Airline Route Profitability Software Market Report

Published Date: 03 February 2026 | Report Code: airline-route-profitability-software

Airline Route Profitability Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Airline Route Profitability Software market from 2023 to 2033, providing insights into market dynamics, size, trends, and key players to offer a comprehensive understanding of this evolving industry.

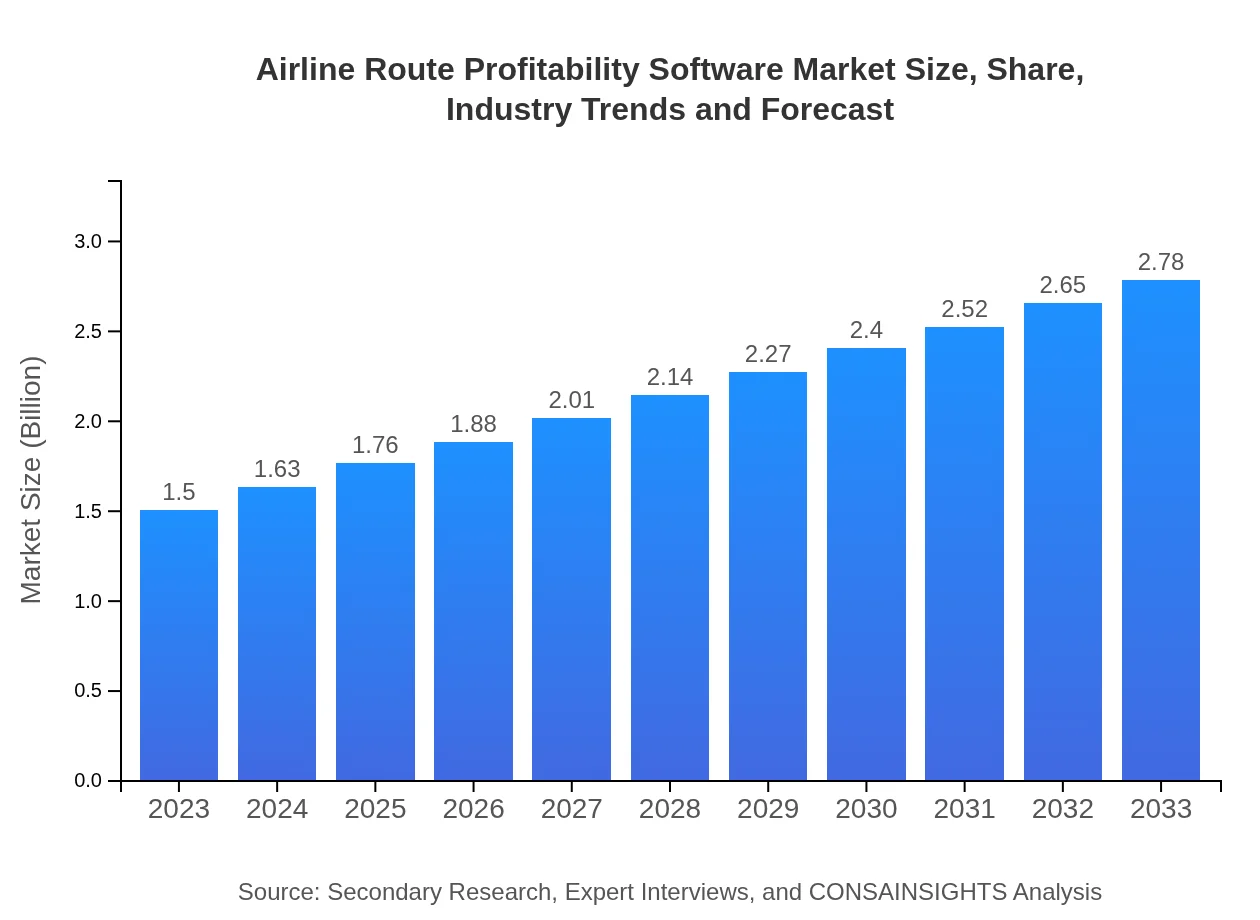

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Sabre Corporation, Amadeus IT Group, FlightAware, Mercator, Riyadh Airports Company |

| Last Modified Date | 03 February 2026 |

Airline Route Profitability Software Market Overview

Customize Airline Route Profitability Software Market Report market research report

- ✔ Get in-depth analysis of Airline Route Profitability Software market size, growth, and forecasts.

- ✔ Understand Airline Route Profitability Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airline Route Profitability Software

What is the Market Size & CAGR of Airline Route Profitability Software market in 2023?

Airline Route Profitability Software Industry Analysis

Airline Route Profitability Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airline Route Profitability Software Market Analysis Report by Region

Europe Airline Route Profitability Software Market Report:

Europe’s Airline Route Profitability Software market is projected to increase from $0.36 billion in 2023 to $0.67 billion by 2033. The market benefits from stringent regulatory frameworks that encourage airlines to optimize their operations and profitability.Asia Pacific Airline Route Profitability Software Market Report:

In the Asia Pacific region, the Airline Route Profitability Software market is anticipated to grow from $0.30 billion in 2023 to $0.55 billion by 2033. The growth is driven by increasing air travel demand and a shift in airline focus towards adopting digital technologies to enhance operational efficiency.North America Airline Route Profitability Software Market Report:

North America holds the largest market share, with the software market expected to grow from $0.50 billion in 2023 to $0.94 billion by 2033. This growth is fueled by the presence of major airlines and significant investments in technology for operational improvements.South America Airline Route Profitability Software Market Report:

The South America market has shown steady growth, expanding from $0.13 billion in 2023 to $0.24 billion in 2033. The region is witnessing a gradual increase in airline competition, prompting operators to seek software solutions that maximize route profitability.Middle East & Africa Airline Route Profitability Software Market Report:

The Middle East and Africa region will see growth from $0.21 billion in 2023 to $0.39 billion by 2033. The increasing number of air travelers and investment in aerospace technologies are key factors driving this trend.Tell us your focus area and get a customized research report.

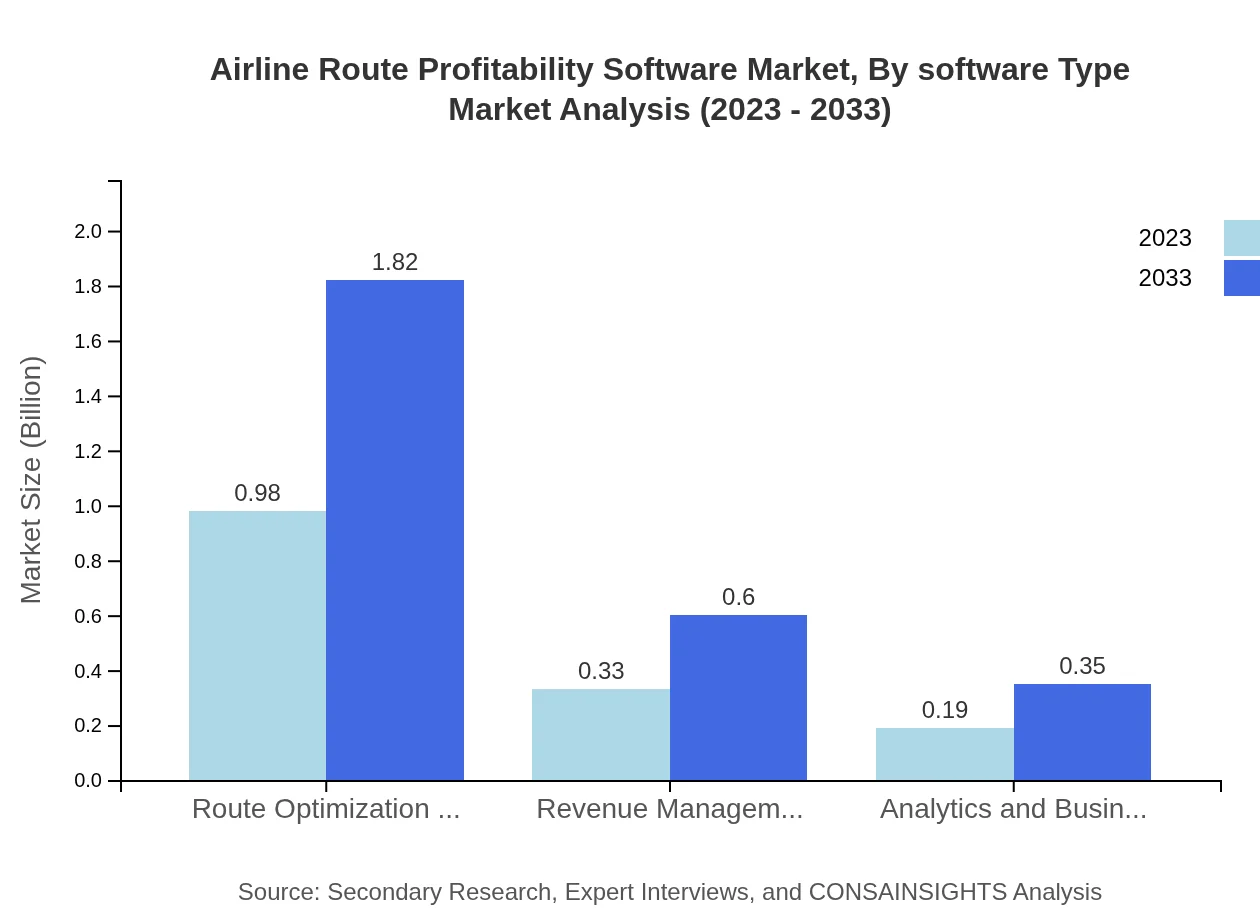

Airline Route Profitability Software Market Analysis By Software Type

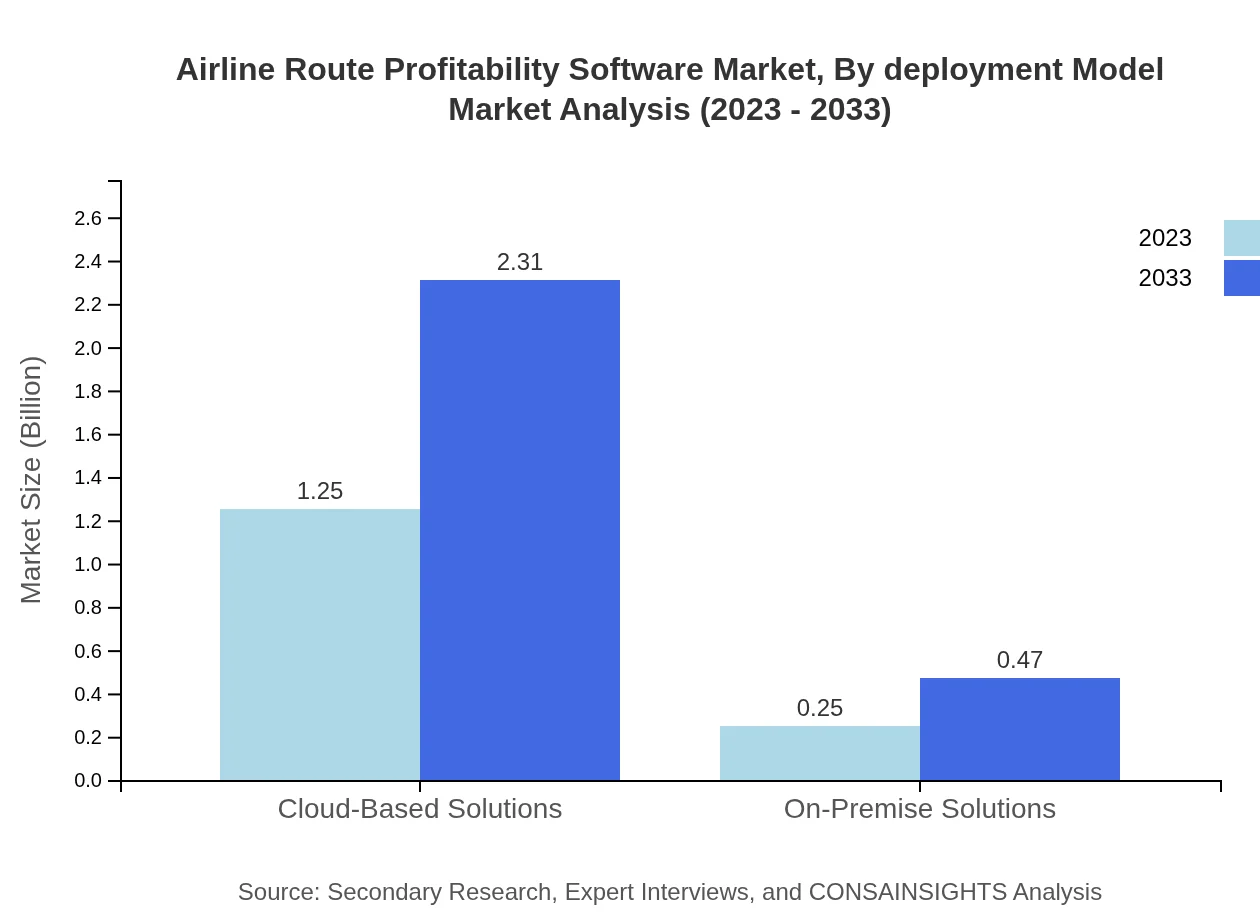

The market is primarily driven by two software types: Cloud-Based Solutions and On-Premise Solutions. Cloud-Based Solutions dominate the market, growing from $1.25 billion in 2023 to $2.31 billion in 2033, constituting 83.17% market share. On-Premise Solutions exhibit slower growth, increasing from $0.25 billion to $0.47 billion, representing 16.83% share.

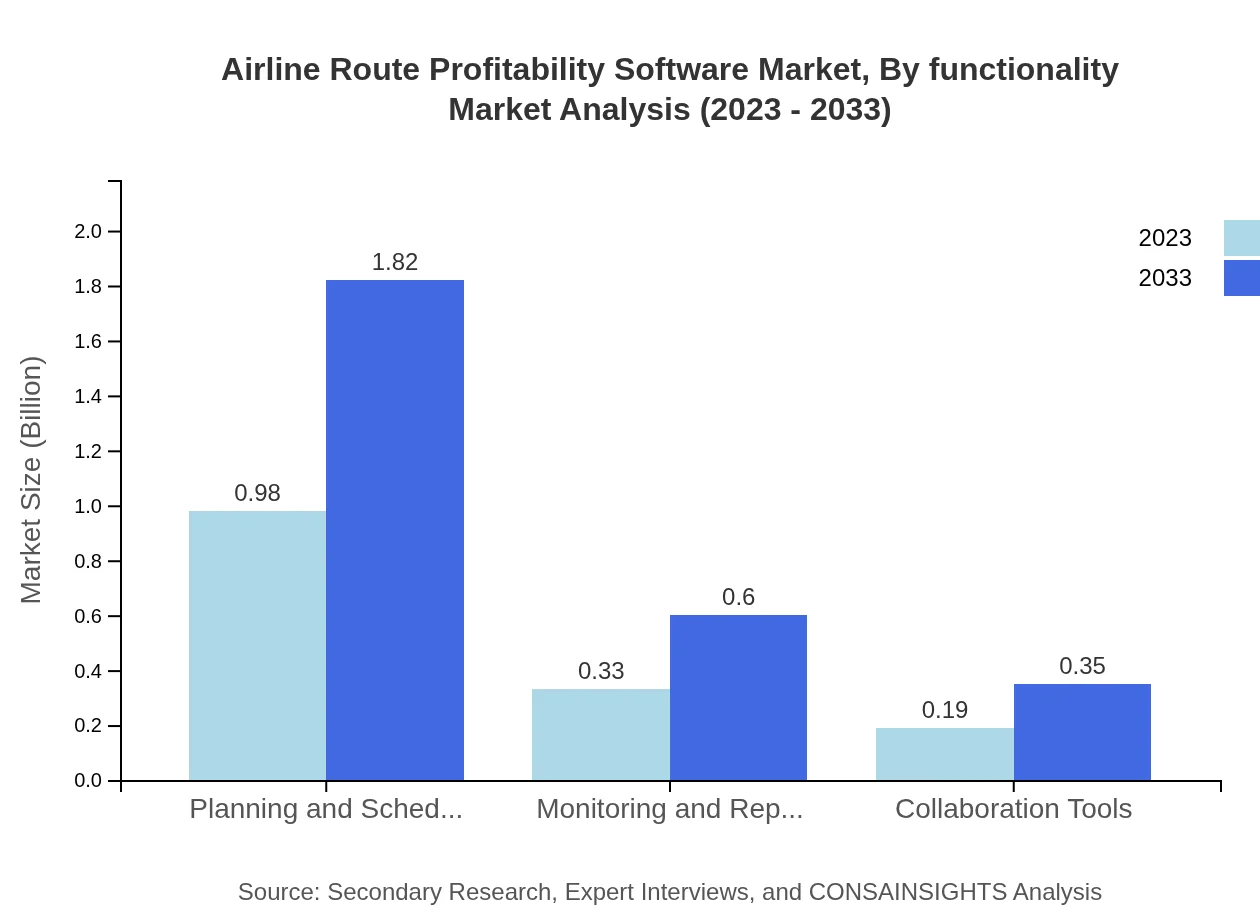

Airline Route Profitability Software Market Analysis By Functionality

Key functionalities include Route Optimization Software and Revenue Management Software. Route Optimization Software is critical, capturing $0.98 billion in 2023, expected to reach $1.82 billion by 2033, for a 65.61% market share. Revenue Management Software holds $0.33 billion now, projected to grow to $0.60 billion over the same period.

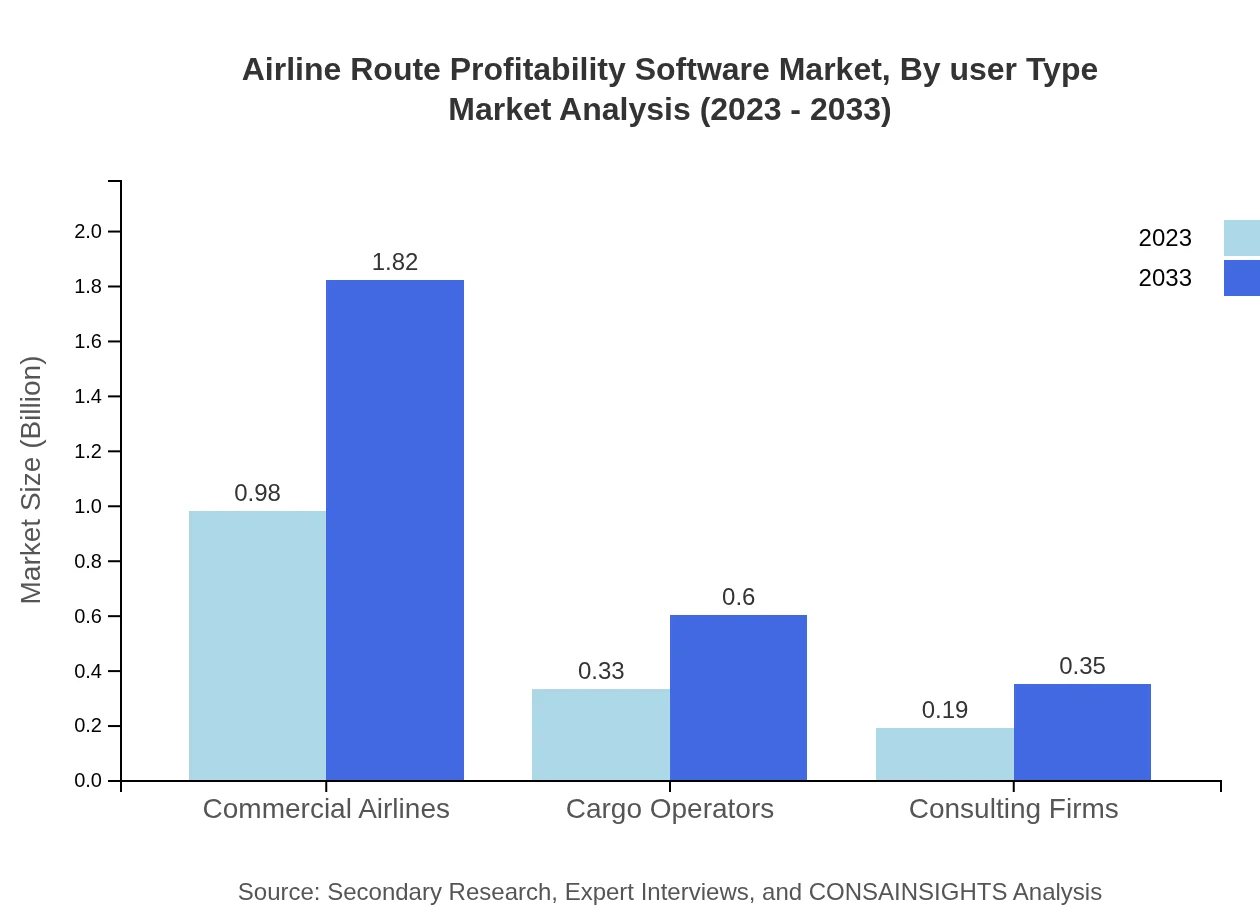

Airline Route Profitability Software Market Analysis By User Type

The primary users of the software are Commercial Airlines, Cargo Operators, and Consulting Firms. Commercial Airlines dominate the market with $0.98 billion in 2023, slated to reach $1.82 billion by 2033. Cargo Operators and Consulting Firms follow, growing from $0.33 billion and $0.19 billion, respectively.

Airline Route Profitability Software Market Analysis By Deployment Model

The deployment models indicate a strong preference for Cloud-Based Solutions, which is projected to account for a substantial majority of the overall market growth, while On-Premise Solutions continue to cater to a niche audience, particularly among legacy airlines seeking to control data privacy.

Airline Route Profitability Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airline Route Profitability Software Industry

Sabre Corporation:

Sabre provides technology and software solutions for the global travel and tourism industry, focusing on enhancing the operational efficiency of airlines.Amadeus IT Group:

Amadeus offers solutions for airlines, including comprehensive profitability software that aids in revenue management and strategic planning.FlightAware:

FlightAware specializes in flight tracking and analytics, offering solutions that help airlines optimize route profitability through data insights.Mercator:

Mercator provides software solutions tailored for the aviation sector, enabling airlines to improve profitability and operational performance.Riyadh Airports Company:

This company focuses on developing innovative applications that help streamline airline performances in the Middle East region.We're grateful to work with incredible clients.

FAQs

What is the market size of airline Route Profitability Software?

The airline route profitability software market is valued at $1.5 billion in 2023, with a projected CAGR of 6.2%. The market is expected to grow significantly, driven by an increasing demand for data analytics in the airline industry.

What are the key market players or companies in this airline Route Profitability Software industry?

Key players in the airline route profitability software market include major airlines, software development firms specializing in aviation analytics, and consulting firms providing business intelligence solutions to optimize profitability and operational efficiency.

What are the primary factors driving the growth in the airline Route Profitability Software industry?

Growth factors for the airline route profitability software market include increasing competition among airlines, the rising demand for data-driven decision-making, expansion in global air travel, and technological advancements in software solutions catering to route optimization.

Which region is the fastest Growing in the airline Route Profitability Software?

The fastest-growing region for airline route profitability software is North America, projected to grow from $0.50 billion in 2023 to $0.94 billion by 2033. Growth in this region is driven by advanced software adoption and increasing operational complexities.

Does ConsaInsights provide customized market report data for the airline Route Profitability Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the airline route profitability software industry, allowing clients to leverage targeted insights for informed decision-making and strategic planning.

What deliverables can I expect from this airline Route Profitability Software market research project?

Deliverables from the airline route profitability software market research project include detailed reports on market size, growth projections, competitive analysis, segment insights, and tailored recommendations for strategic initiatives in the aviation sector.

What are the market trends of airline Route Profitability Software?

Market trends in airline route profitability software include a shift towards cloud-based solutions, increased focus on data analytics and AI for decision-making, rising demand for collaboration tools, and an emphasis on real-time reporting and monitoring capabilities.