Aircraft Wire And Cable Market Report

Published Date: 03 February 2026 | Report Code: aircraft-wire-and-cable

Aircraft Wire And Cable Market Size, Share, Industry Trends and Forecast to 2033

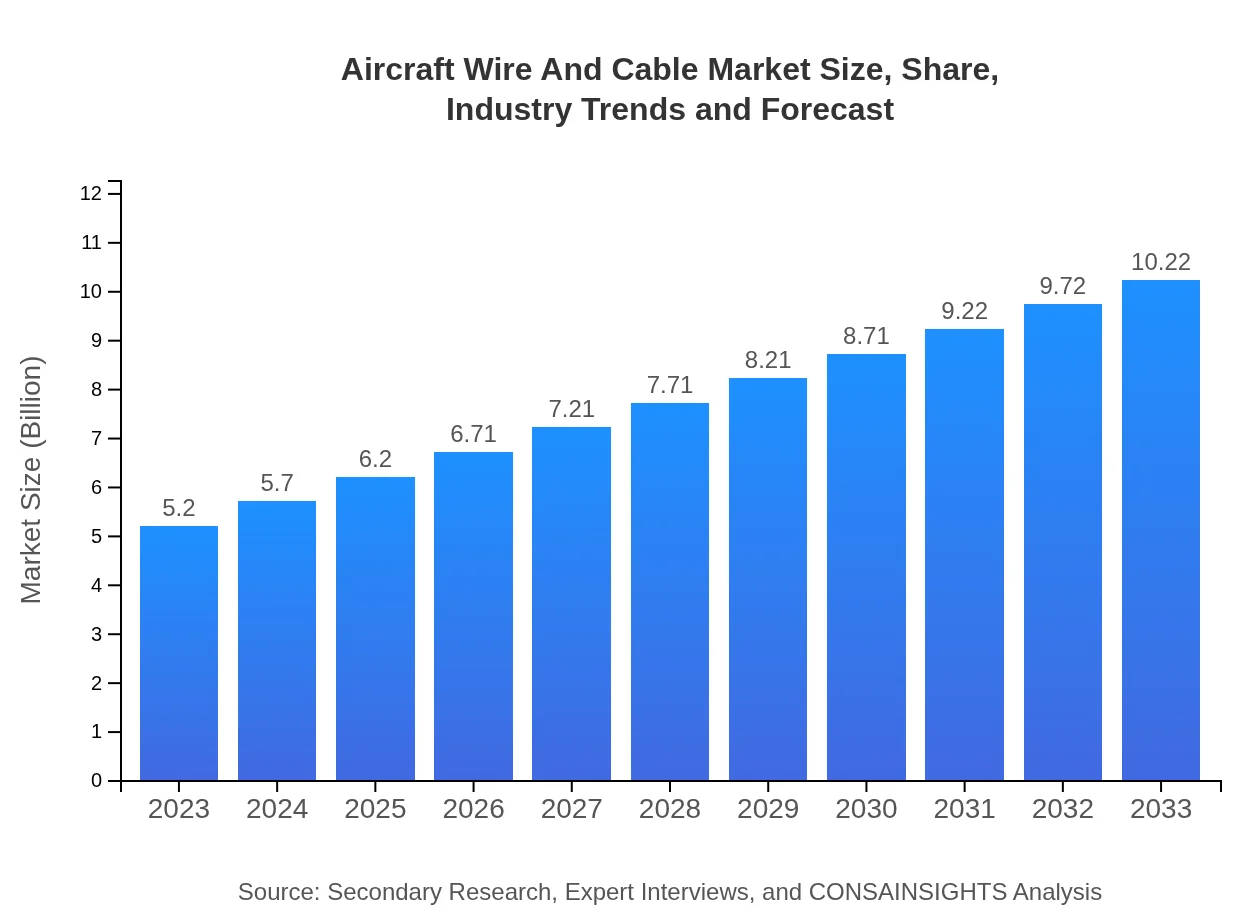

This report investigates the Aircraft Wire and Cable market from 2023 to 2033, offering comprehensive insights including market size, growth rates, segment analysis, and influential trends to aid stakeholders in informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | General Cable Corporation, Southwire Company, LLC, TE Connectivity, Amphenol Corporation, Molex |

| Last Modified Date | 03 February 2026 |

Aircraft Wire And Cable Market Overview

Customize Aircraft Wire And Cable Market Report market research report

- ✔ Get in-depth analysis of Aircraft Wire And Cable market size, growth, and forecasts.

- ✔ Understand Aircraft Wire And Cable's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Wire And Cable

What is the Market Size & CAGR of Aircraft Wire And Cable market in 2023 - 2033?

Aircraft Wire And Cable Industry Analysis

Aircraft Wire And Cable Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Wire And Cable Market Analysis Report by Region

Europe Aircraft Wire And Cable Market Report:

Europe's market is expected to expand from $1.56 billion in 2023 to $3.06 billion in 2033, propelled by stringent safety regulations and the increasing adoption of new technologies in aircraft manufacturing.Asia Pacific Aircraft Wire And Cable Market Report:

The Asia Pacific region is emerging as a significant player in the market with a projected growth from $0.98 billion in 2023 to $1.92 billion in 2033. The increase in regional aircraft manufacturing and maintenance capabilities drives demand for high-quality wire and cable products.North America Aircraft Wire And Cable Market Report:

North America leads the Aircraft Wire and Cable market with a forecast growth from $2.00 billion in 2023 to $3.93 billion by 2033. The presence of major aerospace manufacturers and a significant defense budget fosters innovation and demand in this region.South America Aircraft Wire And Cable Market Report:

In South America, the market is anticipated to grow from $0.31 billion in 2023 to $0.60 billion by 2033, primarily due to increasing investments in aerospace infrastructure and the gradual expansion of the aviation sector in countries like Brazil and Argentina.Middle East & Africa Aircraft Wire And Cable Market Report:

The Middle East and Africa region shows promising growth, from $0.36 billion in 2023 to $0.71 billion in 2033, stimulated by rising air travel and investments in airline modernization and military aircraft.Tell us your focus area and get a customized research report.

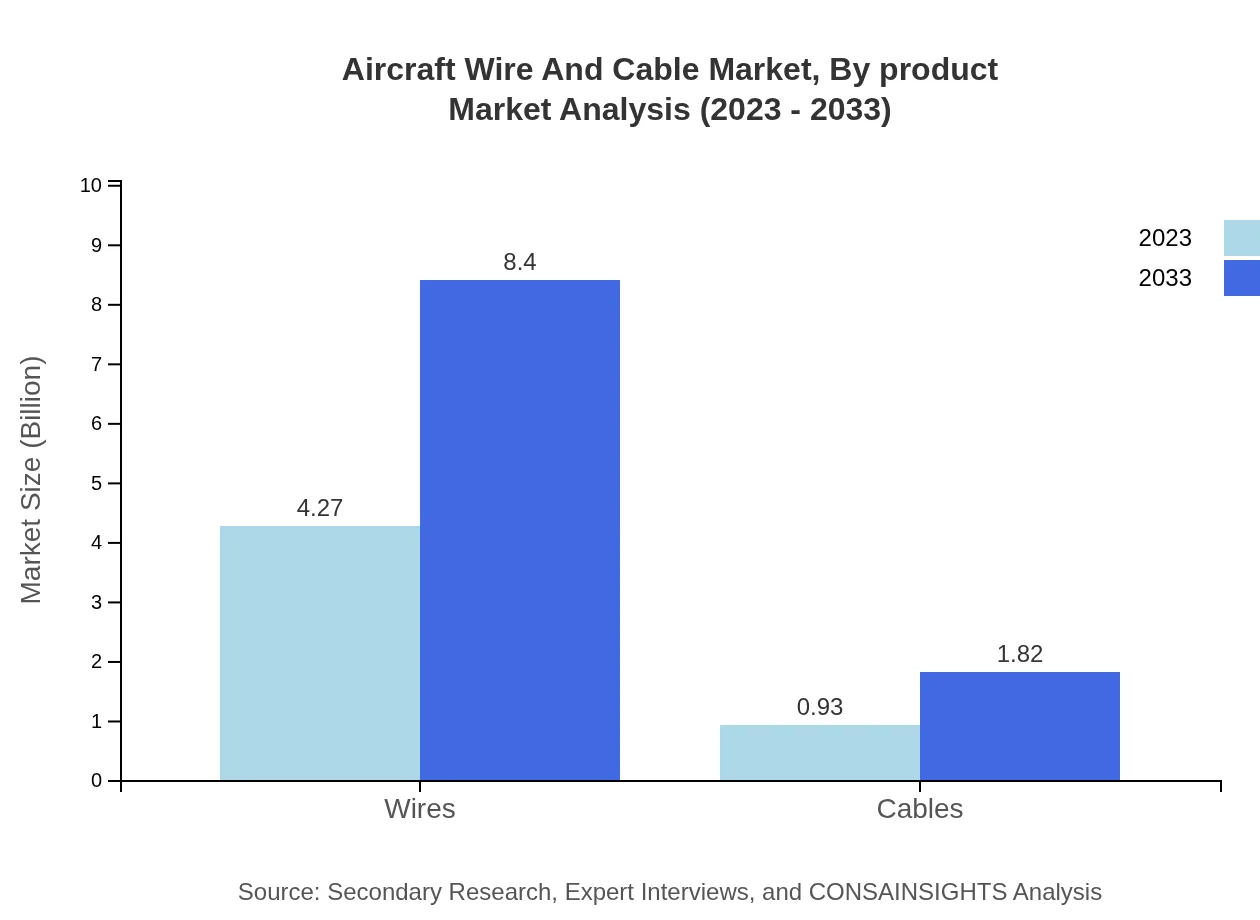

Aircraft Wire And Cable Market Analysis By Product

The wire segment dominates with a market size of $4.27 billion in 2023, projected to reach $8.40 billion by 2033, accounting for approximately 82.17% of the total market share. Conversely, cable systems are significant but less dominant, with a market size starting at $0.93 billion, expanding to $1.82 billion.

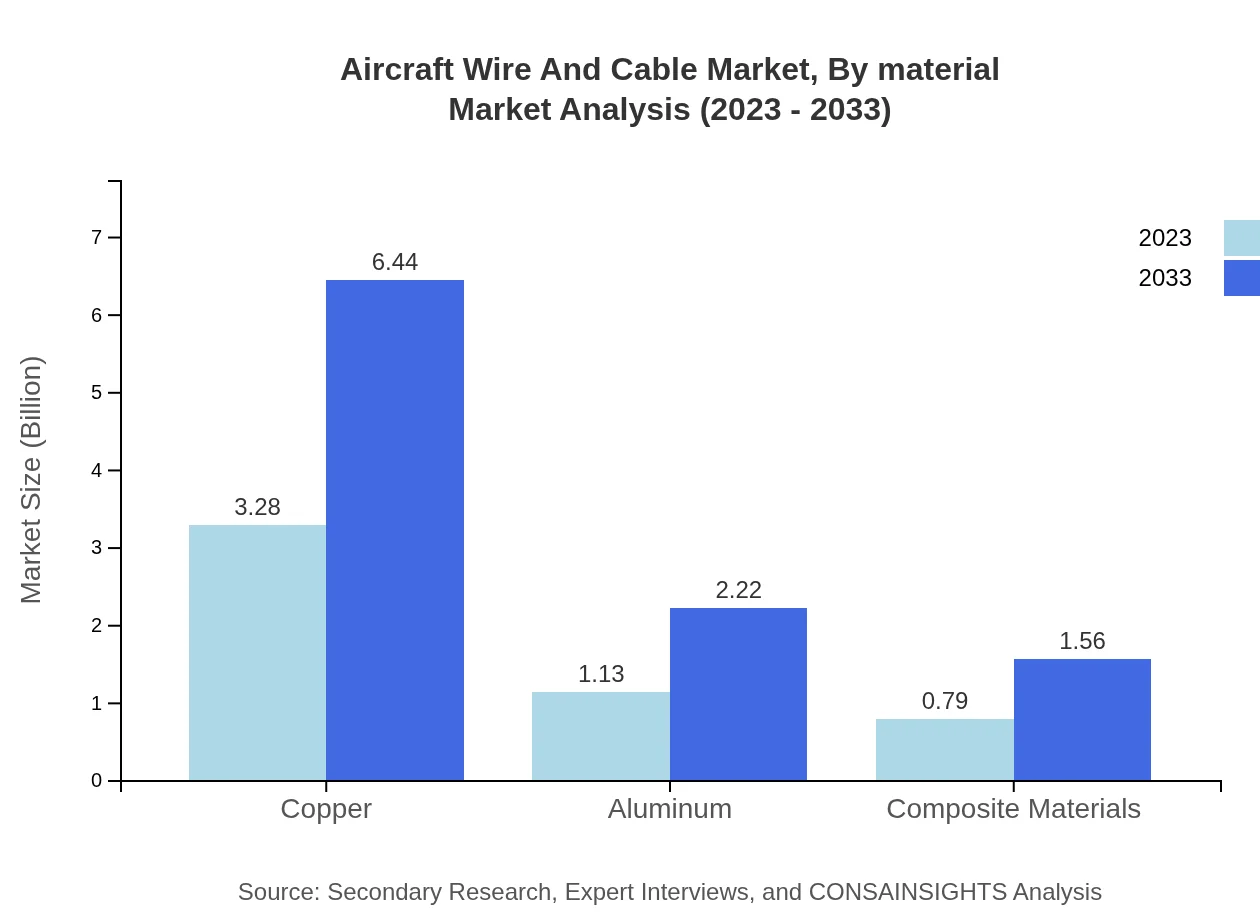

Aircraft Wire And Cable Market Analysis By Material

Copper remains the leading material with a size of $3.28 billion in 2023 and a growth forecast to $6.44 billion. Aluminum and composite materials are also crucial, with figures starting at $1.13 billion and $0.79 billion, respectively.

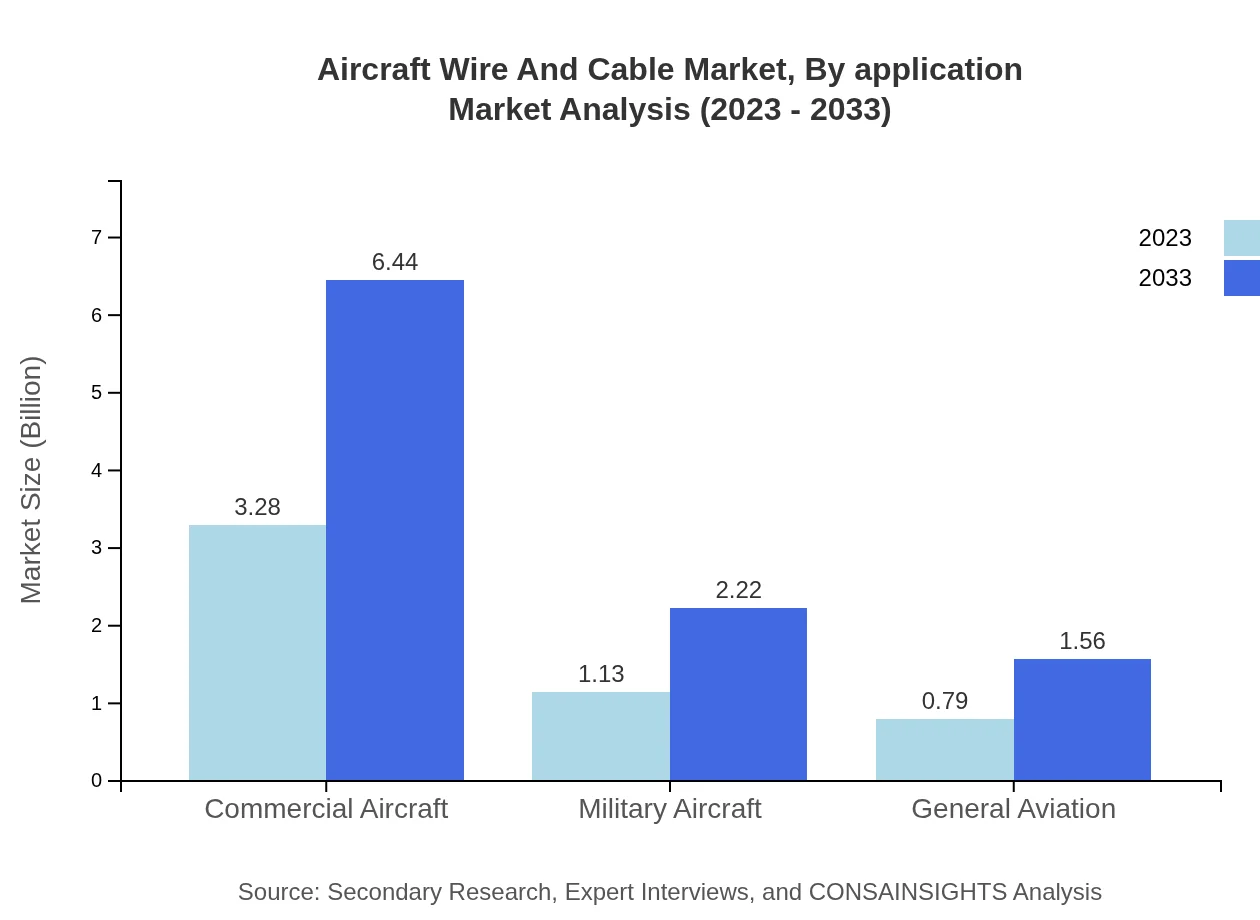

Aircraft Wire And Cable Market Analysis By Application

In terms of application, commercial aircraft represent the largest share with a size of $3.28 billion in 2023, expected to grow to $6.44 billion. Military and general aviation follow, with projected growth rates responding to evolving defense needs and private sector growth.

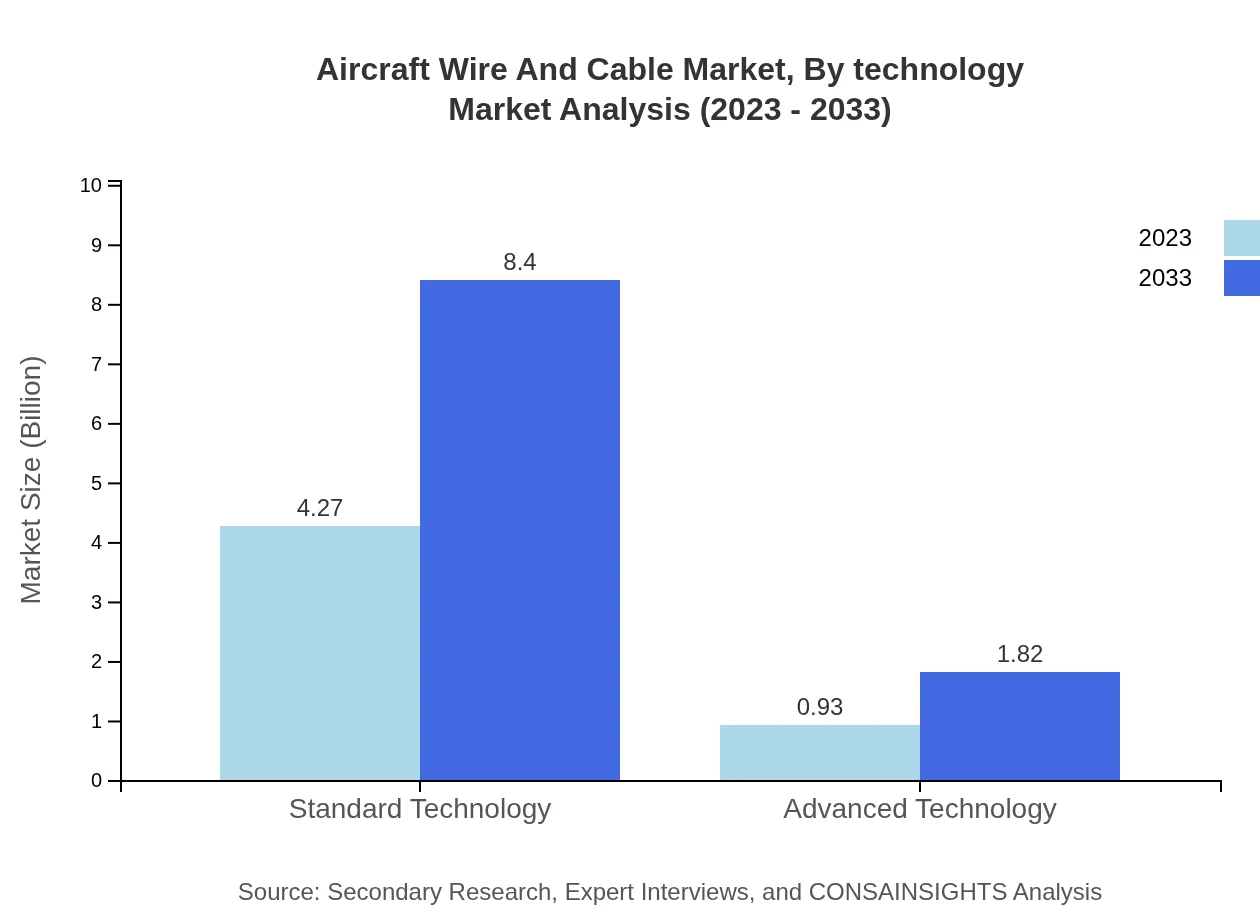

Aircraft Wire And Cable Market Analysis By Technology

The standard technology category leads with a market segment size of $4.27 billion expected to rise to $8.40 billion by 2033, whereas advanced technologies show potential growth, starting at $0.93 billion and projected to reach $1.82 billion.

Aircraft Wire And Cable Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Wire And Cable Industry

General Cable Corporation:

A leading manufacturer focused on industrial cables and high-performance wire specifically designed for aerospace applications.Southwire Company, LLC:

One of the largest wire manufacturers that provide a wide array of products, including specialty cables catering to the aerospace industry.TE Connectivity:

Known for its innovation in connectivity and sensor solutions, TE offers an extensive portfolio of aerospace wires and cables.Amphenol Corporation:

A significant player in interconnect products, providing tailored wire and cable solutions for military and commercial aviation.Molex:

Specializes in connectivity technologies and offers reliable solutions including high-speed data cables for avionics systems.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Wire And Cable?

The global aircraft wire and cable market is valued at approximately $5.2 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, reaching an estimated $9.67 billion by 2033.

What are the key market players or companies in the aircraft Wire And Cable industry?

Key players in the aircraft wire and cable market include major manufacturers such as Amphenol Corporation, Prysmian Group, and TE Connectivity, among others. These companies drive innovation and market expansion through strategic partnerships and product development.

What are the primary factors driving the growth in the aircraft wire and cable industry?

Factors driving growth in the aircraft wire and cable market include the increasing demand for lightweight materials, advancements in aerospace technologies, and a rise in air travel. Additionally, regulatory requirements for safety and performance are also pivotal.

Which region is the fastest Growing in the aircraft wire and cable market?

The Asia-Pacific region is currently the fastest-growing market for aircraft wire and cable, expected to increase from $0.98 billion in 2023 to $1.92 billion by 2033, driven by rising air traffic and increasing aircraft manufacturing.

Does ConsaInsights provide customized market report data for the aircraft wire and cable industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the aircraft wire and cable industry, enabling clients to access relevant insights and data that support strategic decision-making.

What deliverables can I expect from this aircraft wire and cable market research project?

From the aircraft wire and cable market research project, expect detailed market analysis reports, segmented data across various parameters, competitor analysis, and future growth forecasts to aid in strategic business planning.

What are the market trends of aircraft wire and cable?

Current trends in the aircraft wire and cable market include the shift towards composite materials, growing demand for high-performance cables, and increased focus on sustainable manufacturing practices as the aerospace industry prioritizes efficiency and safety.