Aluminum Cladding Panels Market Report

Published Date: 22 January 2026 | Report Code: aluminum-cladding-panels

Aluminum Cladding Panels Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aluminum Cladding Panels market, including trends, forecasts, and segmentation insights for the period from 2023 to 2033.

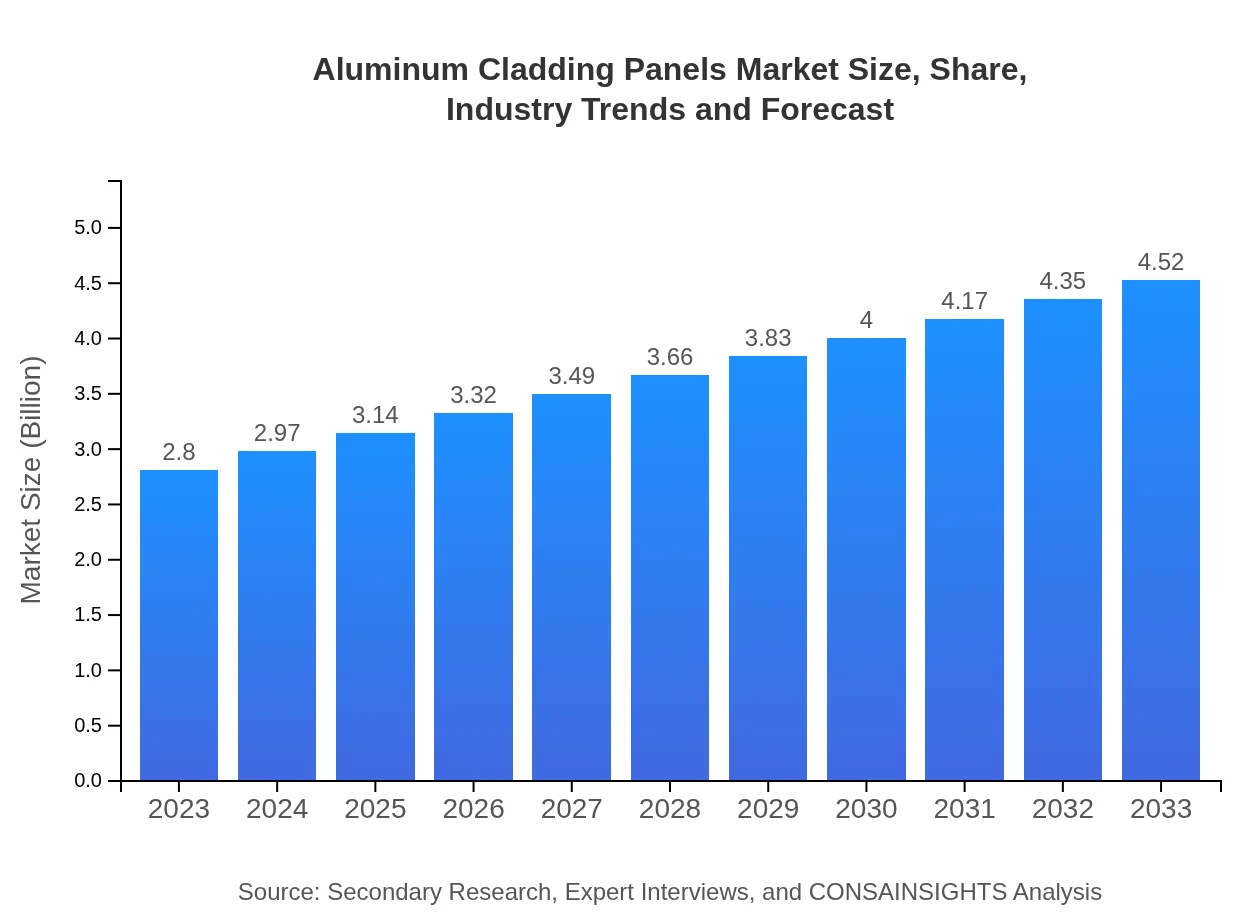

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $4.52 Billion |

| Top Companies | Alcoa Corporation, Arconic Corporation, Constellium SE, Kawneer, Aluminum Company of America (Alcoa) |

| Last Modified Date | 22 January 2026 |

Aluminum Cladding Panels Market Overview

Customize Aluminum Cladding Panels Market Report market research report

- ✔ Get in-depth analysis of Aluminum Cladding Panels market size, growth, and forecasts.

- ✔ Understand Aluminum Cladding Panels's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aluminum Cladding Panels

What is the Market Size & CAGR of Aluminum Cladding Panels market in 2023?

Aluminum Cladding Panels Industry Analysis

Aluminum Cladding Panels Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aluminum Cladding Panels Market Analysis Report by Region

Europe Aluminum Cladding Panels Market Report:

Europe’s market is expected to rise from $0.80 billion in 2023 to $1.30 billion by 2033. Increased focus on renovation and retrofitting existing structures to meet modern standards is creating robust demand. The European market is also buoyed by advancements in architectural design and material technology.Asia Pacific Aluminum Cladding Panels Market Report:

The Asia Pacific region is expected to see a market size growth from $0.51 billion in 2023 to $0.83 billion in 2033. Rapid urbanization and significant infrastructure developments in countries like China and India are driving demand for aluminum cladding panels. Furthermore, government investments in smart city projects and sustainable construction methods are enriching market opportunities.North America Aluminum Cladding Panels Market Report:

North America is projected to show a significant increase in market size from $1.08 billion in 2023 to $1.75 billion in 2033. The region's stringent building codes aimed at enhancing energy efficiency and environmental sustainability are propelling the adoption of aluminum cladding panels, primarily in the U.S. and Canada.South America Aluminum Cladding Panels Market Report:

In South America, the market is anticipated to grow from $0.07 billion in 2023 to $0.12 billion by 2033. The growth is spurred by increased construction activities and investments in urban infrastructure, primarily in Brazil and Argentina, where developmental projects are on the rise.Middle East & Africa Aluminum Cladding Panels Market Report:

The Middle East and Africa market is forecasted to grow from $0.33 billion in 2023 to $0.53 billion in 2033. Driven by urban development and infrastructural upgrades, especially in the GCC countries, the demand for aluminum cladding panels is rising as part of luxurious and environmentally sustainable architectures.Tell us your focus area and get a customized research report.

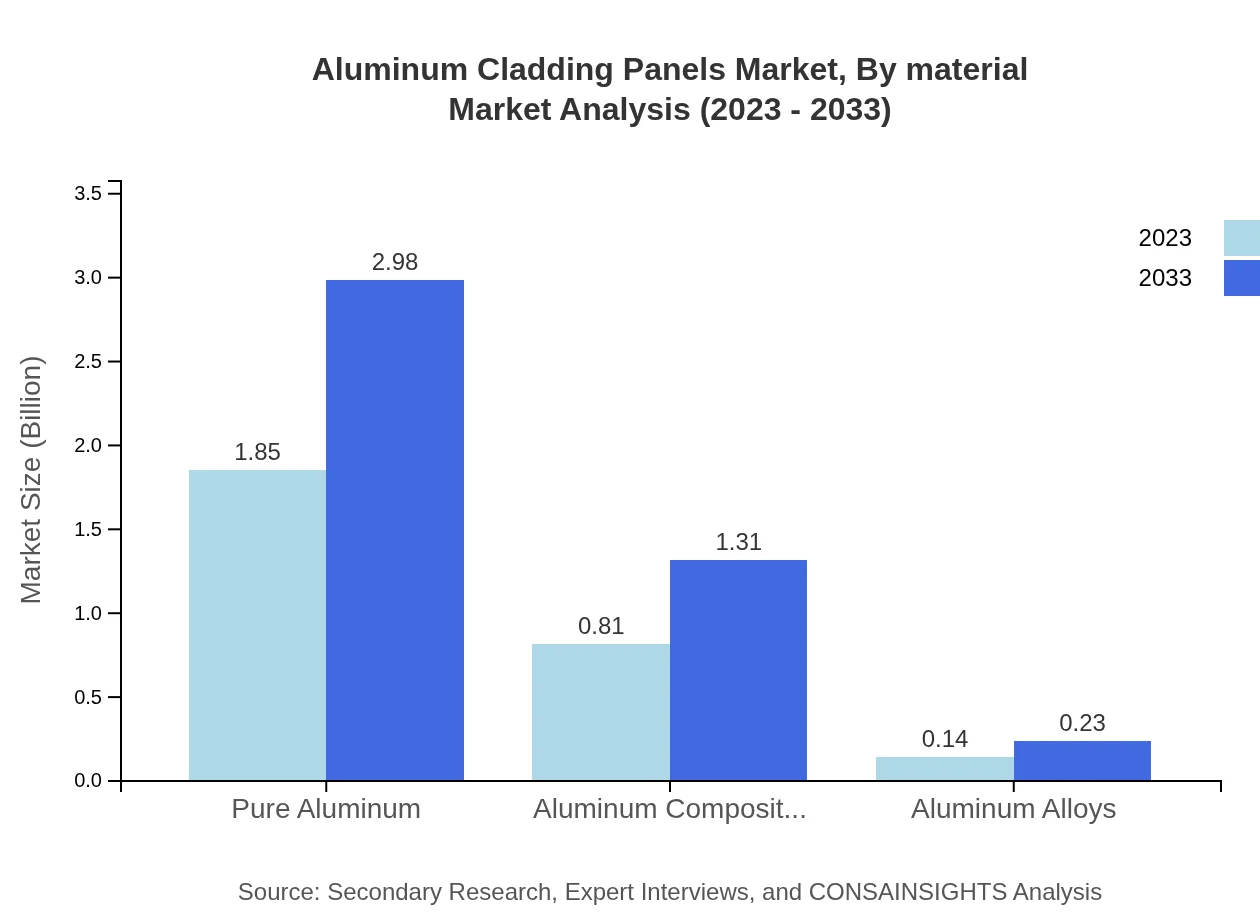

Aluminum Cladding Panels Market Analysis By Material

In 2023, pure aluminum holds a market size of $1.85 billion, projected to grow to $2.98 billion by 2033. Aluminum composite panels are expected to grow from $0.81 billion to $1.31 billion within the same time frame, while aluminum alloys are lower in volume, with $0.14 billion projected to expand to $0.23 billion.

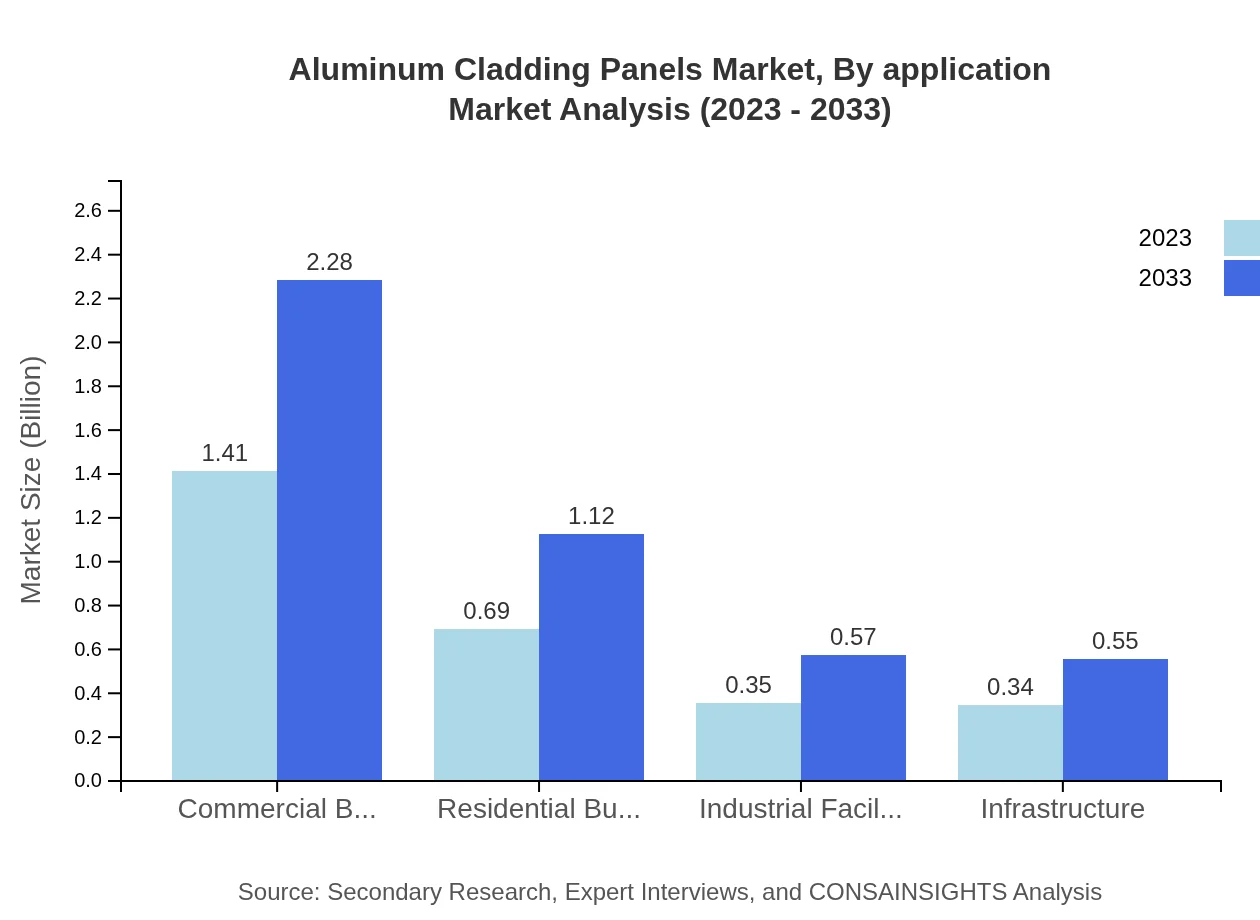

Aluminum Cladding Panels Market Analysis By Application

The market in 2023 for commercial buildings stands at $1.41 billion, expected to rise to $2.28 billion by 2033. Residential buildings account for $0.69 billion, rising to $1.12 billion, while industrial facilities are at $0.35 billion and predicted to hit $0.57 billion with infrastructure reflecting similar growth patterns.

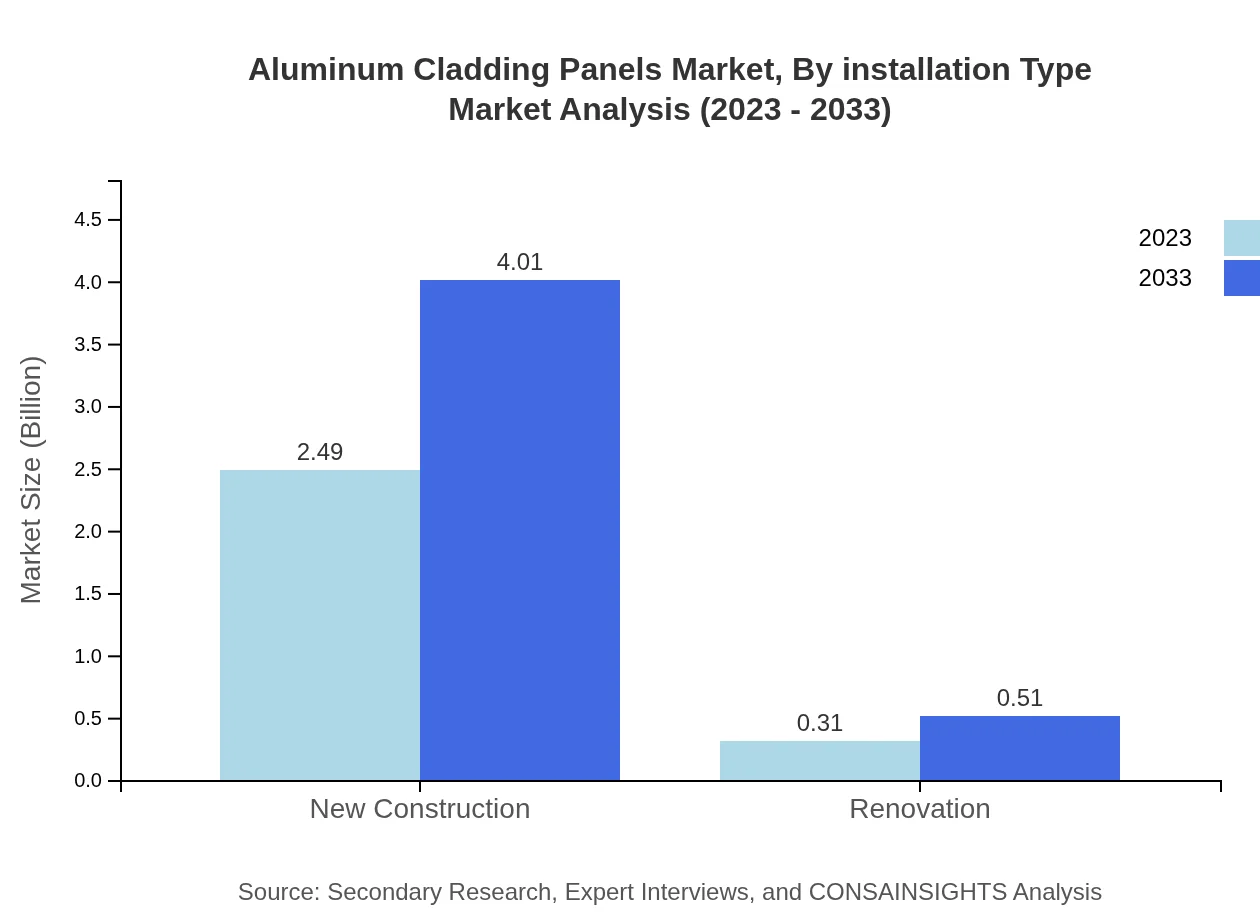

Aluminum Cladding Panels Market Analysis By Installation Type

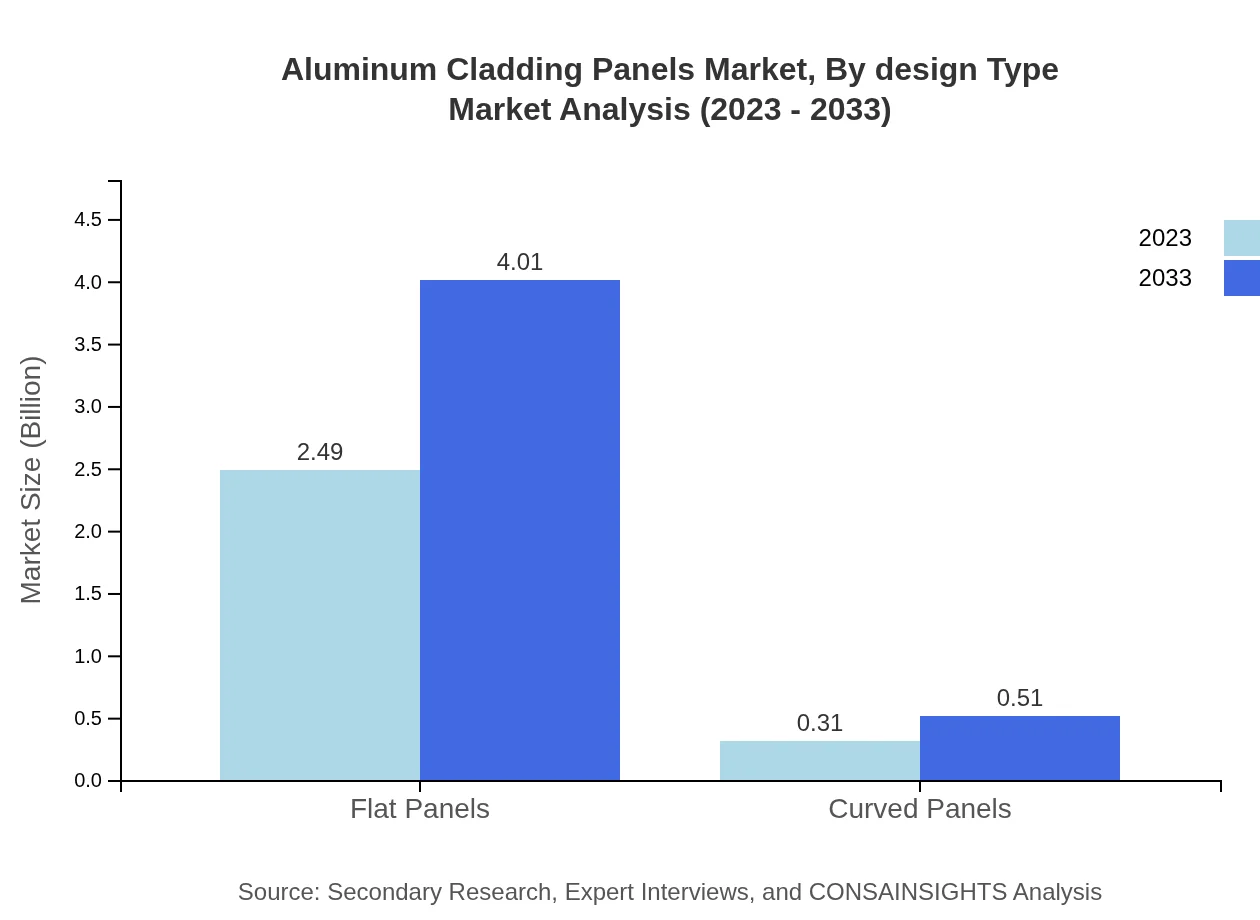

The market in 2023 shows flat panels leading with $2.49 billion, projected to grow to $4.01 billion by 2033, representing significant market share. Curved panels account for a smaller segment, expected to grow moderately from $0.31 billion to $0.51 billion within the same period.

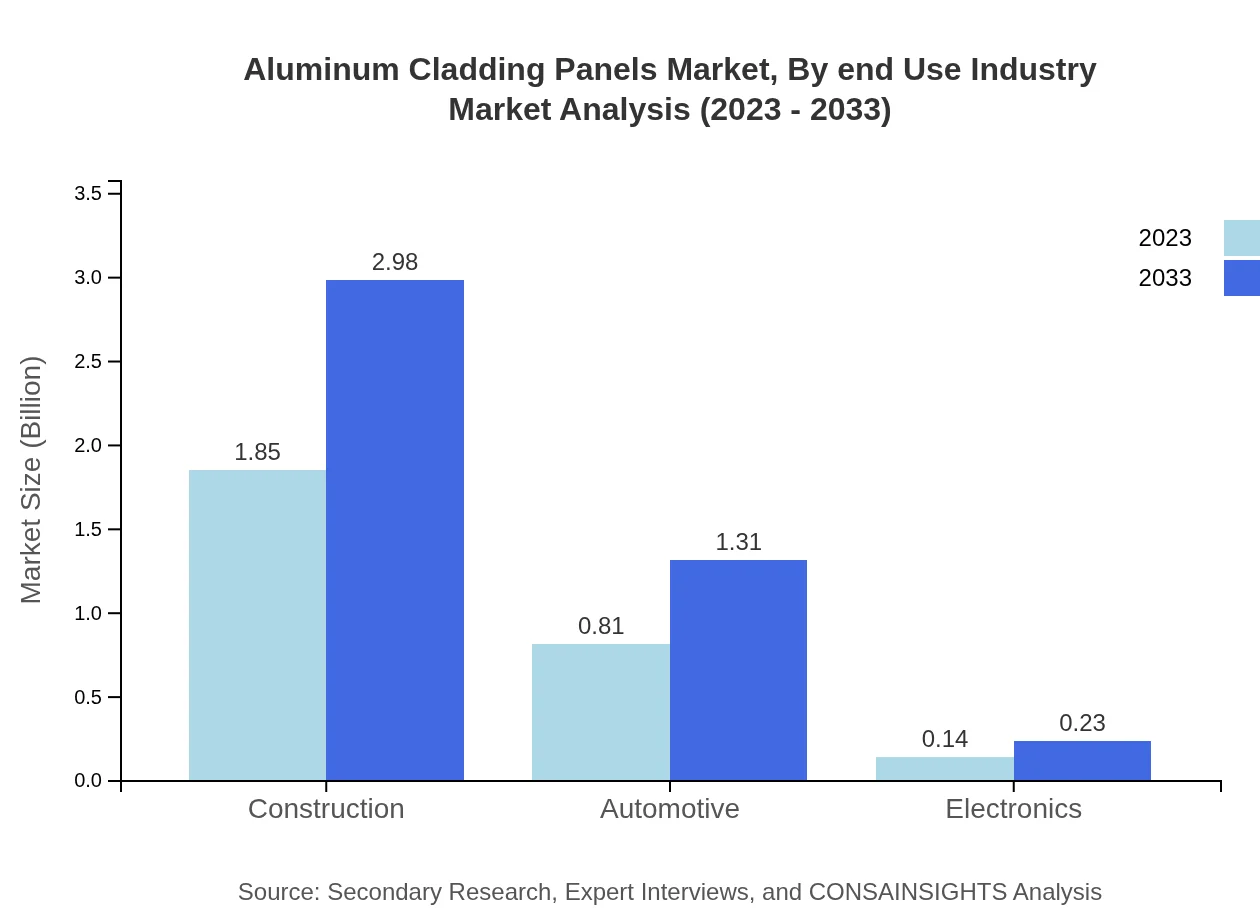

Aluminum Cladding Panels Market Analysis By End Use Industry

In 2023, the construction industry dominates with a market size of $1.85 billion, progressing to $2.98 billion by 2033. The automotive sector stands at $0.81 billion, projected to increase to $1.31 billion. Noteworthy too is the electronics industry, estimated at $0.14 billion and expanding to $0.23 billion.

Aluminum Cladding Panels Market Analysis By Design Type

The market for new construction design is leading with an 88.8% share, moving from $2.49 billion in 2023 to $4.01 billion by 2033. In contrast, renovation design holds a modest share of 11.2%, predicted to grow from $0.31 billion to $0.51 billion.

Aluminum Cladding Panels Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aluminum Cladding Panels Industry

Alcoa Corporation:

Alcoa is a leading global supplier of aluminum products, including cladding, known for innovations in material science and sustainability.Arconic Corporation:

Arconic specializes in aluminum solutions and is recognized for its high-performance cladding products, enhancing architectural design in urban projects.Constellium SE:

Constellium is a key player in the market, providing aluminum products for various sectors, including construction, with a focus on innovation and lightweight materials.Kawneer:

Kawneer focuses on architectural systems including aluminum cladding, emphasizing energy efficiency and durable designs for commercial buildings.Aluminum Company of America (Alcoa):

With a wide portfolio, Alcoa dominates markets through cutting-edge technology and extensive experience in producing aluminum cladding solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of aluminum Cladding Panels?

The market size of aluminum cladding panels is projected to reach approximately $2.8 billion by 2033, growing at a CAGR of 4.8% from 2023 to 2033.

What are the key market players or companies in the aluminum Cladding Panels industry?

Key players in the aluminum-cladding-panels industry include companies specializing in building materials, construction solutions, and architectural designs, such as MAAST, ArcelorMittal, and Alcoa Corporation.

What are the primary factors driving the growth in the aluminum Cladding Panels industry?

The growth in the aluminum cladding panels industry is driven by urbanization, increasing construction activities, the demand for lightweight materials, and heightened awareness of energy-efficient building solutions.

Which region is the fastest Growing in the aluminum Cladding Panels?

The fastest-growing region in the aluminum cladding panels market is North America, projected to increase from $1.08 billion in 2023 to $1.75 billion in 2033.

Does ConsaInsights provide customized market report data for the aluminum Cladding Panels industry?

Yes, ConsaInsights offers customized market report data tailored to client needs within the aluminum cladding panels industry, including specific trends, insights, and forecasts.

What deliverables can I expect from this aluminum Cladding Panels market research project?

Deliverables from the aluminum cladding panels market research project typically include comprehensive market analysis reports, forecasts, trend analyses, and recommendations for industry strategy.

What are the market trends of aluminum Cladding Panels?

Current trends in the aluminum cladding panels market include a shift towards sustainable building practices, increased demand for aesthetic designs, and innovations in panel technologies to enhance performance.