Aircraft Turbine Engine Market Report

Published Date: 03 February 2026 | Report Code: aircraft-turbine-engine

Aircraft Turbine Engine Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Aircraft Turbine Engine market, providing detailed insights into market size, trends, and forecasts from 2023 to 2033. It covers regional analyses, technological advancements, and segment performance to inform stakeholders of potential growth areas.

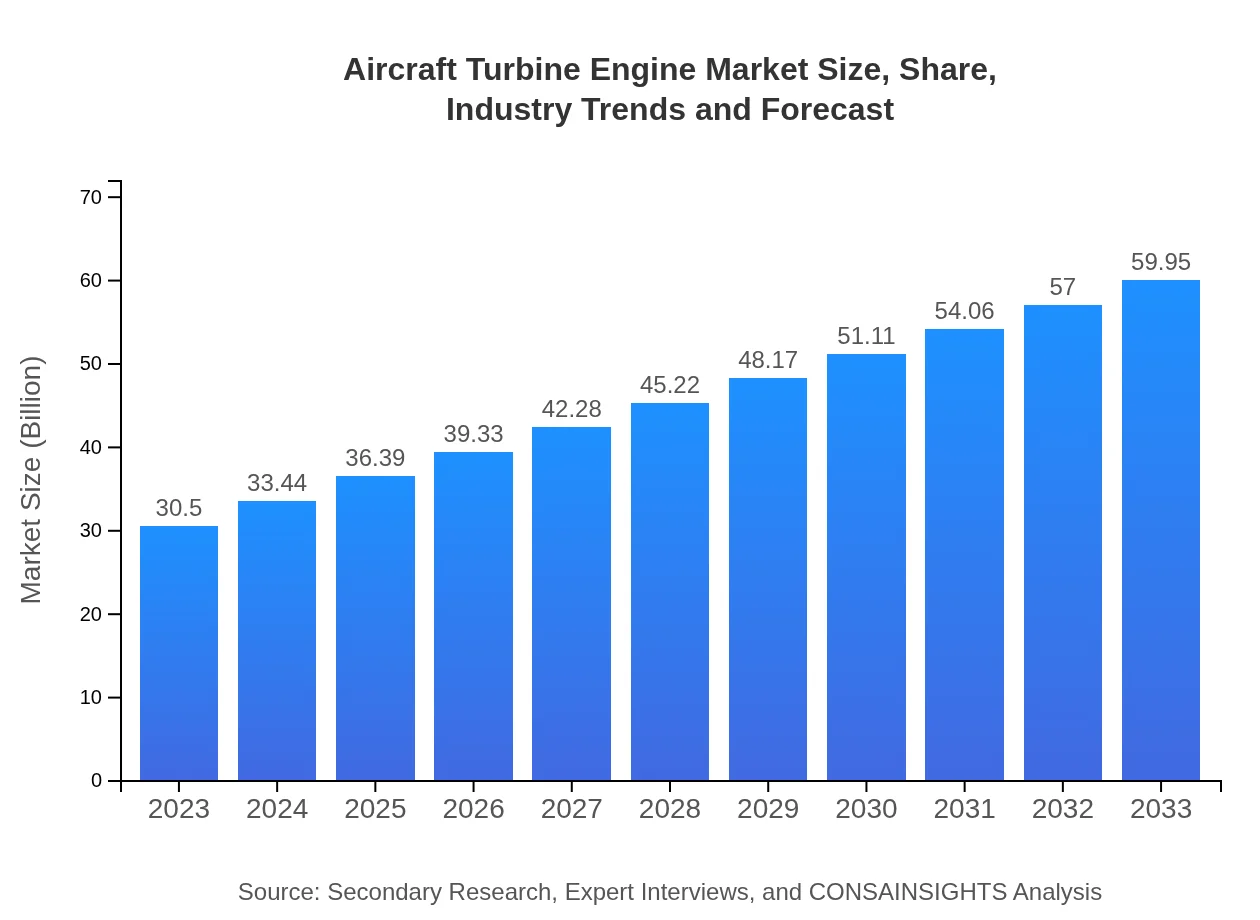

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $59.95 Billion |

| Top Companies | General Electric, Rolls-Royce Holdings plc, Pratt & Whitney, Safran S.A. |

| Last Modified Date | 03 February 2026 |

Aircraft Turbine Engine Market Overview

Customize Aircraft Turbine Engine Market Report market research report

- ✔ Get in-depth analysis of Aircraft Turbine Engine market size, growth, and forecasts.

- ✔ Understand Aircraft Turbine Engine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Turbine Engine

What is the Market Size & CAGR of Aircraft Turbine Engine market in 2023?

Aircraft Turbine Engine Industry Analysis

Aircraft Turbine Engine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Turbine Engine Market Analysis Report by Region

Europe Aircraft Turbine Engine Market Report:

The European market is set to expand from USD 10.79 billion in 2023 to USD 21.21 billion by 2033, recording a CAGR of 7.20%. The focus on environmental sustainability and innovations such as hybrid-electric engines are crucial components of Europe’s market growth strategy.Asia Pacific Aircraft Turbine Engine Market Report:

The Asia Pacific region is projected to grow from USD 5.32 billion in 2023 to USD 10.46 billion by 2033, registering a CAGR of 7.10%. The growth is driven by increasing air travel demand, expansion of low-cost carriers, and government initiatives to boost aerospace manufacturing in countries like China and India.North America Aircraft Turbine Engine Market Report:

North America dominates the market, anticipated to grow from USD 10.09 billion in 2023 to USD 19.83 billion by 2033, showing a CAGR of 7.20%. The region's established aerospace sector, continuous adoption of advanced technologies, and increasing military expenditure underpin this robust growth.South America Aircraft Turbine Engine Market Report:

In South America, the market is expected to grow from USD 0.57 billion in 2023 to USD 1.13 billion by 2033, with a CAGR of 7.30%. Economic development and investments in aviation infrastructure are key drivers. Despite challenges posed by economic volatility, the emerging middle class continues to drive air travel rise in this region.Middle East & Africa Aircraft Turbine Engine Market Report:

The Middle East and Africa region is projected to grow from USD 3.72 billion in 2023 to USD 7.32 billion by 2033, with a CAGR of 7.20%. Investment in regional airlines and airport infrastructure is driving progress, alongside growing air cargo operations to establish the area as a key logistics hub.Tell us your focus area and get a customized research report.

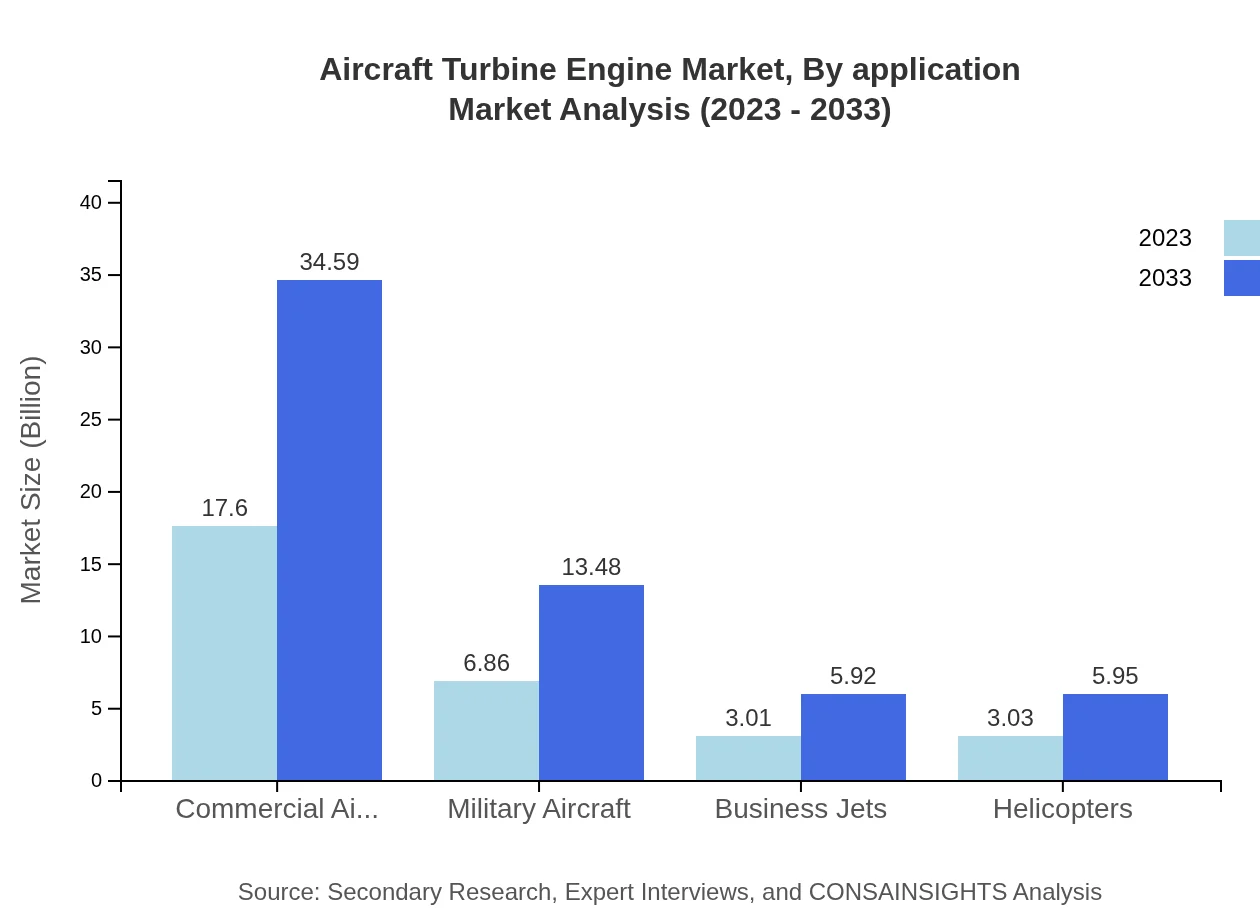

Aircraft Turbine Engine Market Analysis By Application

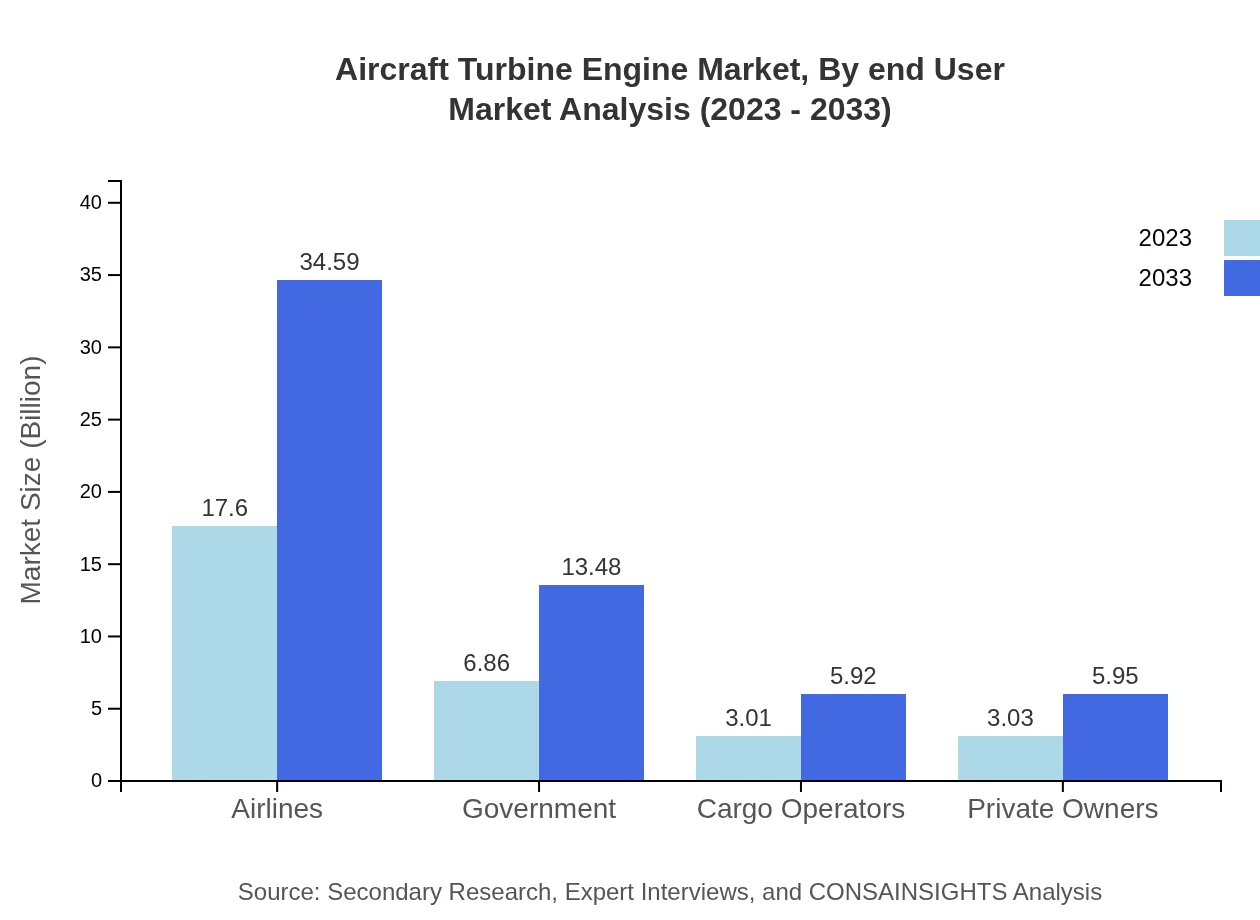

The market by application reveals essential insights into sector demand. The airlines segment stands at USD 17.60 billion in 2023, increasing to USD 34.59 billion by 2033, maintaining a 57.71% market share. Government operations also dominate, with the segment growing from USD 6.86 billion to USD 13.48 billion. Cargo operators and private owners are expected to increase their stakes as air freight and business aviation continue growing.

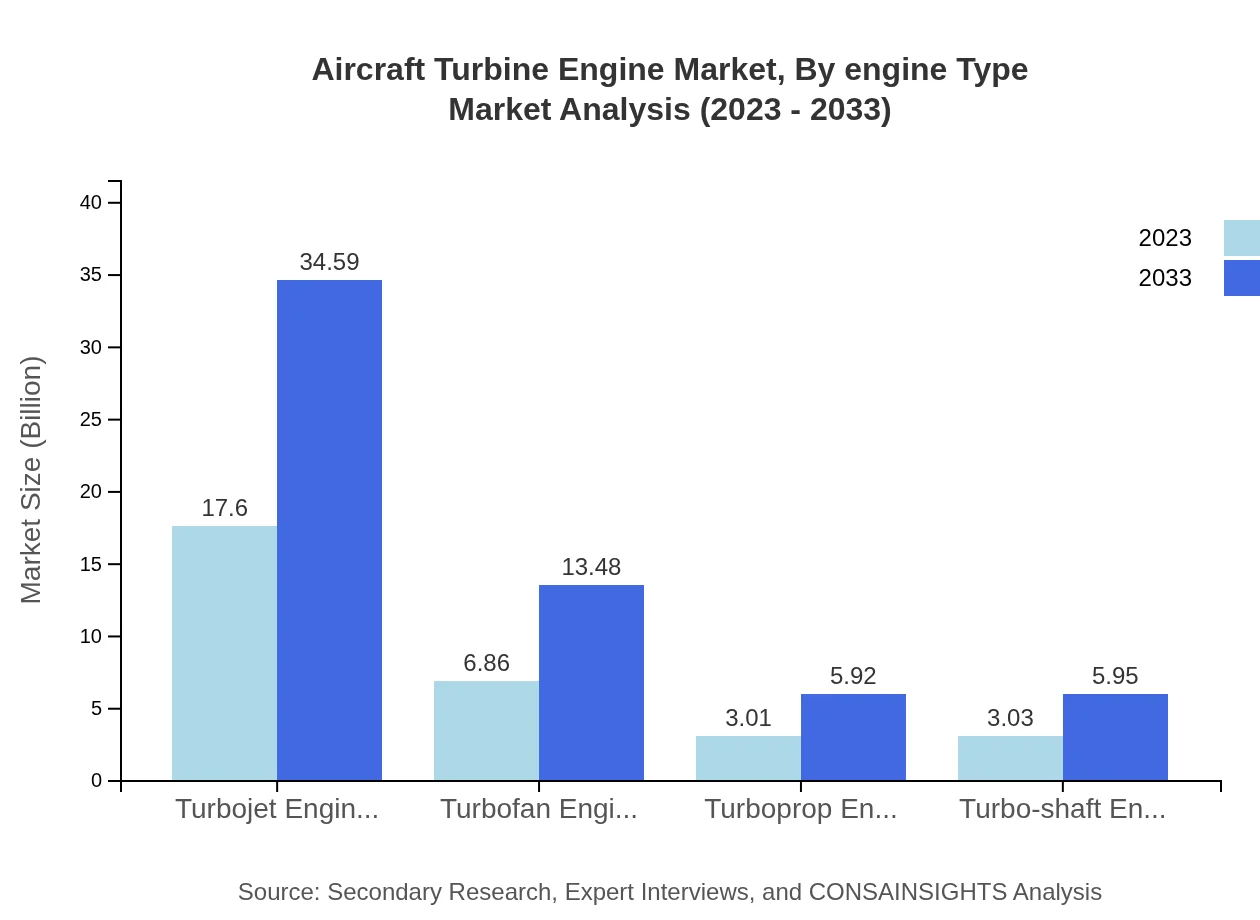

Aircraft Turbine Engine Market Analysis By Engine Type

In terms of engine types, turbofan engines hold the largest market share, attributed to their efficiency and adaptability in commercial applications. Turbojet engines follow, favored in military and specialized designs. Emerging technologies such as geared turbofans and open rotor designs are anticipated to gain traction through the forecast period, fostering competition among manufacturers.

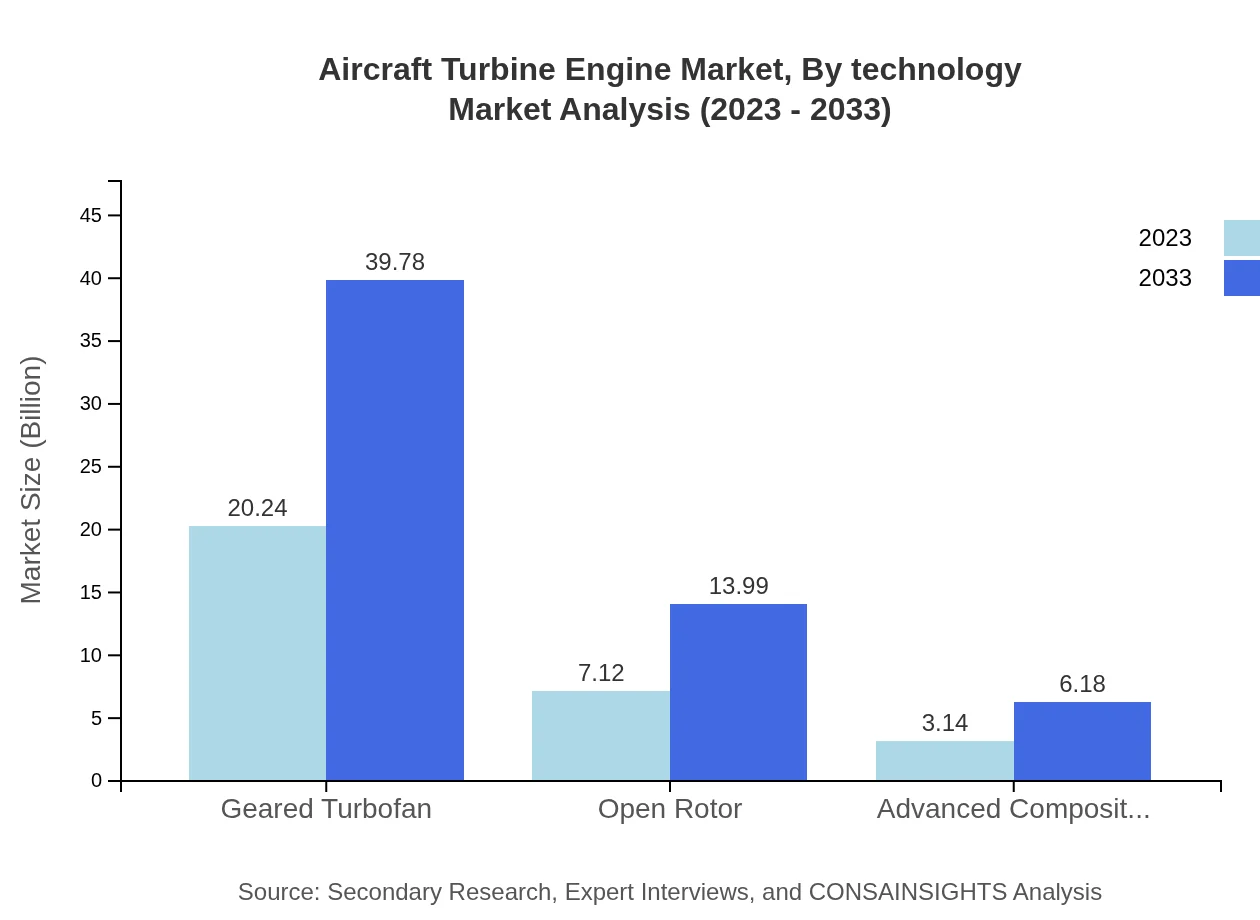

Aircraft Turbine Engine Market Analysis By Technology

Technological advancements, particularly in hybrid-electric engines and sustainable turbojets, are transforming the Aircraft Turbine Engine market. Companies are exploring advanced composite materials for lightweight designs and entering partnerships to foster innovation, consolidating their competitive edge while addressing environmental concerns.

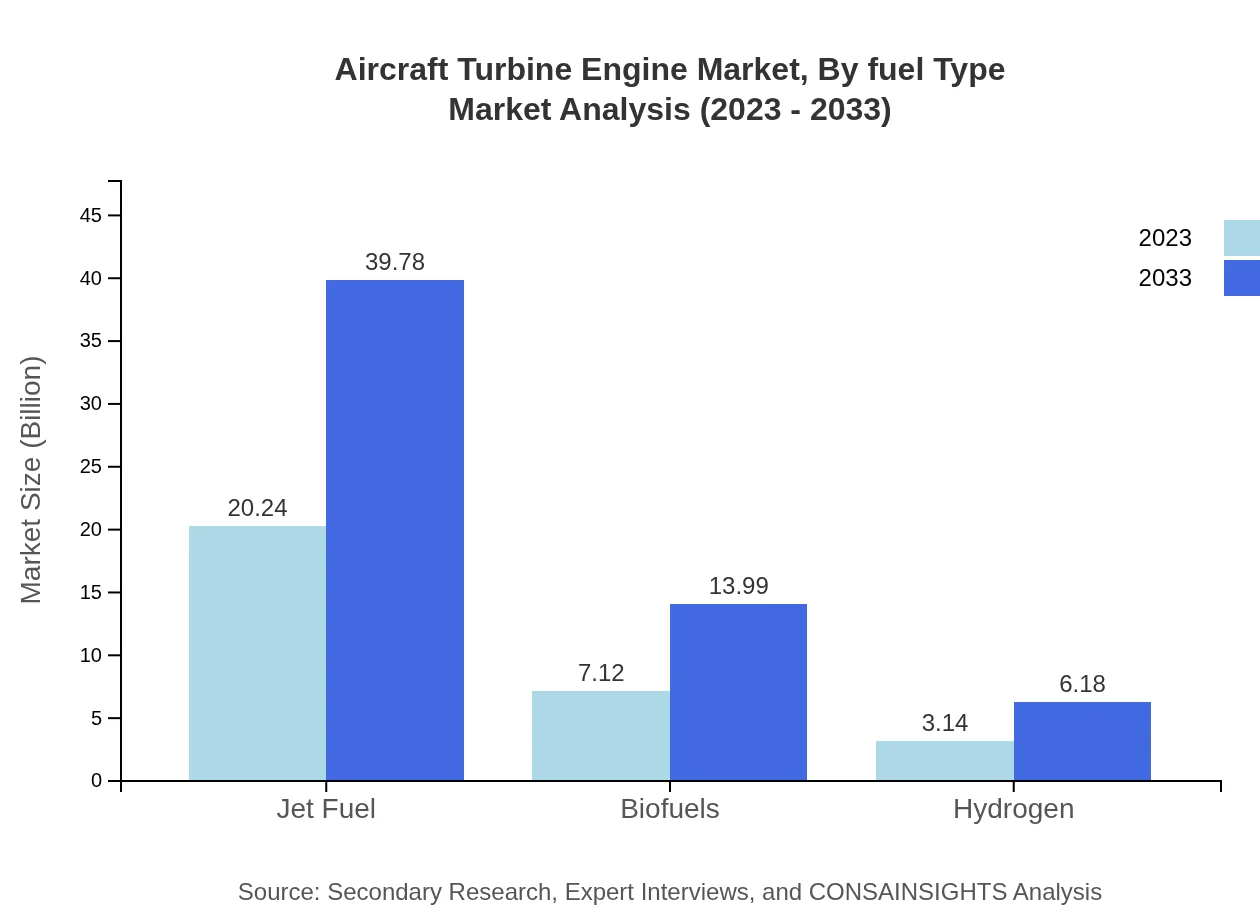

Aircraft Turbine Engine Market Analysis By Fuel Type

Fuel types include jet fuel, biofuels, and hydrogen. The market for jet fuel is valued at USD 20.24 billion in 2023, expected to grow to USD 39.78 billion by 2033, with a stable share of 66.36%. Biofuels are also gaining momentum, reflecting a growing preference for sustainable aviation practices.

Aircraft Turbine Engine Market Analysis By End User

The end-user segmentation reveals that commercial airlines occupy the largest share. Military applications follow, with significant growth anticipated due to global military modernization initiatives. Business and cargo aviation are also projected to expand, aligning with increasing global trade and travel patterns.

Aircraft Turbine Engine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Turbine Engine Industry

General Electric:

General Electric is a leading player in the Aircraft Turbine Engine market, known for its state-of-the-art jet engines that power a significant portion of commercial and military aircraft globally.Rolls-Royce Holdings plc:

Rolls-Royce is renowned for its high-performance engines and a strong presence in the defense sector, contributing significantly through innovative technologies that enhance engine efficiency and durability.Pratt & Whitney:

Pratt & Whitney, part of Raytheon Technologies, specializes in designing and manufacturing advanced turbine engines for commercial and military applications, focusing on sustainability.Safran S.A.:

Safran provides highly reliable turbofan engines and is engaged in extensive research and development for next-generation propulsion systems to reduce environmental impact.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Turbine Engine?

The global market size for aircraft turbine engines stands at approximately $30.5 billion in 2023, with a projected growth at a CAGR of 6.8%, reaching significant market valuations by 2033.

What are the key market players or companies in this aircraft Turbine Engine industry?

Key players in the aircraft turbine engine market include major manufacturers like General Electric, Rolls-Royce, Pratt & Whitney, Safran, and Honeywell, which drive innovation and competition, significantly influencing market dynamics.

What are the primary factors driving the growth in the aircraft Turbine Engine industry?

Growth factors include rising air travel demand, advancements in turbine engine technology for efficiency, increased defense budgets for military aircraft, and the transition towards environmentally sustainable fuel sources, all contributing to robust market expansion.

Which region is the fastest Growing in the aircraft Turbine Engine?

The Asia Pacific region is witnessing rapid growth in the aircraft turbine engine market, expected to increase from $5.32 billion in 2023 to $10.46 billion by 2033, showcasing significant investment in aviation infrastructure.

Does ConsaInsights provide customized market report data for the aircraft Turbine Engine industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the aircraft turbine engine industry, accommodating unique business requirements and insights, ensuring actionable market intelligence.

What deliverables can I expect from this aircraft Turbine Engine market research project?

Deliverables typically include comprehensive market analysis reports, segmentation insights, growth forecasts, competitive landscape assessments, and actionable recommendations tailored to help stakeholders make informed decisions.

What are the market trends of aircraft Turbine Engine?

Current market trends include a shift toward fuel-efficient designs, increased adoption of hybrid propulsion systems, a rise in sustainable fuel use, and innovations driven by digital technologies to enhance operational efficiency.