Alkylamines Market Report

Published Date: 02 February 2026 | Report Code: alkylamines

Alkylamines Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Alkylamines market, encompassing trends, drivers, and challenges from 2023 to 2033. It presents data on market size, growth rates, regional insights, industry analysis, and forecasts, helping stakeholders make informed decisions.

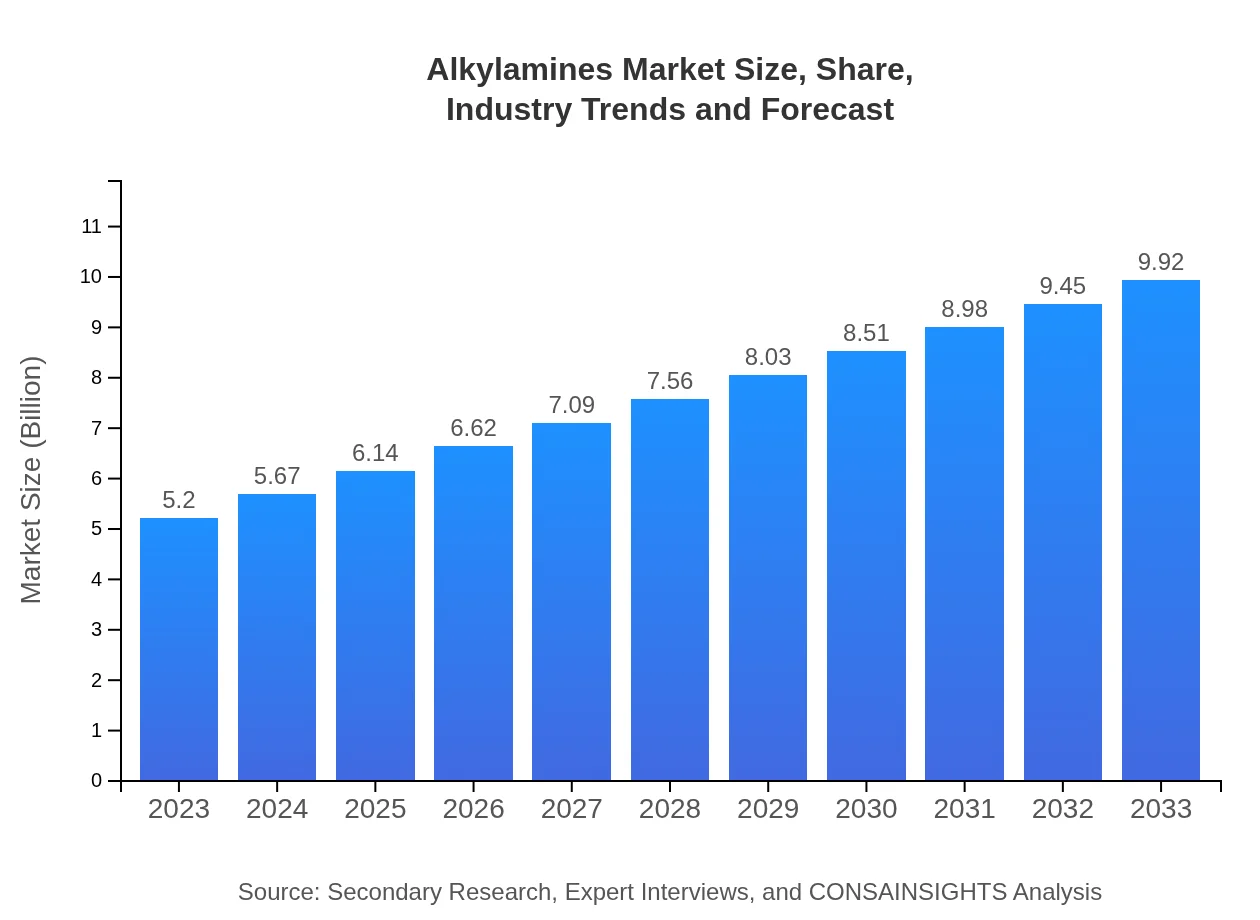

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $9.92 Billion |

| Top Companies | BASF SE, Dow Chemical Company, AkzoNobel N.V., Eastman Chemical Company |

| Last Modified Date | 02 February 2026 |

Alkylamines Market Overview

Customize Alkylamines Market Report market research report

- ✔ Get in-depth analysis of Alkylamines market size, growth, and forecasts.

- ✔ Understand Alkylamines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alkylamines

What is the Market Size & CAGR of Alkylamines market in 2023 and 2033?

Alkylamines Industry Analysis

Alkylamines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alkylamines Market Analysis Report by Region

Europe Alkylamines Market Report:

Europe's Alkylamines market was valued at $1.61 billion in 2023, expected to double to $3.07 billion by 2033. Regulatory frameworks backing chemical safety and environmental sustainability, coupled with strong demand in agrochemicals and pharmaceuticals, boost market growth.Asia Pacific Alkylamines Market Report:

The Asia Pacific region represented a market worth $1.02 billion in 2023, projected to grow to $1.94 billion by 2033. Rapid industrialization in countries like China and India, coupled with increasing agricultural activities, primarily drives this growth. Moreover, the expansion of pharmaceutical and textiles industries in this region remains significant.North America Alkylamines Market Report:

North America had a market size of $1.74 billion in 2023, projected to expand to $3.32 billion by 2033. The robust chemical manufacturing sector and high demand for pharmaceuticals are key drivers. Additionally, environmentally sustainable products and solutions in agriculture are shaping market evolution in this region.South America Alkylamines Market Report:

In South America, the Alkylamines market was valued at $0.41 billion in 2023 and is expected to reach $0.78 billion by 2033. Factors contributing to this growth include rising agricultural production and increasing investments in chemical manufacturing, particularly in Brazil and Argentina.Middle East & Africa Alkylamines Market Report:

The Middle East and Africa market stood at $0.42 billion in 2023, forecasted to grow to $0.80 billion by 2033. Increased agricultural production and emerging manufacturing capabilities in countries like South Africa are expected to uplift market performance in this region.Tell us your focus area and get a customized research report.

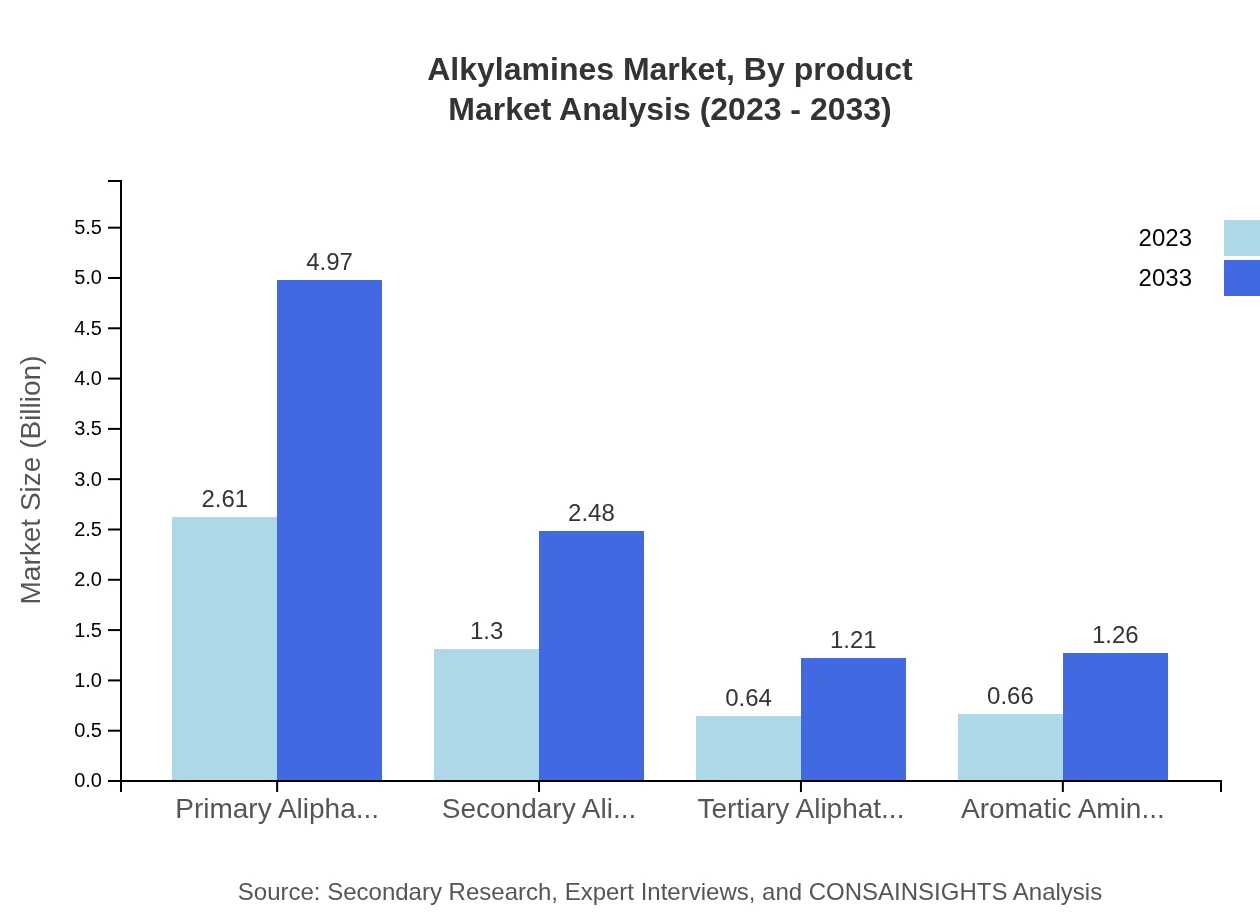

Alkylamines Market Analysis By Product

The Alkylamines market can be broadly categorized into primary aliphatic amines, secondary aliphatic amines, tertiary aliphatic amines, and aromatic amines. In 2023, primary aliphatic amines captured the largest market share at 50.1%, with a market size of $2.61 billion. This is expected to grow to $4.97 billion by 2033. Secondary aliphatic amines also hold a substantial position, representing a market size of $1.30 billion in 2023 and projected to reach $2.48 billion by 2033. The tertiary and aromatic amines, though smaller segments, are vital for specific industrial applications. Overall, each segment demonstrates healthy growth projections due to their integral roles in various applications.

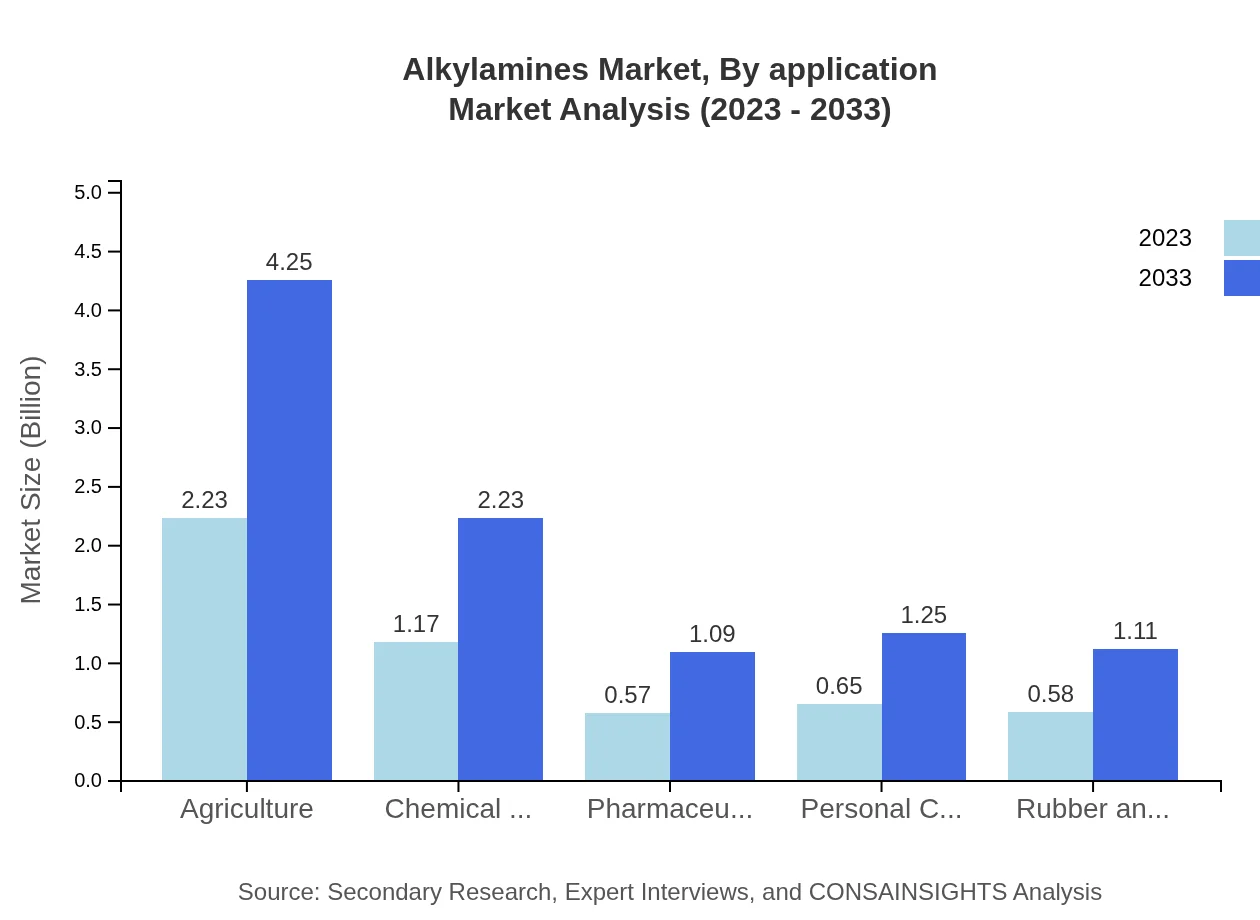

Alkylamines Market Analysis By Application

Agriculture remains the most significant application of Alkylamines, projected to contribute 50.1% of the total market share as of 2023, corresponding to $2.61 billion, and expected to grow to $4.97 billion by 2033. The pharmaceutical sector follows closely with a market size of $1.30 billion, representing 25% of the market in 2023, with growth expected up to $2.48 billion by 2033. Other applications—textiles, automotive, and personal care—together constitute the remainder. Each application faces varying growth rates based on market dynamics and technological innovations.

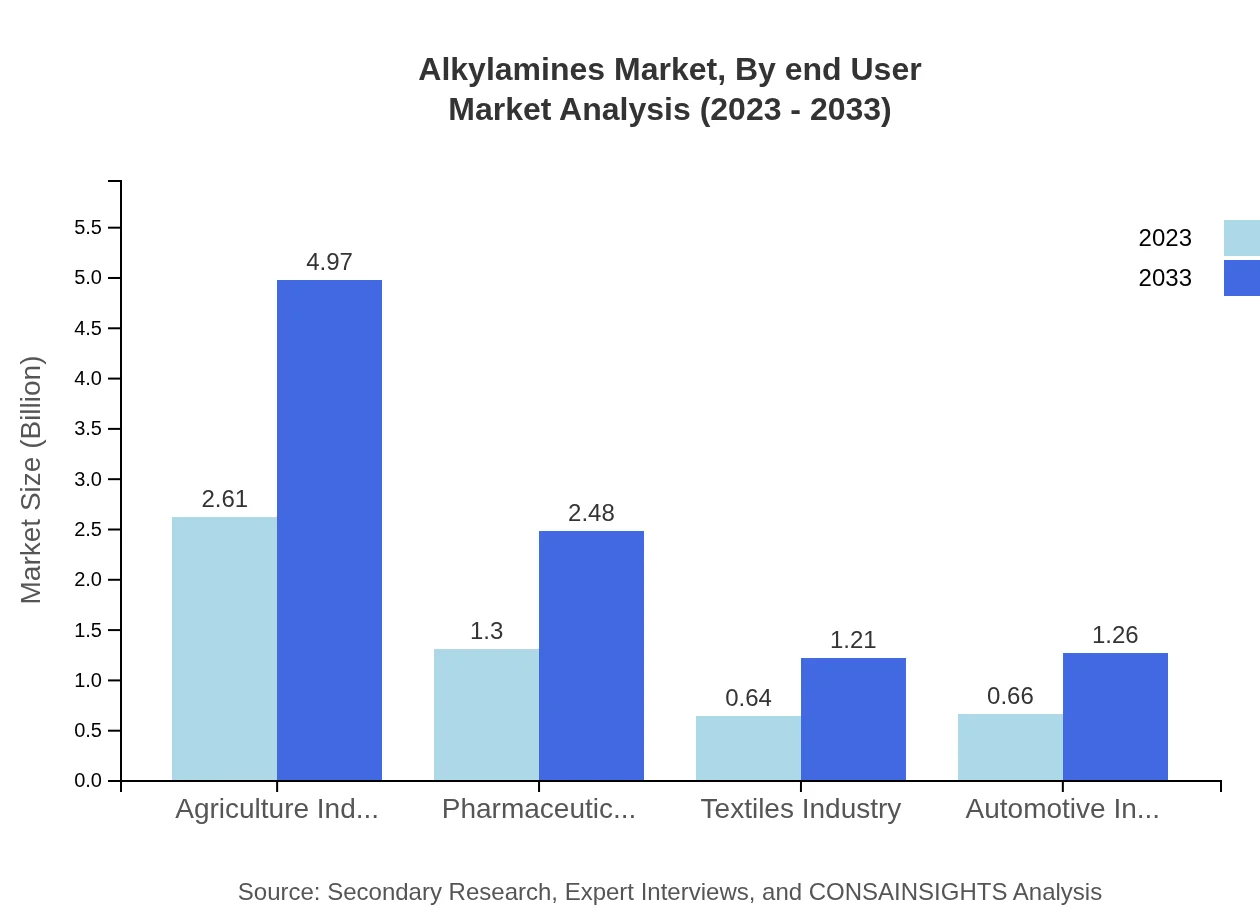

Alkylamines Market Analysis By End User

Key end-user industries for Alkylamines include agriculture, pharmaceuticals, textiles, automotive, and personal care. The agricultural sector retains the largest share, leveraging Alkylamines in fertilizer and pesticide formulation. Pharmaceuticals and textiles also exhibit notable demand, each contributing substantial revenues due to their reliance on specialty chemicals. This trend underlines the significant interdependence between Alkylamines production and industry demand, emphasizing the need for market players to innovate to meet evolving requirements.

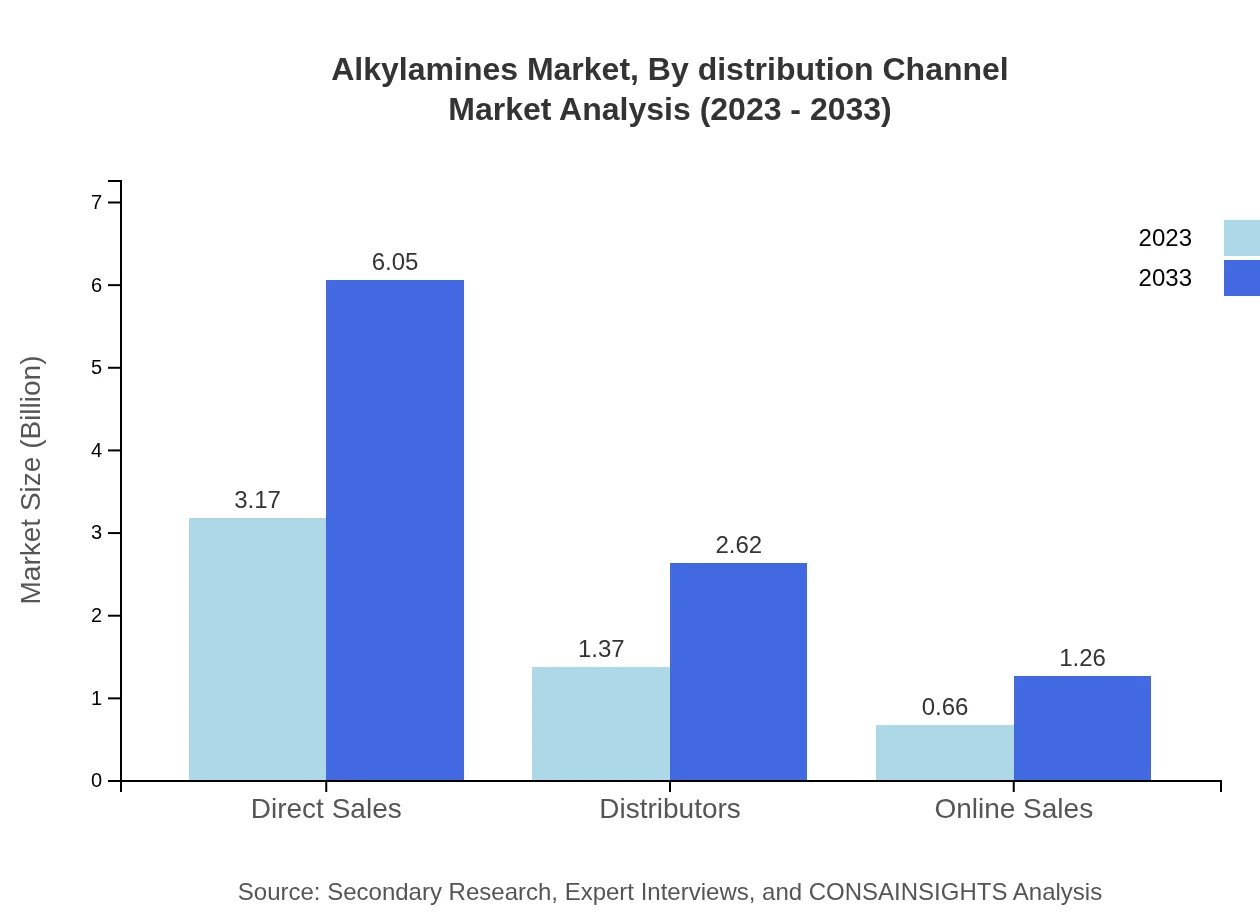

Alkylamines Market Analysis By Distribution Channel

Distribution channels in the Alkylamines market include direct sales, distributors, and online sales. Direct sales accounted for about 60.93% of the market share in 2023, translating to a size of $3.17 billion, projected to reach $6.05 billion by 2033. Distributors follow, holding around 26.39% of the market, with an expected growth trajectory over the forecast period. Online sales, while smaller, are rapidly growing as digital marketplaces expand, illustrating a shift in how consumers access and procure chemical products.

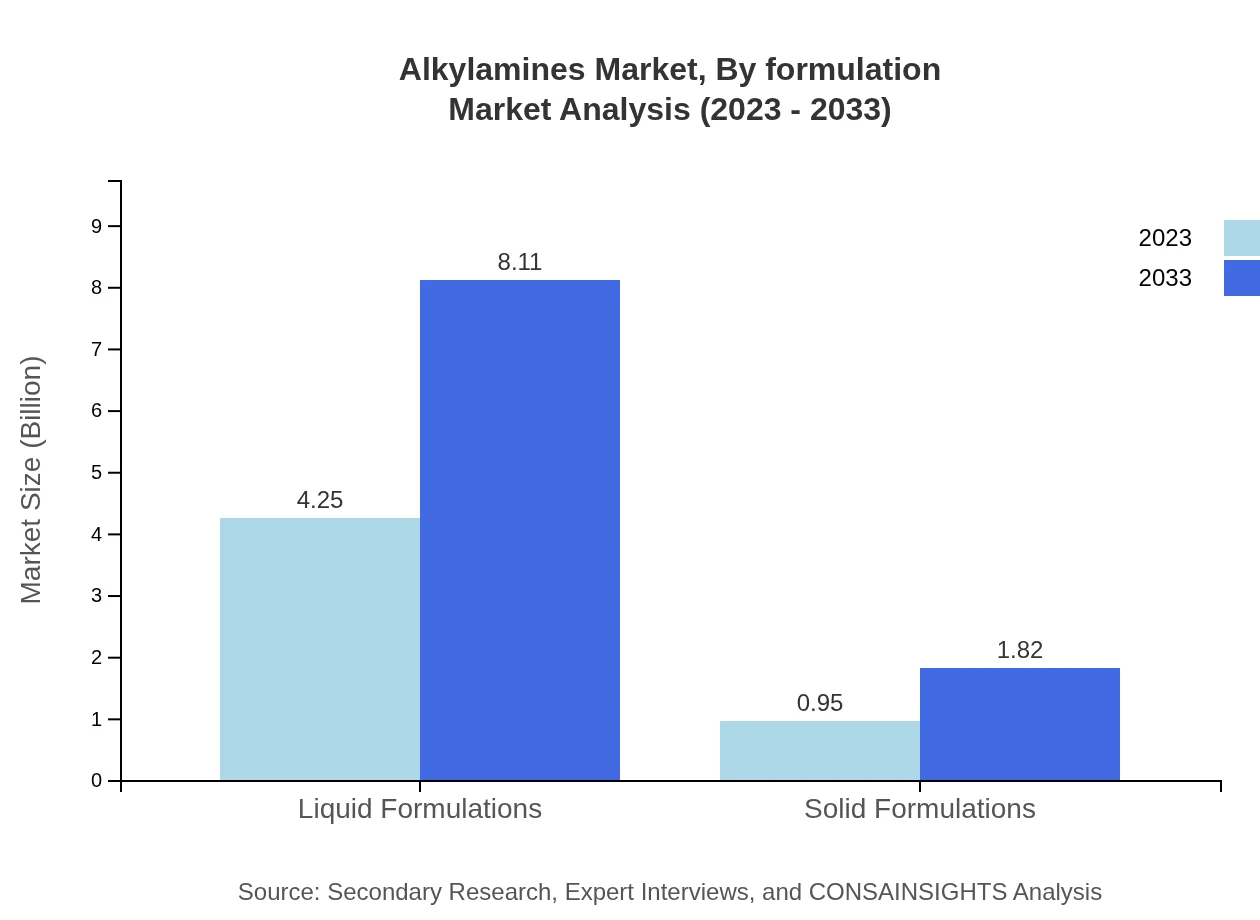

Alkylamines Market Analysis By Formulation

The Alkylamines market is segmented into two primary formulations: liquid and solid. Liquid formulations dominate the market, comprising 81.68% in 2023 with a market value of $4.25 billion, anticipated to grow to $8.11 billion by 2033. Solid formulations, though smaller, are expected to grow steadily, indicating diversification within formulation preferences across industries due to specific application needs.

Alkylamines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alkylamines Industry

BASF SE:

A global leader in chemical production, BASF SE offers a diverse range of alkylamines products catering to agricultural and industrial applications, focusing on sustainability and innovation.Dow Chemical Company:

Dow provides a wide array of alkylamines and related chemicals, emphasizing technological advancements that enhance production efficiency across various sectors.AkzoNobel N.V.:

A key player in specialty chemicals, AkzoNobel manufactures alkylamines with a strong focus on research and development, tailoring solutions to meet customer needs in the agricultural and automotive industries.Eastman Chemical Company:

Eastman produces various alkylamines and offers innovative solutions for pharmaceuticals and personal care, contributing significantly to the global supply chain.We're grateful to work with incredible clients.

FAQs

What is the market size of alkylamines?

The alkylamines market is projected to reach a size of USD 5.2 billion by 2033, growing at a CAGR of 6.5% from its current valuation in 2023.

What are the key market players or companies in the alkylamines industry?

Key players in the alkylamines market include major chemical manufacturers and specialty chemical companies that produce various alkylamines for applications in agriculture, pharmaceuticals, and textiles.

What are the primary factors driving the growth in the alkylamines industry?

Growth in the alkylamines industry is fueled by increasing demand in agriculture, pharmaceuticals, and chemical manufacturing, alongside expansion in the textile and personal care sectors.

Which region is the fastest Growing in the alkylamines?

The fastest-growing region for alkylamines is Europe, expecting a growth from USD 1.61 billion in 2023 to USD 3.07 billion by 2033, followed closely by North America.

Does ConsaInsights provide customized market report data for the alkylamines industry?

Yes, ConsaInsights offers customized market reports for the alkylamines industry, tailored to specific client needs with detailed insights on market trends and forecasts.

What deliverables can I expect from this alkylamines market research project?

Deliverables from the alkylamines market research project include detailed market analysis reports, forecasts, regional insights, company profiles, and trends associated with different segments.

What are the market trends of alkylamines?

Current trends in the alkylamines market highlight a shift towards sustainable production, increased adoption in agriculture, and growth in demand across pharmaceuticals and personal care sectors.