Aircraft Transparencies Market Report

Published Date: 03 February 2026 | Report Code: aircraft-transparencies

Aircraft Transparencies Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Transparencies market, covering insights into market trends, segmentation, regional analysis, and forecasts from 2023 to 2033.

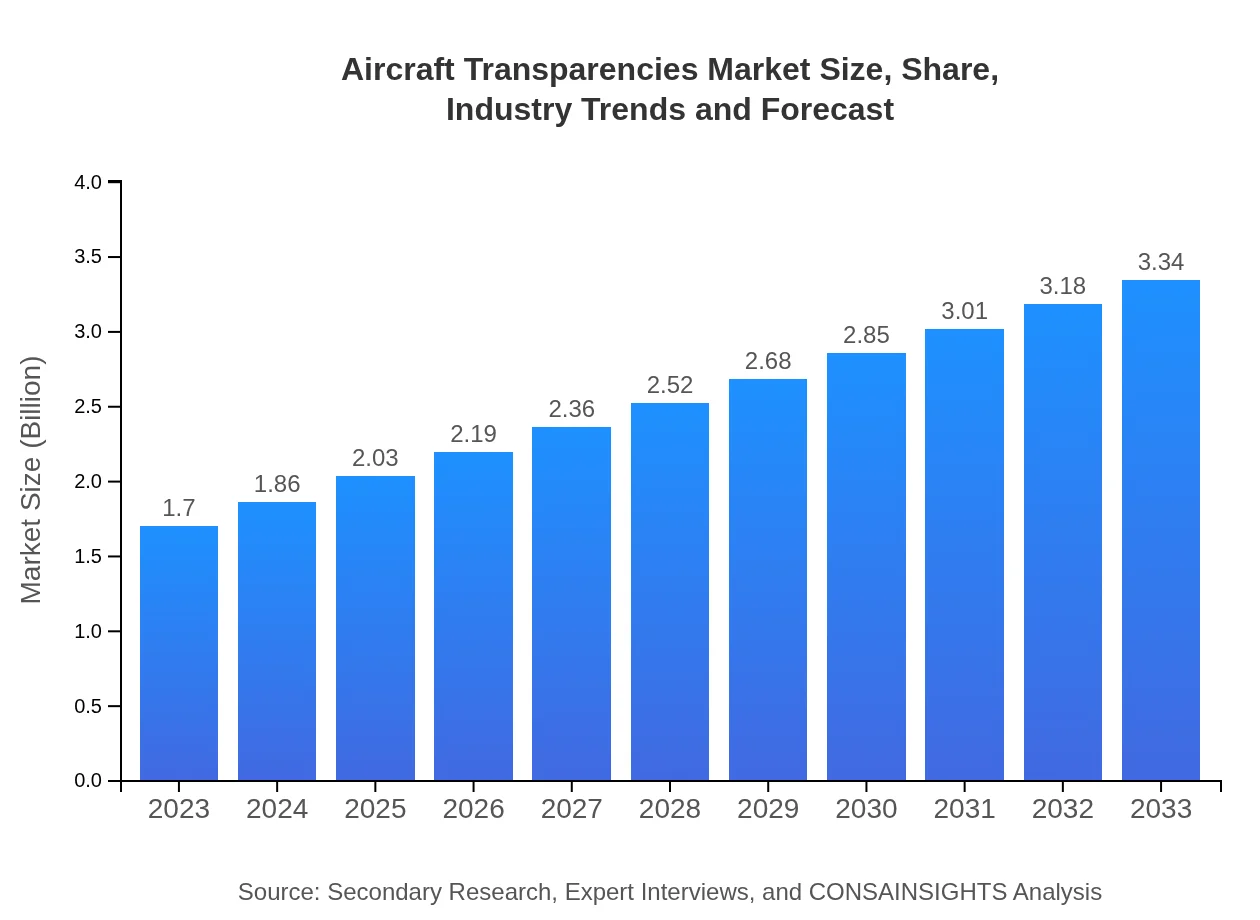

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | GKN Aerospace, Hexcel Corporation, PPG Industries Inc., Saint-Gobain, Safran |

| Last Modified Date | 03 February 2026 |

Aircraft Transparencies Market Overview

Customize Aircraft Transparencies Market Report market research report

- ✔ Get in-depth analysis of Aircraft Transparencies market size, growth, and forecasts.

- ✔ Understand Aircraft Transparencies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Transparencies

What is the Market Size & CAGR of Aircraft Transparencies market in 2023?

Aircraft Transparencies Industry Analysis

Aircraft Transparencies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Transparencies Market Analysis Report by Region

Europe Aircraft Transparencies Market Report:

In Europe, the market is expected to grow from $0.47 billion in 2023 to $0.93 billion by 2033. The region benefits from advanced aerospace technologies and increasing focus on fuel-efficient designs.Asia Pacific Aircraft Transparencies Market Report:

In the Asia-Pacific region, the Aircraft Transparencies market is projected to grow from $0.34 billion in 2023 to $0.67 billion by 2033, driven by increasing aircraft manufacturing in countries like China and India and a rise in air travel.North America Aircraft Transparencies Market Report:

North America leads the market with a value of $0.63 billion in 2023, forecasted to reach $1.24 billion by 2033, bolstered by significant military and commercial aircraft production in the region.South America Aircraft Transparencies Market Report:

South America's market is expected to expand from $0.15 billion in 2023 to $0.29 billion by 2033, supported by growing investments in aviation and fleet modernization.Middle East & Africa Aircraft Transparencies Market Report:

The Middle East and Africa market is forecast to rise from $0.11 billion in 2023 to $0.21 billion by 2033, primarily driven by the growth of the aviation industry and increasing demand for tourism.Tell us your focus area and get a customized research report.

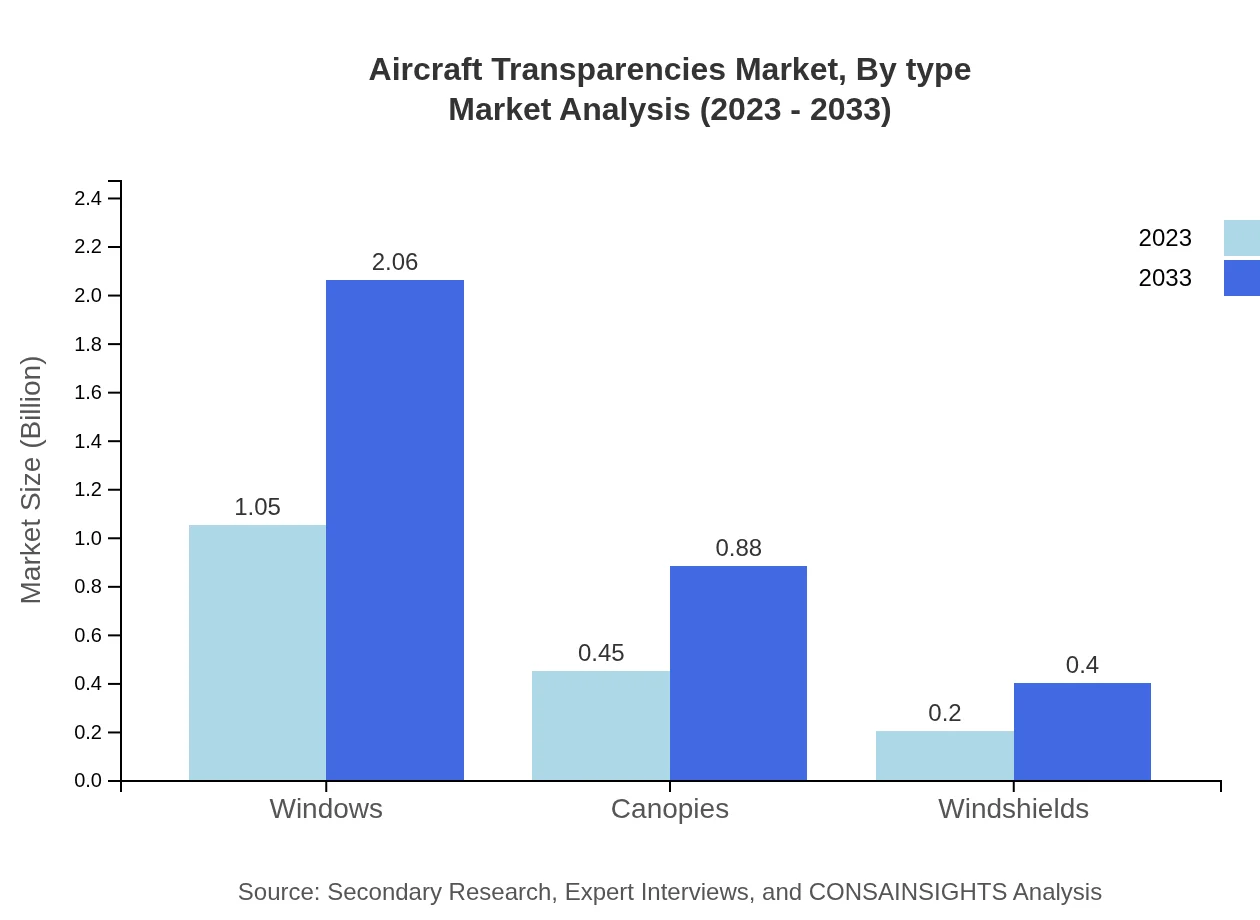

Aircraft Transparencies Market Analysis By Type

In the by-type segment, windows lead the market with a size of $1.05 billion in 2023, expected to reach $2.06 billion by 2033, capturing 61.74% market share. Canopies follow with $0.45 billion and are expected to rise to $0.88 billion, holding 26.23% of the market. Windshields represent a smaller segment with a current value of $0.20 billion, predicted to double to $0.40 billion by 2033, holding 12.03% of the market.

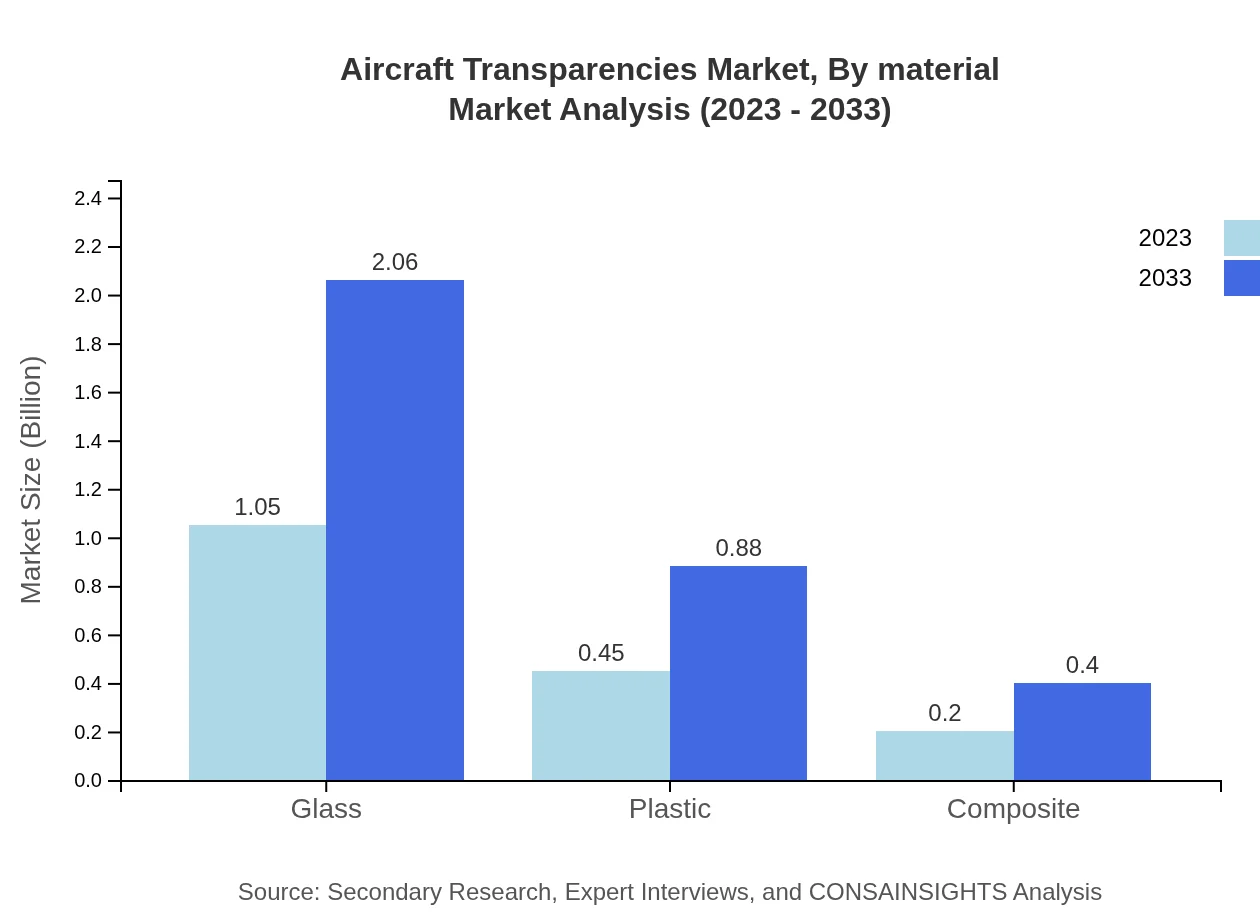

Aircraft Transparencies Market Analysis By Material

The market is dominated by glass, which accounts for $1.05 billion with a share of 61.74% in 2023 and is expected to grow similarly in 2033. Plastic follows with a size of $0.45 billion and a share of 26.23%, projected to reach $0.88 billion. Composites represent 12.03% of the market, starting at $0.20 billion and reaching $0.40 billion by 2033.

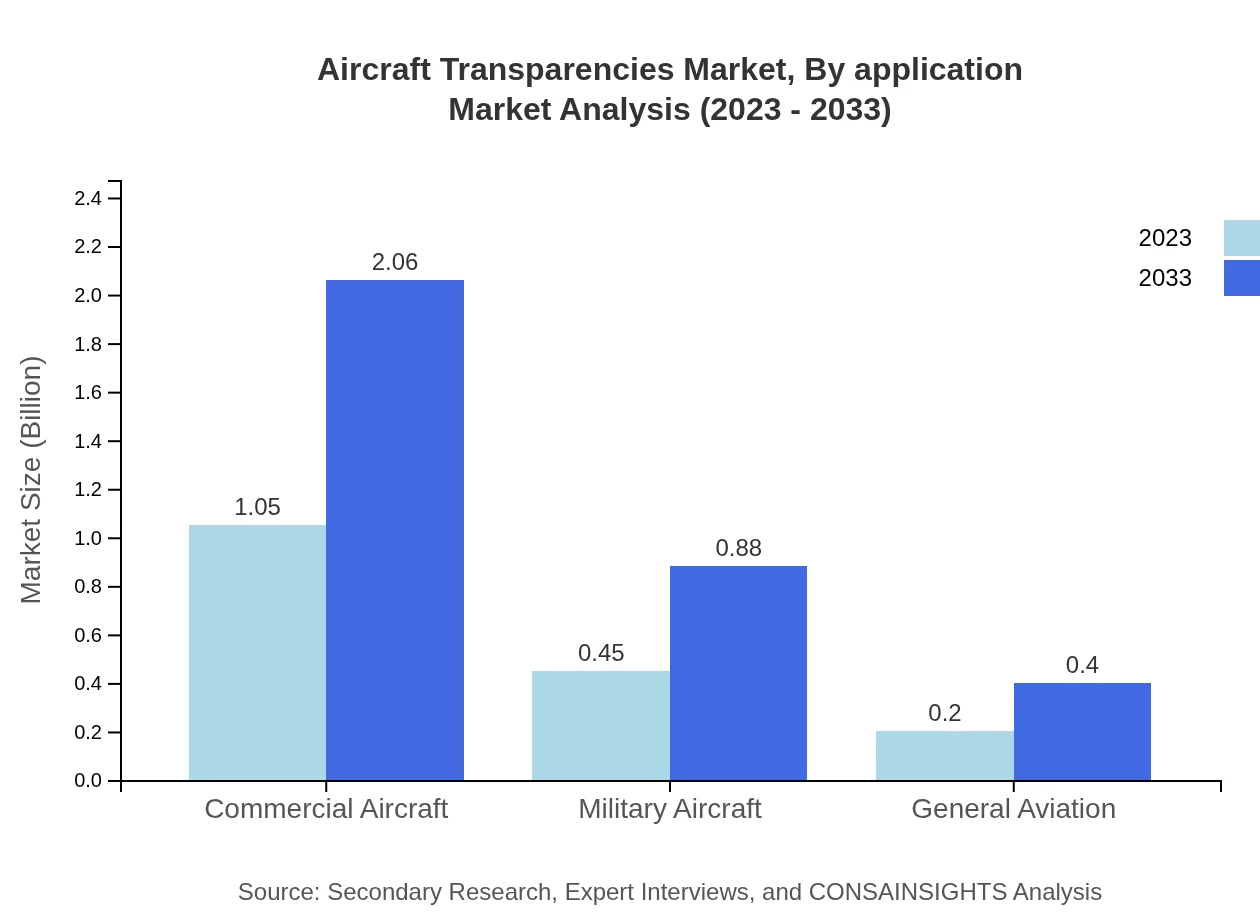

Aircraft Transparencies Market Analysis By Application

In the application segment, commercial aircraft dominate with a market valuation of $1.05 billion in 2023, anticipated to grow to $2.06 billion by 2033, holding 61.74% of the share. Military aircraft account for $0.45 billion and are forecasted to reach $0.88 billion, while general aviation, although smaller at $0.20 billion, is expected to grow to $0.40 billion by 2033.

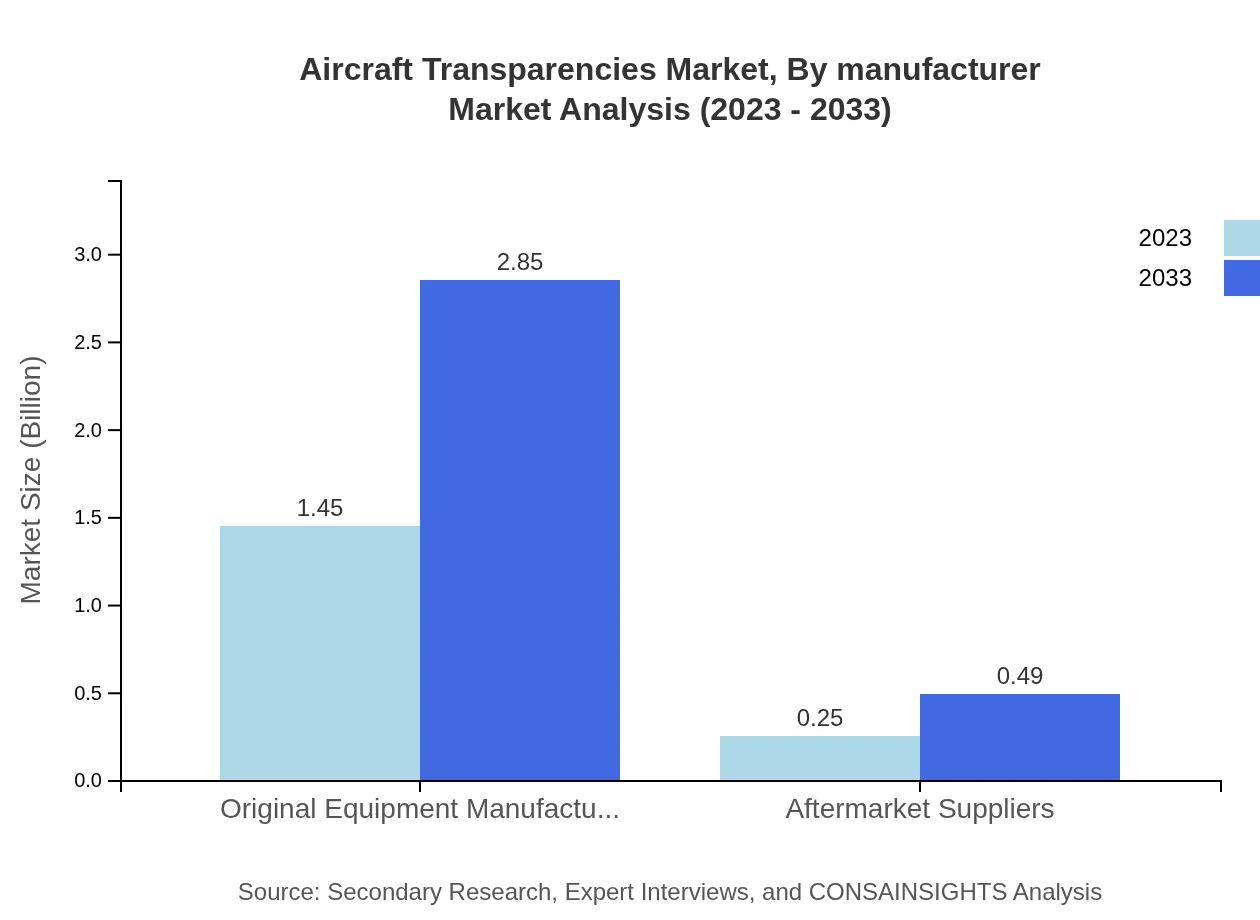

Aircraft Transparencies Market Analysis By Manufacturer

The market is led by OEMs with a market size of $1.45 billion in 2023, projected to reach $2.85 billion by 2033, capturing 85.33% market share. Aftermarket suppliers hold a smaller yet significant portion, starting at $0.25 billion and growing to $0.49 billion.

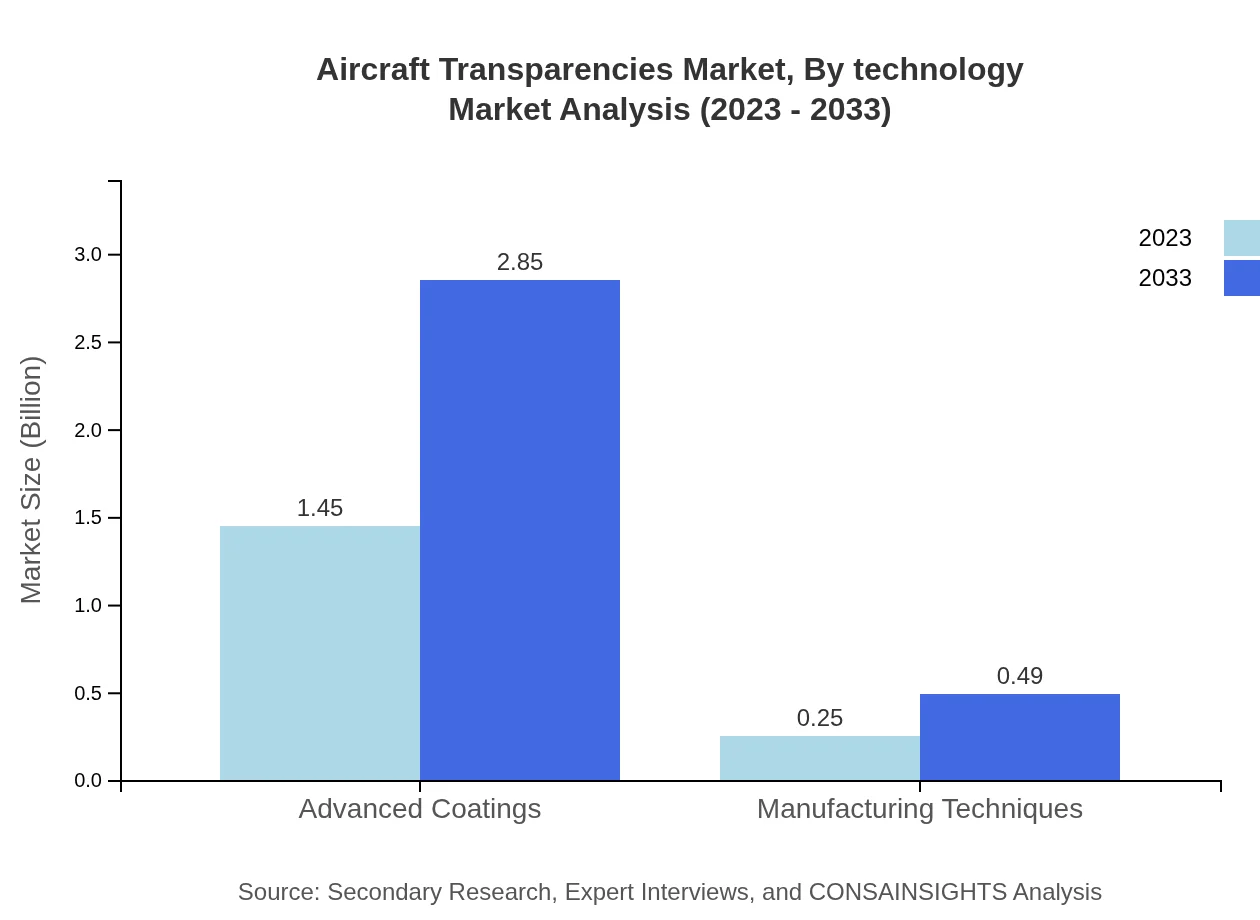

Aircraft Transparencies Market Analysis By Technology

Technologically advanced methods are driving the market, particularly in the use of advanced coatings which have a current market size of $1.45 billion, expected to rise to $2.85 billion by 2033. Manufacturing techniques also contribute to innovation, currently at $0.25 billion and projected to grow to $0.49 billion.

Aircraft Transparencies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Transparencies Industry

GKN Aerospace:

A leader in aerospace technologies, GKN Aerospace focuses on advanced transparencies and composite materials, enhancing aircraft capabilities and performance.Hexcel Corporation:

Hexcel specializes in lightweight composite materials and advanced technology for aircraft transparencies, emphasizing innovation in aerospace applications.PPG Industries Inc.:

A major player in the coatings market, PPG provides advanced coatings and materials for aircraft transparencies, focusing on durability and efficiency.Saint-Gobain:

Saint-Gobain specializes in glass solutions, providing innovative and high-performance glass transparencies for various aircraft applications.Safran:

Safran is a key manufacturer of aircraft equipment, including high-quality transparencies designed for commercial and military aerospace applications.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Transparencies?

The aircraft transparencies market size is currently valued at approximately $1.7 billion, with a projected CAGR of 6.8% from 2023 to 2033. This growth is anticipated due to rising aircraft production and advancements in transparency technology.

What are the key market players or companies in the aircraft Transparencies industry?

Key players in the aircraft transparencies market include major companies such as PPG Aerospace, Saint-Gobain, Gulfstream Aerospace, and GKN Aerospace. These companies lead in technology innovation and production capabilities.

What are the primary factors driving the growth in the aircraft Transparencies industry?

Growth in the aircraft transparencies industry is driven by increasing air travel demand, technological advancements in materials, and the rising production rates of commercial and military aircraft, contributing to a robust market environment.

Which region is the fastest Growing in the aircraft Transparencies?

North America is identified as the fastest-growing region in the aircraft transparencies market, with a market size projected to grow from $0.63 billion in 2023 to $1.24 billion by 2033, driven by high demand for commercial aircraft.

Does ConsaInsights provide customized market report data for the aircraft Transparencies industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the aircraft transparencies industry. This includes in-depth analysis and data to support strategic decision-making.

What deliverables can I expect from this aircraft Transparencies market research project?

Deliverables from the aircraft transparencies market research project include comprehensive market analysis, detailed segmentation data, regional forecasts, competitor analysis, and strategic recommendations to guide business decisions.

What are the market trends of aircraft Transparencies?

Current market trends in aircraft transparencies include a shift towards lightweight materials, increased use of advanced coatings, and a focus on sustainable manufacturing practices as companies adapt to economic and environmental challenges.