Alternative Marine Power Market Report

Published Date: 22 January 2026 | Report Code: alternative-marine-power

Alternative Marine Power Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Alternative Marine Power market, focusing on trends, regional insights, and forecasts for the period 2023 to 2033, encompassing market size, growth potential, and competitive landscape.

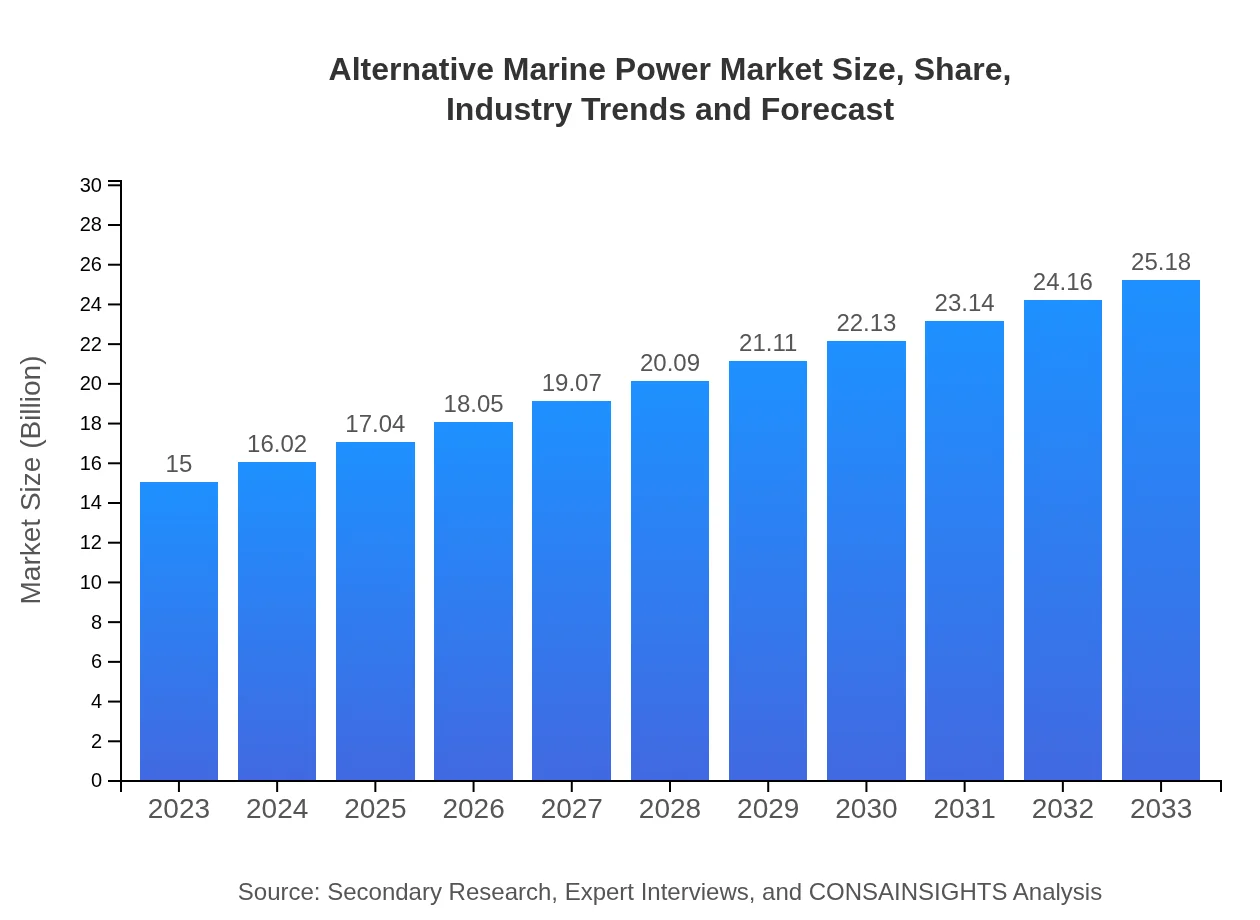

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $25.18 Billion |

| Top Companies | Wärtsilä Corporation, Cavotec SA, ABB Group, Rolls-Royce, Siemens AG |

| Last Modified Date | 22 January 2026 |

Alternative Marine Power Market Overview

Customize Alternative Marine Power Market Report market research report

- ✔ Get in-depth analysis of Alternative Marine Power market size, growth, and forecasts.

- ✔ Understand Alternative Marine Power's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Alternative Marine Power

What is the Market Size & CAGR of Alternative Marine Power market in 2023 and 2033?

Alternative Marine Power Industry Analysis

Alternative Marine Power Market Segmentation and Scope

Tell us your focus area and get a customized research report.

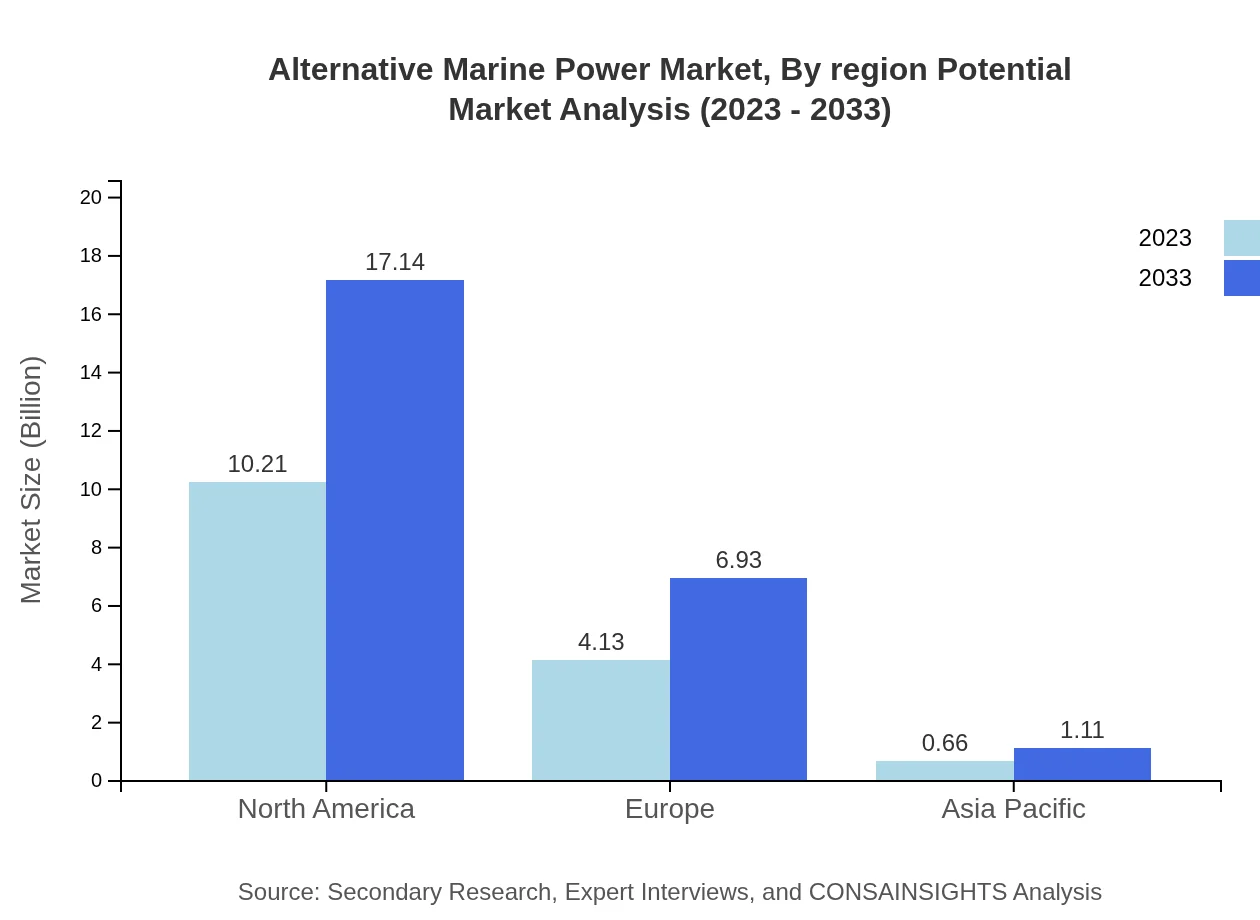

Alternative Marine Power Market Analysis Report by Region

Europe Alternative Marine Power Market Report:

Europe leads the way in the AMP market, with a value of $3.65 billion in 2023, forecasted to reach $6.12 billion by 2033. Stringent emission targets and a robust commitment to reducing the carbon footprint of maritime activities underpin this growth.Asia Pacific Alternative Marine Power Market Report:

In the Asia Pacific region, the market was valued at $2.94 billion in 2023 and is expected to reach $4.93 billion by 2033. Growing port activities and expansion of shipping operations in countries like China and Japan drive this growth, alongside increasing awareness of environmental sustainability.North America Alternative Marine Power Market Report:

North America’s AMP market, valued at $5.29 billion in 2023, is expected to grow to $8.89 billion by 2033. The region's strong regulatory framework and emphasis on environmental protection contribute significantly to the adoption of alternative marine power solutions.South America Alternative Marine Power Market Report:

In South America, the Alternative Marine Power market was valued at $1.29 billion in 2023, projected to rise to $2.17 billion by 2033. Initiatives focusing on environmental regulations and the preservation of marine ecosystems are key factors promoting the adoption of cleaner technologies.Middle East & Africa Alternative Marine Power Market Report:

The Middle East and Africa market is projected to grow from $1.83 billion in 2023 to $3.07 billion by 2033. Investment in port infrastructure and renewable energy initiatives are critical drivers for this region, alongside international pressure to adopt cleaner technologies.Tell us your focus area and get a customized research report.

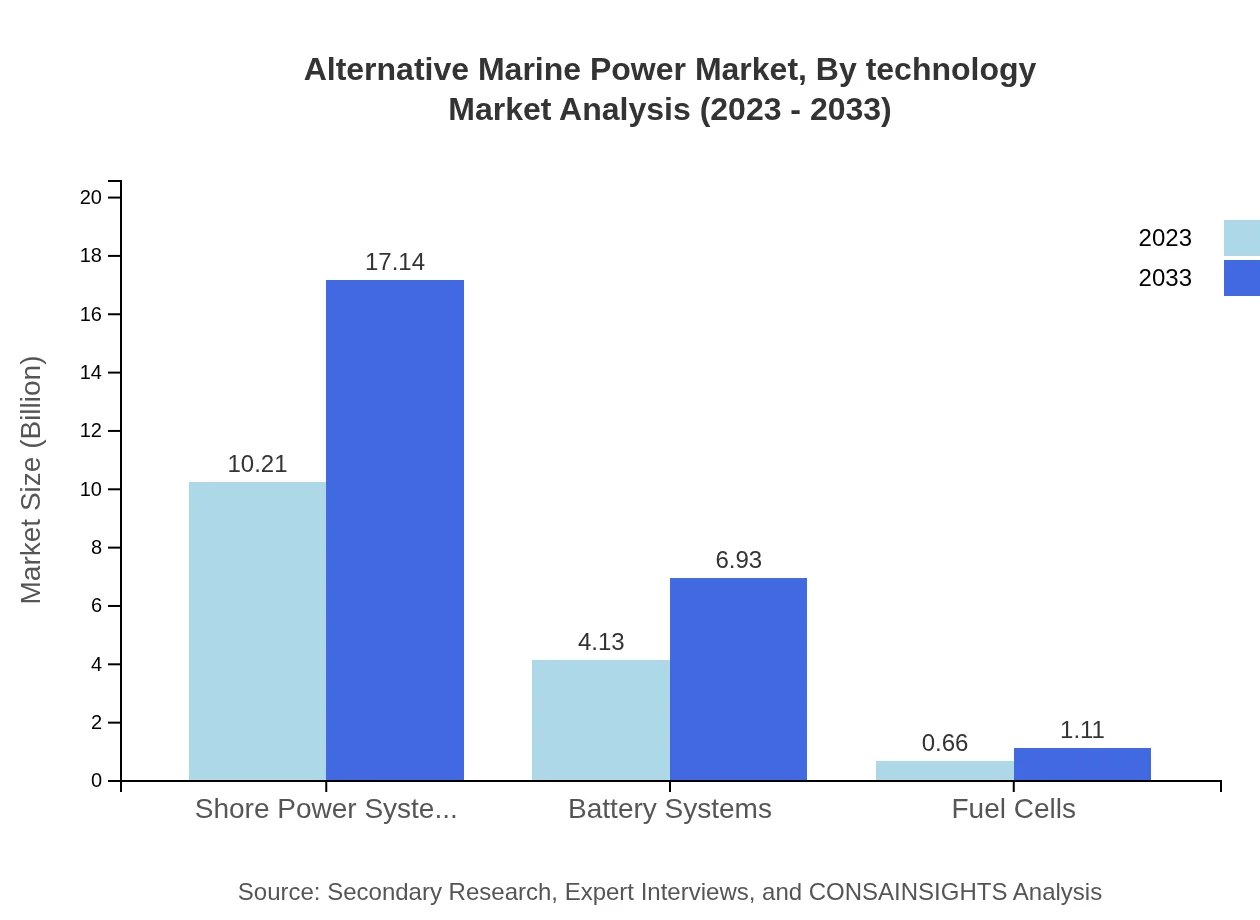

Alternative Marine Power Market Analysis By Technology

The AMP market is led by shore power systems, which accounted for approximately $10.21 billion in 2023 and are expected to grow to $17.14 billion by 2033, comprising 68.09% market share. Battery systems followed, starting at $4.13 billion and projected to reach $6.93 billion, while fuel cells currently represent a smaller segment valued at $0.66 billion with expectations of growth to $1.11 billion. These technologies are critical for transitioning from traditional to alternative energy solutions.

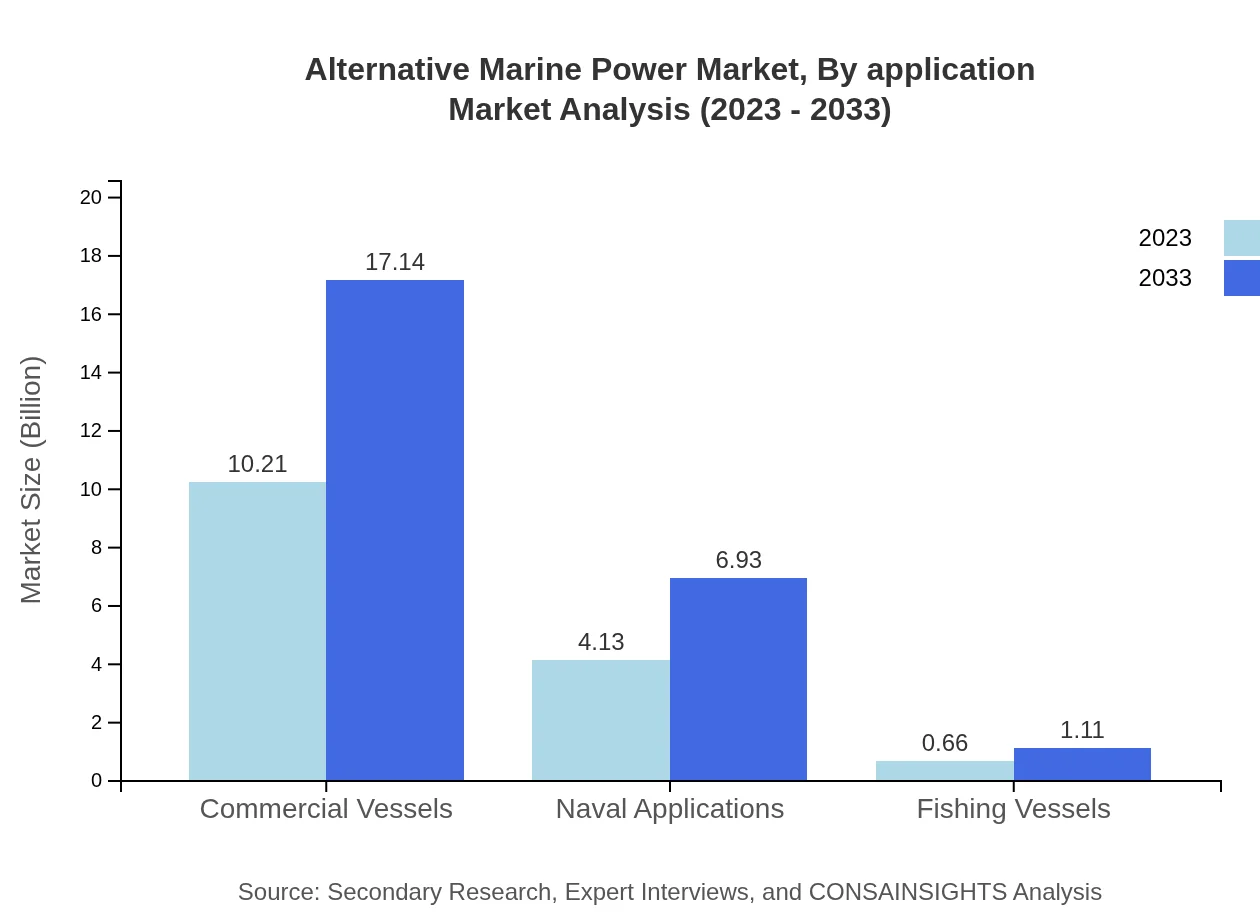

Alternative Marine Power Market Analysis By Application

The commercial vessels application holds the largest market share, estimated at $10.21 billion in 2023 and projected to grow to $17.14 billion by 2033, reflecting the emphasis on reducing emissions in the shipping industry. Naval applications follow, contributing significantly due to increased military focus on sustainability, with their market size growing from $4.13 billion to $6.93 billion. Fishing vessels also show promise, with a projected increase from $0.66 billion to $1.11 billion.

Alternative Marine Power Market Analysis By Region Potential

Regional potential varies significantly, with North America and Europe leading in AMP technology adoption due to stringent regulatory frameworks. Asia Pacific is rapidly expanding as emerging economies invest in cleaner technologies for shipping and ports. South America and the Middle East are also observing growth but at a slower pace, influenced by investment levels and regulatory support.

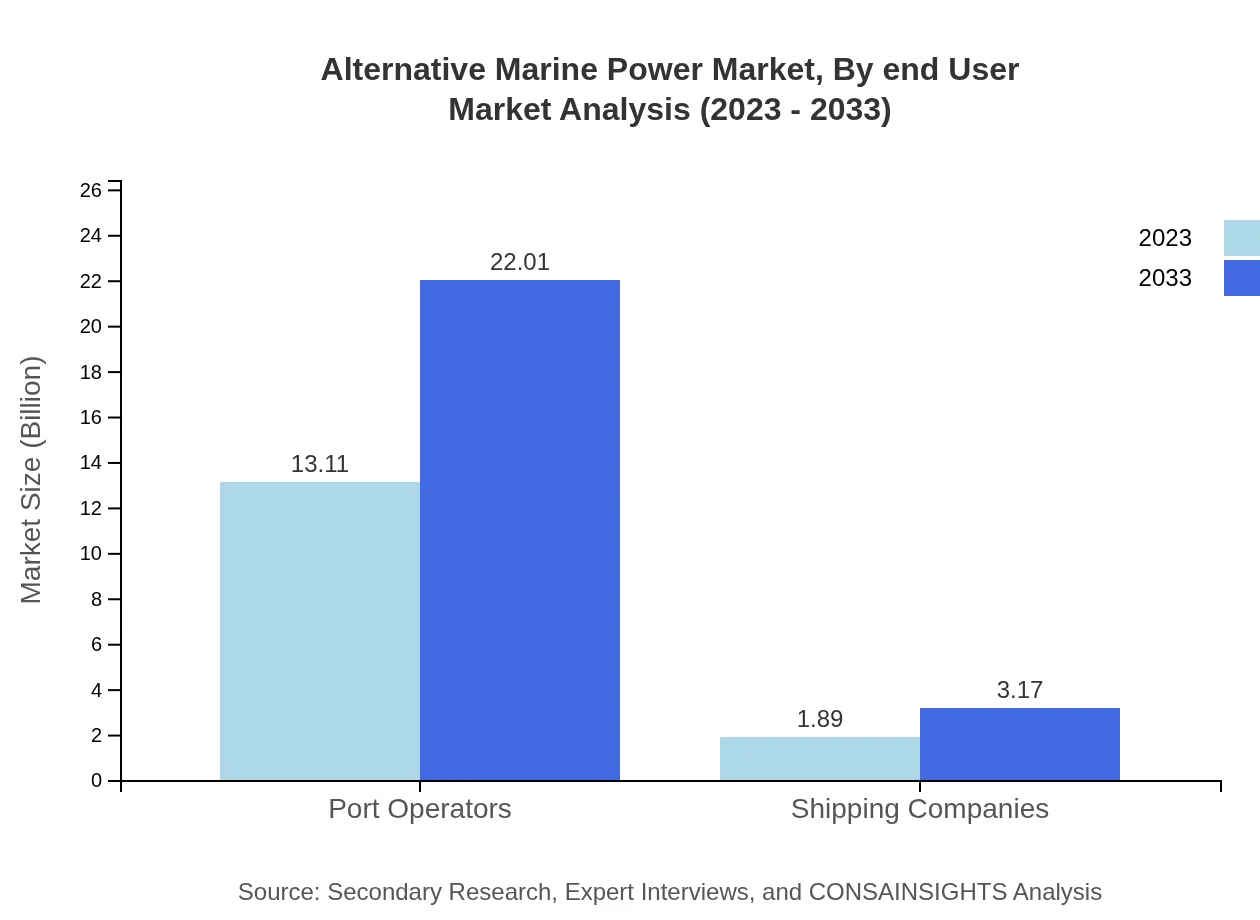

Alternative Marine Power Market Analysis By End User

Port operators represent a significant portion of AMP users, with an expected market growth from $13.11 billion in 2023 to $22.01 billion by 2033, dominating the share landscape at 87.43%. Shipping companies also contribute, with growth from $1.89 billion to $3.17 billion, indicating a rising trend towards sustainability. The interaction between end-users and technology providers will continue to drive market dynamics.

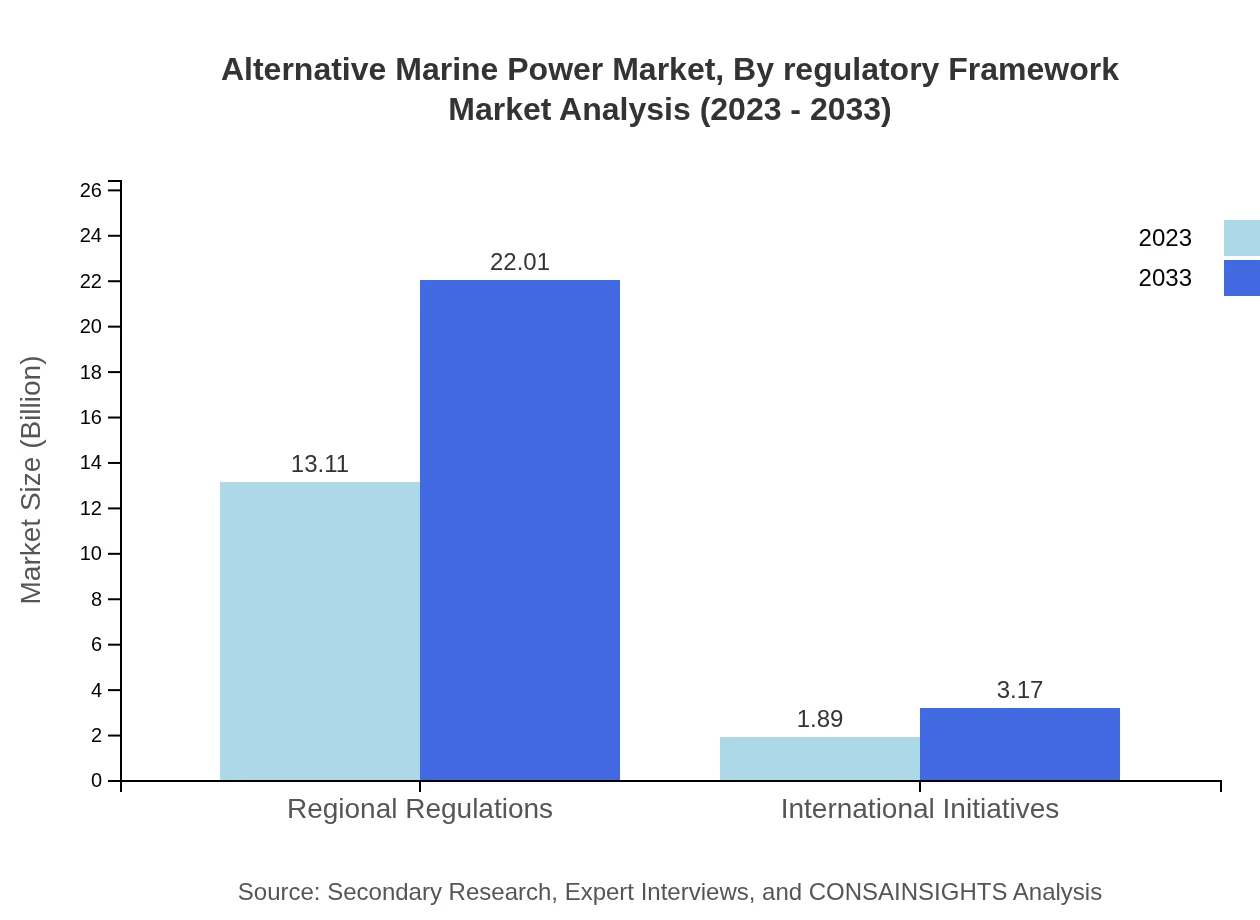

Alternative Marine Power Market Analysis By Regulatory Framework

The regulatory framework segment highlights the critical role of legislation and international agreements in promoting AMP adoption. Regulations have propelled the market size from $13.11 billion in 2023 to $22.01 billion by 2033, ensuring that sustainability remains a top priority as environmental concerns escalate.

Alternative Marine Power Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Alternative Marine Power Industry

Wärtsilä Corporation:

A leading global provider of innovative technologies and lifecycle solutions for the marine and energy markets, working towards a sustainable future.Cavotec SA:

Specializes in power supply to ships at berth and innovative marine applications, driving the adoption of shore power solutions worldwide.ABB Group:

A multinational corporation known for its electrification and automation technologies, investing in alternative energy solutions for marine applications.Rolls-Royce:

Focuses on advanced power and propulsion solutions, integrating sustainability into ship designs.Siemens AG:

Active in providing eco-friendly technologies across various industries, including significant contributions to alternative marine power systems.We're grateful to work with incredible clients.

FAQs

What is the market size of alternative Marine Power?

The alternative marine power market is valued at approximately $15 billion in 2023, with a steady growth forecast leading to a market size of around $25 billion by 2033. This reflects a compound annual growth rate (CAGR) of 5.2%.

What are the key market players or companies in the alternative marine power industry?

Key players in the alternative marine power market include prominent companies engaged in renewable energy solutions, ship manufacturing, and power supply systems, focusing on sustainable and efficient power generation methods.

What are the primary factors driving the growth in the alternative marine power industry?

Growth in the alternative marine power market is propelled by increasing environmental regulations, the demand for energy-efficient solutions, and advancements in power generation technologies that enhance sustainability and reduce carbon emissions.

Which region is the fastest Growing in the alternative marine power?

North America is the fastest-growing region in the alternative marine power market, expanding from $5.29 billion in 2023 to $8.89 billion by 2033, driven by technological advancements and strong regulatory support.

Does ConsaInsights provide customized market report data for the alternative marine power industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the alternative marine power industry, ensuring relevant, actionable insights for strategic decision-making.

What deliverables can I expect from this alternative marine power market research project?

Deliverables include comprehensive market analysis reports, detailed segmentation data, regional insights, growth forecasts, and competitive landscape assessments for the alternative marine power market.

What are the market trends of alternative marine power?

Key trends in the alternative marine power market include increasing investment in renewable energy, a shift towards electrical propulsion systems, and heightened focus on regulatory compliance and sustainability initiatives.