Aircraft Propeller Systems Market Report

Published Date: 03 February 2026 | Report Code: aircraft-propeller-systems

Aircraft Propeller Systems Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Aircraft Propeller Systems market, highlighting its current trends, key players, and future forecasts from 2023 to 2033, providing valuable insights into market dynamics, segmentation, and growth opportunities.

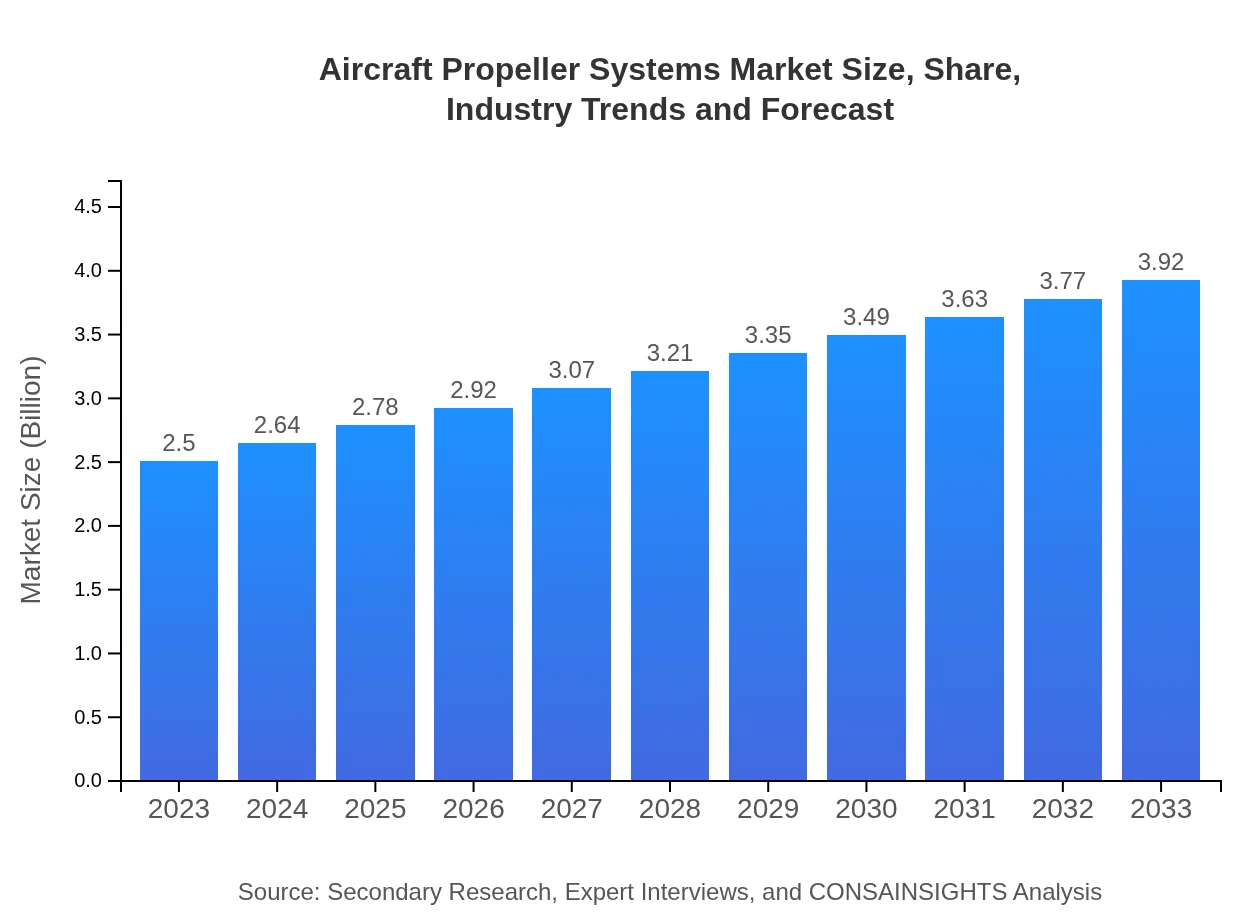

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $3.92 Billion |

| Top Companies | Champagne Aviation, Hartzell Propeller, MT-Propeller Entwicklung GmbH |

| Last Modified Date | 03 February 2026 |

Aircraft Propeller Systems Market Overview

Customize Aircraft Propeller Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Propeller Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Propeller Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Propeller Systems

What is the Market Size & CAGR of Aircraft Propeller Systems market in {Year}?

Aircraft Propeller Systems Industry Analysis

Aircraft Propeller Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Propeller Systems Market Analysis Report by Region

Europe Aircraft Propeller Systems Market Report:

In Europe, the market is projected to expand from $0.78 billion in 2023 to $1.22 billion by 2033, with increasing investments in green aviation technology and a focus on sustainability driving innovation in propeller systems.Asia Pacific Aircraft Propeller Systems Market Report:

In the Asia Pacific region, the Aircraft Propeller Systems market is estimated to grow from $0.41 billion in 2023 to $0.64 billion by 2033, supported by expanding aerospace manufacturing capabilities and increasing demand for commercial aircraft.North America Aircraft Propeller Systems Market Report:

North America remains the leading market with estimates growing from $0.94 billion in 2023 to $1.48 billion in 2033, fueled by robust military contracts and the recovery of commercial aviation post-pandemic.South America Aircraft Propeller Systems Market Report:

The South American market, although smaller, is expected to rise from $0.07 billion in 2023 to $0.11 billion by 2033, driven by modest growth in regional air travel and defense spending.Middle East & Africa Aircraft Propeller Systems Market Report:

The Middle East and Africa market is anticipated to increase from $0.30 billion in 2023 to $0.47 billion by 2033, as the region continues to invest in aviation infrastructure and military capabilities.Tell us your focus area and get a customized research report.

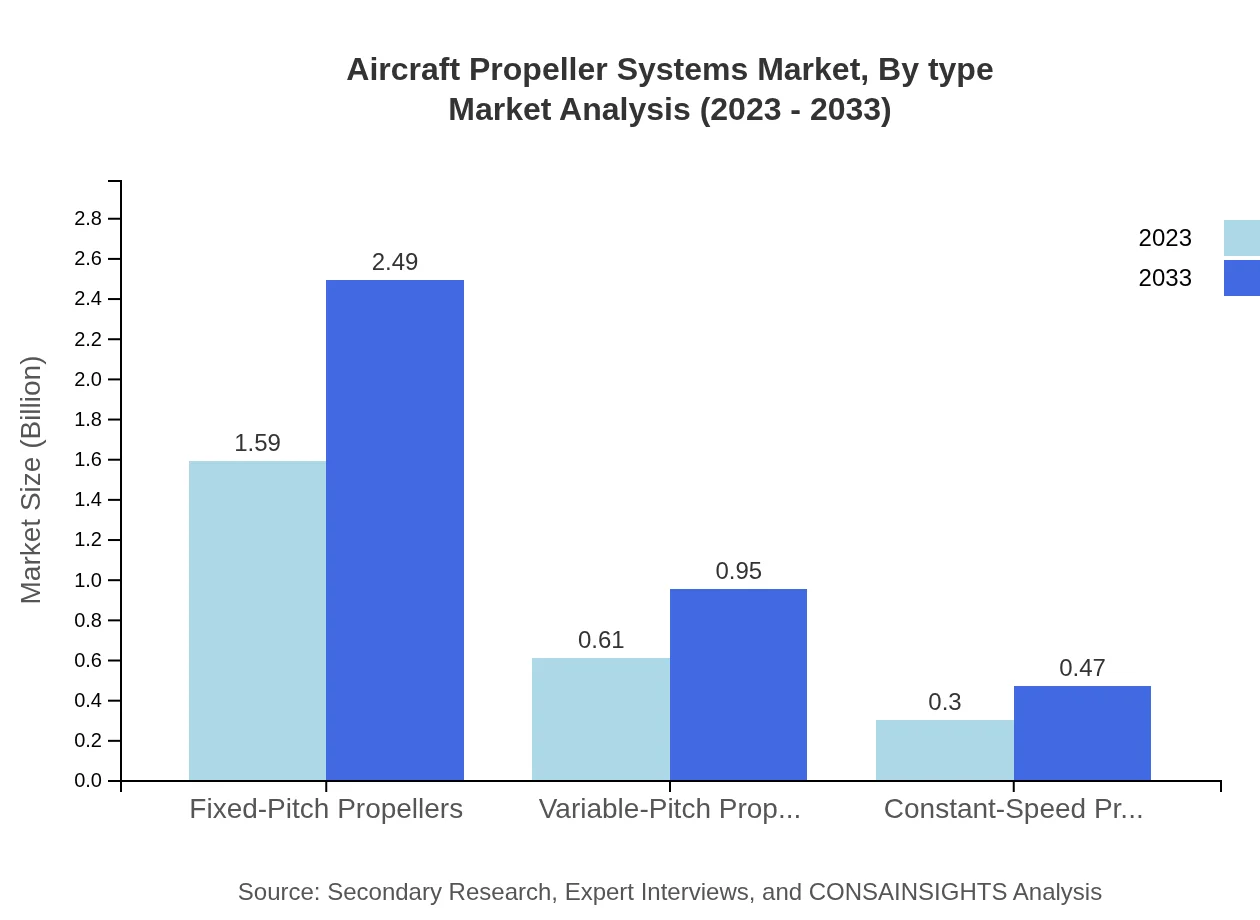

Aircraft Propeller Systems Market Analysis By Type

The market is segmented by type into fixed-pitch, variable-pitch, and constant-speed propellers. Fixed-pitch propellers dominate the market with a size of $1.59 billion in 2023, expected to grow to $2.49 billion by 2033. Variable-pitch propellers, reflecting enhanced performance features, account for $0.61 billion in 2023 and are projected to reach $0.95 billion by 2033. Constant-speed propellers, while having a smaller share, are expected to rise from $0.30 billion to $0.47 billion.

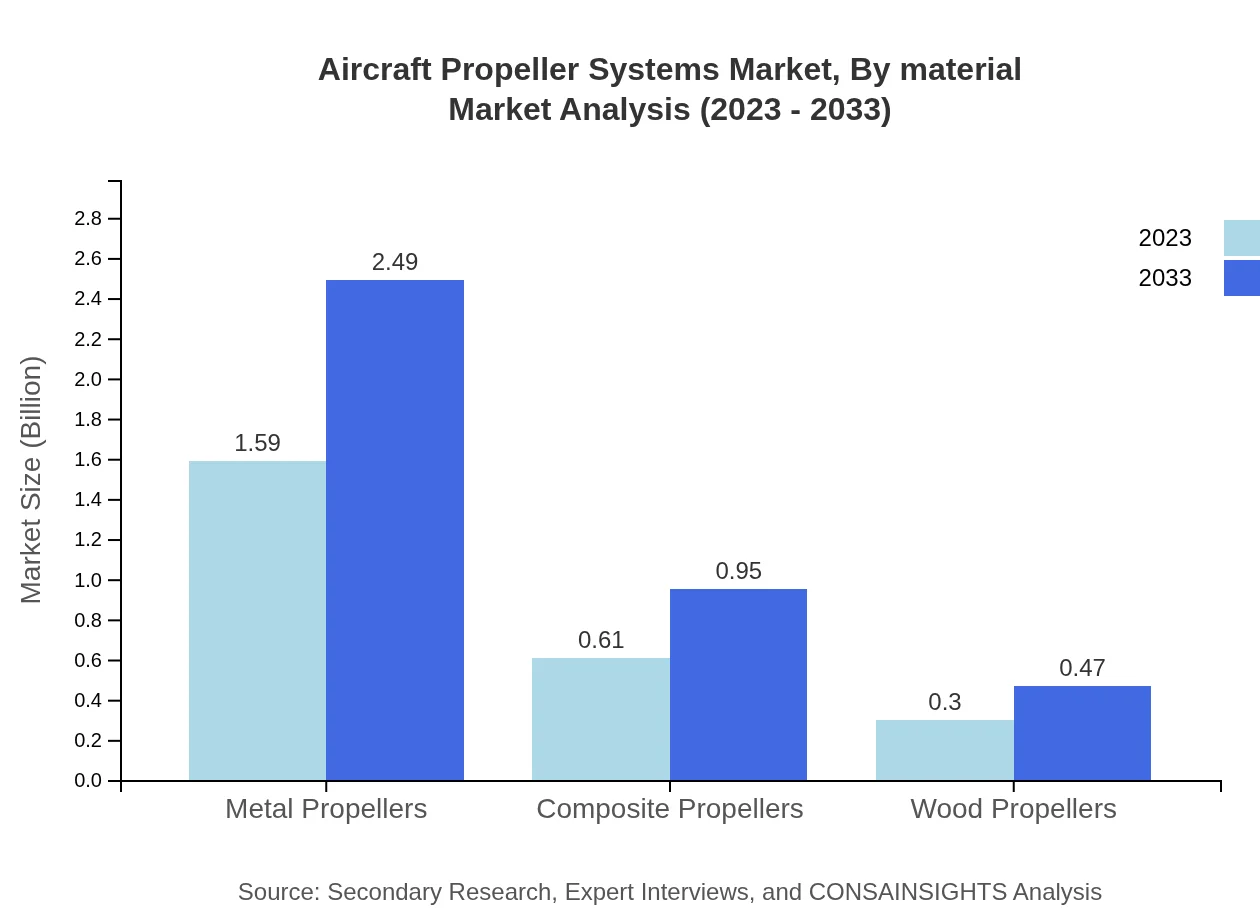

Aircraft Propeller Systems Market Analysis By Material

Materials used for manufacturing propellers include metal, composite, and wood. Metal propellers take the lead with a market size of $1.59 billion in 2023, remaining stable with a high market share of approximately 63.64%. Composite propellers see growth from $0.61 billion in 2023 to $0.95 billion by 2033, reflecting advancements in materials technology. Wood propellers hold a smaller segment but are expected to grow modestly.

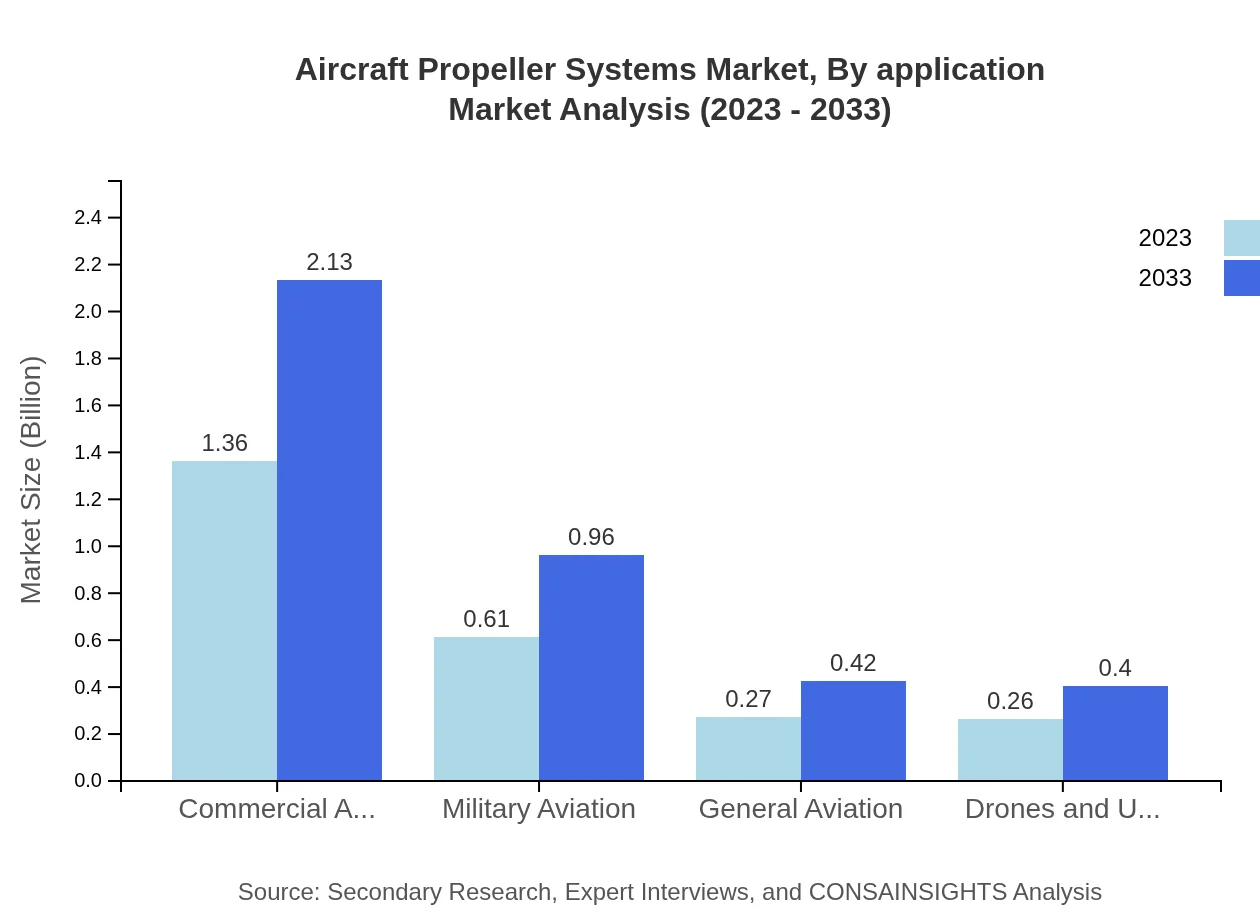

Aircraft Propeller Systems Market Analysis By Application

Applications of aircraft propeller systems are segmented into commercial aviation, military aviation, general aviation, and drones/UAVs. Commercial aviation represents the largest market share at 54.52% in 2023, projected to rise from $1.36 billion to $2.13 billion by 2033. Military aviation is also significant, expected to grow from $0.61 billion to $0.96 billion.

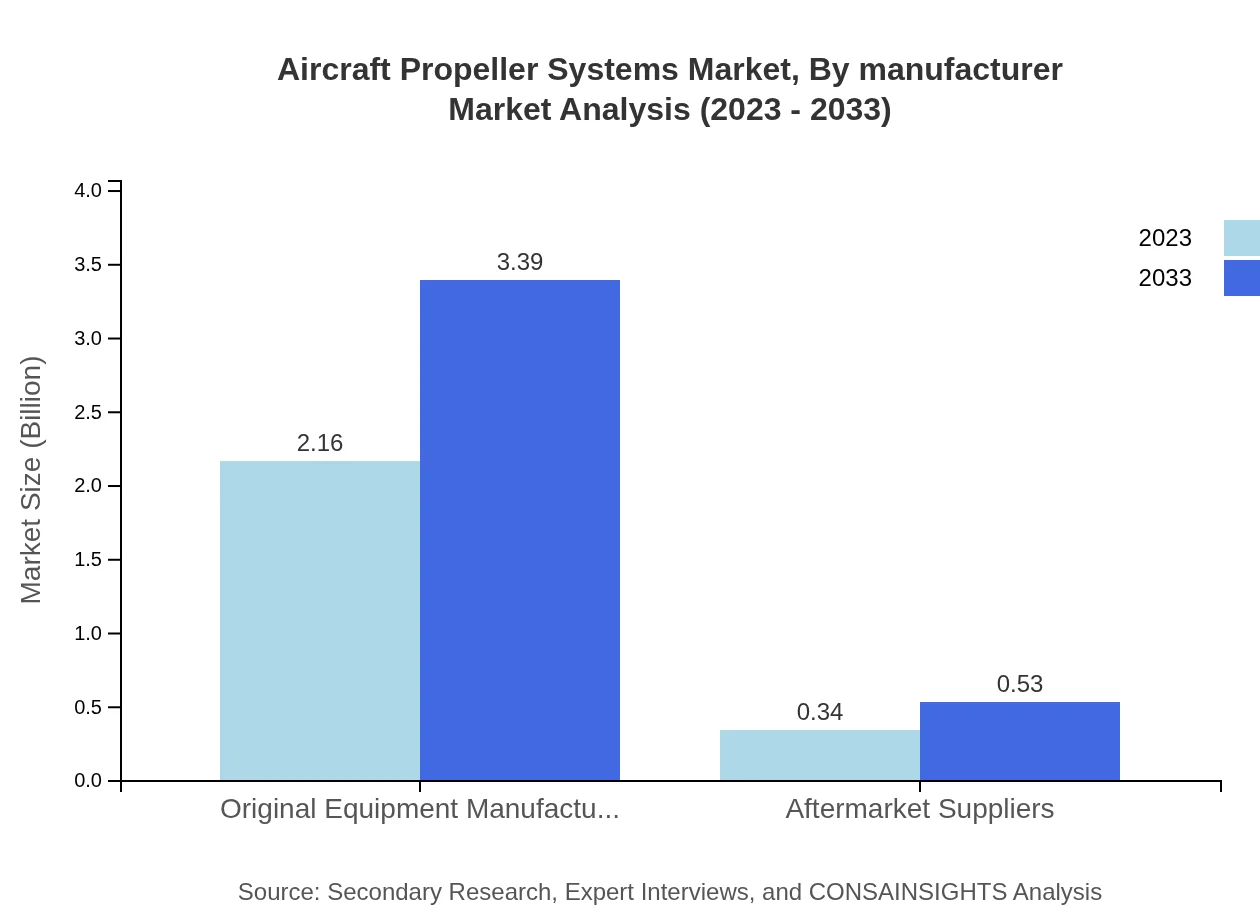

Aircraft Propeller Systems Market Analysis By Manufacturer

The market is categorized into Original Equipment Manufacturers (OEMs) and aftermarket suppliers. OEMs dominate the market with $2.16 billion in 2023, holding 86.56% market share, and are expected to reach $3.39 billion by 2033. Aftermarket suppliers represent a smaller segment with $0.34 billion in 2023 and projected growth to $0.53 billion.

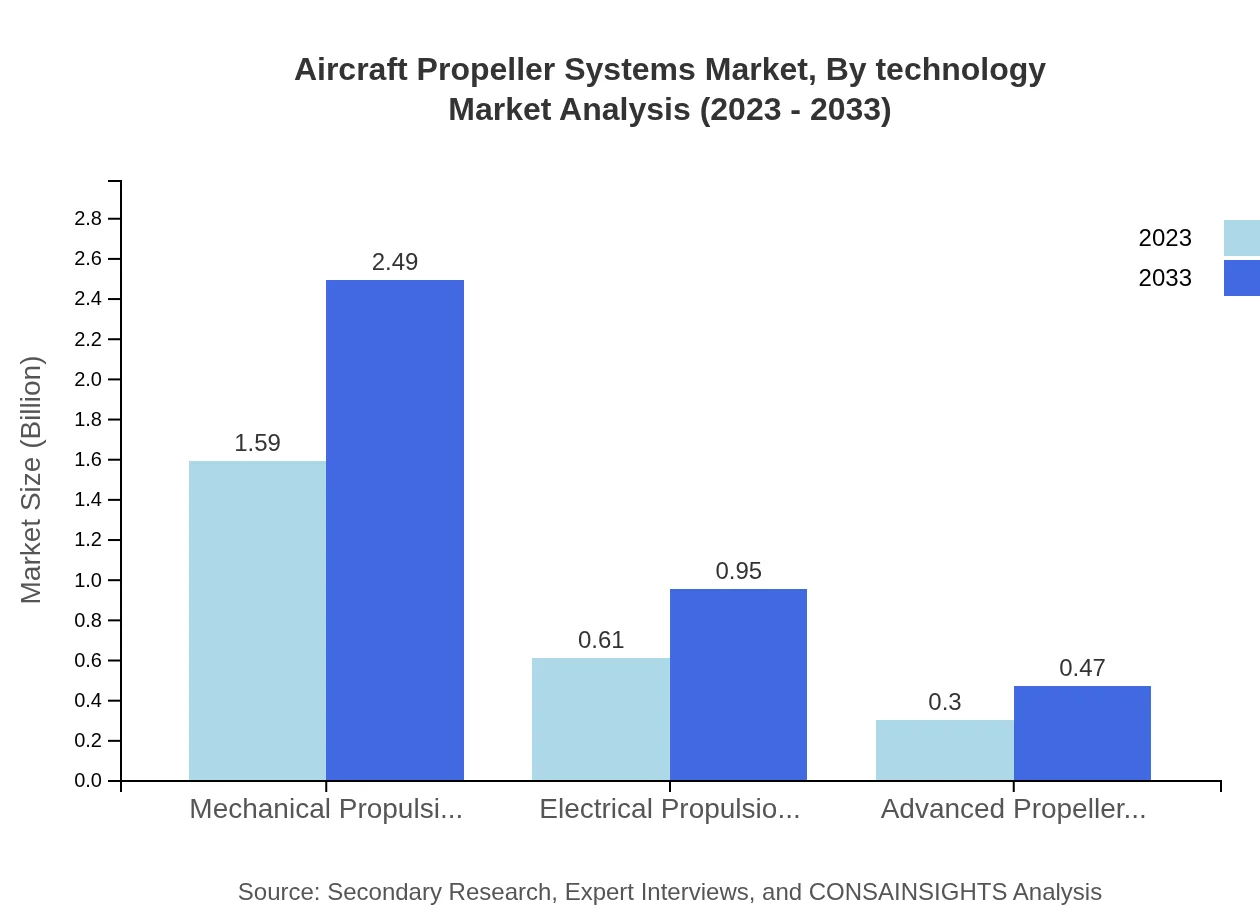

Aircraft Propeller Systems Market Analysis By Technology

Technological insights reveal a shift towards advanced propeller technologies that enhance efficiency and reduce environmental impact. Notably, mechanisms involving electrical and advanced propulsion systems are gaining traction, with significant growth from $0.30 billion in 2023 to $0.47 billion by 2033 for advanced technologies.

Aircraft Propeller Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Propeller Systems Industry

Champagne Aviation:

Known for its innovative propeller design and manufacturing, Champagne Aviation focuses on creating lightweight and durable propellers for commercial and military applications.Hartzell Propeller:

Hartzell is a leader in producing constant-speed propeller systems, emphasizing performance and efficiency. Their technology is widely adopted in the general aviation sector.MT-Propeller Entwicklung GmbH:

This German manufacturer is renowned for its composite propeller technology, providing solutions that are both efficient and environmentally friendly.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft propeller systems?

The aircraft propeller systems market is valued at approximately $2.5 billion in 2023 and is expected to grow at a CAGR of 4.5%. By 2033, the market is projected to reach significant growth, reflecting advancements in aerospace technology.

What are the key market players or companies in the aircraft propeller systems industry?

Key players in the aircraft propeller systems industry include major manufacturers such as Hartzell Propeller, McCauley Propeller Systems, and MTV Flugmotoren GmbH. These companies lead the market through innovation and high-quality product offerings.

What are the primary factors driving the growth in the aircraft propeller systems industry?

Growth in the aircraft propeller systems market is primarily driven by increasing air travel demand, advancements in propeller technology, and a rise in military aviation activities. Additionally, the push for fuel-efficient systems enhances market growth prospects.

Which region is the fastest Growing in the aircraft propeller systems market?

North America is currently the fastest-growing region in the aircraft propeller systems market, with a market size of $0.94 billion in 2023 projected to increase to $1.48 billion by 2033, reflecting a growing demand in aviation sectors across the region.

Does ConsaInsights provide customized market report data for the aircraft propeller systems industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients in the aircraft propeller systems industry. These reports provide specific insights and analyses based on various segments and regional markets.

What deliverables can I expect from this aircraft propeller systems market research project?

Deliverables from the aircraft propeller systems market research project typically include comprehensive market analysis reports, detailed segment breakdowns, competitive landscape assessments, and regional insights tailored to business requirements.

What are the market trends of aircraft propeller systems?

Current trends in the aircraft propeller systems market include a shift towards lightweight materials, the integration of smart technologies, and increased focus on environmental sustainability. These trends are influencing product development and market strategies.