Alcohol Ingredients Market Report

Published Date: 31 January 2026 | Report Code: alcohol-ingredients

Alcohol Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis and forecast of the Alcohol Ingredients market from 2023 to 2033, examining market dynamics, trends, segmentation, regional insights, and key players driving the industry forward.

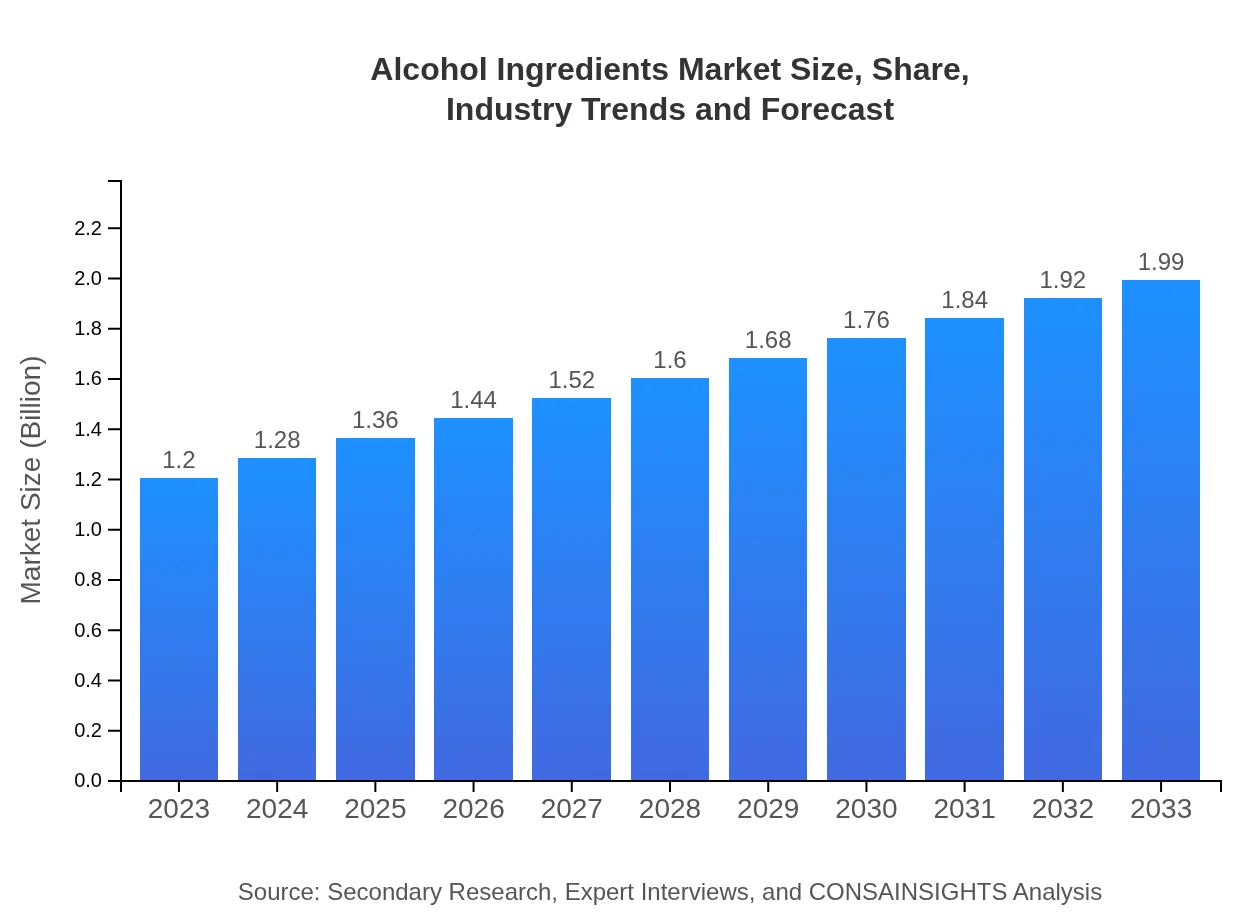

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.1% |

| 2033 Market Size | $1.99 Billion |

| Top Companies | Givaudan, Symrise, Firmenich |

| Last Modified Date | 31 January 2026 |

Alcohol Ingredients Market Overview

Customize Alcohol Ingredients Market Report market research report

- ✔ Get in-depth analysis of Alcohol Ingredients market size, growth, and forecasts.

- ✔ Understand Alcohol Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alcohol Ingredients

What is the Market Size & CAGR of Alcohol Ingredients market in 2023?

Alcohol Ingredients Industry Analysis

Alcohol Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alcohol Ingredients Market Analysis Report by Region

Europe Alcohol Ingredients Market Report:

The European market encompasses a significant transition, expected to rise from 0.34 billion USD in 2023 to 0.57 billion USD in 2033. The market growth is bolstered by stringent regulations on ingredient labeling and the popularity of artisanal alcoholic beverages, with countries like Germany and France leading.Asia Pacific Alcohol Ingredients Market Report:

The Asia Pacific region is anticipated to grow from 0.26 billion USD in 2023 to 0.43 billion USD in 2033. The rise is driven by increased consumption of alcoholic beverages, a growing middle class, and an increasing demand for premium products. China and India are leading markets, influenced by changing drinking habits and younger demographics shifting towards modern alcoholic beverages.North America Alcohol Ingredients Market Report:

North America is projected to grow from 0.41 billion USD in 2023 to 0.68 billion USD by 2033, dominated by a robust craft beer market and an increasing consumption of spirits. The U.S. market remains the largest, promoting trends towards innovative flavor combinations and organic ingredients.South America Alcohol Ingredients Market Report:

In South America, the market for Alcohol Ingredients is expected to advance mildly from 0.03 billion USD in 2023 to 0.04 billion USD in 2033. The growth is primarily fueled by the rising popularity of craft beverages and regional specialties that enhance local traditions.Middle East & Africa Alcohol Ingredients Market Report:

The Middle East and Africa region will likely see growth from 0.16 billion USD in 2023 to around 0.27 billion USD in 2033, influenced by changes in regulations regarding alcohol consumption and an increased interest in Western-style beverages in urban areas. Local players are innovating to cater to regional tastes.Tell us your focus area and get a customized research report.

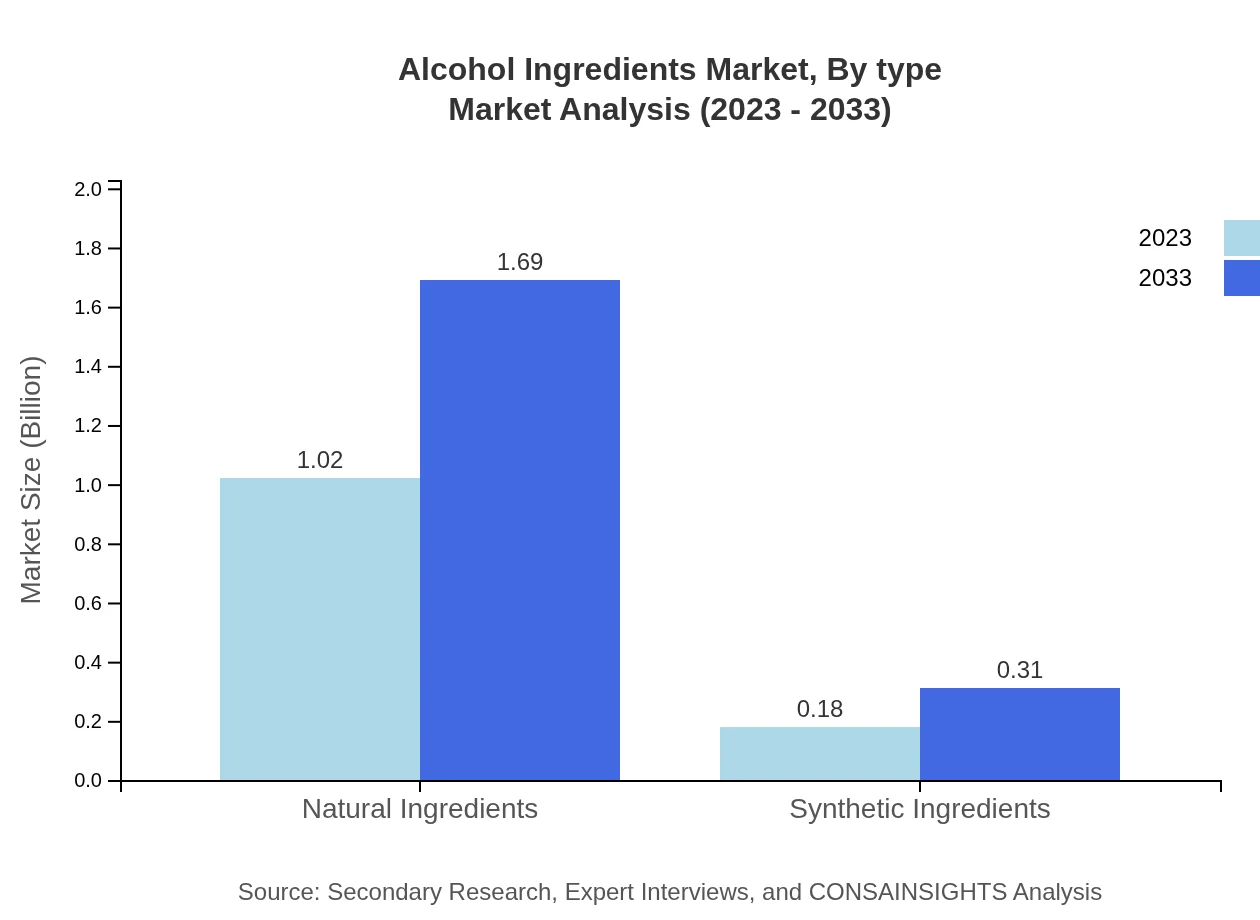

Alcohol Ingredients Market Analysis By Type

The Alcohol Ingredients market, by type, is predominantly occupied by Natural Ingredients with a market size of 1.02 billion USD in 2023, expected to reach 1.69 billion USD by 2033, maintaining a market share of 84.63%. Synthetic Ingredients, although smaller at 0.18 billion USD in 2023, highlighting a growing share of 15.37%, are gaining attention due to their effectiveness in flavor profile enhancement.

Alcohol Ingredients Market Analysis By Alcohol Type

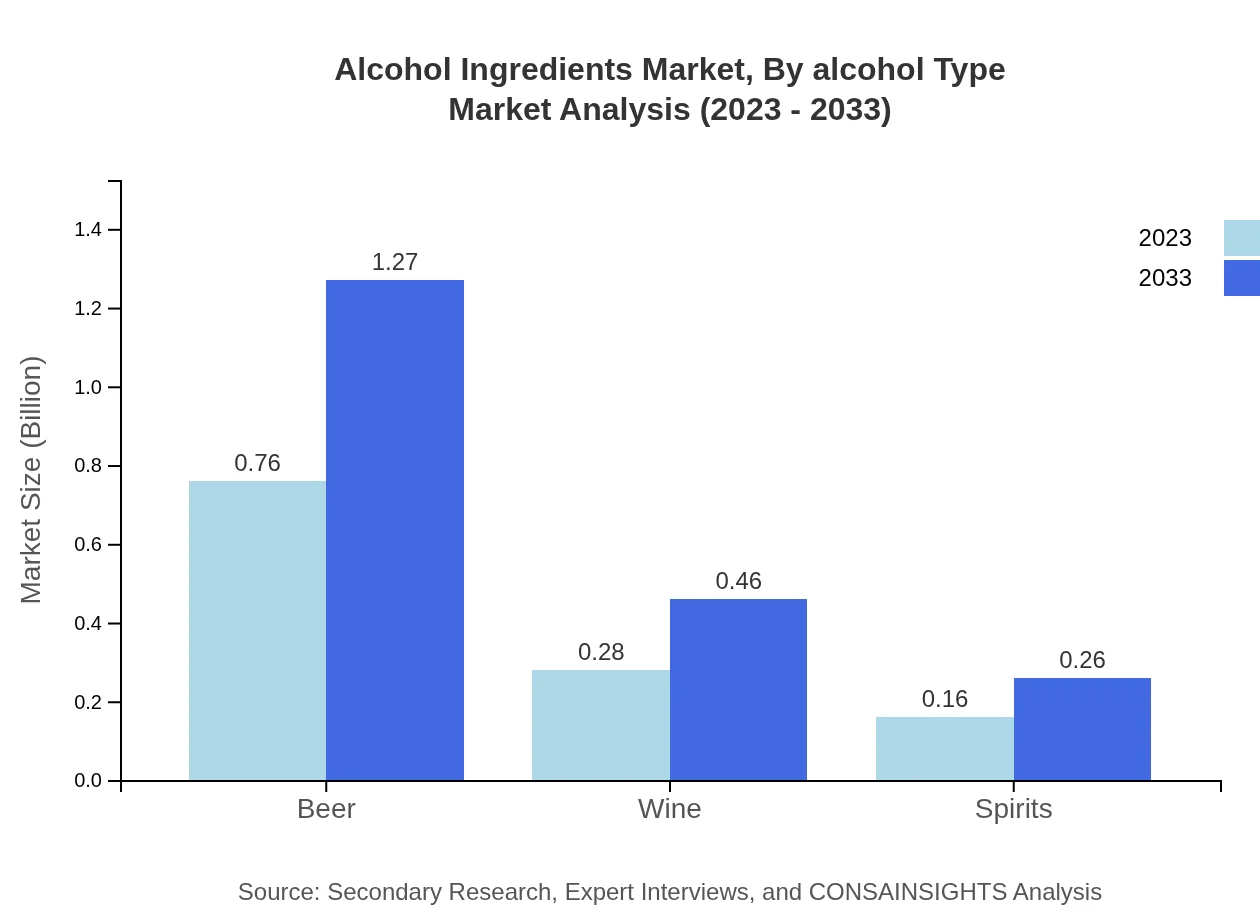

In terms of alcohol types, the market for Beer plays a significant role, with a size of 0.76 billion USD in 2023 and an expected growth up to 1.27 billion USD by 2033, comprising a market share of 63.69%. This is followed by Wine and Spirits, which comprise 23.31% and 13% of the market, respectively, reflecting changing consumer preferences towards craft and unique beverage experiences.

Alcohol Ingredients Market Analysis By Application

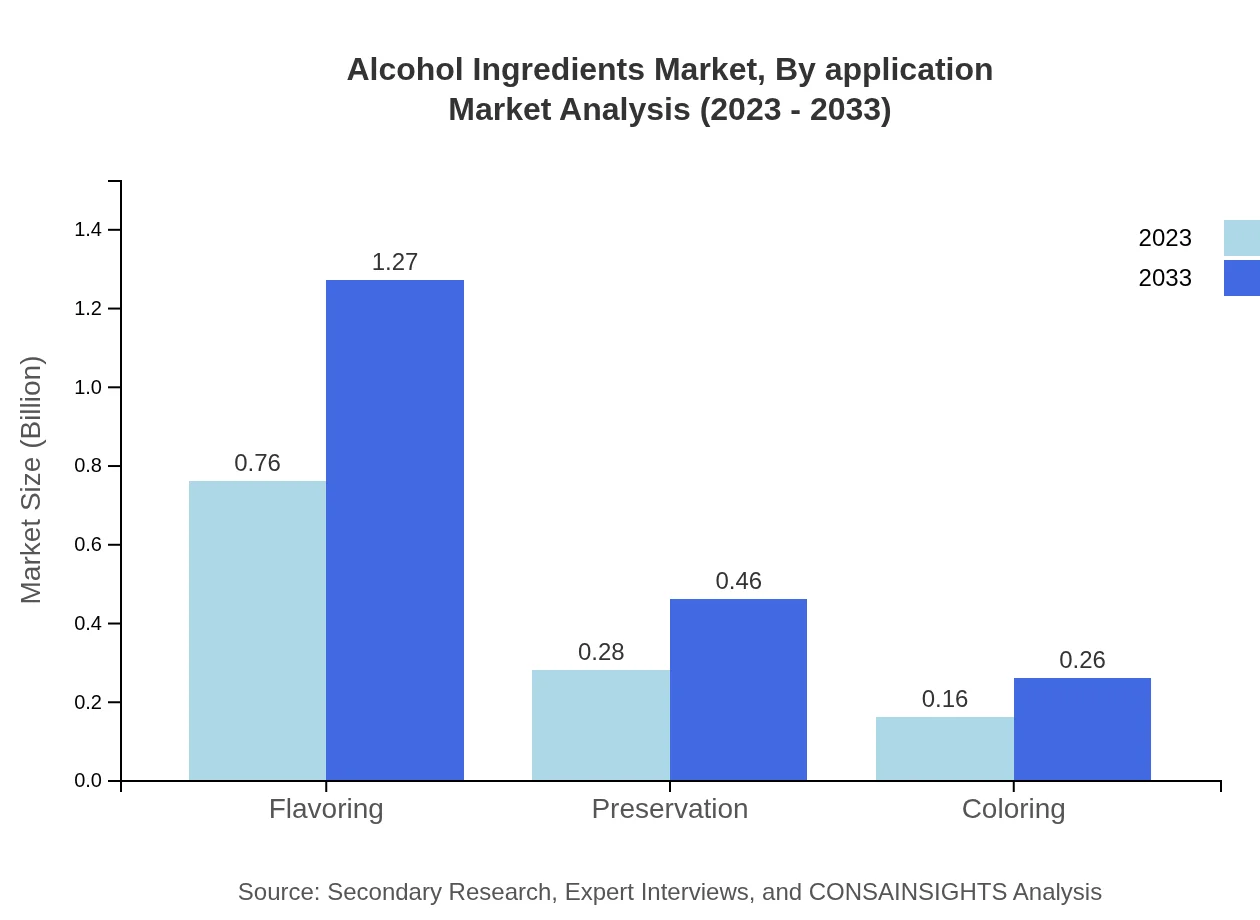

The application segment demonstrates robust performance with Flavoring representing a substantial share of the market at 63.69% in 2023 and projected growth to 1.27 billion USD. Preservation is key as well, expected to grow from 0.28 billion USD in 2023 to 0.46 billion USD by 2033, indicating the significance of quality control in production.

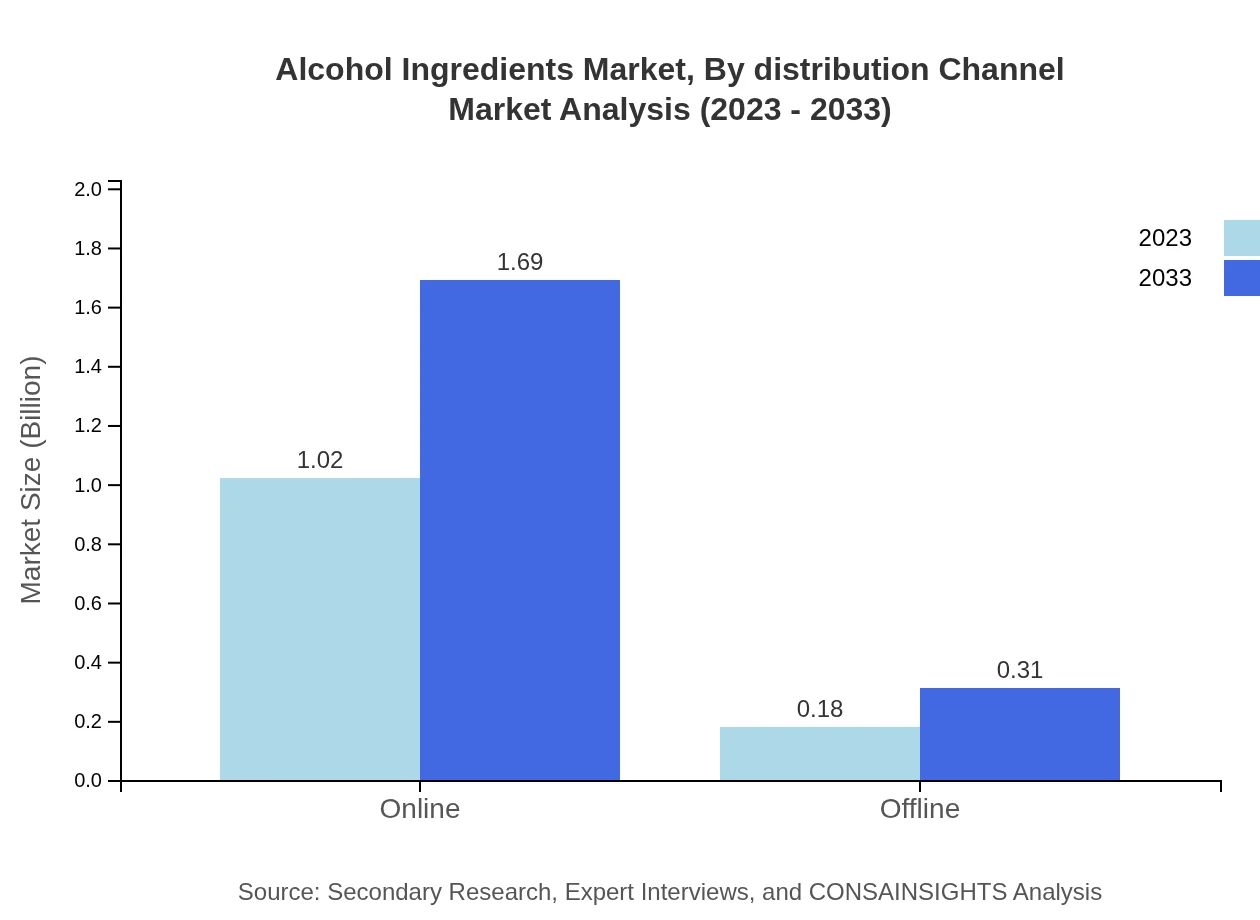

Alcohol Ingredients Market Analysis By Distribution Channel

In the distribution channel segmentation, the online market is increasingly expanding from 1.02 billion USD in 2023 to 1.69 billion USD by 2033, capturing 84.63% of the market share. This trend highlights the increasing reliance on digital platforms for procurement, aligning with consumer shopping habits changing post-pandemic.

Alcohol Ingredients Market Analysis By Formulation

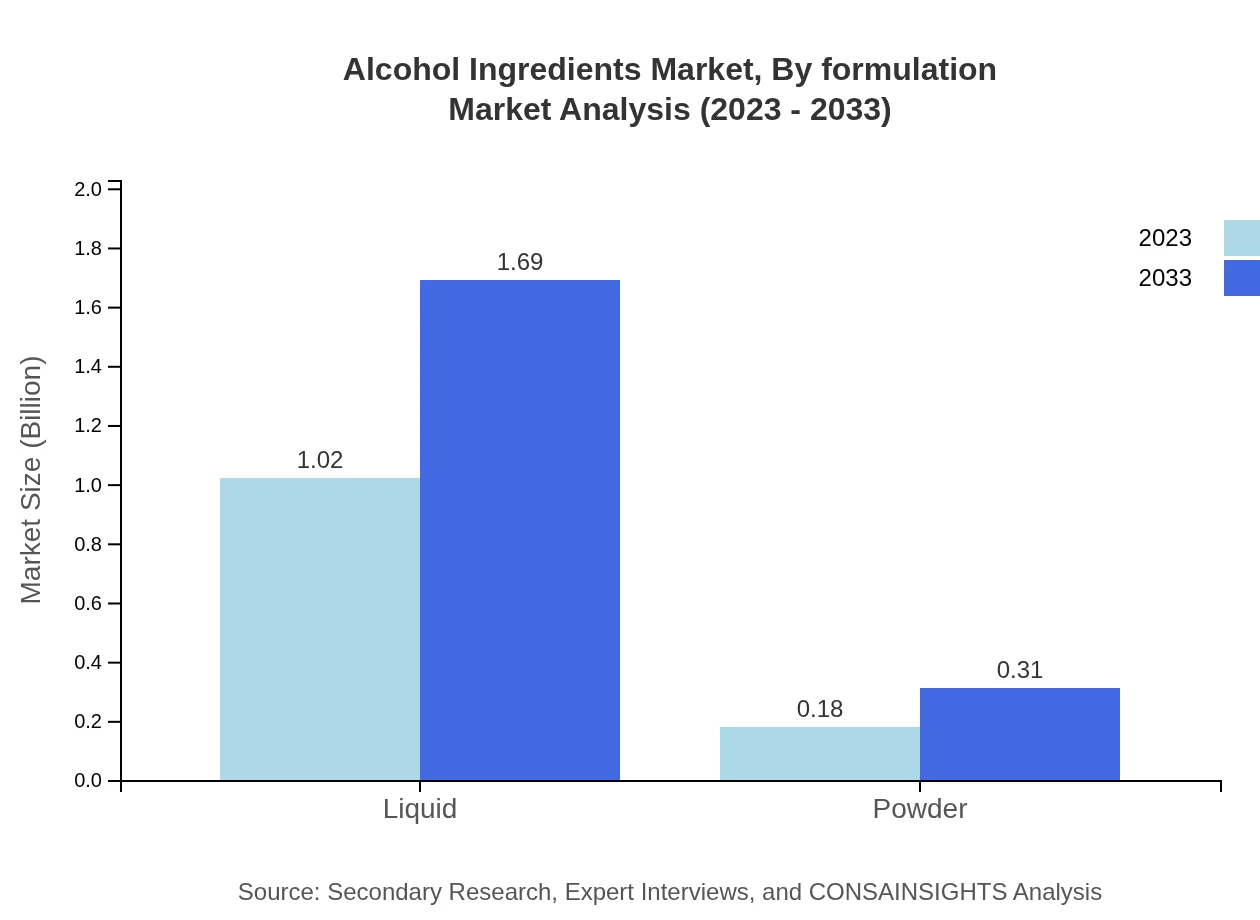

Liquid formulations dominate the Alcohol Ingredients market with a size of 1.02 billion USD in 2023, holding an 84.63% share, expected to grow to 1.69 billion USD by 2033. The powder form is expanding, too, from 0.18 billion USD to 0.31 billion USD, indicating diversification in gatherings and preparation techniques.

Alcohol Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alcohol Ingredients Industry

Givaudan:

Known for its significant innovations in flavors and fragrances, Givaudan leads the market with a wide array of ingredient solutions tailored for alcoholic beverages, focusing heavily on natural extracts.Symrise:

Symrise is another key player recognized for its strong portfolio in flavor systems, offering tailor-made solutions for producers while embracing sustainability principles.Firmenich:

With a dedication to clean labels and natural products, Firmenich has established itself as a leader in the Alcohol Ingredients sector, producing innovative flavors that meet consumer expectations.We're grateful to work with incredible clients.

FAQs

What is the market size of alcohol Ingredients?

The global alcohol ingredients market is valued at approximately $1.2 billion in 2023, with a projected growth at a CAGR of 5.1% through 2033, indicating a robust demand for various alcohol-based products.

What are the key market players or companies in this alcohol ingredients industry?

The alcohol ingredients industry includes major companies such as AB Sugar, Archer Daniels Midland Company, Givaudan, and others, which are critical players contributing to product innovation and market expansion.

What are the primary factors driving the growth in the alcohol ingredients industry?

Key growth drivers in the alcohol ingredients market include increasing consumer demand for unique flavors, the rise of craft beverages, and the shift towards natural ingredients, fostering innovation and product diversification.

Which region is the fastest Growing in the alcohol ingredients?

The Asia Pacific region is anticipated to be the fastest-growing market for alcohol ingredients, evolving from a market size of $0.26 billion in 2023 to $0.43 billion by 2033, fueled by rising consumption trends.

Does ConsaInsights provide customized market report data for the alcohol ingredients industry?

Yes, ConsaInsights offers tailored market report data for the alcohol ingredients industry, allowing clients to receive insights that are specifically aligned with their strategic needs and market interests.

What deliverables can I expect from this alcohol ingredients market research project?

Expect deliverables such as comprehensive market analysis reports, trend assessments, competitive landscape evaluations, and customized insights tailored to your business's focus within the alcohol ingredients sector.

What are the market trends of alcohol ingredients?

Current trends in the alcohol ingredients market include a growing preference for natural ingredients, the expansion of craft alcohol production, and increasing online sales channels, highlighting shifts in consumer preferences.