Aircraft Weapons Market Report

Published Date: 03 February 2026 | Report Code: aircraft-weapons

Aircraft Weapons Market Size, Share, Industry Trends and Forecast to 2033

This detailed market report analyzes the Aircraft Weapons industry, providing insights into current trends, market size, regional breakdown, technology advancements, and forecasts from 2023 to 2033. The objective is to equip stakeholders with data-driven insights for informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

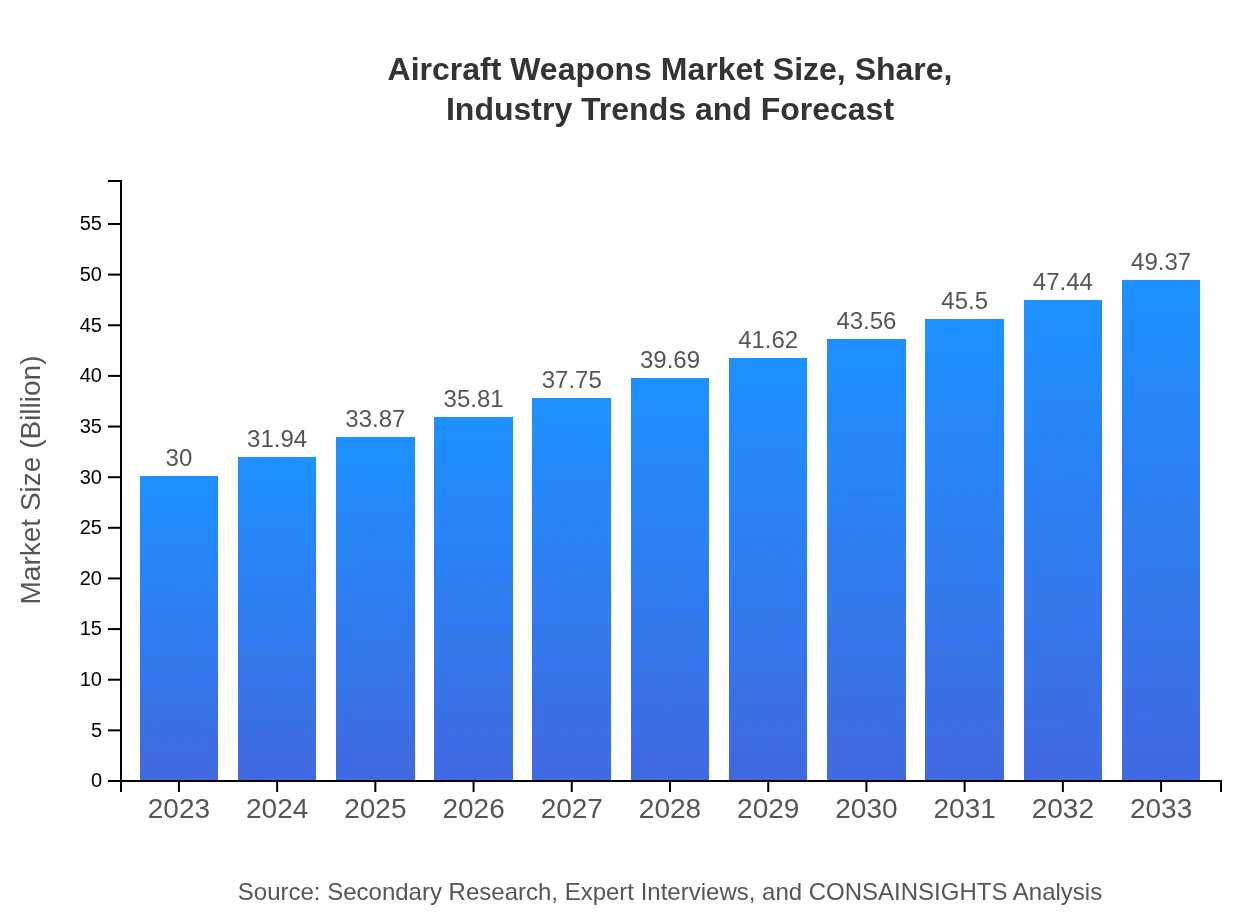

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $49.37 Billion |

| Top Companies | Lockheed Martin Corporation, Boeing Company, Raytheon Technologies Corporation, Northrop Grumman Corporation |

| Last Modified Date | 03 February 2026 |

Aircraft Weapons Market Overview

Customize Aircraft Weapons Market Report market research report

- ✔ Get in-depth analysis of Aircraft Weapons market size, growth, and forecasts.

- ✔ Understand Aircraft Weapons's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Weapons

What is the Market Size & CAGR of Aircraft Weapons market in 2023?

Aircraft Weapons Industry Analysis

Aircraft Weapons Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Weapons Market Analysis Report by Region

Europe Aircraft Weapons Market Report:

Europe's aircraft weapons market is on an upward trajectory, projected to increase from 9.14 billion USD in 2023 to 15.05 billion USD by 2033. NATO's collective defense measures and rising tensions with neighboring countries are prompting European nations to bolster their military resources significantly on air defense systems and precision-guided munitions.Asia Pacific Aircraft Weapons Market Report:

The Asia Pacific region is projected to witness considerable growth, with the market size increasing from 5.13 billion USD in 2023 to 8.44 billion USD in 2033. Countries such as India and China are ramping up their defense expenditures, enhancing their military capabilities to address regional security concerns. This has stimulated demand for advanced aircraft weapons, including UAVs and missile systems.North America Aircraft Weapons Market Report:

In North America, the market is anticipated to grow from 11.45 billion USD in 2023 to 18.85 billion USD in 2033. The United States leads in military expenditure, focusing on next-gen technologies such as hypersonic weapons and AI systems. Furthermore, government contracts with leading defense contractors underscore the region's dominance in the aircraft weapons market.South America Aircraft Weapons Market Report:

The South American market remains modest, expected to grow from 2.93 billion USD in 2023 to 4.82 billion USD in 2033. Key countries like Brazil and Argentina are investing in modernization efforts, albeit at a slower pace compared to global standards. The focus is on building local defense capabilities through international collaborations and joint ventures.Middle East & Africa Aircraft Weapons Market Report:

The Middle East and Africa region is expected to grow from 1.35 billion USD in 2023 to 2.22 billion USD in 2033. Middle Eastern nations are investing heavily in advanced aircraft weaponry due to ongoing regional conflicts and a focus on counterterrorism. Countries like Saudi Arabia and UAE are increasingly purchasing sophisticated military aircraft and integrated weapons systems.Tell us your focus area and get a customized research report.

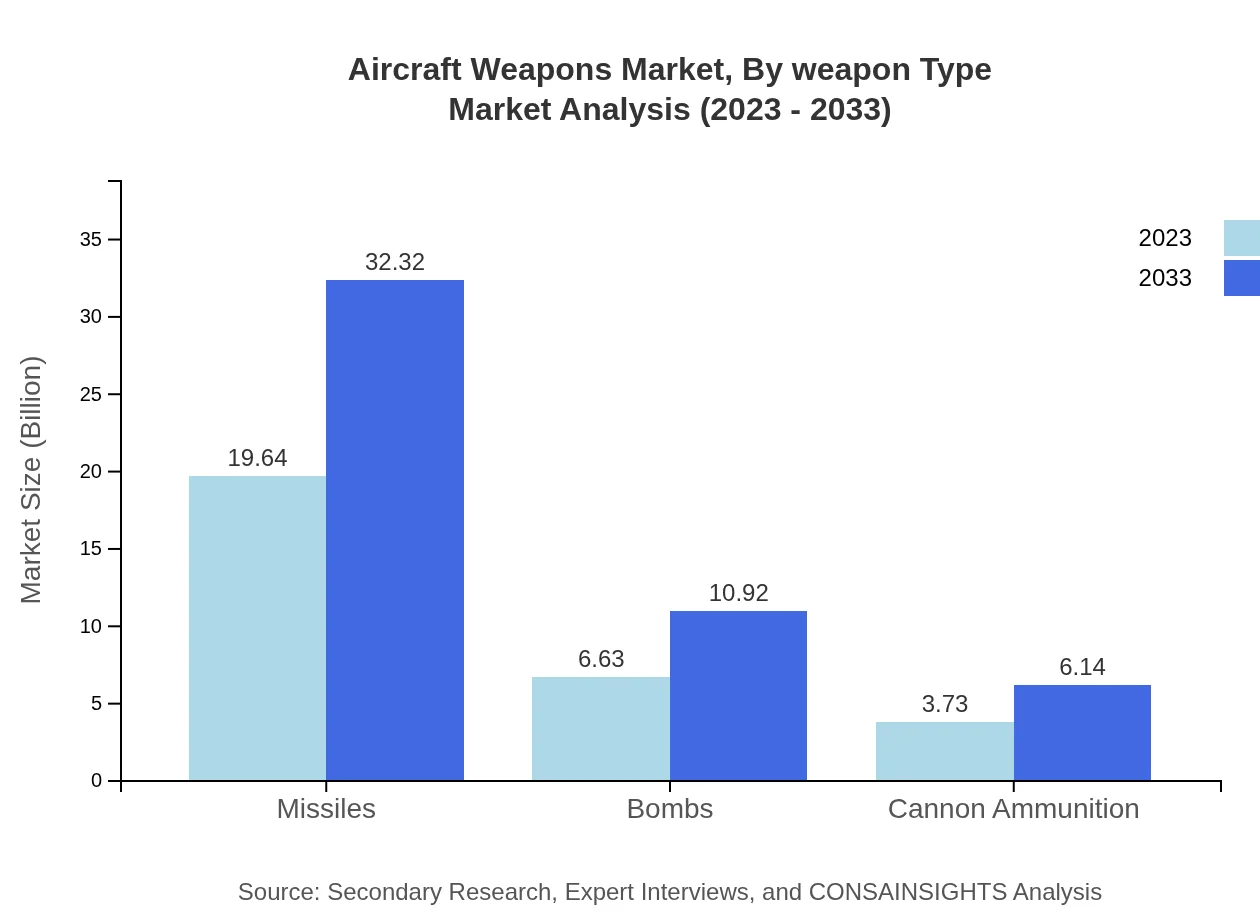

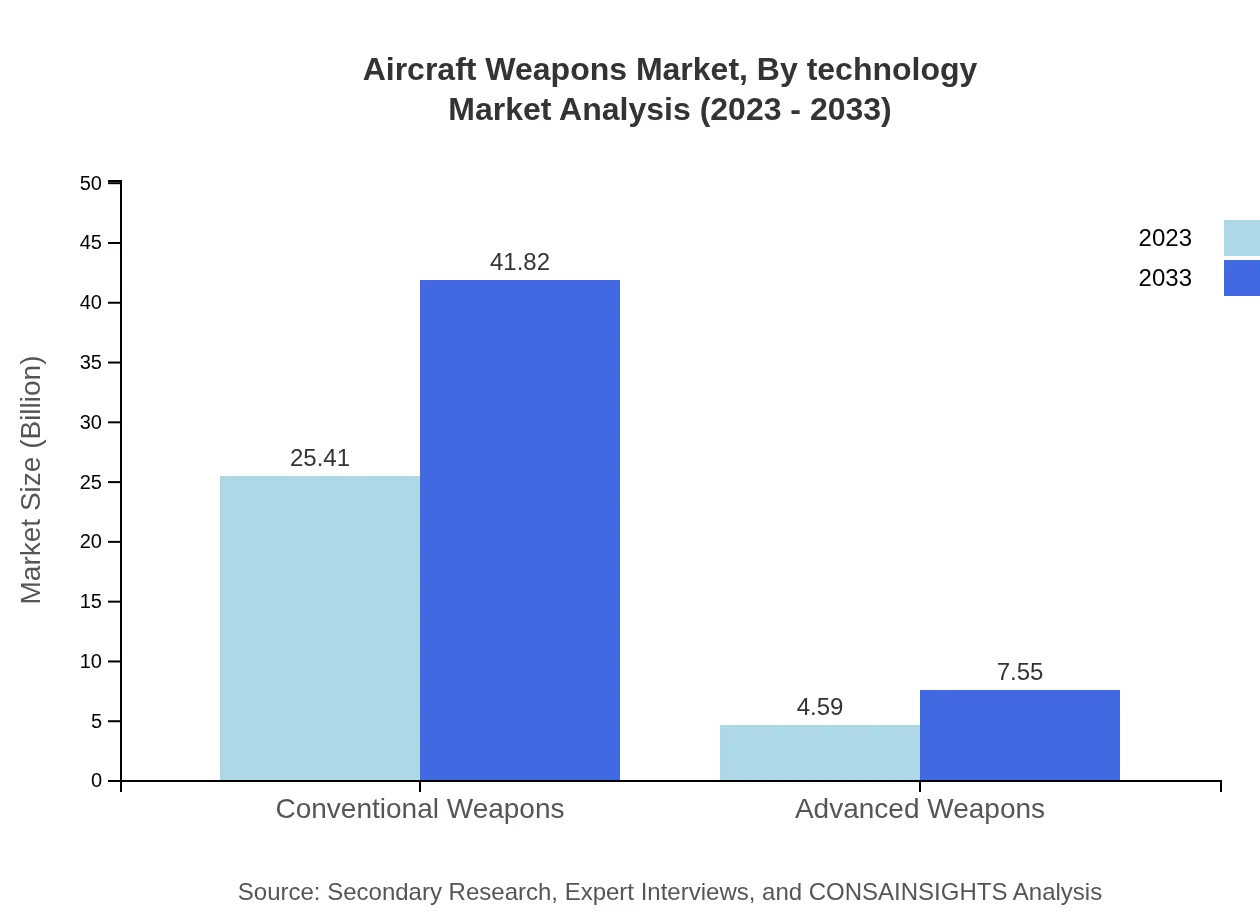

Aircraft Weapons Market Analysis By Weapon Type

The market is divided into Conventional Weapons and Advanced Weapons. In 2023, Conventional Weapons account for approximately 25.41 billion USD, while Advanced Weapons represent 4.59 billion USD. By 2033, the market is expected to reach 41.82 billion USD for Conventional Weapons and 7.55 billion USD for Advanced Weapons.

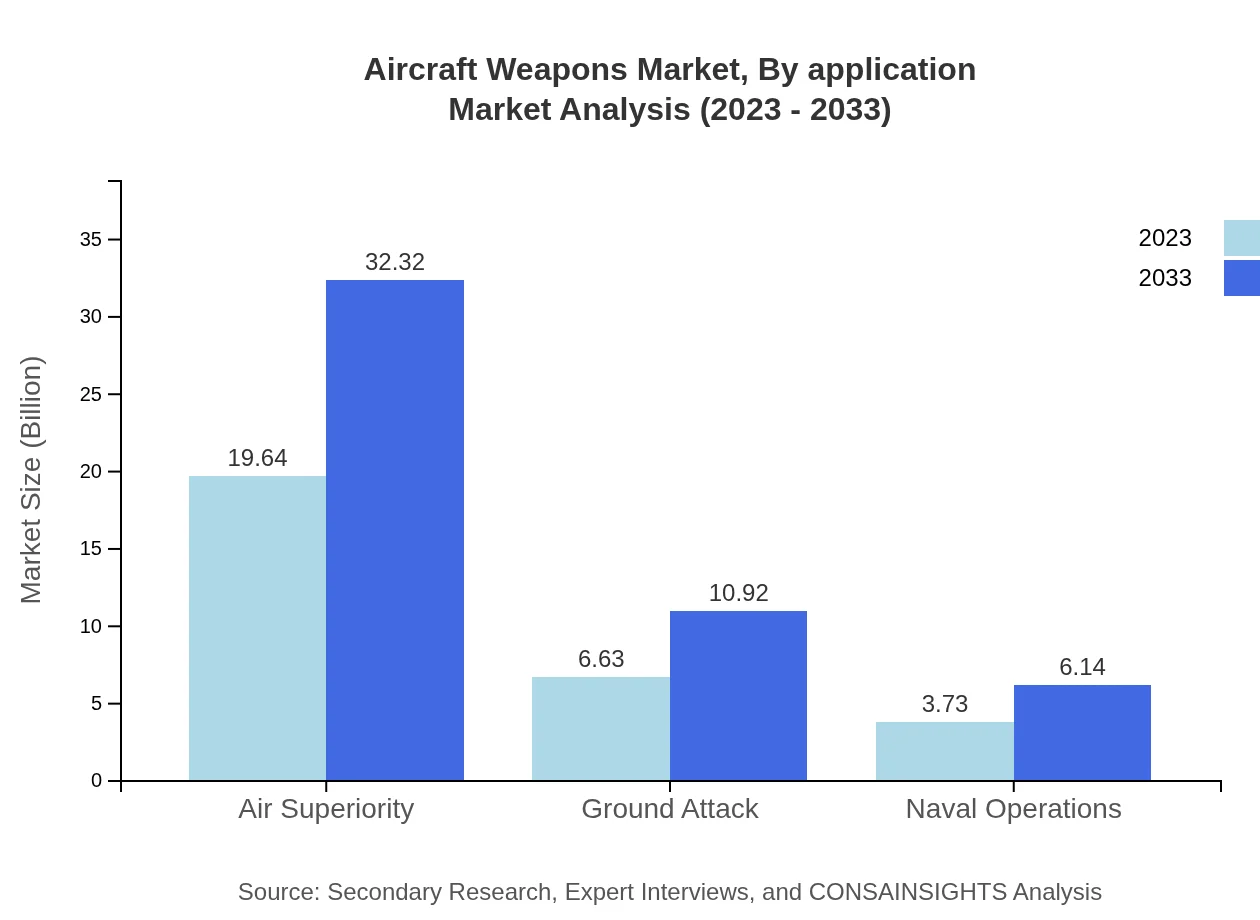

Aircraft Weapons Market Analysis By Application

The primary applications include Air Superiority, Ground Attack, and Naval Operations. Air Superiority predominate the market, expected to rise from 19.64 billion USD in 2023 to 32.32 billion USD in 2033. Ground Attack will expand from 6.63 billion USD to 10.92 billion USD, and Naval Operations from 3.73 billion USD to 6.14 billion USD during the same period.

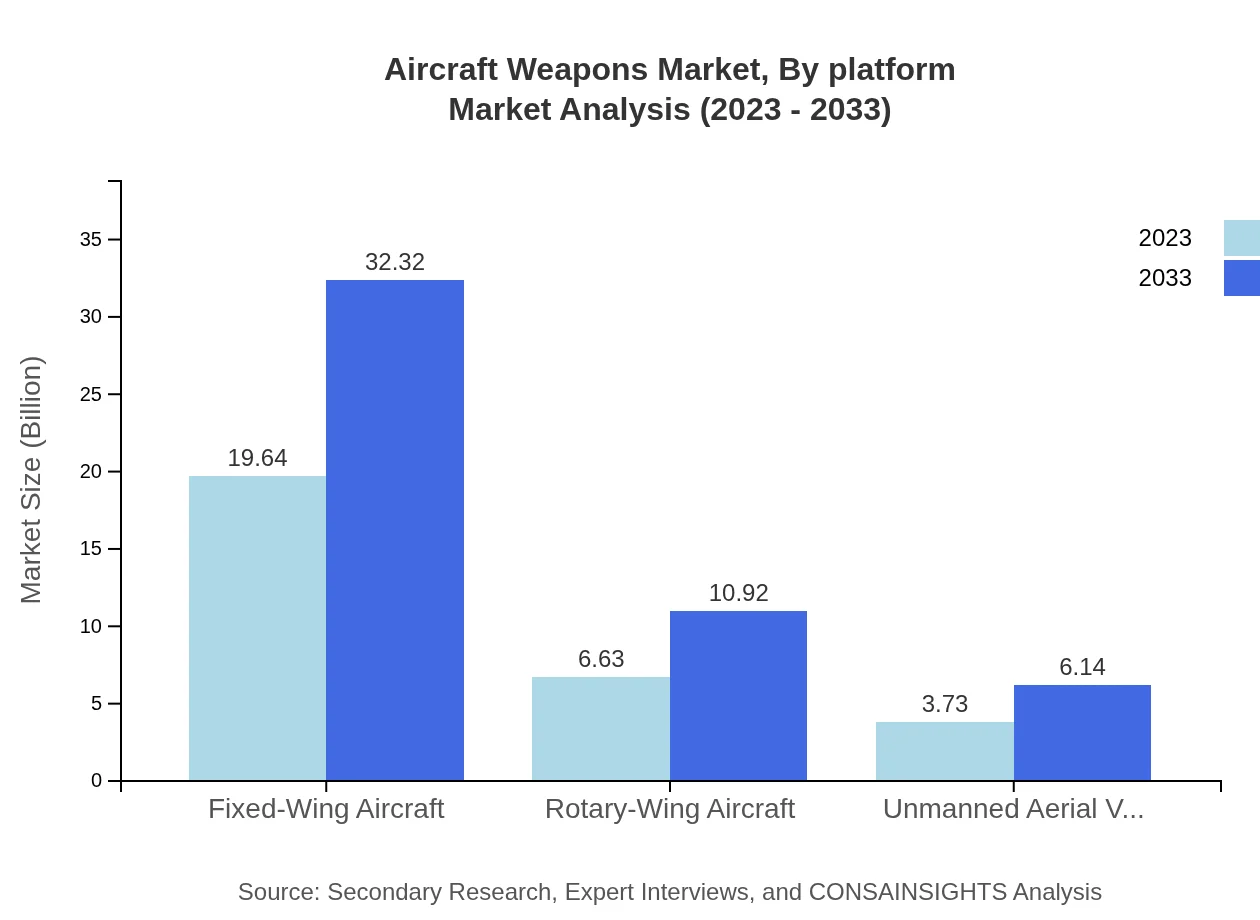

Aircraft Weapons Market Analysis By Platform

Fixed-Wing Aircraft dominate the platform segment, with a market size of 19.64 billion USD in 2023 and projected to grow to 32.32 billion USD in 2033. The Rotary-Wing Aircraft segment and UAVs are also gaining traction, moving from 6.63 billion USD and 3.73 billion USD respectively in 2023 to 10.92 billion USD and 6.14 billion USD by 2033.

Aircraft Weapons Market Analysis By Technology

Significant trends in technology include the rise of smart munitions and AI-driven targeting systems. The increasing need for precision and efficiency in combat situations emphasizes the importance of technological innovation in the Aircraft Weapons market. As military operations transition towards unmanned warfare, the demand for advanced weapons systems incorporating cutting-edge technologies is set to increase.

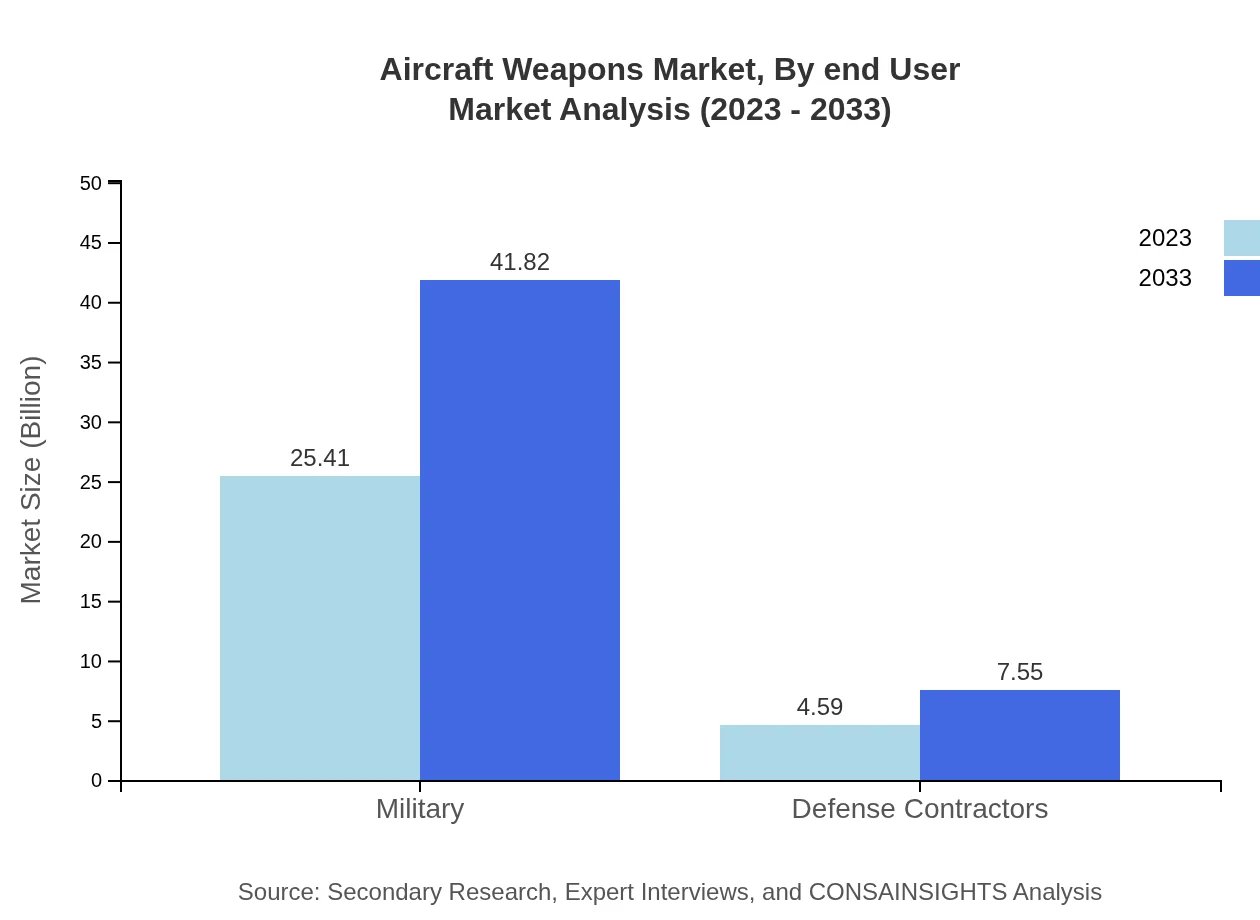

Aircraft Weapons Market Analysis By End User

The key end-users in the Aircraft Weapons market include Military entities, accounting for 25.41 billion USD in 2023, and Defense Contractors at 4.59 billion USD. Both segments are projected to grow, with Military operations reaching 41.82 billion USD and Defense Contractors expanding to 7.55 billion USD by 2033. This reflects ongoing investments in defense capabilities globally.

Aircraft Weapons Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Weapons Industry

Lockheed Martin Corporation:

Lockheed Martin is a global leader in aerospace and defense technologies, specializing in advanced weapon systems, including missile systems and drones.Boeing Company:

Boeing develops state-of-the-art aircraft and weaponry solutions, focusing on innovation and providing tactical platforms for military use.Raytheon Technologies Corporation:

Raytheon is well-known for its missile defense systems and precision-guided munitions, contributing significantly to air defense capabilities worldwide.Northrop Grumman Corporation:

Northrop Grumman specializes in aerospace and defense technologies, particularly in unmanned systems and advanced weaponry.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Weapons?

The global aircraft weapons market is projected to reach approximately $30 billion by 2033, growing at a CAGR of 5% from its current value. This growth reflects the increasing demand for advanced military capabilities and innovations in weaponry.

What are the key market players or companies in this aircraft Weapons industry?

Key players in the aircraft weapons industry include major defense contractors such as Lockheed Martin, Raytheon Technologies, Boeing, and Northrop Grumman. Their expertise and technological advancements drive the evolution and competitiveness of the market.

What are the primary factors driving the growth in the aircraft weapons industry?

Growth in the aircraft weapons market is primarily driven by geopolitical tensions, increasing defense budgets, and advancements in military technologies. Nations are investing heavily in enhancing their aerial capabilities to maintain defense readiness and superiority.

Which region is the fastest Growing in the aircraft weapons market?

North America is currently the fastest-growing region in the aircraft weapons market, expected to increase from $11.45 billion in 2023 to $18.85 billion by 2033, attributed to substantial U.S. military expenditures and technological innovations.

Does ConsaInsights provide customized market report data for the aircraft Weapons industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the aircraft weapons industry. These reports can include detailed analysis, forecasts, and insights based on the client's operational requirements.

What deliverables can I expect from this aircraft Weapons market research project?

Expect comprehensive deliverables including detailed market analysis, growth projections, competitor insights, regional breakdowns, and trend analyses to inform strategic decisions in the aircraft weapons sector.

What are the market trends of aircraft Weapons?

Key trends in the aircraft weapons market include increasing automation in military drones, a shift towards advanced precision munitions, and enhanced focus on cyber warfare capabilities, reshaping the strategies military organizations adopt globally.