Airport Information Systems Market Report

Published Date: 03 February 2026 | Report Code: airport-information-systems

Airport Information Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Airport Information Systems market from 2023 to 2033, exploring market size, key trends, segmentation, regional insights, and future forecasts to guide stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

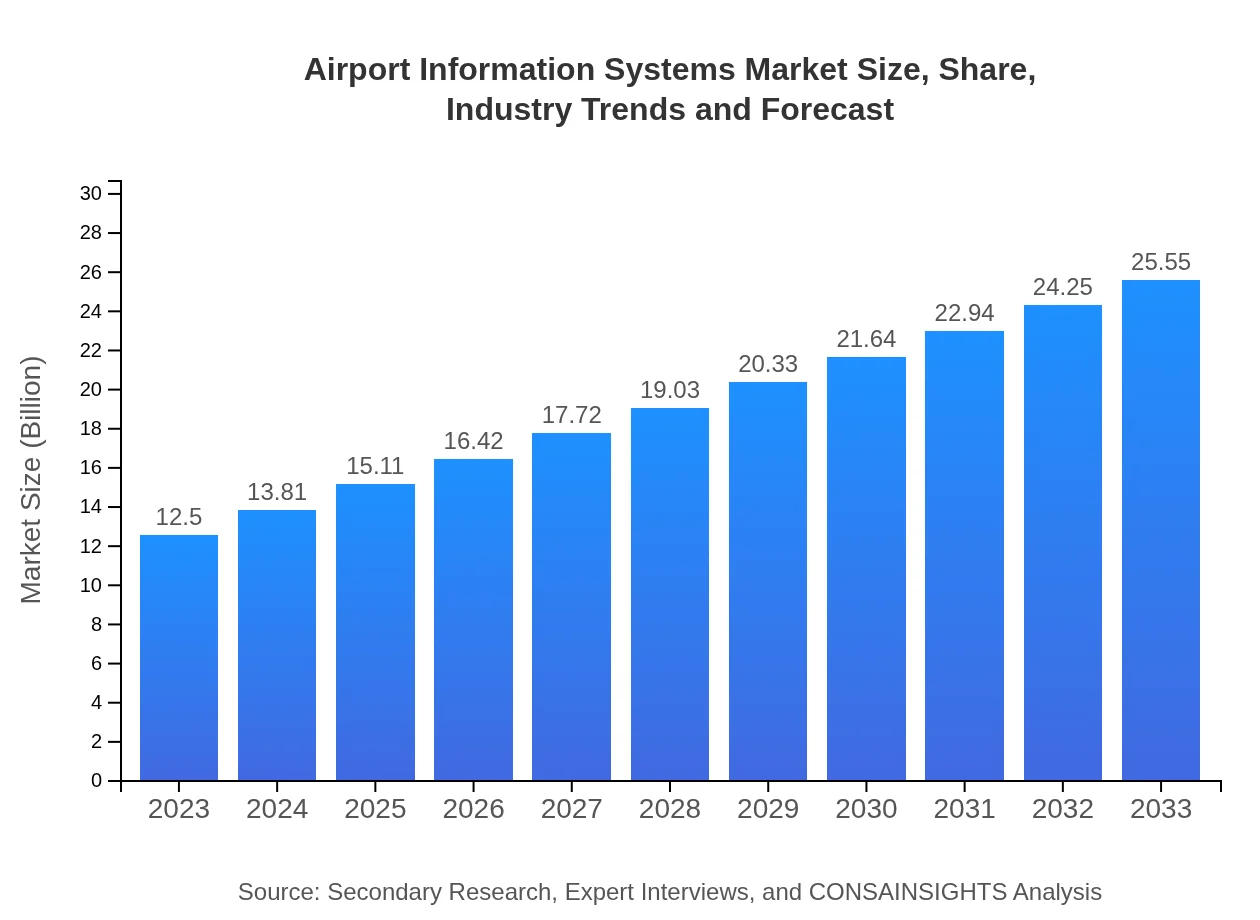

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $25.55 Billion |

| Top Companies | Siemens AG, Amadeus IT Group, SITA, Rockwell Collins |

| Last Modified Date | 03 February 2026 |

Airport Information Systems Market Overview

Customize Airport Information Systems Market Report market research report

- ✔ Get in-depth analysis of Airport Information Systems market size, growth, and forecasts.

- ✔ Understand Airport Information Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airport Information Systems

What is the Market Size & CAGR of Airport Information Systems market in 2023?

Airport Information Systems Industry Analysis

Airport Information Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airport Information Systems Market Analysis Report by Region

Europe Airport Information Systems Market Report:

With a market size of $4.35 billion in 2023, expected to grow to $8.89 billion by 2033, Europe is experiencing robust investments in airport technology due to increased passenger numbers and regulatory demands for improved security measures. Technology adoption within European airports is paving the way for enhanced operational frameworks.Asia Pacific Airport Information Systems Market Report:

The Asia Pacific region holds significant growth potential in the Airport Information Systems market, with a market size of approximately $2.37 billion in 2023, expected to grow to $4.84 billion by 2033. Increased air traffic and government initiatives aiming to boost local airport infrastructure are primary growth drivers. Collaborations between airlines and technology firms are also fostering advancements in operational efficiency.North America Airport Information Systems Market Report:

North America had a market size of approximately $4.37 billion in 2023, projected to rise to $8.94 billion by 2033. The dominance of advanced technologies and the presence of major market players contribute to this growth, alongside a focus on improving passenger experience and operational efficiency.South America Airport Information Systems Market Report:

The South America Airport Information Systems market is smaller, with a forecast size of $0.28 billion in 2023, doubling to $0.56 billion by 2033. The region is gradually modernizing its airport facilities, and investment in technology solutions is increasing, although growth is at a slower pace compared to other global regions.Middle East & Africa Airport Information Systems Market Report:

The market in the Middle East and Africa is projected to increase from $1.14 billion in 2023 to $2.33 billion by 2033. This growth is linked to a rise in air travel demand, particularly in the Gulf region, where countries are investing heavily in international airports and advanced technology systems.Tell us your focus area and get a customized research report.

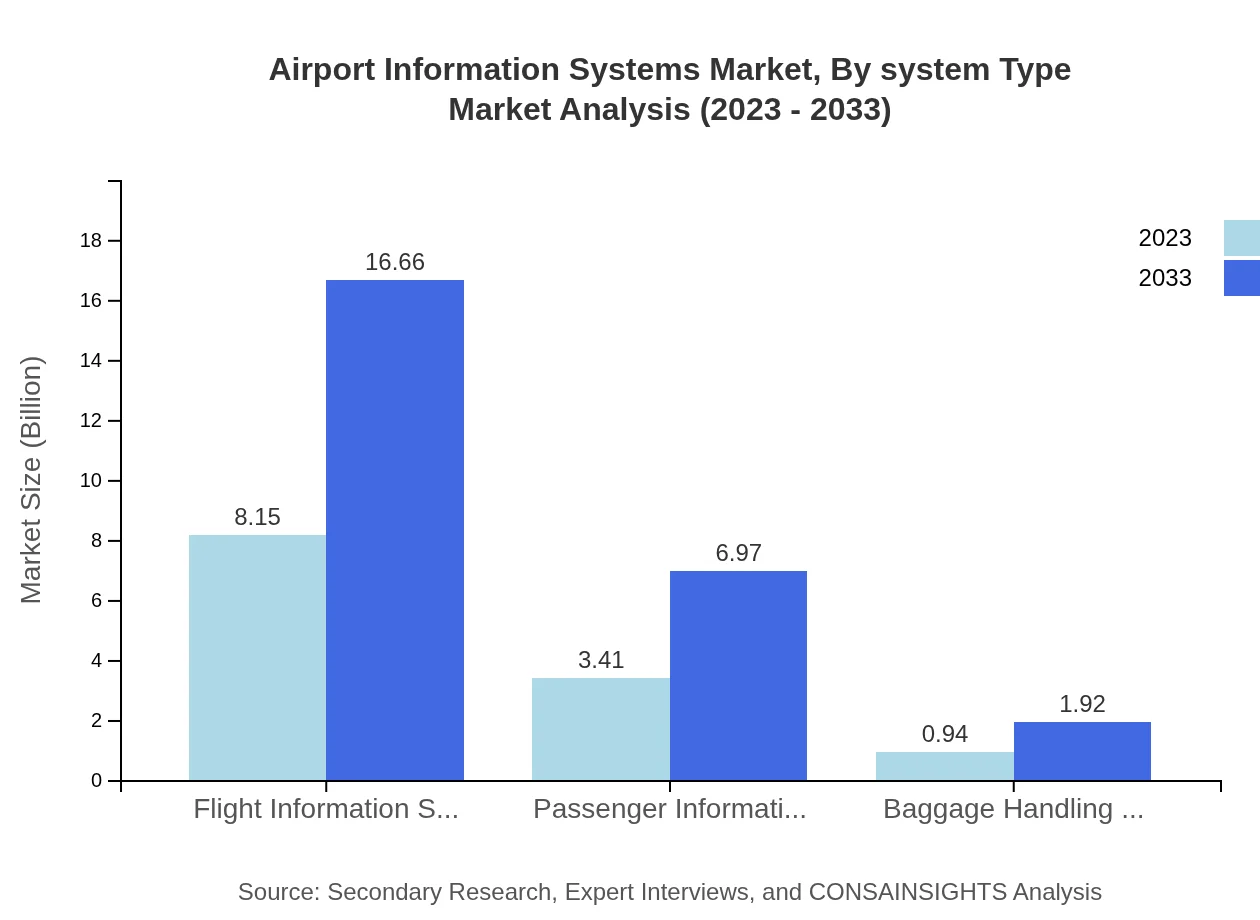

Airport Information Systems Market Analysis By System Type

By system type, the Flight Information Systems segment is a market leader, capturing a significant share due to its critical role in real-time updates for passengers. The Baggage Handling Systems and Passenger Processing Systems are also vital, with increasing integration of IoT technologies to ensure efficiency and reduce delays.

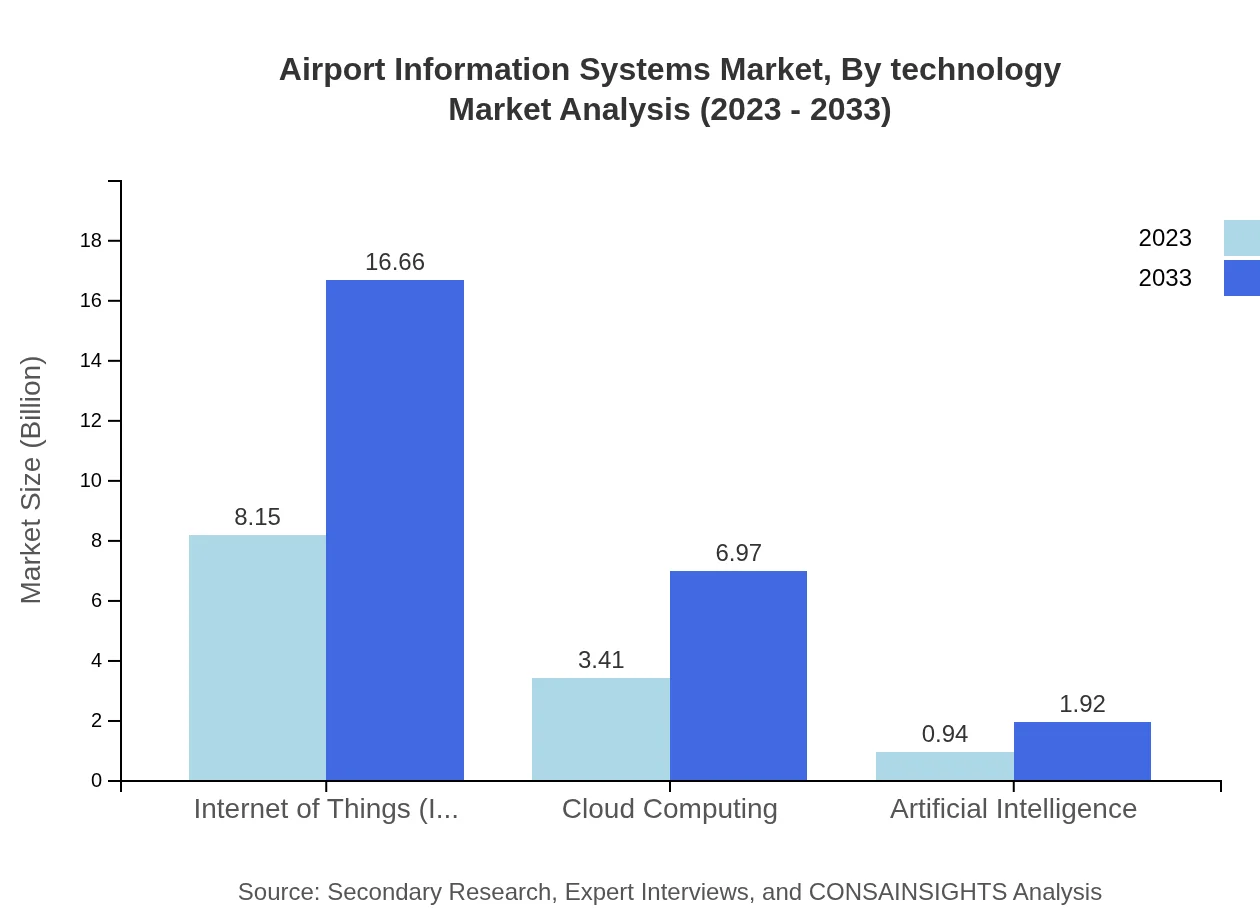

Airport Information Systems Market Analysis By Technology

The use of IoT has surged, with a market size of $8.15 billion in 2023, and is expected to reach $16.66 billion by 2033. Cloud computing and AI are also integral technologies, facilitating better data management and enhancing decision-making processes at airports.

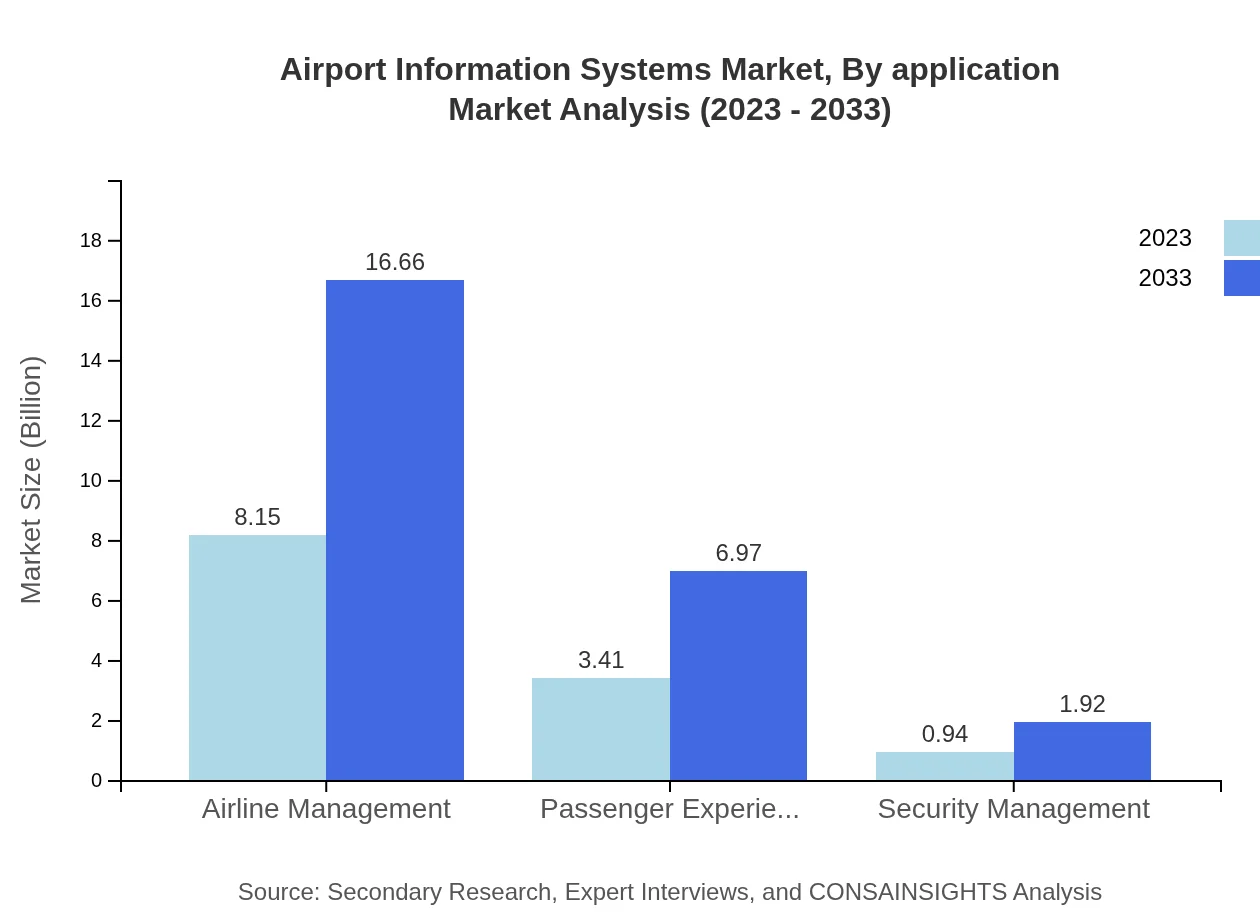

Airport Information Systems Market Analysis By Application

The Airline Management application is crucial, expected to maintain a dominant share throughout the forecast period due to ongoing airline partnerships and operational management needs. Other applications focusing on Passenger Experience and Security Management are also witnessing increased investment.

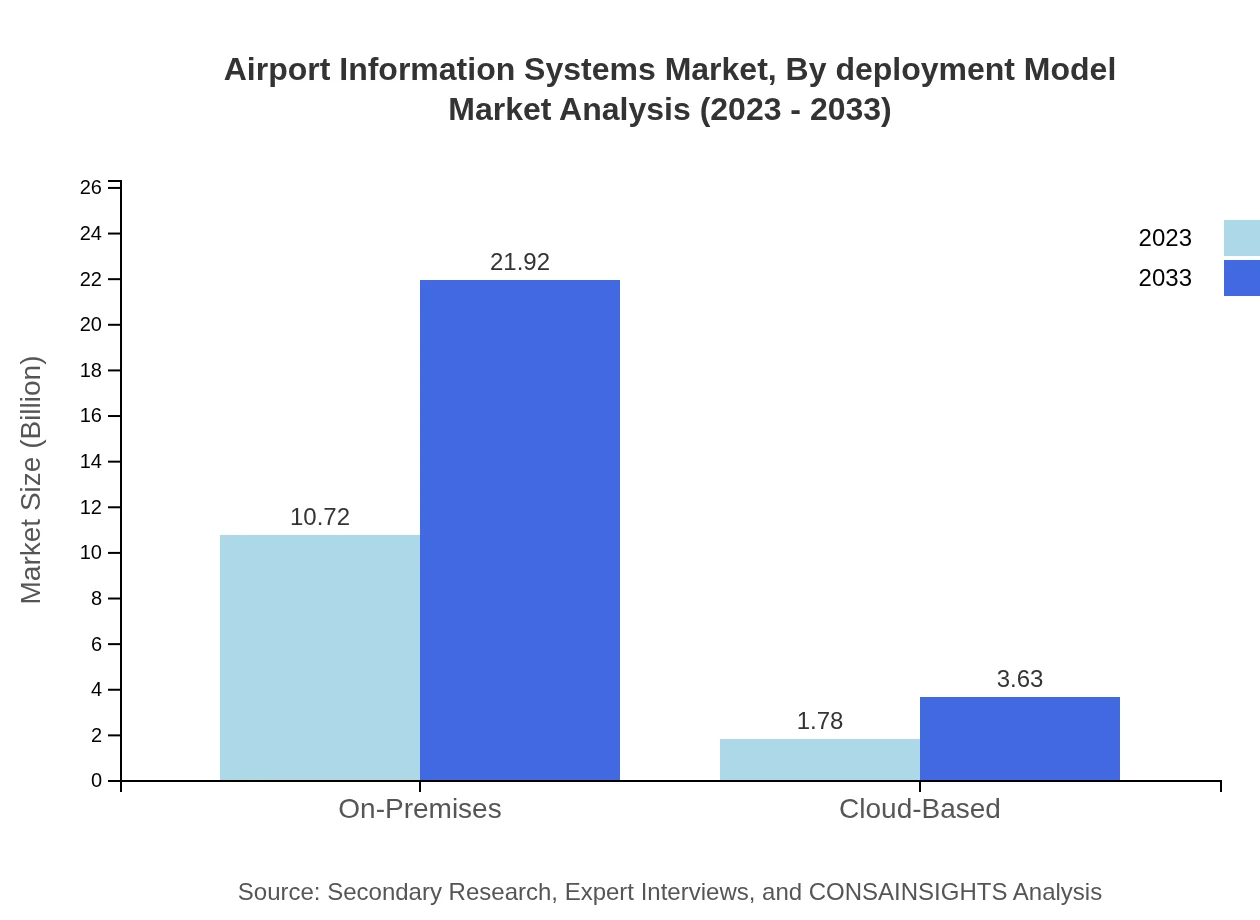

Airport Information Systems Market Analysis By Deployment Model

The on-premises deployment model remains prevalent, accounting for a market size of $10.72 billion in 2023. However, cloud-based solutions, with a size of $1.78 billion, are gaining traction as they promise enhanced flexibility and cost-effectiveness for airports seeking modernization.

Airport Information Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airport Information Systems Industry

Siemens AG:

Siemens AG is a global leader in automation and digitalization in the industrial sector and has made significant inroads into airport operations through advanced information systems, enhancing efficiency and safety.Amadeus IT Group:

Amadeus is a major player in the travel technology sector, providing comprehensive airport management solutions to streamline passenger processing and improve operational efficiency at airports.SITA:

SITA specializes in IT solutions for the air transport industry, offering leading-edge communication and operational efficiency systems coupled with extensive passenger processing technologies.Rockwell Collins:

Rockwell Collins is known for its aviation and high-integrity solutions for airports, enhancing safety and operational control through advanced information systems.We're grateful to work with incredible clients.

FAQs

What is the market size of airport Information Systems?

The airport information systems market is valued at approximately $12.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2% leading to significant growth by 2033.

What are the key market players or companies in the airport Information Systems industry?

Leading companies in the airport information systems market include Amadeus IT Group, SITA, and Honeywell. These organizations dominate with innovative solutions addressing operational efficiency and passenger experience through technology integration.

What are the primary factors driving the growth in the airport Information Systems industry?

Key growth drivers include increasing air travel demand, advancements in IoT and AI technologies, and the necessity for enhanced passenger services and operational efficiencies within airports globally.

Which region is the fastest Growing in the airport Information Systems?

The Asia-Pacific region is the fastest-growing, with the market expected to expand from $2.37 billion in 2023 to $4.84 billion by 2033, driven by rising passenger volumes and infrastructure development.

Does ConsaInsights provide customized market report data for the airport Information Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the airport information systems sector, ensuring relevant insights that cater to particular interests and business goals.

What deliverables can I expect from this airport Information Systems market research project?

Deliverables typically include comprehensive market analysis reports, segment performance insights, forecasts, competitive landscape assessments, and tailored recommendations designed to support strategic decision-making.

What are the market trends of airport Information Systems?

Notable trends include the adoption of cloud-based solutions, increasing reliance on data analytics, focus on passenger experience enhancement, and implementation of integrated security systems for effective operational management.