Aliphatic Hydrocarbon Solvents And Thinners Market Report

Published Date: 02 February 2026 | Report Code: aliphatic-hydrocarbon-solvents-and-thinners

Aliphatic Hydrocarbon Solvents And Thinners Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aliphatic Hydrocarbon Solvents and Thinners market, covering market size, segment analysis, regional insights, and future forecasts from 2023 to 2033.

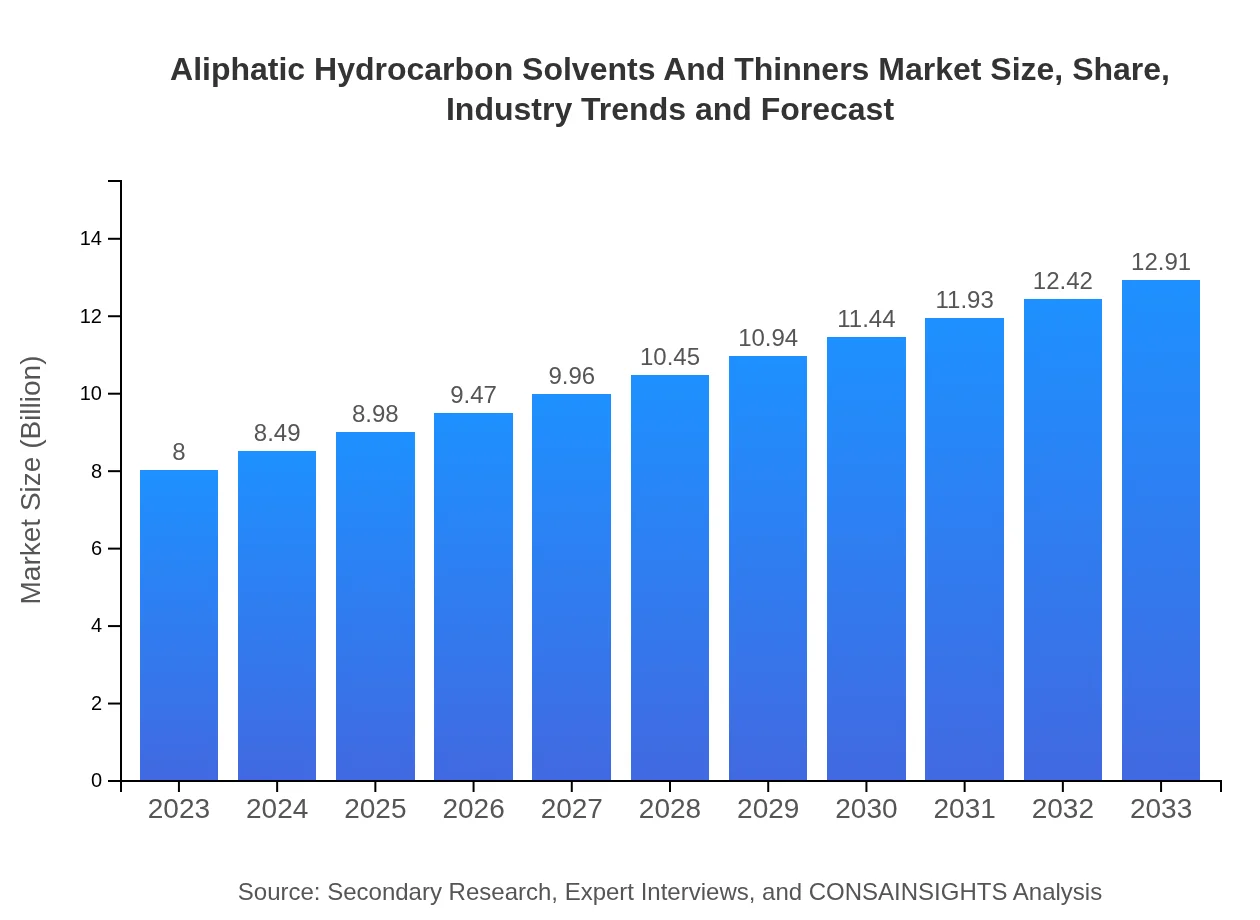

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $12.91 Billion |

| Top Companies | ExxonMobil, Shell, BASF, SABIC |

| Last Modified Date | 02 February 2026 |

Aliphatic Hydrocarbon Solvents And Thinners Market Overview

Customize Aliphatic Hydrocarbon Solvents And Thinners Market Report market research report

- ✔ Get in-depth analysis of Aliphatic Hydrocarbon Solvents And Thinners market size, growth, and forecasts.

- ✔ Understand Aliphatic Hydrocarbon Solvents And Thinners's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aliphatic Hydrocarbon Solvents And Thinners

What is the Market Size & CAGR of Aliphatic Hydrocarbon Solvents And Thinners market in 2023?

Aliphatic Hydrocarbon Solvents And Thinners Industry Analysis

Aliphatic Hydrocarbon Solvents And Thinners Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aliphatic Hydrocarbon Solvents And Thinners Market Analysis Report by Region

Europe Aliphatic Hydrocarbon Solvents And Thinners Market Report:

The European market was valued at $2.49 billion in 2023, estimated to grow to $4.02 billion by 2033. EU regulations aimed at reducing emissions and promoting the use of sustainable products are enhancing growth in this region.Asia Pacific Aliphatic Hydrocarbon Solvents And Thinners Market Report:

The Asia Pacific region has a market size of $1.45 billion in 2023, projected to reach $2.34 billion by 2033. Key drivers include rapid industrialization, increasing construction activities, and rising disposable incomes. Countries like China and India are leading in demand, supported by their expanding automotive and manufacturing sectors.North America Aliphatic Hydrocarbon Solvents And Thinners Market Report:

North America holds a significant share of the market, with a size of $3.05 billion in 2023, expected to rise to $4.92 billion by 2033. The region benefits from advanced manufacturing capabilities and stringent regulations pushing for low-VOC products, further propelling demand.South America Aliphatic Hydrocarbon Solvents And Thinners Market Report:

South America is expected to experience robust growth, starting with a market size of $0.72 billion in 2023 and reaching $1.17 billion by 2033. The region's development is primarily attributed to growth in construction and automotive industries, alongside increasing investments in infrastructure projects.Middle East & Africa Aliphatic Hydrocarbon Solvents And Thinners Market Report:

In the Middle East and Africa, the market is relatively smaller, with a size of $0.29 billion in 2023, expanding to $0.46 billion by 2033. Economic diversification and the burgeoning construction sector in countries like the UAE are prominent drivers.Tell us your focus area and get a customized research report.

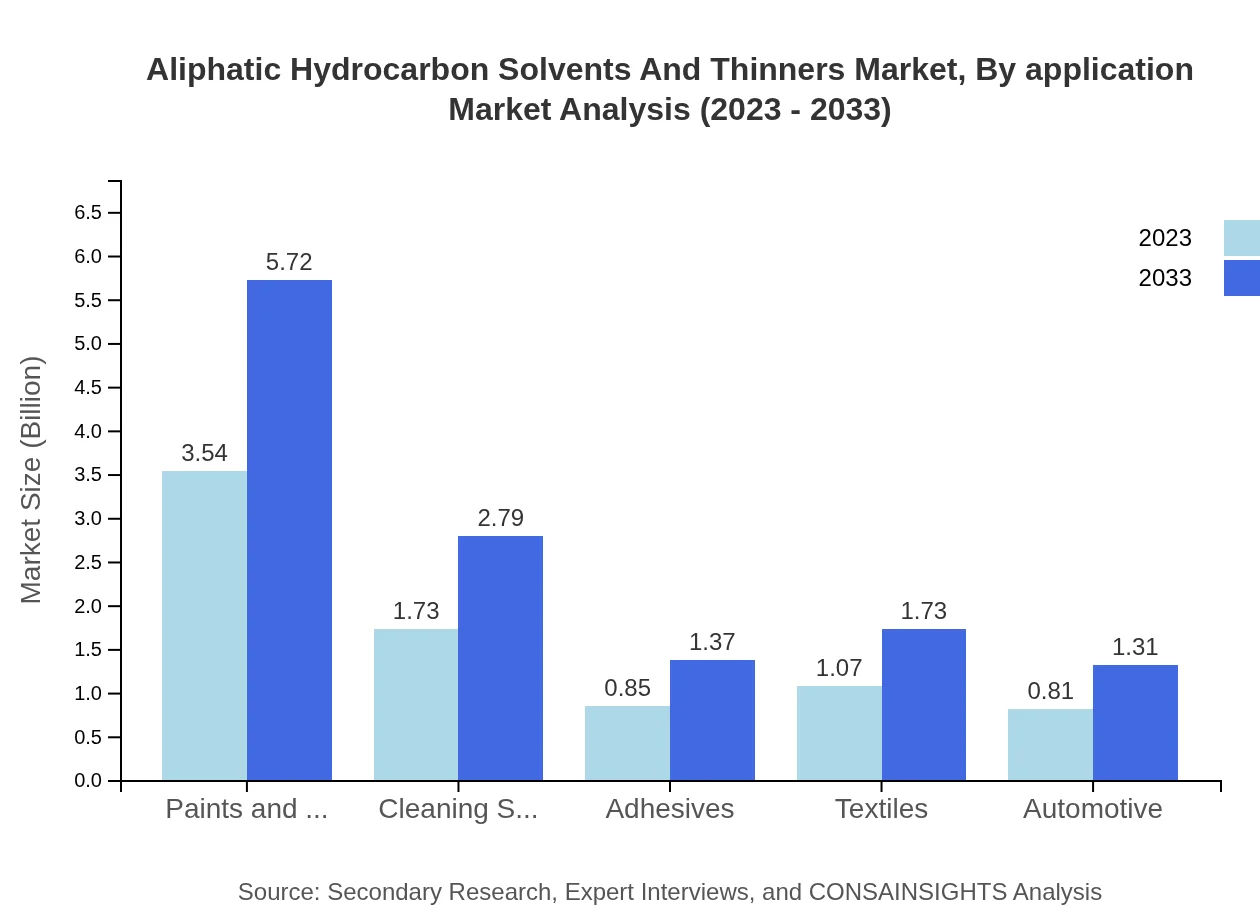

Aliphatic Hydrocarbon Solvents And Thinners Market Analysis By Application

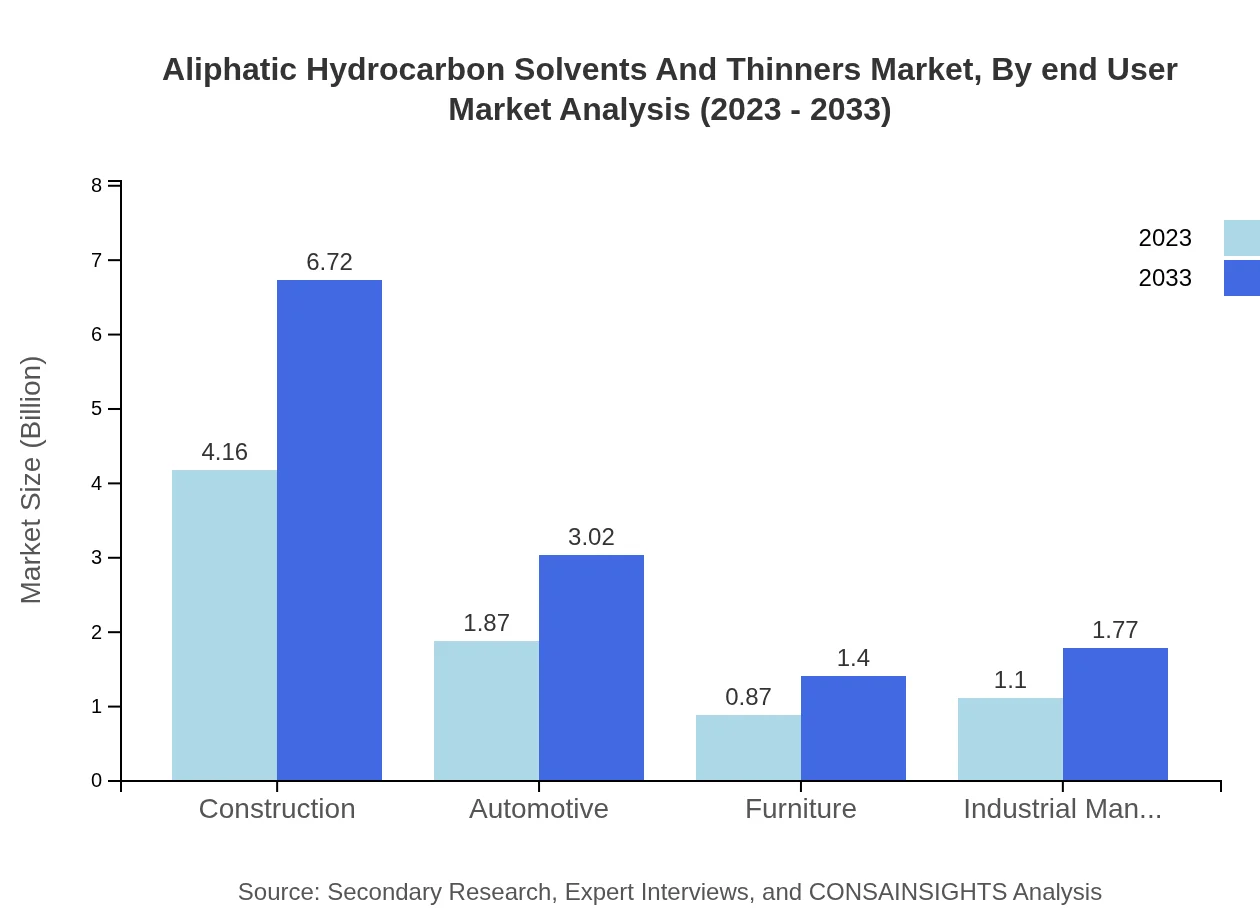

The market segmented by application shows that the construction segment dominates with a size of $4.16 billion in 2023, projected to reach $6.72 billion by 2033, holding a 52.03% market share throughout the period. Other notable applications include automotive with $1.87 billion in 2023 (23.42% share) and paints and coatings contributing $3.54 billion (44.28% share) in the same year.

Aliphatic Hydrocarbon Solvents And Thinners Market Analysis By Product Type

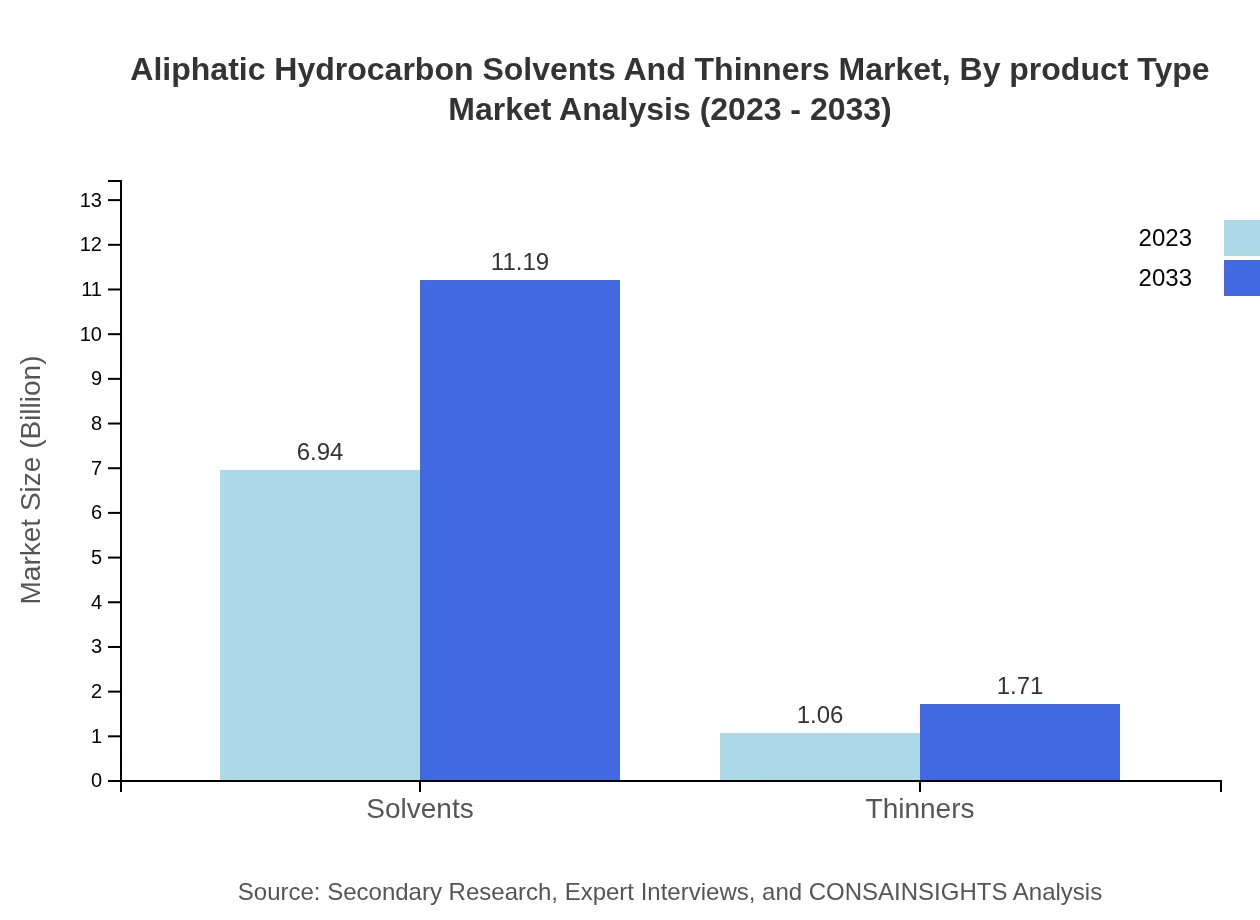

The product type analysis reveals solvents dominate with a market size of $6.94 billion in 2023 and a projection of $11.19 billion by 2033, constituting an 86.72% market share. Thinners represent the remaining segment with $1.06 billion in 2023, expected to account for $1.71 billion by 2033 (13.28% share).

Aliphatic Hydrocarbon Solvents And Thinners Market Analysis By End User

End-user analysis indicates that industries such as paints and coatings and automotive hold substantial shares, alongside strong demand from construction and furniture sectors. The paints and coatings industry alone is anticipated to generate $3.54 billion in 2023, illustrating the sector's importance.

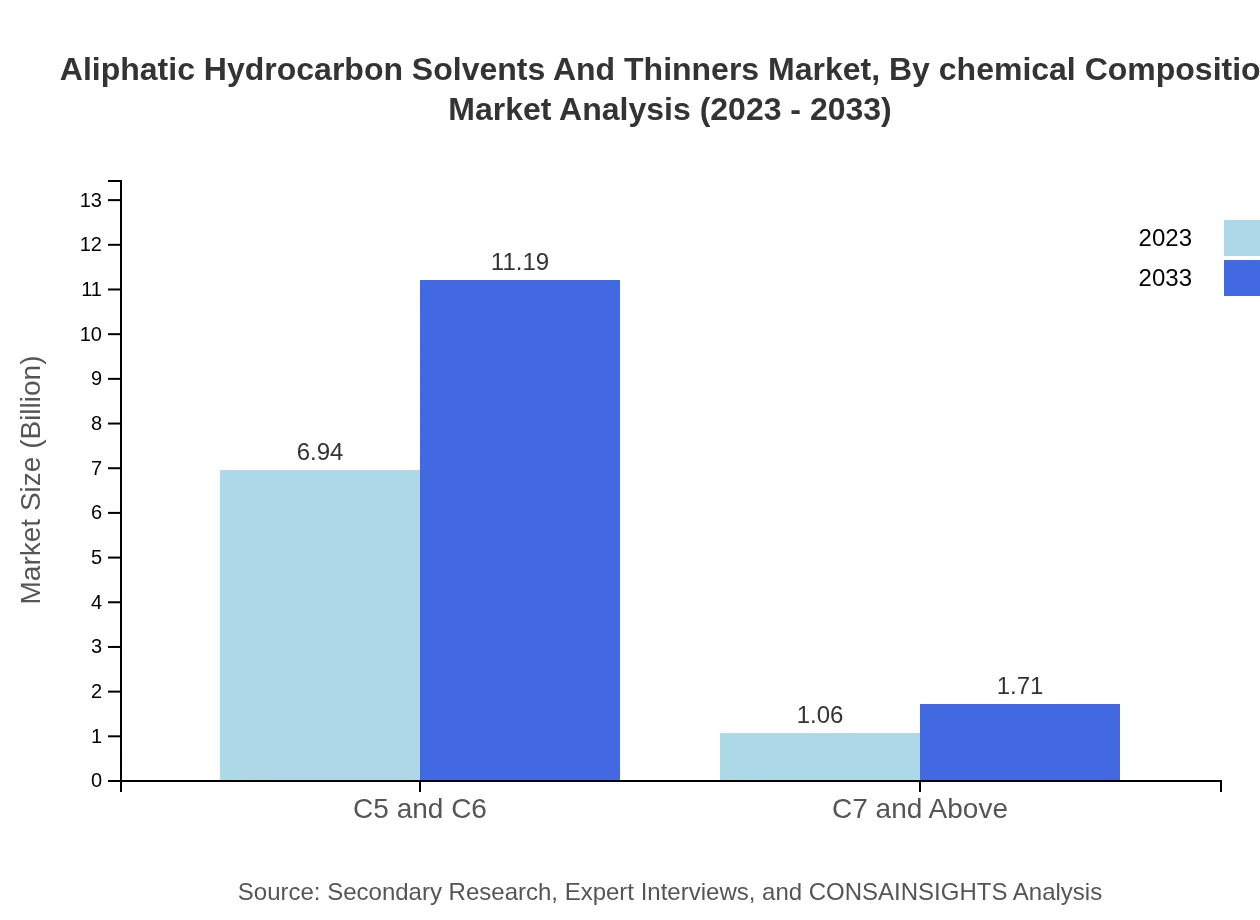

Aliphatic Hydrocarbon Solvents And Thinners Market Analysis By Chemical Composition

The market is divided between aqueous and non-aqueous solvents. Aqueous solvents dominate with a size of $6.94 billion in 2023 and projected to rise to $11.19 billion by 2033, whereas non-aqueous solvents are forecasted to grow from $1.06 billion to $1.71 billion.

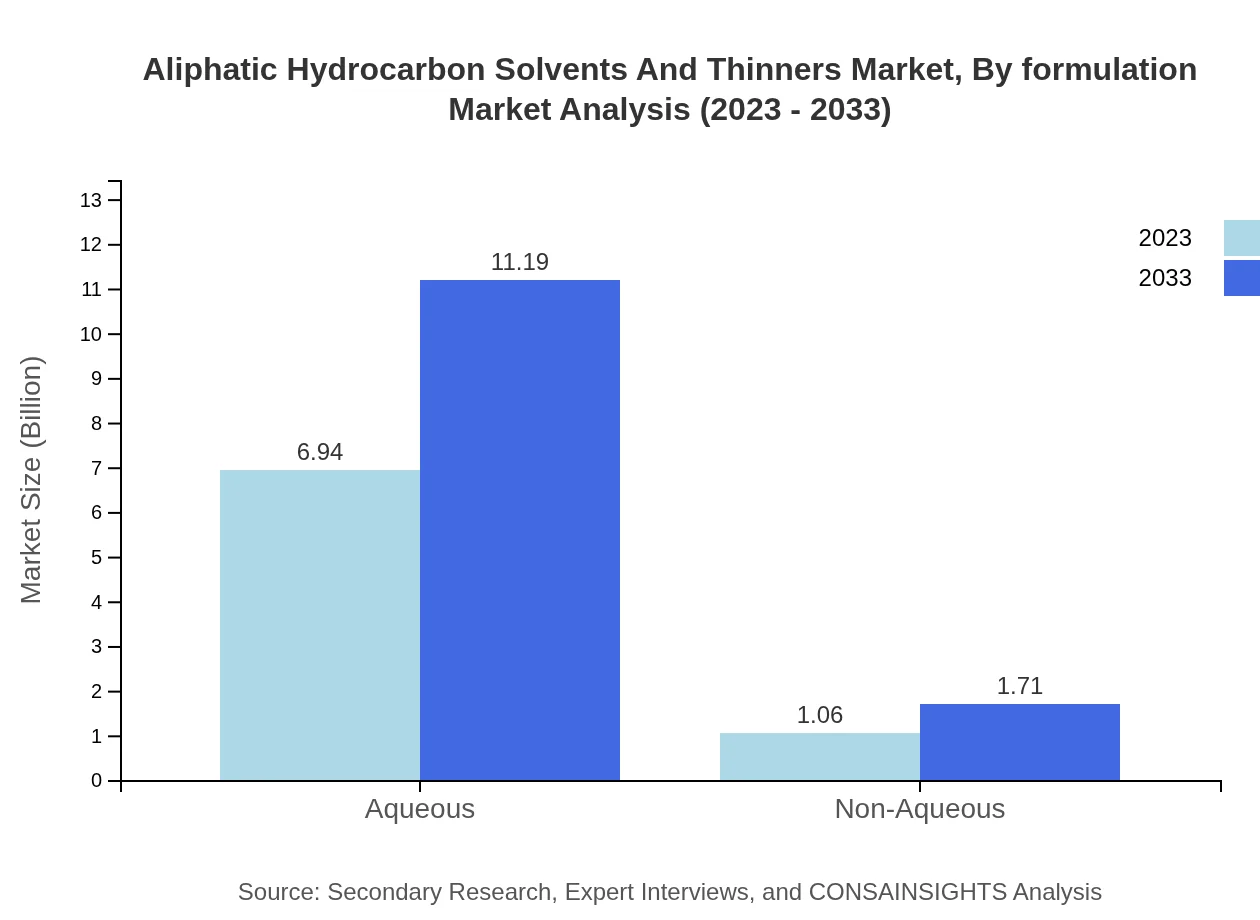

Aliphatic Hydrocarbon Solvents And Thinners Market Analysis By Formulation

Formulation categories play a key role, with varieties tailored for specific applications making up significant portions of the market. Products are being innovated to cater to the growing preference for sustainable and lower VOC formulations.

Aliphatic Hydrocarbon Solvents And Thinners Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aliphatic Hydrocarbon Solvents And Thinners Industry

ExxonMobil:

A leading player in the production of petrochemicals, ExxonMobil provides a range of high-performance aliphatic hydrocarbon solvents and thinners used in various industrial applications.Shell:

Shell is renowned for its innovative chemical solutions and sustainable products designed for use in manufacturing adhesives, coatings, and other industrial applications.BASF:

A global chemical company, BASF offers a wide portfolio of aliphatic hydrocarbon solvents and thinners that cater to diverse industry needs while complying with environmental regulations.SABIC:

SABIC is known for its advanced materials and solutions, including a significant range of aliphatic hydrocarbon solvents, stressing sustainability in its production processes.We're grateful to work with incredible clients.

FAQs

What is the market size of aliphatic Hydrocarbon Solvents And Thinners?

The aliphatic hydrocarbon solvents and thinners market is projected to reach approximately $8 billion by 2033, with a compound annual growth rate (CAGR) of 4.8%. This growth is driven by increasing demand across various sectors.

What are the key market players or companies in the aliphatic Hydrocarbon Solvents And Thinners industry?

Key players in the aliphatic hydrocarbon solvents and thinners market include multinational chemical companies, manufacturers specializing in solvents, and suppliers serving various industries like automotive, construction, and paints.

What are the primary factors driving the growth in the aliphatic Hydrocarbon Solvents And Thinners industry?

Major growth drivers include the rising demand for environmentally friendly solvents, increased industrial production, regulatory support for safer chemical products, and the expanding automotive and construction sectors.

Which region is the fastest Growing in the aliphatic Hydrocarbon Solvents And Thinners?

The fastest-growing region for aliphatic hydrocarbon solvents and thinners is North America, with an increase from $3.05 billion in 2023 to $4.92 billion by 2033. Asia Pacific and Europe also demonstrate significant growth potential.

Does ConsaInsights provide customized market report data for the aliphatic Hydrocarbon Solvents And Thinners industry?

Yes, ConsaInsights offers customized market reports tailored to specific business needs, providing in-depth analysis and insights into the aliphatic hydrocarbon solvents and thinners market.

What deliverables can I expect from this aliphatic Hydrocarbon Solvents And Thinners market research project?

Deliverables typically include comprehensive market analysis, trends assessment, segmentation data, competitive landscape insights, and detailed forecasts for various regional and product categories.

What are the market trends of aliphatic Hydrocarbon Solvents And Thinners?

Current trends include a shift towards eco-friendly solvent formulations, increased adoption in the paints and coatings industry, and a focus on sustainable practices across manufacturing sectors.