Aluminum Cans Market Report

Published Date: 01 February 2026 | Report Code: aluminum-cans

Aluminum Cans Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a detailed analysis of the Aluminum Cans industry from 2023 to 2033, covering insights on market size, growth forecasts, industry trends, segmentation, and regional analysis. It serves as a comprehensive source for understanding market dynamics and future developments.

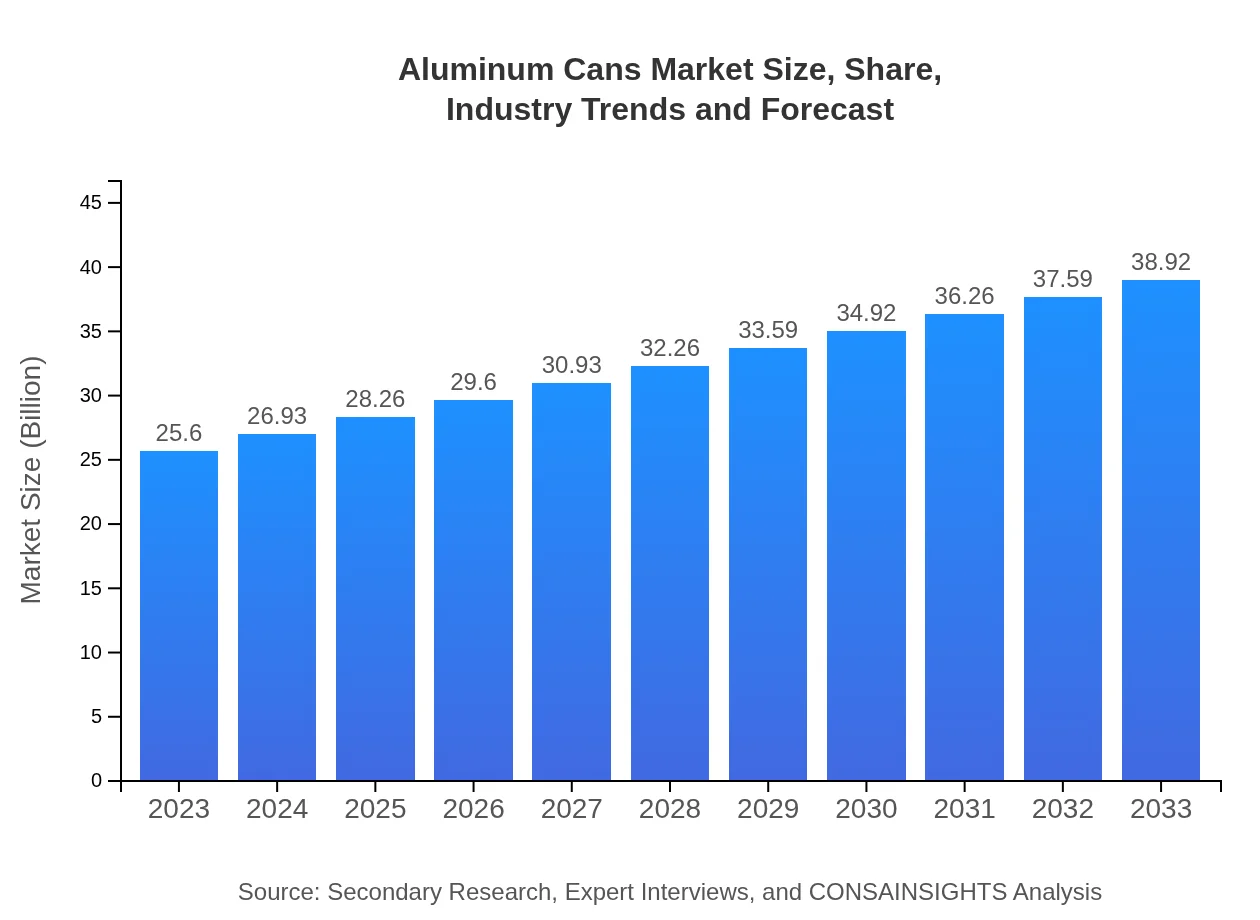

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $38.92 Billion |

| Top Companies | Ball Corporation, Crown Holdings, Inc., Ardagh Group, CanPack Group, Beverage Can Makers Europe (BCME) |

| Last Modified Date | 01 February 2026 |

Aluminum Cans Market Overview

Customize Aluminum Cans Market Report market research report

- ✔ Get in-depth analysis of Aluminum Cans market size, growth, and forecasts.

- ✔ Understand Aluminum Cans's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aluminum Cans

What is the Market Size & CAGR of Aluminum Cans market in 2023?

Aluminum Cans Industry Analysis

Aluminum Cans Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aluminum Cans Market Analysis Report by Region

Europe Aluminum Cans Market Report:

Europe’s Aluminum Cans market is estimated at $8.08 billion in 2023, growing to $12.28 billion by 2033. The region embraces stringent recycling policies and sustainability practices, boosting the demand for aluminum cans, particularly in Germany and the UK, where recycling rates are exceptionally high.Asia Pacific Aluminum Cans Market Report:

In 2023, the Asia Pacific Aluminum Cans market is valued at $4.93 billion, projected to grow to $7.50 billion by 2033, driven by rapid urbanization and a growing beverage industry. Countries like China and India are significant contributors to this growth due to rising disposable incomes and changing consumer preferences towards packaged beverages.North America Aluminum Cans Market Report:

North America holds a robust market for aluminum cans, valued at $8.48 billion in 2023 and expected to reach $12.89 billion by 2033. The market's growth is driven by a strong preference for aluminum over plastic and glass, as consumers become more environmentally conscious. The US remains the largest market due to high demand in the beverage sector.South America Aluminum Cans Market Report:

The South American market is valued at $1.08 billion in 2023, with an expected increase to $1.63 billion by 2033. The growth is primarily attributed to the increasing consumption of canned beverages and effective recycling initiatives. Brazil remains the leading market, promoting eco-friendly packaging solutions.Middle East & Africa Aluminum Cans Market Report:

The Middle East and Africa market is projected to grow from $3.03 billion in 2023 to $4.61 billion by 2033. Increased urbanization and growth in the food and beverage sectors are driving this change, with countries like the UAE and South Africa leading the charge.Tell us your focus area and get a customized research report.

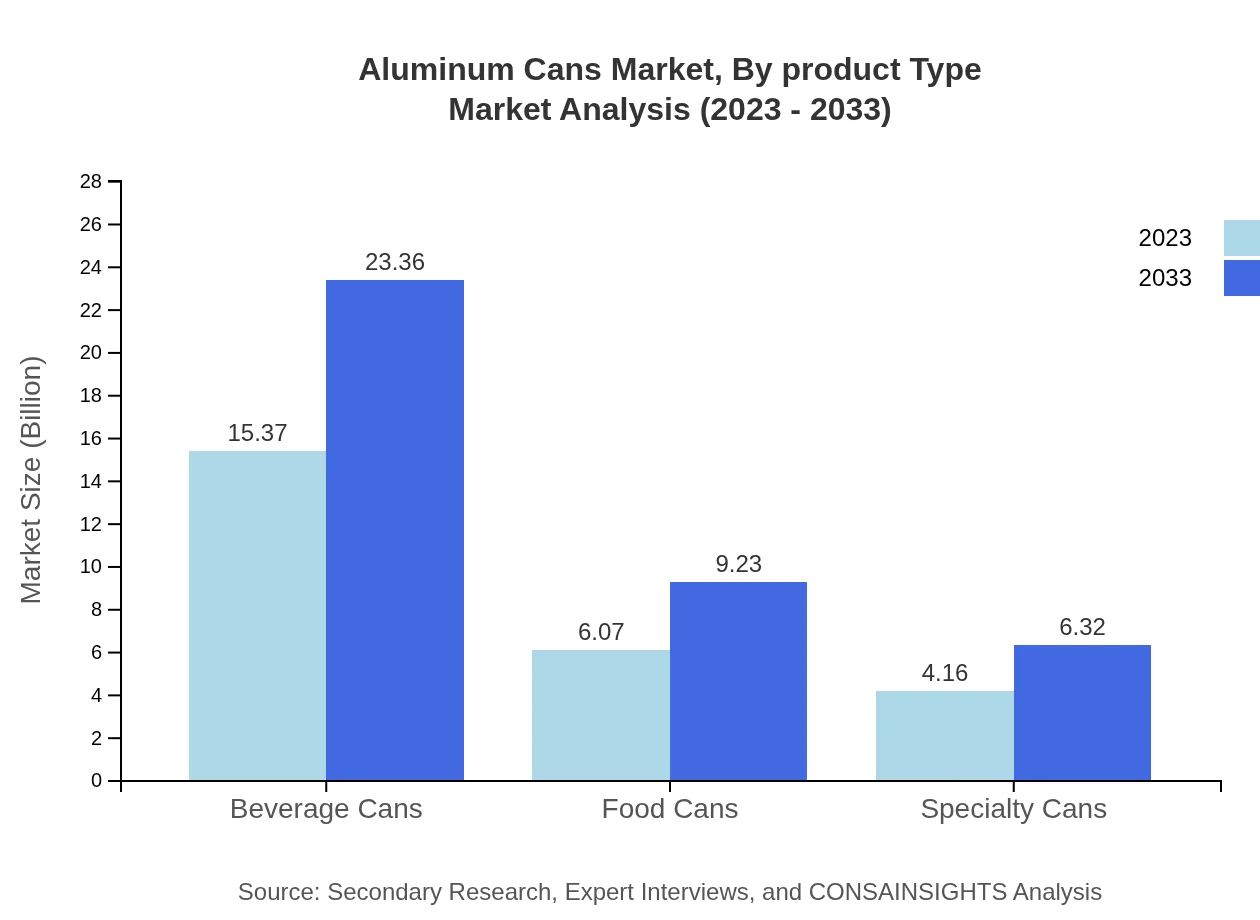

Aluminum Cans Market Analysis By Product Type

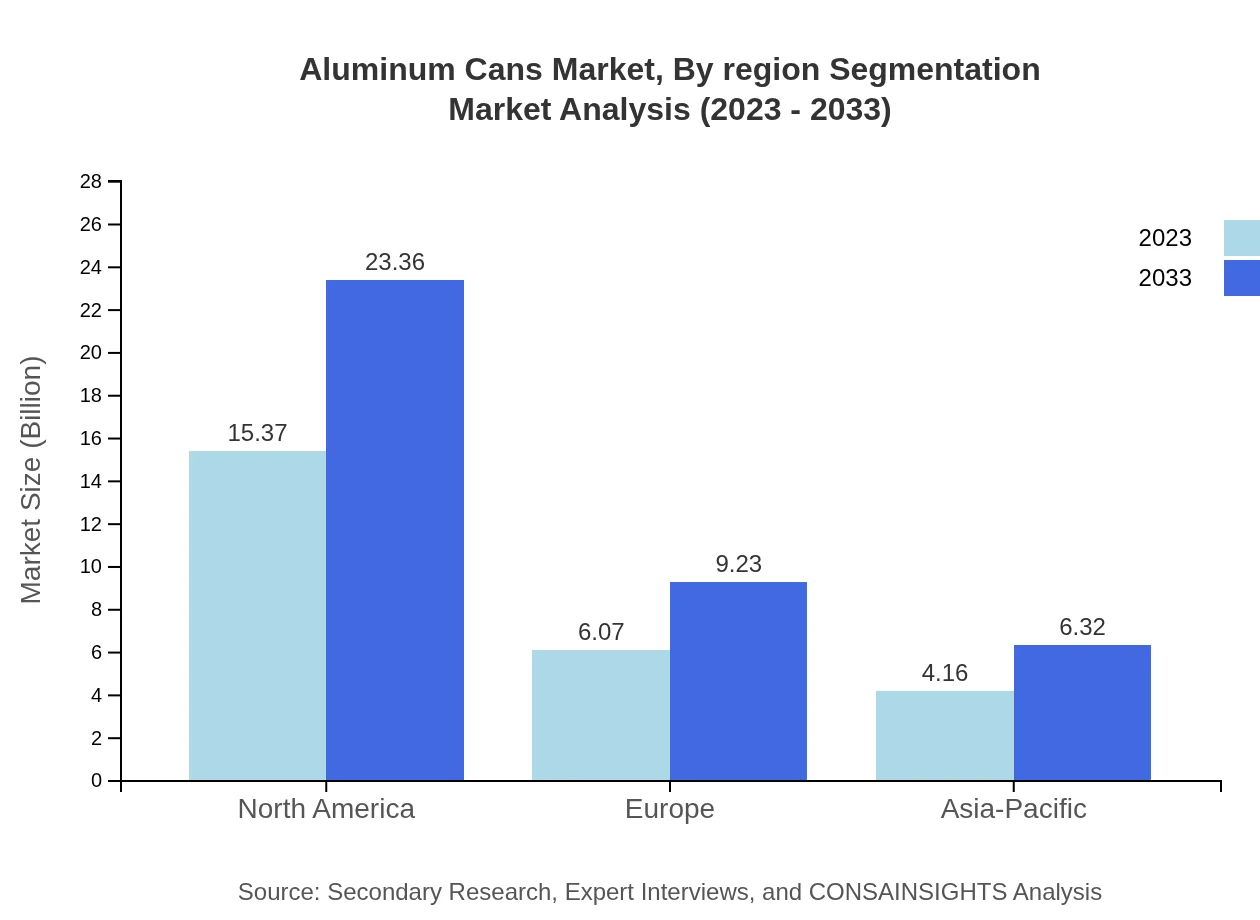

The product type segment includes beverage cans, food cans, and specialty cans. Beverage cans dominate the segment, with a market size of $15.37 billion in 2023 expected to rise to $23.36 billion by 2033, capturing 60.03% of the market share. Food cans, with a size of $6.07 billion in 2023, represent 23.72% market share, projected to grow to $9.23 billion by 2033. Specialty cans, accounting for $4.16 billion in 2023 or 16.25% of the market, are set to grow as niche markets expand.

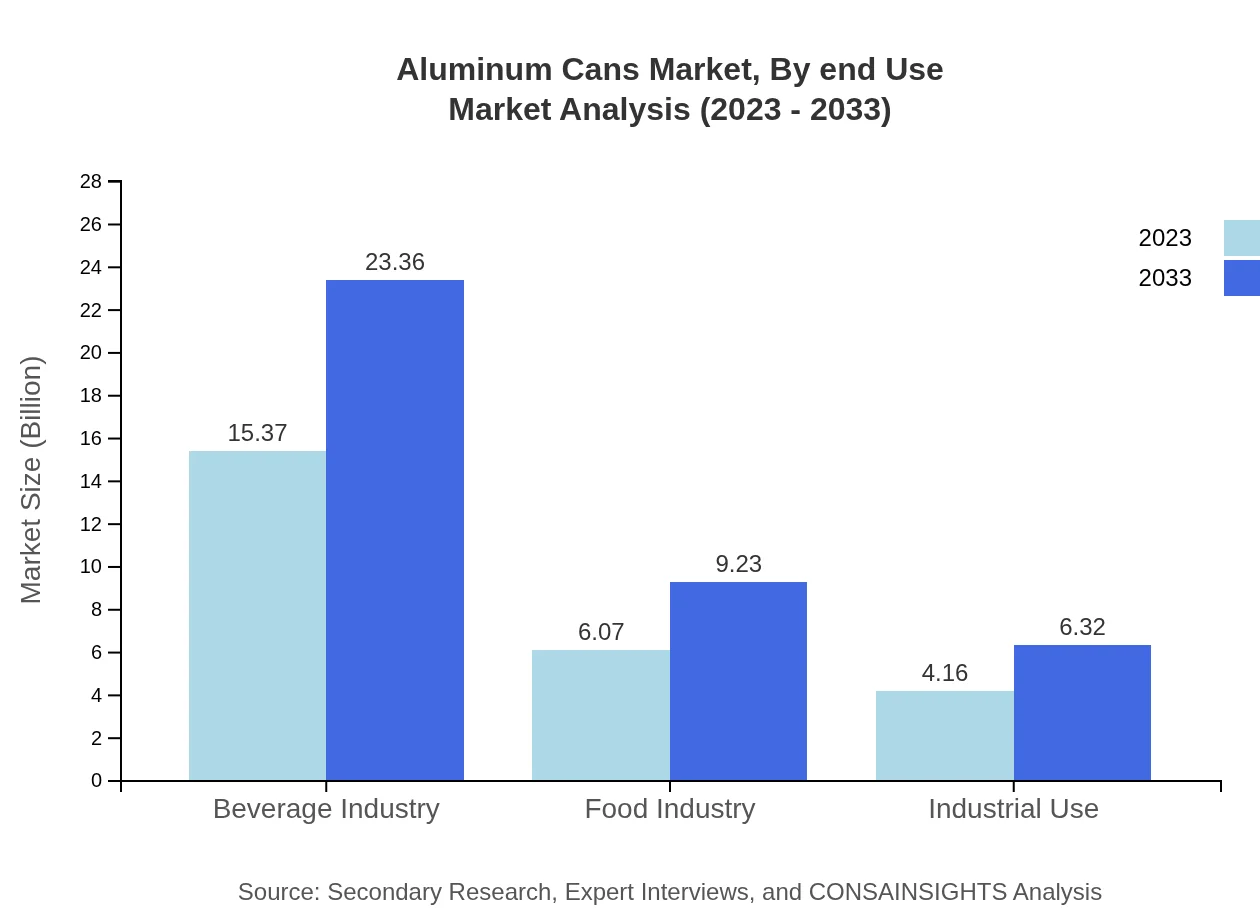

Aluminum Cans Market Analysis By End Use

The end-use segment illustrates the diverse applications of aluminum cans, primarily in the beverage industry, which accounts for a market size of $15.37 billion in 2023, set to reach $23.36 billion by 2033. The food industry represents $6.07 billion with a market share of 23.72%, while industrial use, valued at $4.16 billion, comprises 16.25% of the market.

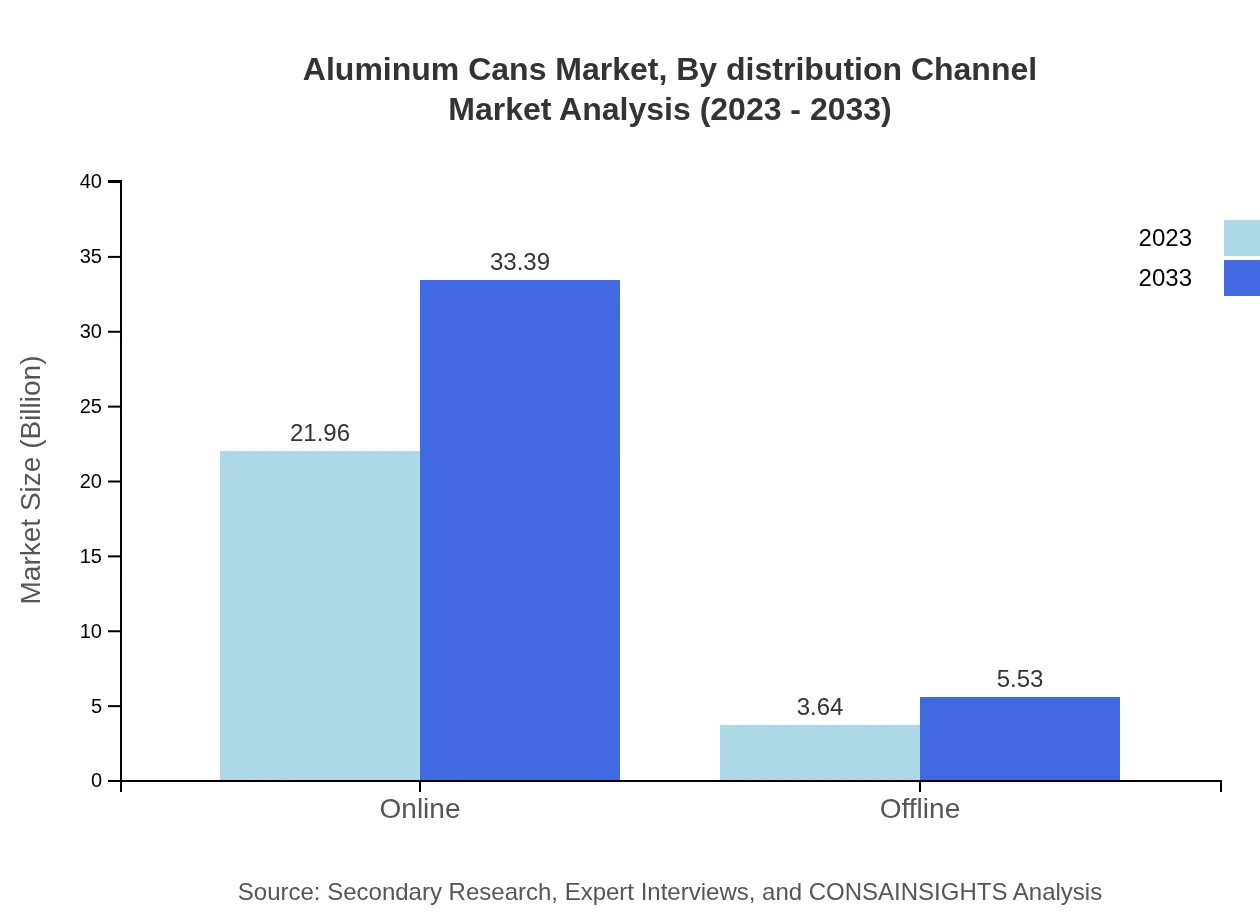

Aluminum Cans Market Analysis By Distribution Channel

In terms of distribution channels, online sales for aluminum cans are projected to grow from $21.96 billion in 2023 to $33.39 billion by 2033, reflecting a dominance in share at 85.8%. Offline distribution is also significant but smaller, valued at $3.64 billion in 2023 with a share of 14.2%, influenced by traditional retail setups.

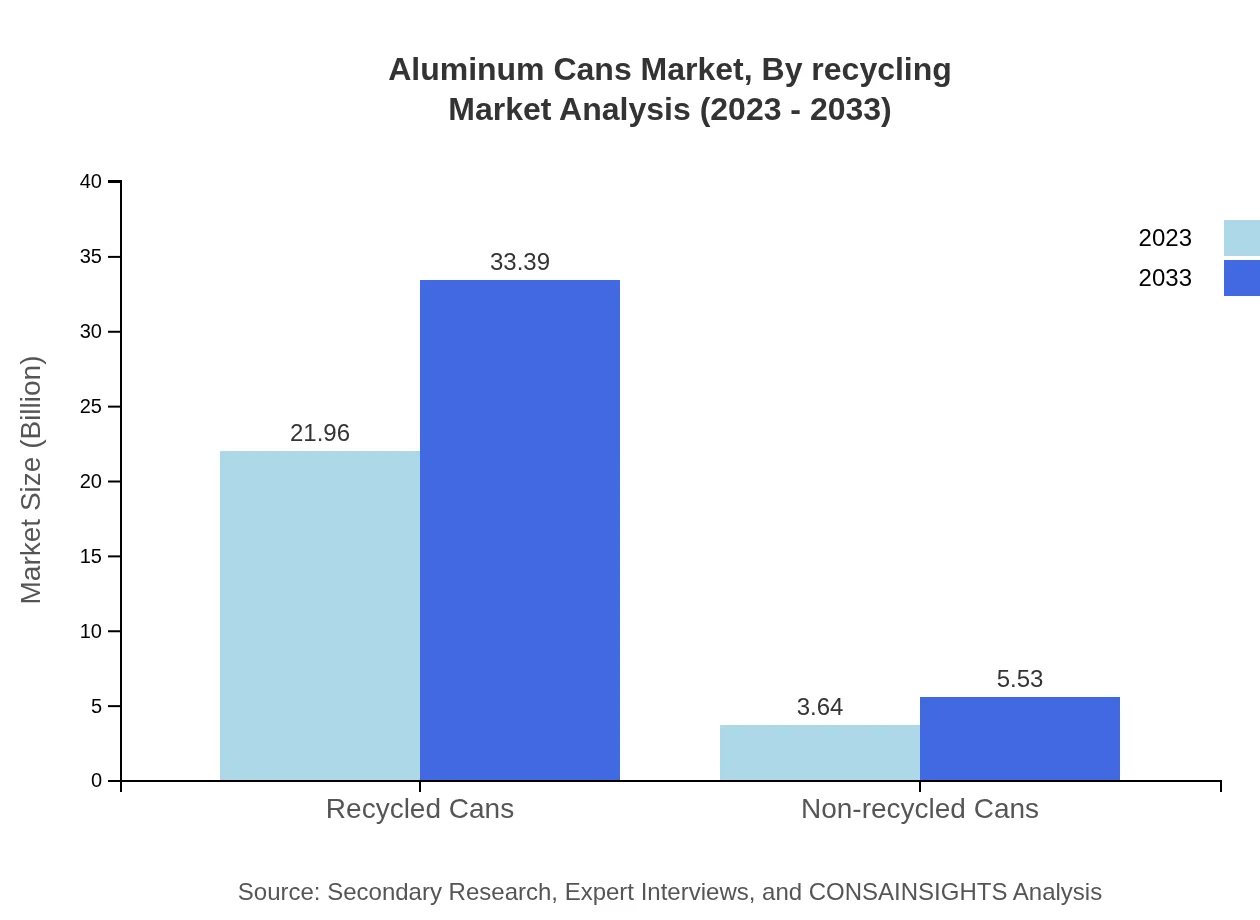

Aluminum Cans Market Analysis By Recycling

The recycling segment of aluminum cans illustrates a strong commitment to sustainability. Recycled cans make up a notable portion of the market with a size of $21.96 billion in 2023, expected to rise to $33.39 billion by 2033, reflecting an 85.8% market share. Non-recycled cans hold a market size of $3.64 billion in 2023, representing 14.2%, but face increasing pressure from eco-conscious consumers to shift towards recycled alternatives.

Aluminum Cans Market Analysis By Region Segmentation

The regional segmentation of the aluminum cans market indicates significant growth across various regions, with North America and Europe leading in terms of market size and sustainability measures. Asia-Pacific shows rapid growth potential due to urbanization, whereas South America and the Middle East & Africa are emerging markets with distinct growth drivers in consumer preferences and industry innovations.

Aluminum Cans Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aluminum Cans Industry

Ball Corporation:

A leading manufacturer in the aluminum packaging industry, known for innovative products and sustainability initiatives.Crown Holdings, Inc.:

A global supplier of packaging products, specializing in aluminum cans across multiple sectors, with a focus on environmental responsibility.Ardagh Group:

A key player in the aluminum can manufacturing sector, committed to sustainable packaging solutions and technological advancements.CanPack Group:

A prominent manufacturer of packaging products, heavily invested in producing high-quality aluminum cans for beverages and food.Beverage Can Makers Europe (BCME):

An organization representing leading beverage can manufacturers in Europe, promoting the benefits of aluminum cans for sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of aluminum cans?

The global aluminum cans market was valued at approximately $25.6 billion in 2023, driven by a projected CAGR of 4.2% from 2023 to 2033, indicating robust growth as demand for sustainable packaging solutions increases.

What are the key market players or companies in the aluminum cans industry?

Prominent players in the aluminum cans market include Ball Corporation, Crown Holdings, and Rexam. These companies are recognized for their innovation, operational efficiency, and market leadership, making them essential contributors to the industry's development and expansion.

What are the primary factors driving the growth in the aluminum cans industry?

Key growth drivers in the aluminum cans market include increasing consumer preference for sustainable packaging, growth in the beverage industry, stringent environmental regulations, and advancements in recycling technologies, enhancing the overall market potential and attractiveness.

Which region is the fastest Growing in the aluminum cans market?

The Asia-Pacific region is the fastest-growing market for aluminum cans, with a projected market size growth from $4.93 billion in 2023 to $7.50 billion by 2033, indicating robust demand and rapid economic development, particularly in emerging economies.

Does ConsaInsights provide customized market report data for the aluminum cans industry?

Yes, ConsaInsights offers customized market report data tailored to the aluminum cans industry, enabling clients to access specific insights and analytics that are directly aligned with their business strategies and market interests.

What deliverables can I expect from this aluminum cans market research project?

Expect comprehensive deliverables including a detailed report covering market size, growth trends, regional analysis, competitive landscape, and strategic recommendations catered to inform investment decisions and operational strategies.

What are the market trends of aluminum cans?

Current trends in the aluminum cans market include the rise in recycled aluminum usage, increasing demand for lightweight packaging, and growth in e-commerce, aligning with sustainability goals and consumer preferences towards eco-friendly packaging choices.