Aircraft Synthetic Vision Systems Market Report

Published Date: 03 February 2026 | Report Code: aircraft-synthetic-vision-systems

Aircraft Synthetic Vision Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Synthetic Vision Systems market, featuring insights on market size, growth forecasts from 2023 to 2033, and segmentation by technology, application, end-user, and region.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

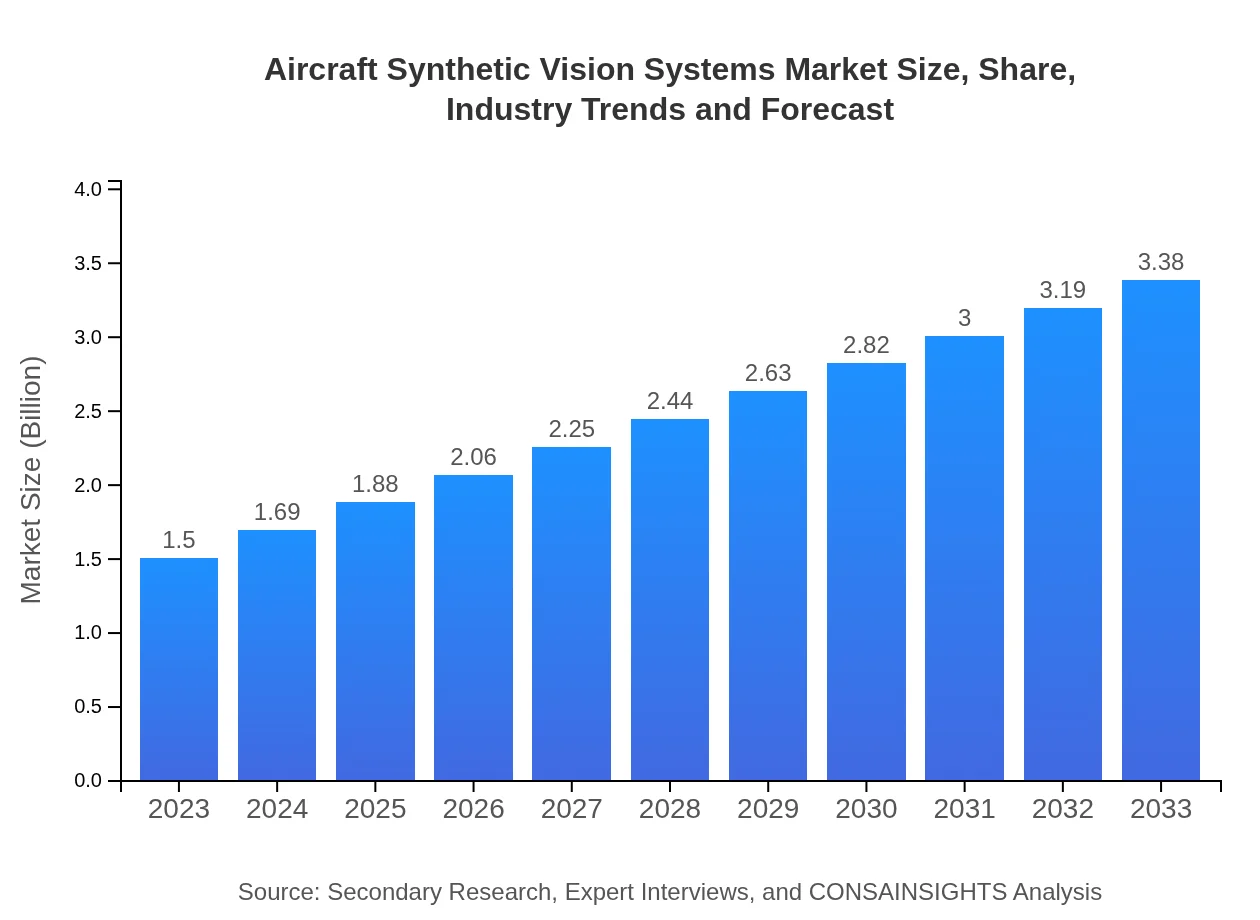

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $3.38 Billion |

| Top Companies | Rockwell Collins, Garmin Ltd., Honeywell Aerospace, Thales Group |

| Last Modified Date | 03 February 2026 |

Aircraft Synthetic Vision Systems Market Overview

Customize Aircraft Synthetic Vision Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Synthetic Vision Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Synthetic Vision Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Synthetic Vision Systems

What is the Market Size & CAGR of Aircraft Synthetic Vision Systems market in 2023?

Aircraft Synthetic Vision Systems Industry Analysis

Aircraft Synthetic Vision Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Synthetic Vision Systems Market Analysis Report by Region

Europe Aircraft Synthetic Vision Systems Market Report:

The European market for Aircraft Synthetic Vision Systems is projected to grow from $0.46 billion in 2023 to $1.05 billion by 2033. The presence of major aircraft manufacturers and growing investments in air traffic management systems contribute significantly to this expansion.Asia Pacific Aircraft Synthetic Vision Systems Market Report:

The Asia Pacific region is projected to grow from $0.28 billion in 2023 to $0.64 billion by 2033, driven by increasing air traffic and rising investment in modern aircraft infrastructure. The demand for advanced navigation and control technology in emerging economies enhances the region's market potential.North America Aircraft Synthetic Vision Systems Market Report:

North America currently dominates the market, with an anticipated rise from $0.54 billion in 2023 to $1.21 billion in 2033. The region’s robust aviation sector, characterized by innovative technological applications and stringent safety requirements, drives this market surge.South America Aircraft Synthetic Vision Systems Market Report:

In South America, the market is expected to increase from $0.03 billion in 2023 to $0.06 billion by 2033. This growth is attributed to the limited but increasing adoption of advanced aviation technologies as local airlines seek to enhance operational safety and efficiency.Middle East & Africa Aircraft Synthetic Vision Systems Market Report:

In the Middle East and Africa, the market size is expected to grow from $0.19 billion in 2023 to $0.43 billion in 2033. Increased investments in military aviation and enhancements in airport infrastructure are key factors driving demand in this region.Tell us your focus area and get a customized research report.

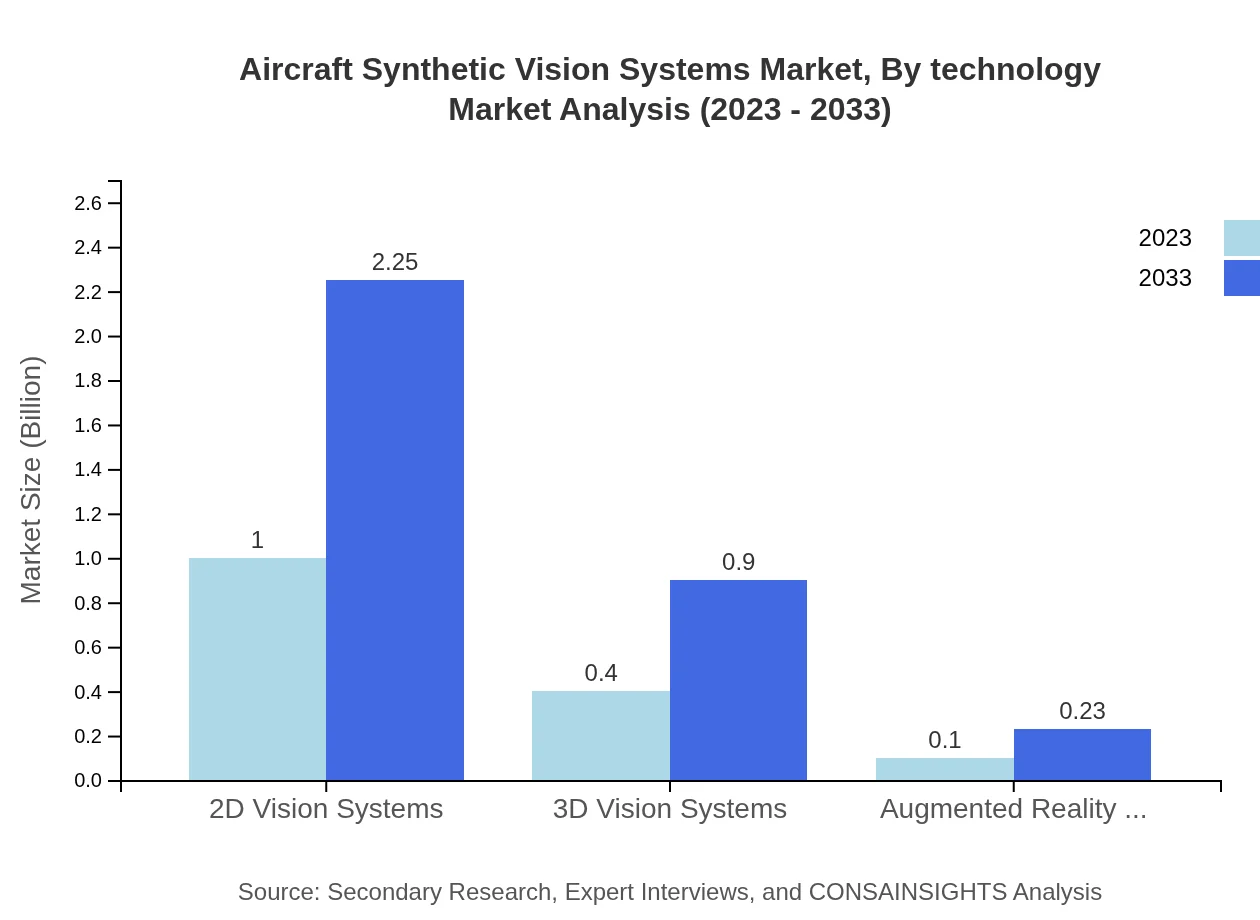

Aircraft Synthetic Vision Systems Market Analysis By Technology

The technology segment is bifurcated into 2D vision systems, 3D vision systems, and augmented reality systems. 2D systems account for a significant portion of the market, with an expected size of $1.00 billion in 2023 and growing to $2.25 billion in 2033. 3D vision systems show promising growth from $0.40 billion to $0.90 billion, while augmented reality systems will see an increase from $0.10 billion to $0.23 billion in the same timeframe.

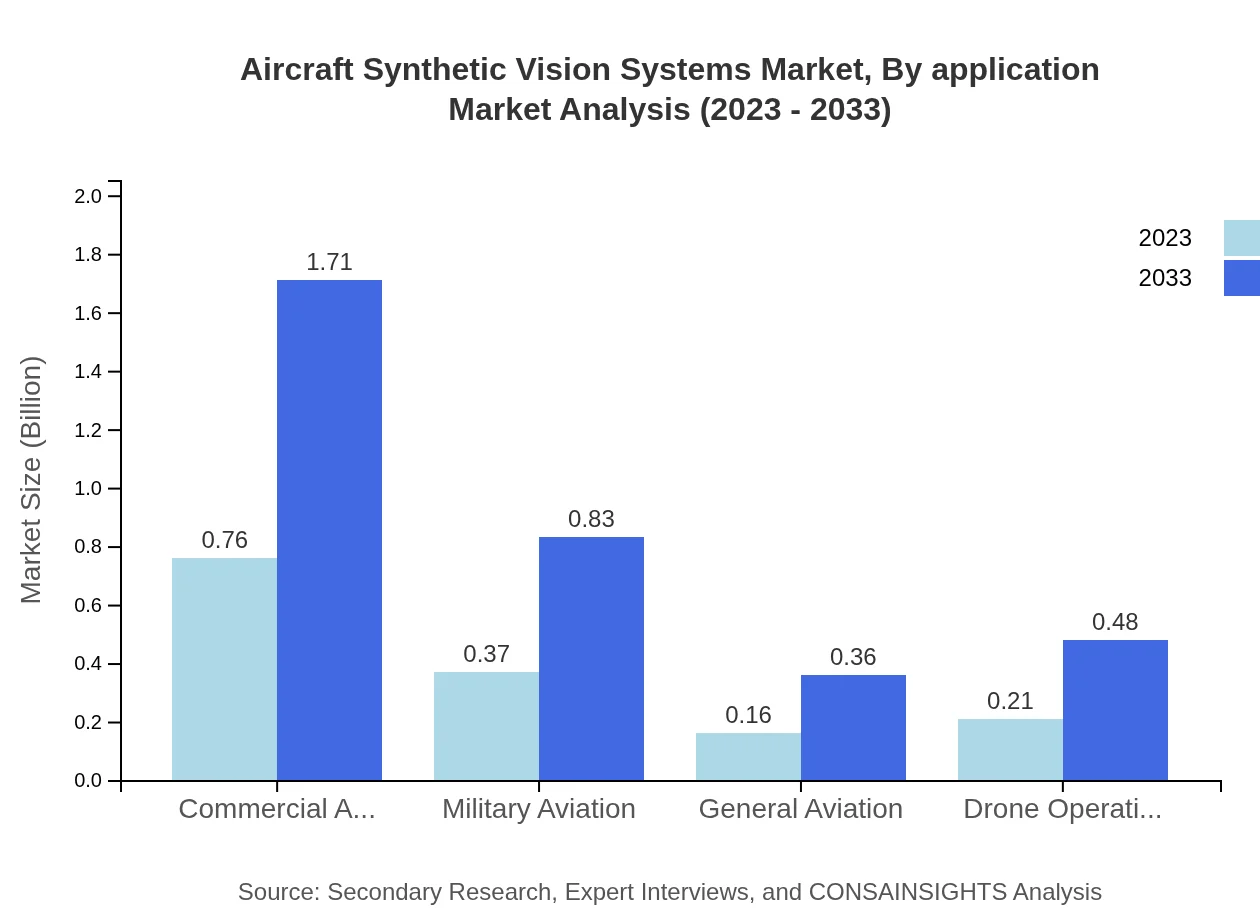

Aircraft Synthetic Vision Systems Market Analysis By Application

The application sector includes commercial aviation, military aviation, general aviation, and drone operations. Commercial aviation leads the segment with a market size of $0.76 billion in 2023, expected to rise to $1.71 billion in 2033. Military aviation is poised for growth, increasing from $0.37 billion to $0.83 billion, while drone operations are projected to expand from $0.21 billion to $0.48 billion.

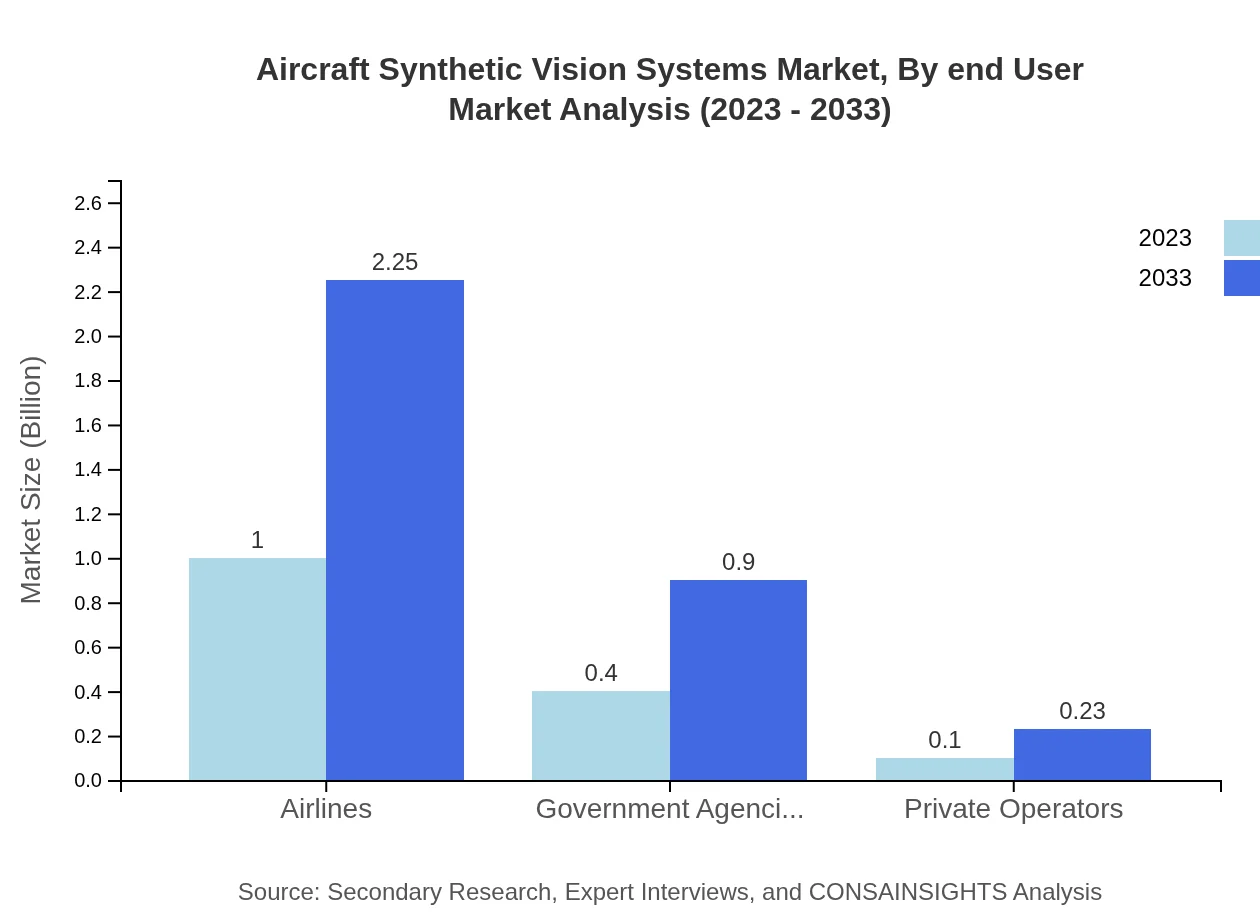

Aircraft Synthetic Vision Systems Market Analysis By End User

Key end-users include airlines, government agencies, and private operators. Airlines dominate the sector with a market share of 66.66% in 2023, forecasted to remain steady through 2033. Government agencies are projected to increase their market presence from $0.40 billion to $0.90 billion, while private operators will show gradual growth from $0.10 billion to $0.23 billion.

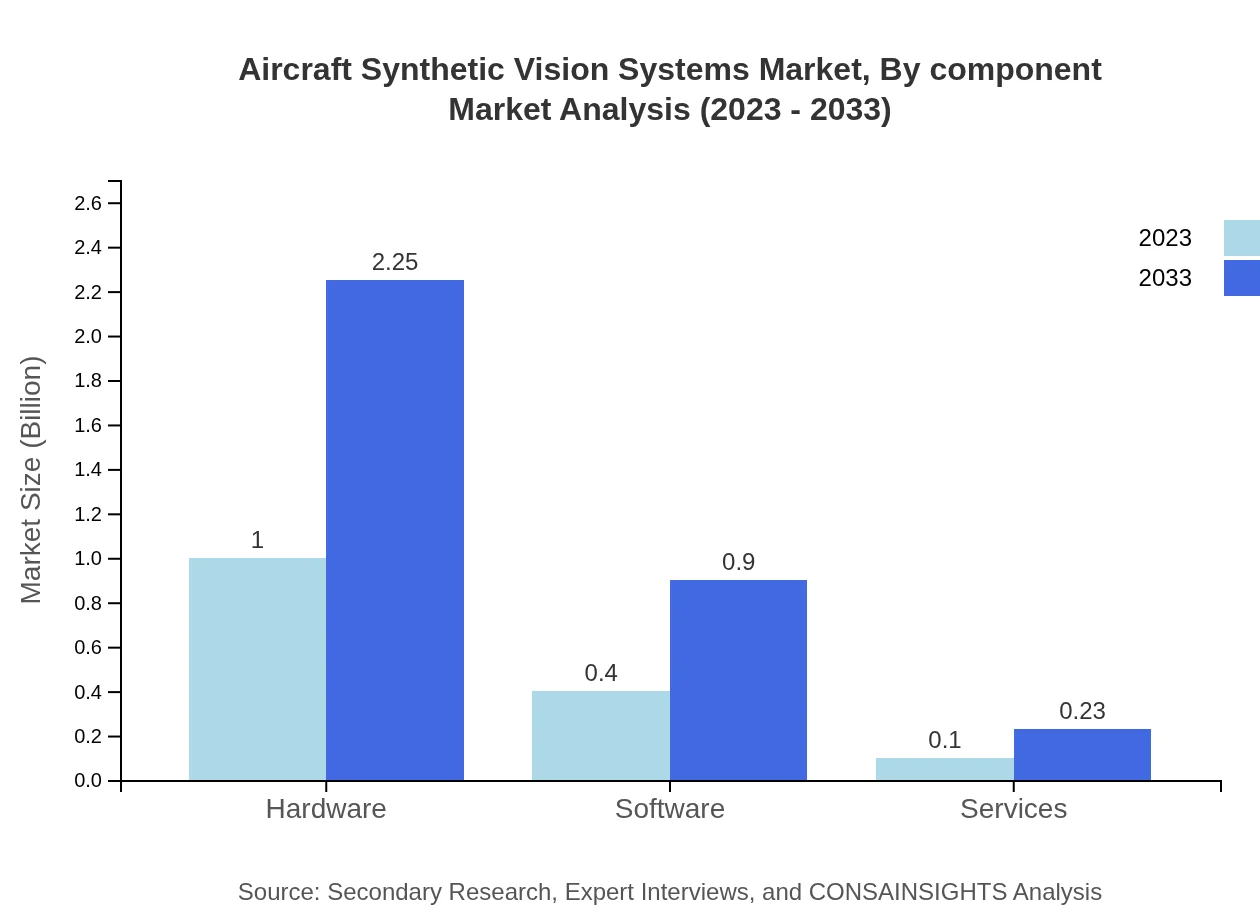

Aircraft Synthetic Vision Systems Market Analysis By Component

Components of Aircraft Synthetic Vision Systems are classified into hardware and software. Hardware accounts for a more significant portion, valued at $1.00 billion in 2023, anticipated to reach $2.25 billion by 2033. Software contributes with a size growth from $0.40 billion to $0.90 billion.

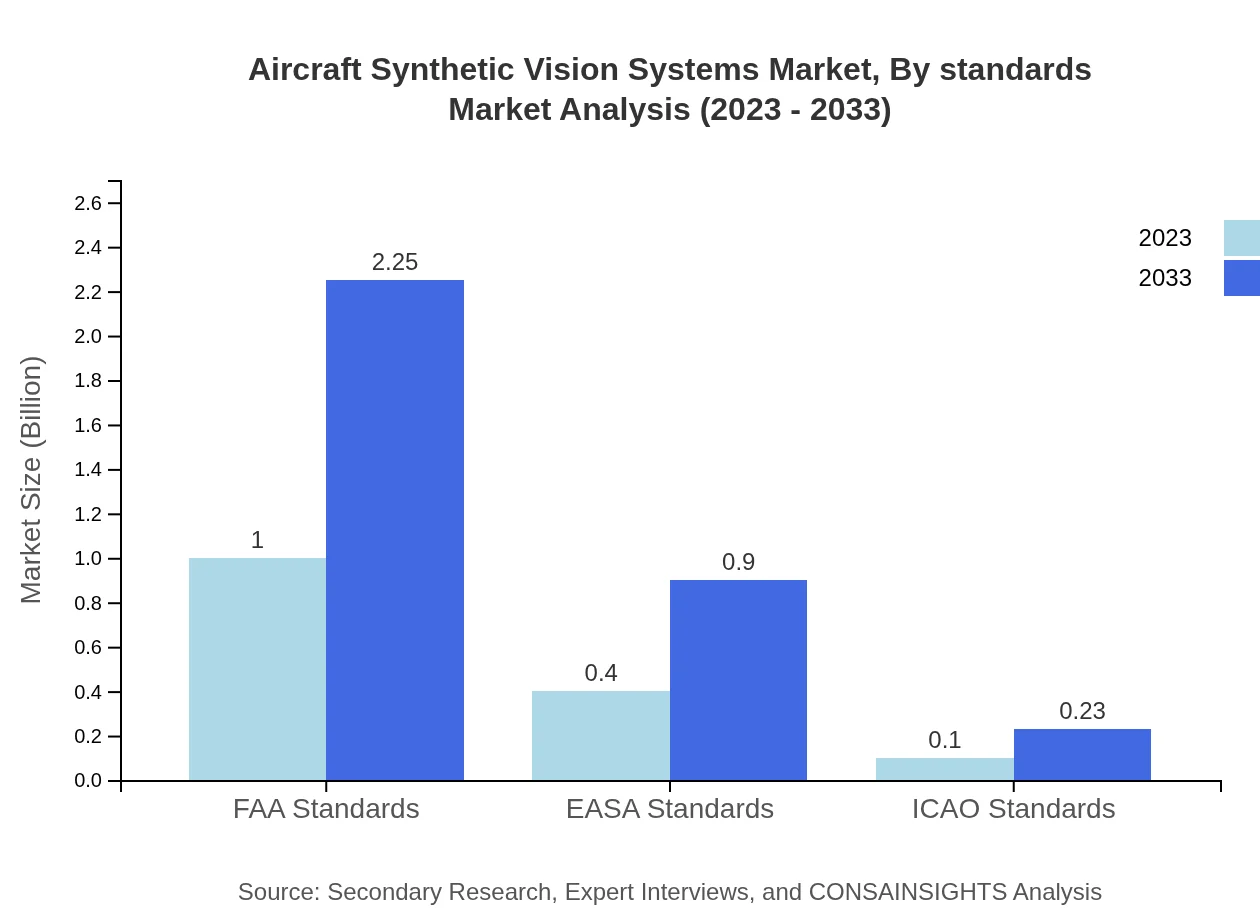

Aircraft Synthetic Vision Systems Market Analysis By Standards

The market standards include FAA, EASA, and ICAO guidelines. FAA standards dominate with a market size of $1.00 billion in 2023, expected to grow to $2.25 billion by 2033. EASA and ICAO standards, while smaller in scale, also showcase consistent growth from $0.40 billion to $0.90 billion and from $0.10 billion to $0.23 billion, respectively.

Aircraft Synthetic Vision Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Synthetic Vision Systems Industry

Rockwell Collins:

A leading provider of avionics and flight control systems, Rockwell Collins offers innovative solutions in synthetic vision technology, enhancing situational awareness for pilots.Garmin Ltd.:

Garmin is recognized for its advanced navigational systems, including synthetic vision technology that integrates seamlessly with general aviation aircraft.Honeywell Aerospace:

Honeywell Aerospace plays a pivotal role in the development of synthetic vision systems, offering state-of-the-art avionics that improve operational efficiency for commercial and military aviation.Thales Group:

Thales is instrumental in providing synthetic vision systems that integrate advanced technologies to enhance pilot situational awareness in varying flight conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of Aircraft Synthetic Vision Systems?

The Aircraft Synthetic Vision Systems market is projected to grow from approximately $1.5 billion in 2023 to higher valuations by 2033, reflecting a compound annual growth rate (CAGR) of 8.2% over this period.

What are the key market players in the Aircraft Synthetic Vision Systems industry?

Key players in the Aircraft Synthetic Vision Systems market include major aerospace corporations, technology firms specializing in avionics, and software companies that develop vision and display systems. Their innovations significantly shape the industry.

What are the primary factors driving the growth in the Aircraft Synthetic Vision Systems industry?

Growth in the Aircraft Synthetic Vision Systems is driven by advancements in aerospace technology, increasing demand for enhanced safety features in aviation, regulatory requirements, and the expansion of commercial aviation, particularly in emerging economies.

Which region is the fastest Growing in the Aircraft Synthetic Vision Systems market?

The North American region is the fastest-growing in the Aircraft Synthetic Vision Systems market, expected to expand from $0.54 billion in 2023 to $1.21 billion by 2033, indicative of rising aviation demand and technological advancements.

Does ConsaInsights provide customized market report data for the Aircraft Synthetic Vision Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific queries related to Aircraft Synthetic Vision Systems, allowing stakeholders to gain insights that meet their unique business needs.

What deliverables can I expect from the Aircraft Synthetic Vision Systems market research project?

Deliverables from the Aircraft Synthetic Vision Systems market research project typically include comprehensive reports, data analyses, market forecasts, trend insights, and recommendations specific to various segments and regions.

What are the market trends of Aircraft Synthetic Vision Systems?

Trends in the Aircraft Synthetic Vision Systems market include a shift towards integrated systems, increased use of augmented reality, enhancements in software capabilities, and a growing focus on regulatory compliance and operational efficiency.