Aloe Vera Extract Market Report

Published Date: 31 January 2026 | Report Code: aloe-vera-extract

Aloe Vera Extract Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the Aloe Vera Extract market from 2023 to 2033, focusing on market trends, size, segmentation, regional insights, and leading players, providing valuable insights and forecasts for stakeholders.

| Metric | Value |

|---|---|

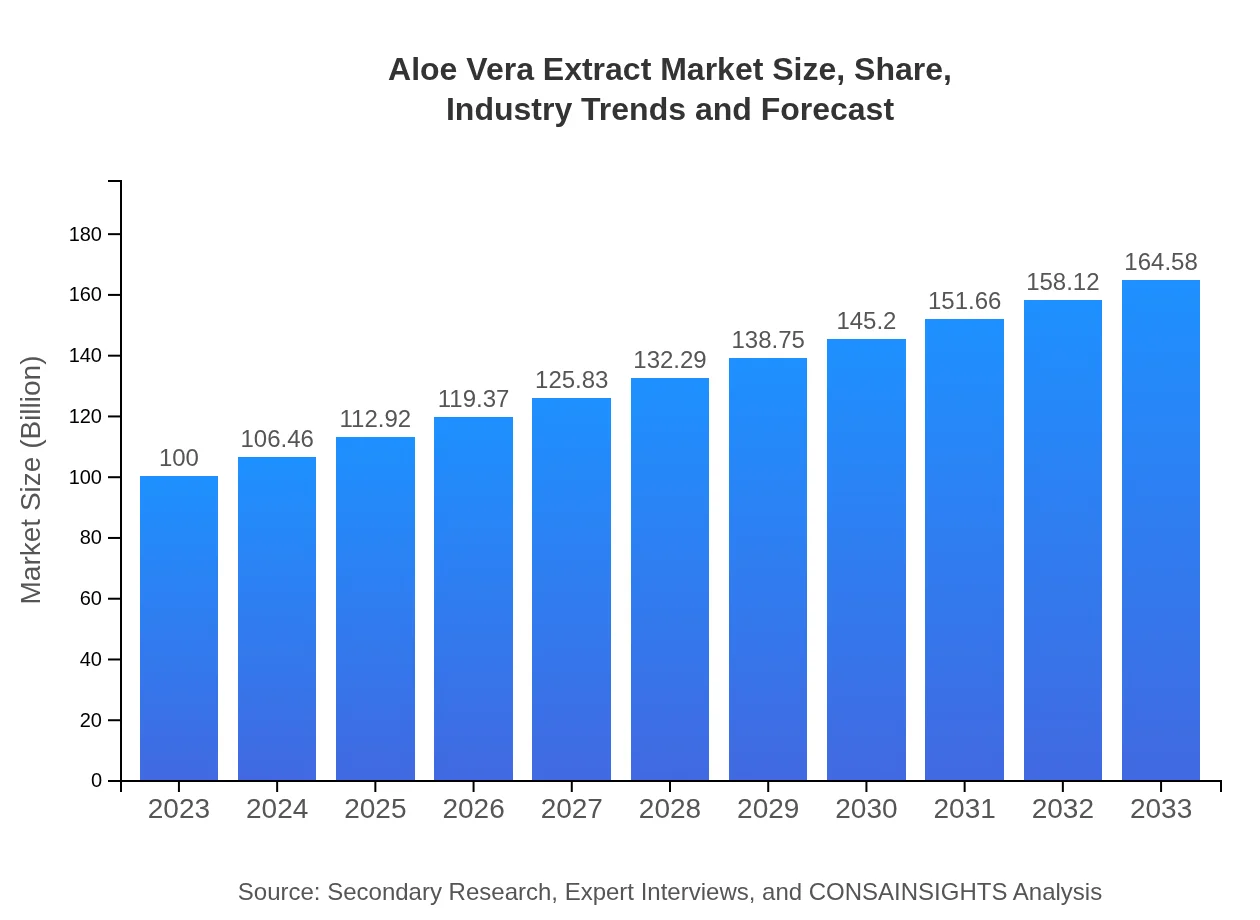

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Forever Living Products, Aloecorp Inc., Herbalife Nutrition Ltd. |

| Last Modified Date | 31 January 2026 |

Aloe Vera Extract Market Overview

Customize Aloe Vera Extract Market Report market research report

- ✔ Get in-depth analysis of Aloe Vera Extract market size, growth, and forecasts.

- ✔ Understand Aloe Vera Extract's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aloe Vera Extract

What is the Market Size & CAGR of Aloe Vera Extract market in 2023 and 2033?

Aloe Vera Extract Industry Analysis

Aloe Vera Extract Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aloe Vera Extract Market Analysis Report by Region

Europe Aloe Vera Extract Market Report:

Europe's Aloe Vera Extract market is estimated at USD 26.56 million in 2023, projected to grow to USD 43.71 million by 2033. The region's robust beauty and wellness sector, along with stringent regulations for product safety, enhances market development.Asia Pacific Aloe Vera Extract Market Report:

The Asia Pacific region, valued at USD 21.30 million in 2023, is projected to reach USD 35.05 million by 2033. The significant increase is driven by rising demands for beauty and personal care products, spurred by a growing middle-class population and inclinations toward natural ingredients.North America Aloe Vera Extract Market Report:

North America leads the market with a valuation of USD 35.47 million in 2023, forecasted to rise to USD 58.38 million by 2033. The region's extensive consumer base and established retail frameworks, combined with a strong interest in wellness, contribute to this growth.South America Aloe Vera Extract Market Report:

In South America, the Aloe Vera Extract market is expected to grow from USD 9.40 million in 2023 to USD 15.47 million by 2033. The growth is fueled by increased health consciousness and demand for organic products, predominantly in Brazil and Argentina.Middle East & Africa Aloe Vera Extract Market Report:

The Middle East and Africa market is relatively smaller, valued at USD 7.27 million in 2023 and expected to reach USD 11.96 million by 2033. Growing agricultural awareness and trends toward health and wellness products in urban areas drive this growth.Tell us your focus area and get a customized research report.

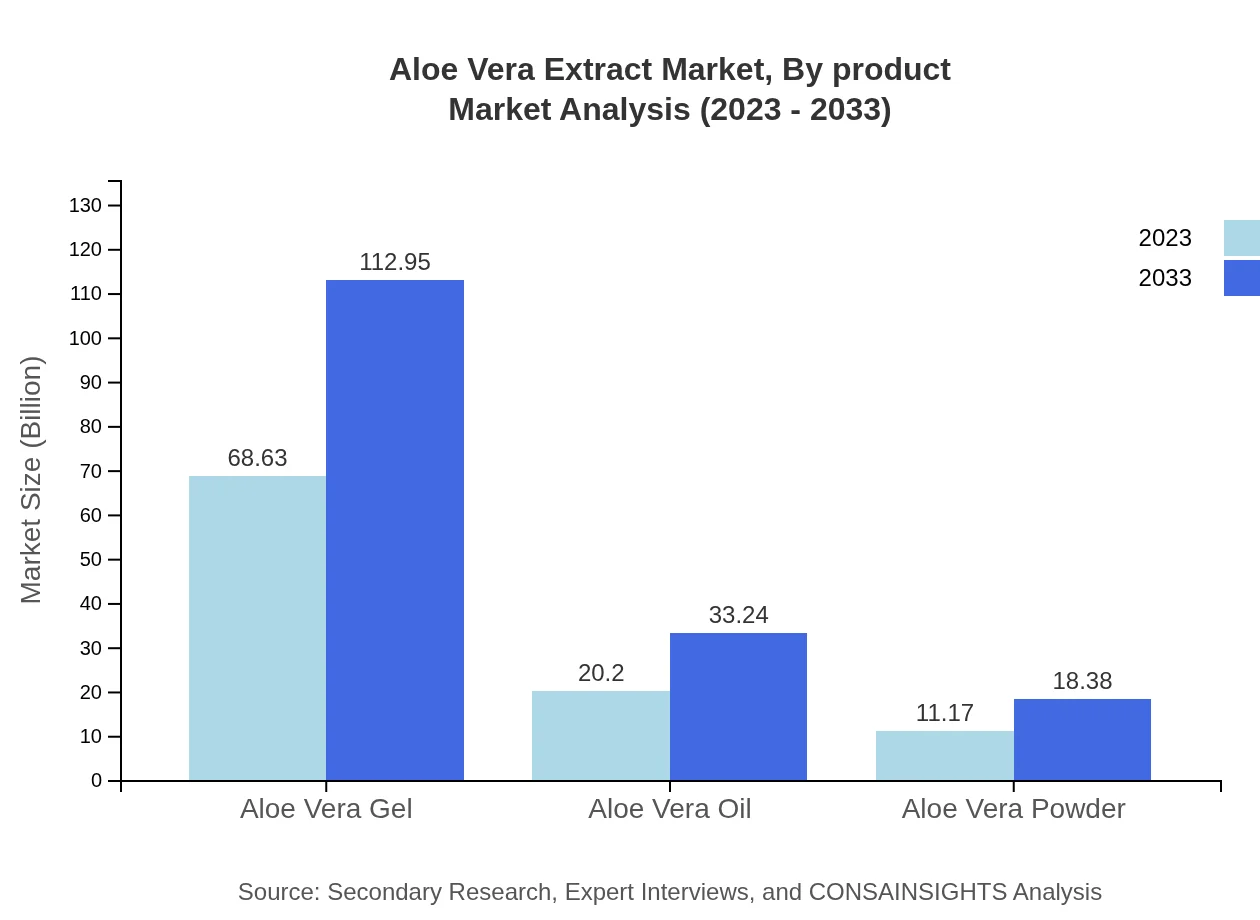

Aloe Vera Extract Market Analysis By Product

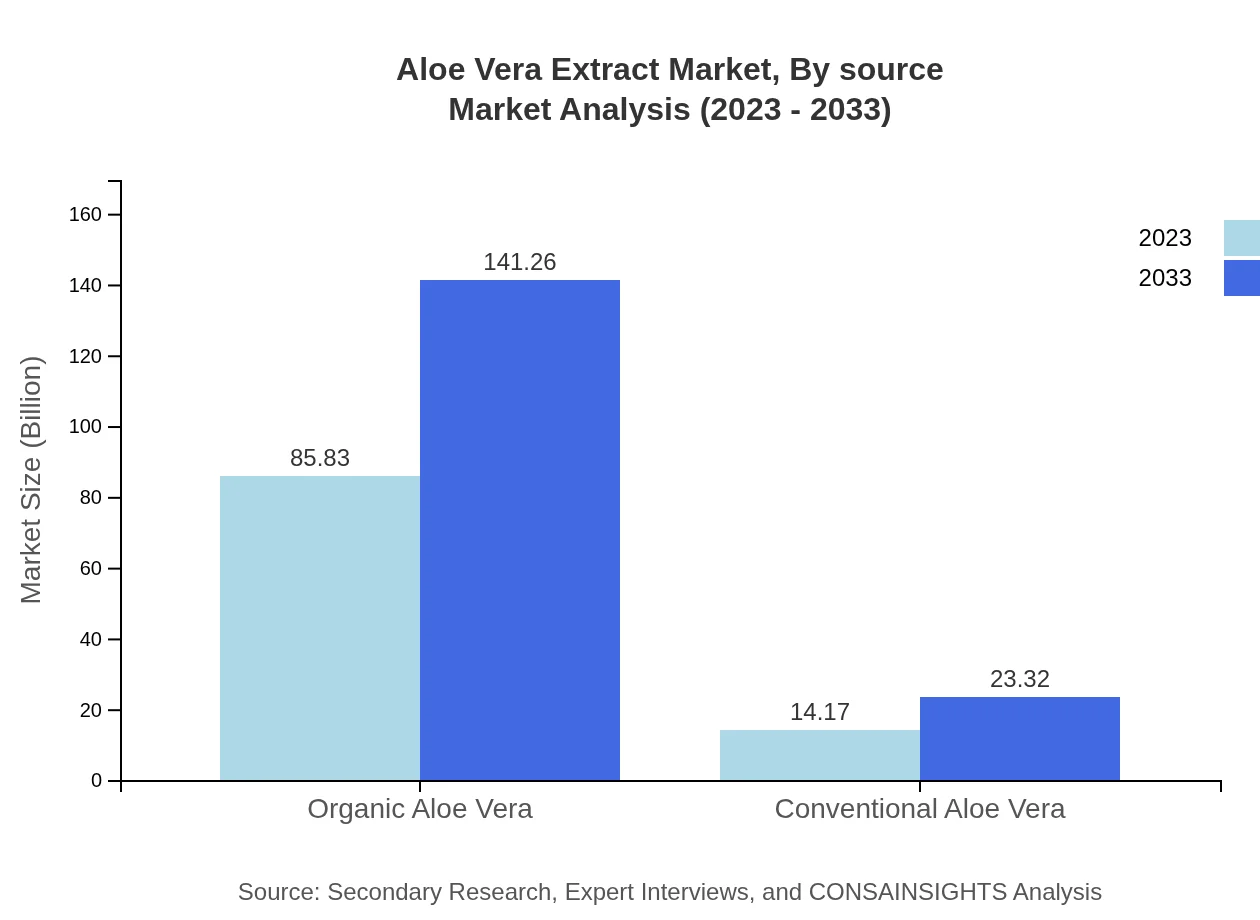

Market analysis reveals that Organic Aloe Vera dominates with a size of USD 85.83 million in 2023 and expected growth to USD 141.26 million by 2033. Conventional Aloe Vera follows, scaling from USD 14.17 million in 2023 to USD 23.32 million by 2033. These trends highlight the rising consumer preference for organic options.

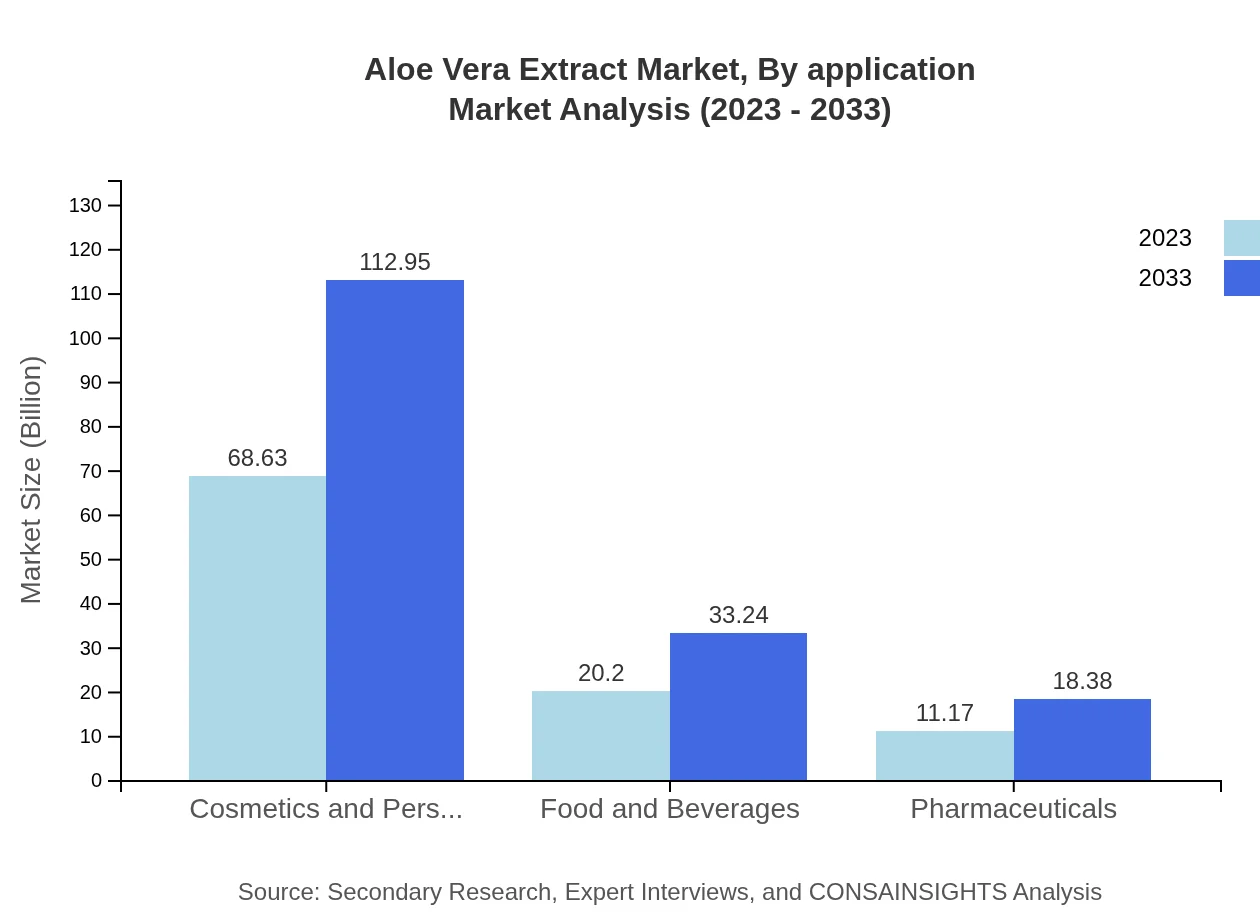

Aloe Vera Extract Market Analysis By Application

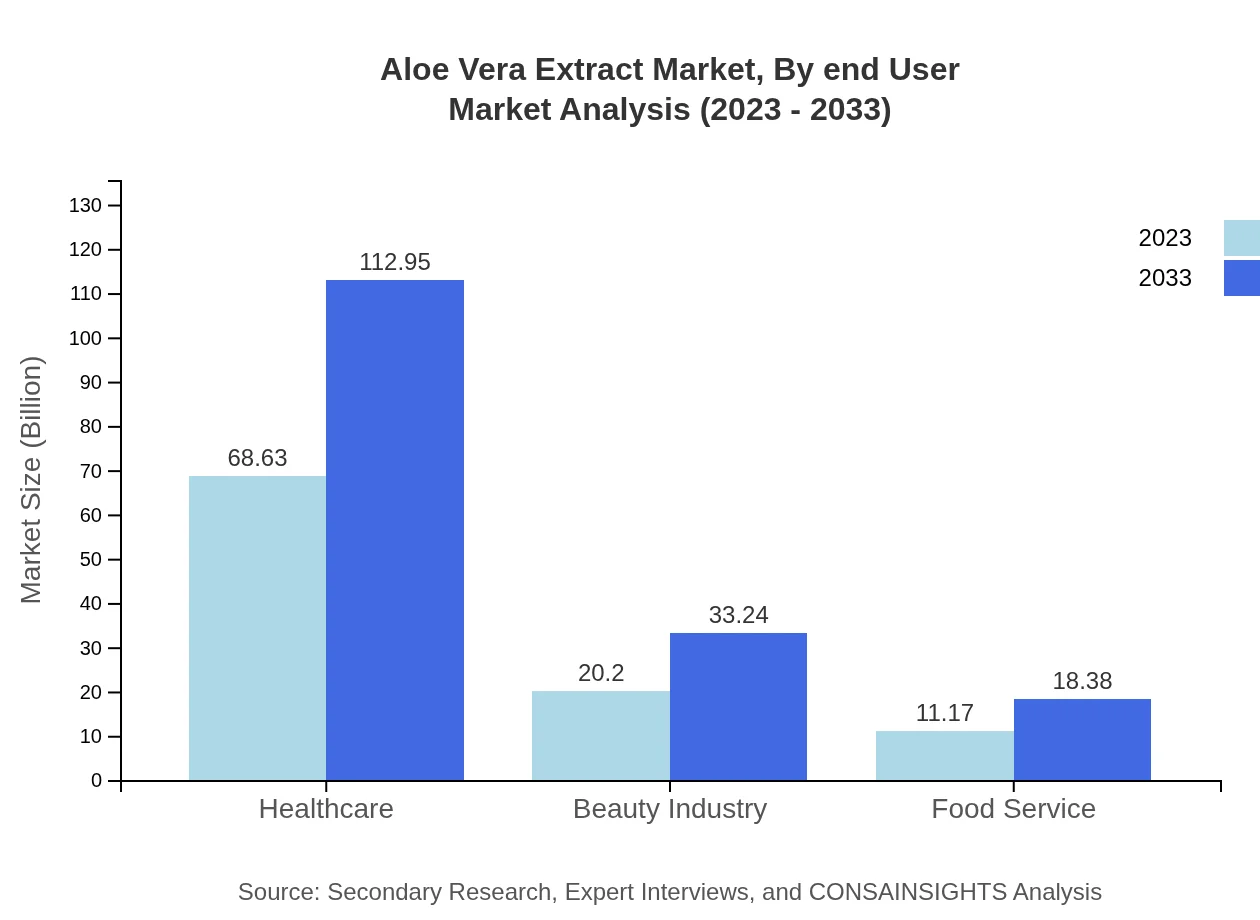

The healthcare sector leads Aloe Vera applications, valued at USD 68.63 million in 2023, anticipated to increase to USD 112.95 million by 2033. Cosmetics and Personal Care also exhibit robust performance, mirroring healthcare growth. The trend towards natural and herbal products ensures steady demand across applications.

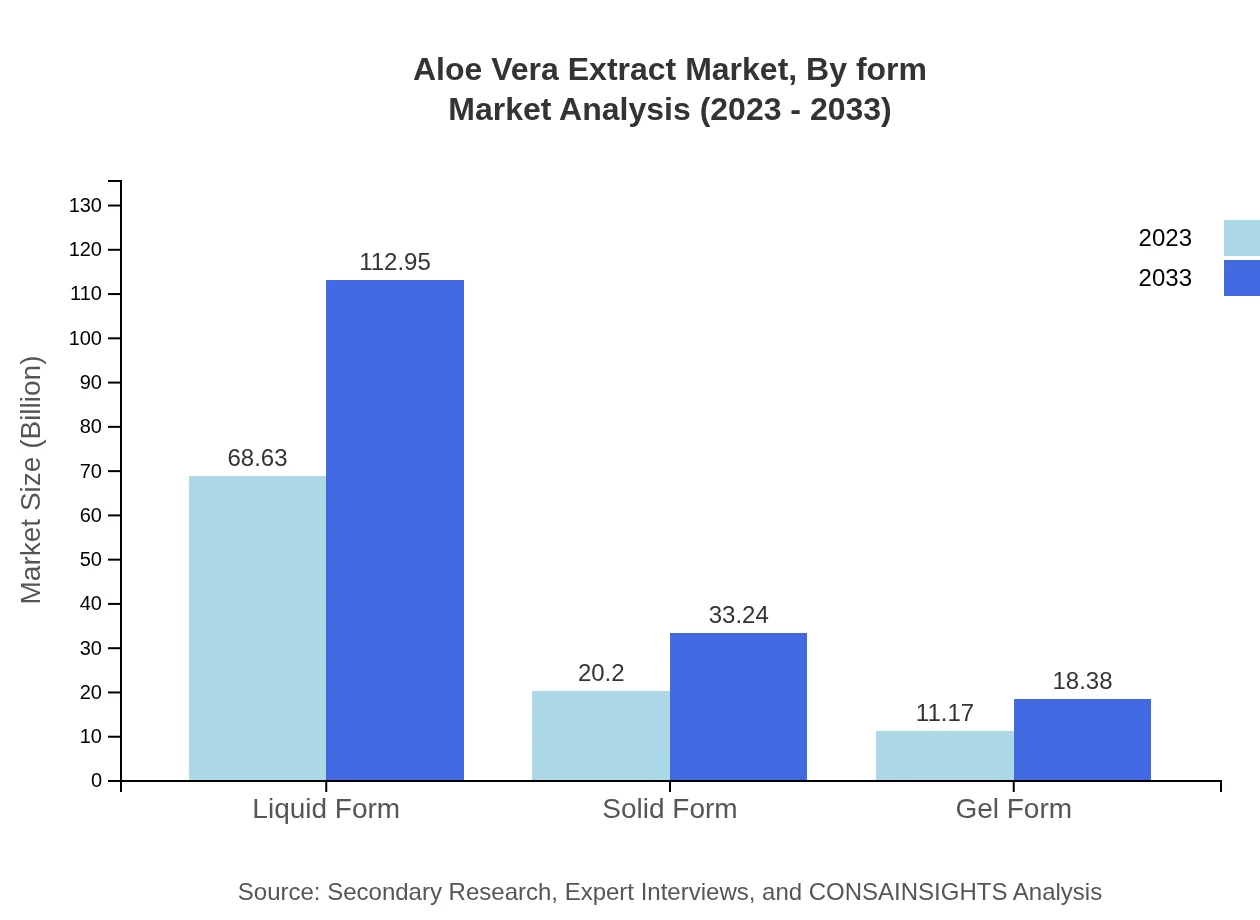

Aloe Vera Extract Market Analysis By Form

Liquid Form accounts for a market size of USD 68.63 million in 2023, projected to reach USD 112.95 million by 2033. Solid and gel forms also show favorable growth trajectories, indicating diverse consumer preferences for Aloe Vera's versatile applications.

Aloe Vera Extract Market Analysis By End User

Key end-users include pharmaceuticals, cosmetics, and food service industries. Each industry exhibits varying demands, with significant growth expected in pharmaceuticals as consumers favor natural remedies for health issues.

Aloe Vera Extract Market Analysis By Source

The analysis indicates a steady demand from both organic and conventional sources. However, organic sources are projected to lead due to the rising preference for environmentally friendly and sustainable products.

Aloe Vera Extract Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aloe Vera Extract Industry

Forever Living Products:

A key player in the Aloe Vera Extract market, specializing in direct sales of health and beauty products featuring Aloe Vera as a primary ingredient.Aloecorp Inc.:

A leading supplier of Aloe Vera and its derivatives, Aloecorp provides high-quality Aloe products for various industries, catering to the global market.Herbalife Nutrition Ltd.:

This global nutrition company utilizes Aloe Vera in many of its health and wellness products, significantly impacting the market through innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of aloe vera extract?

The aloe vera extract market is valued at approximately $100 million in 2023, with a projected CAGR of 5% through 2033. This growth underscores a solid demand across various applications since the market continues to expand significantly.

What are the key market players or companies in the aloe vera extract industry?

Key players in the aloe vera extract market include industry leaders specializing in herbal products and food additives. These organizations drive innovation and expand their product ranges to meet the rising consumer demand for natural and organic products.

What are the primary factors driving the growth in the aloe vera extract industry?

The growth of the aloe vera extract industry is propelled by increasing consumer awareness of health benefits, the rise in demand for organic products, and broad applications in pharmaceuticals, cosmetics, and food industries. These trends are fostering a robust expansion.

Which region is the fastest Growing in the aloe vera extract market?

Notably, North America stands out as the fastest-growing region, with a market size increasing from $35.47 million in 2023 to $58.38 million in 2033. Its growth reflects strong consumer preferences towards natural health supplements and cosmetics.

Does ConsaInsights provide customized market report data for the aloe vera extract industry?

Yes, ConsaInsights offers customized market report data for the aloe vera extract industry. Tailored reports can provide specific insights based on unique business requirements across different market segments and regional distributions.

What deliverables can I expect from this aloe vera extract market research project?

From the aloe vera extract market research project, you can expect comprehensive deliverables, including detailed market analysis, trend forecasting, competitive landscape overviews, and insights on growth drivers, regional segmentation, and emerging opportunities.

What are the market trends of aloe vera extract?

Current market trends indicate a rising shift towards organic aloe vera products and innovation in delivery formats. With health and wellness gaining traction, increased demand is observed in healthcare, beauty, and dietary applications, signifying a continual evolution in consumer preferences.