Alarm Monitoring Market Report

Published Date: 31 January 2026 | Report Code: alarm-monitoring

Alarm Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global alarm monitoring market, offering insights into its segmentation, regional performance, technological advancements, and trends from 2023 to 2033. It emphasizes current market conditions and future forecasts for key player strategies.

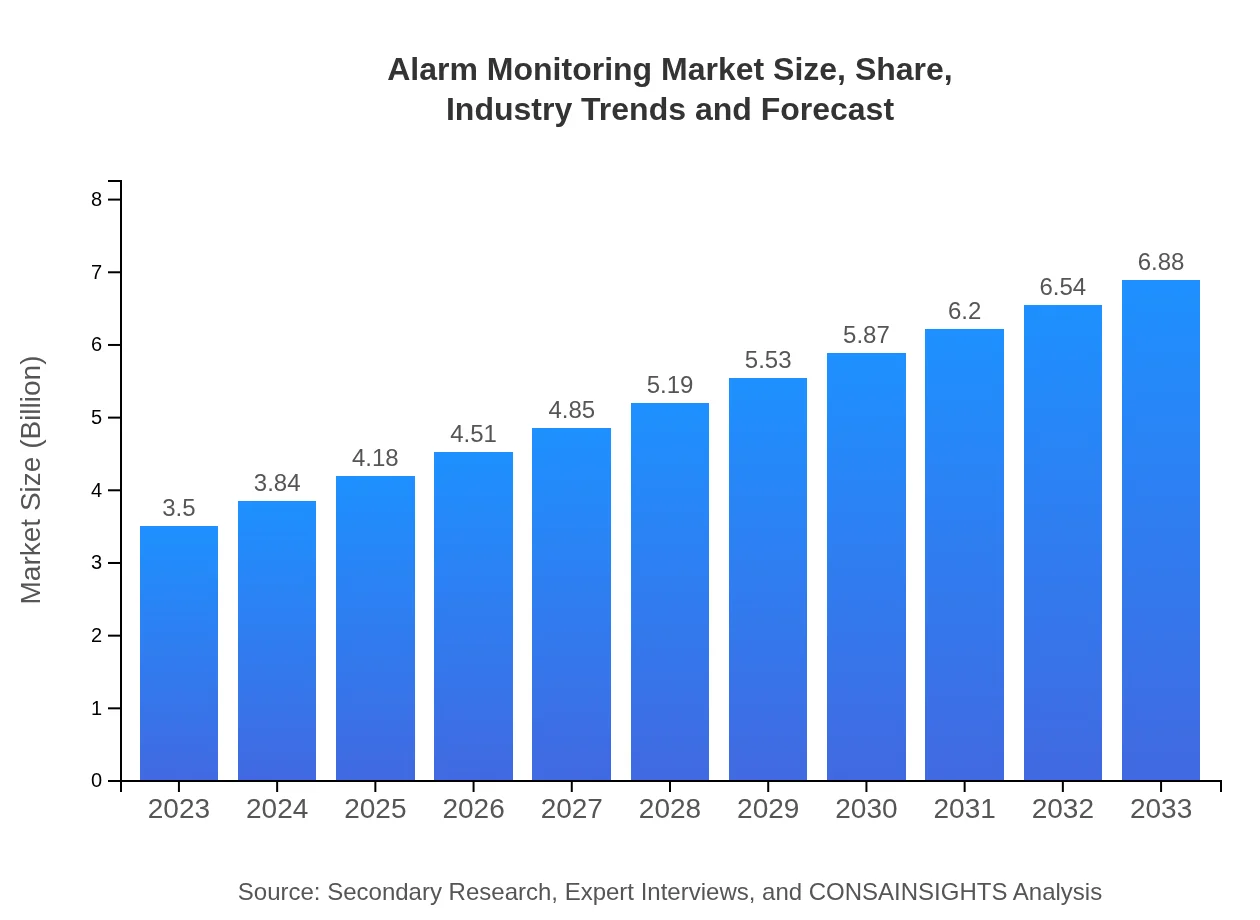

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | ADT Inc., Honeywell International Inc., Johnson Controls, Vivint Smart Home, Brinks Home Security |

| Last Modified Date | 31 January 2026 |

Alarm Monitoring Market Overview

Customize Alarm Monitoring Market Report market research report

- ✔ Get in-depth analysis of Alarm Monitoring market size, growth, and forecasts.

- ✔ Understand Alarm Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alarm Monitoring

What is the Market Size & CAGR of Alarm Monitoring market in 2023?

Alarm Monitoring Industry Analysis

Alarm Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alarm Monitoring Market Analysis Report by Region

Europe Alarm Monitoring Market Report:

The European market is estimated to expand from $1.04 billion in 2023 to $2.05 billion by 2033, fueled by stringent regulations around safety and security, alongside a growing emphasis on smart cities. The region's advanced infrastructure supports high technology integrations such as IoT in alarm systems.Asia Pacific Alarm Monitoring Market Report:

The Asia Pacific region, expected to grow from $0.65 billion in 2023 to $1.27 billion in 2033, is emerging as a significant player in the alarm monitoring market. Factors contributing to this growth include an increasing population, higher disposable incomes, and rapid urbanization. Countries like China and India are experiencing increased demand for smart homes, driving the adoption of alarm monitoring systems.North America Alarm Monitoring Market Report:

North America is anticipated to grow significantly from $1.29 billion in 2023 to $2.54 billion in 2033. The U.S. leads the charge due to strong consumer awareness about safety and the presence of significant market players. The market benefits from technological advancements and a shift towards smart home solutions.South America Alarm Monitoring Market Report:

In South America, the market is set to expand from $0.04 billion in 2023 to $0.08 billion by 2033. This growth can be attributed to rising security concerns due to urban crime rates and an increase in government initiatives to improve public safety infrastructure. Brazil and Argentina are key markets where investment in security systems is projected to rise.Middle East & Africa Alarm Monitoring Market Report:

In the Middle East and Africa, the market is projected to rise from $0.48 billion in 2023 to $0.94 billion by 2033. Investments in public safety infrastructure and an increasing awareness of personal safety measures drive this growth. Rapid urbanization in countries like the UAE and South Africa also contributes significantly.Tell us your focus area and get a customized research report.

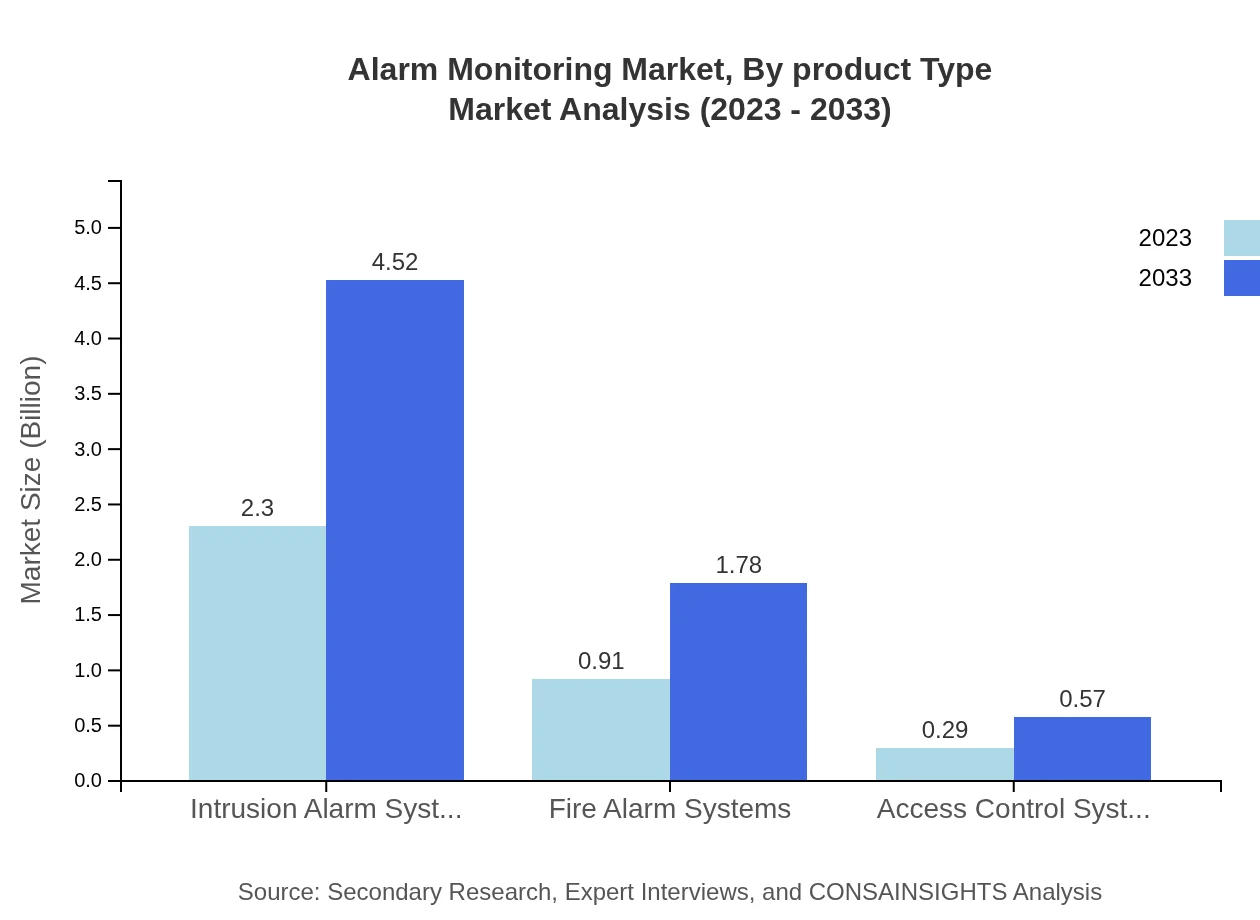

Alarm Monitoring Market Analysis By Product Type

The product type segment is dominated by Intrusion Alarm Systems, valued at $2.30 billion in 2023, projected to reach $4.52 billion by 2033, maintaining a 65.74% market share. Fire Alarm Systems follow, expected to rise from $0.91 billion to $1.78 billion over the forecast period, accounting for approximately 25.91% market share. Access Control Systems, though smaller, also contribute with expected growth from $0.29 billion to $0.57 billion.

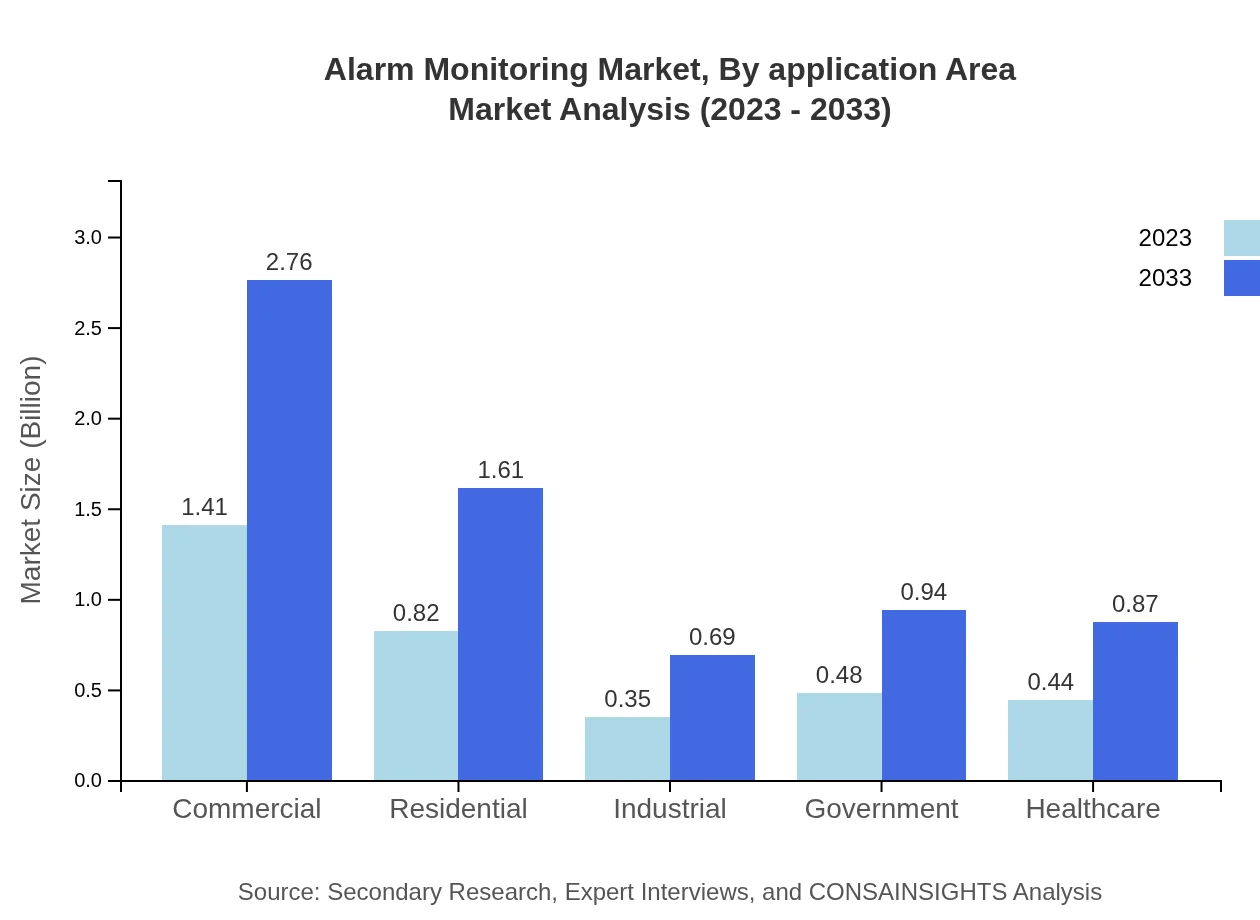

Alarm Monitoring Market Analysis By Application Area

Segmented by application, the Commercial sector leads with a size of $1.41 billion in 2023, projected to nearly double to $2.76 billion by 2033, capturing a 40.17% share. The Residential segment is significant due to smart home integrations, growing from $0.82 billion to $1.61 billion. Industrial and Government sectors show promising growth as businesses and public institutions prioritize security measures.

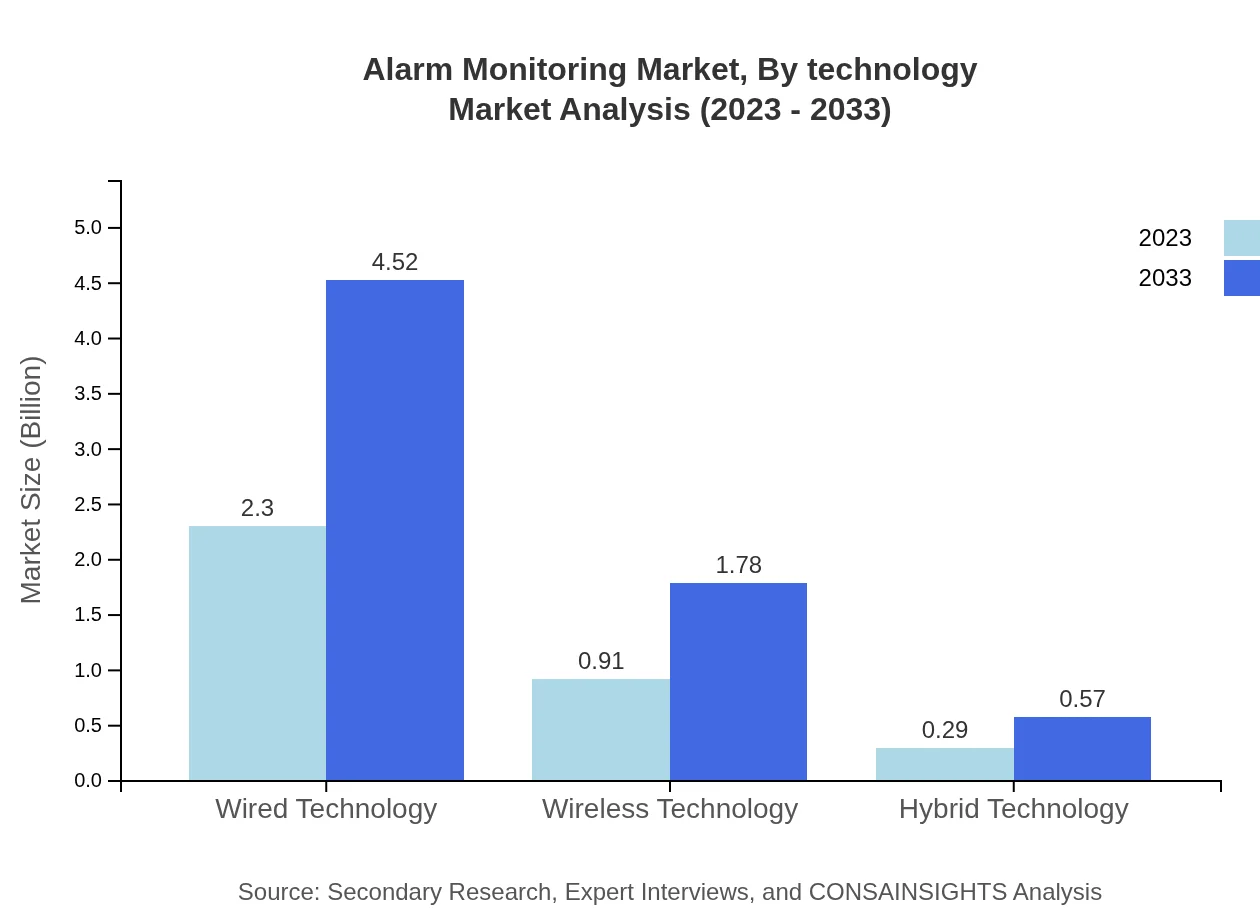

Alarm Monitoring Market Analysis By Technology

Wired Technology holds a dominant market position, valued at $2.30 billion in 2023 with a strong forecast to $4.52 billion, while Wireless Technology is gaining traction due to flexibility and ease of installation, growing from $0.91 billion to $1.78 billion. Hybrid Technology, albeit a smaller segment, is slowly increasing its presence, expected to reach $0.57 billion in 2033.

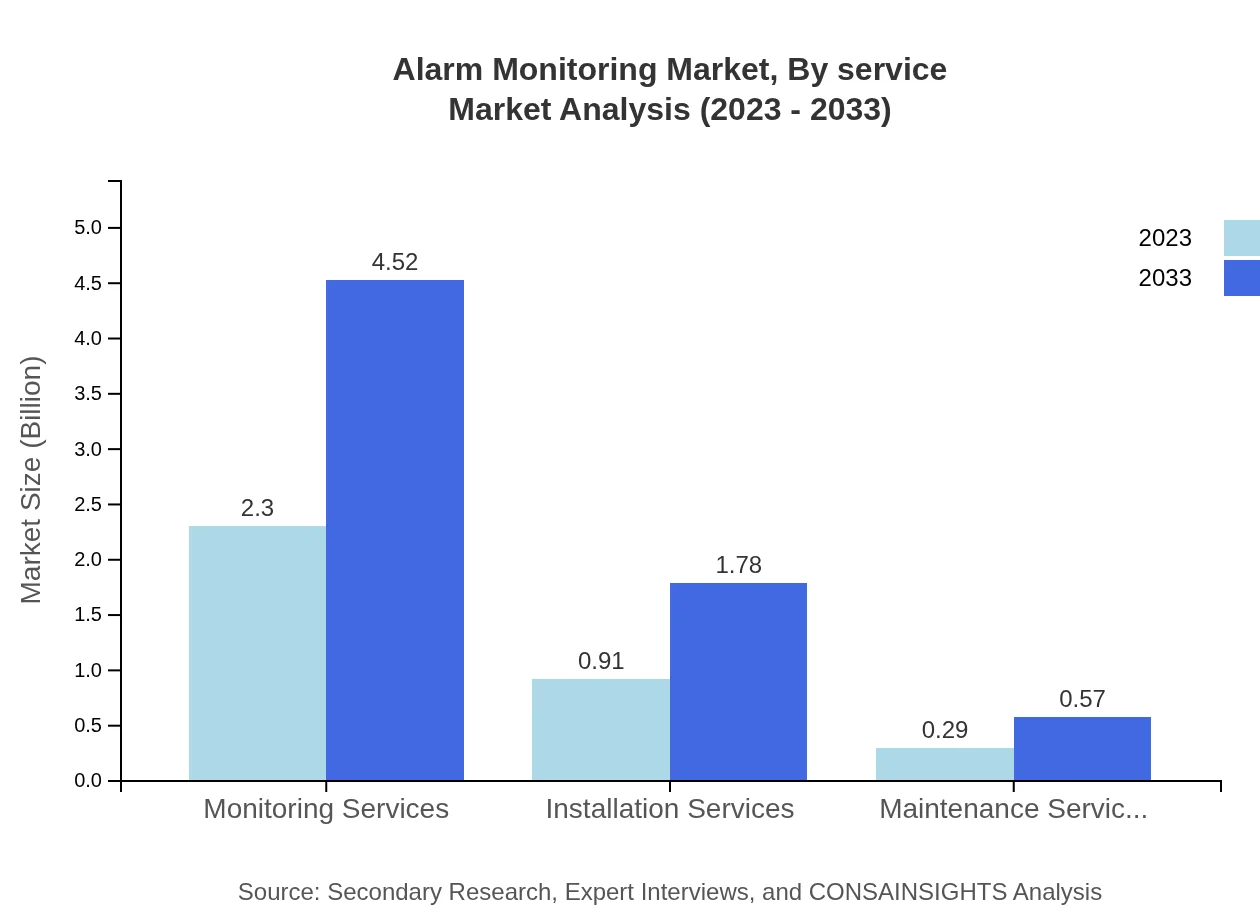

Alarm Monitoring Market Analysis By Service

Monitoring Services are the backbone, projected to grow from $2.30 billion to $4.52 billion, while Installation Services also see strong growth from $0.91 billion to $1.78 billion. Maintenance Services contribute steadily, expected to rise from $0.29 billion to $0.57 billion, reinforcing the overall service segment.

Alarm Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alarm Monitoring Industry

ADT Inc.:

A leading provider of security and automation solutions, known for its extensive experience in alarm monitoring services and innovations in smart home technology.Honeywell International Inc.:

A global leader in connected security solutions, offering diverse integrated alarm systems tailored to meet both residential and commercial needs.Johnson Controls:

Offers advanced integrated security technologies and alarm monitoring services that provide enhanced safety for businesses and homes.Vivint Smart Home:

Recognized for its smart home security systems and monitoring services, Vivint focuses on innovative integrations and customer-oriented solutions.Brinks Home Security:

A prominent name in the alarm monitoring industry, known for its reliable security systems and around-the-clock customer service.We're grateful to work with incredible clients.

FAQs

What is the market size of Alarm Monitoring?

The global alarm monitoring market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 6.8% over the next decade. This growth highlights the increasing emphasis on security across various sectors globally.

What are the key market players or companies in the Alarm Monitoring industry?

Key players in the alarm monitoring industry include ADT Inc., Johnson Controls International plc, and Vivint Smart Home. These companies lead the market through innovative alarm technologies and comprehensive service offerings.

What are the primary factors driving the growth in the alarm Monitoring industry?

Growth in the alarm monitoring industry is driven by rising crime rates, increased consumer awareness of security systems, technological advancements in alarm systems, and the growing integration of smart home devices.

Which region is the fastest Growing in the alarm monitoring industry?

The fastest-growing region in the alarm monitoring industry is North America, expected to expand from $1.29 billion in 2023 to $2.54 billion by 2033. However, Asia Pacific also shows significant potential, projected to grow from $0.65 billion to $1.27 billion.

Does ConsaInsights provide customized market report data for the alarm monitoring industry?

Yes, ConsaInsights offers customized market report data tailored to the alarm monitoring industry, allowing businesses to gain insights specific to their requirements, trends, and competitive landscape.

What deliverables can I expect from this alarm monitoring market research project?

Deliverables from an alarm monitoring market research project include comprehensive reports, market segmentation analysis, trend forecasts, competitive landscape assessments, and tailored insights into specific regions and technologies.

What are the market trends of the alarm monitoring industry?

Current trends in the alarm monitoring industry include increased adoption of wireless technology, integration of IoT devices, demand for user-friendly mobile applications, and a focus on enhancing cybersecurity measures in alarm systems.