Aircraft Seat Upholstery Market Report

Published Date: 03 February 2026 | Report Code: aircraft-seat-upholstery

Aircraft Seat Upholstery Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Aircraft Seat Upholstery market, exploring market size, growth trends, and future forecasts from 2023 to 2033. It offers detailed analyses of regions, segments, technologies, and key market players shaping this industry.

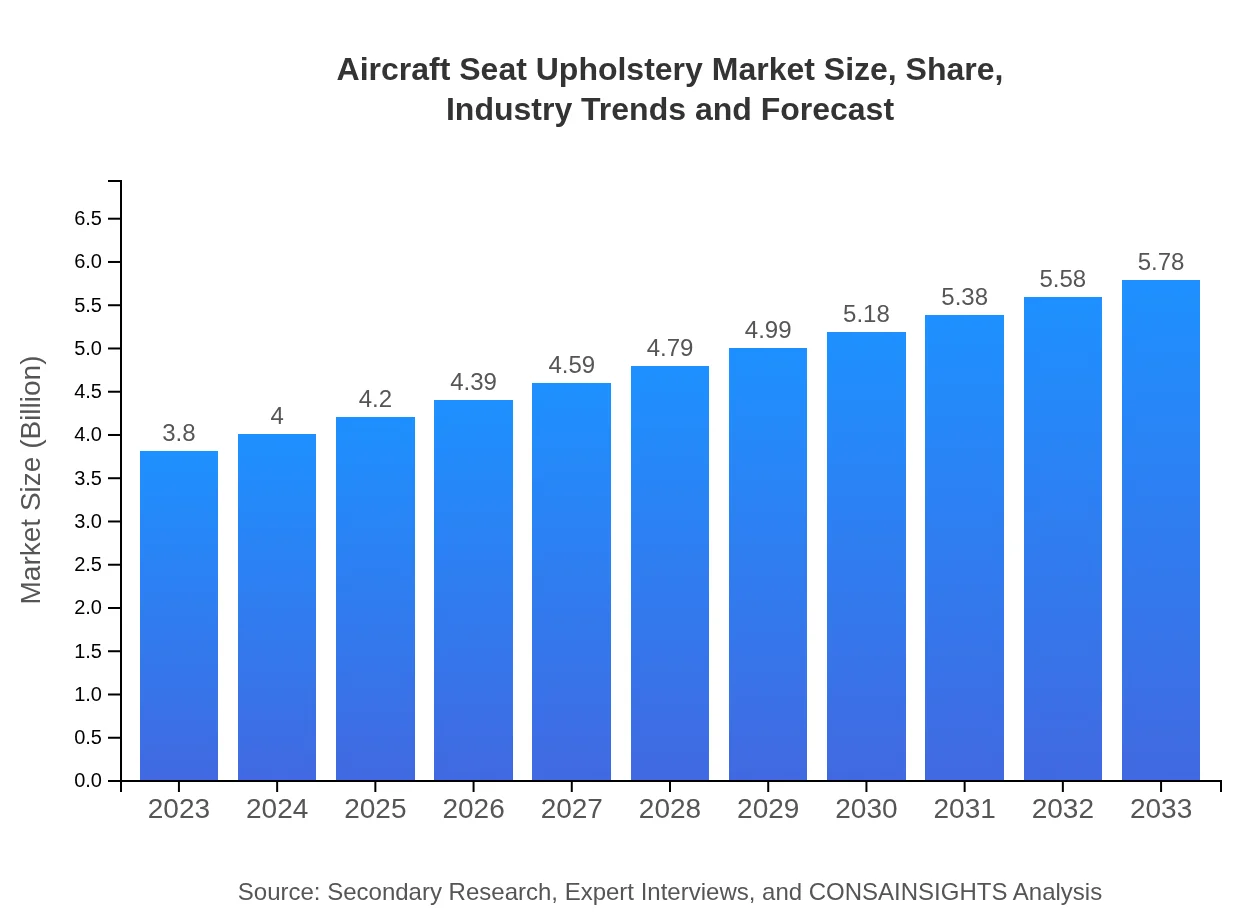

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $5.78 Billion |

| Top Companies | Zodiac Aerospace, B/E Aerospace (part of Rockwell Collins), Aqua Aeromotive, Trim Design, Katzkin Leather |

| Last Modified Date | 03 February 2026 |

Aircraft Seat Upholstery Market Overview

Customize Aircraft Seat Upholstery Market Report market research report

- ✔ Get in-depth analysis of Aircraft Seat Upholstery market size, growth, and forecasts.

- ✔ Understand Aircraft Seat Upholstery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Seat Upholstery

What is the Market Size & CAGR of Aircraft Seat Upholstery market in 2023?

Aircraft Seat Upholstery Industry Analysis

Aircraft Seat Upholstery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Seat Upholstery Market Analysis Report by Region

Europe Aircraft Seat Upholstery Market Report:

Europe is expected to increase from $1.25 billion in 2023 to $1.89 billion by 2033. The European market thrives on a diverse range of airlines demanding both luxury and affordable seating solutions. Eco-friendly initiatives and a strong emphasis on passenger comfort further fuel the growth of the Aircraft Seat Upholstery market in this region.Asia Pacific Aircraft Seat Upholstery Market Report:

The Asia Pacific region is projected to grow significantly, from $0.75 billion in 2023 to $1.13 billion by 2033. This growth is driven by increasing air travel demand, expansion of airline fleets, and the emergence of low-cost carriers in numerous countries. Innovations in upholstery materials and designs tailored for aesthetic appeal in expanding aviation markets augment this region's market potential.North America Aircraft Seat Upholstery Market Report:

North America stands as one of the largest markets for Aircraft Seat Upholstery, with an anticipated growth from $1.23 billion in 2023 to $1.87 billion by 2033. This region benefits from a mature airline industry, continuous investment in innovation, and a high preference for premium seating options. Furthermore, regulatory standards governing materials contribute to a robust demand for high-quality upholstery solutions.South America Aircraft Seat Upholstery Market Report:

South America exhibits a gradual growth trend, expanding from $0.28 billion in 2023 to $0.43 billion by 2033. Factors contributing to this growth include the rising number of domestic and international flights and an enhanced focus on passenger comfort to stimulate air travel within the region. The establishment of new airlines and modernization of existing fleets is expected to demand upgraded upholstery solutions.Middle East & Africa Aircraft Seat Upholstery Market Report:

The Middle East and Africa market is set to rise from $0.29 billion in 2023 to $0.45 billion by 2033. This growth can be attributed to the expansion of airline operations and the Gulf region's increasing accessibility. The influx of international tourism and business travel in addition to initiatives to improve travel experiences are vital influences driving market demand.Tell us your focus area and get a customized research report.

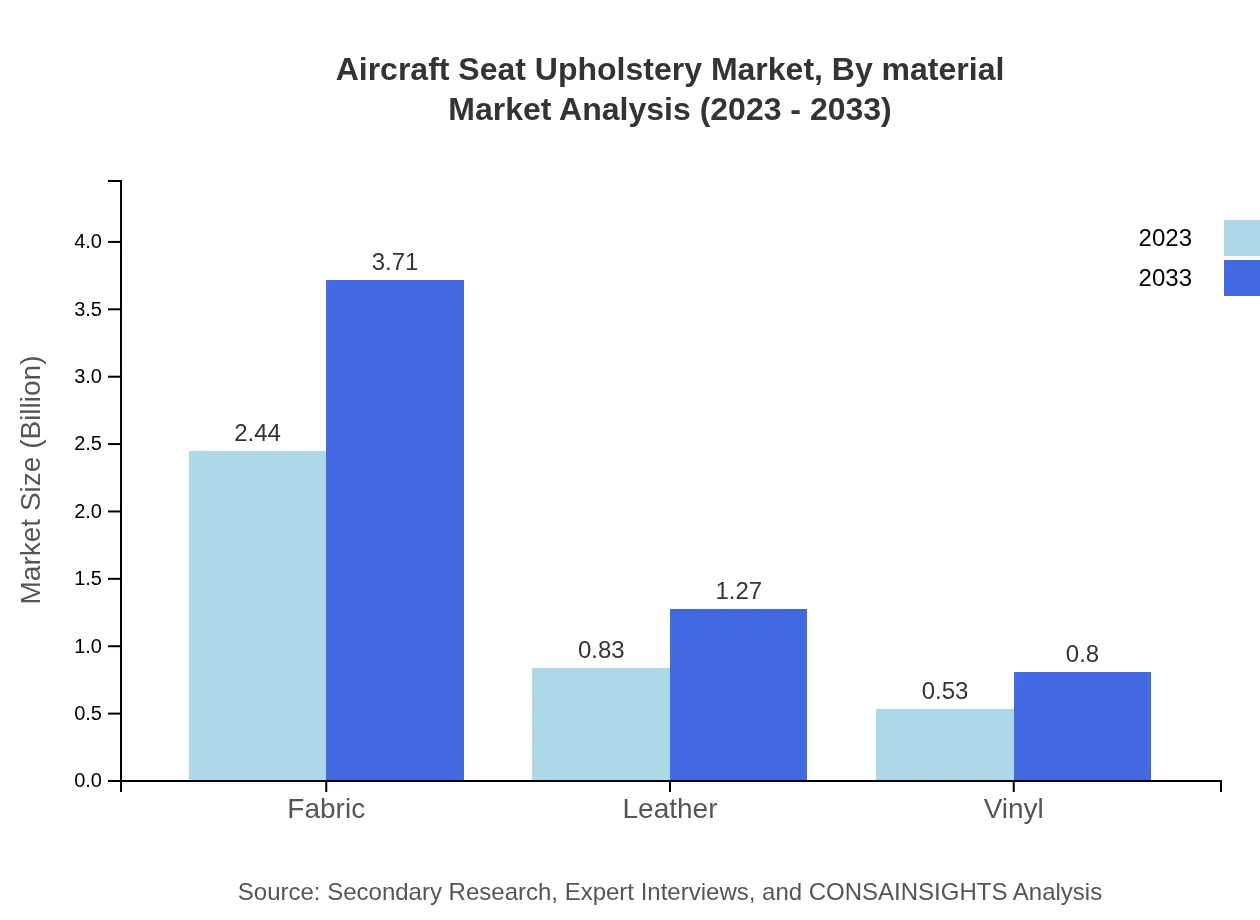

Aircraft Seat Upholstery Market Analysis By Material

The material segment showcases key players engaging in offerings of Fabric, Leather, and Vinyl upholstery. By 2033, the Fabric segment is expected to maintain dominance with 64.18% of market share, while Leather and Vinyl are projected to hold 21.92% and 13.9% respectively. This distribution highlights the preference for comfort and durability offered by Fabric upholstery in aircraft seating.

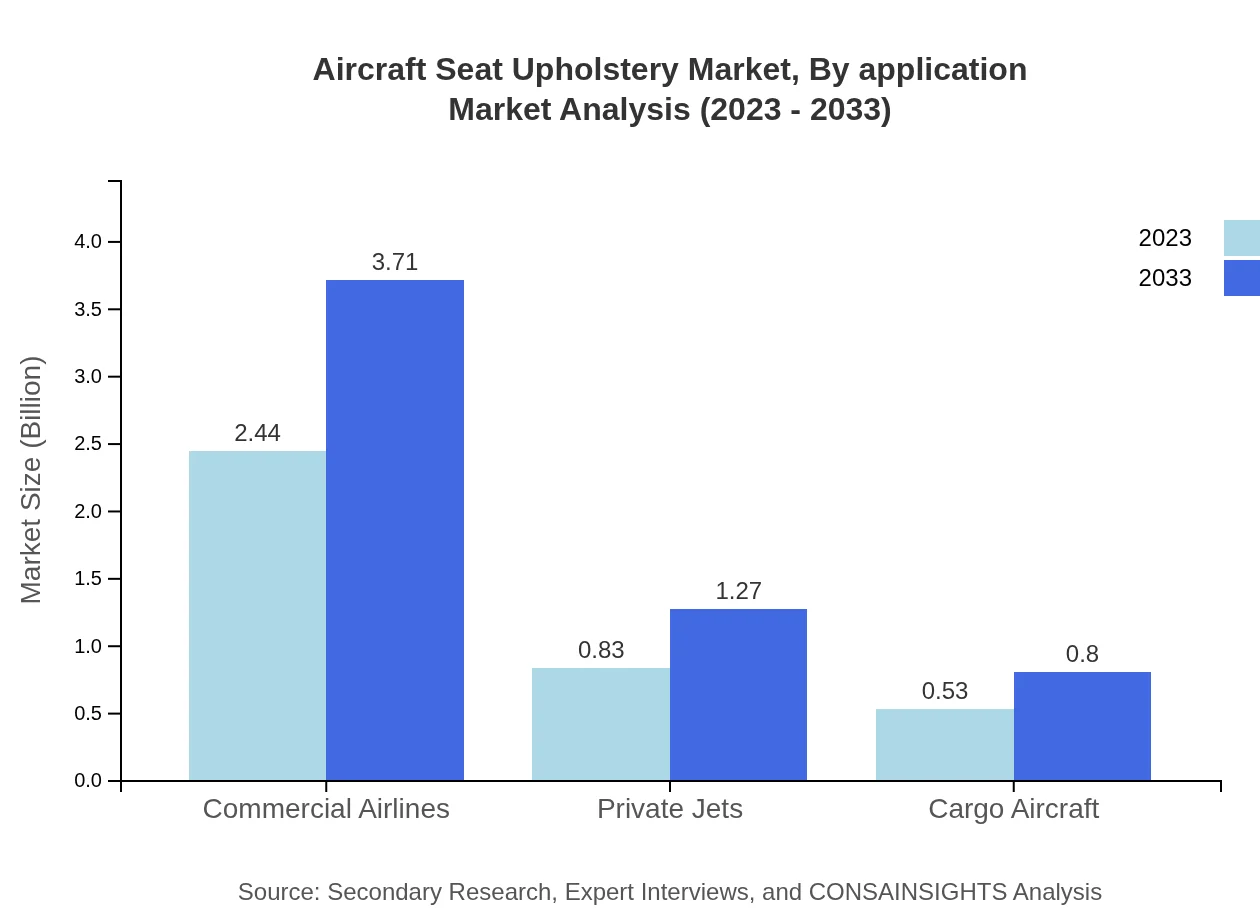

Aircraft Seat Upholstery Market Analysis By Application

In application segmentation, Commercial Airlines constitute a significant portion, growing from $2.44 billion in 2023 to $3.71 billion by 2033. This reflects a continuous improvement towards enhancing guest experiences in commercial flights. Private Jets are also a considerable segment with expected growth, indicating luxury market demands are on the rise.

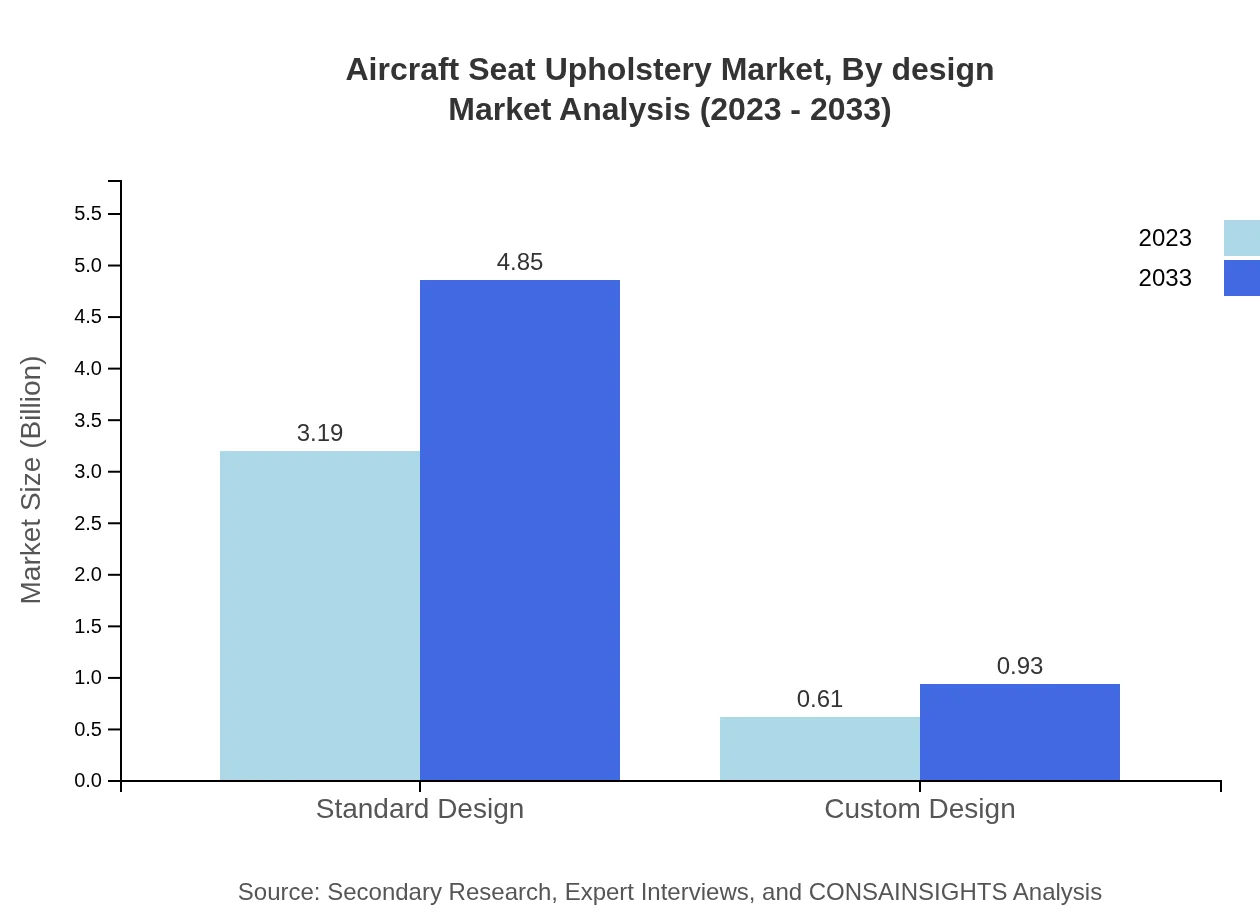

Aircraft Seat Upholstery Market Analysis By Design

The design segment reveals a stark division between Standard and Custom designs. Standard Design is forecasted to dominate with a share of 83.87%, while Custom Design represents a smaller segment at 16.13%. Custom designs are increasingly appealing to airlines trying to solidify brand identity through unique cabin experiences, albeit at a higher cost.

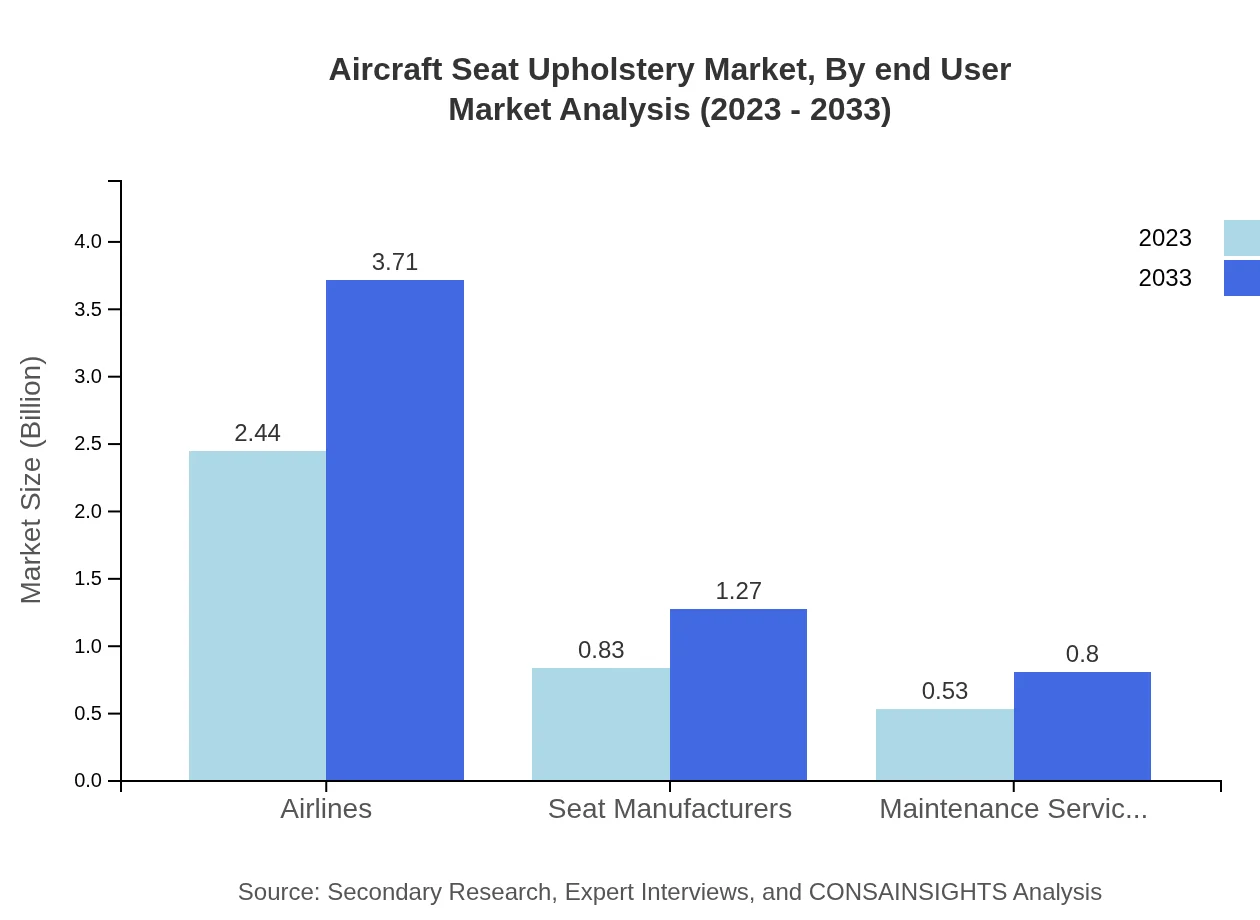

Aircraft Seat Upholstery Market Analysis By End User

End-users are categorized primarily as Airlines, Seat Manufacturers, and Maintenance Service Providers. Airlines share the largest market portion of 64.18%. Seat Manufacturers follow suit with 21.92%, reflecting the collaborative effort required in the supply chain for quality upholstery solutions in aircraft.

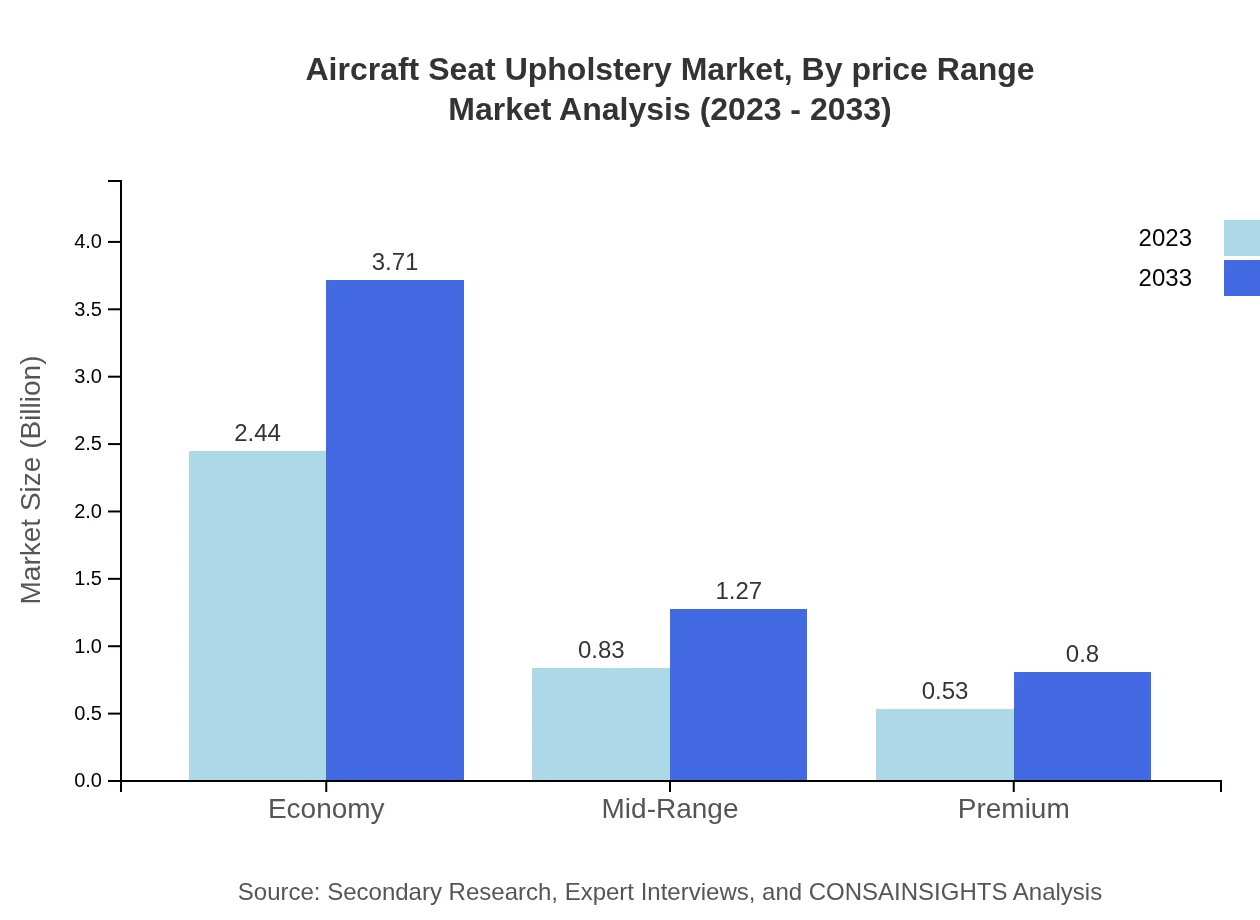

Aircraft Seat Upholstery Market Analysis By Price Range

The segmentation by price range highlights Economy, Mid-Range, and Premium upholstery. The Economy segment leads with 64.18% market share, emphasizing demand for cost-effective solutions. Mid-Range and Premium options capture 21.92% and 13.9% respectively, indicating a market willing to pay more for enhanced quality and aesthetics.

Aircraft Seat Upholstery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Seat Upholstery Industry

Zodiac Aerospace:

Zodiac Aerospace is a leader in aerospace equipment, focusing on innovative solutions for aircraft interiors, including upholstery designs that enhance comfort and style.B/E Aerospace (part of Rockwell Collins):

B/E Aerospace specializes in aircraft seats, cabin products, and advanced passenger services focusing on delivering high-quality upholstery solutions within the aviation sector.Aqua Aeromotive:

Aqua Aeromotive offers design and manufacturing services for aircraft interiors, including upholstery solutions tailored to meet the demands of both commercial and private aviation markets.Trim Design:

Trim Design is renowned for its high-quality aircraft upholstery materials, concentrating on innovative and sustainable solutions, thus leading market trends in eco-friendly upholstery.Katzkin Leather:

Katzkin Leather is known for custom automotive upholstery but extends its expertise to aviation, providing premium leather upholstery options for various aircraft applications.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft seat upholstery?

The global aircraft seat upholstery market size is approximately $3.8 billion in 2023, with a projected CAGR of 4.2% from 2023 to 2033. This growth is fueled by rising air travel demands and advancements in upholstery materials.

What are the key market players or companies in the aircraft seat upholstery industry?

The market features key players such as Collins Aerospace, Ametek, Inc., Acro Aircraft Seating, and Safran, who dominate with innovative products and robust supply chains, facilitating their competitive edge in the aircraft seat upholstery sector.

What are the primary factors driving the growth in the aircraft seat upholstery industry?

Key growth drivers include increasing passenger air transportation demand, advancements in material technology for durability and comfort, and rising investments in fleet upgrades by airlines promoting enhanced passenger experience.

Which region is the fastest Growing in the aircraft seat upholstery market?

The Asia Pacific region is currently the fastest-growing market, projected to grow from $0.75 billion in 2023 to $1.13 billion by 2033, driven by increasing air travel and expanding airline fleets.

Does ConsaInsights provide customized market report data for the aircraft seat upholstery industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements, enabling clients to access detailed insights regarding market trends, consumer preferences, and competitive analysis in the aircraft seat upholstery industry.

What deliverables can I expect from this aircraft seat upholstery market research project?

Clients can expect comprehensive reports detailing market analysis, competitive landscape, consumer insights, growth forecasts, and tailored recommendations for strategic decisions within the aircraft seat upholstery market.

What are the market trends of aircraft seat upholstery?

Current market trends include a shift towards sustainable materials, increased customization in upholstery designs, and enhanced focus on passenger wellness, driving innovation and changing consumer preferences in the aircraft seat upholstery sector.