Aluminum Rolled Products Market Report

Published Date: 02 February 2026 | Report Code: aluminum-rolled-products

Aluminum Rolled Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aluminum Rolled Products market, including market size, growth projections, and key trends from 2023 to 2033, offering insights into regional performances and industry dynamics.

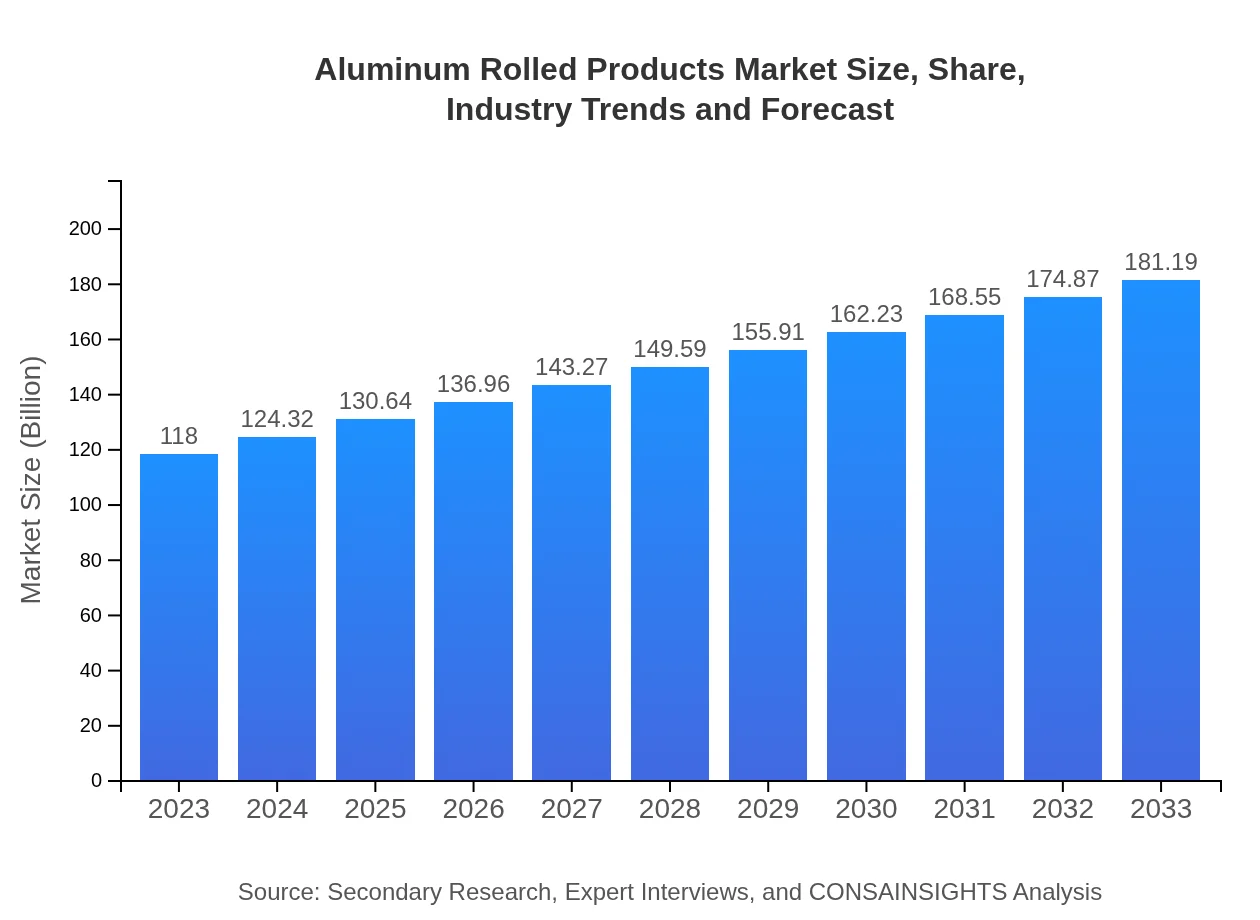

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $118.00 Billion |

| CAGR (2023-2033) | 4.3% |

| 2033 Market Size | $181.19 Billion |

| Top Companies | Alcoa Corporation, Rio Tinto, Constellium, Novelis Inc. |

| Last Modified Date | 02 February 2026 |

Aluminum Rolled Products Market Overview

Customize Aluminum Rolled Products Market Report market research report

- ✔ Get in-depth analysis of Aluminum Rolled Products market size, growth, and forecasts.

- ✔ Understand Aluminum Rolled Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aluminum Rolled Products

What is the Market Size & CAGR of Aluminum Rolled Products market in 2023?

Aluminum Rolled Products Industry Analysis

Aluminum Rolled Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

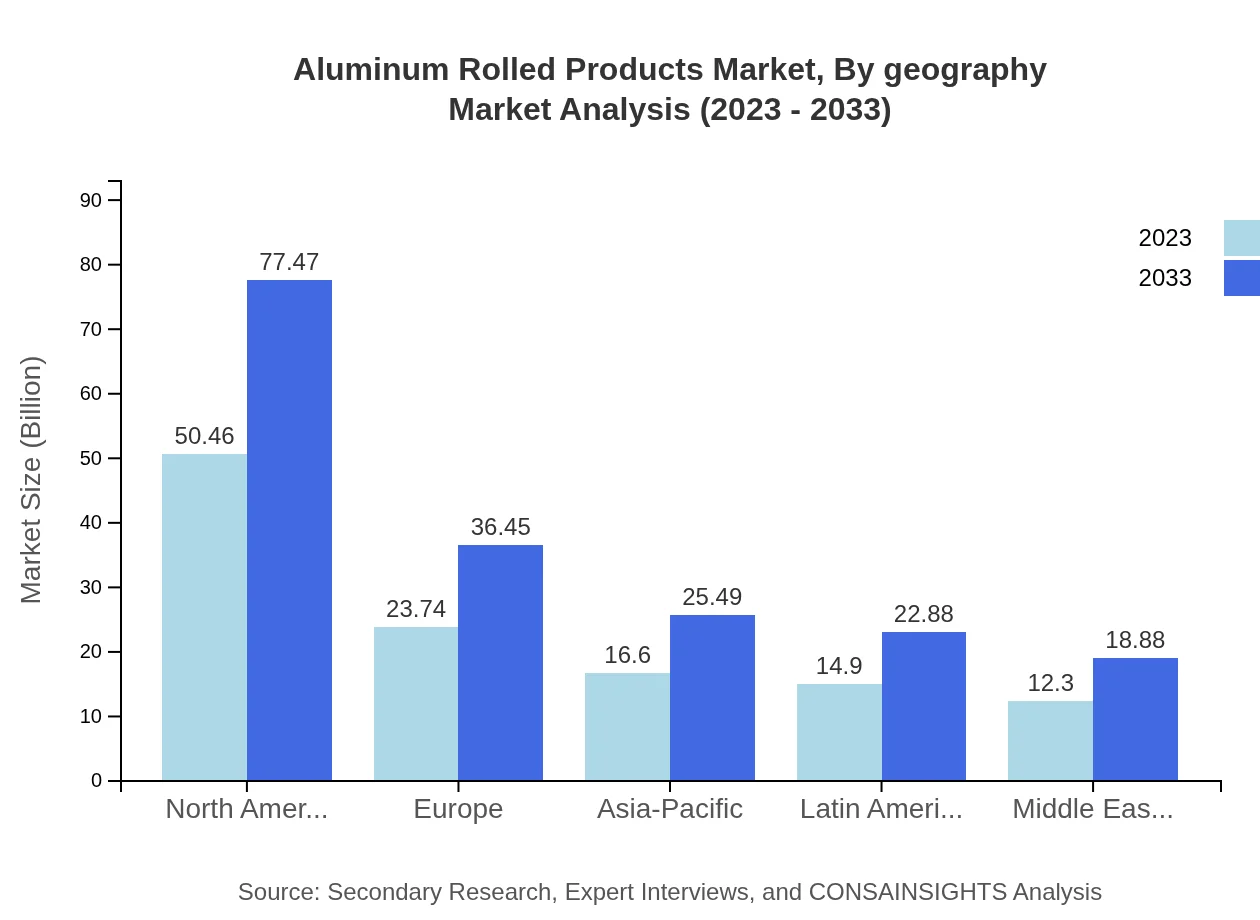

Aluminum Rolled Products Market Analysis Report by Region

Europe Aluminum Rolled Products Market Report:

The European market for Aluminum Rolled Products is estimated at $33.67 billion in 2023, growing to $51.69 billion by 2033. Regulations promoting sustainability and a shift towards lighter materials in vehicle production are driving demand.Asia Pacific Aluminum Rolled Products Market Report:

In the Asia Pacific region, the Aluminum Rolled Products market is projected to grow from $22.02 billion in 2023 to $33.81 billion by 2033. The growth is driven by strong industrial production in emerging economies, particularly China and India, bolstering demand for aluminum in transportation and packaging applications.North America Aluminum Rolled Products Market Report:

North America leads the market with a size of $45.06 billion in 2023, projected to reach $69.19 billion by 2033. This robust growth is attributed to technological advancements in manufacturing processes and significant investments in the automotive sector aimed at enhancing fuel efficiency.South America Aluminum Rolled Products Market Report:

The South American market is expected to expand from $5.92 billion in 2023 to $9.10 billion by 2033, fueled by rising construction activities and increased use of aluminum in packaging due to its lightweight properties and recyclability.Middle East & Africa Aluminum Rolled Products Market Report:

The Middle East and Africa market is expected to increase from $11.33 billion in 2023 to $17.39 billion by 2033, with growth driven by development projects in construction and a shift towards more sustainable practices.Tell us your focus area and get a customized research report.

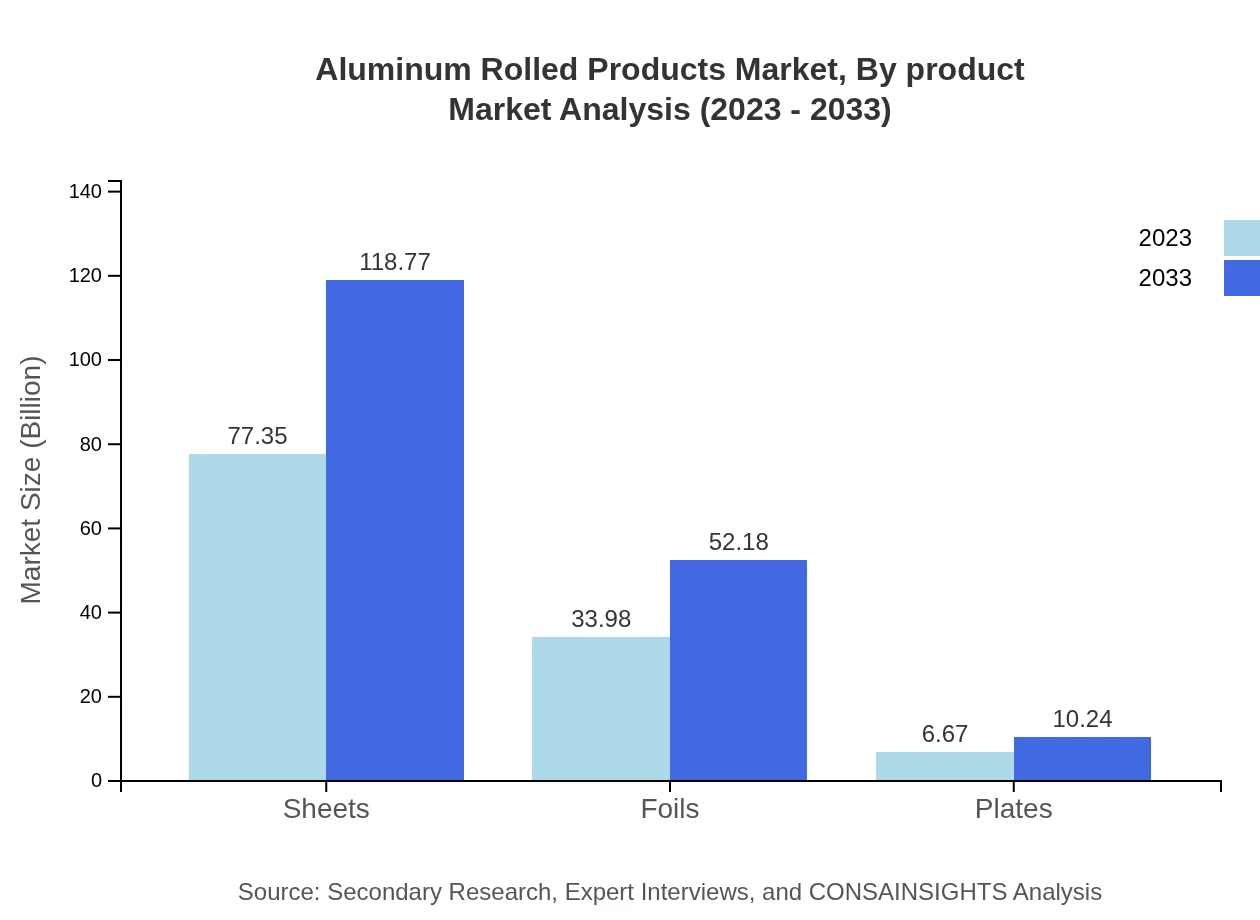

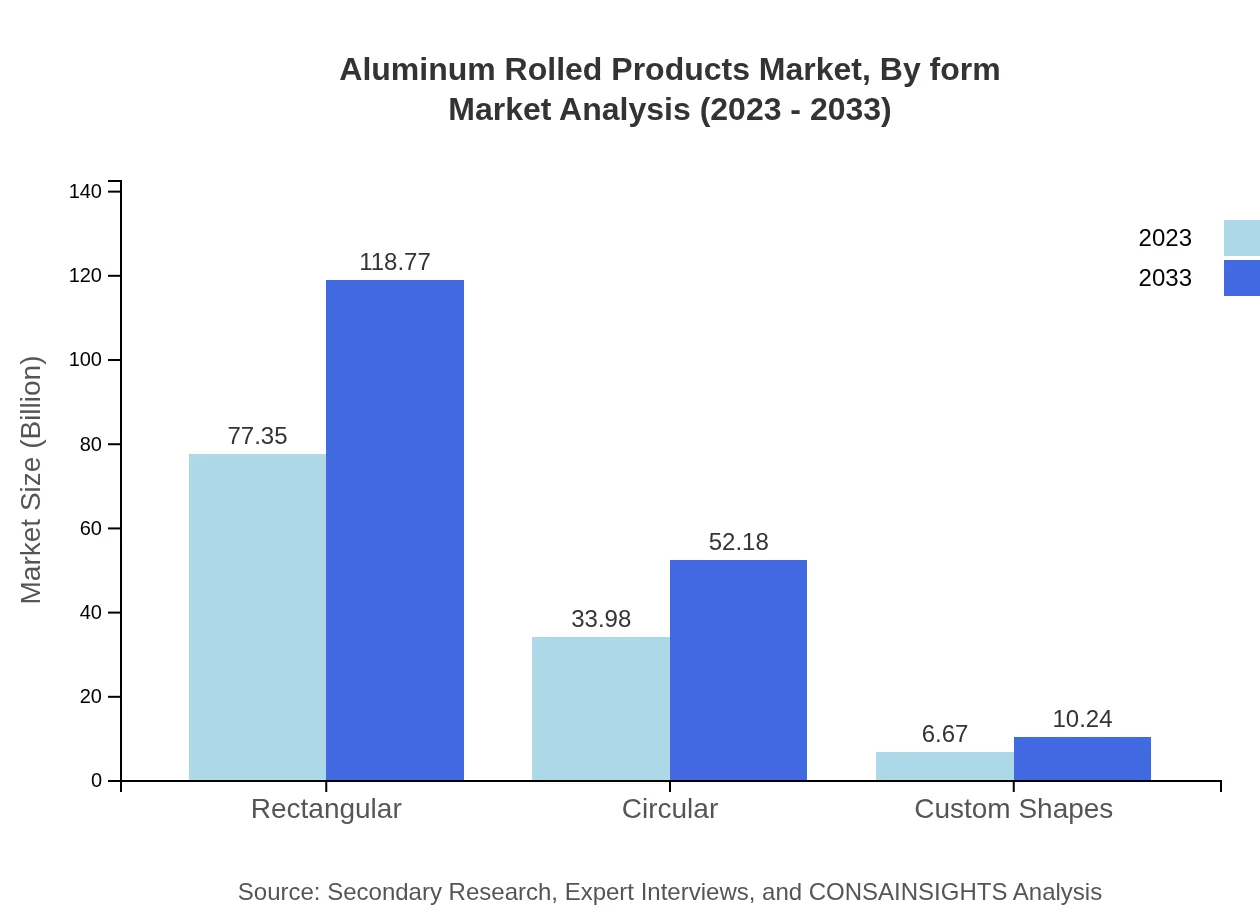

Aluminum Rolled Products Market Analysis By Product

In terms of product type, sheets and foils dominate, accounting for most of the market share. The market for sheets was valued at $77.35 billion in 2023, expected to rise to $118.77 billion by 2033. Foils also show significant growth, progressing from $33.98 billion to $52.18 billion. Custom shapes and plates are smaller segments but are demonstrating increased demand as industry ingenuity expands.

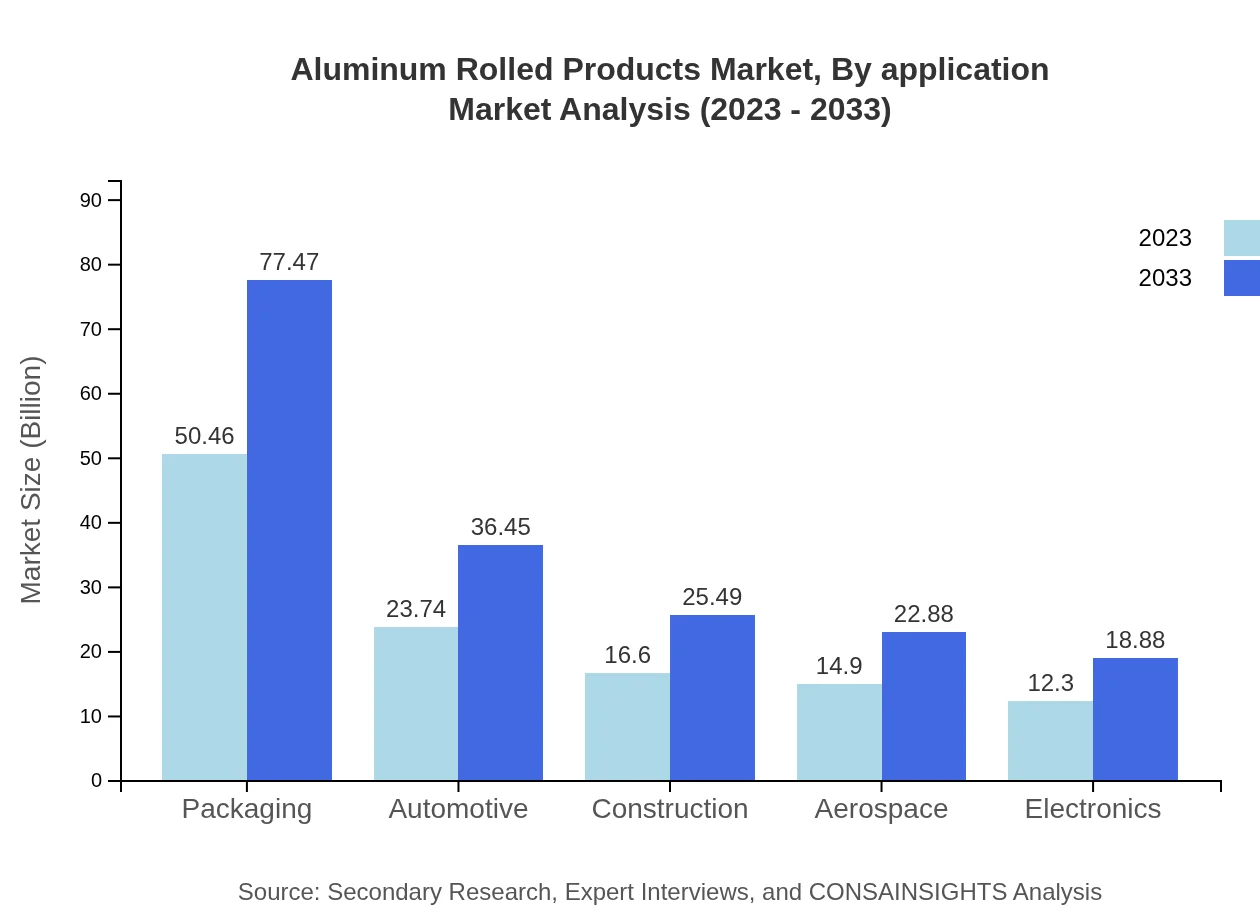

Aluminum Rolled Products Market Analysis By Application

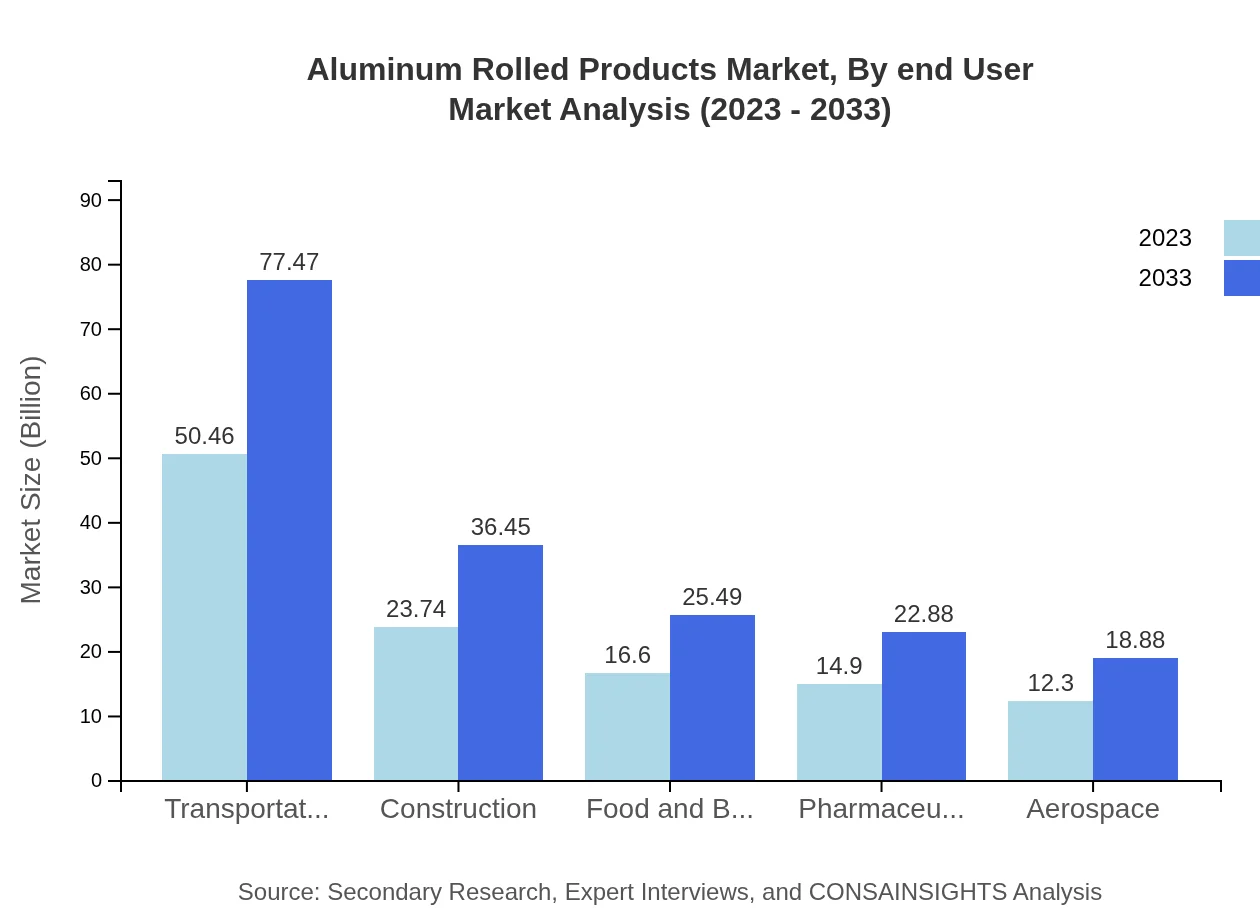

The applications can be characterized by sectors like construction, transportation, packaging, and aerospace. The transportation sector is currently the largest consumer, with market size hitting $50.46 billion in 2023 and expected to grow to $77.47 billion. The packaging sector follows closely due to the growth in consumer goods and sustainable practices.

Aluminum Rolled Products Market Analysis By End User

Key end-user industries include automotive, aerospace, packaging, and construction. The automotive industry reports a considerable market size of $23.74 billion in 2023, projected at $36.45 billion by 2033, highlighting the critical role of aluminum in manufacturing fuel-efficient vehicles.

Aluminum Rolled Products Market Analysis By Geography

Geographically, North America, Asia Pacific, and Europe are the leading markets for Aluminum Rolled Products. North America stands out with its advanced manufacturing capabilities and high demand in aerospace and automotive sectors.

Aluminum Rolled Products Market Analysis By Form

The market is also segmented by form, including rolled sheets, foils, custom shapes, and plates. With sheets and foils being the most significant contributors, innovations in recycling and cold rolling technologies continue to enhance market prospects.

Aluminum Rolled Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aluminum Rolled Products Industry

Alcoa Corporation:

Alcoa is a global leader in bauxite and alumina, and the world’s most sustainable aluminum producer, capitalizing on innovation and responsible practices.Rio Tinto:

Rio Tinto is a leading global mining group that focuses on finding, mining, and processing essential minerals. Their aluminum segment is among their significant profit-generating division.Constellium:

Constellium specializes in the design and manufacturing of innovative and high-value-added aluminum products and is a major player in the global rolled products market.Novelis Inc.:

Novelis is the world leader in aluminum rolled products and recycling, advancing sustainable products and providing solutions for vital applications.We're grateful to work with incredible clients.

FAQs

What is the market size of aluminum Rolled Products?

The aluminum rolled products market is projected to reach approximately $118 billion by 2033, growing at a CAGR of 4.3% from a market size of $118 billion in 2023.

What are the key market players or companies in this aluminum Rolled Products industry?

Key players in the aluminum rolled products industry include companies like Alcoa Corporation, Novelis Inc., and Aleris Corporation, among others, dominating various segments such as manufacturing and distribution.

What are the primary factors driving the growth in the aluminum Rolled Products industry?

Growth drivers for the aluminum rolled products industry include increasing demand in construction, automotive, and packaging sectors, along with growing environmental concerns promoting lightweight materials.

Which region is the fastest Growing in the aluminum rolled products market?

Asia Pacific is expected to witness significant growth in the aluminum rolled products market, projecting a market size increase from $22.02 billion in 2023 to $33.81 billion by 2033.

Does ConsaInsights provide customized market report data for the aluminum Rolled Products industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients within the aluminum rolled products industry, ensuring comprehensive insights.

What deliverables can I expect from this aluminum Rolled Products market research project?

Deliverables from the market research project include detailed reports, executive summaries, and data-driven insights on market trends, regional analyses, and competitive landscapes in the aluminum rolled products industry.

What are the market trends of aluminum Rolled Products?

Current trends in the aluminum rolled products market include increased usage in renewable energy sectors, advancements in manufacturing technologies, and a shift towards sustainable practices in production.