Alkyd Coatings Market Report

Published Date: 02 February 2026 | Report Code: alkyd-coatings

Alkyd Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the alkyd coatings market from 2023 to 2033, covering market size, growth forecasts, regional segments, industry insights, and key players in the industry.

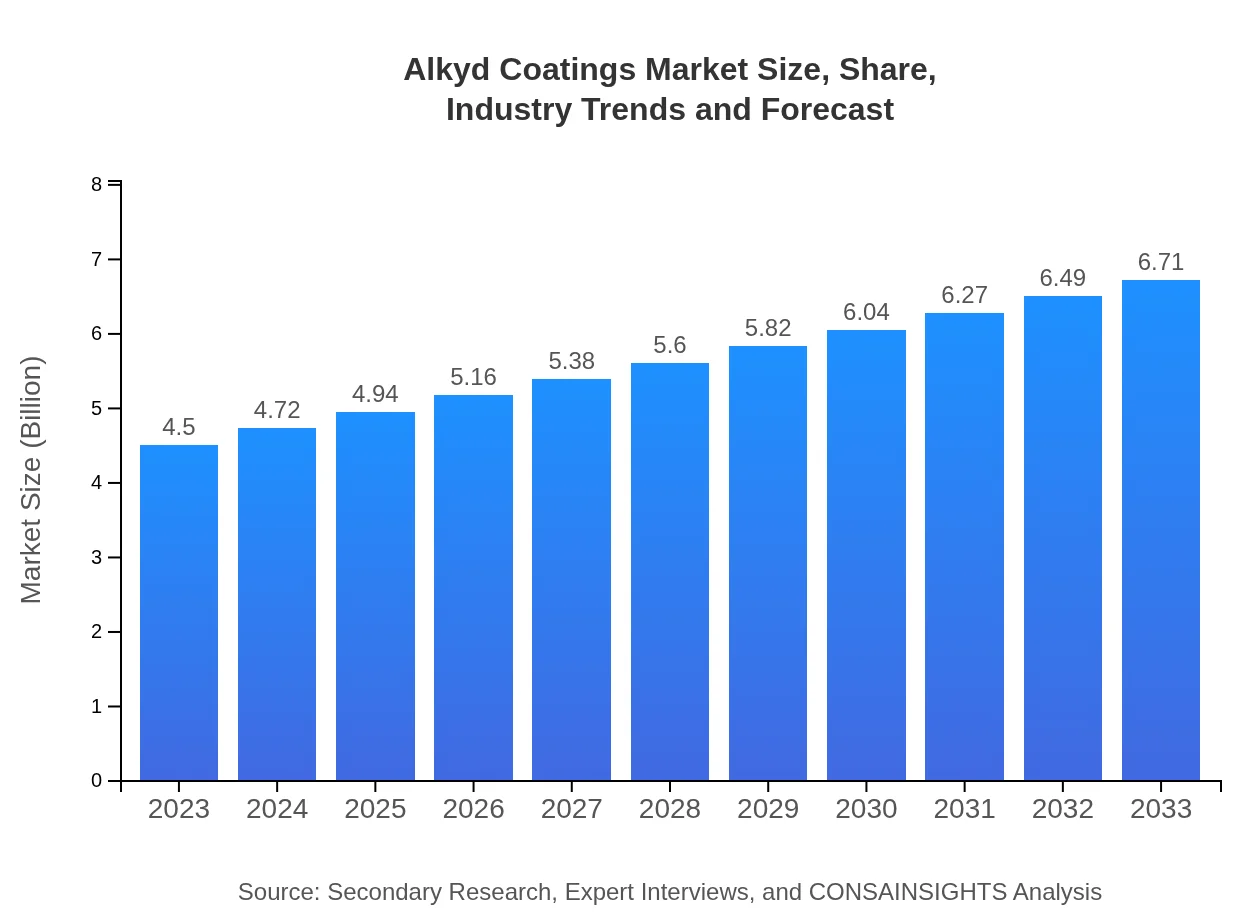

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 4.0% |

| 2033 Market Size | $6.71 Billion |

| Top Companies | AkzoNobel, BASF SE, PPG Industries, Sherwin-Williams |

| Last Modified Date | 02 February 2026 |

Alkyd Coatings Market Overview

Customize Alkyd Coatings Market Report market research report

- ✔ Get in-depth analysis of Alkyd Coatings market size, growth, and forecasts.

- ✔ Understand Alkyd Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alkyd Coatings

What is the Market Size & CAGR of Alkyd Coatings market in 2023?

Alkyd Coatings Industry Analysis

Alkyd Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alkyd Coatings Market Analysis Report by Region

Europe Alkyd Coatings Market Report:

Europe's alkyd coatings market is estimated to increase from $1.23 billion in 2023 to $1.84 billion by 2033. Regulatory changes focused on sustainability and the reduction of solvent-based products are driving innovations in the region.Asia Pacific Alkyd Coatings Market Report:

The Asia Pacific region is projected to exhibit significant growth, with a market value expected to rise from $0.90 billion in 2023 to $1.34 billion by 2033. The expansion is driven by increasing construction activities and growing demand for automotive coatings in countries like China and India.North America Alkyd Coatings Market Report:

North America is expected to see robust growth, with market values escalating from $1.68 billion in 2023 to $2.51 billion by 2033. The region's growth is supported by the strong presence of automotive and construction sectors, alongside increasing incorporation of eco-friendly products.South America Alkyd Coatings Market Report:

In South America, the alkyd coatings market is anticipated to grow from $0.45 billion in 2023 to $0.67 billion by 2033. The growth is primarily driven by rising investments in infrastructure and construction projects amid urbanization trends.Middle East & Africa Alkyd Coatings Market Report:

In the Middle East and Africa, the market is expected to show moderate growth from $0.24 billion in 2023 to $0.35 billion by 2033. Growth factors include diverse applications in construction and improvements in manufacturing capabilities.Tell us your focus area and get a customized research report.

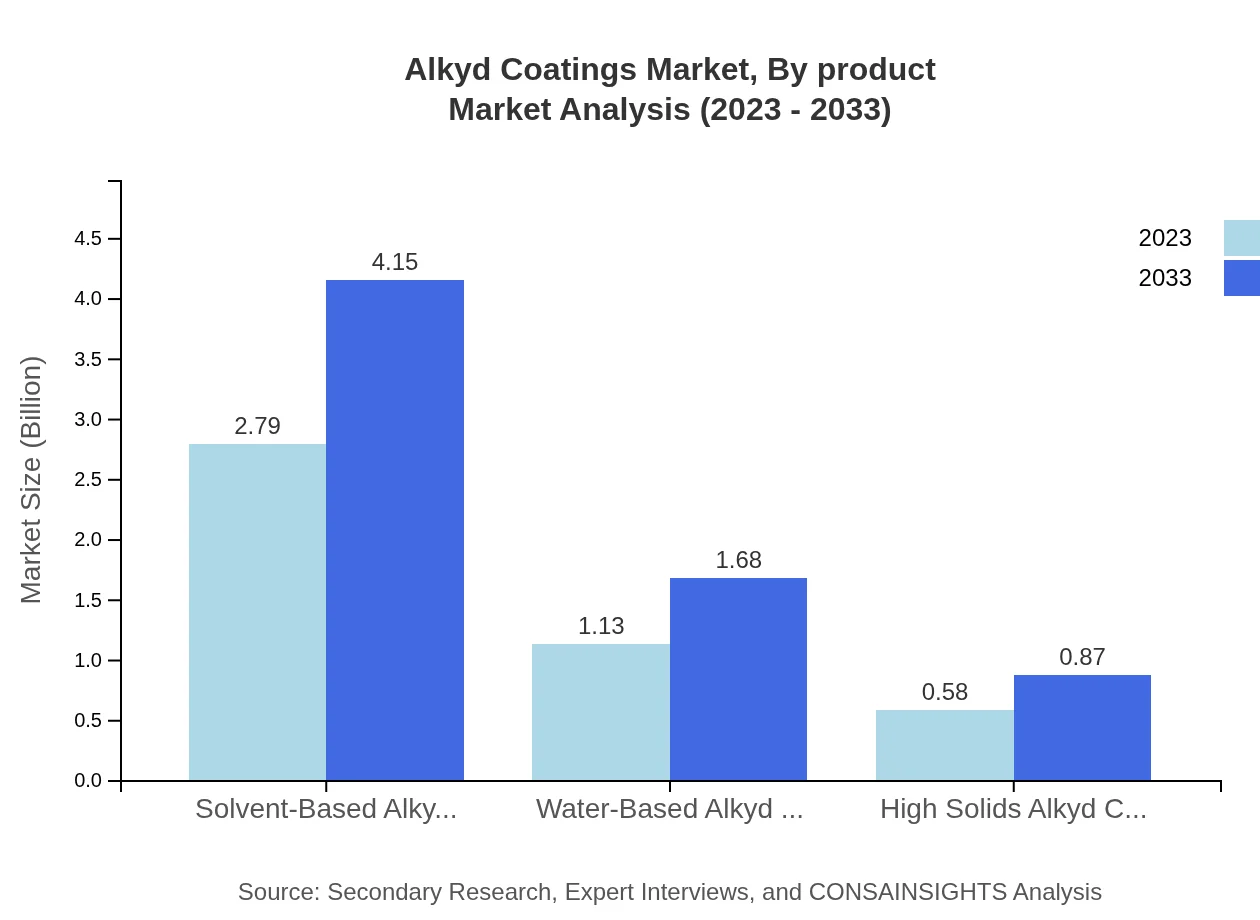

Alkyd Coatings Market Analysis By Product

Solvent-based alkyd coatings dominate the market with an estimated value of $2.79 billion in 2023, projected to grow to $4.15 billion by 2033. Water-based and high solids coatings are gaining traction due to regulatory pressures, with respective market values increasing from $1.13 billion to $1.68 billion and from $0.58 billion to $0.87 billion during the same period.

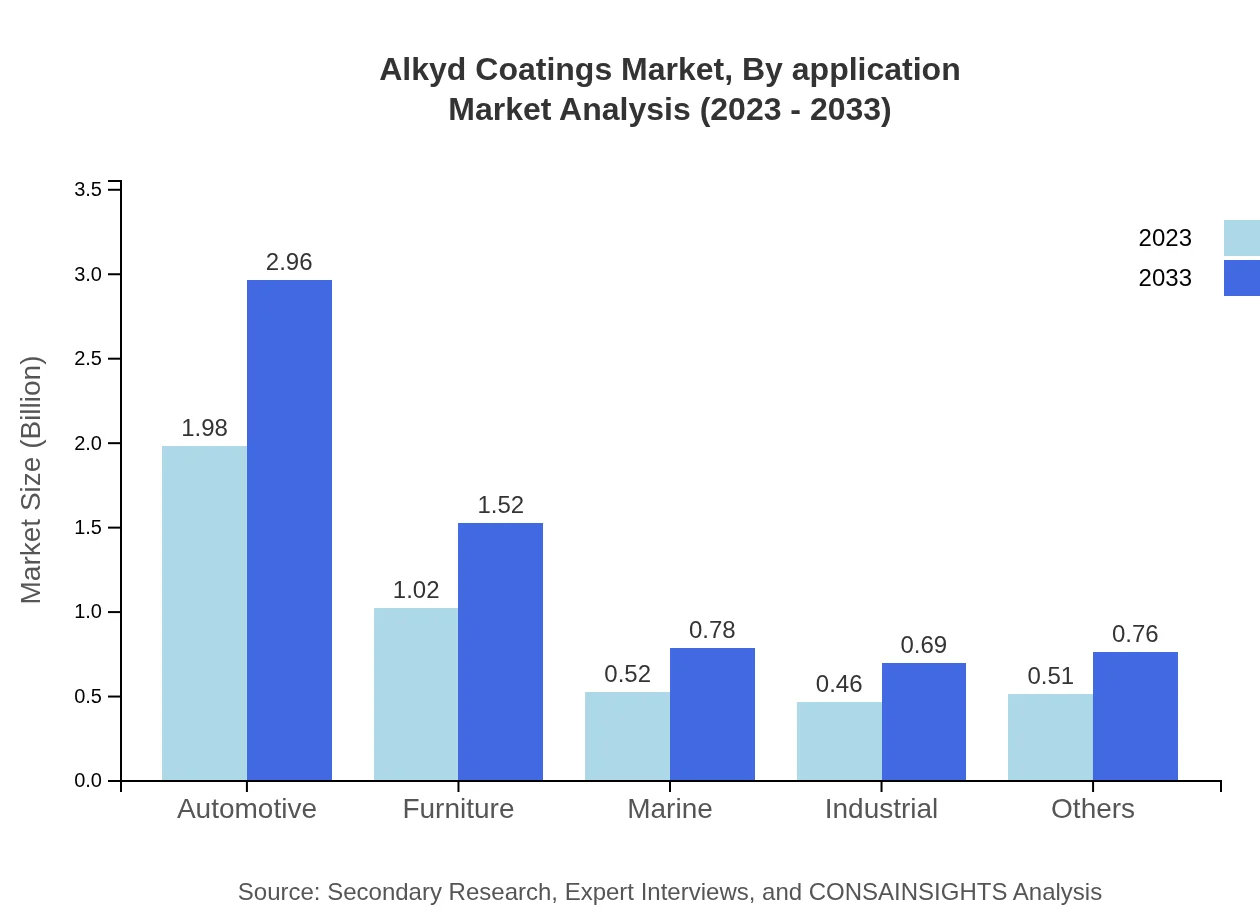

Alkyd Coatings Market Analysis By Application

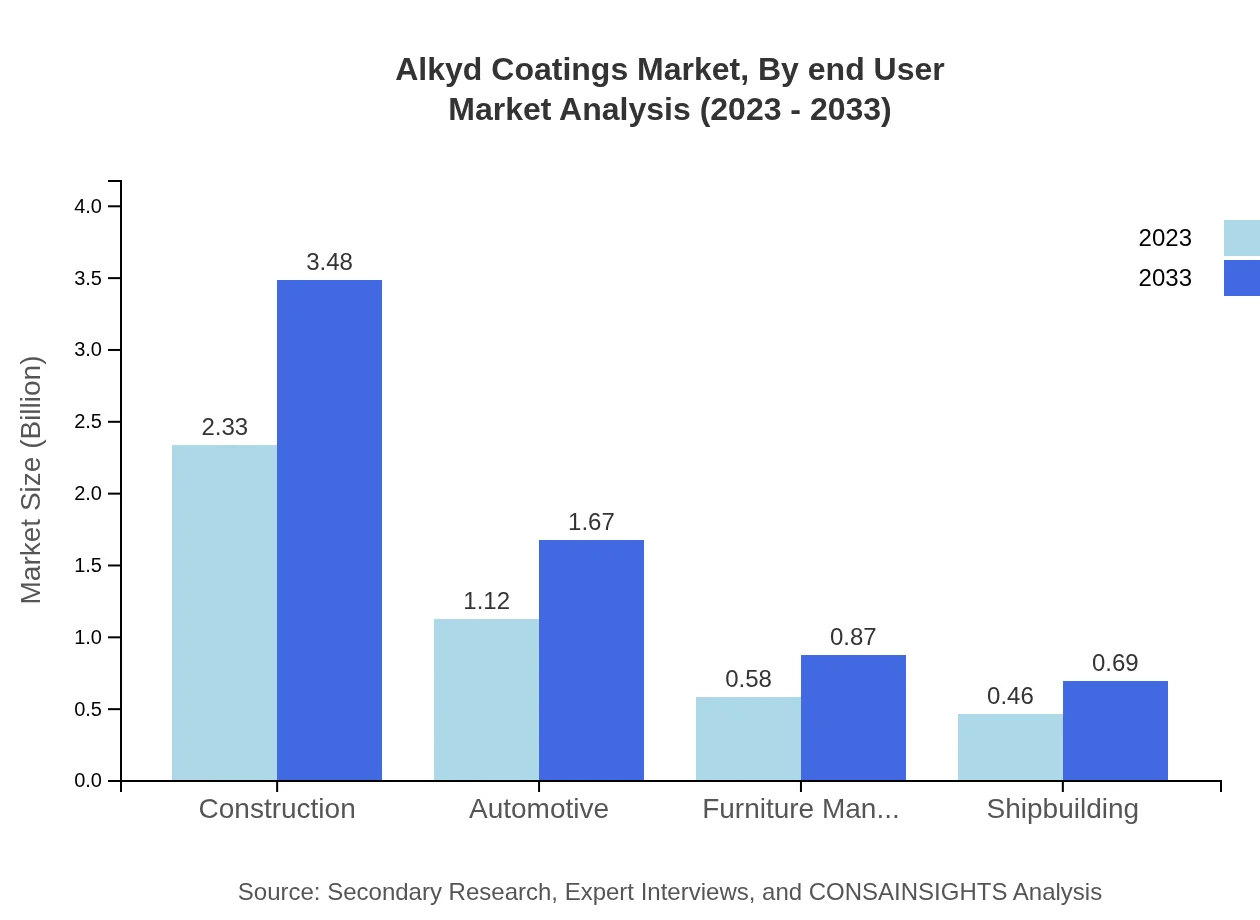

The construction sector is the largest end-use industry for alkyd coatings, accounting for approximately $2.33 billion in 2023, growing to $3.48 billion by 2033. The automotive sector holds a significant share as well, with figures projected to rise from $1.12 billion to $1.67 billion. Furniture manufacturing and shipbuilding also constitute important segments.

Alkyd Coatings Market Analysis By End User

Key end-user industries for alkyd coatings include construction, automotive, furniture manufacturers, industrial applications, and marine sectors. The construction industry is expected to maintain its dominance, while increasing applications in automotive and furniture manufacturing will foster further growth in these areas.

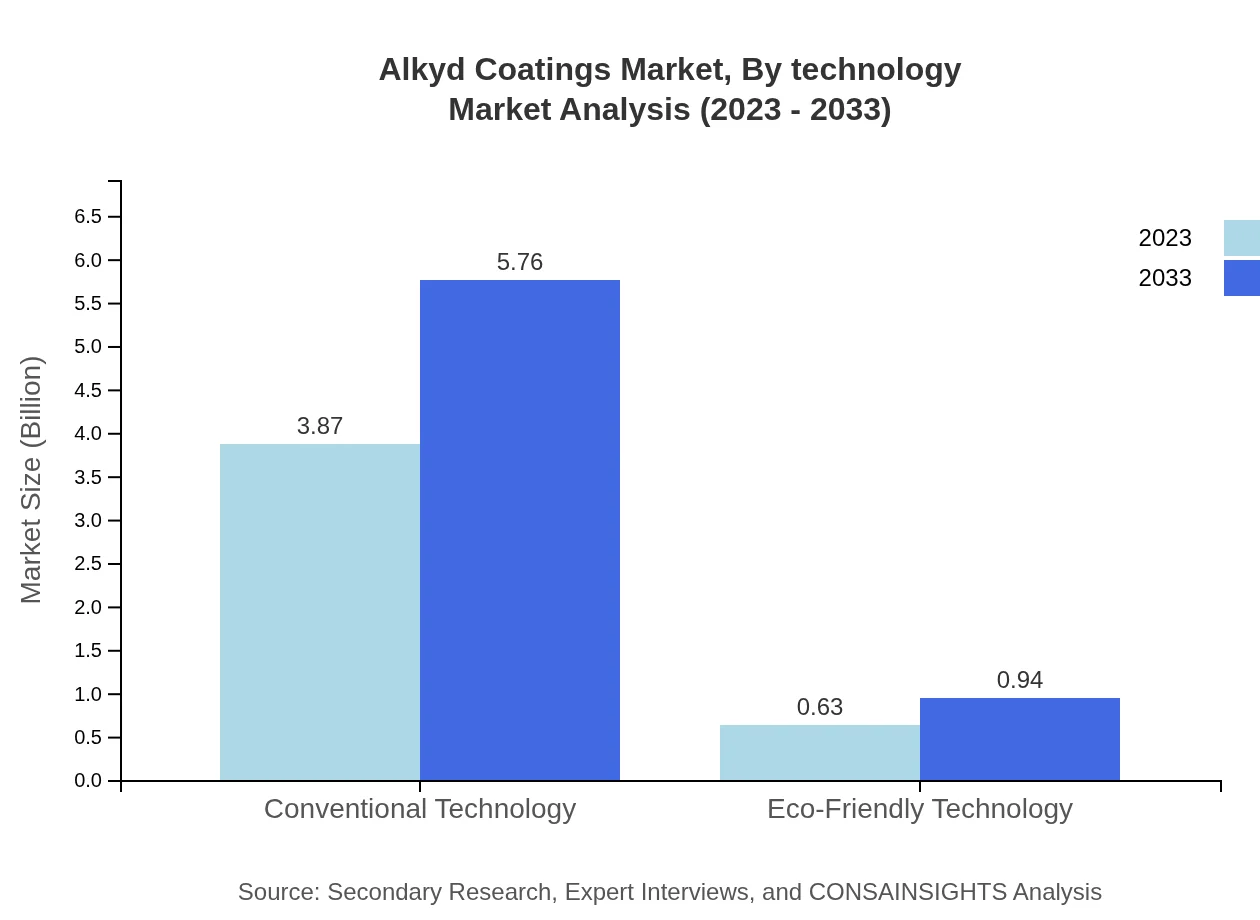

Alkyd Coatings Market Analysis By Technology

The conventional technology segment is leading the market, with expected revenues from $3.87 billion in 2023 growing to $5.76 billion by 2033. The eco-friendly technology segment is seeing steady growth with market numbers expected to reach $0.94 billion by 2033.

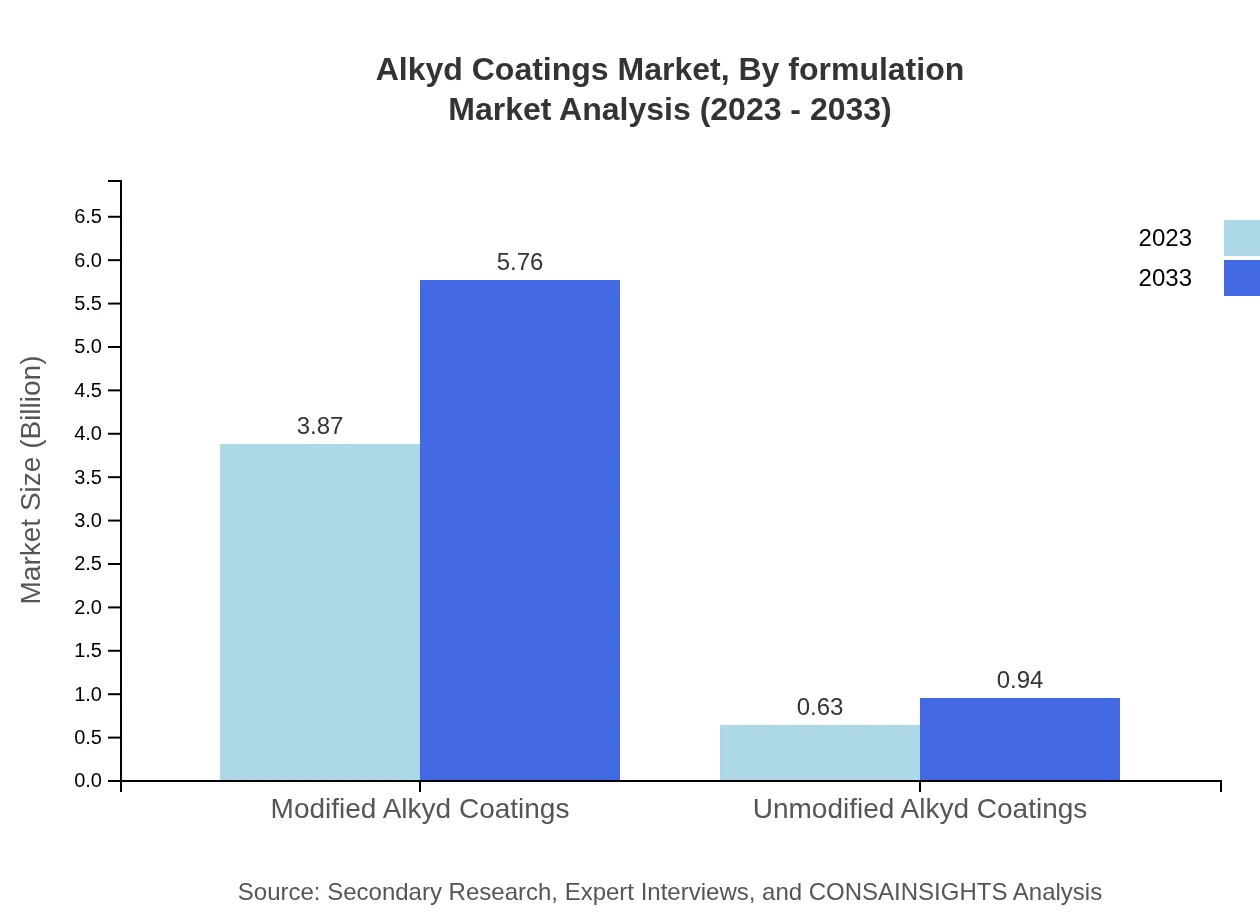

Alkyd Coatings Market Analysis By Formulation

Alkyd coatings are primarily formulated for specific applications, with modified alkyd coatings dominating the market due to their enhanced properties. The market for unmodified alkyd coatings, while smaller, is expected to see growth driven by cost-effectiveness and versatility.

Alkyd Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alkyd Coatings Industry

AkzoNobel:

A leading global manufacturer of paints and coatings, AkzoNobel offers a variety of alkyd coatings known for durability and performance in multiple applications.BASF SE:

BASF is a prominent player in the specialty chemicals sector with a strong portfolio in alkyd coatings, focusing on sustainability and innovative solutions.PPG Industries:

PPG is renowned for its high-quality coatings, providing innovative alkyd products that cater to diverse industrial needs.Sherwin-Williams:

A major player in the coatings sector, Sherwin-Williams manufactures a wide range of alkyd coatings that are well-regarded for their protective qualities.We're grateful to work with incredible clients.

FAQs

What is the market size of alkyd coatings?

The global alkyd coatings market is currently valued at approximately $4.5 billion, showing a steady growth with a compound annual growth rate (CAGR) of 4.0%. This indicates a robust demand in various application segments across the industry.

What are the key market players or companies in the alkyd coatings industry?

Key players in the alkyd coatings market include renowned companies such as PPG Industries, AkzoNobel, Sherwin-Williams, and BASF. These companies dominate the market through innovation, a wide product range, and significant investments in research and development.

What are the primary factors driving the growth in the alkyd coatings industry?

Several factors drive the growth of the alkyd coatings industry, including increasing construction activities, rising automotive production, and growing demand for eco-friendly products. The robustness of alkyd coatings in terms of durability and aesthetics also supports their widespread application.

Which region is the fastest Growing in the alkyd coatings market?

North America stands out as the fastest-growing region in the alkyd coatings market, with a market size projected to increase from $1.68 billion in 2023 to $2.51 billion by 2033. Other growing regions include Asia Pacific and Europe, as demand rises.

Does ConsaInsights provide customized market report data for the alkyd coatings industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients within the alkyd coatings industry. This includes specific market insights, forecasts, and segment analysis that cater to unique business requirements.

What deliverables can I expect from this alkyd coatings market research project?

From the alkyd coatings market research project, you can expect comprehensive deliverables such as detailed market analysis, segmentation data, growth forecasts, and insights on key players, helping you make informed strategic decisions.

What are the market trends of alkyd coatings?

Current trends in the alkyd coatings market highlight a shift towards eco-friendly and high solid formulations, as well as increasing demand in the construction and automotive sectors. The market continues to evolve with innovations focusing on sustainability.