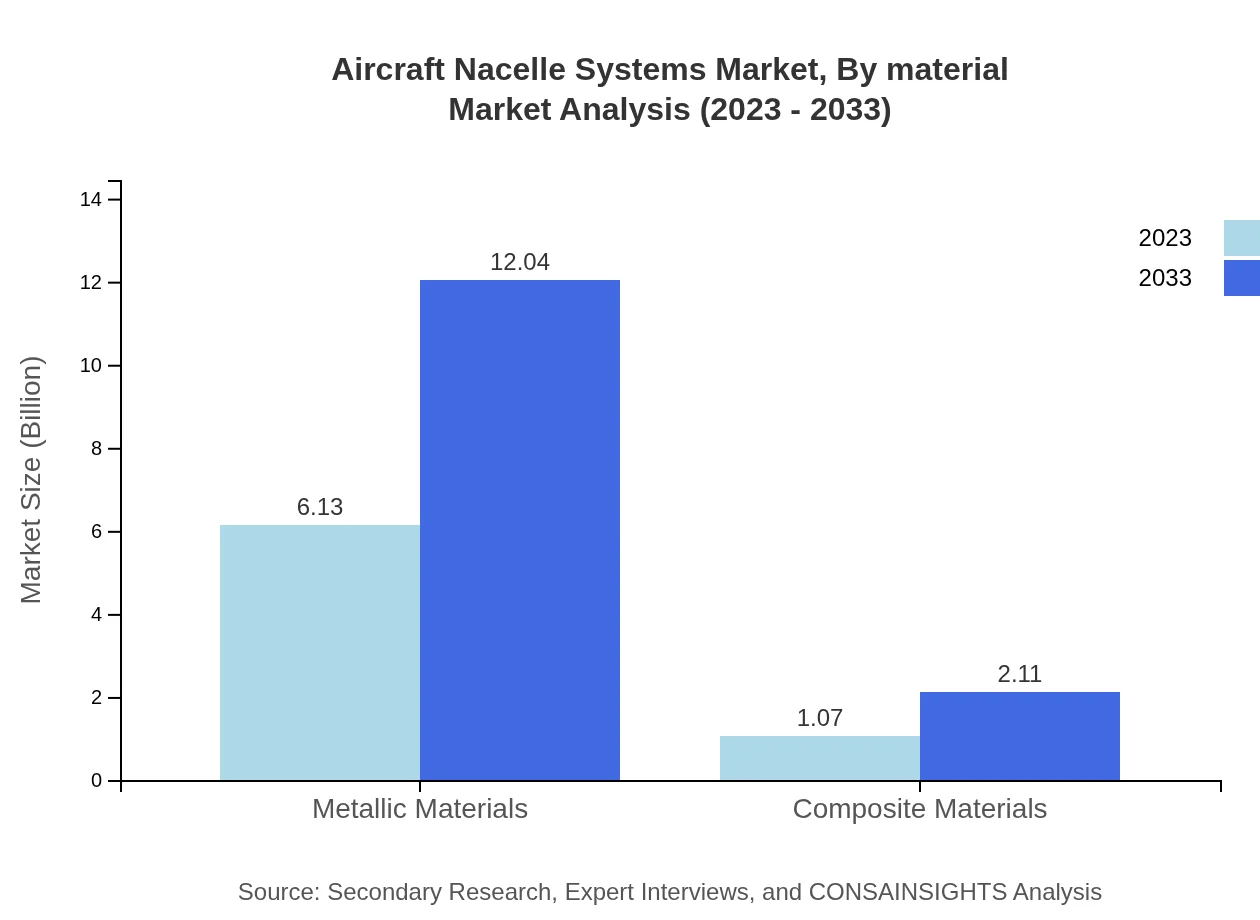

Aircraft Nacelle Systems Market Analysis By Material

Metallic materials currently dominate, with a market size of $6.13 billion in 2023, maintaining a stable share of 85.08% as traditional materials still play critical roles in nacelle design. However, the composite materials segment is gradually gaining traction, expected to rise from $1.07 billion to $2.11 billion, reflecting an increased desire for lightweight designs.

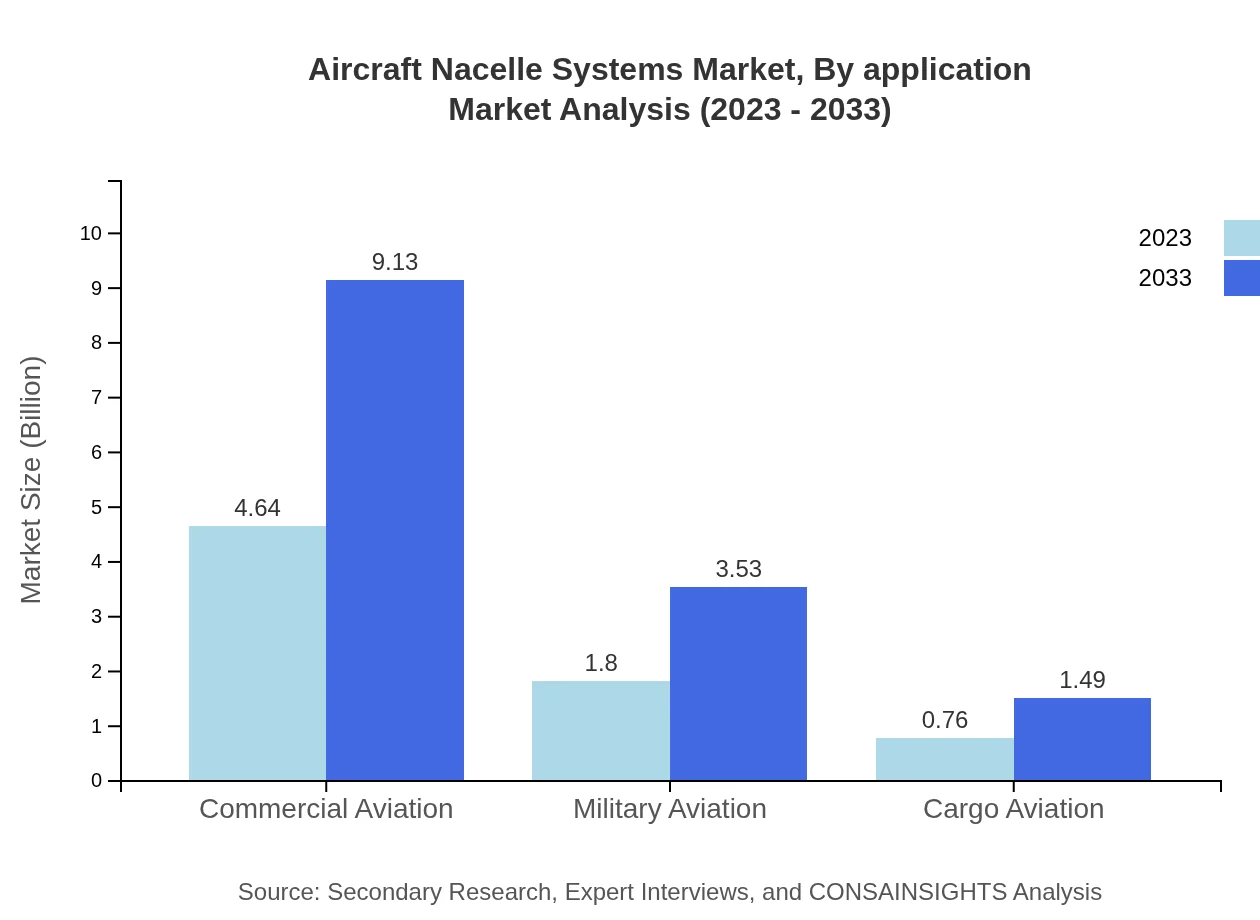

Aircraft Nacelle Systems Market Analysis By Application

The Commercial Aviation segment is the largest, with a projected growth from $4.64 billion to $9.13 billion by 2033, accounting for 64.51% of market share driven by growing travel demand. Military and Cargo Aviation segments will also grow, aligning with rising defense expenditures and e-commerce demands.

Aircraft Nacelle Systems Market Analysis By End User

Aircraft Manufacturers will continue to dominate, expanding from $6.13 billion to $12.04 billion, accounting for 85.08% share, while Maintenance, Repair, and Overhaul (MRO) operations are anticipated to increase their value from $1.07 to $2.11 billion, catering to aging fleets and service longevity.

Aircraft Nacelle Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Nacelle Systems Industry

Safran S.A.:

A global leader in aircraft equipment and systems, Safran specializes in nacelle technology and has pioneered numerous innovations, enhancing efficiency across several aircraft models.General Electric Company:

GE is known for its in-depth expertise in both military and commercial sectors, producing advanced nacelle systems that leverage its extensive engine technology and manufacturing capabilities.Honeywell International Inc.:

Honeywell contributes significantly to the nacelle market with its integrated solutions and performance-enhancing technologies aimed at modernizing both commercial and military aircraft.Meggitt PLC:

Meggitt provides engineered products that enhance aircraft performance and safety, supporting a wide range of applications within the aviation industry.Collins Aerospace:

Part of Raytheon Technologies, Collins Aerospace offers comprehensive nacelle systems and support services, contributing to safer and more fuel-efficient aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft nacelle systems?

The aircraft nacelle systems market is valued at approximately $7.2 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth reflects increasing demand for advanced aircraft systems across commercial, military, and cargo aviation sectors.

What are the key market players or companies in the aircraft nacelle systems industry?

Key players in the aircraft nacelle systems market include prominent manufacturers such as General Electric, Safran, Rolls Royce, and Honeywell. These companies lead in innovation and technology, contributing significantly to market growth and competition.

What are the primary factors driving the growth in the aircraft nacelle systems industry?

Growth in the aircraft nacelle systems industry is driven by increased air travel demand, advancements in aerospace technology, and the transition to more fuel-efficient aircraft. Environmental regulations also push for innovations that reduce emissions and improve performance.

Which region is the fastest Growing in the aircraft nacelle systems?

The Asia-Pacific region is currently the fastest-growing market for aircraft nacelle systems. With a projected increase from $1.51 billion in 2023 to $2.97 billion in 2033, the region is benefiting from rising aviation demands and investments in aircraft manufacturing.

Does ConsaInsights provide customized market report data for the aircraft nacelle systems industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the aircraft nacelle systems industry. This includes in-depth analysis, regional insights, and segmented data to facilitate strategic decision-making.

What deliverables can I expect from this aircraft nacelle systems market research project?

Deliverables from the aircraft nacelle systems market research project will include comprehensive reports, market size analysis, competitive landscape evaluations, and forecasts. Additionally, segmented breakdowns and regional insights will be provided for targeted strategies.

What are the market trends of aircraft nacelle systems?

Market trends in aircraft nacelle systems include increasing adoption of composite materials, a shift toward integrated nacelle designs, and rising investments in sustainable aviation technologies. These trends are shaping the future of the aerospace industry.