Alcoholic Beverages Market Report

Published Date: 31 January 2026 | Report Code: alcoholic-beverages

Alcoholic Beverages Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the alcoholic beverages market from 2023 to 2033, offering insights into market size, segmentation, trends, and forecasts. It aims to deliver valuable data for stakeholders to make informed decisions in this dynamic industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

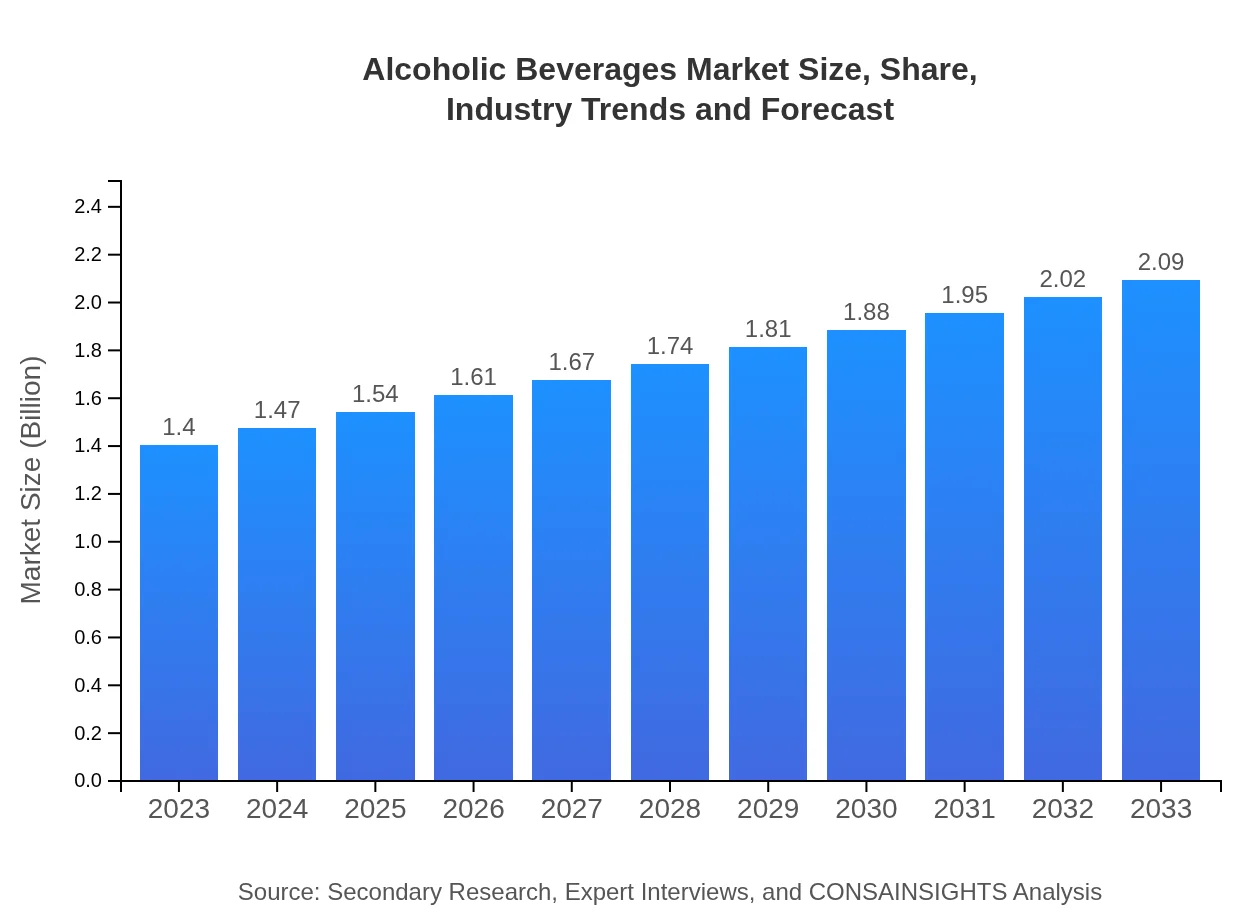

| 2023 Market Size | $1.40 Trillion |

| CAGR (2023-2033) | 4% |

| 2033 Market Size | $2.09 Trillion |

| Top Companies | Anheuser-Busch InBev, Diageo, Pernod Ricard, Heineken N.V., Constellation Brands |

| Last Modified Date | 31 January 2026 |

Alcoholic Beverages Market Overview

Customize Alcoholic Beverages Market Report market research report

- ✔ Get in-depth analysis of Alcoholic Beverages market size, growth, and forecasts.

- ✔ Understand Alcoholic Beverages's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alcoholic Beverages

What is the Market Size & CAGR of Alcoholic Beverages market in 2023?

Alcoholic Beverages Industry Analysis

Alcoholic Beverages Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alcoholic Beverages Market Analysis Report by Region

Europe Alcoholic Beverages Market Report:

Europe, with a substantial market size of $400 billion in 2023, is anticipated to reach $600 billion in 2033. The region exhibits a well-established consumption culture, with countries like Germany and France being notable contributors, especially in beer and wine respectively. Health-conscious alcoholic beverages are gaining traction here as well.Asia Pacific Alcoholic Beverages Market Report:

In the Asia Pacific, the alcoholic beverages market is projected to grow from $260 billion in 2023 to $390 billion by 2033. This region benefits from urbanization and increasing disposable incomes, coupled with a growing acceptance of alcoholic beverages among the younger population. Premiumization and craft products are becoming more sought after in markets like China and Japan.North America Alcoholic Beverages Market Report:

The North American market, valued at $540 billion in 2023, is expected to rise to $800 billion by 2033. The United States is the largest market due to the high demand for craft beers and premium spirits. The trend of social drinking is a key driver, alongside innovative marketing strategies employed by leading companies.South America Alcoholic Beverages Market Report:

South America is anticipated to grow from $40 billion in 2023 to $60 billion by 2033. Countries like Brazil and Argentina are leading this growth owing to their rich traditions of wine and spirits production. The rise in tourism also augments local alcoholic beverage sales.Middle East & Africa Alcoholic Beverages Market Report:

The Middle East and Africa region is expected to expand from $160 billion in 2023 to $240 billion by 2033, with varying regulations impacting market dynamics. The rise in expatriate populations and changing attitudes towards alcohol consumption in certain countries, such as South Africa, are contributing to market growth.Tell us your focus area and get a customized research report.

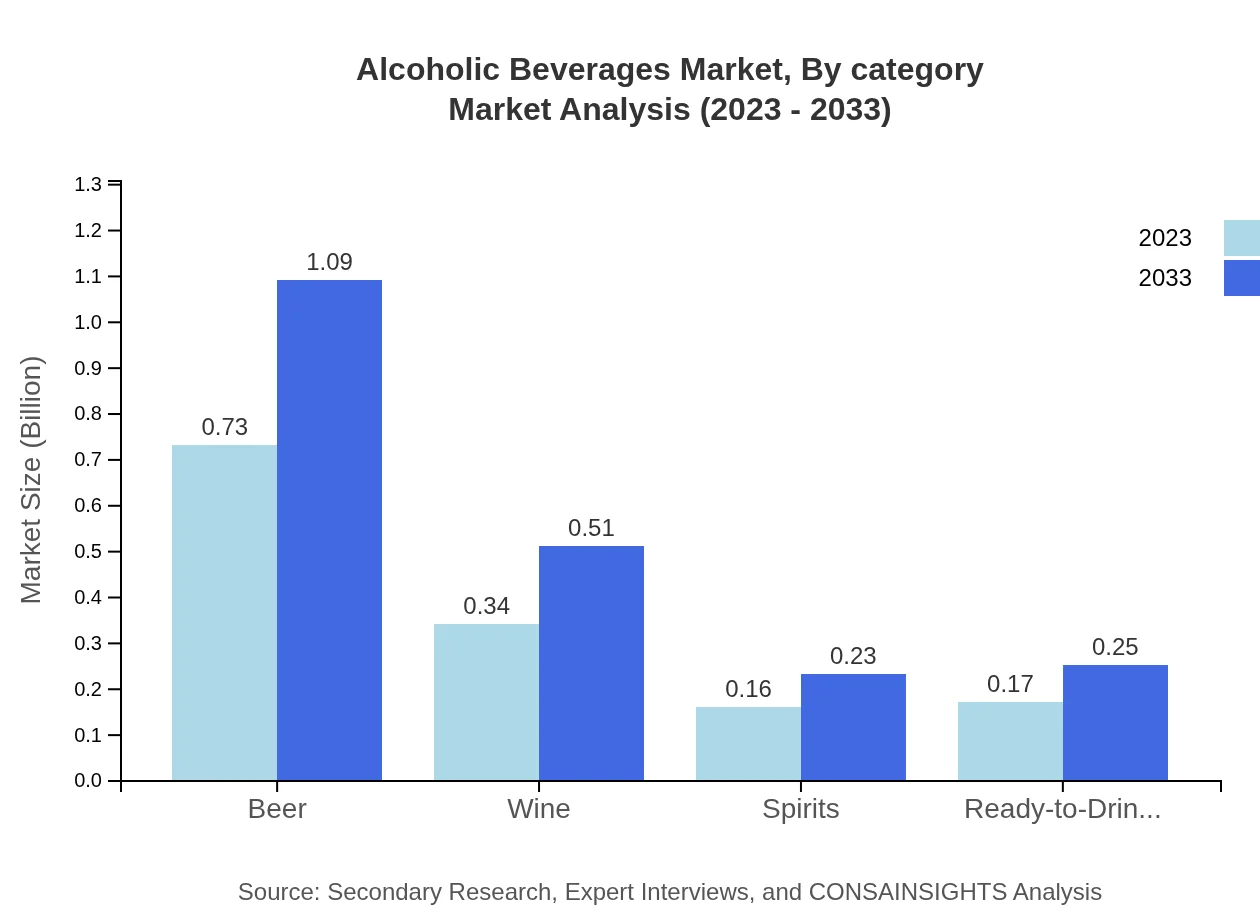

Alcoholic Beverages Market Analysis By Category

The alcoholic beverages market, by category, highlights several significant segments. Beer dominates the overall market share, projected to grow from $730 billion in 2023 to $1.09 trillion in 2033, maintaining a significant market share. Wine follows closely, with expectations of growth from $340 billion to $510 billion, representing a strong interest in premium wines. Spirits make up a smaller yet growing segment with growth from $160 billion to $230 billion. Ready-to-drink formats and innovative product segments are also on the rise, appealing particularly to younger consumers.

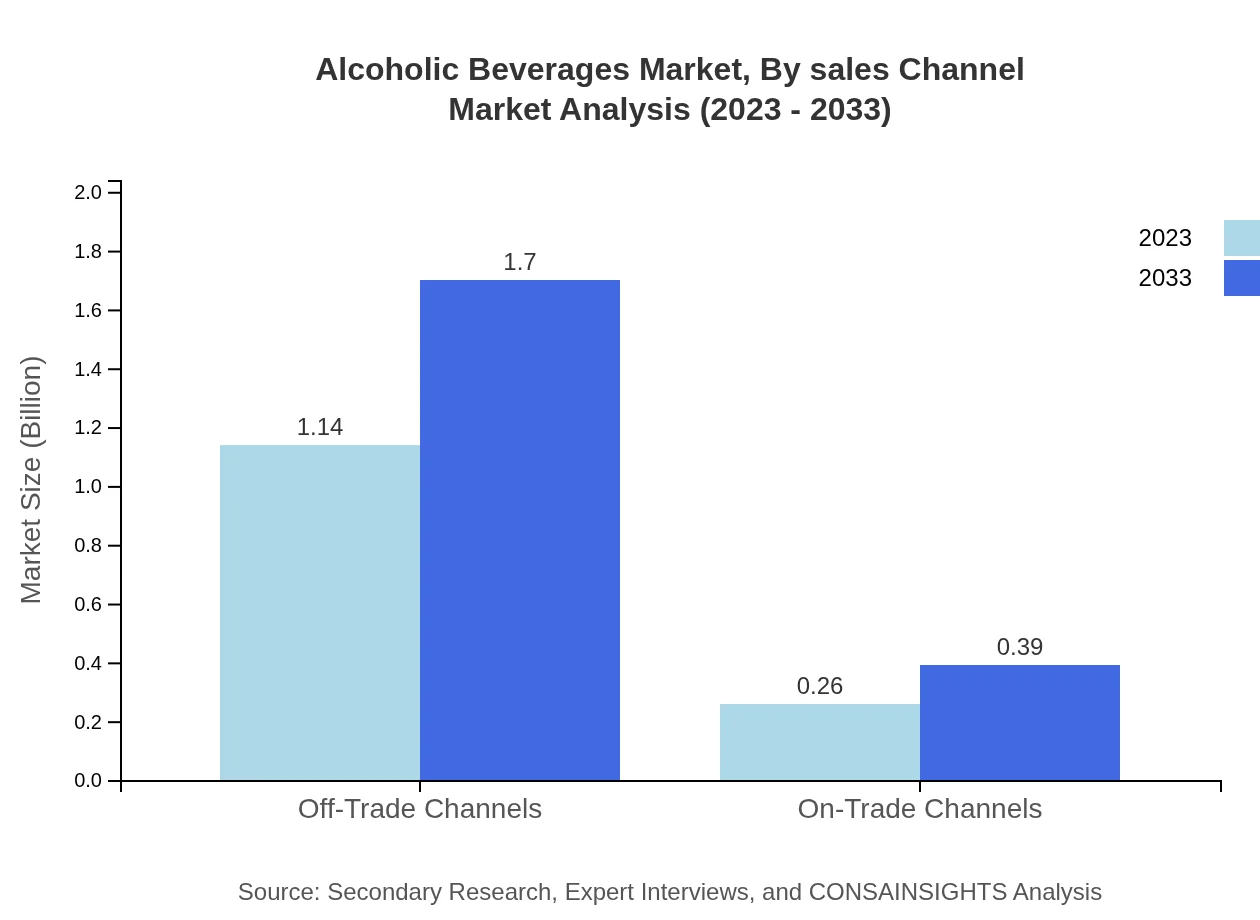

Alcoholic Beverages Market Analysis By Sales Channel

Market segmentation by sales channels shows a robust performance in both off-trade and on-trade channels. Off-trade channels, which include retail and e-commerce, expectedly lead the market with sales growing from $1.14 trillion in 2023 to $1.70 trillion by 2033. A shift towards online shopping has accelerated this growth. On-trade channels, such as bars and restaurants, are forecasted to grow from $260 billion to $390 billion, driven by a resurgence in social activities post-pandemic.

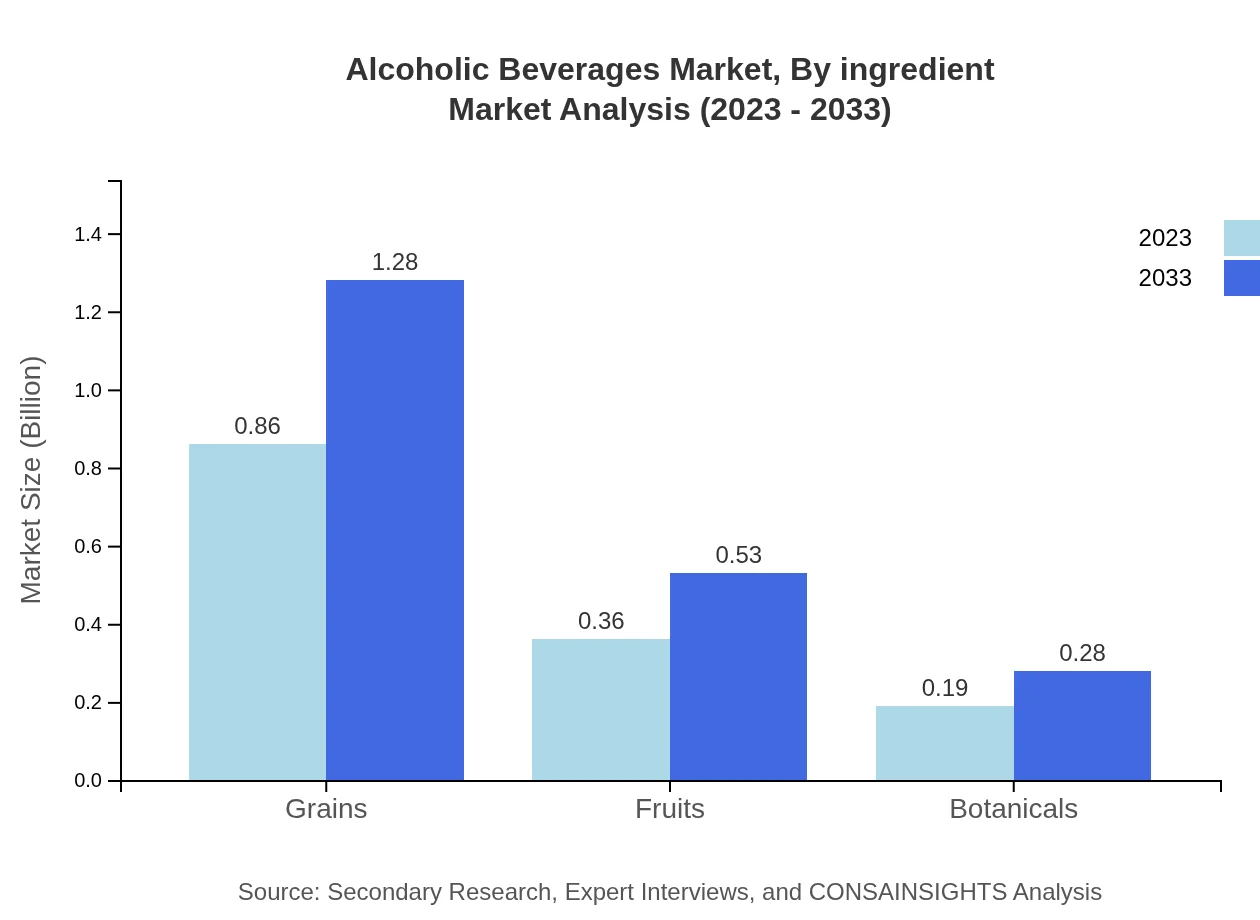

Alcoholic Beverages Market Analysis By Ingredient

By ingredient analysis showcases the importance of grains, fruits, and botanicals in the alcoholic beverages market. Grains remain the primary ingredient, growing from $860 billion to $1.28 trillion, and capturing nearly 61.24% of the market share. Fruits constitute a significant segment as well, with a projected growth from $360 billion to $530 billion. Botanical ingredients, while a smaller category, are gaining popularity, with a rise from $190 billion to $280 billion reflecting a trend towards innovative and naturally flavored products.

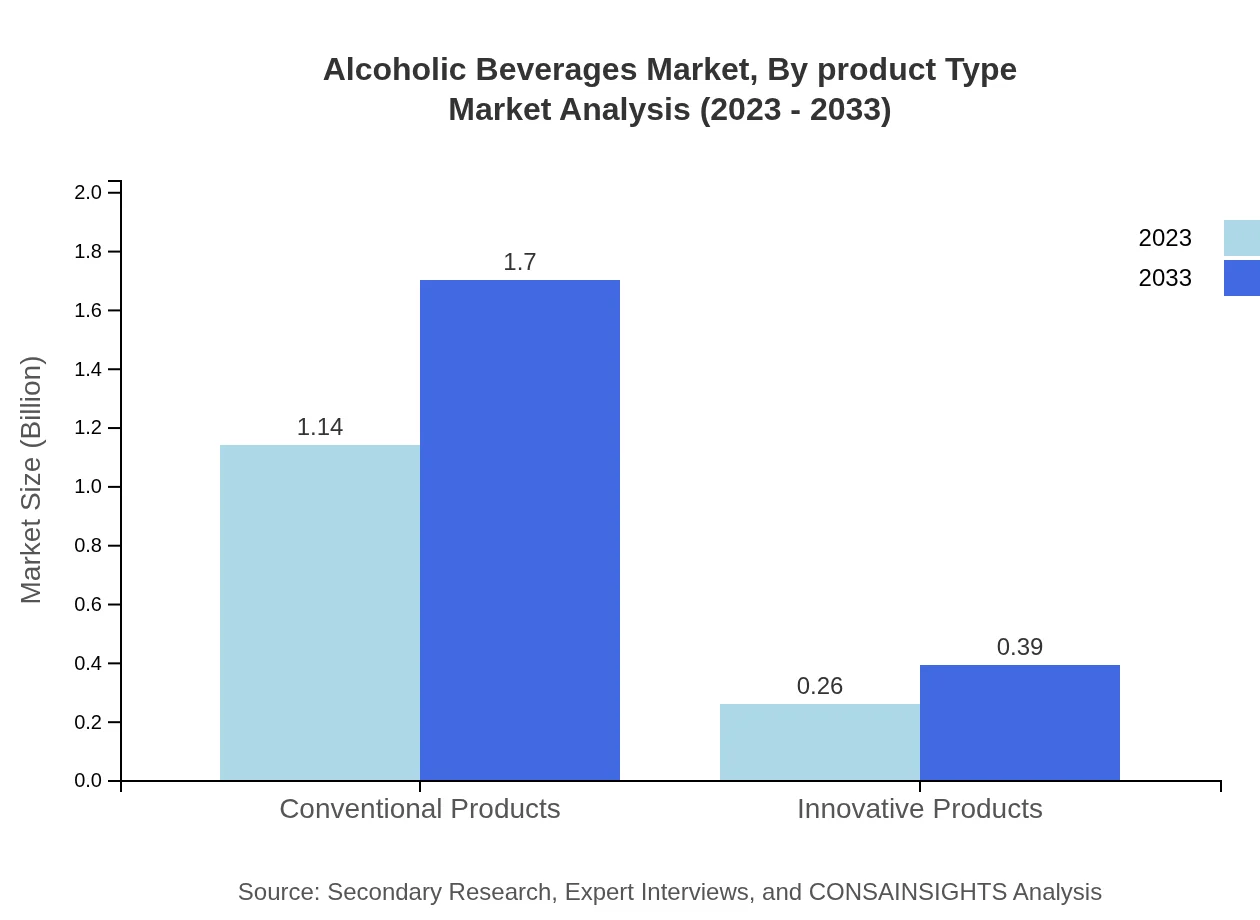

Alcoholic Beverages Market Analysis By Product Type

The products types in the alcoholic beverages market are divided into conventional and innovative products. Conventional products currently dominate with $1.14 trillion in 2023, anticipated to grow to $1.70 trillion by 2033, holding 81.36% of market share. Innovative products, which include craft beers and unique flavors, will see growth from $260 billion to $390 billion, highlighting the growing consumer demand for variety and new experiences in taste.

Alcoholic Beverages Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alcoholic Beverages Industry

Anheuser-Busch InBev:

The world's largest brewer known for its portfolio of over 500 beer brands, including Budweiser and Stella Artois. Anheuser-Busch InBev continues to lead through innovation and marketing.Diageo:

A leading global beverage alcohol company producing iconic brands like Johnnie Walker, Guinness, and Smirnoff. Diageo is focused on sustainability and responsible drinking initiatives.Pernod Ricard:

A multinational company specializing in wines and spirits such as Absolut Vodka and Chivas Regal. Pernod Ricard promotes a diverse portfolio and strong growth in emerging markets.Heineken N.V.:

Known for its extensive range of beers, Heineken operates internationally with a strong emphasis on innovation and consumer engagement.Constellation Brands:

A major player in wine, beer, and spirits with brands like Corona and Robert Mondavi. Constellation is adept at leveraging trends in the U.S. market.We're grateful to work with incredible clients.

FAQs

What is the market size of alcoholic Beverages?

The global alcoholic beverages market size was valued at approximately $1.4 trillion in 2023, with a projected compound annual growth rate (CAGR) of 4% through 2033. This growth reflects increasing consumption trends and diversification in beverage offerings.

What are the key market players or companies in this alcoholic Beverages industry?

Key players in the alcoholic beverages industry include Anheuser-Busch InBev, Diageo, and Heineken. These companies dominate market share and influence trends, continuously innovating to meet evolving consumer preferences and exploring new distribution channels.

What are the primary factors driving the growth in the alcoholic Beverages industry?

Growth in the alcoholic beverages industry is driven by an increase in disposable incomes, changing social norms around alcohol consumption, and the rising popularity of craft and premium products, alongside innovations in marketing strategies and distribution.

Which region is the fastest Growing in the alcoholic Beverages?

The fastest-growing region in the alcoholic beverages market is Asia Pacific. Market projections suggest growth from $0.26 trillion in 2023 to $0.39 trillion by 2033, fueled by urbanization, changing demographics, and growing middle-class populations.

Does Consainsights provide customized market report data for the alcoholic Beverages industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the alcoholic beverages industry, allowing stakeholders to gain insights into market dynamics, trends, consumer behavior, and competitive landscapes.

What deliverables can I expect from this alcoholic Beverages market research project?

From the alcoholic beverages market research project, clients can expect comprehensive reports, market analysis, segment performance evaluations, competitive landscape assessments, and actionable insights that guide strategic business decisions.

What are the market trends of alcoholic Beverages?

Current market trends in alcoholic beverages include the rise of health-conscious drinking, the growth of e-commerce distribution channels, and increasing demand for ready-to-drink formats. Innovative product offerings and sustainability practices are also gaining traction.