Aluminum Extruded Products Market Report

Published Date: 02 February 2026 | Report Code: aluminum-extruded-products

Aluminum Extruded Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aluminum Extruded Products market, covering market trends, regional insights, growth forecasts, and key segments from 2023 to 2033. It aims to deliver data-driven insights into market dynamics, growth opportunities, and competitive landscape.

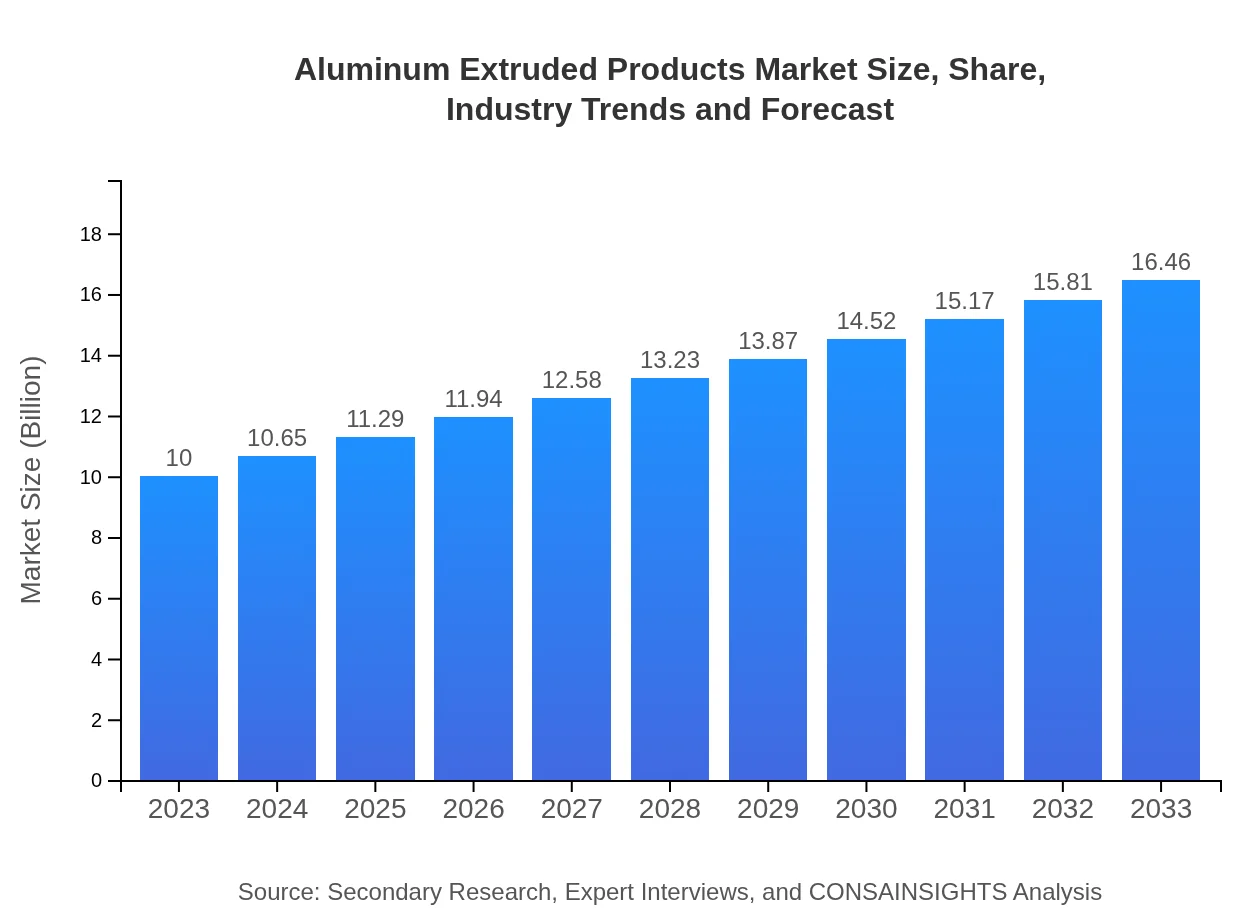

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Alcoa Corporation, Rio Tinto Group, Constellium N.V., Hindalco Industries Limited |

| Last Modified Date | 02 February 2026 |

Aluminum Extruded Products Market Overview

Customize Aluminum Extruded Products Market Report market research report

- ✔ Get in-depth analysis of Aluminum Extruded Products market size, growth, and forecasts.

- ✔ Understand Aluminum Extruded Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aluminum Extruded Products

What is the Market Size & CAGR of Aluminum Extruded Products market in 2023?

Aluminum Extruded Products Industry Analysis

Aluminum Extruded Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aluminum Extruded Products Market Analysis Report by Region

Europe Aluminum Extruded Products Market Report:

In Europe, the market is projected to grow from $2.56 billion in 2023 to $4.21 billion by 2033. The region is witnessing a shift towards energy-efficient products and increased usage of aluminum in construction, driving the market further.Asia Pacific Aluminum Extruded Products Market Report:

In the Asia-Pacific region, the market was valued at $2.01 billion in 2023 and is projected to reach $3.30 billion by 2033. Rapid industrialization, urbanization, and a growing population are driving demand for aluminum extruded products, particularly in construction and automotive applications.North America Aluminum Extruded Products Market Report:

The North American market, valued at $3.90 billion in 2023, is anticipated to grow to $6.41 billion by 2033. Key factors influencing this growth include a stable construction sector, automotive manufacturing advancements, and increasing demand for lightweight materials.South America Aluminum Extruded Products Market Report:

South America’s market is expected to grow from $0.59 billion in 2023 to $0.98 billion in 2033. The region's growth is propelled by ongoing infrastructure development and an increasing emphasis on sustainability in material selection.Middle East & Africa Aluminum Extruded Products Market Report:

The market in the Middle East and Africa is forecasted to grow from $0.95 billion in 2023 to $1.56 billion by 2033. Growth in this region is benefitting from infrastructure projects and government initiatives aimed at boosting regional manufacturing capabilities.Tell us your focus area and get a customized research report.

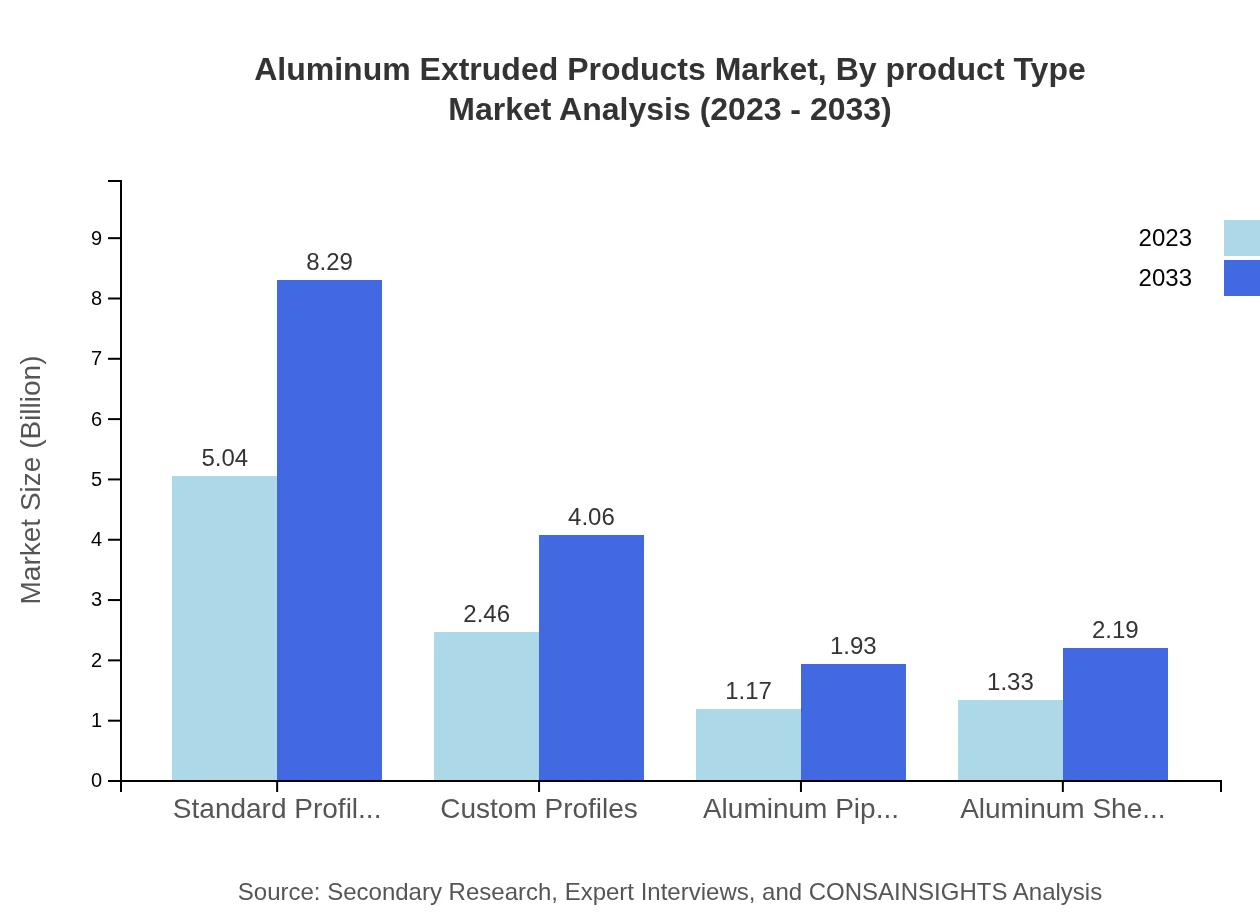

Aluminum Extruded Products Market Analysis By Product Type

The Aluminum Extruded Products market can be further broken down into various product types including standard profiles, custom profiles, aluminum pipes and tubes, and aluminum sheets and plates. Standard profiles lead in market share, contributing 50.36% in 2023, reflecting their widespread usage in construction and infrastructure projects. Custom profiles are also gaining traction, especially for specialized applications in automotive and aerospace industries. The growth of each product type aligns with overall industry trends toward customization and lightweight construction methods.

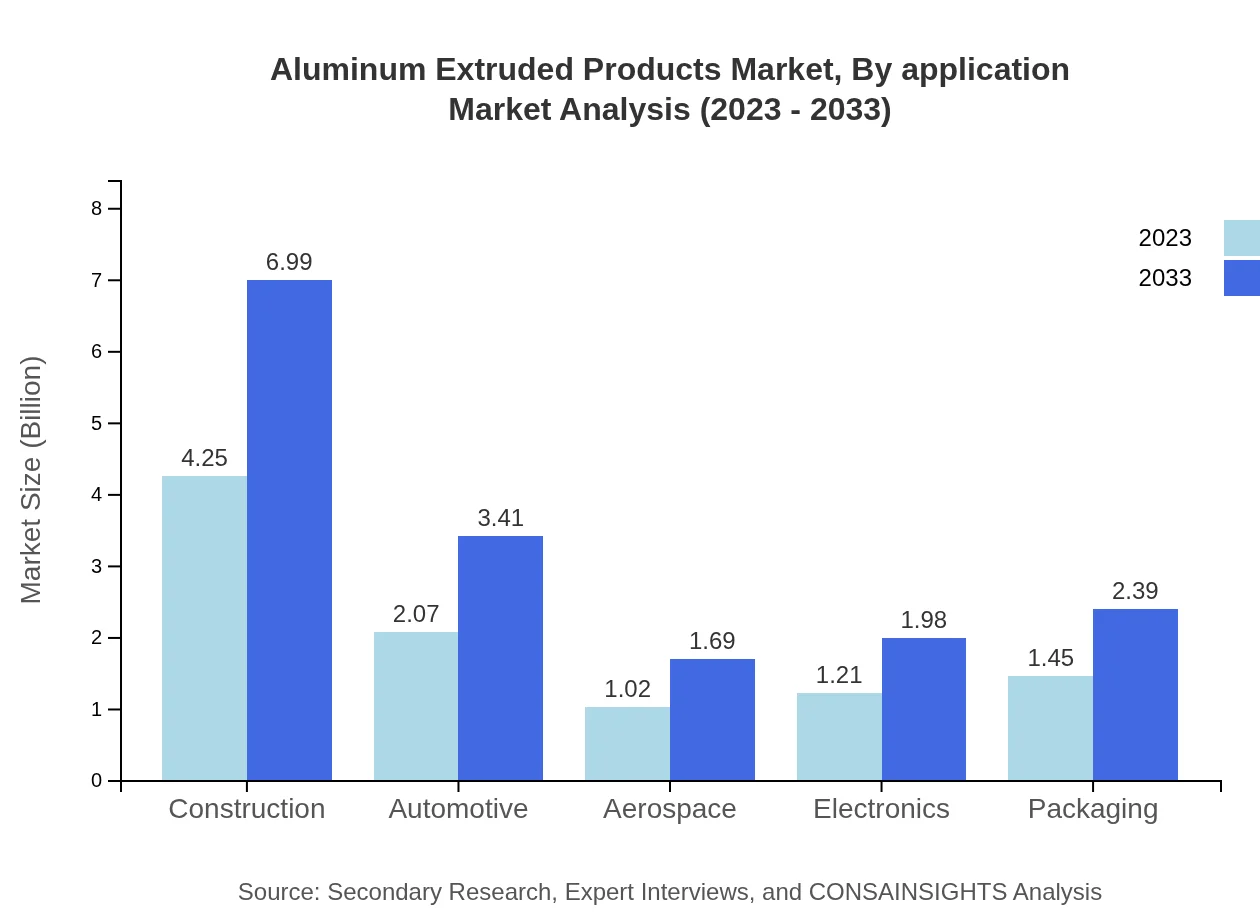

Aluminum Extruded Products Market Analysis By Application

In terms of applications, the major segments include construction, automotive, aerospace, electronics, and packaging. The construction industry holds a significant share at 42.49%, largely due to the increasing demand for sustainable and efficient building materials. The automotive sector, also vital, is expected to occupy 20.71% of the market, reflecting trends towards lightweight vehicles and fuel efficiency. Other applications like aerospace and electronics are expected to grow as industries shift towards innovative solutions.

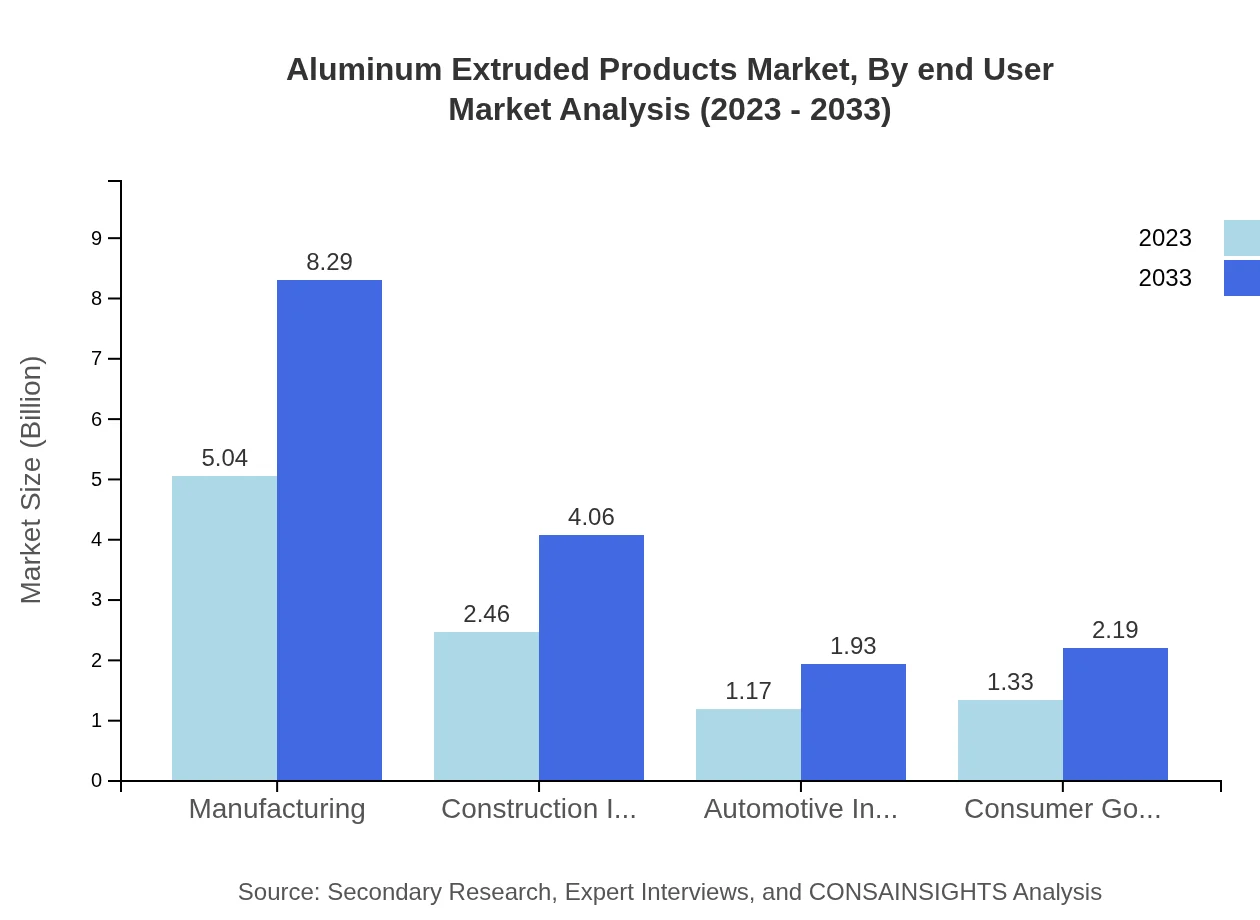

Aluminum Extruded Products Market Analysis By End User

The market segments according to end-users include manufacturers, contractors, and retailers. Manufacturers are the largest end-user segment, expected to capture 68.19% market share in 2023, driven by high volume production for various applications. Contractors, especially in the construction and automotive work, contribute significantly as well due to rising infrastructure projects affecting demand for aluminum extrusions.

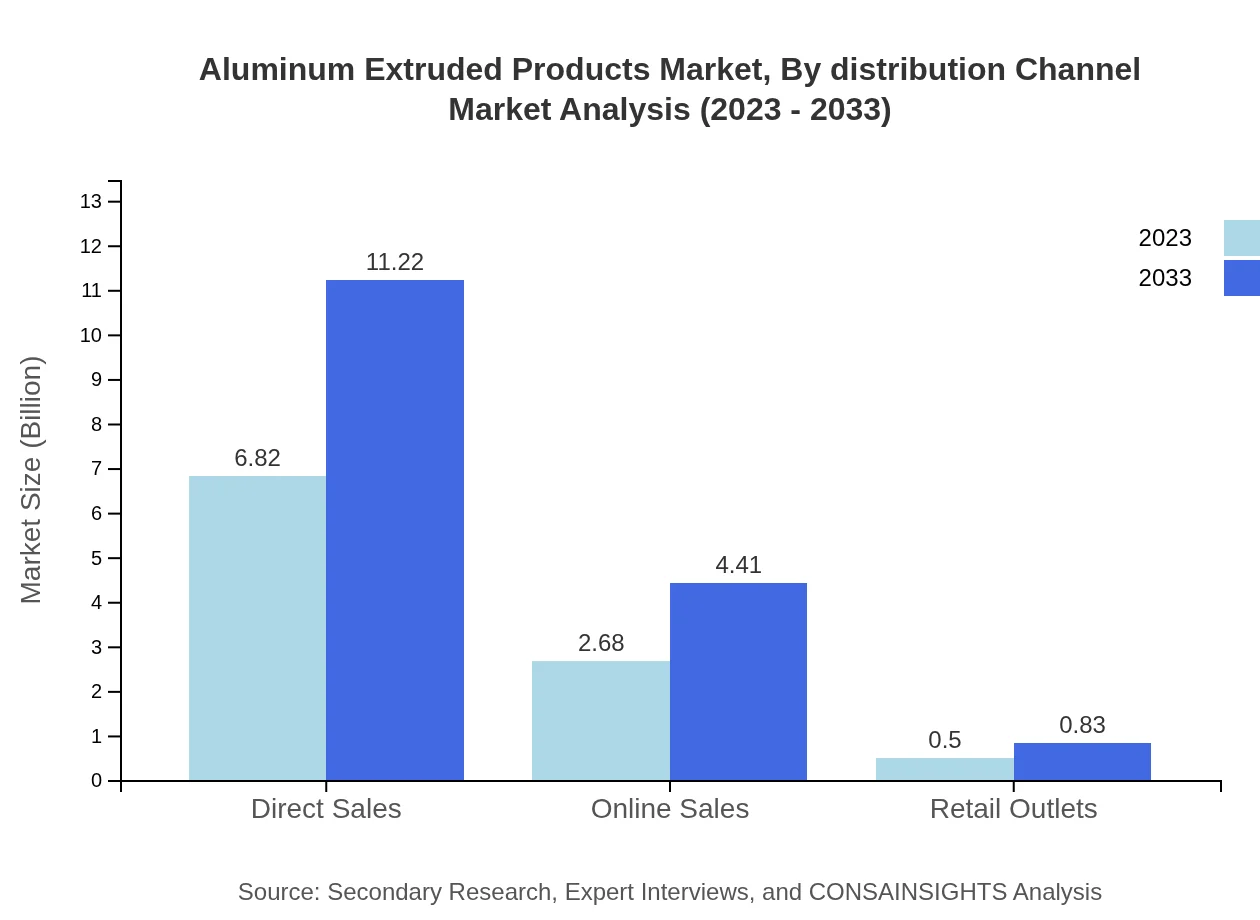

Aluminum Extruded Products Market Analysis By Distribution Channel

Distribution channels include direct sales, online sales, and retail outlets. Direct sales dominate the distribution approach with a share of 68.19% in 2023, as manufacturers often engage directly with clients for bulk orders. Online sales are emerging rapidly, projected to grow significantly due to changing buying patterns and the convenience of e-commerce platforms.

Aluminum Extruded Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aluminum Extruded Products Industry

Alcoa Corporation:

A global leader in the production and management of aluminum, Alcoa operates across 10 countries and has made significant investments in technology and sustainability.Rio Tinto Group:

Rio Tinto is one of the world's leading mining companies, with a strong foothold in aluminum production, focusing on sustainable sourcing and innovative technologies.Constellium N.V.:

Constellium specializes in the development of sustainable aluminum solutions for a variety of markets. The company emphasizes high-performing products and eco-friendly practices.Hindalco Industries Limited:

A flagship company of the Aditya Birla Group, Hindalco is recognized for its strong presence in the aluminum sector, offering a diverse range of aluminum products and solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of aluminum Extruded Products?

The aluminum extruded products market is projected to reach a size of USD 10 billion by 2033, growing at a CAGR of 5% from 2023. This growth is fueled by increasing applications across various industries and rising demand for lightweight materials.

What are the key market players or companies in the aluminum Extruded Products industry?

Key players in the aluminum extruded products market include major companies specializing in aluminum manufacturing, extrusion technologies, and supply chain operations. Their competitive strategies focus on innovation, diversification, and expanding production capacities to meet market demand.

What are the primary factors driving the growth in the aluminum Extruded Products industry?

Growth drivers for the aluminum extruded products market include the rising demand from the construction sector, increased automotive production, and a push for lightweight materials to enhance energy efficiency. Additionally, technological advancements and sustainable manufacturing practices are pivotal.

Which region is the fastest Growing in the aluminum Extruded Products?

The Asia Pacific region is the fastest-growing market for aluminum extruded products. By 2033, market size is expected to hit USD 3.30 billion, up from USD 2.01 billion in 2023, driven by rapid industrialization and urbanization in countries like China and India.

Does ConsaInsights provide customized market report data for the aluminum Extruded Products industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the aluminum extruded products industry. Clients can obtain insights tailored to particular segments, regions, or competitive landscapes to better inform strategic decisions.

What deliverables can I expect from this aluminum Extruded Products market research project?

Deliverables from the aluminum extruded products market research project typically include comprehensive market analysis reports, segmentation insights, forecasts, and actionable recommendations, alongside visual data representations such as charts and graphs for easier interpretation.

What are the market trends of aluminum Extruded Products?

Current trends in the aluminum extruded products market include a shift towards sustainable manufacturing, increasing automation in extrusion processes, and the growing inclusion of smart technologies in product development. There is also a notable trend in custom profiles catering to niche sectors.