Alpha Olefins Market Report

Published Date: 02 February 2026 | Report Code: alpha-olefins

Alpha Olefins Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Alpha Olefins market, detailing current market conditions, forecasts for 2023-2033, regional insights, and key industry dynamics, including trends and competitive landscape.

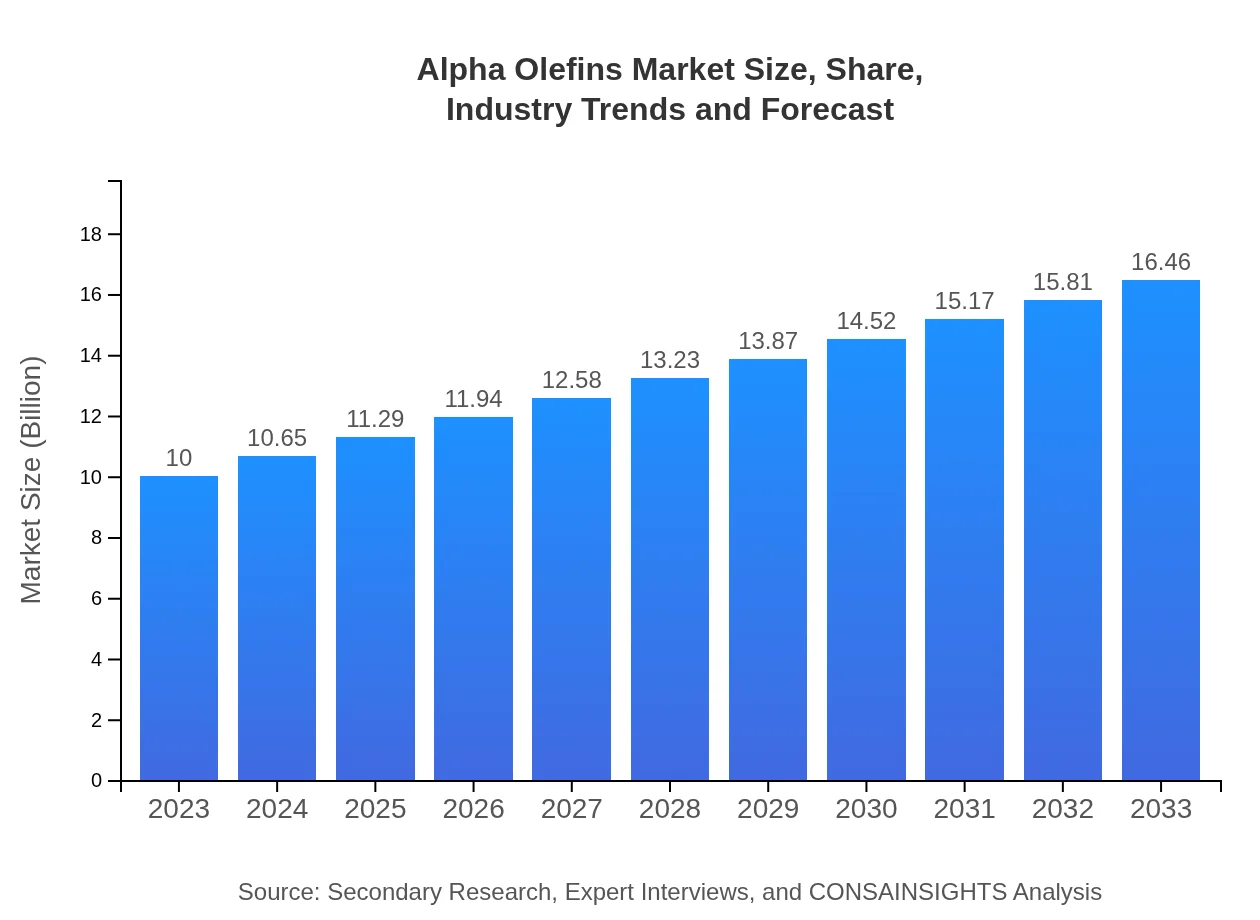

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | LyondellBasell Industries, SABIC, Chevron Phillips Chemical Company, ExxonMobil Chemical |

| Last Modified Date | 02 February 2026 |

Alpha Olefins Market Overview

Customize Alpha Olefins Market Report market research report

- ✔ Get in-depth analysis of Alpha Olefins market size, growth, and forecasts.

- ✔ Understand Alpha Olefins's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alpha Olefins

What is the Market Size & CAGR of Alpha Olefins market in 2023?

Alpha Olefins Industry Analysis

Alpha Olefins Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Alpha Olefins Market Analysis Report by Region

Europe Alpha Olefins Market Report:

Europe holds a significant share in the Alpha Olefins market, with a size of $3.25 billion in 2023, anticipated to grow to $5.35 billion by 2033. The market is driven by strong environmental regulations and a push for sustainable production methods, alongside the continuous demand from the automotive and packaging sectors.Asia Pacific Alpha Olefins Market Report:

The Asia Pacific region is a key driver for the Alpha Olefins market, accounting for about 42% of the total market share in 2023. The market size is projected to grow from $2.01 billion in 2023 to $3.31 billion by 2033, with increased demand in plastics and textiles industries coupled with expansions in manufacturing capabilities in countries like China and India, promoting growth in this segment.North America Alpha Olefins Market Report:

North America exhibits a robust Alpha Olefins market, with a size of $3.23 billion in 2023, expected to rise to $5.32 billion by 2033. The demand is largely fueled by advancements in shale gas production, leading to increased ethylene production, thereby benefiting alpha olefin production chains.South America Alpha Olefins Market Report:

In South America, the Alpha Olefins market is comparatively smaller, valued at $0.26 billion in 2023 and expected to reach $0.42 billion by 2033. The growth in this region is primarily driven by increasing demand in agricultural and surfactant applications, aligning with the region's unique market dynamics.Middle East & Africa Alpha Olefins Market Report:

The Middle East and Africa region's market is estimated to be $1.25 billion in 2023, with projections scaling to $2.06 billion by 2033. Growth is supported by increasing refining capacities and favorable government policies for petrochemical production, particularly in GCC countries.Tell us your focus area and get a customized research report.

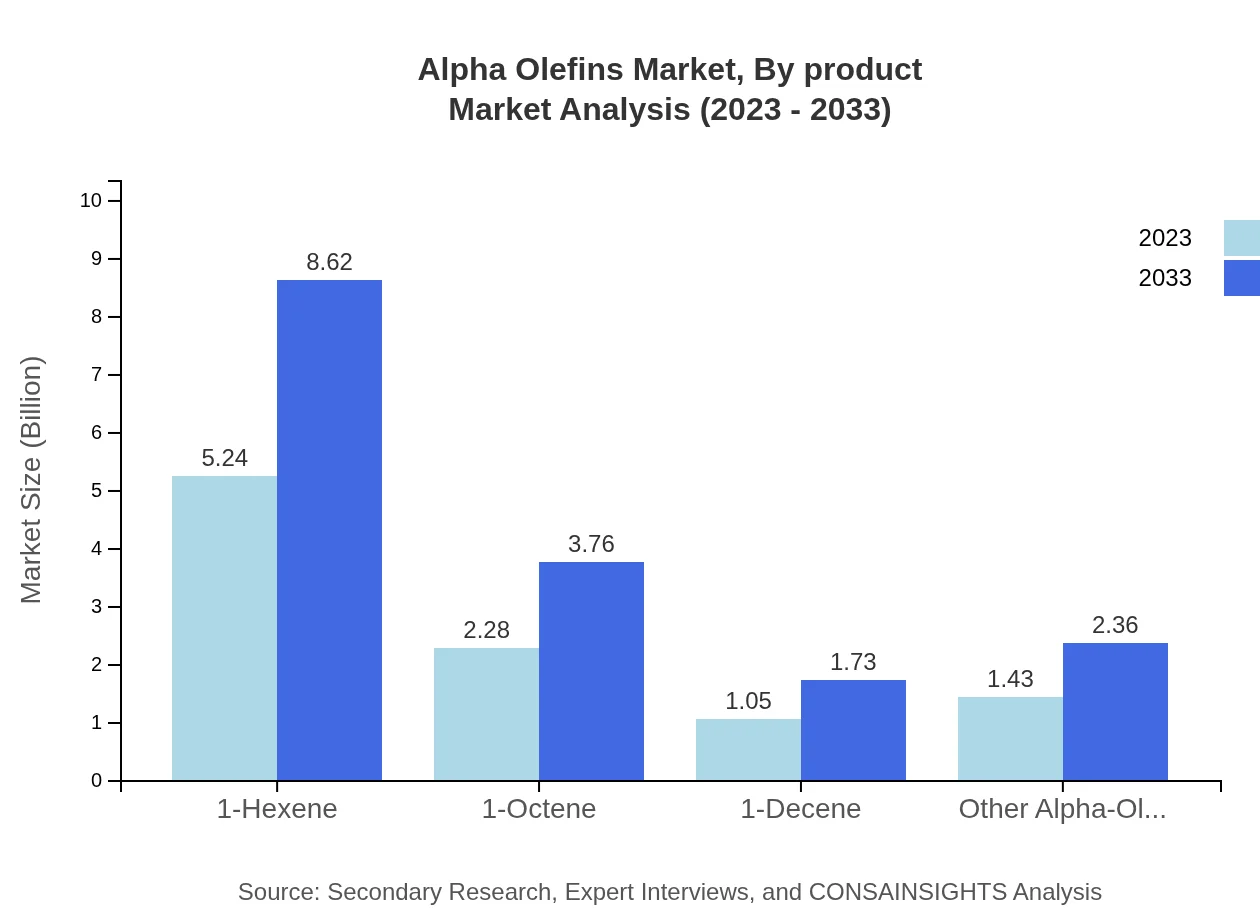

Alpha Olefins Market Analysis By Product

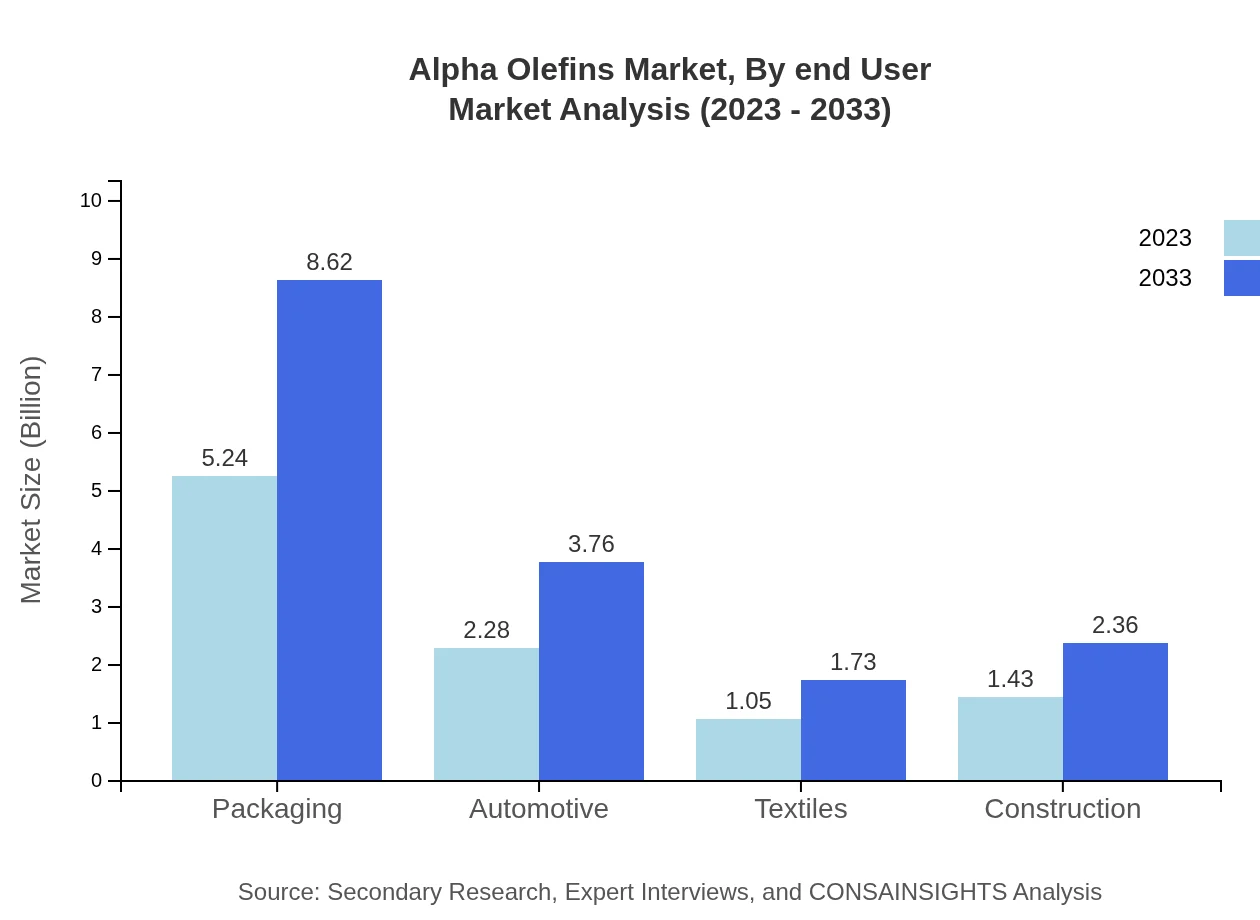

The Alpha-Olefins market is dominated by 1-Hexene, which accounted for approximately 52.36% of market share in 2023, with a market size of $5.24 billion. It is anticipated to reach $8.62 billion by 2033. The 1-Octene segment follows, representing 22.83% of market share in 2023, growing from $2.28 billion to $3.76 billion in 2033. Other smaller segments like 1-Decene and Other Alpha-Olefins contribute similarly, reflecting the diverse applications and consistent demand across the industry.

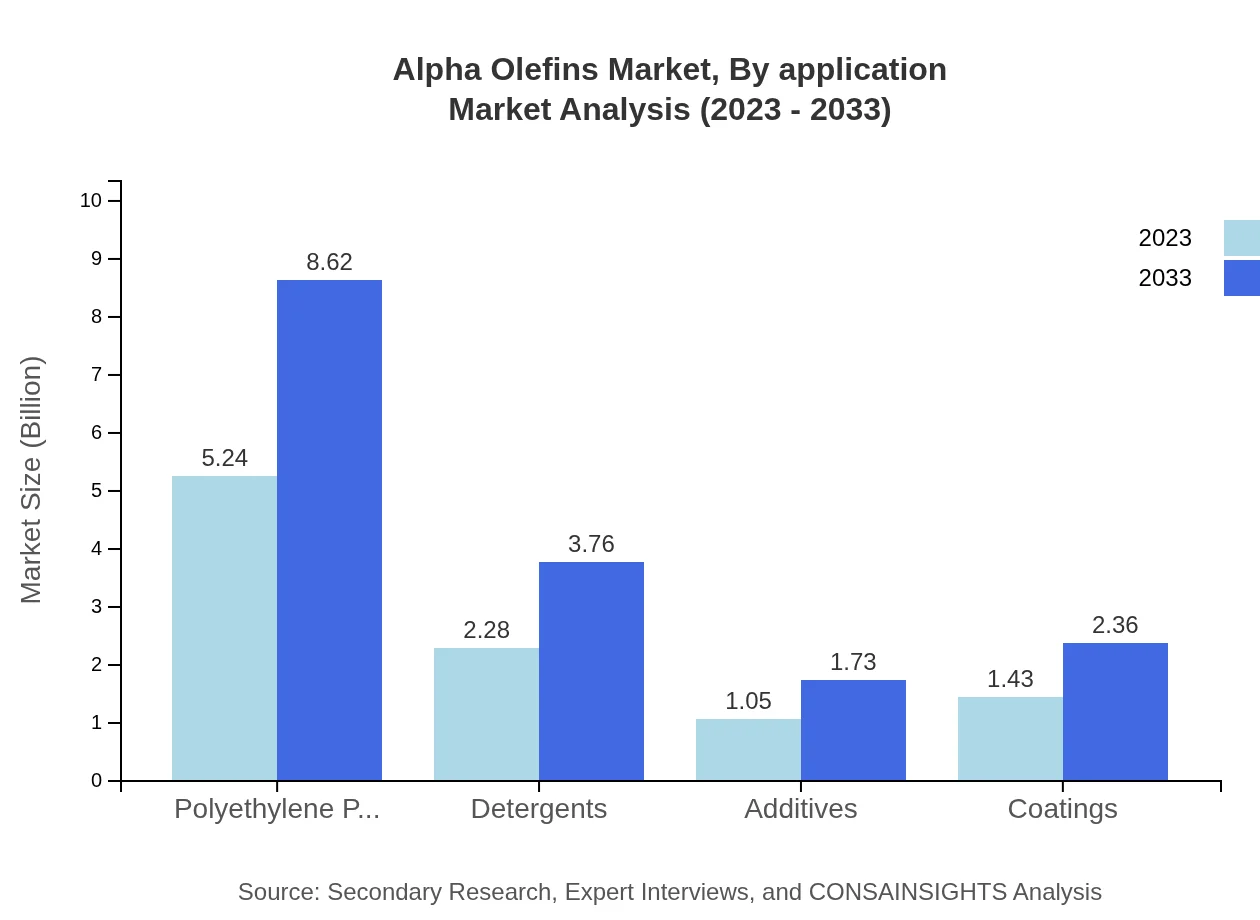

Alpha Olefins Market Analysis By Application

In terms of application, the packaging sector is the largest, dominating with a share of 52.36% and a market value of $5.24 billion in 2023, projected to grow to $8.62 billion by 2033. This is closely followed by automotive and textile applications, illustrating the importance of alpha olefins in producing high-performance materials that meet industry standards and consumer needs.

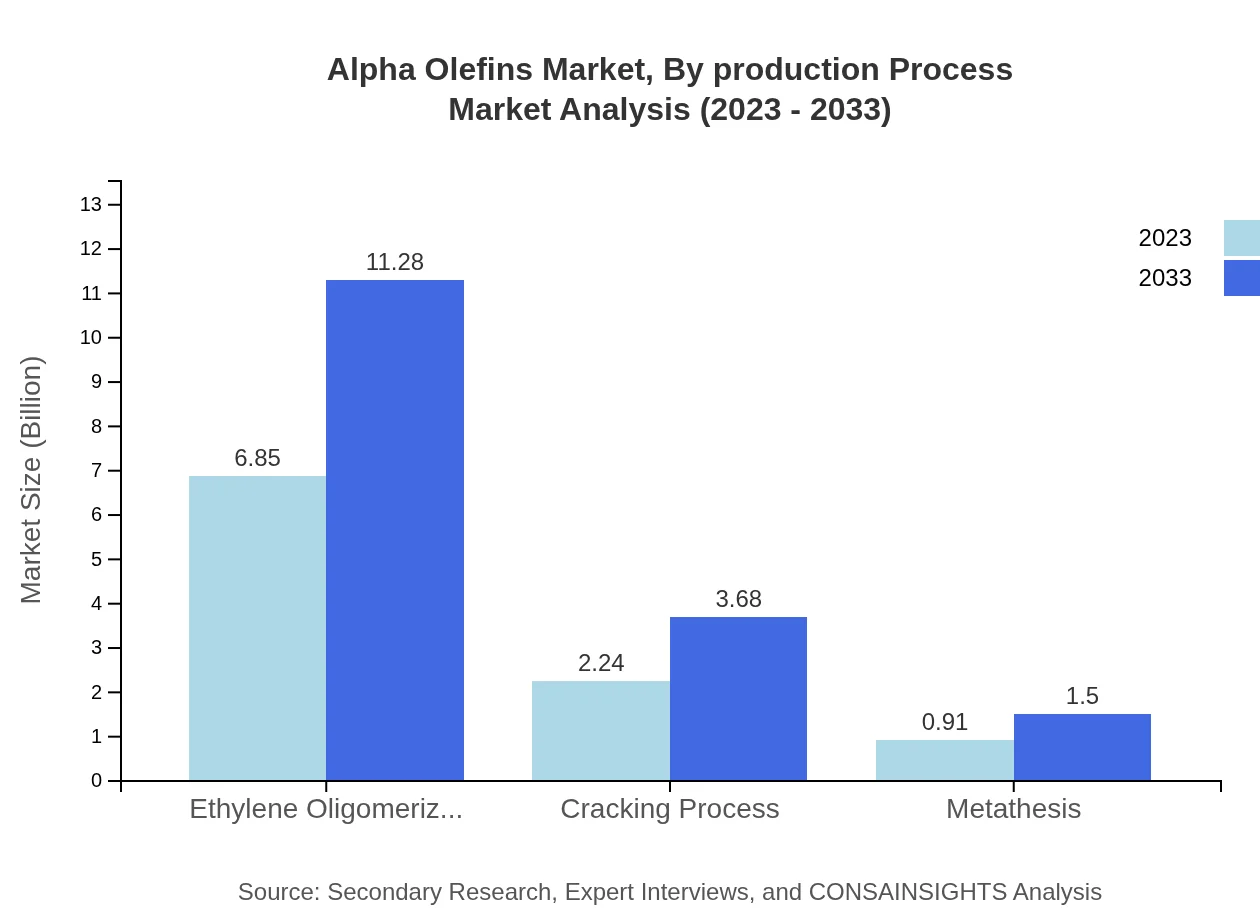

Alpha Olefins Market Analysis By Production Process

The market for Alpha Olefins is primarily influenced by preferred production processes such as Ethylene Oligomerization, which holds 68.52% of market share. This process ensures cost-effective production of alpha olefins, contributing significantly to the overall efficiency of the market. Cracking and metathesis processes also play roles but are less dominant.

Alpha Olefins Market Analysis By End User

Key end-user industries for alpha olefins include packaging, automotive, and textiles. Packaging forms a significant segment, representing over 52% of total demand, followed by automotive and textiles, which significantly rely on the chemical properties of alpha olefins for superior product performance and sustainability.

Alpha Olefins Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alpha Olefins Industry

LyondellBasell Industries:

A leading global chemical company known for its manufacture of polyolefins and alpha olefins, LyondellBasell plays a crucial role in advancing production technologies in the sector.SABIC:

Saudi Basic Industries Corporation (SABIC) is a prominent player in the production of alpha olefins, emphasizing innovation and sustainable practices within its operations.Chevron Phillips Chemical Company:

Chevron Phillips is renowned for its extensive product portfolio in the alpha olefins market, leveraging its advanced technology to enhance production efficiency.ExxonMobil Chemical:

ExxonMobil is a key strategic player in the global alpha olefins market, focusing on research and development to drive improvements in alpha olefin production.We're grateful to work with incredible clients.

FAQs

What is the market size of Alpha-Olefins?

The Alpha-Olefins market is valued at approximately $10 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 5% over the next decade. This growth signals increasing demand in various industries.

What are the key market players or companies in the Alpha-Olefins industry?

Key players in the Alpha-Olefins market include companies such as Shell, Chevron Phillips Chemical, and Ineos, which play significant roles in production and distribution across various regions.

What are the primary factors driving the growth in the Alpha-Olefins industry?

The growth in the Alpha-Olefins industry is driven by increased demand in packaging, automotive, and textile sectors. Additionally, advancements in production technologies contribute to improved efficiency and sustainability.

Which region is the fastest Growing in the Alpha-Olefins market?

In the Alpha-Olefins market, Europe is projected to be the fastest-growing region, with a market increase from $3.25 billion in 2023 to $5.35 billion by 2033, reflecting strong industrial demand.

Does ConsaInsights provide customized market report data for the Alpha-Olefins industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Alpha-Olefins industry, allowing clients to access detailed insights and analytics.

What deliverables can I expect from this Alpha-Olefins market research project?

Deliverables from the Alpha-Olefins market research project include comprehensive reports, market analysis charts, regional data insights, and segment-specific trends that facilitate informed decision-making.

What are the market trends of Alpha-Olefins?

Market trends in the Alpha-Olefins industry show a growing emphasis on sustainability and eco-friendly production processes. Innovations in product applications across diverse sectors are also notable.