Aircraft Tires Market Report

Published Date: 03 February 2026 | Report Code: aircraft-tires

Aircraft Tires Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Tires market from 2023 to 2033, highlighting market size, growth trends, and segmentation. It focuses on key insights regarding regional performances, technological advancements, and leading companies in the industry.

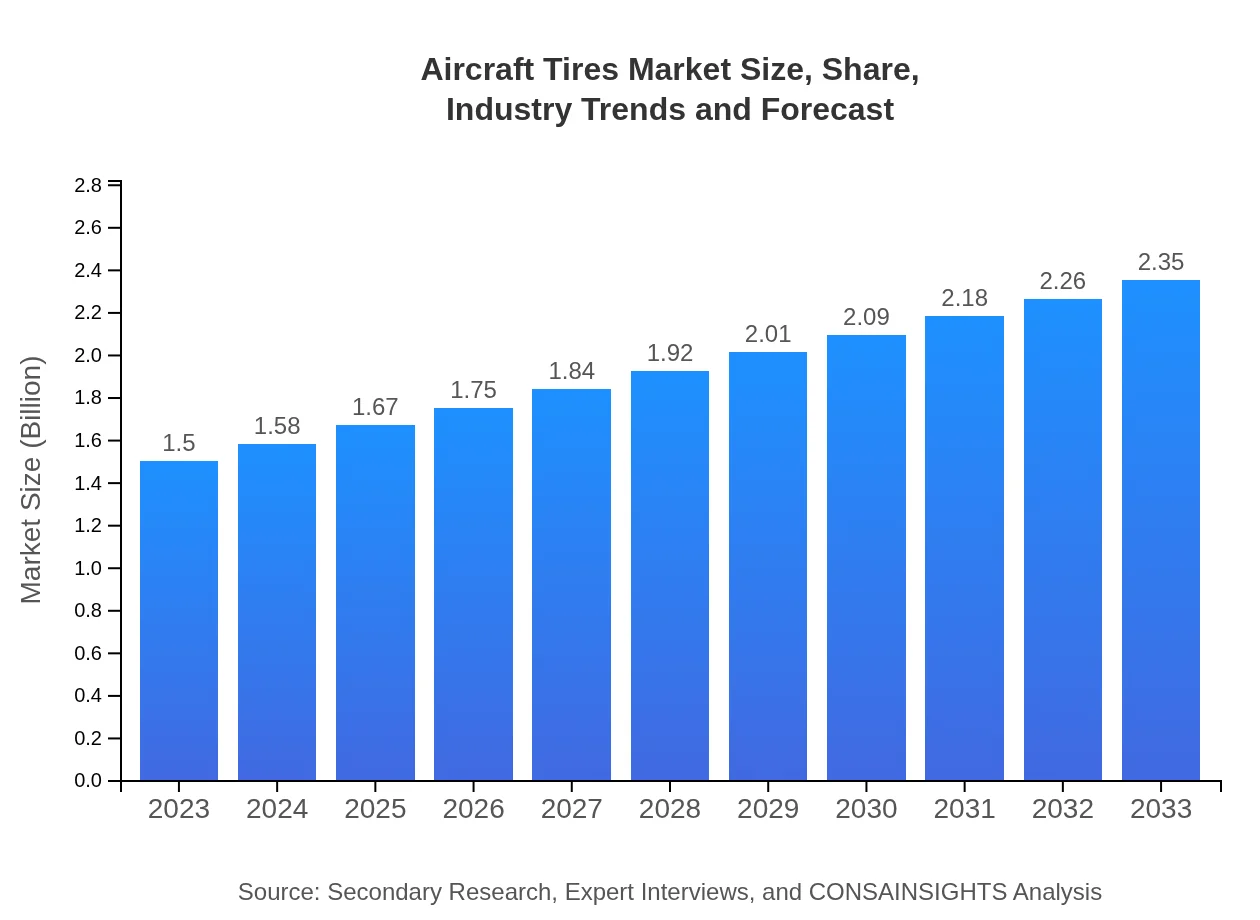

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $2.35 Billion |

| Top Companies | Michelin, Bridgestone, Goodyear Tire & Rubber Company, Continental |

| Last Modified Date | 03 February 2026 |

Aircraft Tires Market Overview

Customize Aircraft Tires Market Report market research report

- ✔ Get in-depth analysis of Aircraft Tires market size, growth, and forecasts.

- ✔ Understand Aircraft Tires's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Tires

What is the Market Size & CAGR of the Aircraft Tires market in 2023?

Aircraft Tires Industry Analysis

Aircraft Tires Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Tires Market Analysis Report by Region

Europe Aircraft Tires Market Report:

Europe's market is valued at $0.49 billion in 2023, rising to $0.76 billion by 2033. The region's commitment to safety regulations and sustainability practices drives innovations in aircraft tire technologies.Asia Pacific Aircraft Tires Market Report:

In 2023, the Asia Pacific Aircraft Tires market is valued at $0.25 billion, projected to reach $0.40 billion by 2033. The region is experiencing rapid growth due to increasing air passenger traffic, robust airline industry expansion, and investments in airport infrastructure.North America Aircraft Tires Market Report:

North America leads the market with a valuation of $0.55 billion in 2023, forecasted to reach $0.86 billion by 2033. The robust presence of major airlines and ongoing investment in fleet expansions significantly boost demand for aircraft tires.South America Aircraft Tires Market Report:

The South American market is valued at $0.06 billion in 2023, expected to increase to $0.10 billion by 2033. Growth in this region is attributed to a gradual recovery in air travel and improvements in the aviation sector following the pandemic.Middle East & Africa Aircraft Tires Market Report:

The Middle East and Africa market is estimated at $0.15 billion in 2023, set to grow to $0.23 billion by 2033. The expansion of low-cost carriers and the growth in tourism contribute to the increasing demand for aircraft tires in this region.Tell us your focus area and get a customized research report.

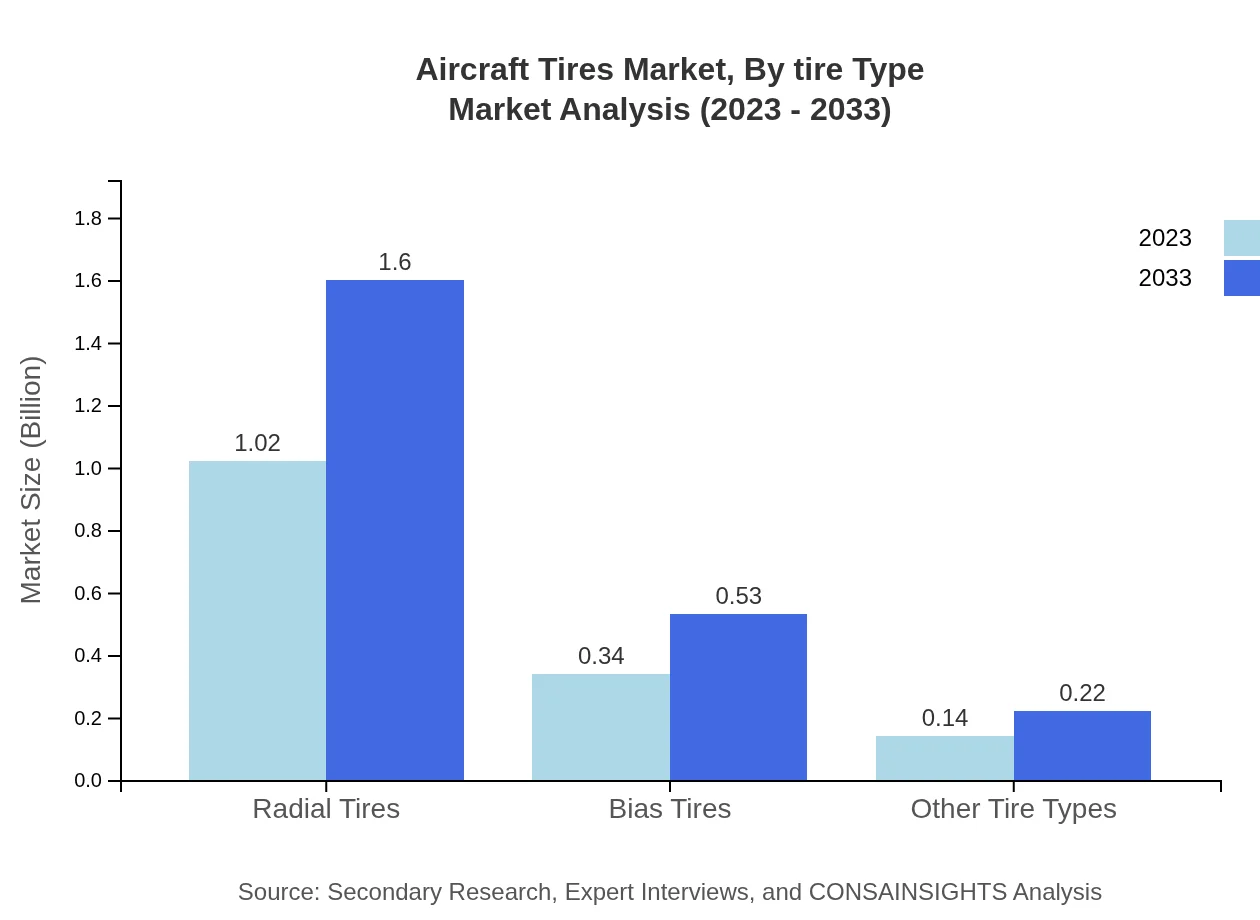

Aircraft Tires Market Analysis By Tire Type

In the Aircraft Tires market, Radial Tires dominate with a market size of $1.02 billion in 2023, expected to grow to $1.60 billion by 2033, maintaining a share of 68.2%. Bias Tires follow with a market size of $0.34 billion, projected to increase to $0.53 billion, covering 22.54% of the market. Other Tire Types represent a smaller segment, with a size increasing from $0.14 billion to $0.22 billion, holding a 9.26% share.

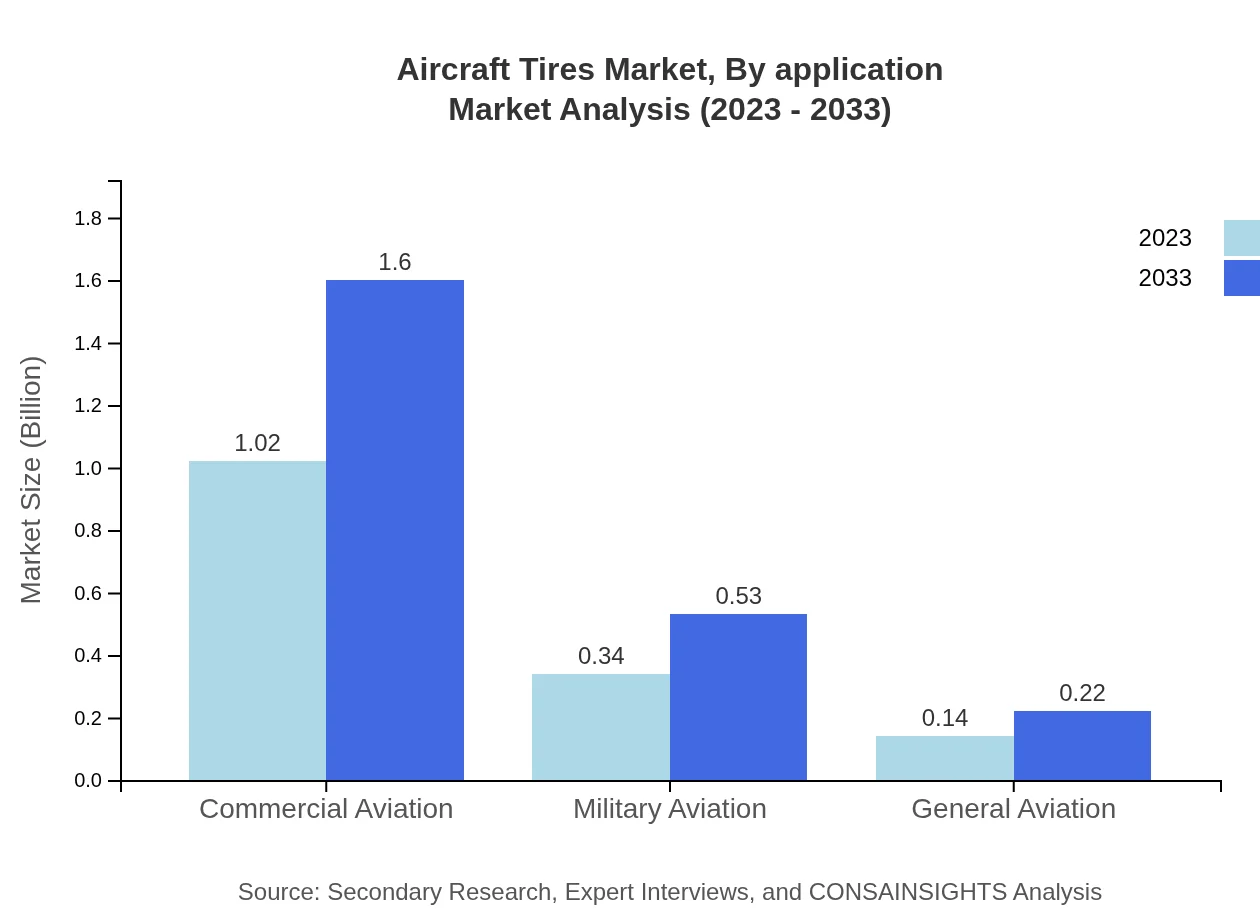

Aircraft Tires Market Analysis By Application

The Commercial Aviation segment leads the Aircraft Tires market, with a size of $1.02 billion in 2023 and expected growth to $1.60 billion by 2033, accounting for 68.2% of the market. The Military Aviation segment follows with $0.34 billion, growing to $0.53 billion, sustaining a market share of 22.54%. General Aviation, representing the smallest segment, will grow from $0.14 billion to $0.22 billion, maintaining a 9.26% market share.

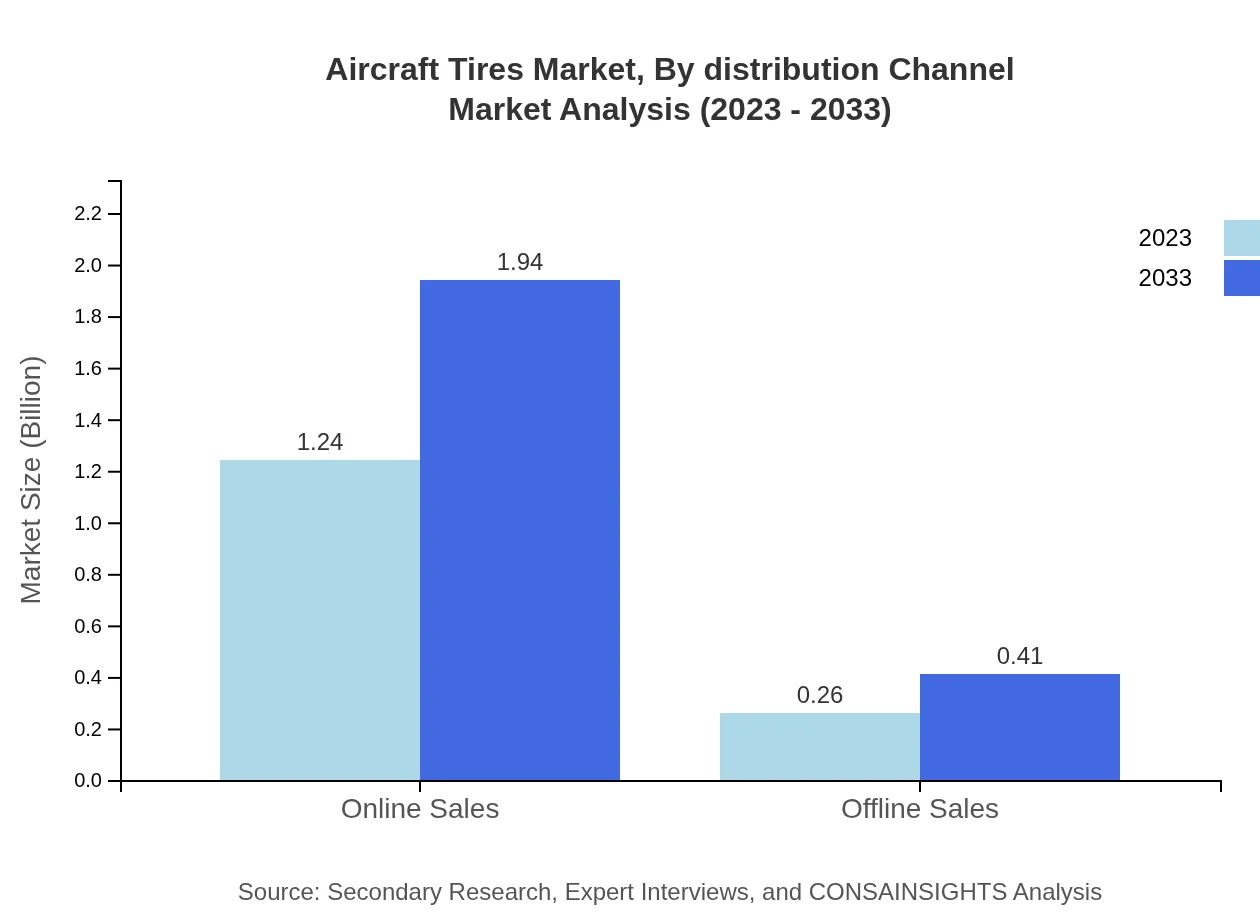

Aircraft Tires Market Analysis By Distribution Channel

Online Sales channels dominate the Aircraft Tires market, valued at $1.24 billion in 2023 and slated for growth to $1.94 billion by 2033, making up 82.46% of the market. Offline Sales, on the other hand, show growth from $0.26 billion to $0.41 billion, covering 17.54%.

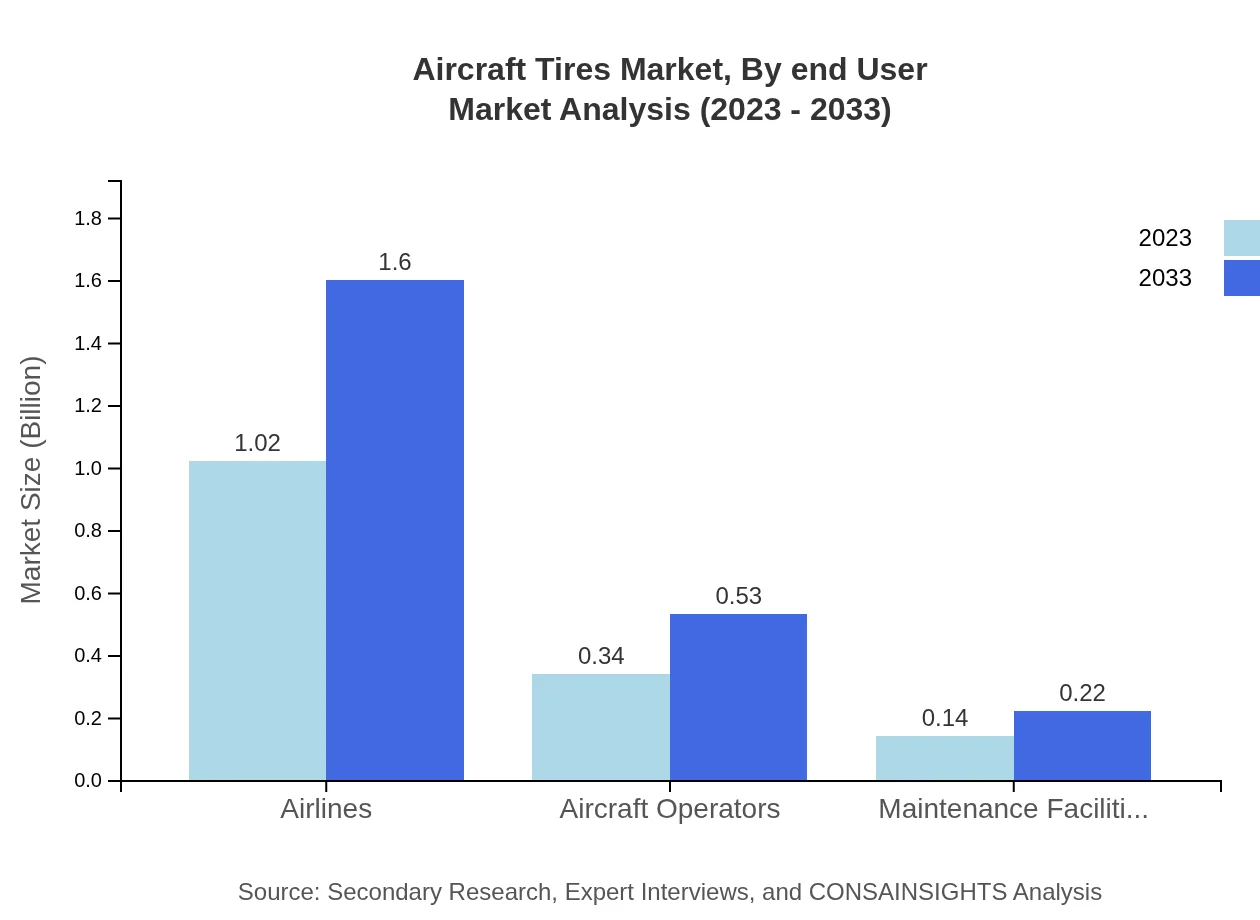

Aircraft Tires Market Analysis By End User

Airlines represent the primary end-user in the market, with a size of $1.02 billion, projected to reach $1.60 billion by 2033, sustaining a significant 68.2% market share. Aircraft Operators contribute significantly with a size of $0.34 billion, forecasted to grow to $0.53 billion, maintaining 22.54% share, while Maintenance Facilities will expand from $0.14 billion to $0.22 billion, accounting for 9.26% market share.

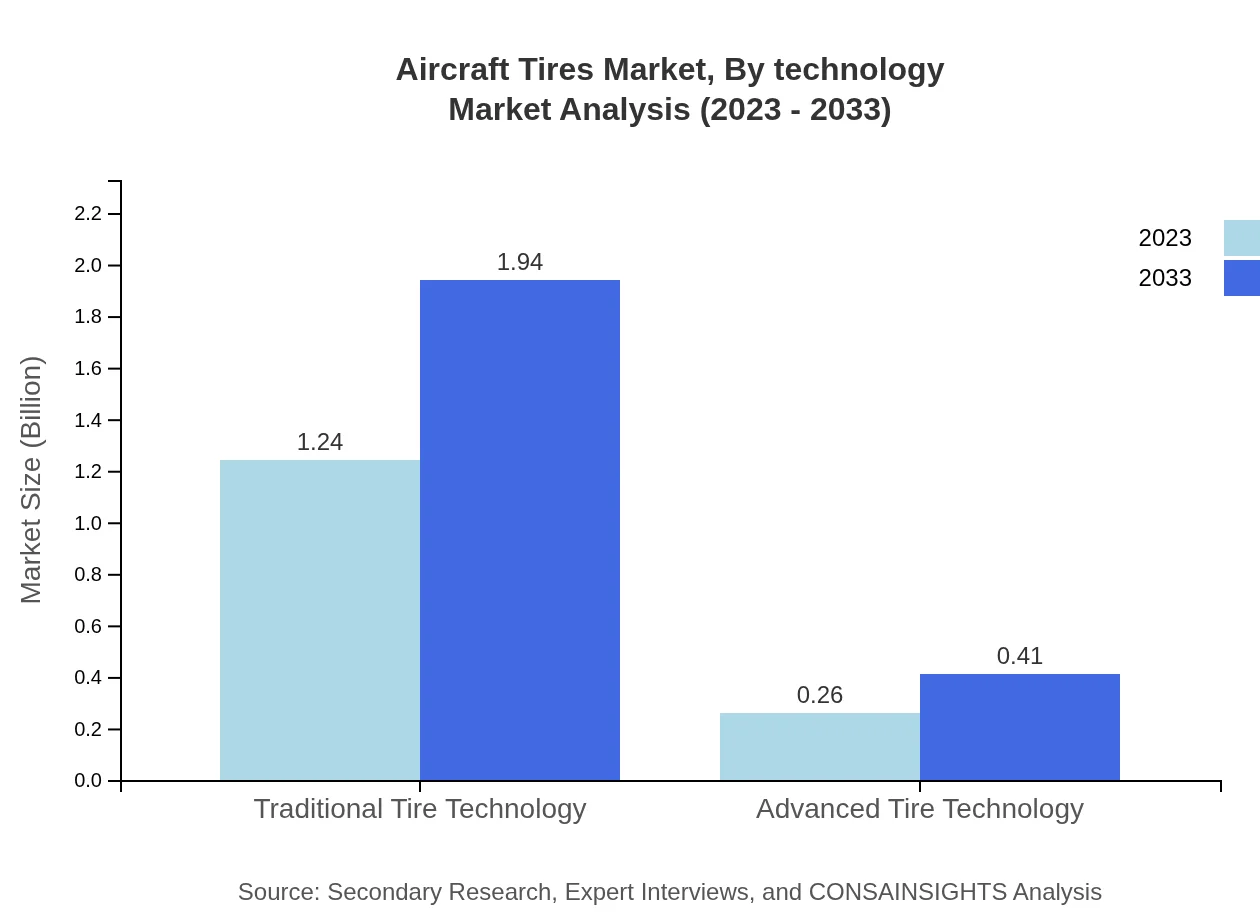

Aircraft Tires Market Analysis By Technology

Traditional Tire Technology holds the majority share of the market at $1.24 billion in 2023, expected to grow to $1.94 billion by 2033, representing 82.46%. Meanwhile, Advanced Tire Technology is anticipated to grow from $0.26 billion to $0.41 billion, maintaining a 17.54% share. The shift towards advanced tire technologies is being driven by the demand for smarter and more efficient tire solutions.

Aircraft Tires Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Aircraft Tires Industry

Michelin:

A leading global tire manufacturer renowned for its commitment to innovation and sustainability, Michelin produces a wide range of aircraft tires known for their durability and performance.Bridgestone:

Bridgestone is a major player in the aircraft tire market, focusing on advanced technologies to enhance fuel efficiency and safety. The company is dedicated to research and development for superior product offerings.Goodyear Tire & Rubber Company:

Known for its pioneering efforts in the aviation tire sector, Goodyear has a longstanding history of providing quality tires for commercial and military aircraft.Continental:

Continental specializes in producing high-performance aircraft tires and emphasizes innovative designs and sustainable production processes.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft tires?

The global aircraft tires market is valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of 4.5%, reaching significant market size by 2033.

What are the key market players or companies in the aircraft tires industry?

The key players in the aircraft tires industry include companies like Michelin, Goodyear, and Bridgestone, which dominate the market through innovative tire technologies and widespread distribution channels.

What are the primary factors driving the growth in the aircraft tires industry?

Key growth factors include increasing air travel demand, advancements in tire technology, and a focus on safety and efficiency in aviation, contributing significantly to the aircraft tires market growth.

Which region is the fastest Growing in the aircraft tires market?

The Asia Pacific region is the fastest-growing market for aircraft tires, projected to grow from $0.25 billion in 2023 to $0.40 billion by 2033, driven by rising air traffic and infrastructure developments.

Does ConsaInsights provide customized market report data for the aircraft tires industry?

Yes, ConsaInsights offers customized market report data for the aircraft tires industry, tailoring insights and analytics to meet specific client needs and market conditions.

What deliverables can I expect from this aircraft tires market research project?

Deliverables include detailed market analysis, regional insights, competitive landscape evaluations, and future growth forecasts, providing a comprehensive overview of the aircraft tires market dynamics.

What are the market trends of aircraft tires?

Current market trends in aircraft tires show a shift towards advanced tire technology, increased use of radial tires, and expanding online sales channels, reflecting changing consumer preferences and technological advancements.