Aircraft Sensors Market Report

Published Date: 31 January 2026 | Report Code: aircraft-sensors

Aircraft Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Sensors market, highlighting significant insights and data trends from 2023 to 2033, including market size, growth forecasts, segmentation analysis, and regional insights.

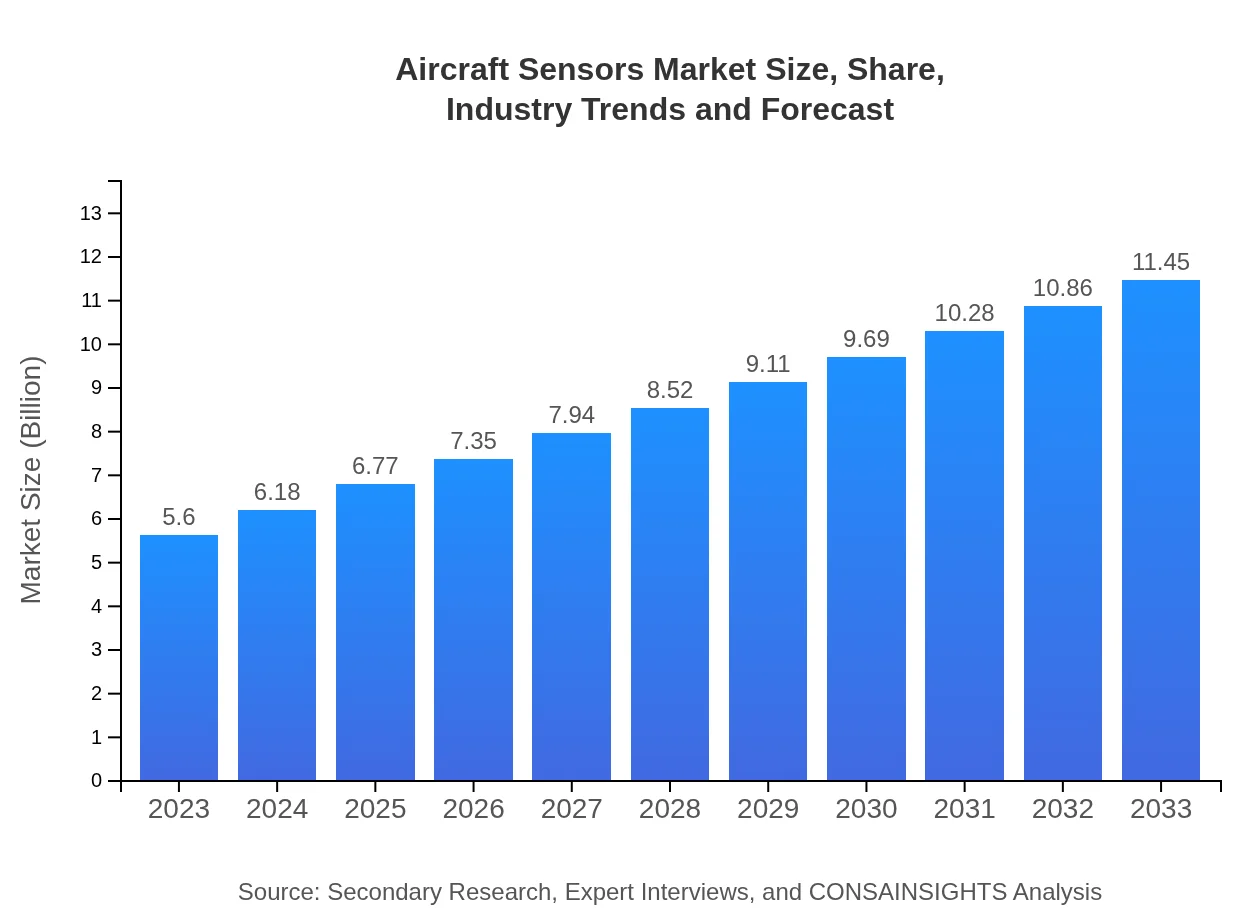

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Honeywell International Inc., General Electric Company, Boeing , Thales Group |

| Last Modified Date | 31 January 2026 |

Aircraft Sensors Market Overview

Customize Aircraft Sensors Market Report market research report

- ✔ Get in-depth analysis of Aircraft Sensors market size, growth, and forecasts.

- ✔ Understand Aircraft Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Sensors

What is the Market Size & CAGR of Aircraft Sensors market in 2023?

Aircraft Sensors Industry Analysis

Aircraft Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Sensors Market Analysis Report by Region

Europe Aircraft Sensors Market Report:

Europe's market is poised to grow from $1.87 billion in 2023 to $3.82 billion by 2033. Increasing government regulations regarding aviation safety and the presence of key players in the region are expected to enhance the aircraft sensors market.Asia Pacific Aircraft Sensors Market Report:

In 2023, the Asia-Pacific region is expected to hold a market size of $1.01 billion, growing to $2.06 billion by 2033. The rapid growth in the aviation sector, coupled with increasing investments in modernizing aircraft fleets and rising passenger traffic, is driving demand for advanced sensor technologies across this region.North America Aircraft Sensors Market Report:

With a market size of $1.96 billion in 2023, North America is projected to reach $4.01 billion by 2033. The presence of major aerospace manufacturers and continuous innovation in sensor technology for commercial and military aviation are significant factors driving market growth.South America Aircraft Sensors Market Report:

The South American market is anticipated to grow from $0.12 billion in 2023 to around $0.25 billion by 2033. The increasing focus on improving internal and external flight safety measures in the region is expected to drive demand for sophisticated aircraft sensors.Middle East & Africa Aircraft Sensors Market Report:

The Middle East and Africa market is expected to increase from $0.63 billion in 2023 to $1.30 billion by 2033. Growing investments in the aviation infrastructure and rising demand for passenger and cargo transportation will contribute to market expansion in this region.Tell us your focus area and get a customized research report.

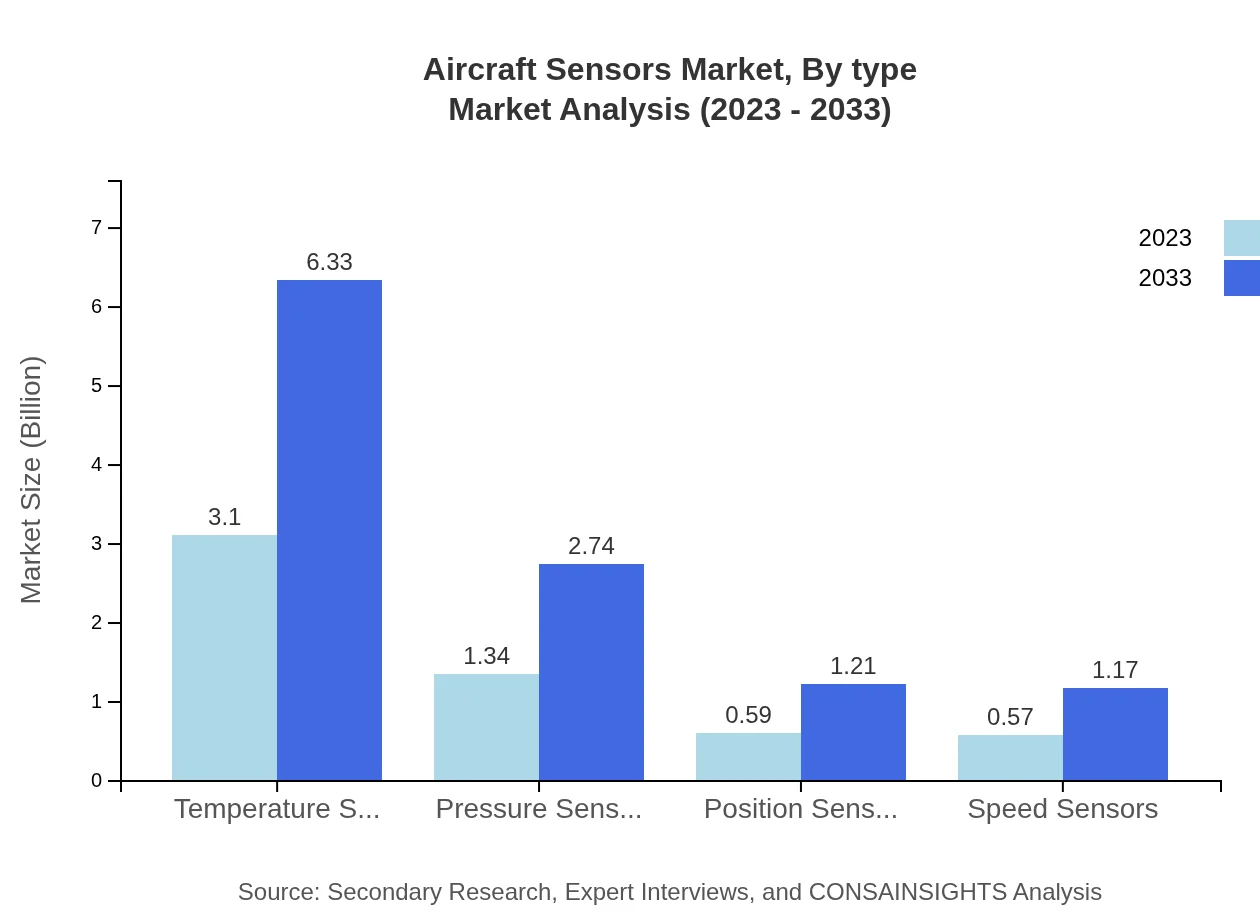

Aircraft Sensors Market Analysis By Type

The Aircraft Sensors Market can be categorized into various types, including: Temperature Sensors (2023 Market Size: $3.10 billion, Share: 55.29%), Pressure Sensors (2023 Market Size: $1.34 billion, Share: 23.92%), Position Sensors (2023 Market Size: $0.59 billion, Share: 10.58%), Speed Sensors (2023 Market Size: $0.57 billion, Share: 10.21%). These sensors are integral in ensuring aircraft safety and operational efficiency.

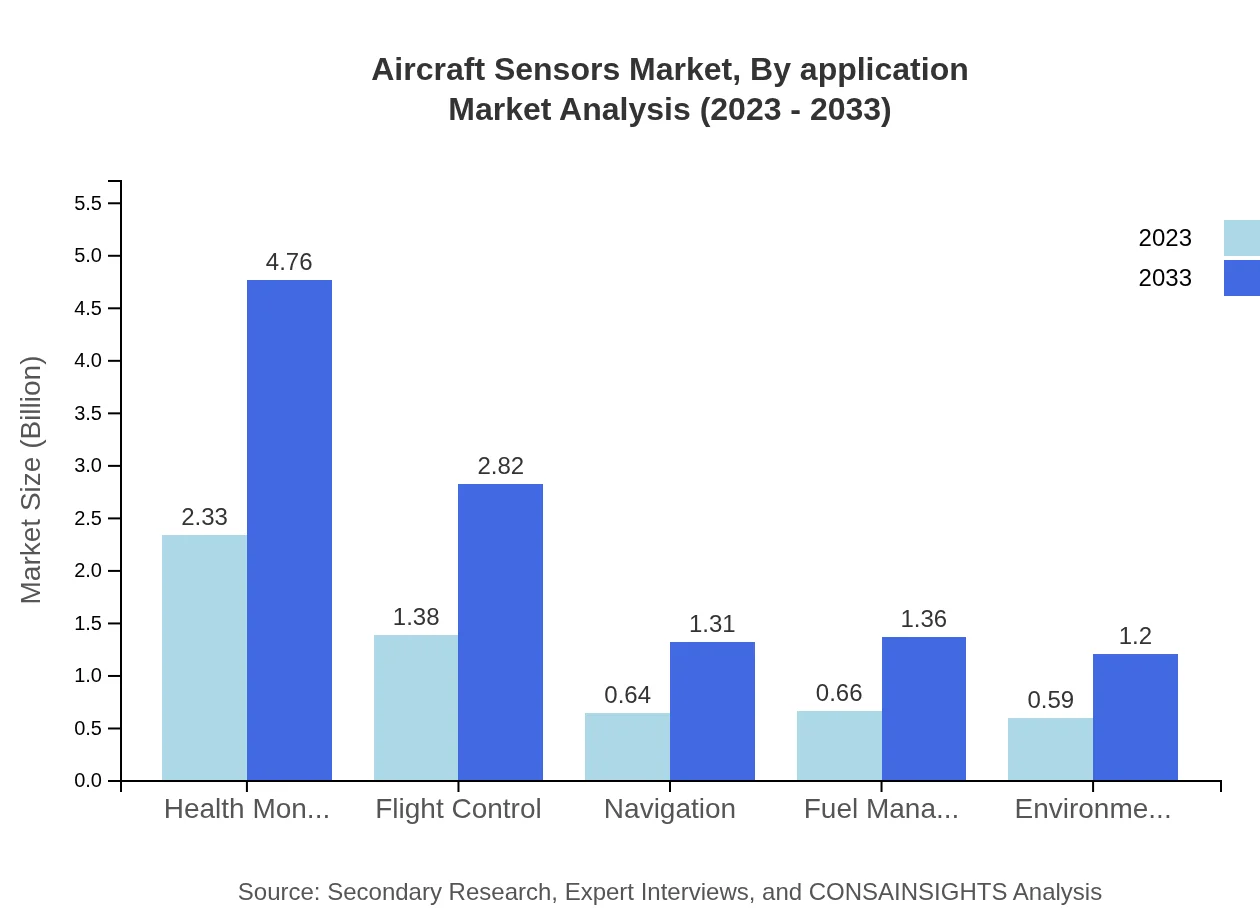

Aircraft Sensors Market Analysis By Application

Key applications of aircraft sensors include: Health Monitoring (2023 Market Size: $2.33 billion, Share: 41.55%), Flight Control (2023 Market Size: $1.38 billion, Share: 24.66%), Navigation (2023 Market Size: $0.64 billion, Share: 11.46%). These applications are crucial for maintaining and optimizing aircraft performance.

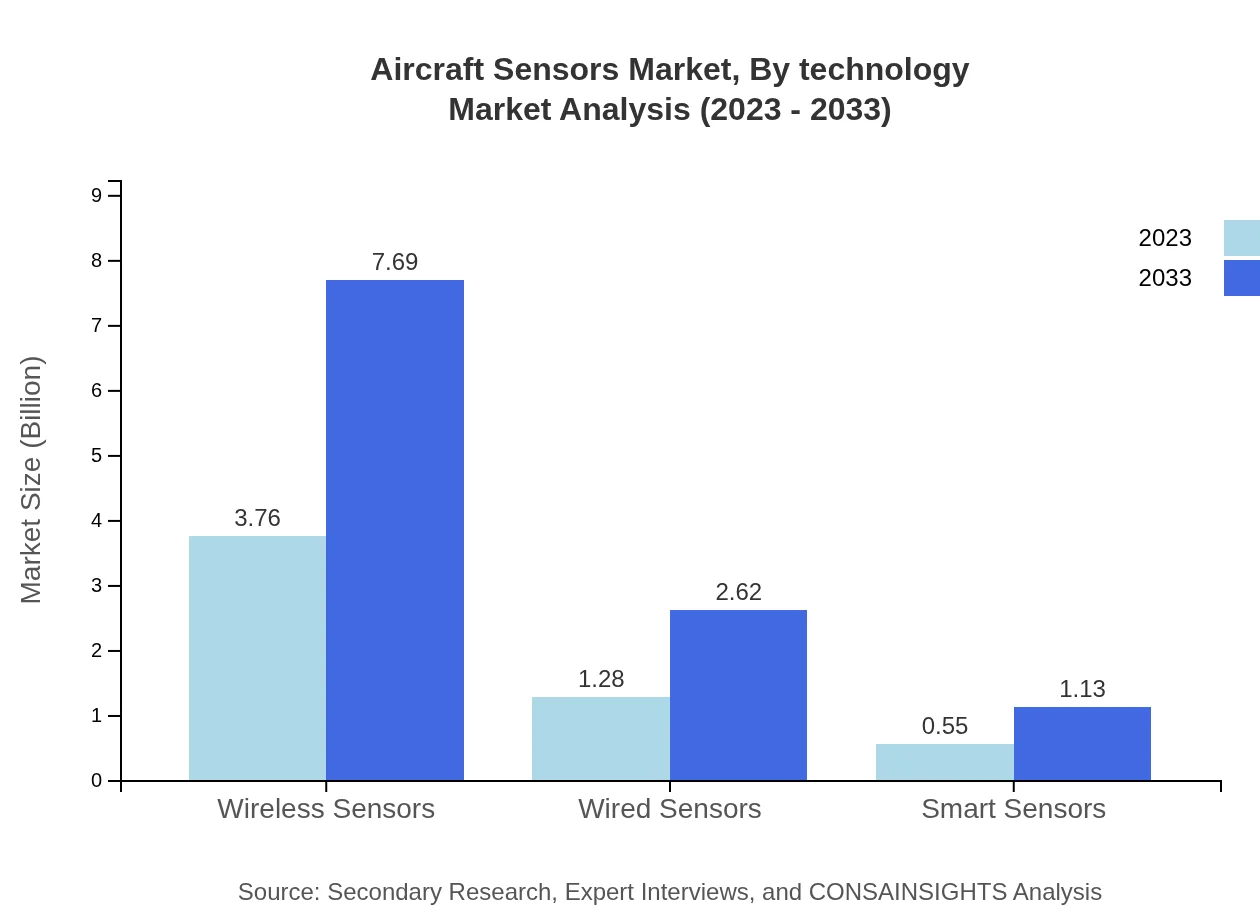

Aircraft Sensors Market Analysis By Technology

The market is segmented by technology, featuring Wireless Sensors (2023 Market Size: $3.76 billion, Share: 67.22%) and Wired Sensors (2023 Market Size: $1.28 billion, Share: 22.87%). Wireless technology is increasingly favored due to its advantages such as reduced installation costs and flexibility in sensor placements.

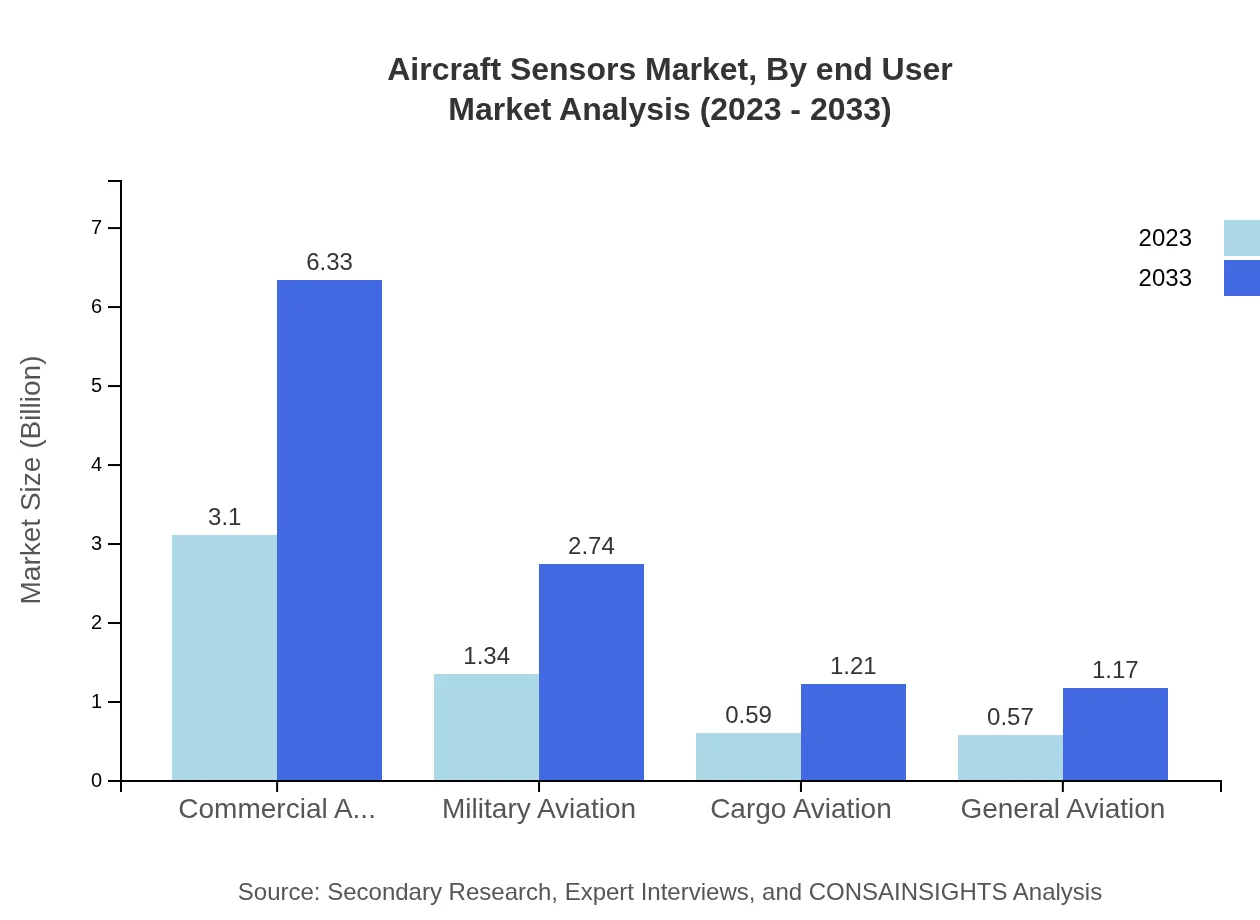

Aircraft Sensors Market Analysis By End User

Key end-users of aircraft sensors are classified into Commercial Aviation (2023 Market Size: $3.10 billion, Share: 55.29%), Military Aviation (2023 Market Size: $1.34 billion, Share: 23.92%), and Cargo Aviation (2023 Market Size: $0.59 billion, Share: 10.58%). The commercial segment remains dominant owing to the high demand for passenger air travel.

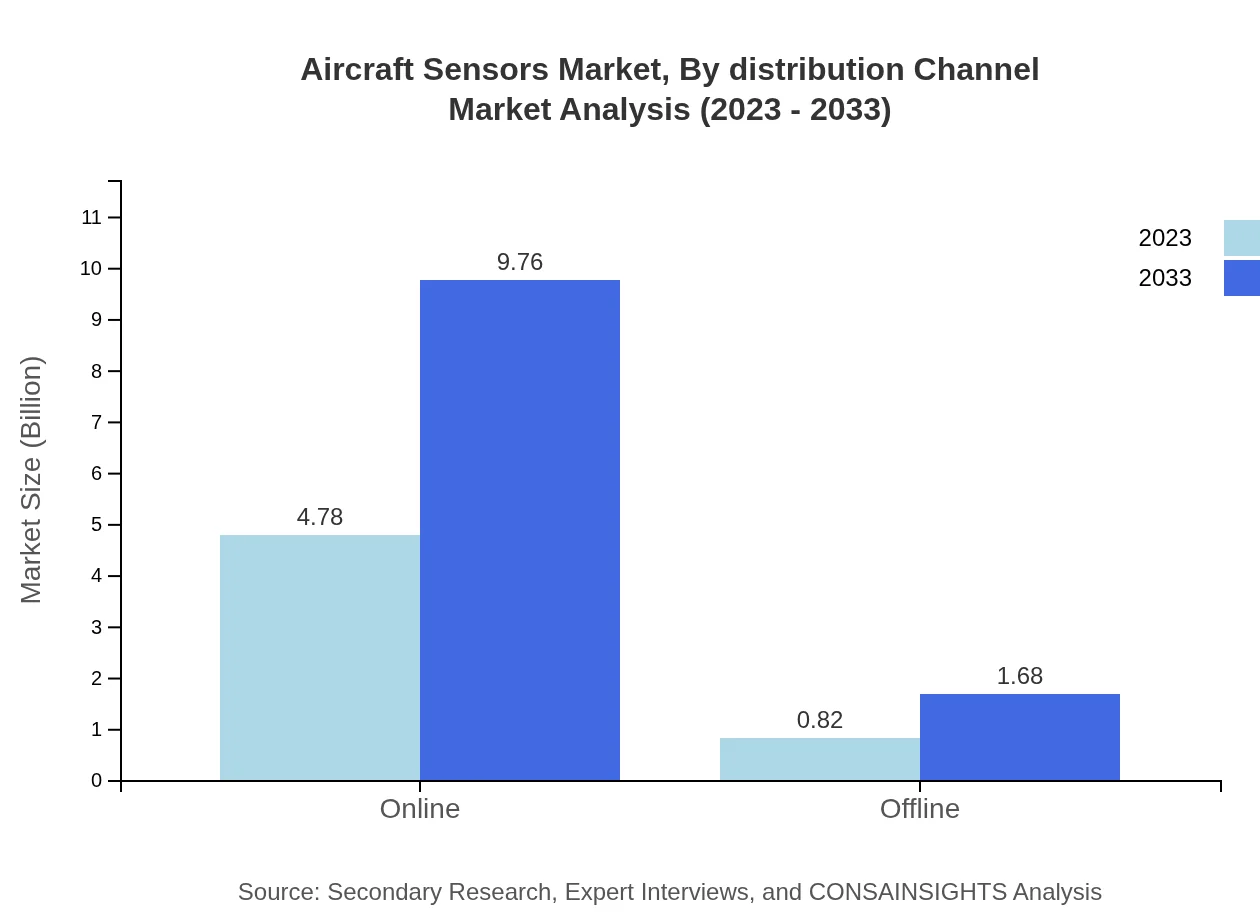

Aircraft Sensors Market Analysis By Distribution Channel

The distribution of aircraft sensors occurs through Online channels (2023 Market Size: $4.78 billion, Share: 85.29%) and Offline channels (2023 Market Size: $0.82 billion, Share: 14.71%). The significant share of the online channel indicates a growing trend towards digital commerce in the aviation sector.

Aircraft Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Sensors Industry

Honeywell International Inc.:

A leading manufacturer of aerospace products, providing a diverse range of sensors that enhance safety and reliability in aviation.General Electric Company:

A major player in the aviation sector, known for its advanced sensor technologies utilized in both commercial and military aircraft.Boeing :

One of the largest aerospace companies globally, producing aircraft equipped with cutting-edge sensor technology to improve operational efficiency.Thales Group:

A global technology leader in aerospace, Thales provides innovative sensor solutions essential for avionics and aircraft control.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft sensors?

The global aircraft sensors market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 7.2%, expected to reach a significantly larger market size by 2033, reflecting robust growth in the aerospace sector.

What are the key market players or companies in the aircraft sensors industry?

Key players in the aircraft sensors market include major corporations like Honeywell International Inc., Boeing, and Thales Group, among others, recognized for innovation and extensive product offerings in aviation technology.

What are the primary factors driving the growth in the aircraft sensors industry?

Key growth drivers for the aircraft sensors industry include increasing air traffic, advancements in sensor technology, and growing demand for safety and efficiency improvements in aviation systems.

Which region is the fastest Growing in the aircraft sensors?

The North American region is the fastest-growing market for aircraft sensors, projected to increase from $1.96 billion in 2023 to $4.01 billion by 2033, indicating a strong demand driven by technological advancement.

Does ConsaInsights provide customized market report data for the aircraft sensors industry?

Yes, ConsaInsights offers tailored market report data for the aircraft sensors industry, allowing stakeholders to receive insights specific to their needs and areas of interest.

What deliverables can I expect from this aircraft sensors market research project?

Deliverables from the aircraft sensors market research project include detailed reports, market forecasts, competitive analysis, and segment data, providing comprehensive insights essential for strategic planning.

What are the market trends of aircraft sensors?

Trends in the aircraft sensors market include an increasing shift to wireless and smart sensors, heightened focus on health monitoring systems, and advancements in navigation and fuel management technologies.