Almond Products Market Report

Published Date: 31 January 2026 | Report Code: almond-products

Almond Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Almond Products market, covering various segments, regional insights, and forecasts from 2023 to 2033. It includes key market size metrics, technological advancements, and trends influencing growth in the industry.

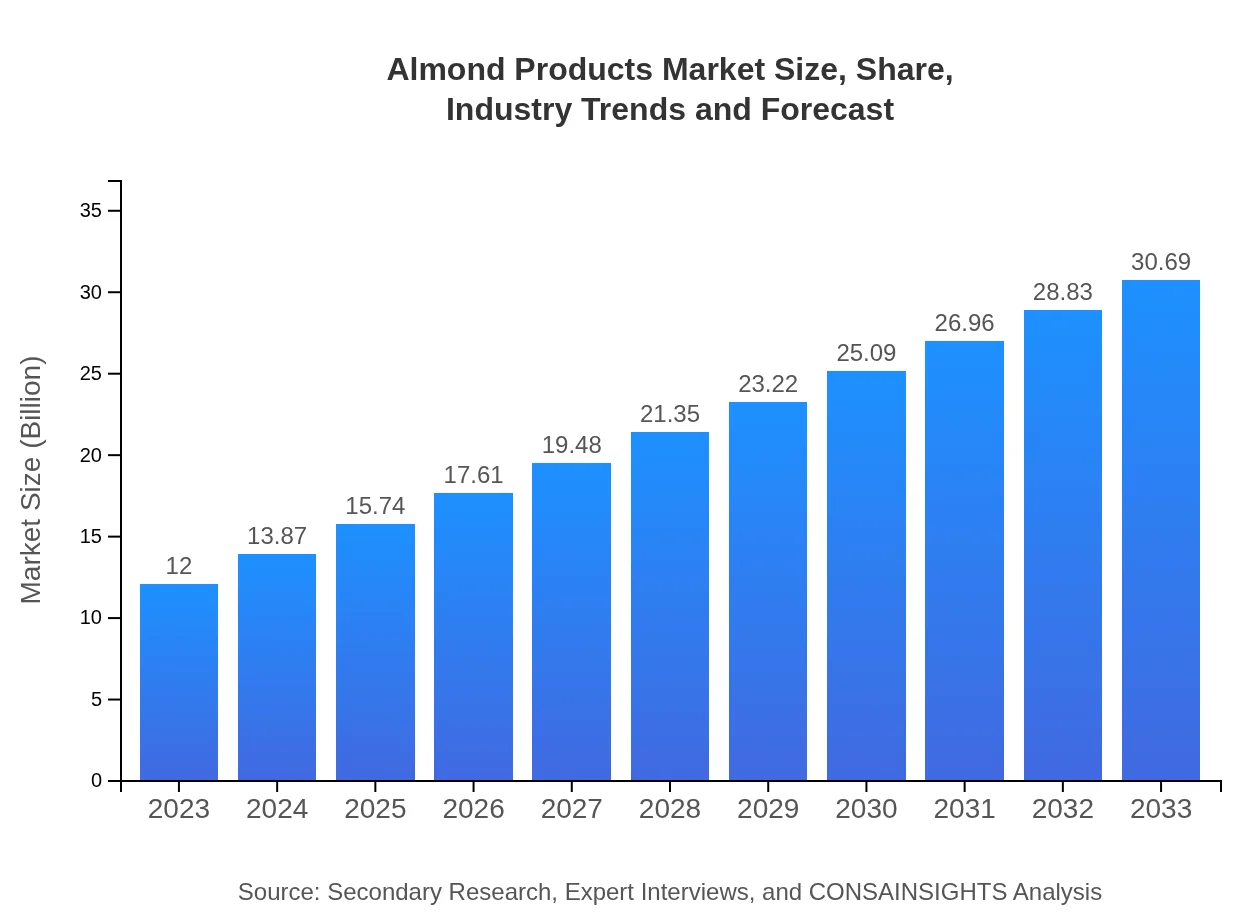

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Blue Diamond Growers, California Almonds, Almonds de Provence |

| Last Modified Date | 31 January 2026 |

Almond Products Market Overview

Customize Almond Products Market Report market research report

- ✔ Get in-depth analysis of Almond Products market size, growth, and forecasts.

- ✔ Understand Almond Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Almond Products

What is the Market Size & CAGR of Almond Products market in 2023?

Almond Products Industry Analysis

Almond Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Almond Products Market Analysis Report by Region

Europe Almond Products Market Report:

The European market for Almond Products is set to experience robust growth from $3.49 billion in 2023 to $8.94 billion by 2033. The shift towards vegan diets and clean label products is pushing almond-based products to the forefront of the food industry. Furthermore, the popularity of almond-derived ingredients in snacks and dairy alternatives boosts overall market value.Asia Pacific Almond Products Market Report:

The Asia Pacific region is witnessing rapid growth, with the market estimate rising from $2.52 billion in 2023 to approximately $6.46 billion by 2033. The demand for health-oriented products drives the consumption of almond-based offerings, especially in countries such as China and India, where dietary preferences are shifting toward plant-based nutrition.North America Almond Products Market Report:

North America remains a pivotal market for Almond Products, expected to grow from $3.94 billion in 2023 to $10.07 billion by 2033. The United States leads the way in almond consumption driven by high demand for almond milk and snacks among health-conscious consumers. Additionally, significant investments in almond farming and processing enhance market presence.South America Almond Products Market Report:

In South America, the Almond Products market is projected to increase from $0.96 billion in 2023 to $2.46 billion in 2033. As more consumers become aware of the health benefits provided by almonds, the opportunity for market growth is encouraged through product innovations and increasing availability in various distribution channels.Middle East & Africa Almond Products Market Report:

In the Middle East and Africa, the Almond Products market is anticipated to rise from $1.08 billion in 2023 to $2.77 billion by 2033. Growing health consciousness and expanding retail channels in urban regions are major factors contributing to this growth. Additionally, the rise in the number of health and wellness trends is further propelling consumer interest.Tell us your focus area and get a customized research report.

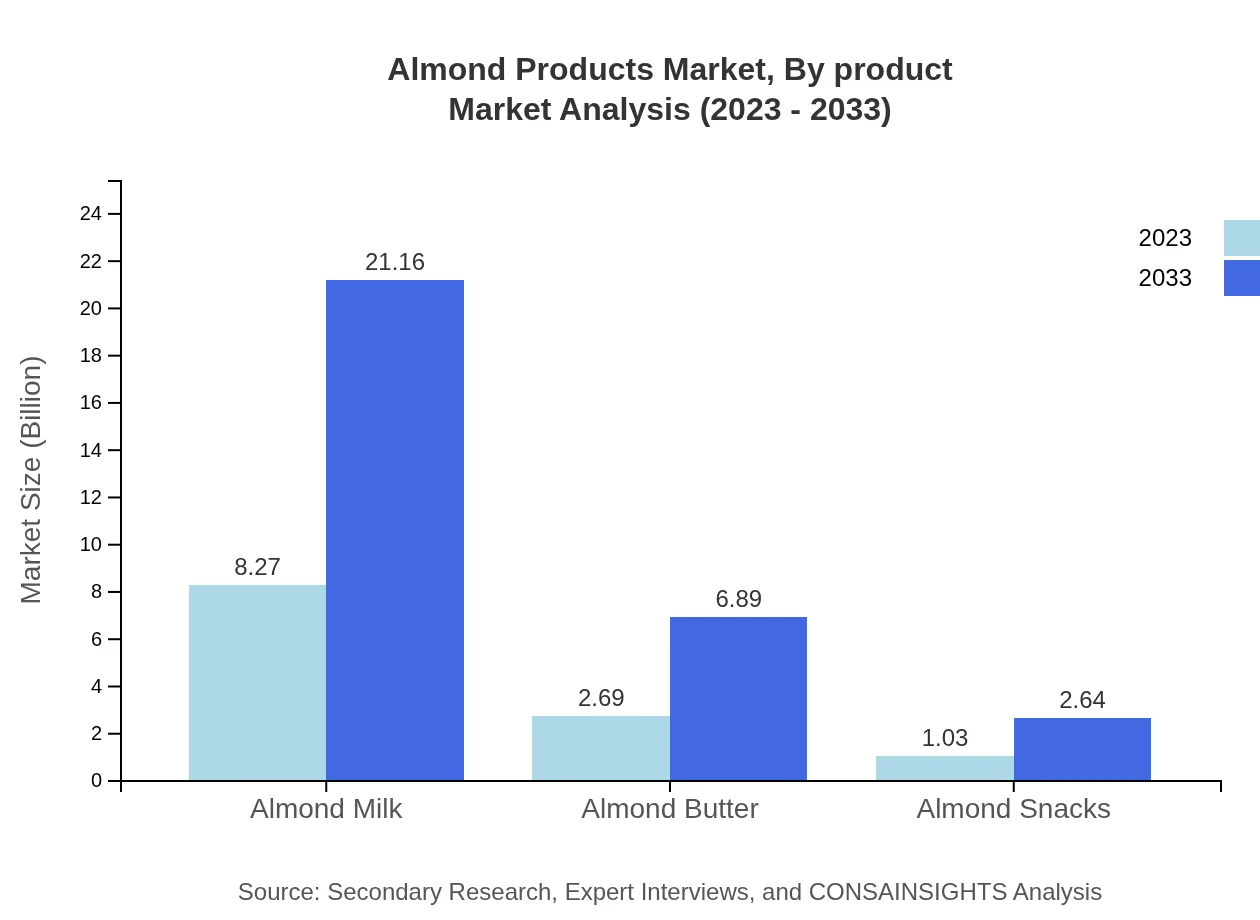

Almond Products Market Analysis By Product

The almond milk segment is anticipated to dominate the market with a significant size increase from $8.27 billion in 2023 to $21.16 billion by 2033, holding a market share of about 68.94%. Almond butter, with an expected growth from $2.69 billion to $6.89 billion by 2033, holds approximately 22.45% market share. The almond snacks segment, while smaller, is projected to grow from $1.03 billion to $2.64 billion, representing 8.61% share.

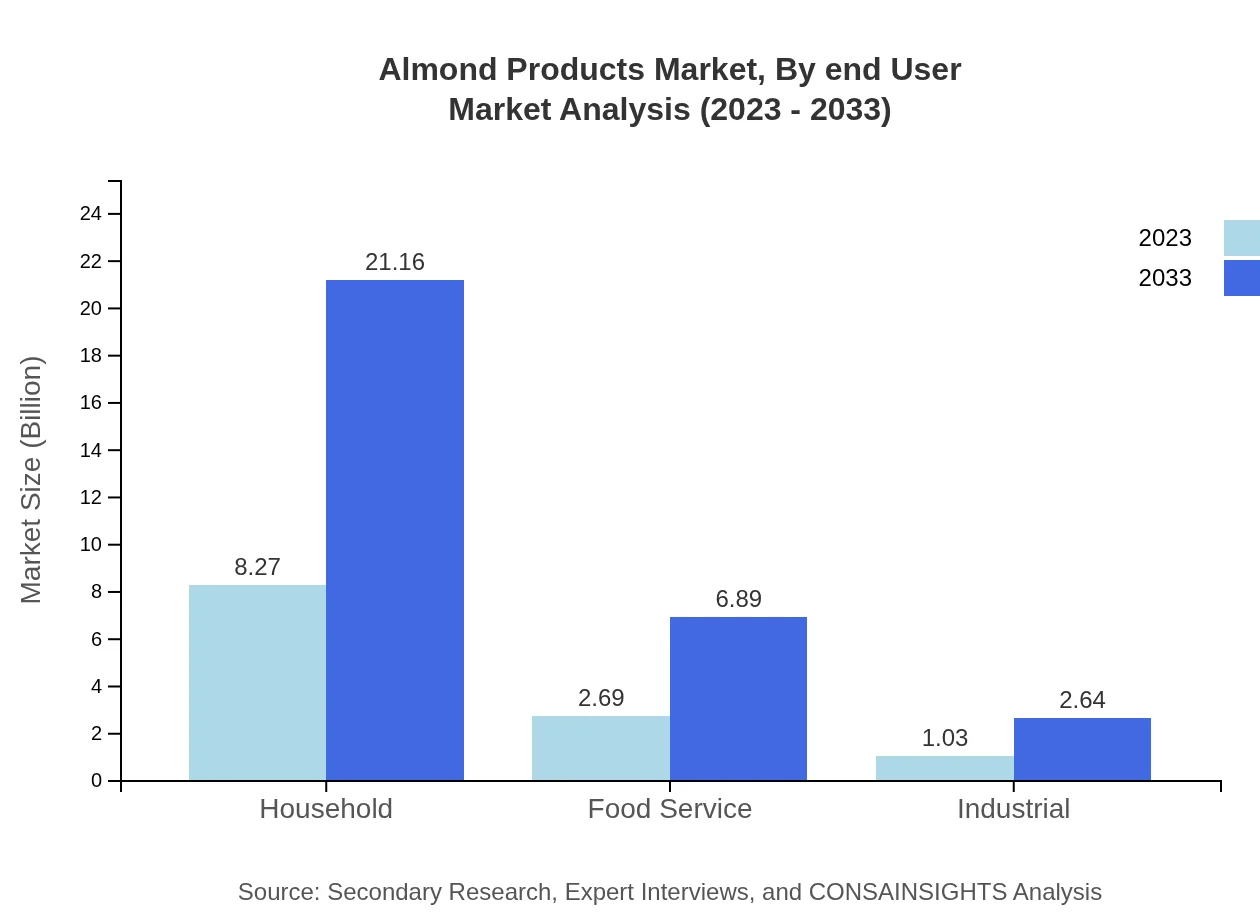

Almond Products Market Analysis By Application

In the application segment, the food service industry is expected to increase from $2.69 billion to $6.89 billion, capturing a robust share of 22.45%. Households also present a significant market, predicted to rise from $8.27 billion to approximately $21.16 billion, equally holding 68.94% share. The industrial application segment, currently valued at $1.03 billion, is anticipated to expand to $2.64 billion, with 8.61% share by 2033.

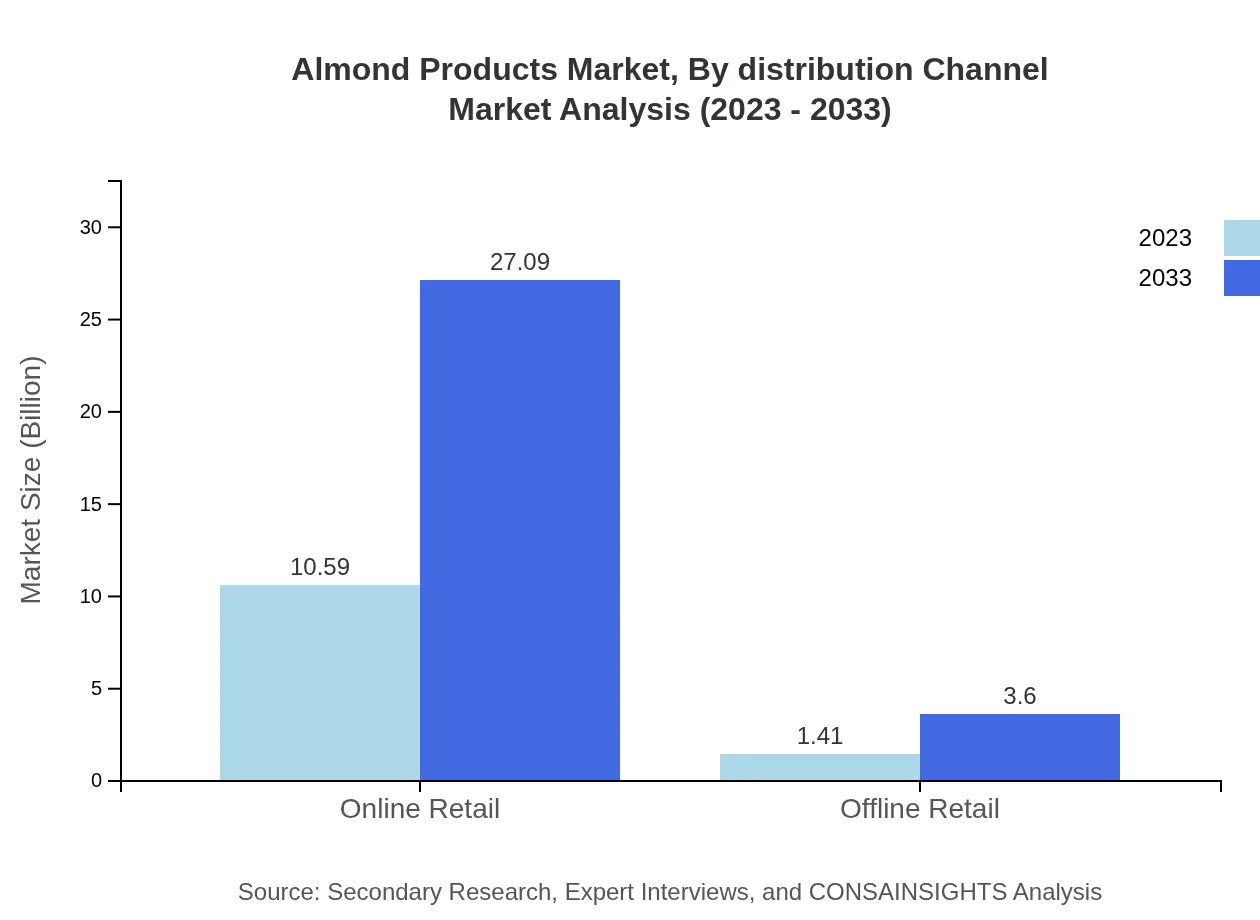

Almond Products Market Analysis By Distribution Channel

Online retail is set to dominate the distribution channel with a size increase from $10.59 billion in 2023 to $27.09 billion in 2033, reflecting an 88.26% share. Meanwhile, offline retail is projected to grow modestly from $1.41 billion to $3.60 billion, corresponding to an 11.74% share.

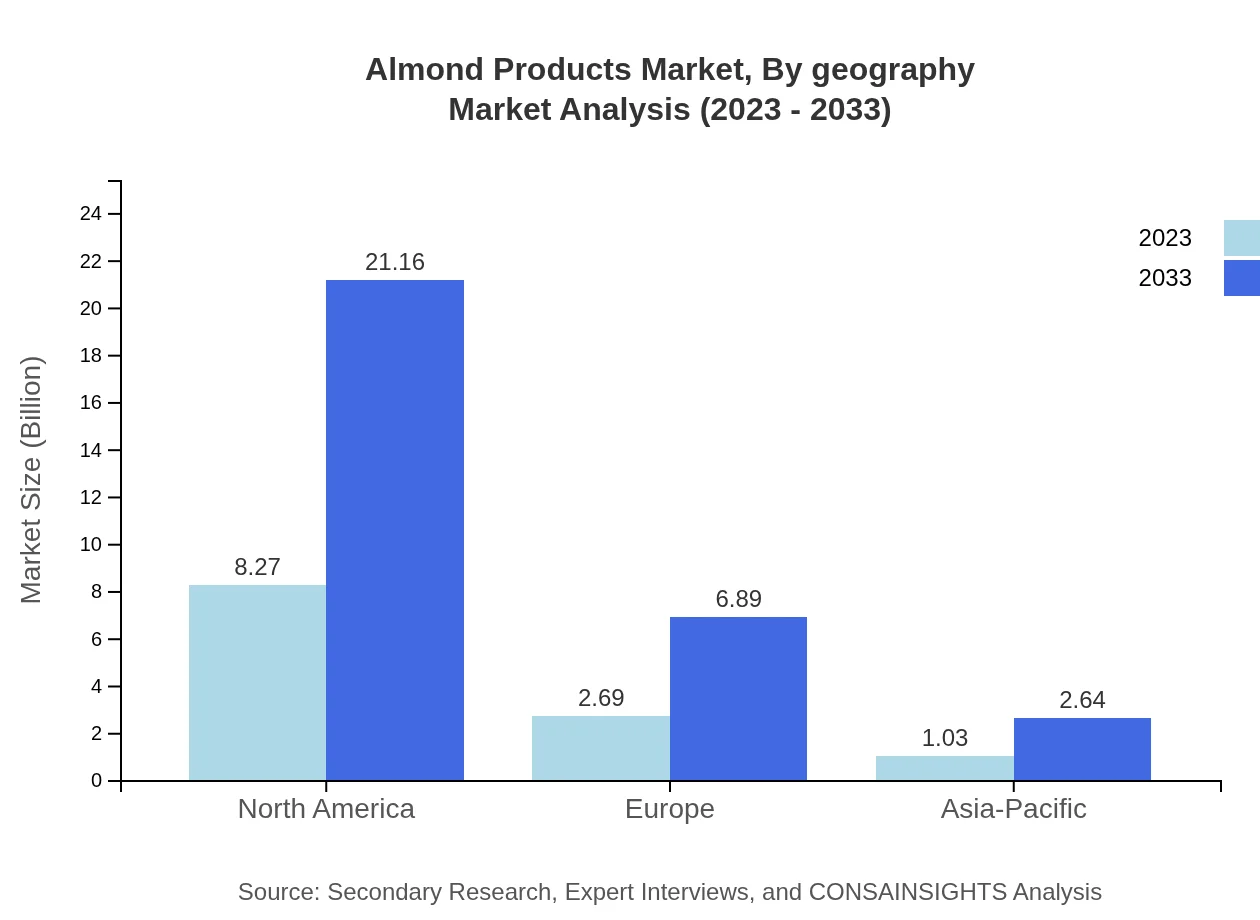

Almond Products Market Analysis By Geography

Geographically, North America is anticipated to be a leading market with growth from $3.94 billion to $10.07 billion. Europe is also expected to see significant growth, rising from $3.49 billion to $8.94 billion. Asia Pacific shows great potential, with an increase from $2.52 billion to $6.46 billion, while the Middle East and Africa segment is projected to move from $1.08 billion to $2.77 billion.

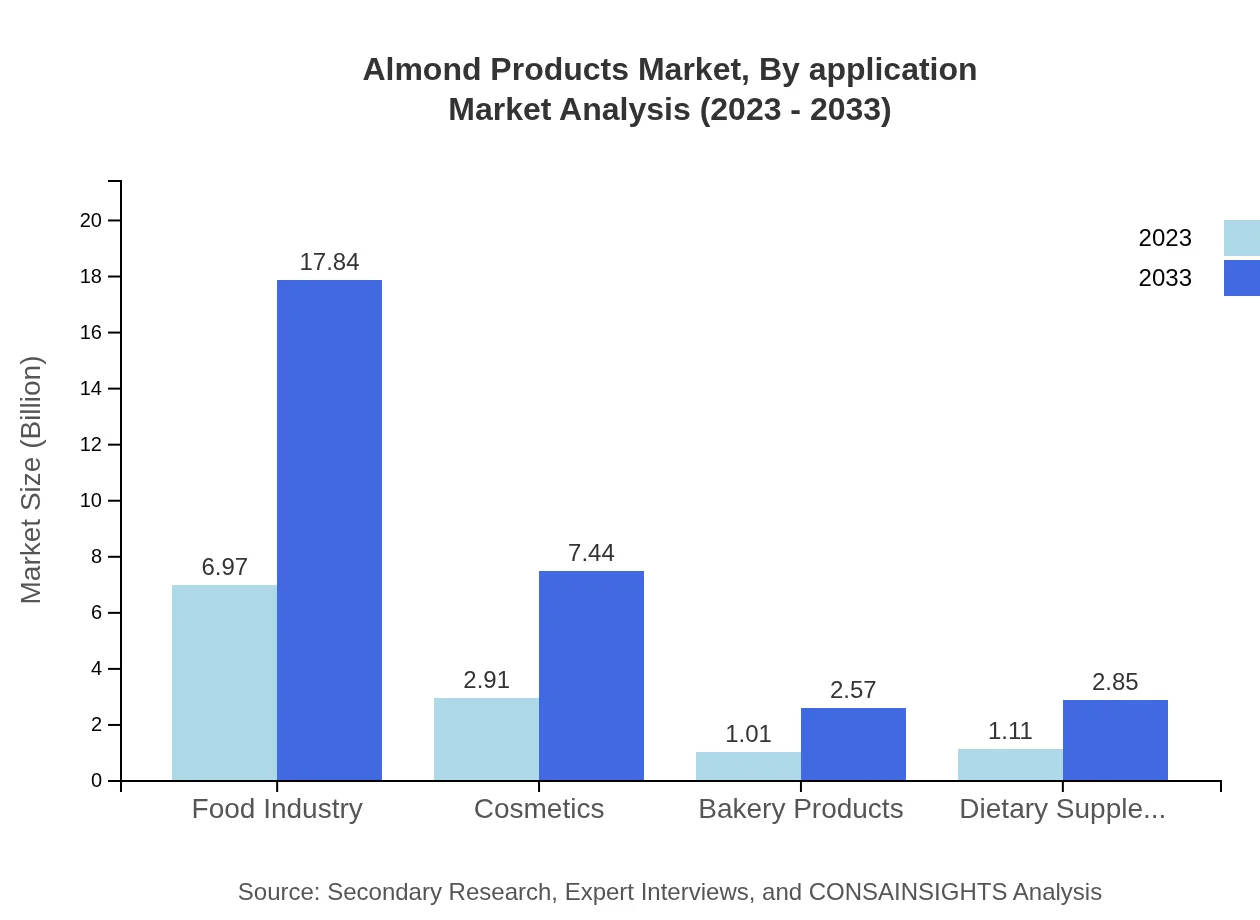

Almond Products Market Analysis By End User

The key end-user segments include the food industry, projected to grow from $6.97 billion to $17.84 billion, holding a 58.11% share by 2033, followed closely by cosmetics, which is forecasted to rise from $2.91 billion to $7.44 billion (24.23% share). The bakery products and dietary supplements sectors also show promise, with significant expected growth through 2033.

Almond Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Almond Products Industry

Blue Diamond Growers:

The largest almond processing and marketing company globally, known for its extensive range of almond products including almond milk and snacks.California Almonds:

A marketing program representing California almond growers, promoting almond consumption and sustainable farming practices.Almonds de Provence:

A prominent supplier of gourmet almond products, providing high-quality almond snacks and ingredients for culinary applications.We're grateful to work with incredible clients.

FAQs

What is the market size of almond products?

The almond products market is currently valued at approximately $12 billion and is expected to grow at a CAGR of 9.5% over the coming years. This growth reflects rising consumer demand for plant-based alternatives and health-conscious products.

What are the key market players or companies in the almond products industry?

Key players in the almond products market include established firms that dominate production and distribution. These companies focus on innovation, product quality, and expanding their presence across global markets to meet increasing consumer demands.

What are the primary factors driving the growth in the almond products industry?

The growth of the almond products market is driven by increased health consciousness, the rising popularity of plant-based foods, and growing demand for almond milk and snacks. Furthermore, advancements in production techniques and distribution have positively impacted market expansion.

Which region is the fastest Growing in the almond products market?

The North American region is the fastest-growing in the almond products market, projected to grow from $3.94 billion in 2023 to $10.07 billion by 2033. Other growing regions include Europe and Asia-Pacific, contributing significantly to market growth.

Does ConsaInsights provide customized market report data for the almond products industry?

Yes, ConsaInsights offers customized market report data tailored to client needs within the almond products industry. These bespoke reports can focus on specific segments, geographic regions, or emerging trends to inform strategic decision-making.

What deliverables can I expect from this almond products market research project?

Deliverables from the almond products market research include detailed market analysis, growth projections, regional insights, competitive landscapes, and segment breakdowns. These insights will help stakeholders identify opportunities and craft effective strategies.

What are the market trends of almond products?

Market trends in almond products include an increasing shift towards plant-based diets, innovation in product offerings such as flavored almond milk, and a growing focus on sustainability in production methods and packaging solutions.