Aircraft Windows And Windshields Market Report

Published Date: 03 February 2026 | Report Code: aircraft-windows-and-windshields

Aircraft Windows And Windshields Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Windows and Windshields market, including insights on market size, trends, and forecasts from 2023 to 2033. It highlights key segments, regional performances, and the market's competitive landscape.

| Metric | Value |

|---|---|

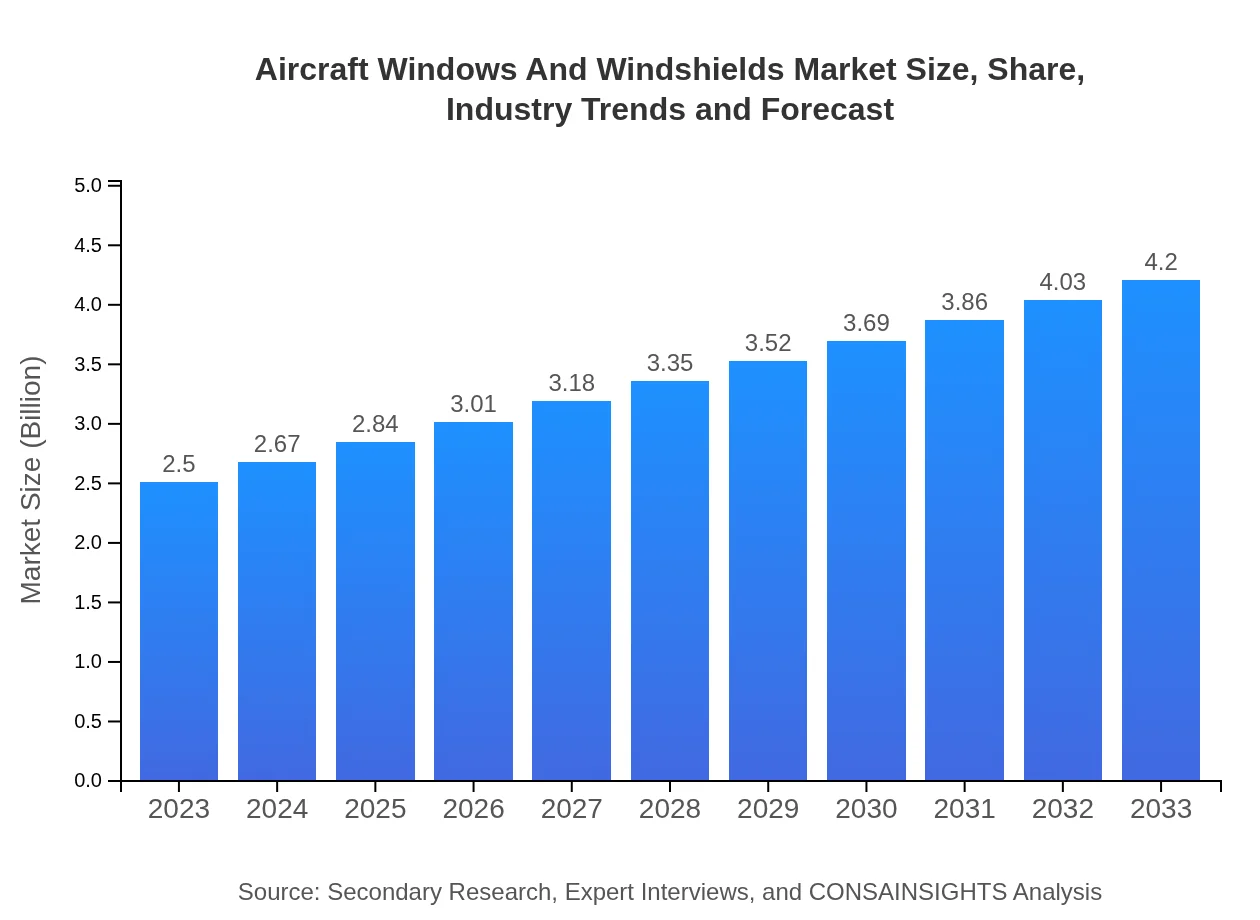

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $4.20 Billion |

| Top Companies | P PG Industries, GKN Aerospace, Honeywell , Saint-Gobain |

| Last Modified Date | 03 February 2026 |

Aircraft Windows And Windshields Market Overview

Customize Aircraft Windows And Windshields Market Report market research report

- ✔ Get in-depth analysis of Aircraft Windows And Windshields market size, growth, and forecasts.

- ✔ Understand Aircraft Windows And Windshields's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Windows And Windshields

What is the Market Size & CAGR of Aircraft Windows And Windshields market in 2023?

Aircraft Windows And Windshields Industry Analysis

Aircraft Windows And Windshields Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Windows And Windshields Market Analysis Report by Region

Europe Aircraft Windows And Windshields Market Report:

In Europe, the market size is estimated to be $0.63 billion in 2023 and projected to increase to $1.06 billion by 2033. Economic recovery and environmental regulations promoting fuel efficiency in aircraft are key growth drivers.Asia Pacific Aircraft Windows And Windshields Market Report:

In 2023, the Aircraft Windows and Windshields market in the Asia-Pacific region is valued at $0.54 billion, projected to grow to $0.91 billion by 2033. The robust growth is driven by increasing air traffic and expanding fleet sizes in countries like China and India.North America Aircraft Windows And Windshields Market Report:

North America holds a significant share of the market at $0.93 billion in 2023, forecasted to grow to $1.56 billion by 2033. The region's growth is driven by the presence of major aircraft manufacturers and a strong aftermarket segment.South America Aircraft Windows And Windshields Market Report:

The South American market is valued at $0.11 billion in 2023 and expected to reach $0.19 billion by 2033. Factors affecting this growth include rising investments in aviation infrastructure and a recovery in air travel post-pandemic.Middle East & Africa Aircraft Windows And Windshields Market Report:

This region's market is valued at $0.28 billion in 2023, with expectations to reach $0.48 billion by 2033. Growth is fueled by an increase in tourism and business travel, alongside regional investments in aviation.Tell us your focus area and get a customized research report.

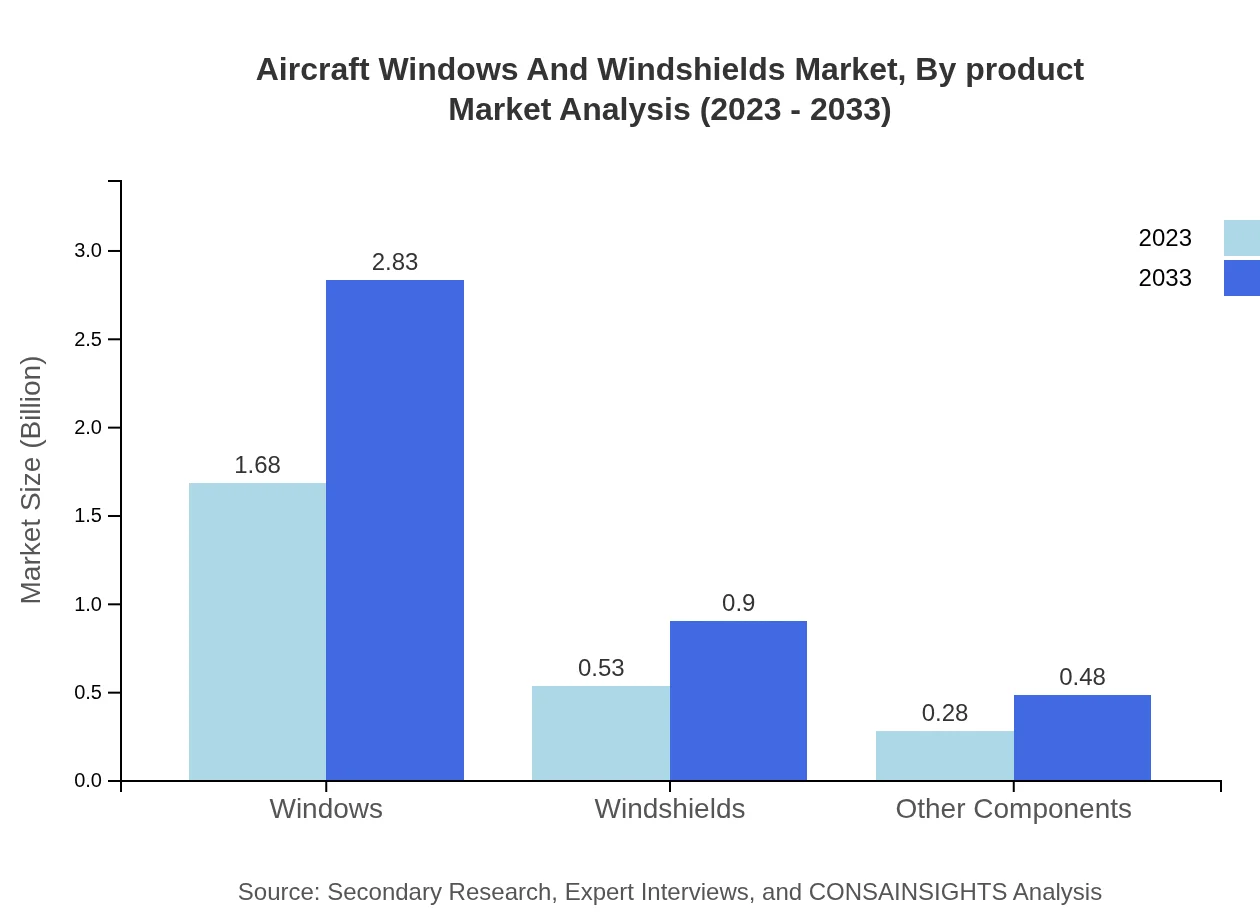

Aircraft Windows And Windshields Market Analysis By Product

In 2023, the Windows segment dominates the market with a size of $1.68 billion, expected to grow to $2.83 billion by 2033. Windshields hold a market size of $0.53 billion, projected to increase to $0.90 billion, while Other Components account for $0.28 billion in 2023, rising to $0.48 billion. These segments are essential for aircraft operation and passenger safety.

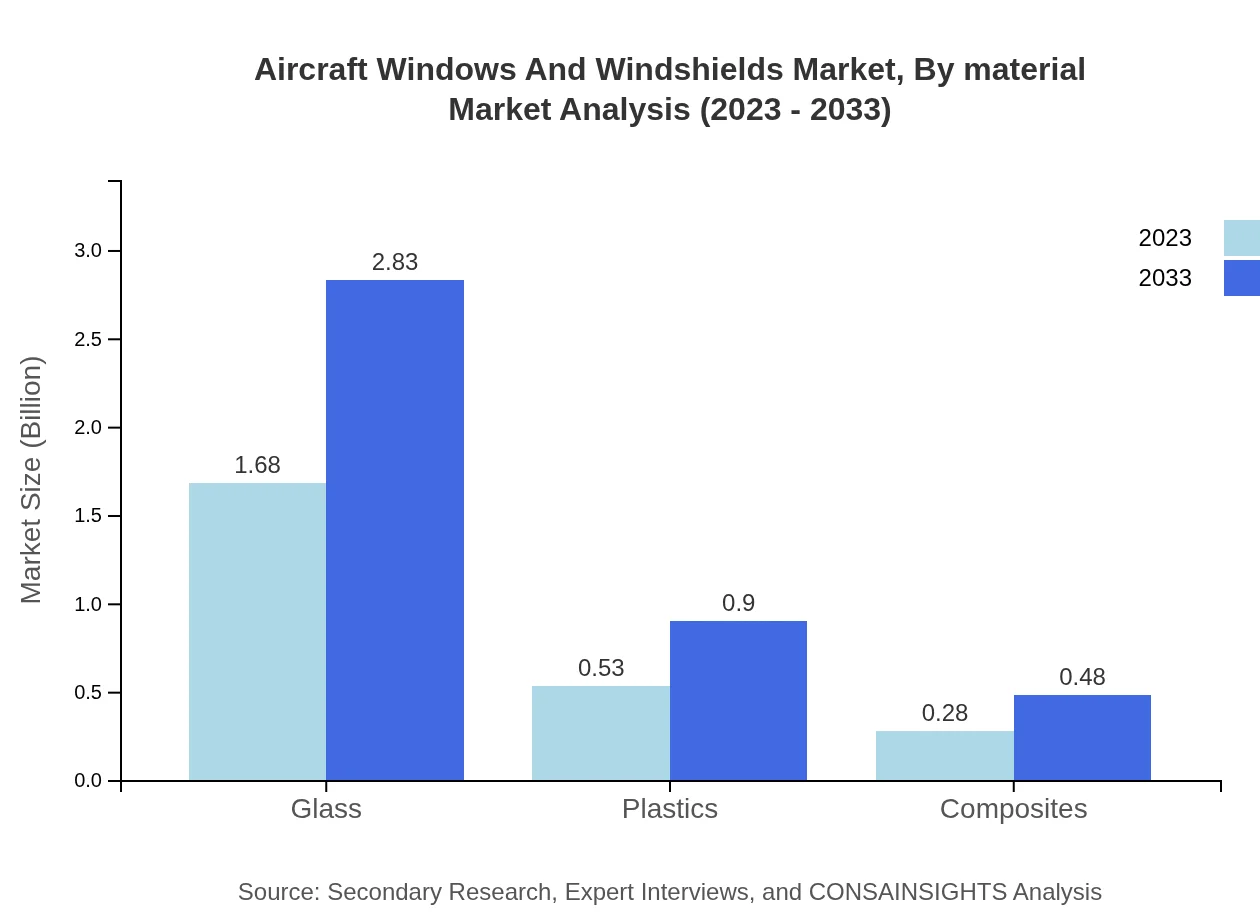

Aircraft Windows And Windshields Market Analysis By Material

The market is dominated by Glass, with a size of $1.68 billion and a steady share of 67.32% as of 2023. Plastics, while holding a market size of $0.53 billion (21.36% share), are gaining traction due to their lightweight properties. Composites represent a smaller segment at $0.28 billion (11.32% share) but show growth potential due to innovative applications.

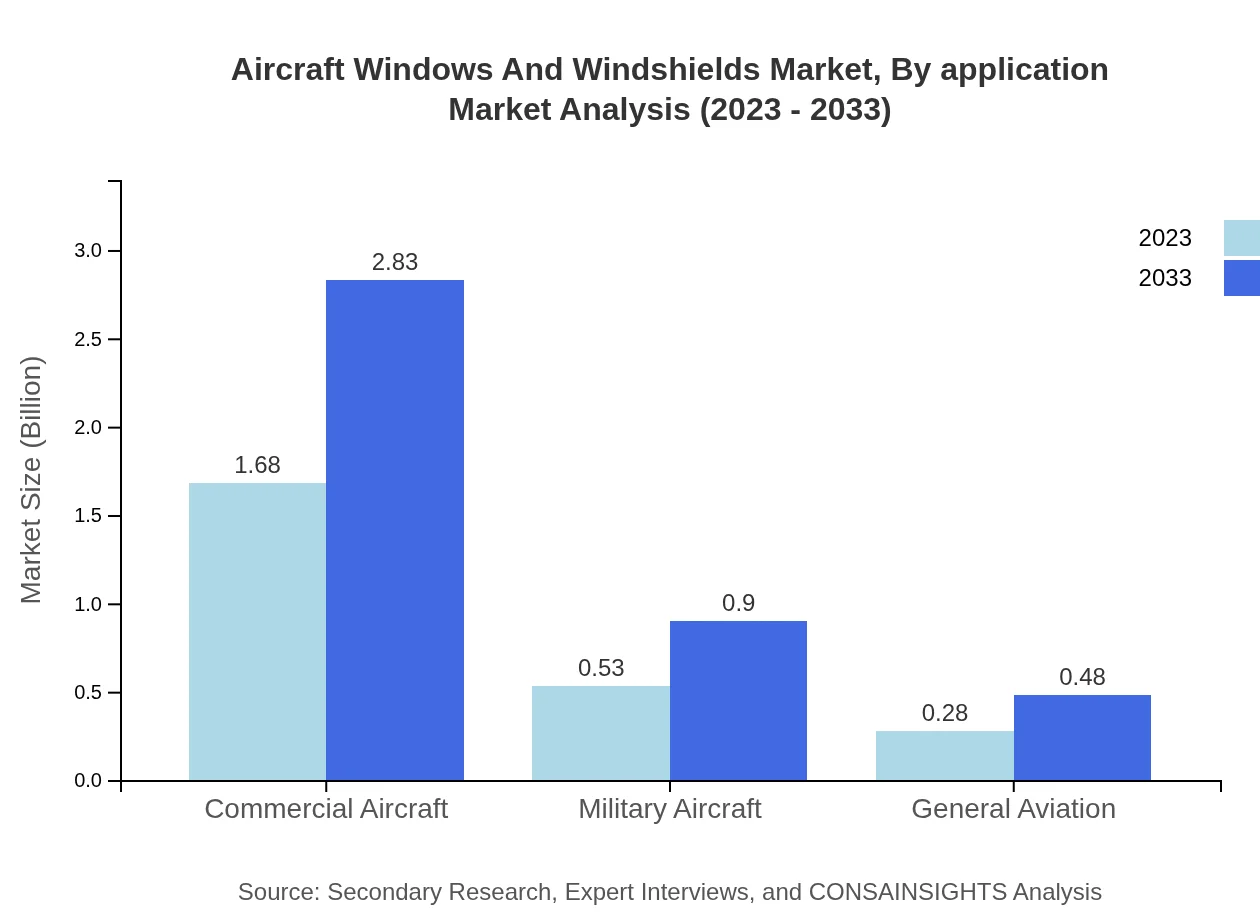

Aircraft Windows And Windshields Market Analysis By Application

Commercial Aircraft account for $1.68 billion in 2023 and maintain a 67.32% market share, while Military Aircraft, estimated at $0.53 billion (21.36% share), continue to represent a crucial segment due to defense enhancements. General Aviation captures $0.28 billion (11.32% share) and is also important for both recreational and business flights.

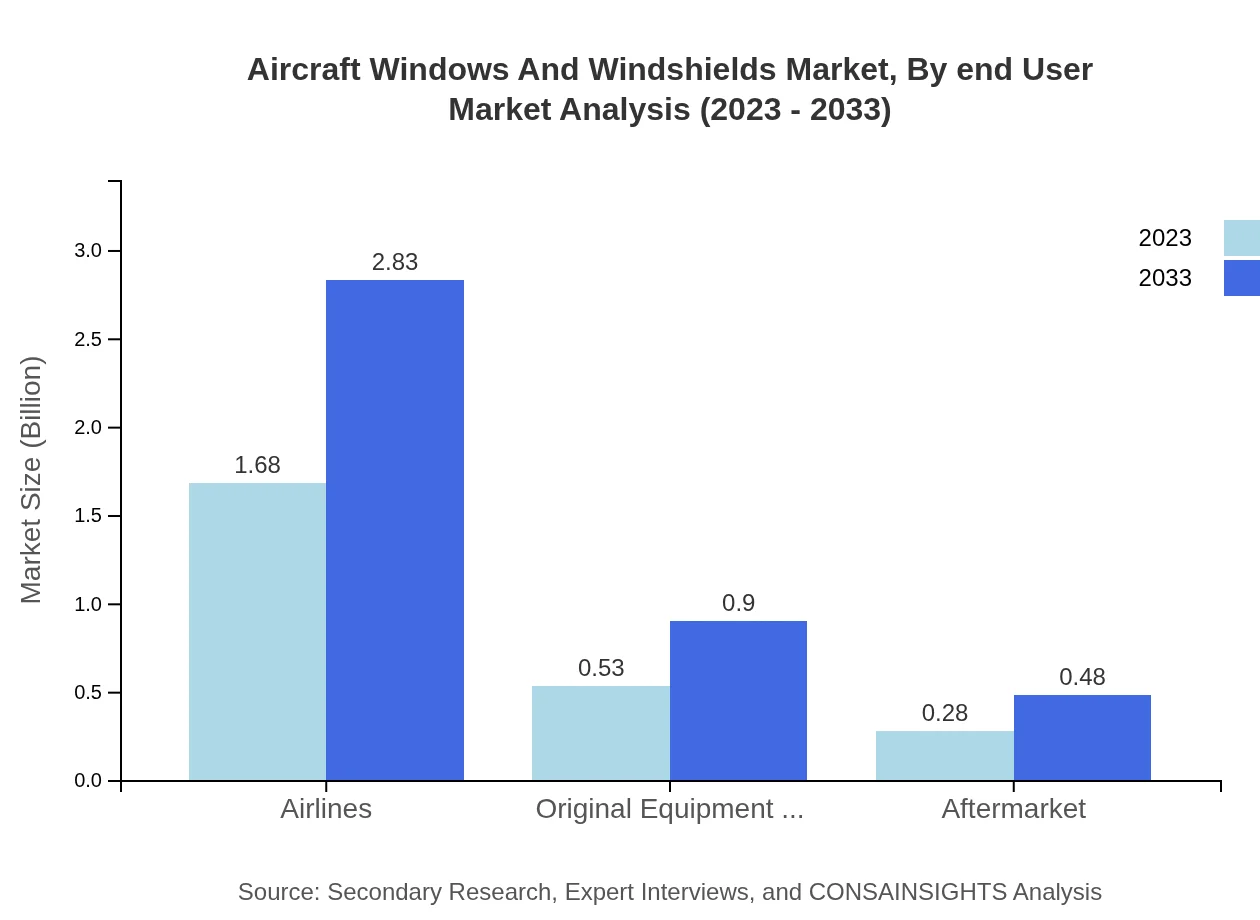

Aircraft Windows And Windshields Market Analysis By End User

The Airlines segment leads the market with $1.68 billion (67.32% share) in 2023, driven by the growing fleet of commercial airplanes. The OEMs segment is valued at $0.53 billion (21.36% share), while Aftermarket services stand at $0.28 billion (11.32% share) and are essential for maintaining aircraft compliance and safety.

Aircraft Windows And Windshields Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Windows And Windshields Industry

P PG Industries:

A leading supplier of glass and plastics for the aerospace industry, PPG Industries is known for its innovative solutions and high-quality products.GKN Aerospace:

As a global engineering company, GKN Aerospace specializes in advanced composites and manufacturing technologies for aircraft windows and windshields.Honeywell :

Honeywell is a key player in aviation technologies, providing advanced materials and systems for aircraft windows and windshields.Saint-Gobain:

A global leader in sustainable habitat solutions, Saint-Gobain produces high-performance glass for aircraft that adheres to strict safety and environmental standards.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Windows And Windshields?

The aircraft windows and windshields market is estimated to reach $2.5 billion by 2033, growing at a CAGR of 5.2%. In 2023, the market stands at $1.63 billion, highlighting significant growth prospects in aviation.

What are the key market players or companies in this industry?

Key players in the aircraft windows and windshields market include major companies specializing in aerospace manufacturing, such as PPG Industries, Saint-Gobain, and GKN Aerospace, among others, all contributing to the market's evolution.

What are the primary factors driving the growth in the aircraft windows and windshields industry?

Growth in the aircraft windows and windshields market is influenced by increasing air travel demand, advancements in material technology, and the need for enhanced safety and efficiency in aircraft design.

Which region is the fastest Growing in the aircraft windows and windshields market?

The Asia-Pacific region is the fastest-growing market for aircraft windows and windshields, projected to grow from $0.54 billion in 2023 to $0.91 billion by 2033, reflecting increasing demand for air travel and aerospace innovation.

Does ConsaInsights provide customized market report data for the aircraft Windows And Windshields industry?

Yes, ConsaInsights offers tailored market reports to address specific research needs, allowing businesses to gain insights and strategic guidance in the aircraft windows and windshields sector.

What deliverables can I expect from this aircraft Windows And Windshields market research project?

Deliverables include comprehensive market analysis reports, segment data insights, regional growth forecasts, competitive landscape assessments, and actionable recommendations tailored to stakeholder needs.

What are the market trends of aircraft windows and windshields?

Current trends include the shift towards lighter materials like composites and plastics, increased focus on energy efficiency, and the integration of smart window technologies, enhancing both functionality and passenger experience.