Aluminum Market Report

Published Date: 02 February 2026 | Report Code: aluminum

Aluminum Market Size, Share, Industry Trends and Forecast to 2033

This market report presents an in-depth analysis of the Aluminum industry from 2023 to 2033, examining market size, growth factors, regional insights, and leading companies. Key trends and forecasts will also be highlighted to provide actionable insights into future developments in this sector.

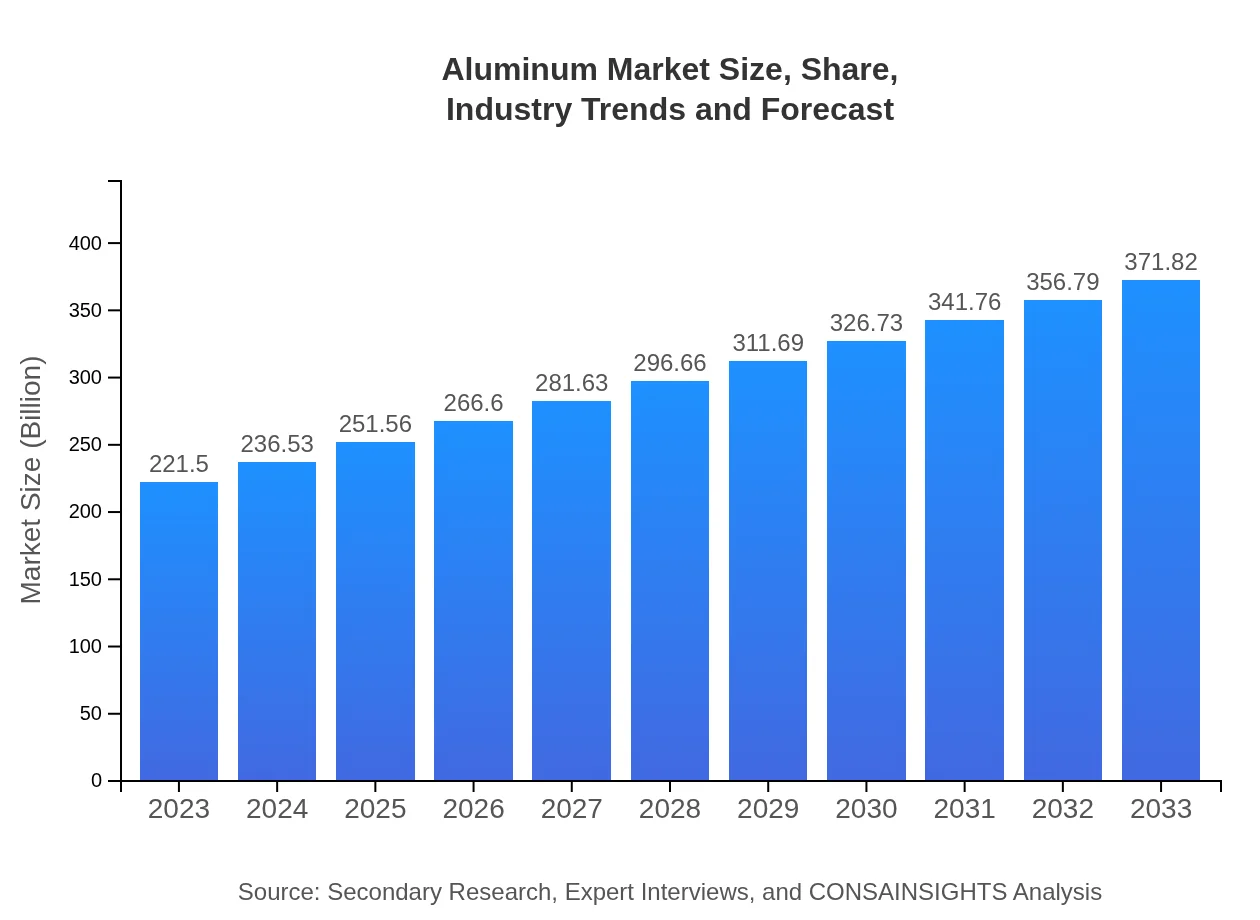

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $221.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $371.82 Billion |

| Top Companies | Alcoa Corporation, Rio Tinto Group, Rusal, Constellium |

| Last Modified Date | 02 February 2026 |

Aluminum Market Overview

Customize Aluminum Market Report market research report

- ✔ Get in-depth analysis of Aluminum market size, growth, and forecasts.

- ✔ Understand Aluminum's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aluminum

What is the Market Size & CAGR of Aluminum market in 2023?

Aluminum Industry Analysis

Aluminum Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aluminum Market Analysis Report by Region

Europe Aluminum Market Report:

Europe's aluminum market is the largest in 2023 at $72.36 billion and is projected to reach $121.47 billion by 2033. The demand is driven mainly by stringent regulations promoting the use of lightweight materials in the automotive sector.Asia Pacific Aluminum Market Report:

The Asia Pacific region, valued at approximately $40.07 billion in 2023, is projected to reach $67.26 billion by 2033. This growth is spurred by rapid industrialization, urban development, and increased investments in infrastructure across countries such as China and India.North America Aluminum Market Report:

North America's market, valued at $77.17 billion in 2023, is expected to grow to $129.54 billion by 2033. The region benefits from a robust automotive industry and increased investments in sustainable building practices.South America Aluminum Market Report:

South America’s aluminum market is currently valued at $7.75 billion in 2023, anticipated to expand to $13.01 billion by 2033. The region's growth is primarily driven by the construction and transportation sectors as its economies recover.Middle East & Africa Aluminum Market Report:

The Middle East and Africa market is valued at $24.14 billion in 2023, expected to expand to $40.53 billion by 2033. This growth is fueled by infrastructure development and energy efficiency initiatives across several countries.Tell us your focus area and get a customized research report.

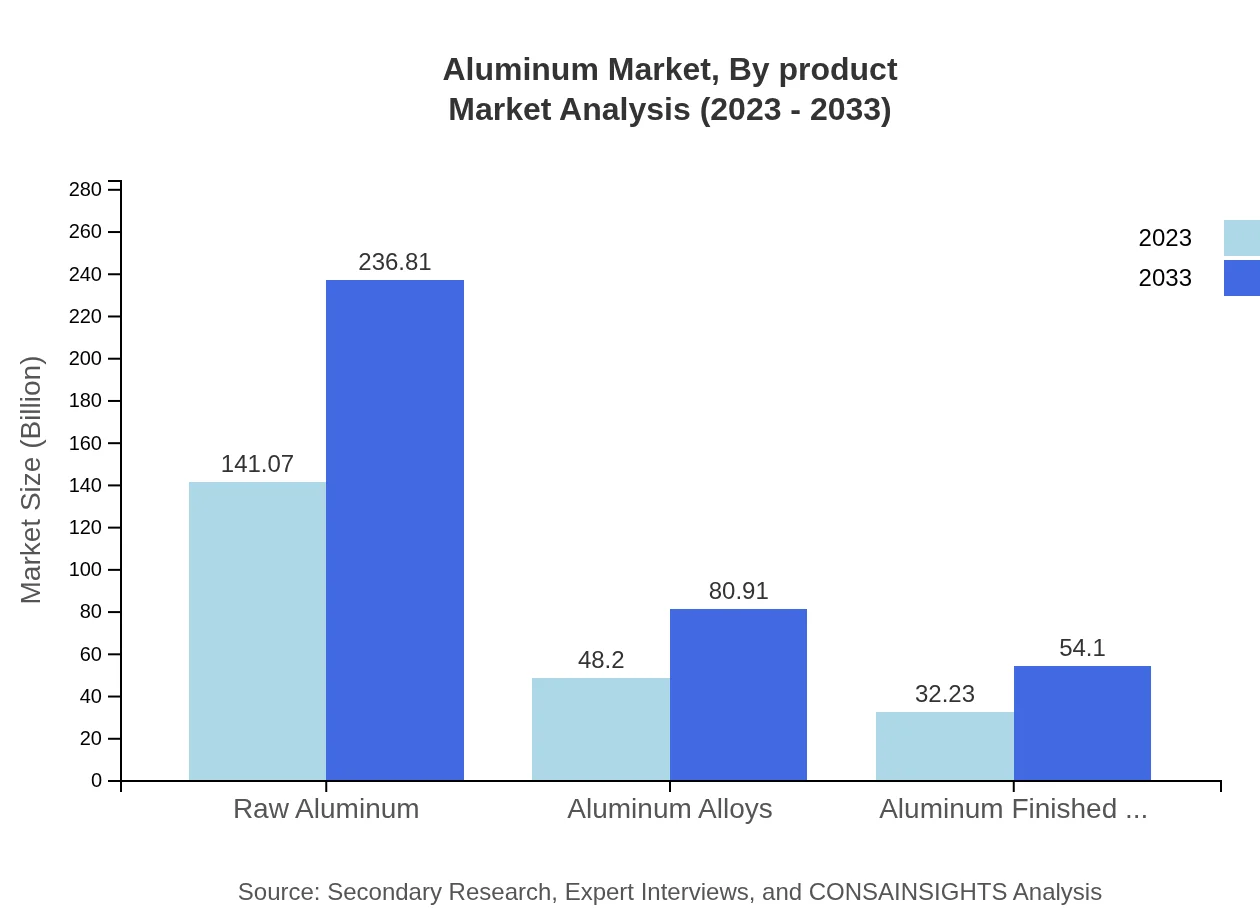

Aluminum Market Analysis By Product

The aluminum market by product includes segments such as raw aluminum, aluminum alloys, and finished products. In 2023, raw aluminum holds a substantial market share valued at $141.07 billion, projected to grow to $236.81 billion by 2033, accounting for 63.69% of the total market. Aluminum alloys, critical for application in aerospace and automotive industries, are valued at $48.20 billion in 2023, expected to reach $80.91 billion by 2033.

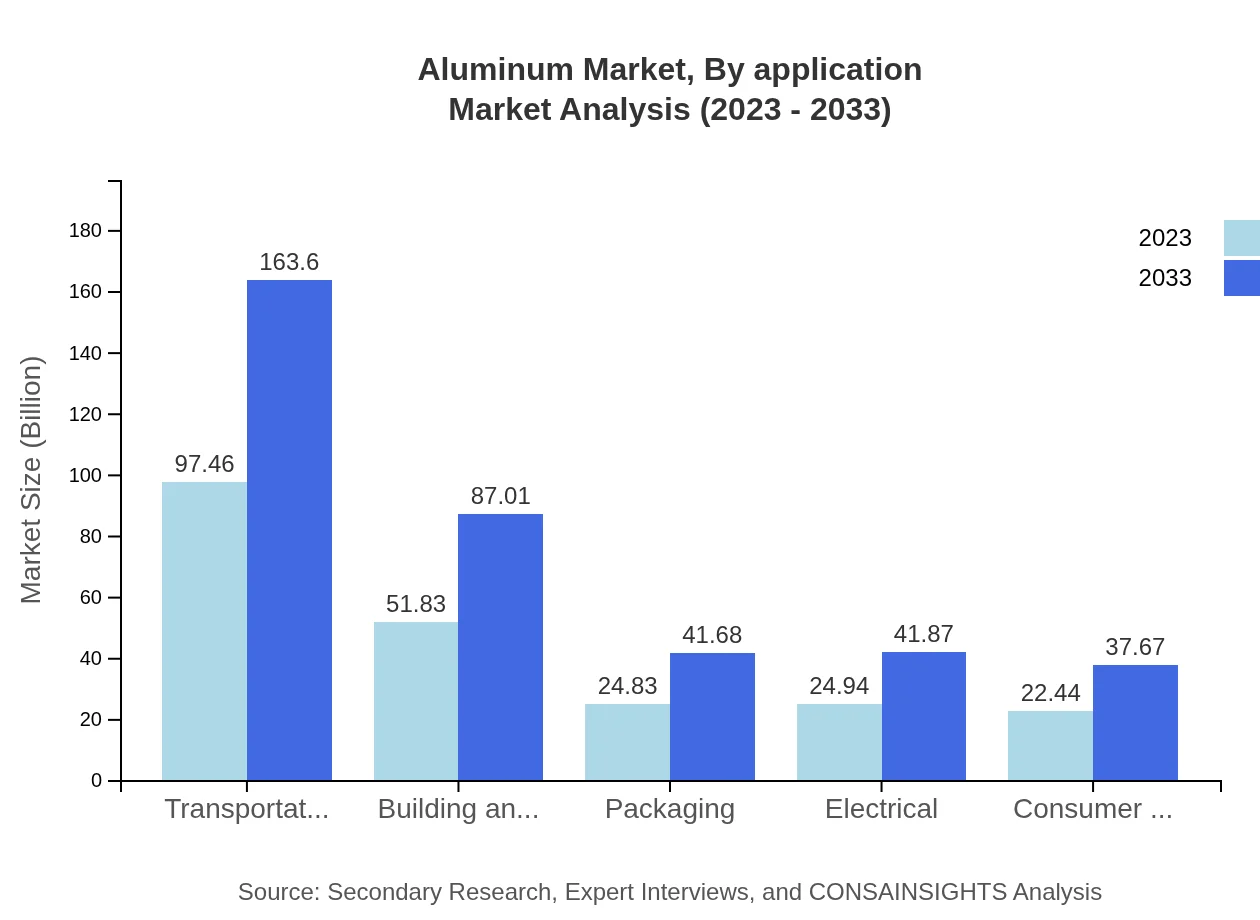

Aluminum Market Analysis By Application

Applications of aluminum span across multiple industries, with transportation leading at $97.46 billion in 2023, growing to $163.60 billion by 2033. This is followed by building and construction at $51.83 billion in 2023, reaching $87.01 billion by 2033. Packaging and electrical applications also contribute significantly to the market, highlighting aluminum's versatility.

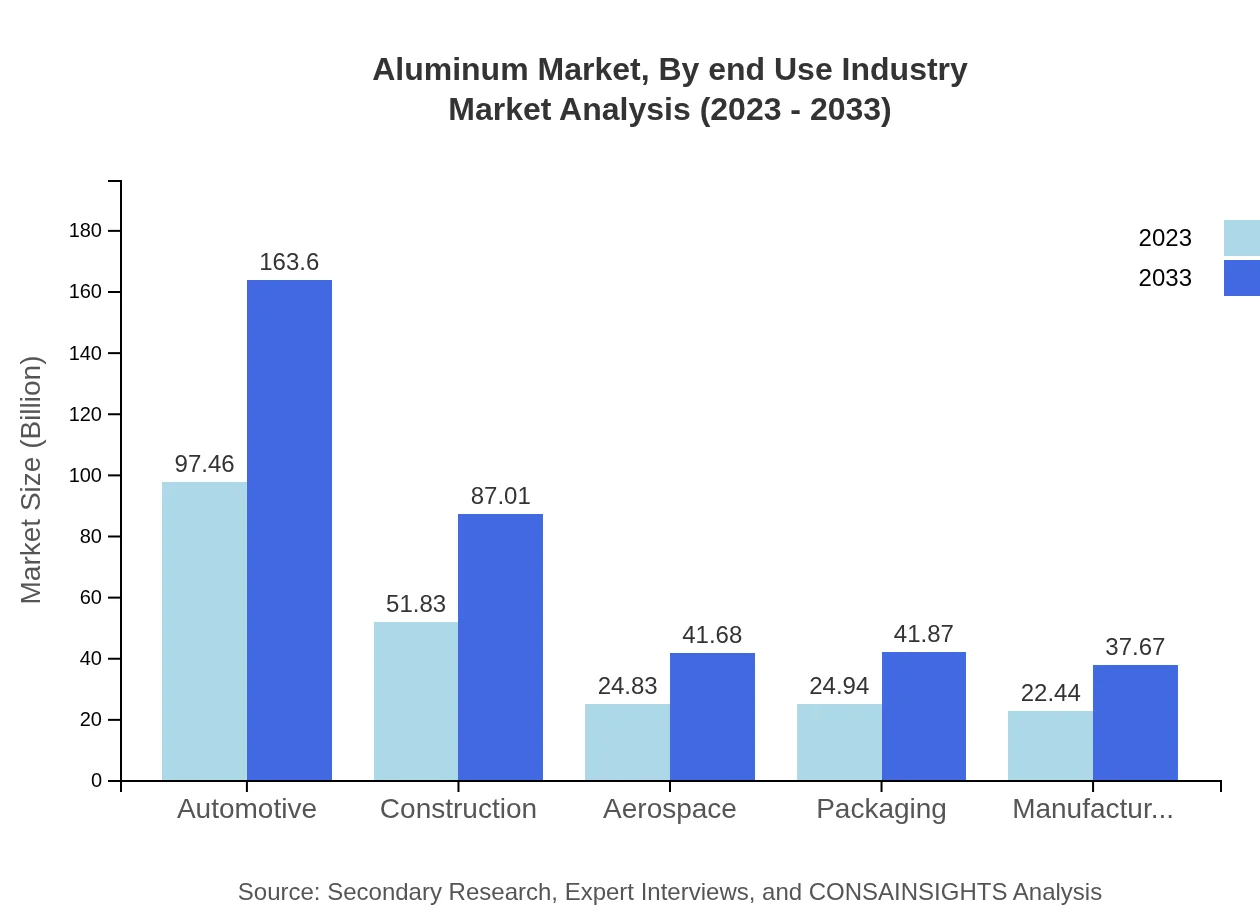

Aluminum Market Analysis By End Use Industry

End-use industries such as automotive, construction, aerospace, and consumer goods shape the aluminum market. The automotive sector alone represents a substantial share, valued at $97.46 billion in 2023 and expected to grow to $163.60 billion by 2033. This increase is driven by the demand for lightweight vehicles that enhance fuel efficiency and reduce emissions.

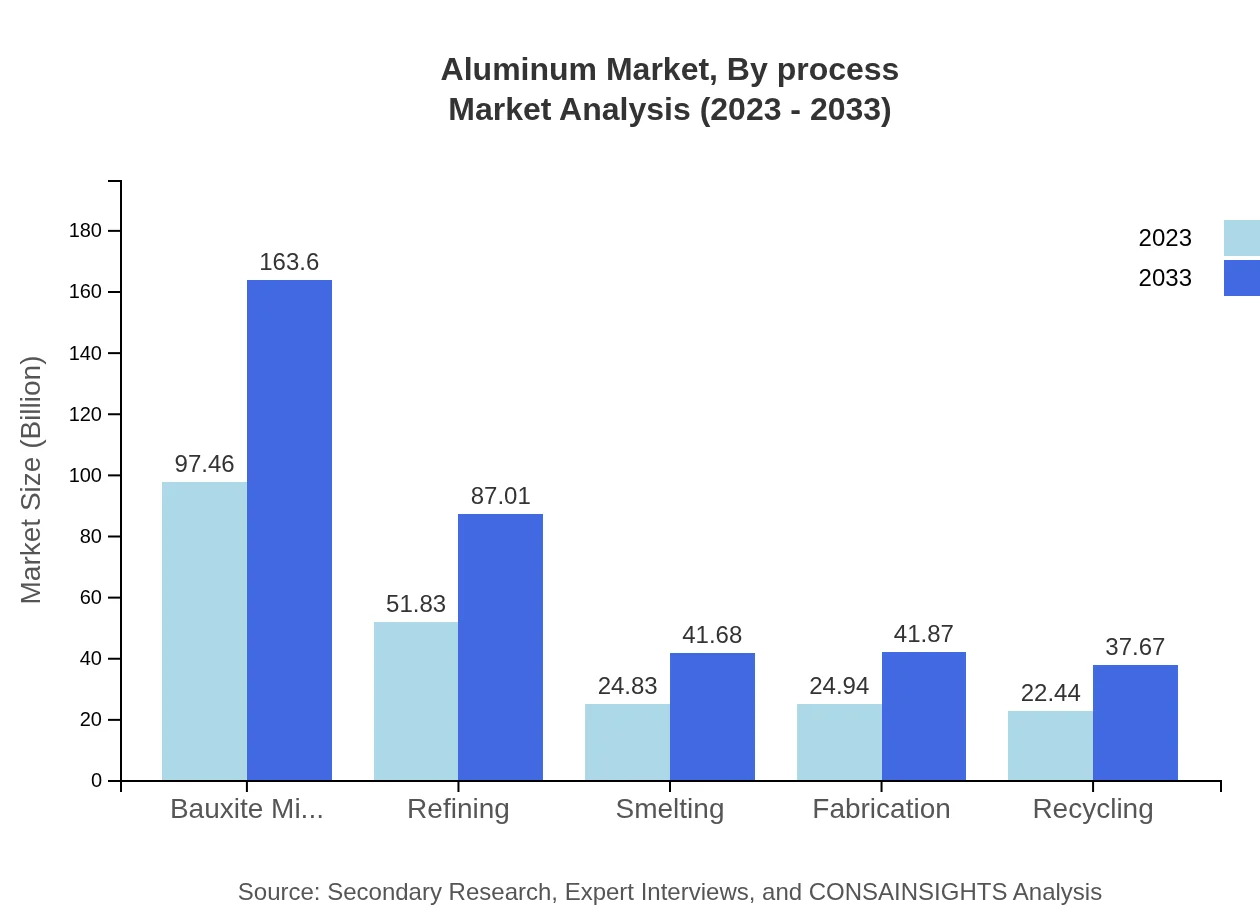

Aluminum Market Analysis By Process

Aluminum production includes critical processes like bauxite mining, refining, smelting, fabrication, and recycling. In 2023, bauxite mining is valued at $97.46 billion and is projected to grow to $163.60 billion by 2033, emphasizing its foundational role in aluminium production. Refining and smelting also constitute key segments, with respective market values of $51.83 billion and $24.83 billion in 2023.

Aluminum Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aluminum Industry

Alcoa Corporation:

One of the largest producers of aluminum, Alcoa is known for its commitment to sustainability and innovation in production processes.Rio Tinto Group:

A major player in the global aluminum industry, Rio Tinto is involved in every stage of the aluminum supply chain, from bauxite mining to production.Rusal:

A leading aluminum producer, Rusal focuses on using advanced technologies to enhance production efficiency and decrease environmental impacts.Constellium:

Specializing in aluminum solutions, Constellium serves diverse sectors, including automotive and aerospace, with a strong focus on innovative product development.We're grateful to work with incredible clients.

FAQs

What is the market size of aluminum?

The global aluminum market is currently valued at approximately $221.5 billion, with a projected annual growth rate (CAGR) of 5.2% leading towards 2033. This growth indicates strong demand across various applications and regions.

What are the key market players or companies in this aluminum industry?

Key players in the aluminum industry include Alcoa Corporation, Rio Tinto Group, Norsk Hydro ASA, Rusal, and Constellium SE. These companies contribute significantly to the market through their various operations in mining, refining, and fabrication.

What are the primary factors driving the growth in the aluminum industry?

The growth of the aluminum industry is driven by rising demand in construction, automotive, and packaging sectors. Furthermore, increasing emphasis on lightweight materials for energy efficiency and sustainability enhances aluminum's appeal.

Which region is the fastest Growing in the aluminum market?

The Asia Pacific region is the fastest-growing area in the aluminum market, expected to grow from $40.07 billion in 2023 to $67.26 billion by 2033. This growth is fueled by expanding industries and urbanization efforts.

Does ConsaInsights provide customized market report data for the aluminum industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the aluminum industry. These reports can be adjusted to focus on particular regions, segments, or trends.

What deliverables can I expect from this aluminum market research project?

Deliverables from the aluminum market research project include detailed market analysis reports, segment insights, regional forecasts, competitive landscape evaluations, and actionable recommendations based on the latest data.

What are the market trends of aluminum?

Current trends in the aluminum market include increased recycling efforts, adoption of advanced fabrication technologies, and a focus on lightweight solutions. These trends aim to enhance sustainability and efficiency across various applications.