Aircraft Radome Market Report

Published Date: 03 February 2026 | Report Code: aircraft-radome

Aircraft Radome Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Radome market, covering key trends, challenges, and forecasts from 2023 to 2033, providing valuable insights for stakeholders in this dynamic industry.

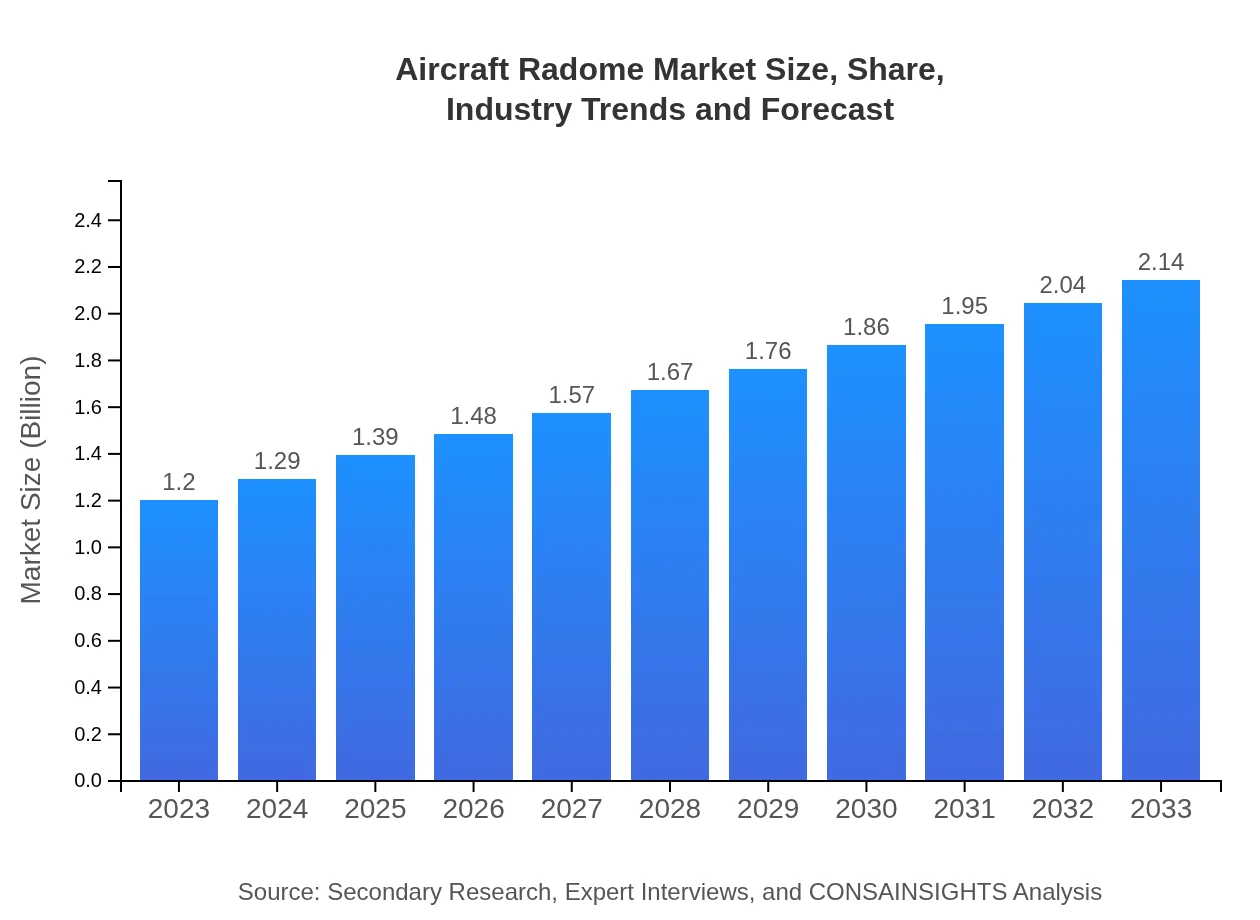

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.14 Billion |

| Top Companies | Northrop Grumman, Honeywell Aerospace, Raytheon Technologies, GKN Aerospace, L3Harris Technologies |

| Last Modified Date | 03 February 2026 |

Aircraft Radome Market Overview

Customize Aircraft Radome Market Report market research report

- ✔ Get in-depth analysis of Aircraft Radome market size, growth, and forecasts.

- ✔ Understand Aircraft Radome's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Radome

What is the Market Size & CAGR of Aircraft Radome market in 2033?

Aircraft Radome Industry Analysis

Aircraft Radome Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Radome Market Analysis Report by Region

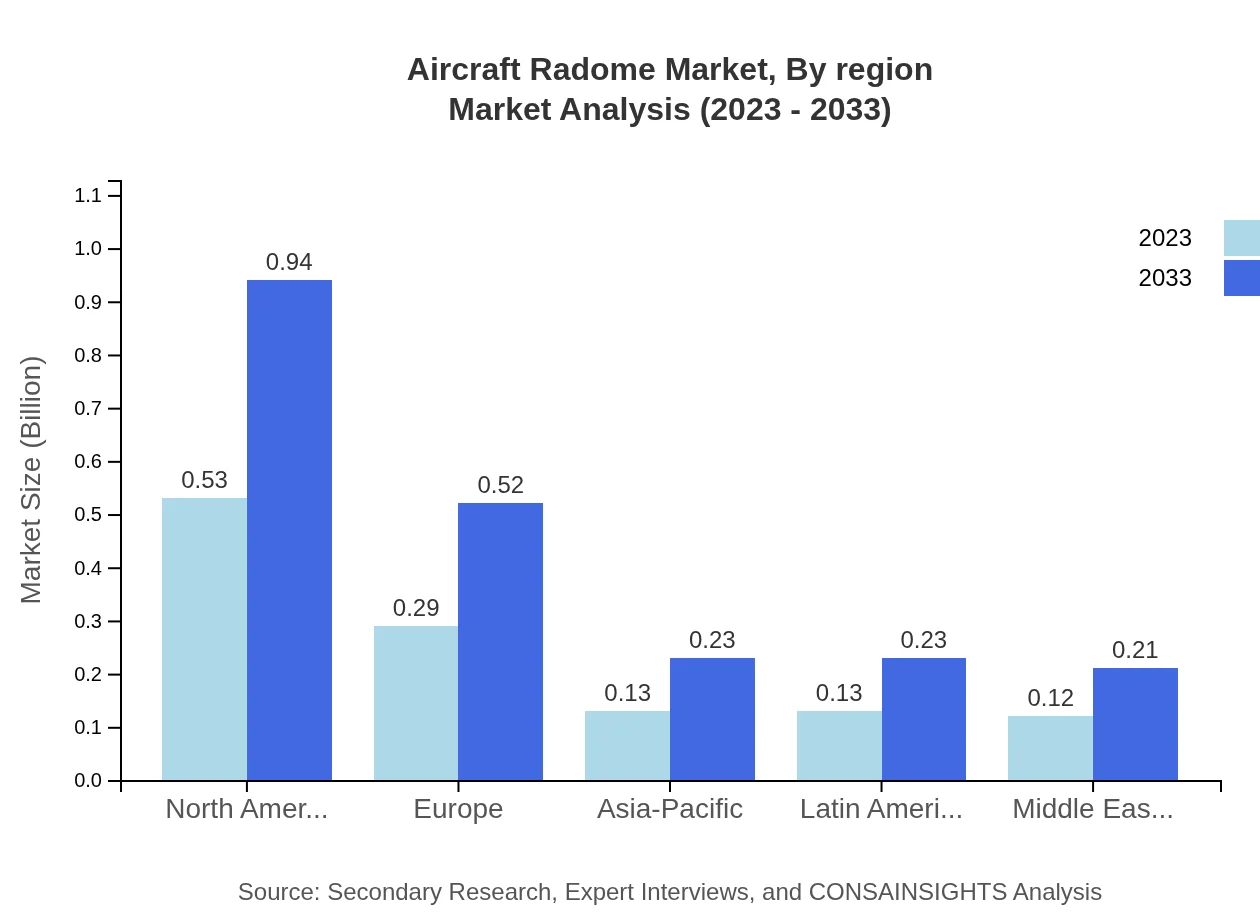

Europe Aircraft Radome Market Report:

Europe's Aircraft Radome market is projected to expand from $0.33 billion in 2023 to $0.59 billion by 2033, with significant contributions from established aircraft manufacturers. The region is also heavily investing in R&D for composite materials, enhancing product performance and sustainability in aviation.Asia Pacific Aircraft Radome Market Report:

The Asia Pacific region is projected to grow substantially from $0.24 billion in 2023 to $0.42 billion by 2033. Increased air traffic, rising incomes, and demand for advanced technology aircraft are driving this growth. Regional components manufacturers are benefiting from a surge in aircraft orders, which is expected to enhance local manufacturing capabilities and supply chain robustness.North America Aircraft Radome Market Report:

North America is the largest market for Aircraft Radome, forecasted to grow from $0.45 billion in 2023 to $0.80 billion by 2033. The presence of major aircraft manufacturers, favorable regulations, and robust military spending contribute significantly to market expansion in this region. The demand for high-tech radomes for both military and commercial applications is particularly strong.South America Aircraft Radome Market Report:

The South American market for Aircraft Radome is expected to grow from $0.06 billion in 2023 to $0.10 billion in 2033. The region's growth is likely supported by increasing investments in defense and rising demand for commercial aircraft, particularly as economies rebound post-pandemic, leading to greater air travel.Middle East & Africa Aircraft Radome Market Report:

The Middle East and Africa market is expected to increase from $0.12 billion in 2023 to $0.22 billion by 2033. Growth in this region is driven by increasing defense budgets and investments in modernization of military aircraft, alongside rising passenger traffic in commercial aviation sectors.Tell us your focus area and get a customized research report.

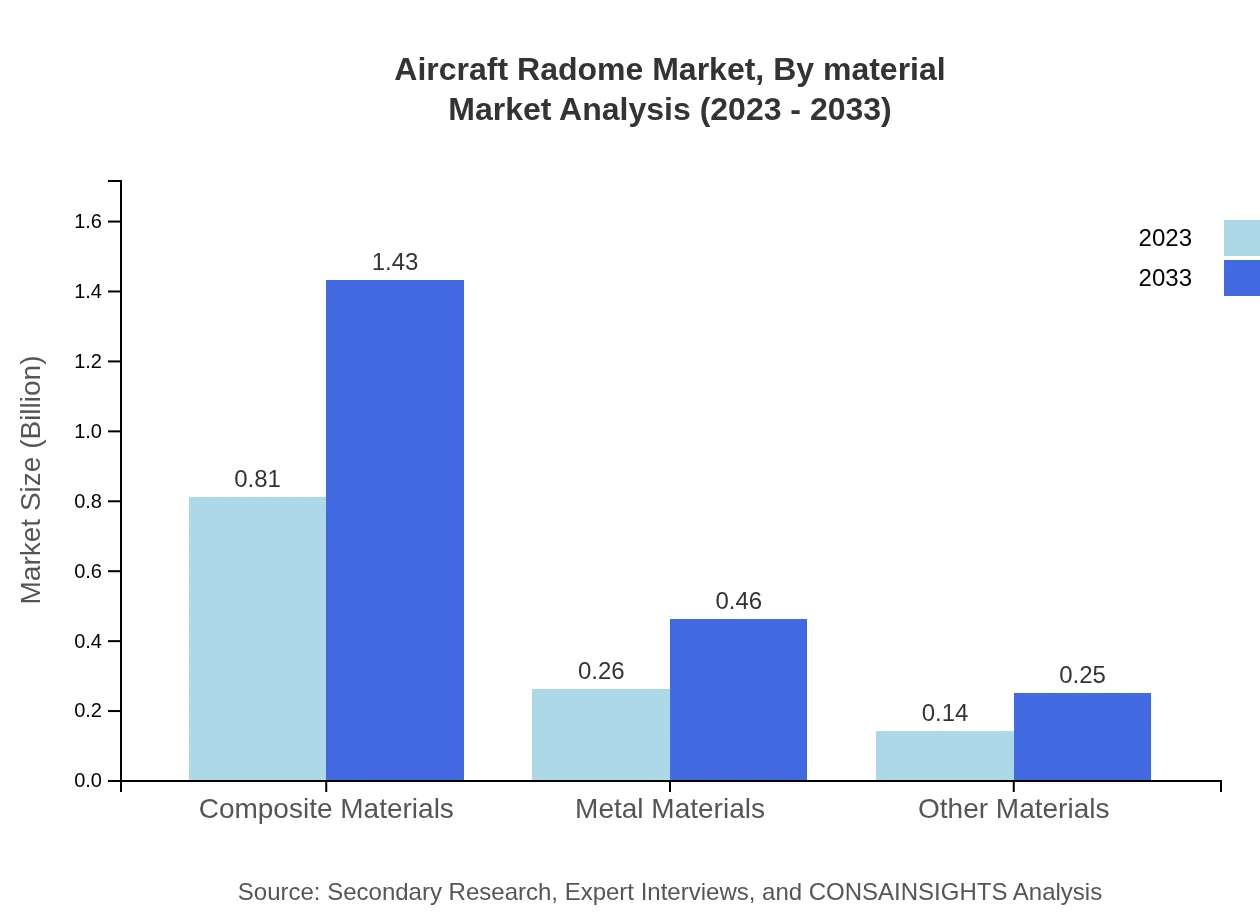

Aircraft Radome Market Analysis By Material

In 2023, composite materials hold a significant share, accounting for approximately 67.1% of the market, projected to reach 67.1% in 2033. This is driven by their lightweight and durable properties suitable for both commercial and military applications. In contrast, metal materials currently represent 21.34% and are expected to retain this market position with slight growth, while other materials make up 11.56%.

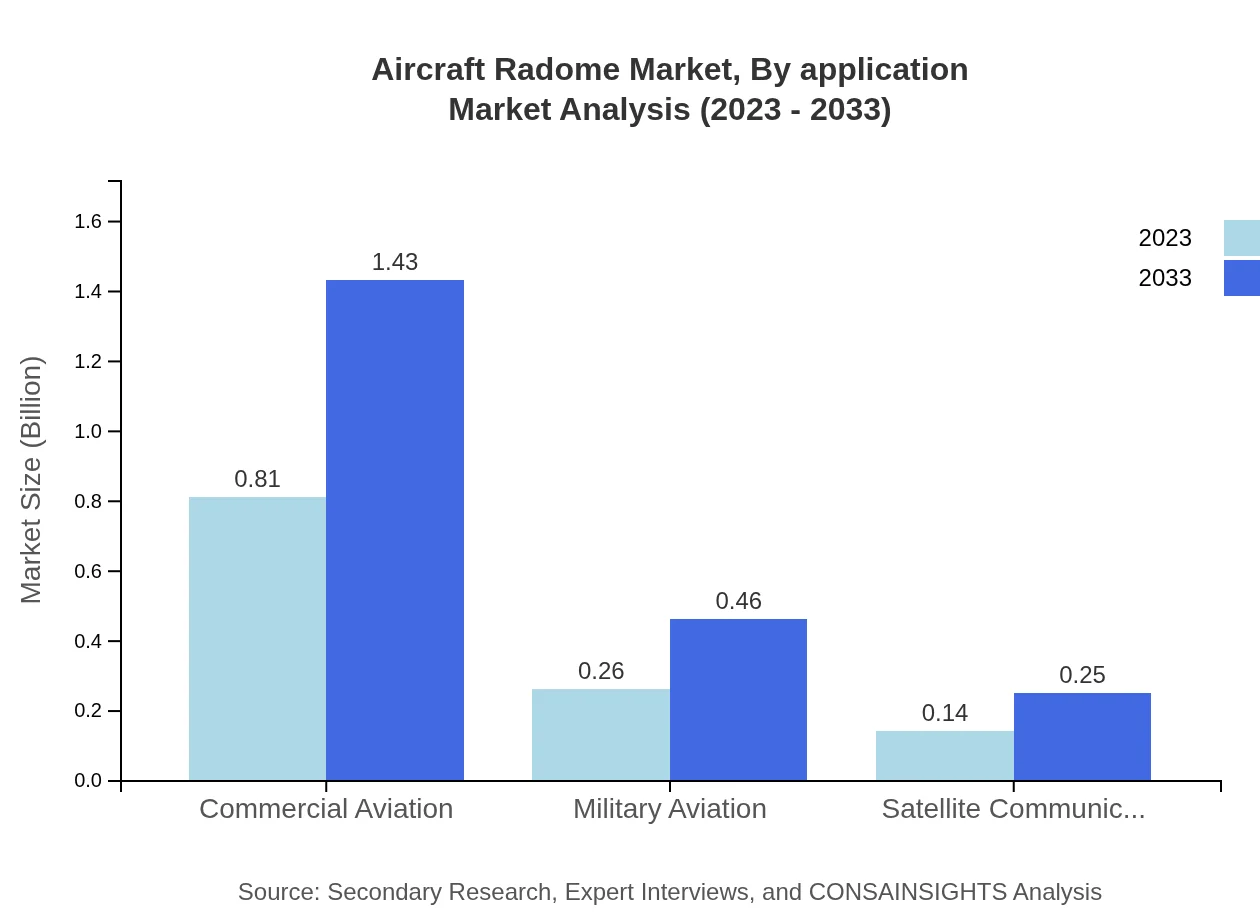

Aircraft Radome Market Analysis By Application

The commercial aviation segment is dominant with a market share of 67.1% in 2023, expected to remain stable through 2033. Military aviation follows, capturing approximately 21.34%, reflecting consistent defense spending. The satellite communication segment, less prominent, accounts for 11.56% of the market but is poised for growth as the demand for aerial technologies rises.

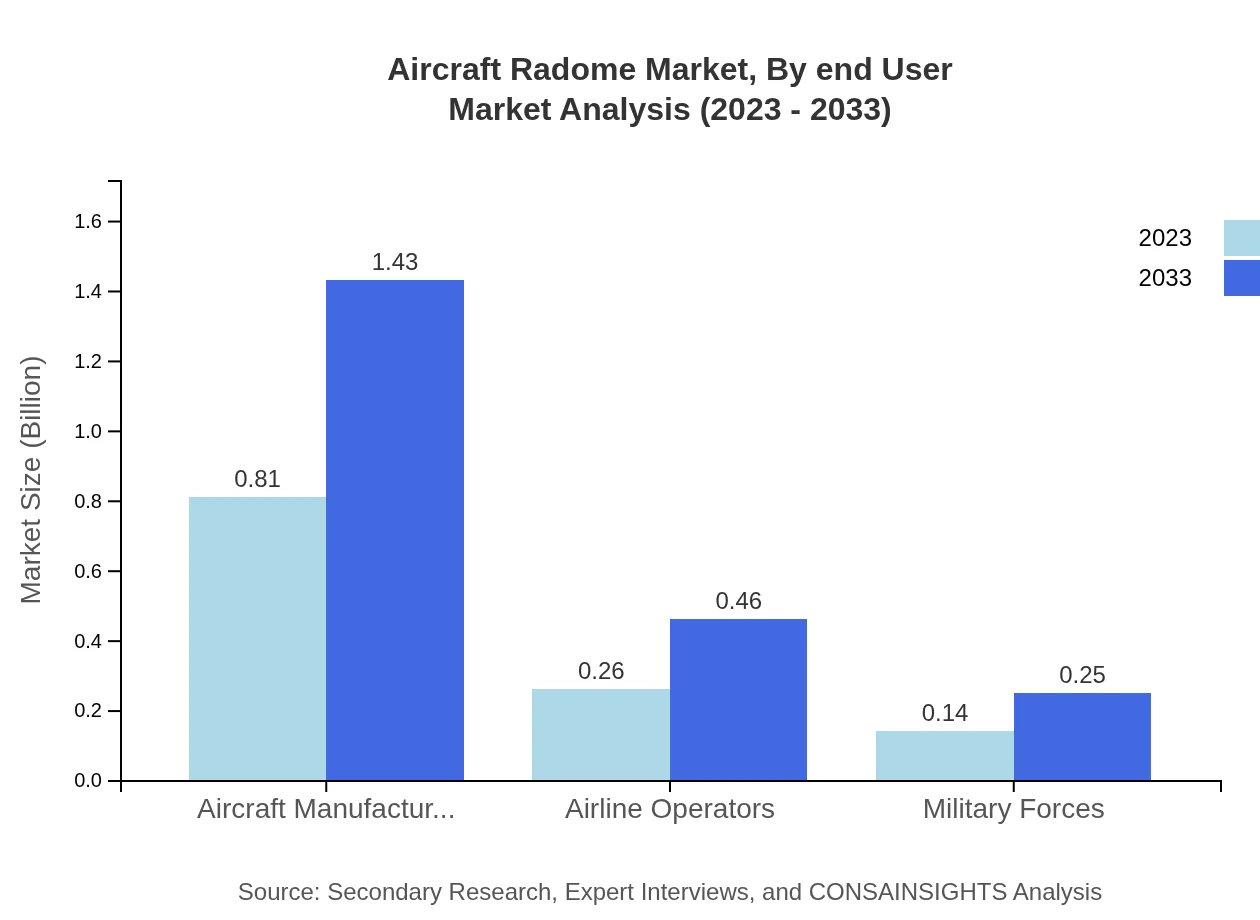

Aircraft Radome Market Analysis By End User

Aircraft manufacturers dominate the market, accounting for 67.1% of the share in 2023 and projected to hold this percentage through 2033. The airline operators segment follows closely with 21.34%, benefitting greatly from new aircraft deliveries and upgrades, while military forces claim 11.56% reflecting their ongoing requirements for advanced aircraft systems.

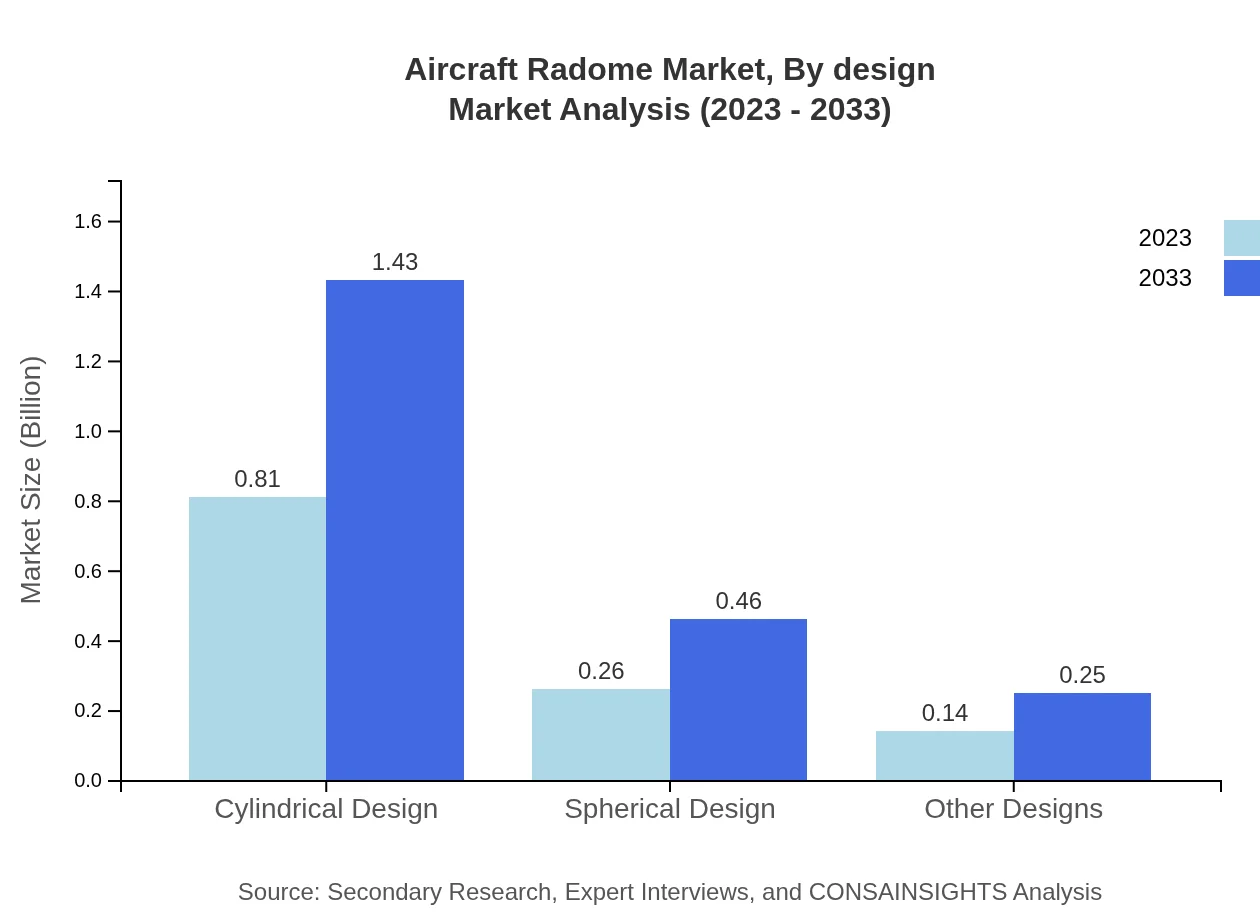

Aircraft Radome Market Analysis By Design

Cylindrical designs lead the market due to their structural benefits, occupying approximately 67.1% in 2023, remaining stable until 2033. Spherical designs constitute 21.34% and are favored for specific applications where radar performance is critical. Other designs collectively contribute 11.56%, relevant in niche applications.

Aircraft Radome Market Analysis By Region

Each regional market presents unique growth dynamics. North America remains a stronghold due to established aerospace sectors. Europe and Asia are expanding rapidly with increasing investments in aviation. Meanwhile, developing markets in the Middle East and Latin America are emerging as key areas for growth and modernization.

Aircraft Radome Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Radome Industry

Northrop Grumman:

A leader in aerospace and defense technology, Northrop Grumman specializes in developing advanced radome solutions for both military and commercial applications.Honeywell Aerospace:

Honeywell Aerospace provides a range of aerospace products, including high-tech radomes for commercial and military aircraft, focusing on enhancing performance and safety.Raytheon Technologies:

Raytheon Technologies is a major player in the aerospace sector, offering innovative radome technologies aimed at improving aircraft communication and navigation capabilities.GKN Aerospace:

GKN Aerospace specializes in innovative composite structures, contributing significantly to lightweight radome designs that improve aircraft efficiency.L3Harris Technologies:

A key provider of electronic systems, L3Harris Technologies develops advanced radomes focused on enhancing military aviation systems.We're grateful to work with incredible clients.

FAQs

What is the market size of Aircraft Radome?

The Aircraft Radome market is projected to reach a size of $1.2 billion by 2033, growing at a CAGR of 5.8% from its current valuation. This growth reflects the increasing demand for enhanced aircraft capabilities and advancements in technology.

What are the key market players or companies in the Aircraft Radome industry?

Key players in the Aircraft Radome industry include major aircraft manufacturers like Boeing and Airbus, along with specialized companies like L3Harris and Meggitt, which focus on radome design and manufacturing.

What are the primary factors driving the growth in the Aircraft Radome industry?

Growth in the Aircraft Radome industry is primarily driven by the rising demand for commercial aircraft, advancements in radar technology, and increasing investments in military aviation. The shift towards composite materials for lightweight designs also fuels market expansion.

Which region is the fastest Growing in the Aircraft Radome market?

North America is currently the fastest-growing region in the Aircraft Radome market, projected to grow from $0.45 billion in 2023 to $0.80 billion by 2033. The strong presence of aircraft manufacturers in this region enhances its market expansion.

Does ConsaInsights provide customized market report data for the Aircraft Radome industry?

Yes, ConsaInsights offers customized market report data specifically tailored to the Aircraft Radome industry, allowing clients to obtain insights based on their unique needs and specifications.

What deliverables can I expect from this Aircraft Radome market research project?

Deliverables from the Aircraft Radome market research project typically include detailed market analysis, competitive landscape assessments, segmented data by region and design type, and comprehensive forecasting reports.

What are the market trends of Aircraft Radome?

Current trends in the Aircraft Radome market include a growing preference for composite materials, an increase in military applications, and technological advancements aimed at improving radar performance and fuel efficiency in aircraft.