Alginates Market Report

Published Date: 31 January 2026 | Report Code: alginates

Alginates Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the alginates market from 2023 to 2033, highlighting key market insights, trends, size forecasts, and regional dynamics to guide stakeholders in decision-making.

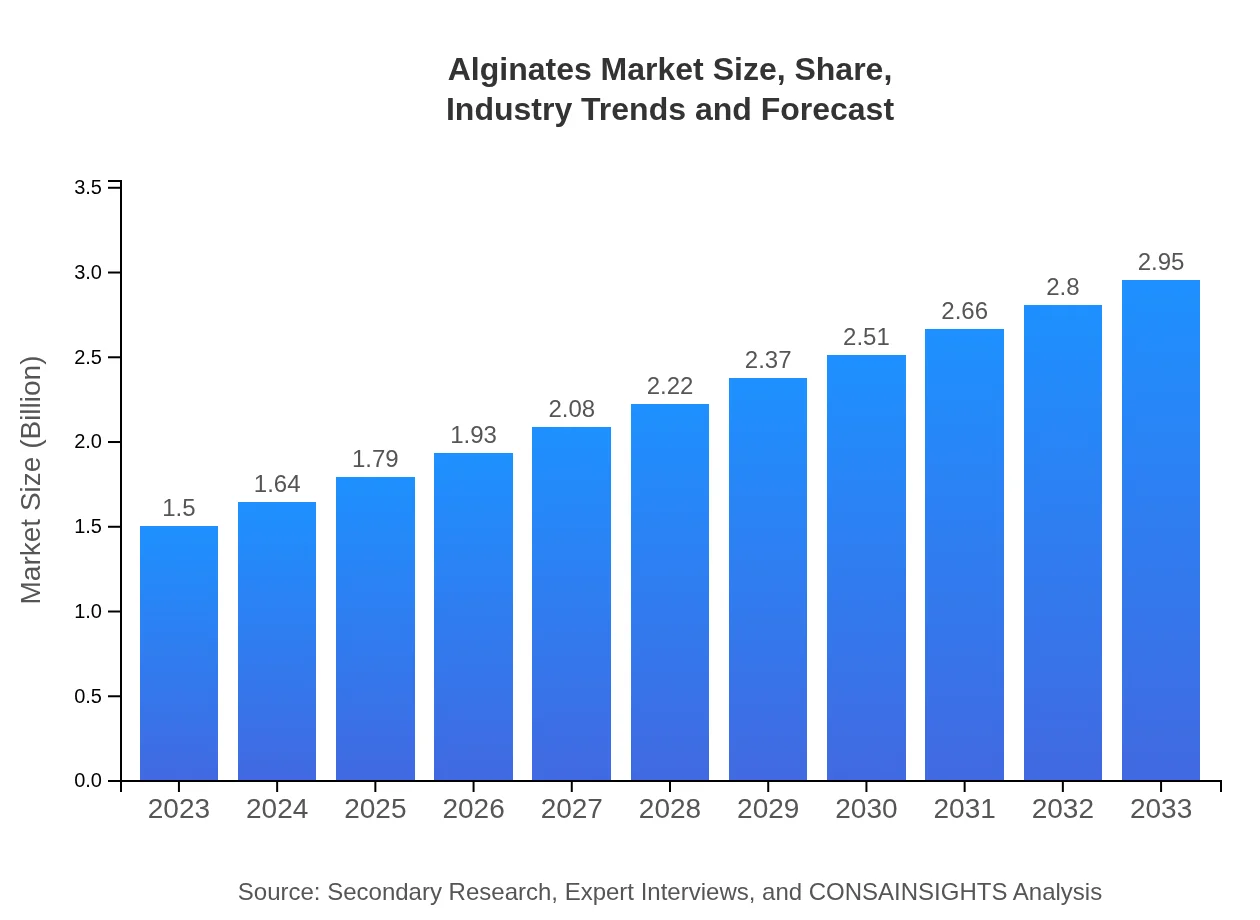

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | KIMICA Corporation, Algaia S.A., DuPont, Ingredients Solutions, Inc. |

| Last Modified Date | 31 January 2026 |

Alginates Market Overview

Customize Alginates Market Report market research report

- ✔ Get in-depth analysis of Alginates market size, growth, and forecasts.

- ✔ Understand Alginates's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alginates

What is the Market Size & CAGR of Alginates market in 2023?

Alginates Industry Analysis

Alginates Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alginates Market Analysis Report by Region

Europe Alginates Market Report:

Europe leads with an estimated market size of $0.43 billion in 2023, expected to reach $0.85 billion by 2033, supported by strict food regulations and a favorable market for healthy additives.Asia Pacific Alginates Market Report:

In 2023, the Asia Pacific alginates market is valued at $0.29 billion and is projected to grow to $0.57 billion by 2033, driven by growing food, pharmaceutical, and cosmetic industries in rapidly developing economies like China and India.North America Alginates Market Report:

North America is anticipated to grow from $0.49 billion in 2023 to $0.97 billion in 2033, propelled by a strong focus on health and wellness trends and increasing applications in the food sector.South America Alginates Market Report:

The South American market is smaller, starting at $0.14 billion in 2023 and reaching $0.28 billion by 2033, with opportunities arising from increased demand for functional foods and natural products.Middle East & Africa Alginates Market Report:

The Middle East and Africa alginates market is valued at $0.14 billion in 2023 and is projected to grow to $0.28 billion by 2033, driven by growing healthcare needs and demand for organic cosmetics.Tell us your focus area and get a customized research report.

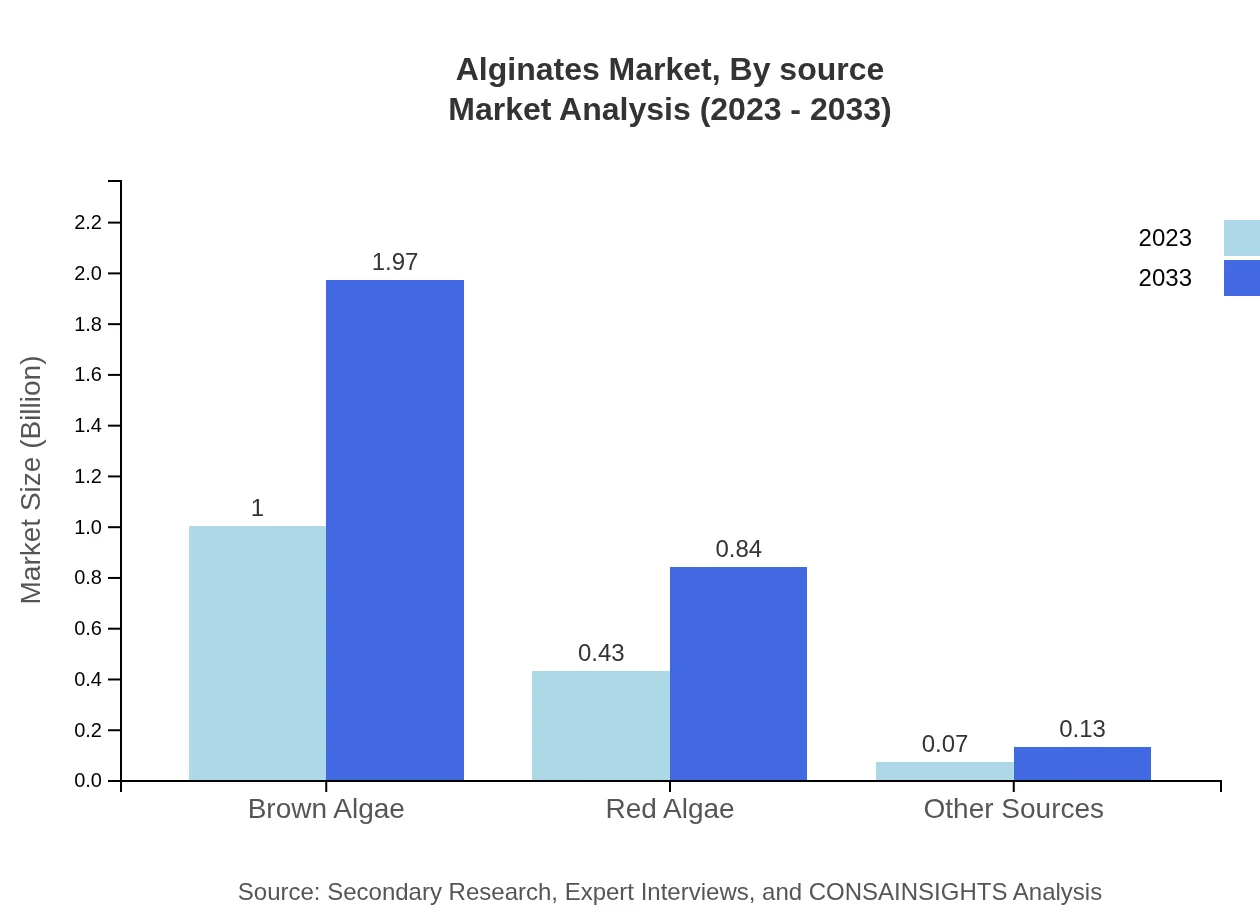

Alginates Market Analysis By Source

In terms of source, brown algae dominate the alginates market, representing a significant portion with a market size of approximately $1.00 billion in 2023, expected to reach $1.97 billion by 2033. Red algae follow with a market size of $0.43 billion in 2023, projected to grow to $0.84 billion by 2033. Other sources maintain a smaller segment but are seeing increased interest in niche applications.

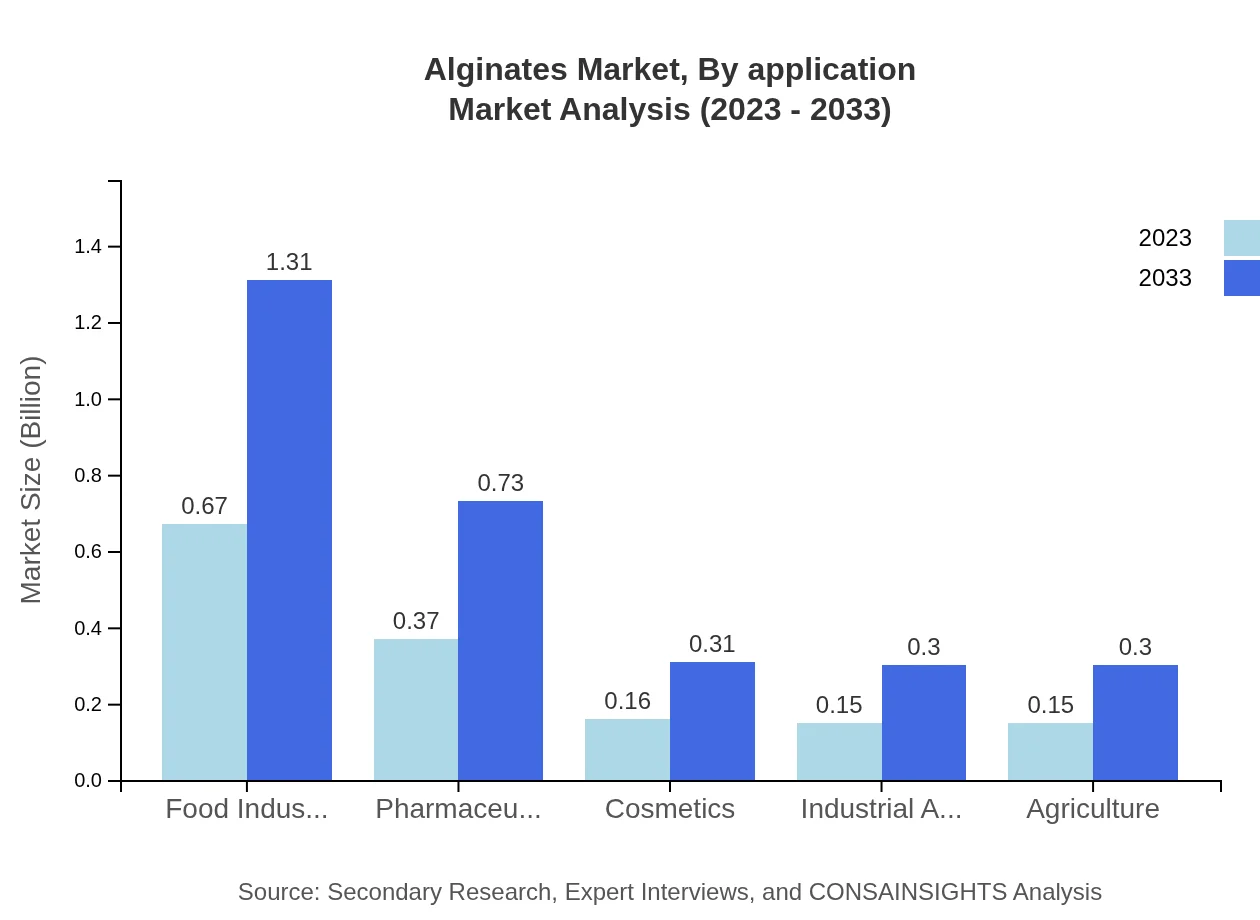

Alginates Market Analysis By Application

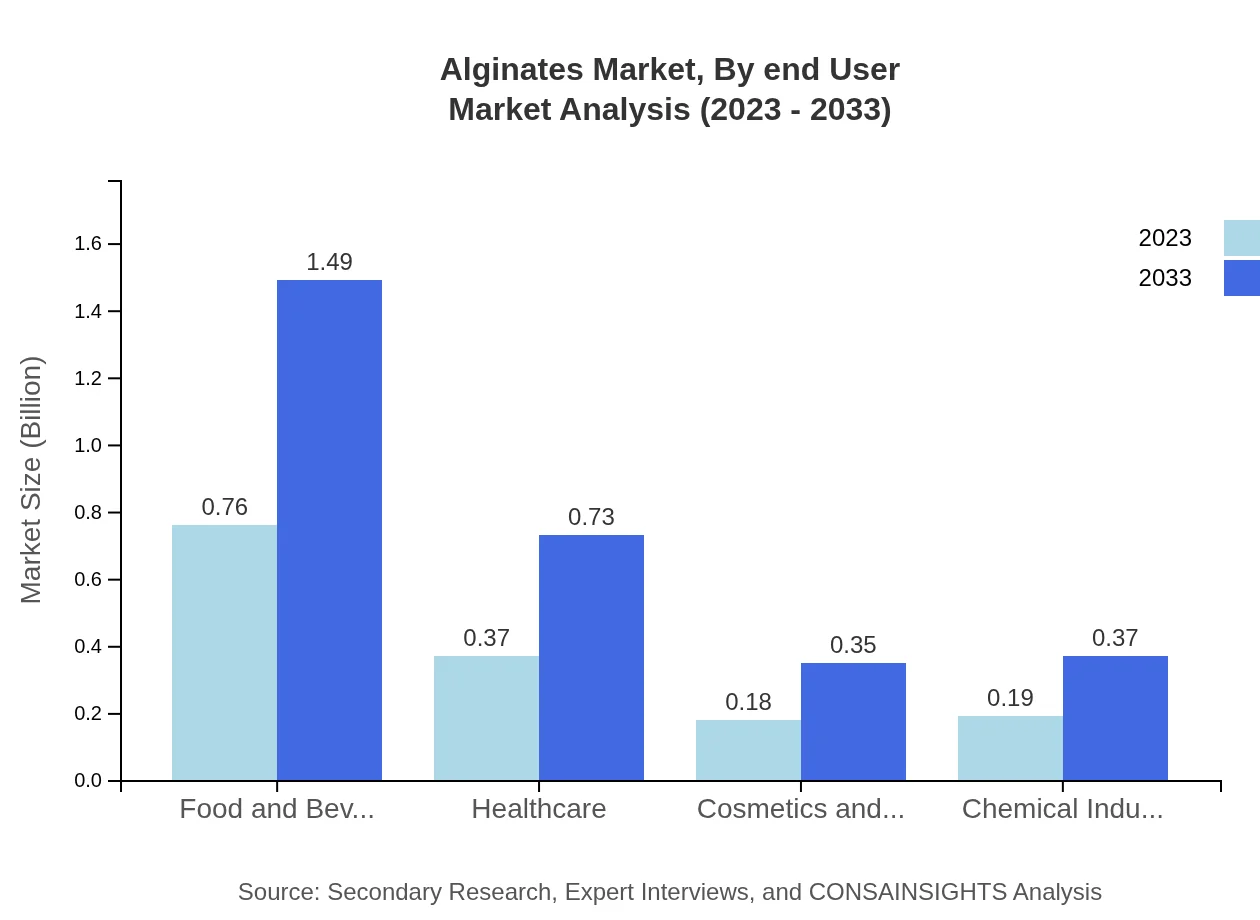

The food and beverage industry remains the largest application segment with a size of $0.76 billion in 2023 and poised to reach $1.49 billion by 2033. Pharmaceuticals and healthcare follow, with significant growth opportunities as alginates are adopted in drug delivery systems and medical devices. Cosmetics also present a growing segment, reflecting the trend towards natural formulations.

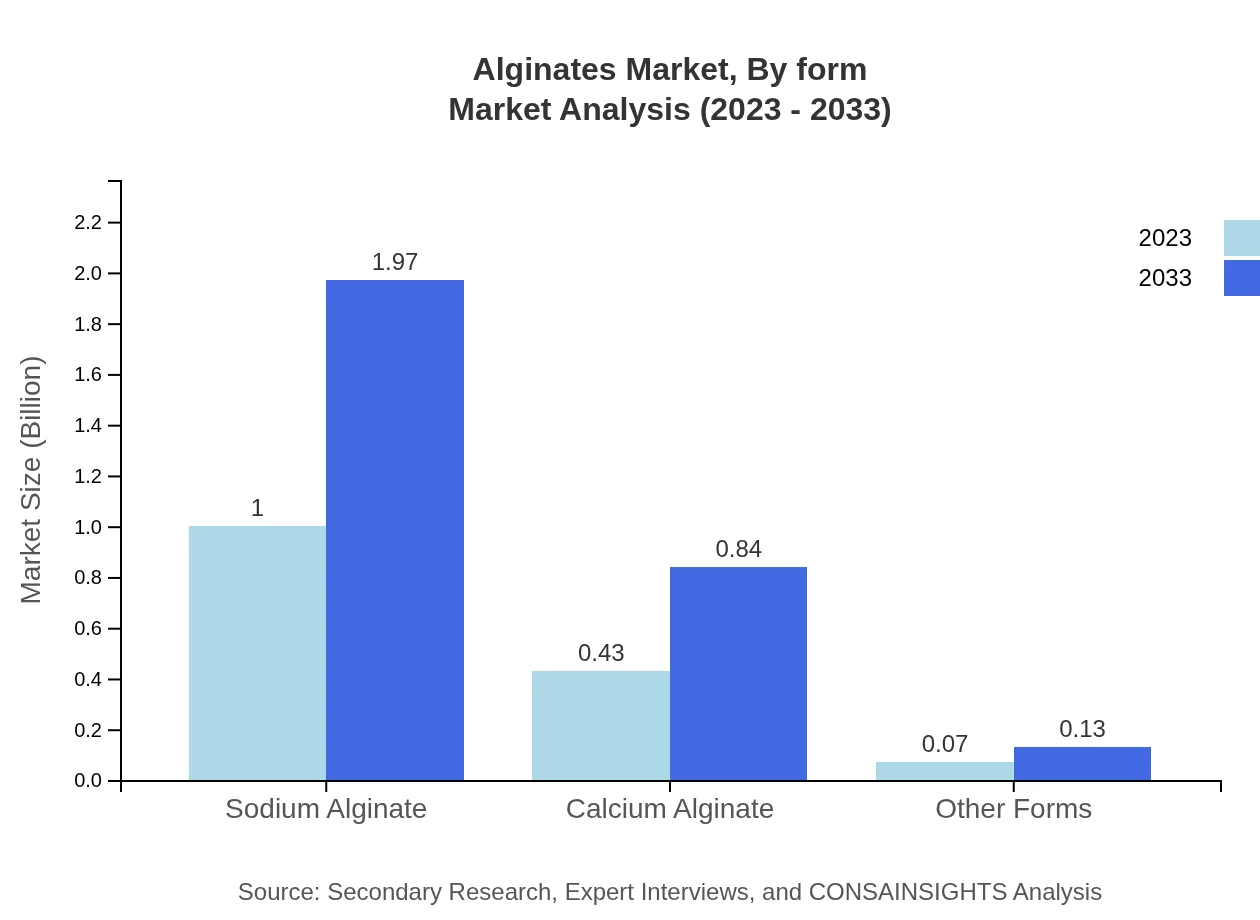

Alginates Market Analysis By Form

Sodium alginate dominates the market by form with a size of $1.00 billion in 2023, expected to grow to $1.97 billion by 2033, due to its versatility. Calcium alginate and other forms also play significant roles, with calcium alginate projected to grow from $0.43 billion to $0.84 billion over the same period.

Alginates Market Analysis By End User

End-user industries span several sectors, with food and beverage accounting for the largest share at 50.6% in 2023. Healthcare follows closely, representing 24.81%, while cosmetics, industrial applications, and agriculture also contribute to the overall market dynamics.

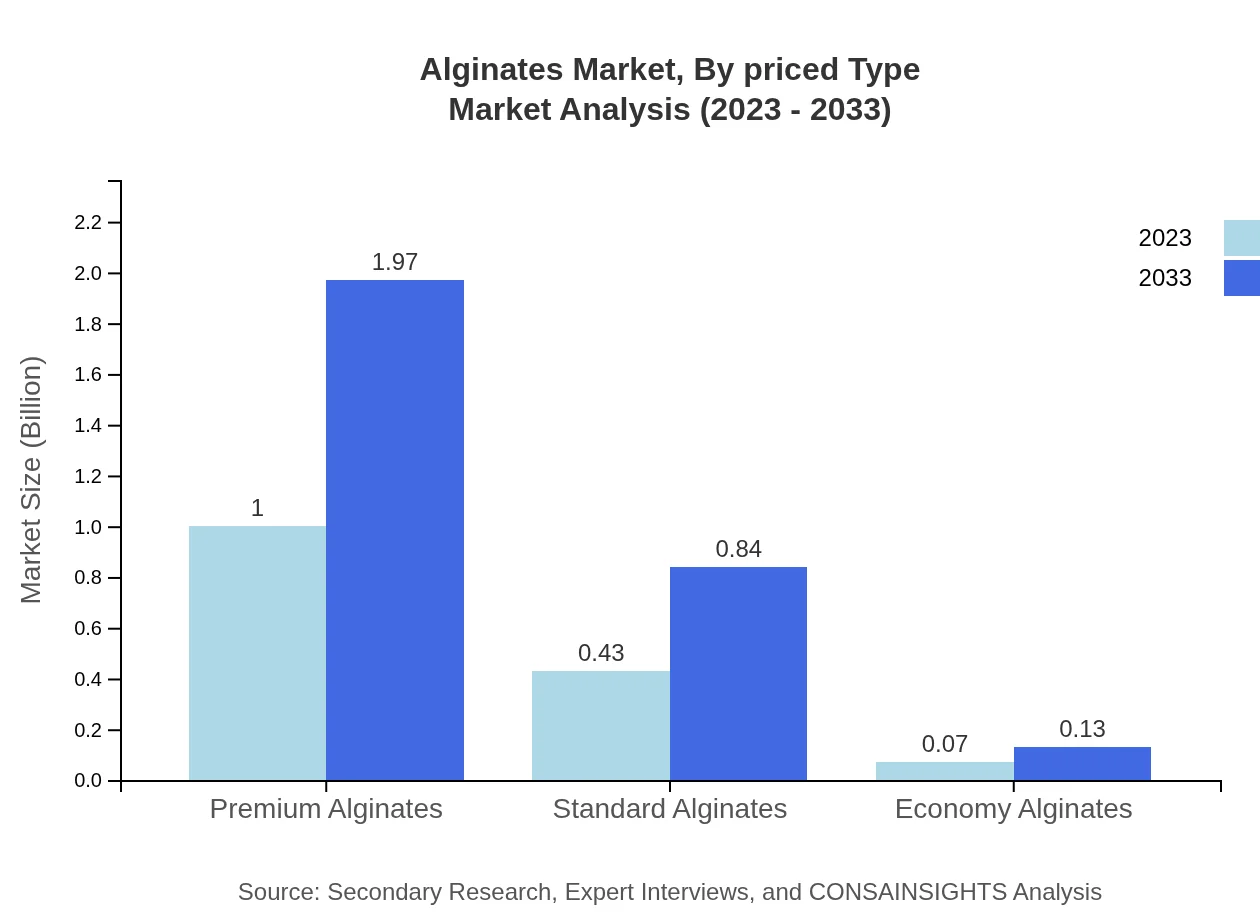

Alginates Market Analysis By Priced Type

The price segment is classified into premium, standard, and economy alginates, where premium alginates account for the largest share of 66.88% in 2023. Standard alginates hold 28.59%, reflecting stable demand across multiple applications.

Alginates Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alginates Industry

KIMICA Corporation:

A Japan-based leader in alginates production, KIMICA Corporation specializes in extracting alginates from brown algae and is known for its commitment to quality and sustainability.Algaia S.A.:

Based in France, Algaia S.A. is a key player in the production of algal ingredients, with a strong focus on natural and organic products catering to the food, pharmaceutical, and cosmetic sectors.DuPont:

DuPont is a diversified global leader in science and technology, providing innovative alginate solutions primarily for the food and beverage industry, with marked investments in research and development.Ingredients Solutions, Inc.:

A US-based company, Ingredients Solutions, Inc. specializes in the formulation of alginate products for a variety of applications, enhancing functionality and performance in food formulations.We're grateful to work with incredible clients.

FAQs

What is the market size of alginates?

The global alginates market was valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating robust growth and increasing demand across various industries.

What are the key market players or companies in this alginates industry?

Key players in the alginates market include major companies such as DuPont, KIMICA Corporation, and ISP (International Specialty Products), which are renowned for their innovative products and extensive distribution networks.

What are the primary factors driving the growth in the alginates industry?

Growth in the alginates industry is primarily driven by increasing demand in food and beverage, healthcare, and pharmaceuticals, alongside favorable properties such as thickening, gelling, and stabilizing.

Which region is the fastest Growing in the alginates?

The Asia Pacific region is expected to show rapid growth in the alginates market, with a market size increasing from $0.29 billion in 2023 to $0.57 billion in 2033, driven by rising population and urbanization.

Does ConsaInsights provide customized market report data for the alginates industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the alginates industry, allowing clients to obtain insights that meet their specific research and business needs.

What deliverables can I expect from this alginates market research project?

Deliverables from the alginates market research project typically include detailed market analysis, regional insights, growth projections, competitive landscape assessments, and market trends summaries.

What are the market trends of alginates?

Market trends in the alginates sector indicate a rising demand for sustainable and natural food additives, increased investment in research and development, and higher application of alginates in emerging industries such as biotechnology.