Allyl Chloride Market Report

Published Date: 02 February 2026 | Report Code: allyl-chloride

Allyl Chloride Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Allyl Chloride market, exploring market size, segmentation, regional insights, and industry trends from 2023 to 2033.

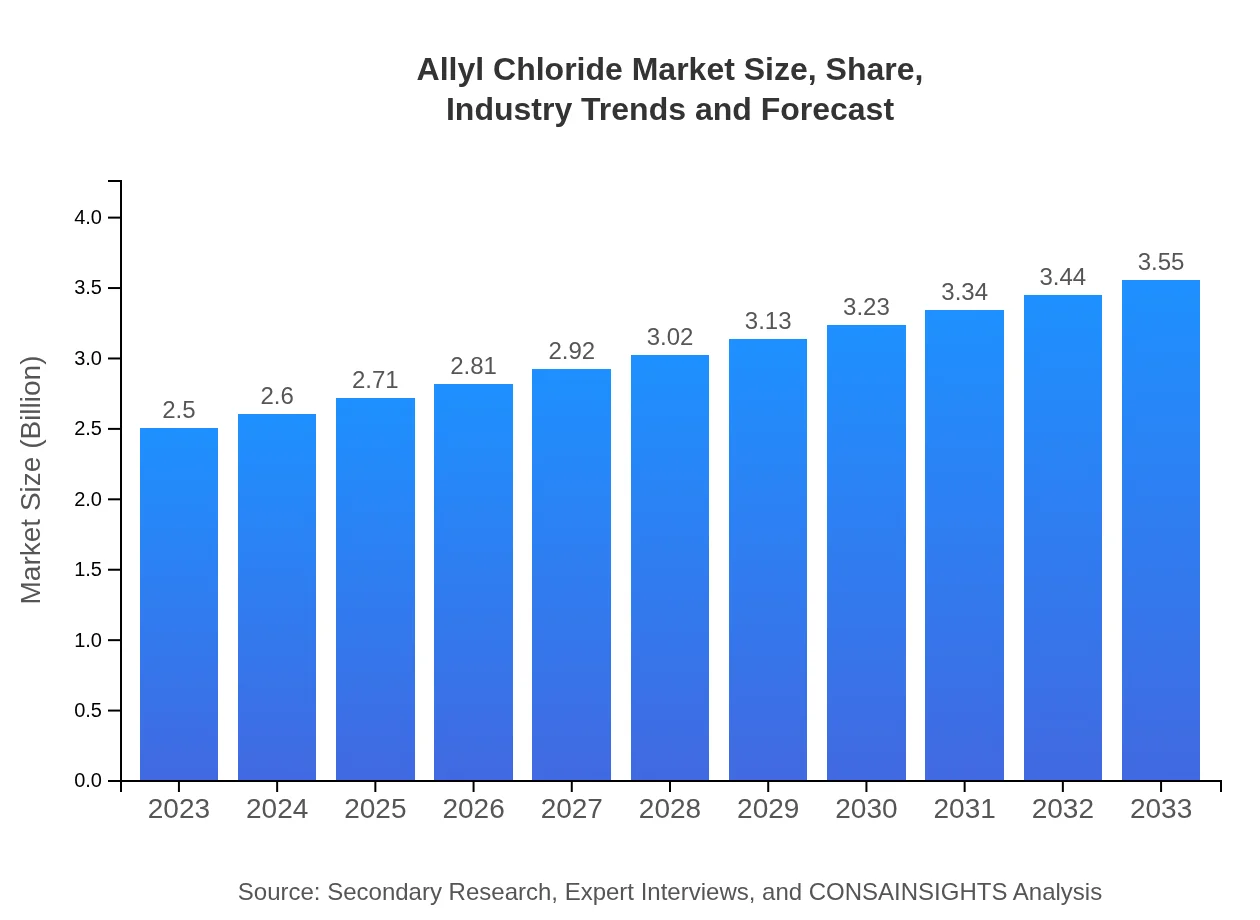

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 3.5% |

| 2033 Market Size | $3.55 Billion |

| Top Companies | Company A, Company B, Company C, Company D |

| Last Modified Date | 02 February 2026 |

Allyl Chloride Market Overview

Customize Allyl Chloride Market Report market research report

- ✔ Get in-depth analysis of Allyl Chloride market size, growth, and forecasts.

- ✔ Understand Allyl Chloride's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Allyl Chloride

What is the Market Size & CAGR of Allyl Chloride market in 2023?

Allyl Chloride Industry Analysis

Allyl Chloride Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Allyl Chloride Market Analysis Report by Region

Europe Allyl Chloride Market Report:

In Europe, the market is anticipated to grow from 0.75 billion USD in 2023 to 1.07 billion USD by 2033, with regulatory focus on sustainable practices boosting the adoption of environmentally friendly chemicals.Asia Pacific Allyl Chloride Market Report:

In the Asia Pacific region, the Allyl Chloride market is expected to grow from 0.44 billion USD in 2023 to 0.62 billion USD by 2033, reflecting a strong CAGR due to rapid industrial growth and increasing demand for agrochemicals.North America Allyl Chloride Market Report:

North America's Allyl Chloride market is projected to increase from 0.95 billion USD in 2023 to 1.35 billion USD by 2033. The region benefits from strong pharmaceutical and agricultural sectors driving demand.South America Allyl Chloride Market Report:

The South American market is relatively small, with an expected growth from 0.03 billion USD in 2023 to 0.04 billion USD by 2033. The limited industrial base impacts the growth potential, though emerging markets may present opportunities.Middle East & Africa Allyl Chloride Market Report:

The Middle East and Africa region estimates an increase in market size from 0.33 billion USD in 2023 to 0.47 billion USD by 2033. The growth is attributed to developing chemical manufacturing bases and increasing import demands.Tell us your focus area and get a customized research report.

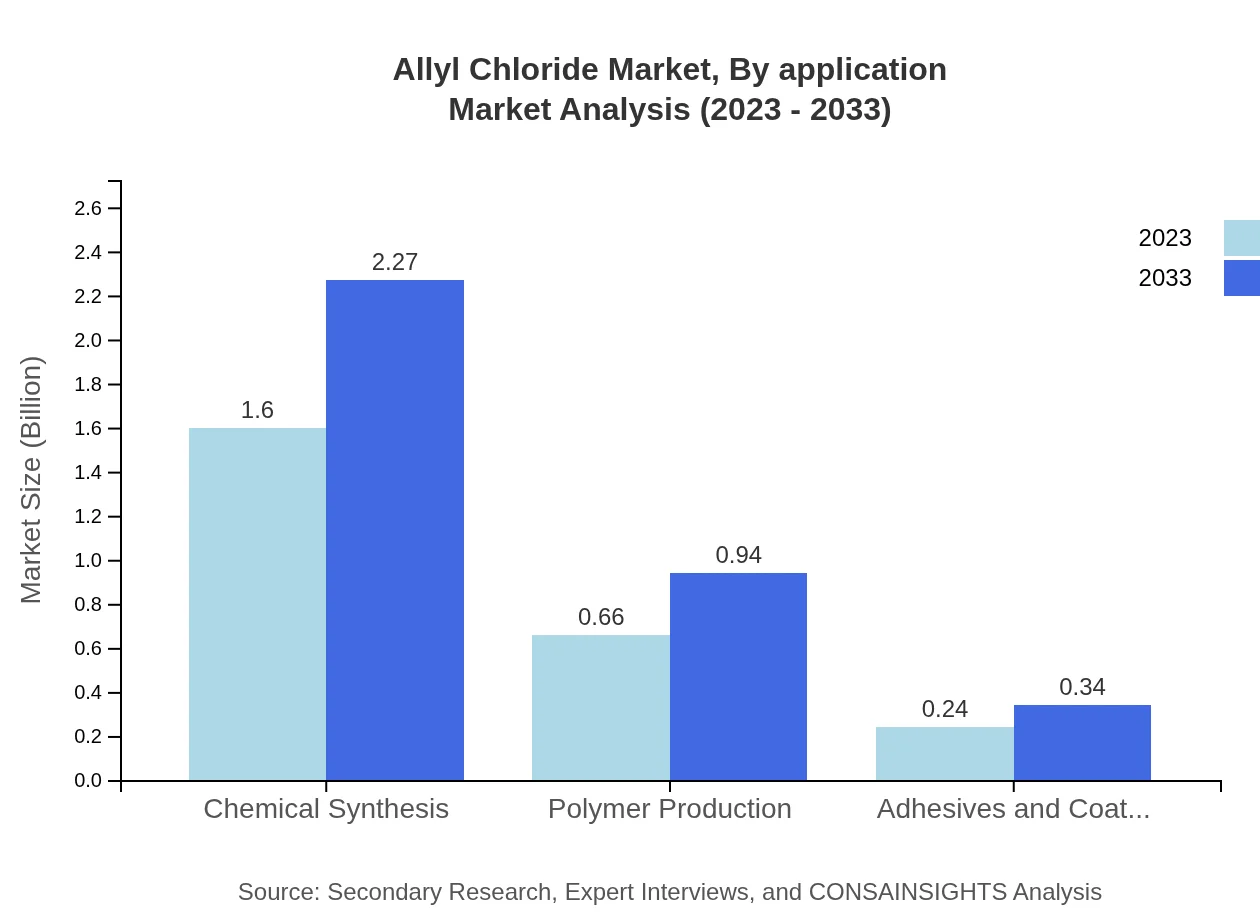

Allyl Chloride Market Analysis By Application

The application analysis reveals that the pharmaceutical sector is the largest segment, projected to grow from 1.60 billion USD in 2023 to 2.27 billion USD by 2033, accounting for a significant market share of 63.98%. Other key applications include polymer production, which will grow from 0.66 billion USD to 0.94 billion USD, and agriculture, with similar growth rates. The adhesives and coatings segment, while smaller, also presents growth opportunities.

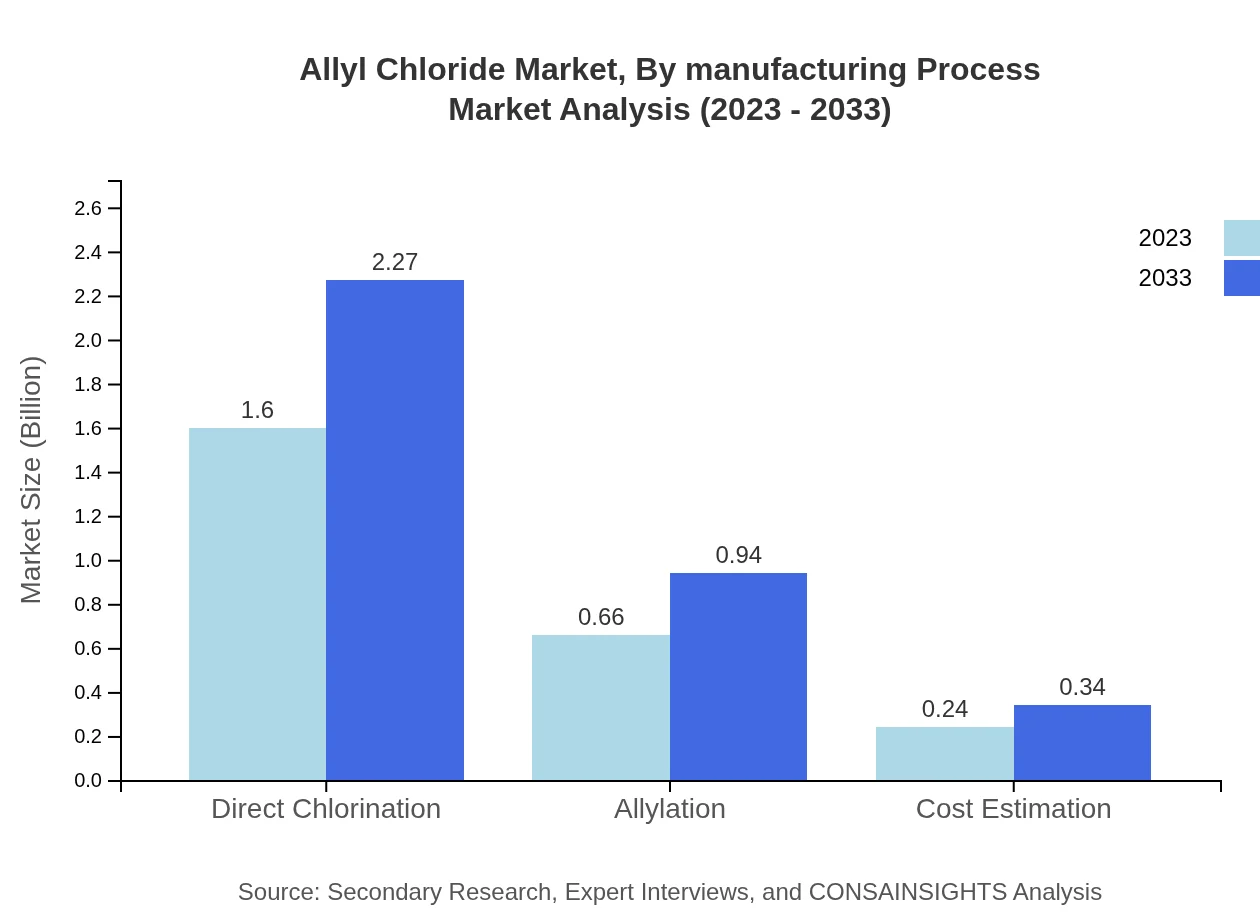

Allyl Chloride Market Analysis By Manufacturing Process

By manufacturing process, the market is dominated by direct chlorination, accounting for a substantial share and projected growth from 1.60 billion USD in 2023 to 2.27 billion USD by 2033, maintaining over 63.98%. The allylation process is also significant, expected to expand from 0.66 billion USD to 0.94 billion USD, indicating stable demand across processes.

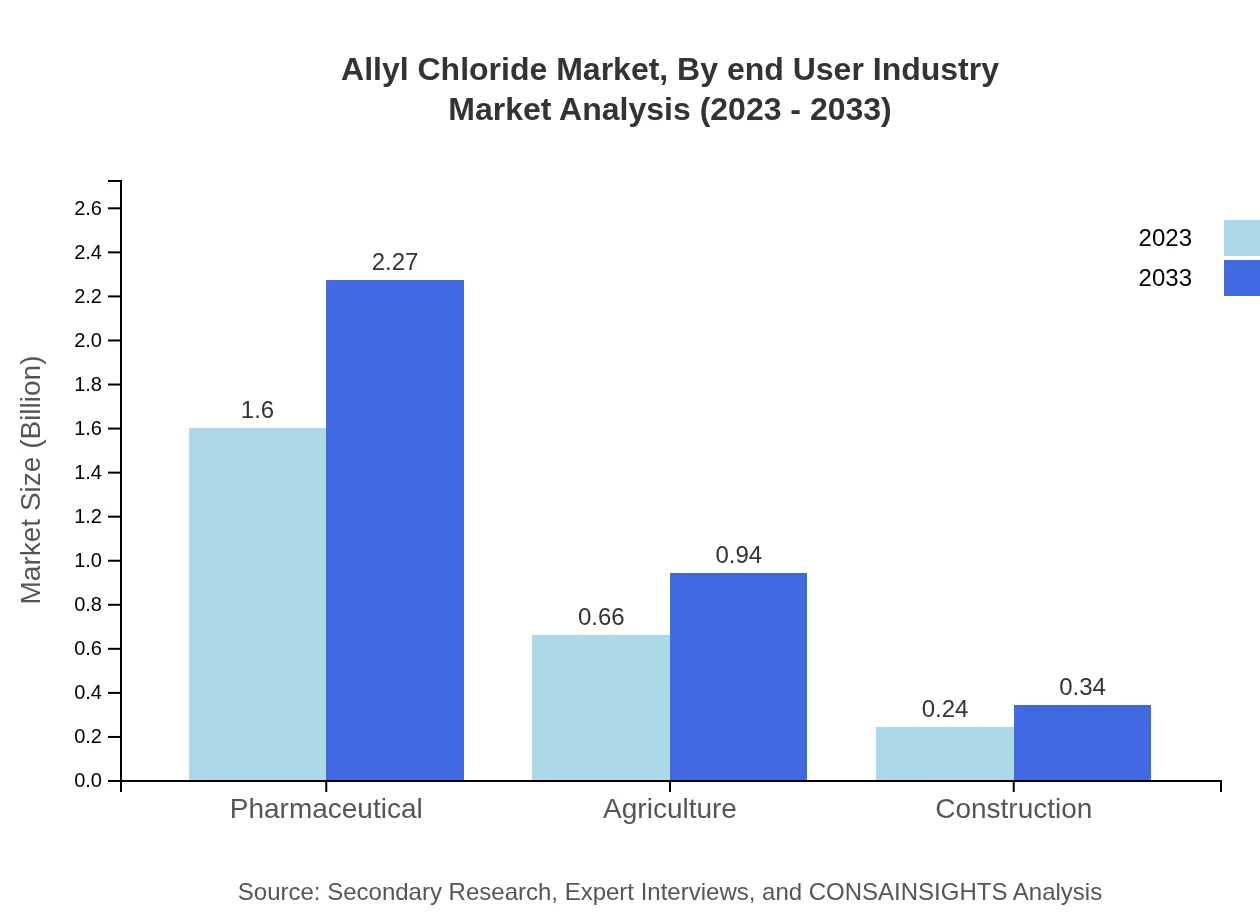

Allyl Chloride Market Analysis By End User Industry

The end-user industry segment highlights the critical role of pharmaceuticals, maintaining a dominant position with market size growth from 1.60 billion USD to 2.27 billion USD. Following closely, agriculture is projected to increase from 0.66 billion USD to 0.94 billion USD, indicating substantial growth opportunities driven by agrochemical needs.

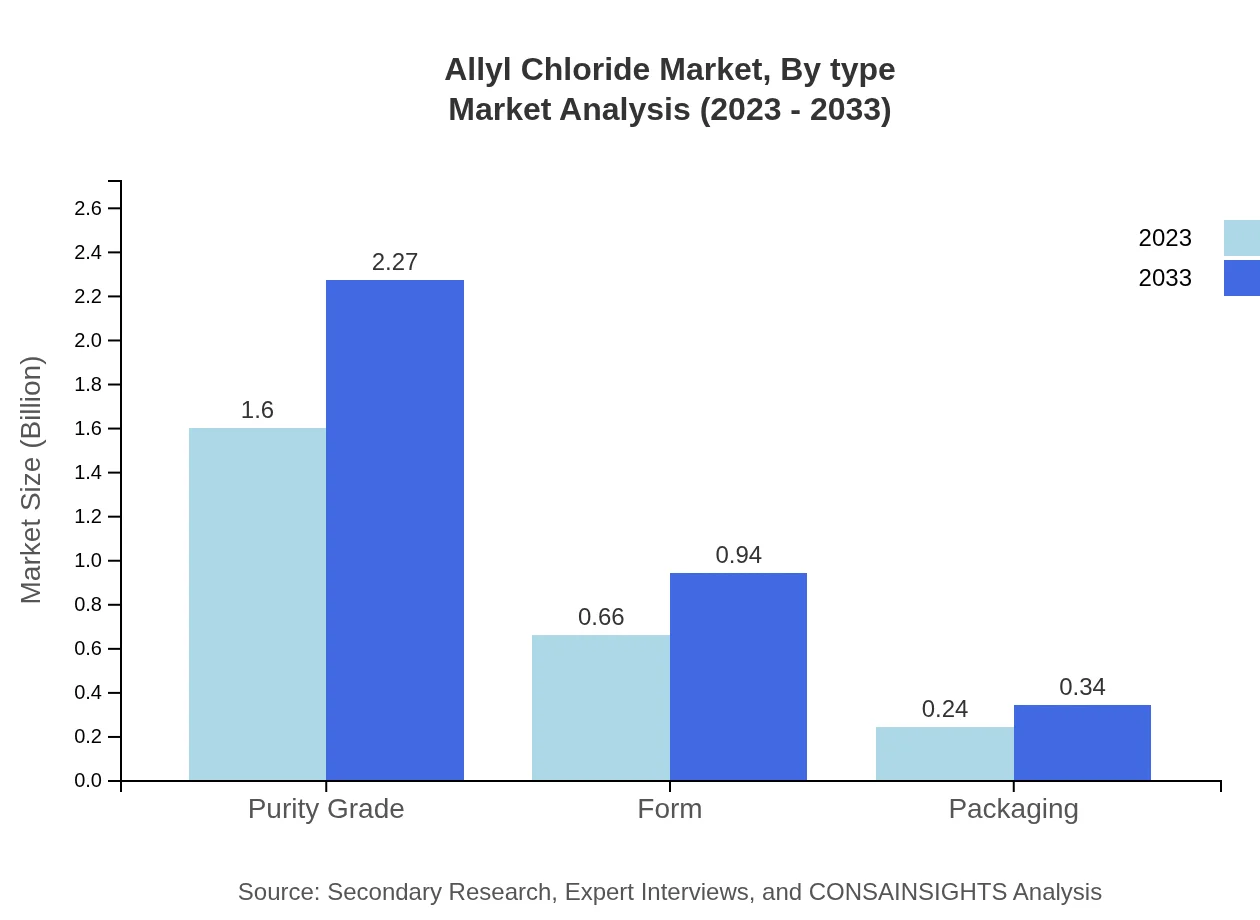

Allyl Chloride Market Analysis By Type

The market is analyzed by type where purity grade leads with a significant market size forecasted from 1.60 billion USD in 2023 to 2.27 billion USD by 2033. The form segment, while smaller, shows promise with a projected increase from 0.66 billion USD to 0.94 billion USD, denoting a diversification in product offerings.

Allyl Chloride Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Allyl Chloride Industry

Company A:

Company A is a leading manufacturer of specialty chemicals, providing high-quality Allyl Chloride for various industrial applications. Their commitment to innovation has made them a key player in the Allyl Chloride market.Company B:

Company B operates globally and has a strong focus on developing sustainable production processes for Allyl Chloride. Their strategic investments have solidified their position as a market leader.Company C:

A prominent player in the chemicals industry, Company C specializes in Allyl Chloride and has expanded its market reach through strategic partnerships and extensive distribution networks.Company D:

Company D is recognized for its advanced research and development capabilities in chemical production, leading to innovative applications of Allyl Chloride in various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of allyl Chloride?

The global allyl-chloride market size is estimated to be $2.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 3.5% from 2023 to 2033.

What are the key market players or companies in this allyl Chloride industry?

Key players in the allyl-chloride market include major chemical manufacturers specializing in chlorinated compounds and their derivatives, including but not limited to established chemical synthesis and polymer production firms.

What are the primary factors driving the growth in the allyl Chloride industry?

The growth in the allyl-chloride market is driven by its increasing applications in industries such as pharmaceuticals, agriculture, and polymer production, alongside expanding demand for specialty chemicals in various sectors.

Which region is the fastest Growing in the allyl Chloride?

Europe is the fastest-growing region for allyl-chloride, with a market size of $0.75 billion in 2023, projected to grow to $1.07 billion by 2033, driven by robust industrial demand.

Does ConsaInsights provide customized market report data for the allyl Chloride industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the allyl-chloride industry, ensuring detailed insights based on specific needs and market dynamics.

What deliverables can I expect from this allyl Chloride market research project?

Deliverables from the allyl-chloride market research project include comprehensive market analysis reports, segmented data insights, regional forecasts, and strategic recommendations for players in the industry.

What are the market trends of allyl Chloride?

Current trends in the allyl-chloride market include a shift towards sustainable and efficient production methods, a rise in demand for high-purity grades in applications, and a growing focus on regulatory compliance in chemical manufacturing.