All Flash Array Market Report

Published Date: 22 January 2026 | Report Code: all-flash-array

All Flash Array Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the All Flash Array market, covering trends, size, growth forecasts, and regional insights from 2023 to 2033. It offers essential data for stakeholders to make informed decisions in this rapidly evolving industry.

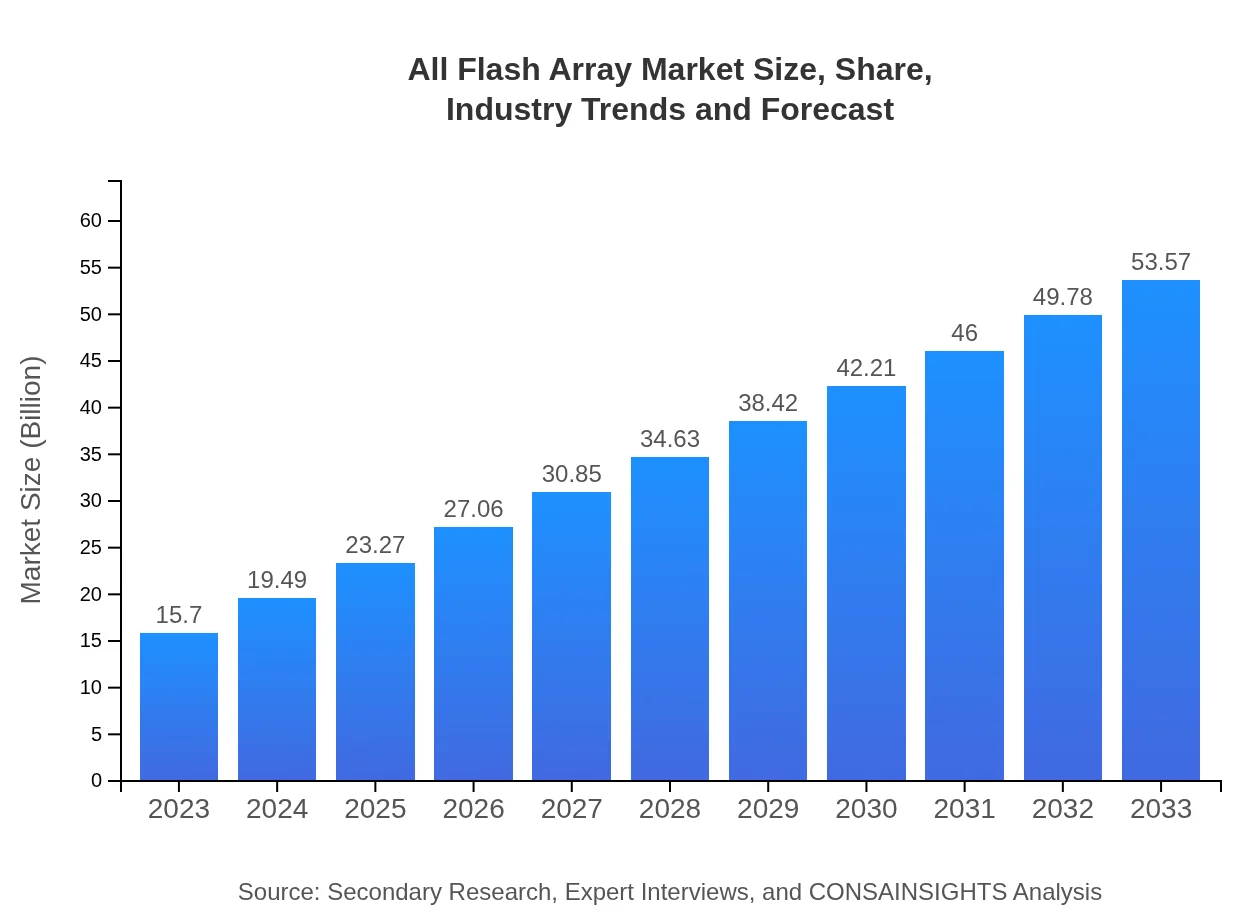

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $53.57 Billion |

| Top Companies | Dell Technologies, IBM, Pure Storage, Hewlett Packard Enterprise (HPE) |

| Last Modified Date | 22 January 2026 |

All Flash Array Market Overview

Customize All Flash Array Market Report market research report

- ✔ Get in-depth analysis of All Flash Array market size, growth, and forecasts.

- ✔ Understand All Flash Array's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in All Flash Array

What is the Market Size & CAGR of All Flash Array market in 2023?

All Flash Array Industry Analysis

All Flash Array Market Segmentation and Scope

Tell us your focus area and get a customized research report.

All Flash Array Market Analysis Report by Region

Europe All Flash Array Market Report:

The European market, with a valuation of $4.02 billion in 2023, is expected to expand to $13.72 billion by 2033. Increasing regulatory requirements for data storage and management, alongside growing cloud adoption, are key drivers for market growth in the region.Asia Pacific All Flash Array Market Report:

The Asia Pacific region, valued at $3.37 billion in 2023, is projected to grow to $11.49 billion by 2033. This growth is driven by expanding data centers and cloud services across countries like China and India. The rising adoption of digital services in healthcare and finance sectors further boosts demand for AFAs.North America All Flash Array Market Report:

North America stands as the largest market for All Flash Arrays, valued at $5.79 billion in 2023 and projected to soar to $19.77 billion by 2033. The dominance is attributed to a myriad of data-intensive industries, robust technological infrastructure, and substantial investments in cloud solutions and AI technologies.South America All Flash Array Market Report:

In South America, the market is relatively smaller, with a valuation of $0.38 billion in 2023, expected to reach $1.30 billion by 2033. However, increasing investments in digital transformation and big data initiatives are anticipated to foster growth in this region.Middle East & Africa All Flash Array Market Report:

In the Middle East and Africa, the AFA market is anticipated to grow from $2.14 billion in 2023 to $7.29 billion by 2033. The region is witnessing an increase in data center investments and a shift towards digital services, particularly in sectors like healthcare and finance.Tell us your focus area and get a customized research report.

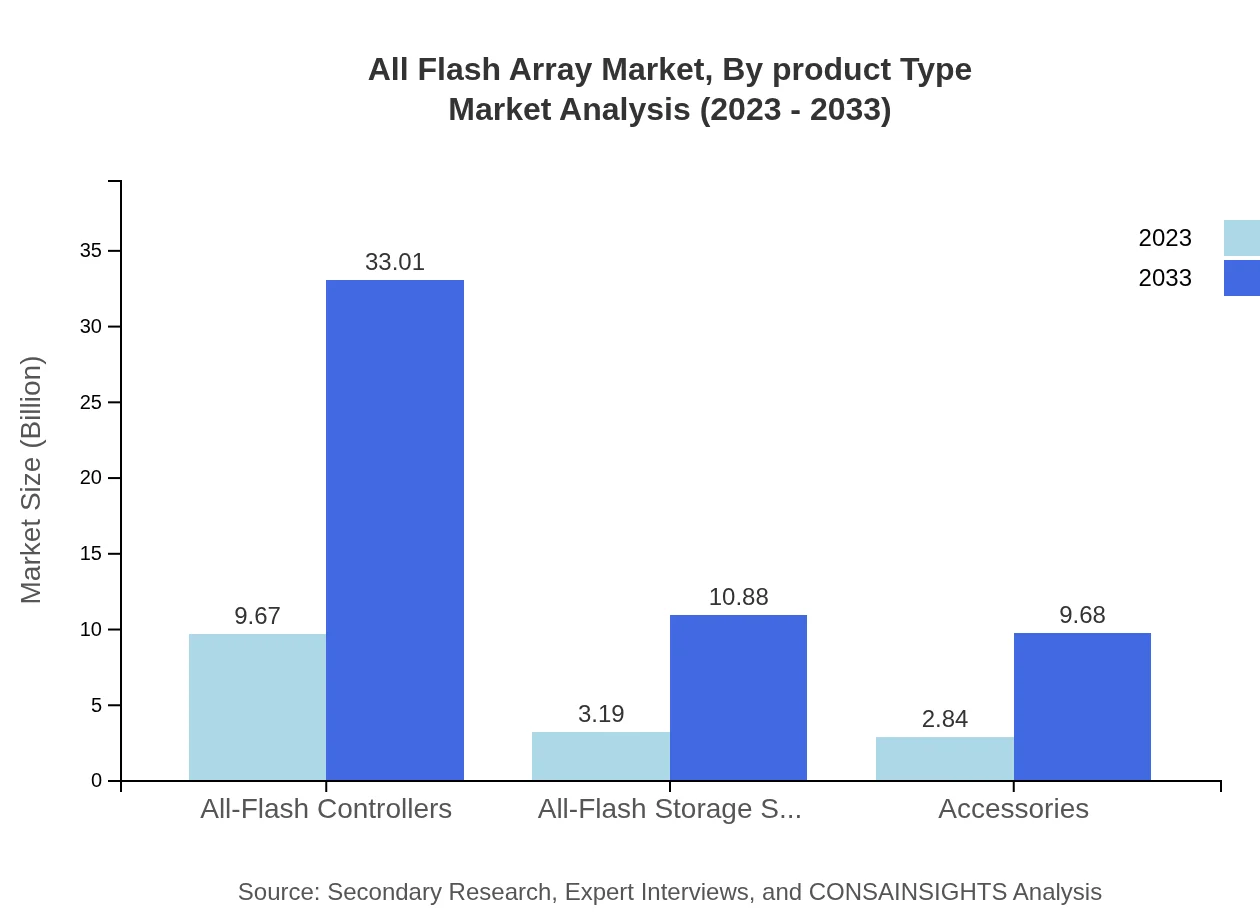

All Flash Array Market Analysis By Product Type

In 2023, the All Flash Controllers segment leads the AFA market with a size of $9.67 billion, holding a 61.62% market share. By 2033, this segment is expected to grow to $33.01 billion, dominating the landscape. All Flash Storage Systems also show growth, projected to rise from $3.19 billion in 2023 to $10.88 billion in 2033, reflecting increasing adoption across enterprises.

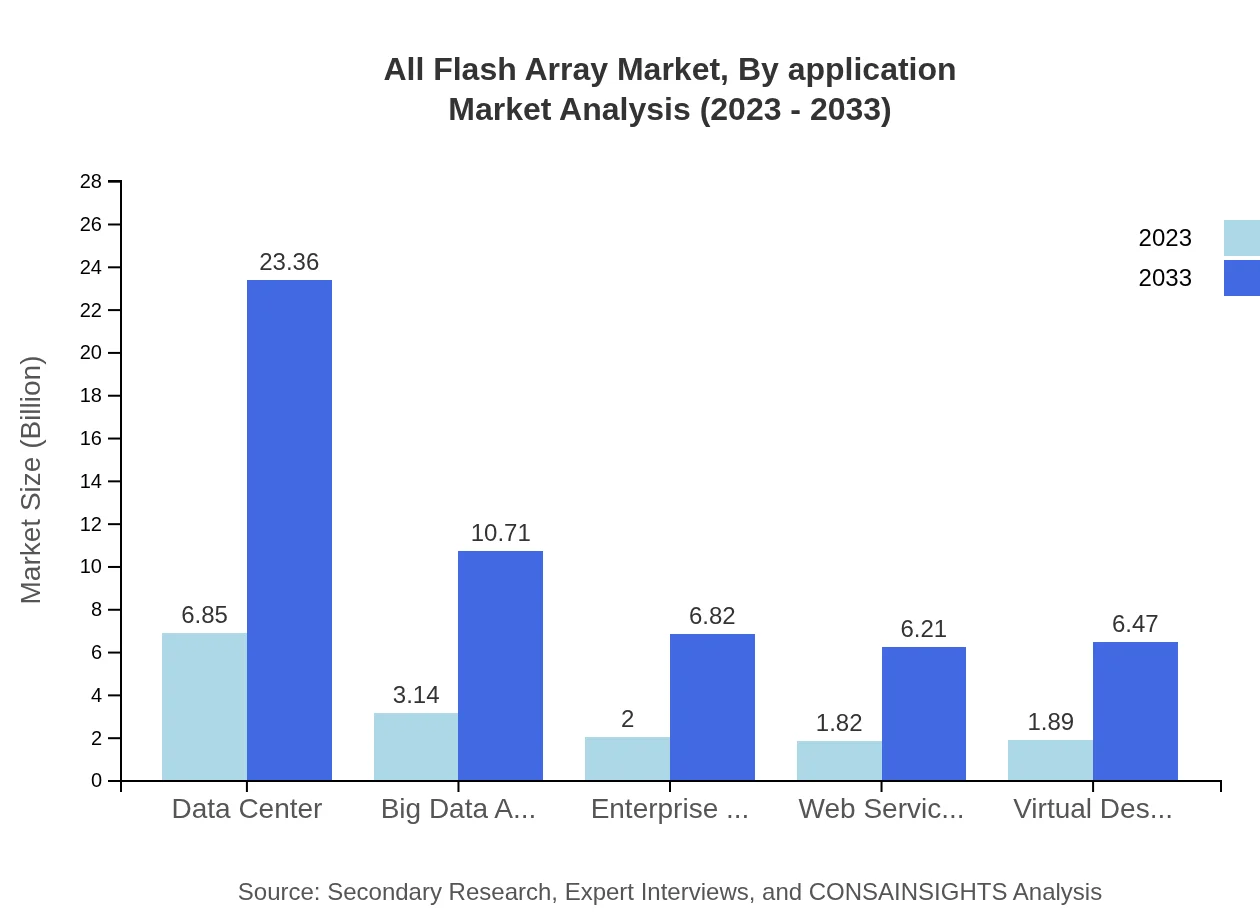

All Flash Array Market Analysis By Application

The Data Center application segment is the largest, valued at $6.85 billion in 2023, expected to reach $23.36 billion by 2033. Big Data Analytics and Web Services also demonstrate promising growth, with sizes projected to grow from $3.14 billion to $10.71 billion and from $1.82 billion to $6.21 billion respectively, highlighting the increasing reliance on data-driven decision-making.

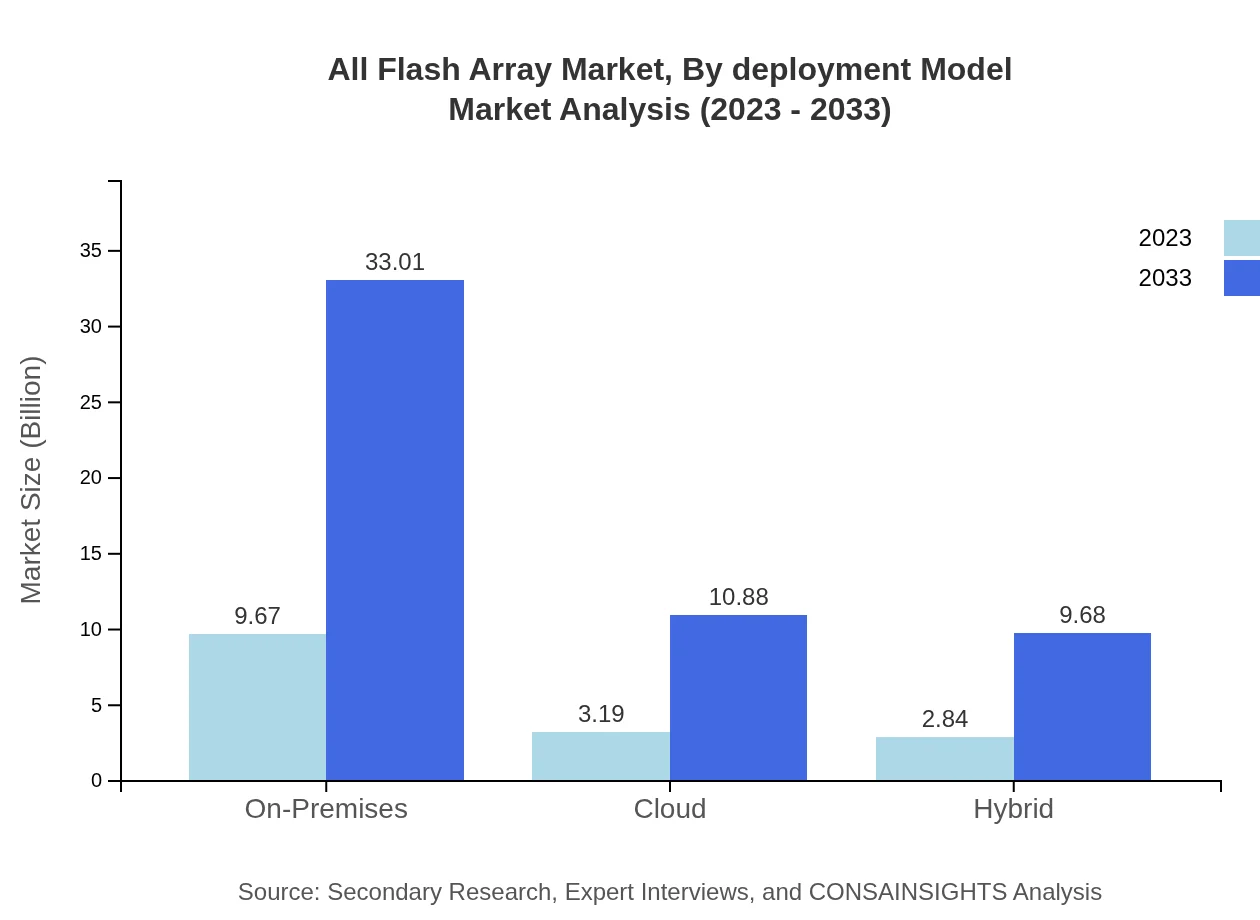

All Flash Array Market Analysis By Deployment Model

On-Premises models currently lead the deployment segment with a size of $9.67 billion (61.62% share) in 2023, rising to $33.01 billion by 2033. However, Cloud deployment models are gaining traction, estimated to grow from $3.19 billion to $10.88 billion over the same period, as enterprises shift towards hybrid architectures.

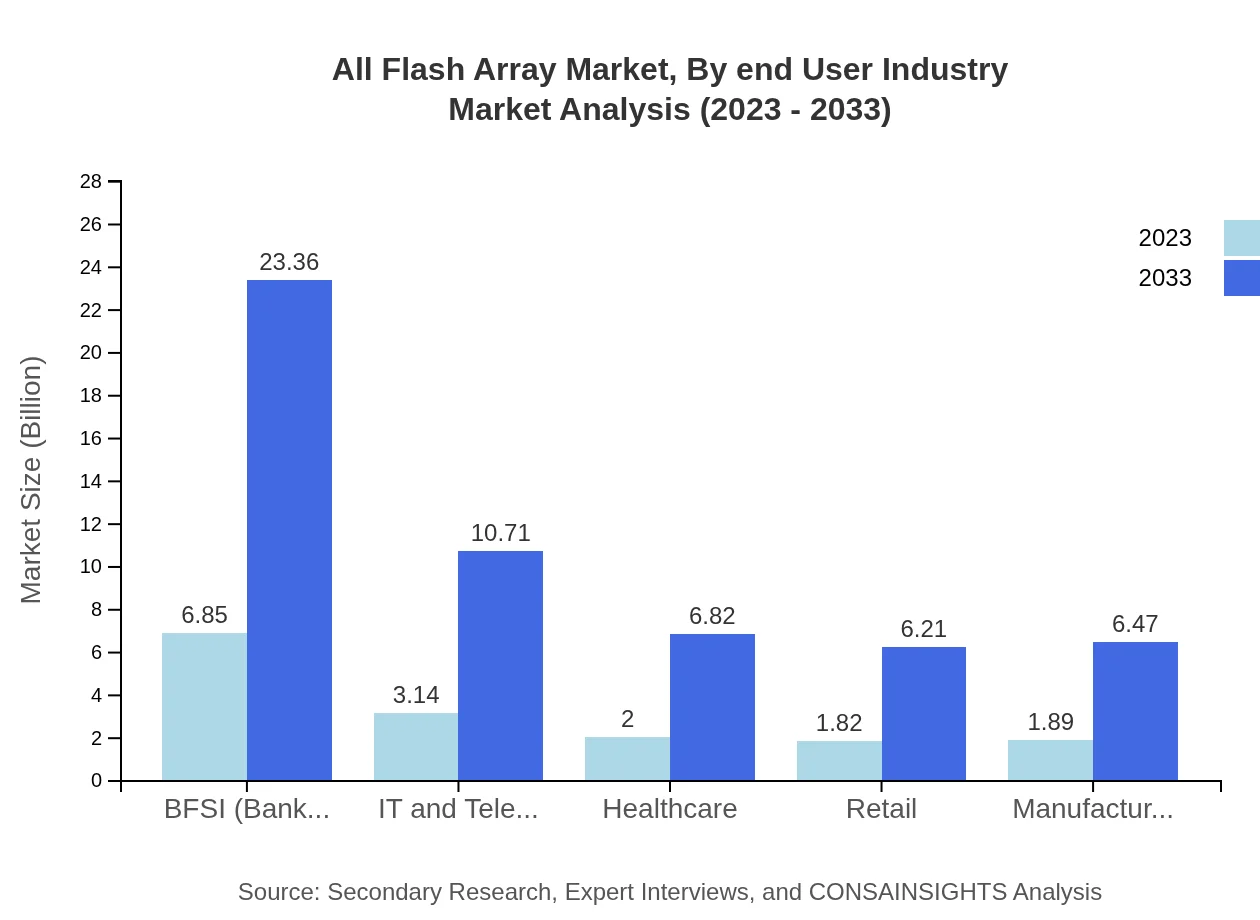

All Flash Array Market Analysis By End User Industry

The BFSI sector is a strong driver for AFA adoption, with its market size expected to grow from $6.85 billion to $23.36 billion by 2033, holding a significant 43.61% market share. Other sectors like IT and Telecom, and Healthcare are also critical growth areas, emphasizing the AFA's importance in operational efficiency and data handling.

All Flash Array Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in All Flash Array Industry

Dell Technologies:

A leading provider of technology solutions, Dell offers a range of flash storage products known for high performance and reliability, catering to various industries.IBM:

IBM is recognized for its innovative cloud solutions and storage technologies, including All Flash Arrays that support big data and AI applications.Pure Storage:

Known for pioneering all-flash storage solutions, Pure Storage delivers high-performance AFA solutions that help organizations reduce latencies and accelerate workloads.Hewlett Packard Enterprise (HPE):

HPE offers a comprehensive portfolio of storage solutions, including all-flash arrays designed to enhance performance and reduce operational costs.We're grateful to work with incredible clients.

FAQs

What is the market size of all Flash Array?

The all-flash array market size is projected to reach approximately $15.7 billion by 2033, growing at a CAGR of 12.5%. This indicates robust growth in demand for high-performance storage solutions in various industries.

What are the key market players or companies in this all Flash Array industry?

Prominent players in the all-flash-array market include Dell EMC, NetApp, Pure Storage, HPE, and IBM. These companies drive innovation and competition, focusing on performance, scalability, and integration with cloud services.

What are the primary factors driving the growth in the all Flash Array industry?

Key factors fueling growth in the all-flash-array market include increasing data generation, the need for faster data access, cloud adoption, and the rise of AI and big data analytics, which demand high-performance storage solutions.

Which region is the fastest Growing in the all Flash Array?

North America is the fastest-growing region in the all-flash-array market, anticipating growth from $5.79 billion in 2023 to $19.77 billion by 2033, driven by technological advancements and demand from data centers.

Does ConsaInsights provide customized market report data for the all Flash Array industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the all-flash-array industry, helping businesses make informed decisions based on comprehensive market insights.

What deliverables can I expect from this all Flash Array market research project?

From the all-flash-array market research project, you can expect detailed market size analysis, growth forecasts, competitive landscape assessments, segmentation insights, and regional market evaluations to guide strategic planning.

What are the market trends of all Flash Array?

Current trends in the all-flash-array market include increased adoption of hybrid cloud solutions, growing demand for data protection solutions, and the integration of AI technologies to enhance data management and storage efficiencies.