Alfalfa Market Report

Published Date: 02 February 2026 | Report Code: alfalfa

Alfalfa Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the alfalfa market from 2023 to 2033, covering market size, growth forecasts, industry trends, and the competitive landscape. Key insights include regional performance and technological advancements within the alfalfa sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

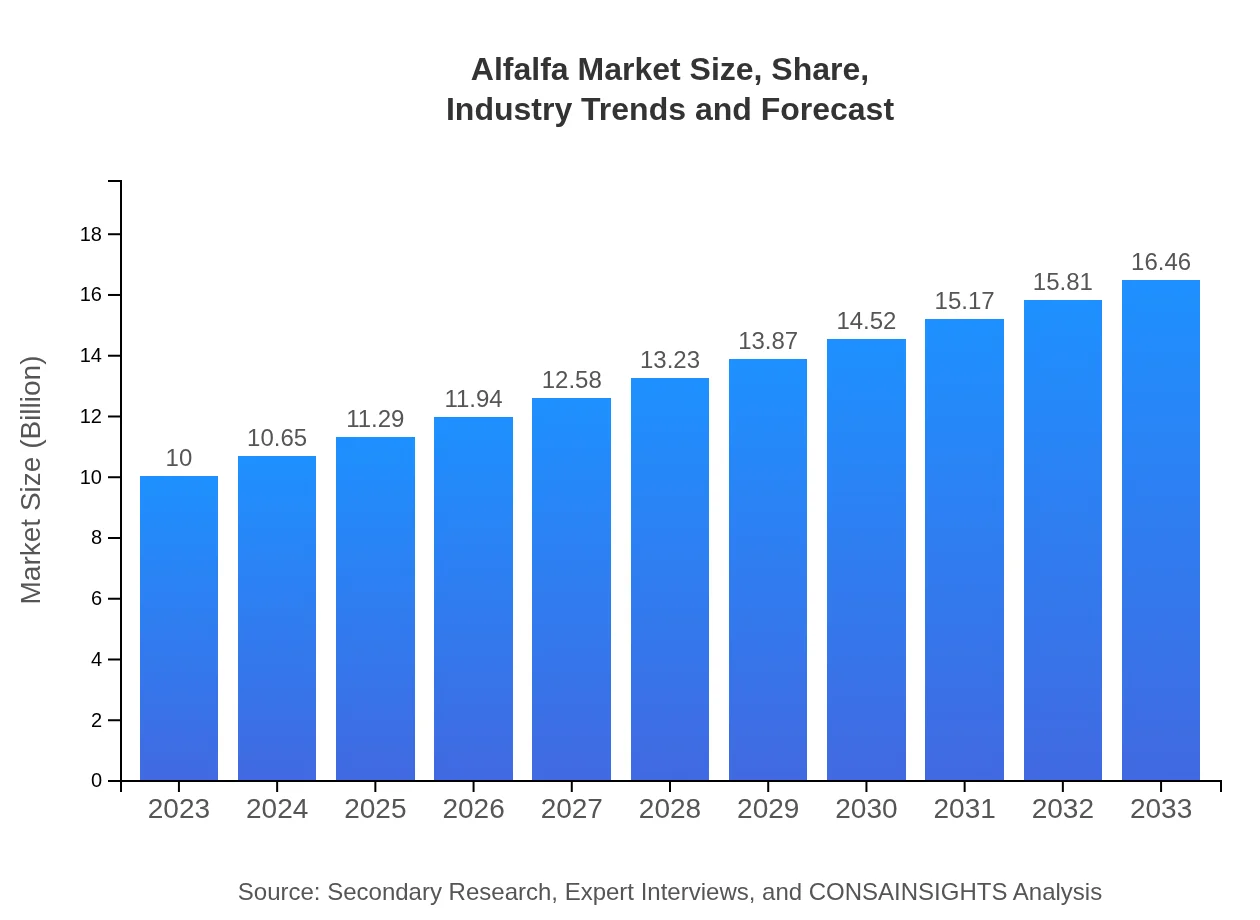

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Anderson Hay & Grain Co., Cal/West Seeds, Alfalfa Pellets, Inc., Richards & Hartman, Inc. |

| Last Modified Date | 02 February 2026 |

Alfalfa Market Overview

Customize Alfalfa Market Report market research report

- ✔ Get in-depth analysis of Alfalfa market size, growth, and forecasts.

- ✔ Understand Alfalfa's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alfalfa

What is the Market Size & CAGR of Alfalfa market in 2023?

Alfalfa Industry Analysis

Alfalfa Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alfalfa Market Analysis Report by Region

Europe Alfalfa Market Report:

The European alfalfa market is estimated to increase from $3.39 billion in 2023 to $5.57 billion by 2033, driven by the EU's agricultural policies favoring sustainable farming and organic livestock feed, alongside growing demand for high-quality dairy products.Asia Pacific Alfalfa Market Report:

The Asia-Pacific region is expected to witness considerable growth in the alfalfa market, with a projected size increasing from $1.78 billion in 2023 to $2.93 billion by 2033. This growth is driven by rising livestock production rates and increased feed requirements in countries like China and India, where the demand for dairy and meat products is surging.North America Alfalfa Market Report:

North America, particularly the United States, represents a major portion of the alfalfa market, projected to grow from $3.42 billion in 2023 to $5.63 billion in 2033. This growth stems from established agricultural practices, advanced technologies, and a robust livestock industry that utilizes alfalfa as a primary feed.South America Alfalfa Market Report:

In South America, the alfalfa market is anticipated to grow from $0.54 billion in 2023 to $0.89 billion in 2033. The increasing focus on improving the quality of livestock feed and the expansion of cattle ranching in Brazil and Argentina are key factors behind this growth.Middle East & Africa Alfalfa Market Report:

In the Middle East and Africa, the alfalfa market is expected to grow from $0.87 billion in 2023 to $1.44 billion in 2033. The growth is supported by improvements in agricultural practices and an increasing focus on livestock nutrition in regions experiencing rapid urbanization and dietary changes.Tell us your focus area and get a customized research report.

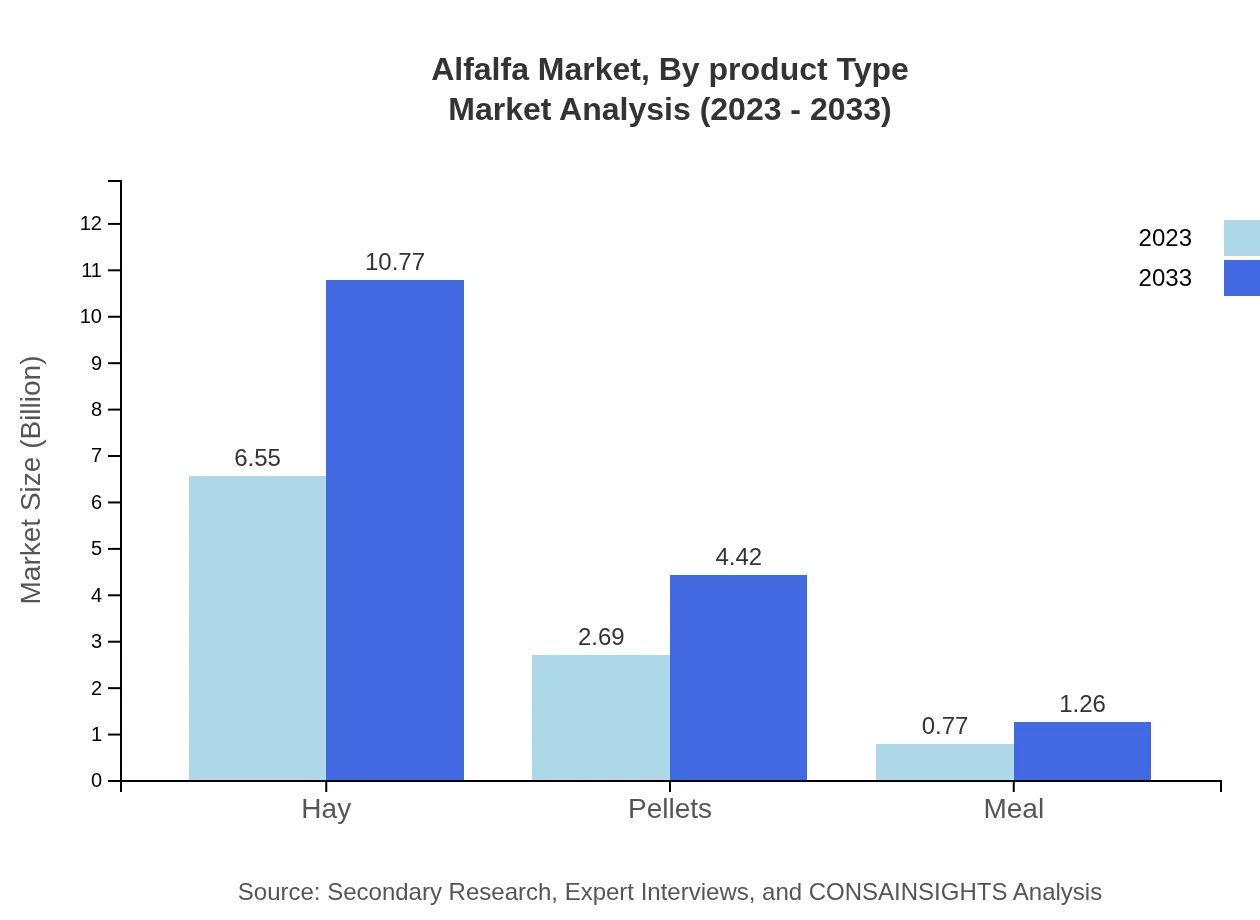

Alfalfa Market Analysis By Product Type

The alfalfa market by product type includes Hay, Pellets, and Meal. In 2023, Hay made up a significant portion with a market share of 65.45% valued at $6.55 billion, projected to grow to $10.77 billion by 2033. Pellets and Meal together represent a growing sector, reflecting innovation in processing and convenience for end-users.

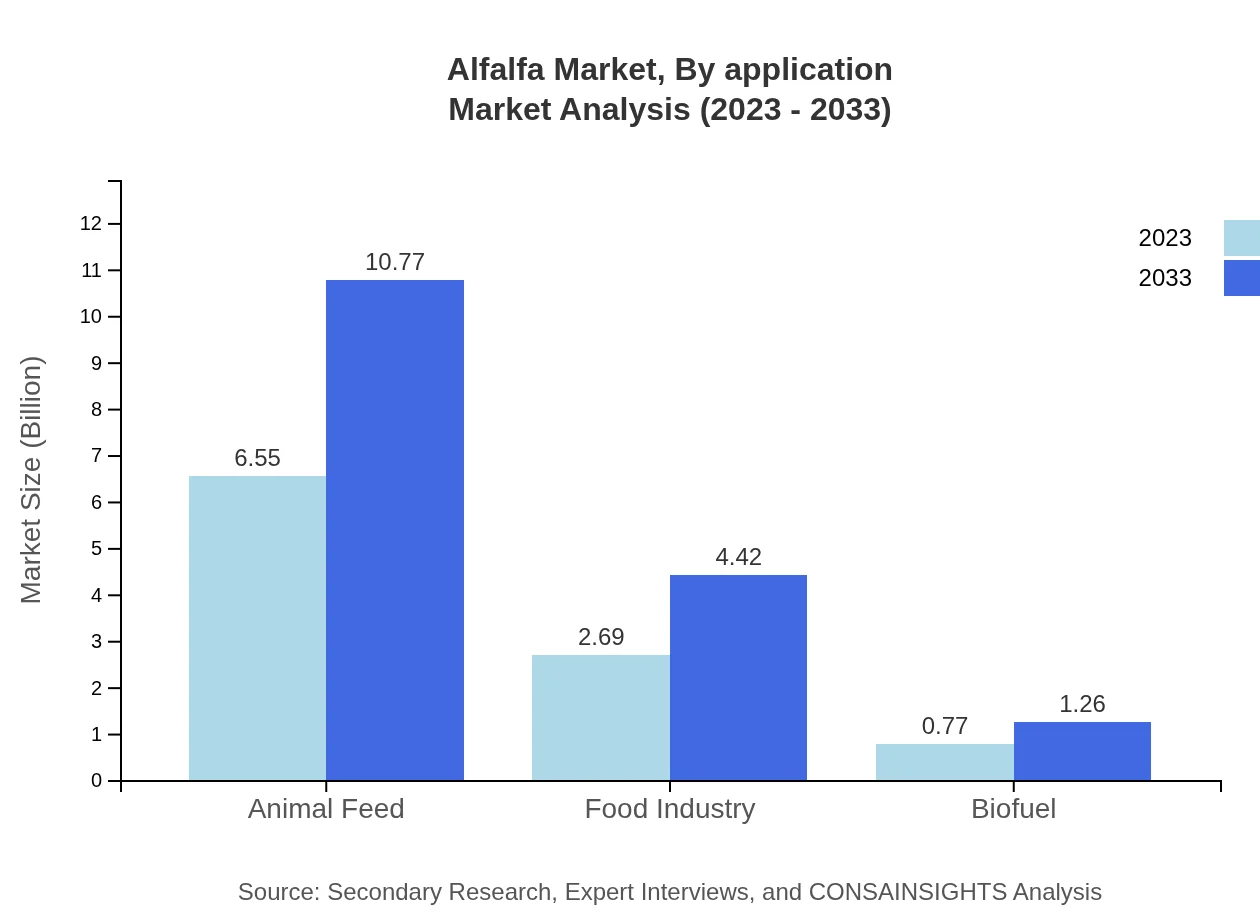

Alfalfa Market Analysis By Application

The major applications of alfalfa include Animal Feed, Biofuel, and Food Industry. Animal Feed holds the largest market share at 65.45% in 2023, growing from $6.55 billion to $10.77 billion by 2033. The Biofuel and Food Industries are also growing as they seek protein-rich sources for their respective products.

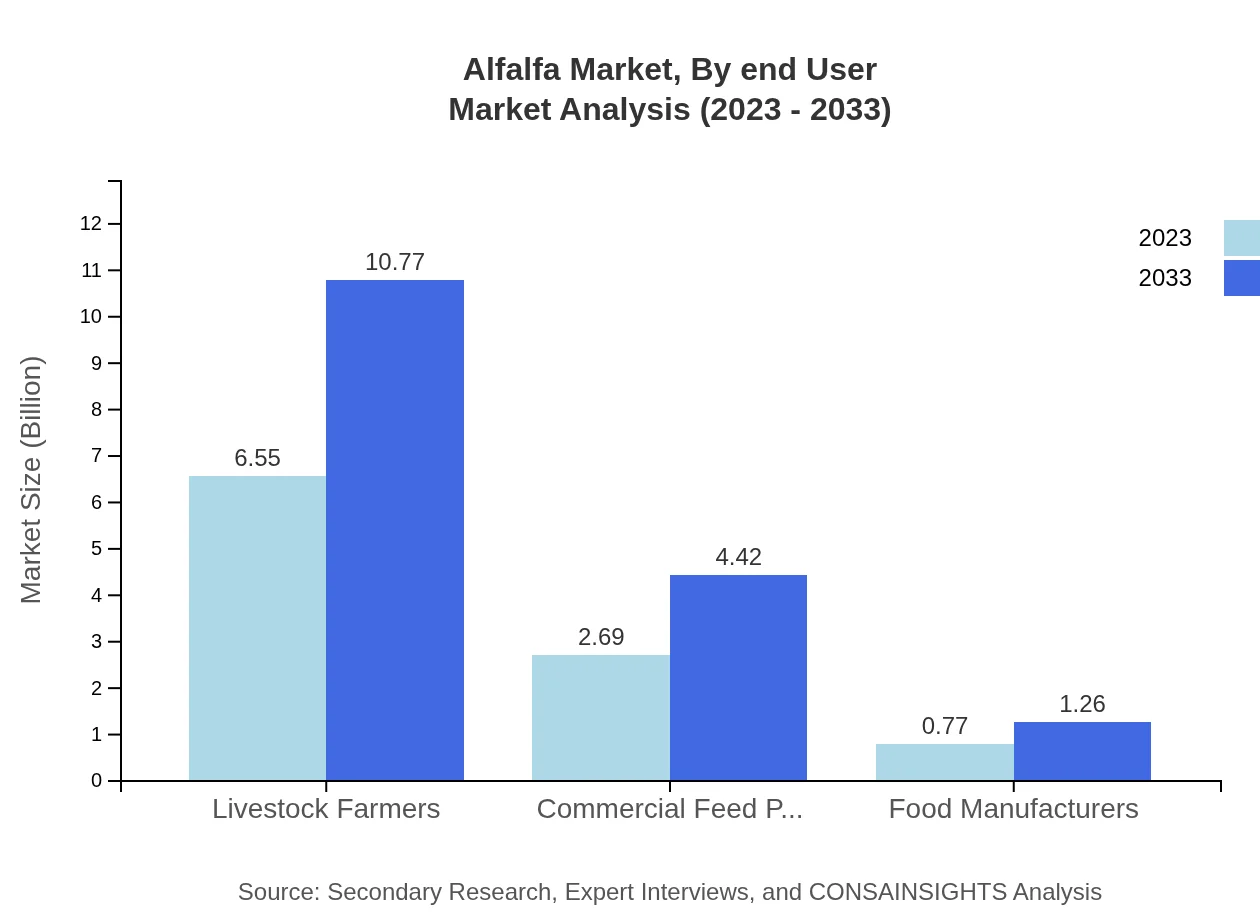

Alfalfa Market Analysis By End User

The primary end-users of alfalfa are livestock farmers and commercial feed producers. Livestock farmers account for a share of 65.45% of the market in 2023, value estimated at $6.55 billion, which will rise to $10.77 billion by 2033. Commercial feed producers also play a crucial role, driven by the increasing requirement for quality feed investments.

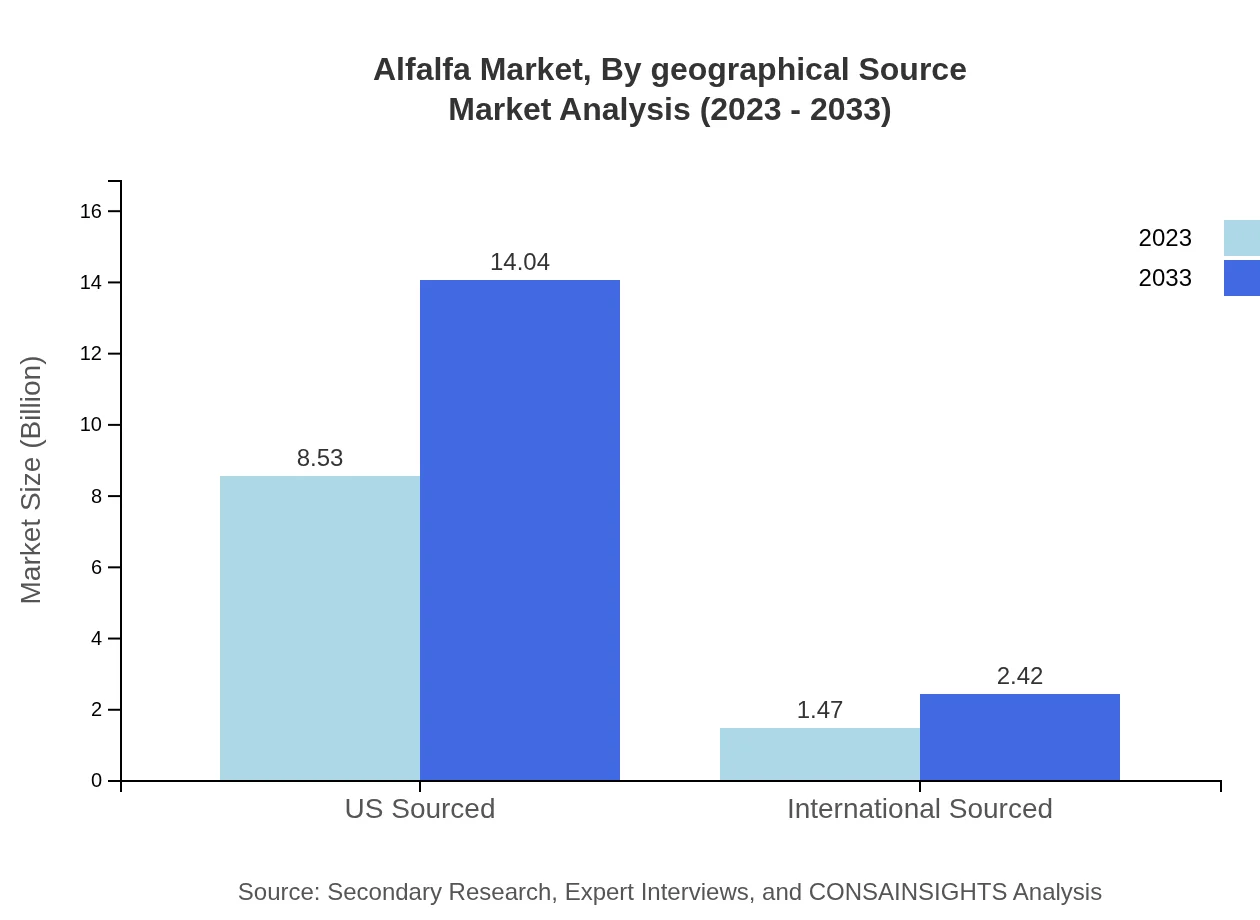

Alfalfa Market Analysis By Geographical Source

The geographical sourcing of alfalfa consists of US Sourced and International Sourced alfalfa. The US Sourced segment dominates with a market valuation of $8.53 billion (85.3% market share) in 2023, growing to $14.04 billion by 2033, whereas International Sourced alfalfa is expected to grow from $1.47 billion in 2023 to $2.42 billion by 2033.

Alfalfa Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alfalfa Industry

Anderson Hay & Grain Co.:

A leading supplier of high-quality alfalfa hay, Anderson Hay & Grain focuses on sustainable farming practices and innovative technologies to enhance yield and quality.Cal/West Seeds:

Cal/West Seeds is known for its research-driven approaches in alfalfa seed production, offering a wide variety of seeds tailored for optimal growth in different climatic conditions.Alfalfa Pellets, Inc.:

This company specializes in the production of alfalfa pellets used for animal feed and recognizes the importance of providing nutrient-rich products while maintaining sustainable practices.Richards & Hartman, Inc.:

Richards & Hartman is an established player in the alfalfa market, committed to high standards of quality and innovation in alfalfa hay production and distribution.We're grateful to work with incredible clients.

FAQs

What is the market size of alfalfa?

The global alfalfa market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5%. In 2023, the market stands at significant levels across various sectors, indicating robust demand and applicability.

What are the key market players or companies in this alfalfa industry?

Key players in the alfalfa market include major agricultural firms and cooperatives that specialize in livestock feed, commercial feed production, and food manufacturing, supporting the diverse uses of alfalfa in different sectors.

What are the primary factors driving the growth in the alfalfa industry?

Growth drivers for the alfalfa industry include rising demand for animal feed, increased livestock farming, and the push towards sustainable agricultural practices, with alfalfa being recognized for its nutrient-rich profile.

Which region is the fastest Growing in the alfalfa market?

The North American region is the fastest-growing market for alfalfa, projected to expand from $3.42 billion in 2023 to $5.63 billion by 2033, driven by its large livestock industry and innovative farming practices.

Does ConsaInsights provide customized market report data for the alfalfa industry?

Yes, ConsaInsights offers customized market report data tailored to specific research needs in the alfalfa industry, ensuring clients receive relevant and actionable insights based on their objectives.

What deliverables can I expect from this alfalfa market research project?

Deliverables from the alfalfa market research project typically include comprehensive market analysis, trend reports, regional assessments, and segmented data, offering insights into current and future market dynamics.

What are the market trends of alfalfa?

Current trends in the alfalfa market show an increase in organic production methods, expansion into biofuel applications, and a greater use of alfalfa in food manufacturing, highlighting its versatility and health benefits.