Aluminum Systems Market Report

Published Date: 02 February 2026 | Report Code: aluminum-systems

Aluminum Systems Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the global Aluminum Systems market from 2023 to 2033, providing insights into market size, growth rates, regional dynamics, industry trends, segmentation, and competitive landscape. It offers valuable data for stakeholders to understand emerging opportunities and challenges in this evolving sector.

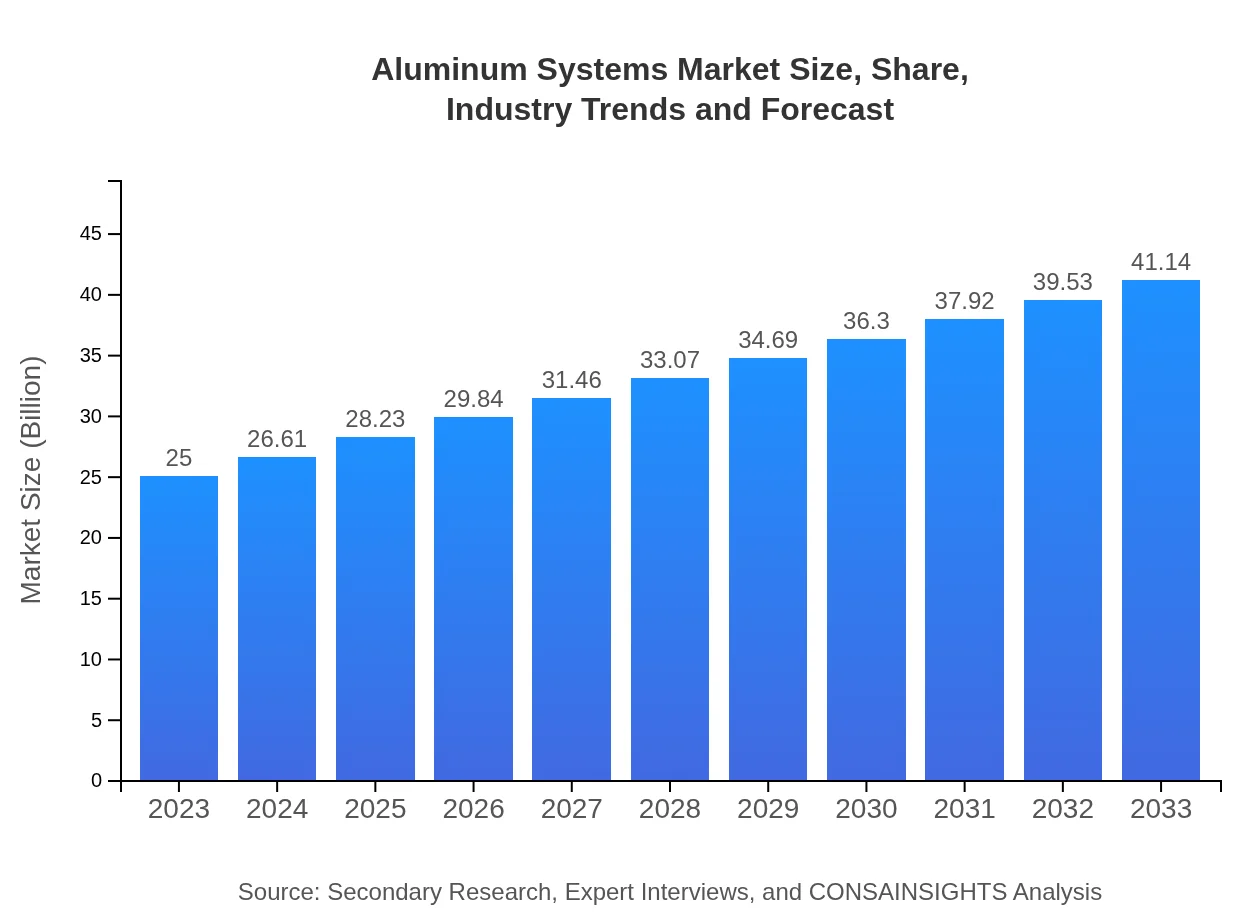

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $41.14 Billion |

| Top Companies | Alcoa Corporation, Rio Tinto Aluminum, Constellium, Novelis |

| Last Modified Date | 02 February 2026 |

Aluminum Systems Market Overview

Customize Aluminum Systems Market Report market research report

- ✔ Get in-depth analysis of Aluminum Systems market size, growth, and forecasts.

- ✔ Understand Aluminum Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aluminum Systems

What is the Market Size & CAGR of Aluminum Systems market in 2023?

Aluminum Systems Industry Analysis

Aluminum Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aluminum Systems Market Analysis Report by Region

Europe Aluminum Systems Market Report:

Europe's market, estimated at $7.18 billion in 2023, is expected to reach $11.81 billion by 2033. The region is characterized by a substantial focus on sustainability and recycling initiatives. The automotive industry and construction are primary growth drivers, aligning with the region's sustainability goals.Asia Pacific Aluminum Systems Market Report:

The Asia Pacific region accounted for $5.04 billion in 2023, projected to grow to $8.29 billion by 2033. Increased urbanization and enhanced production capabilities in countries like China and India are driving significant demand for aluminum systems in construction and automotive sectors, positioning it as a key growth market.North America Aluminum Systems Market Report:

North America represented a market size of $8.61 billion in 2023, with estimates suggesting it will grow to $14.17 billion by 2033. The region benefits from technological advancements and a strong automotive sector, particularly in the U.S. and Canada, which is projected to boost the adoption of aluminum systems significantly.South America Aluminum Systems Market Report:

In South America, the market size was approximately $1.45 billion in 2023, forecasted to reach $2.39 billion by 2033. The growth is supported by a rise in construction activities and automotive production within the region, alongside a burgeoning consumer goods market that increasingly utilizes aluminum.Middle East & Africa Aluminum Systems Market Report:

The market in the Middle East and Africa was valued at $2.73 billion in 2023, projected to reach $4.48 billion by 2033. Growing infrastructure projects and rising industrial sectors are creating new opportunities for aluminum systems, underscoring the region's potential in the global market landscape.Tell us your focus area and get a customized research report.

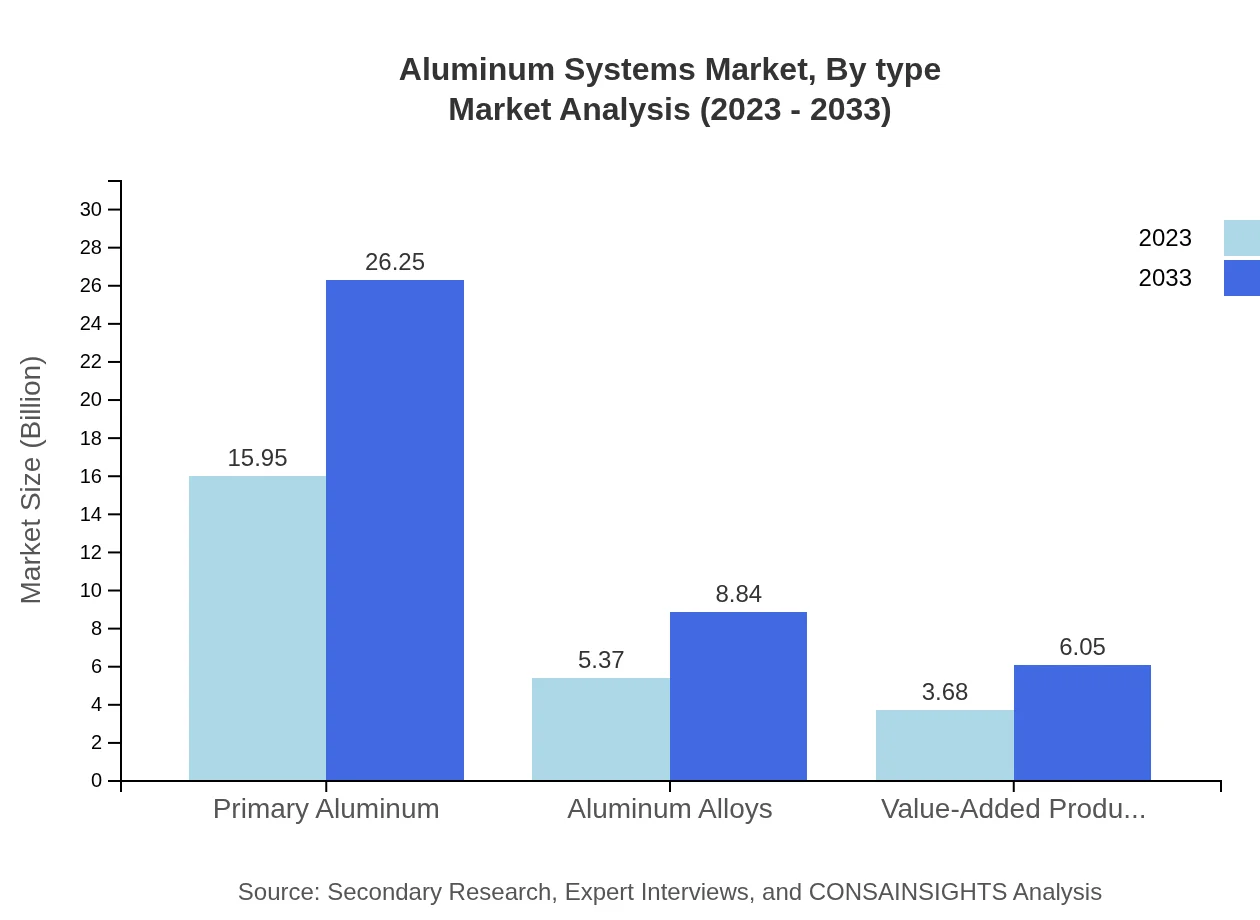

Aluminum Systems Market Analysis By Type

By type, the Aluminum Systems market includes segments like Primary Aluminum, Aluminum Alloys, and Value-Added Products. In 2023, Primary Aluminum accounted for $15.95 billion, with projections reaching $26.25 billion by 2033. Aluminum Alloys also hold a significant market share with a growth trajectory from $5.37 billion to $8.84 billion in the same period. Value-Added Products segment is expanding, projected to grow from $3.68 billion to $6.05 billion, indicating a trend towards alloys and advanced aluminum forms.

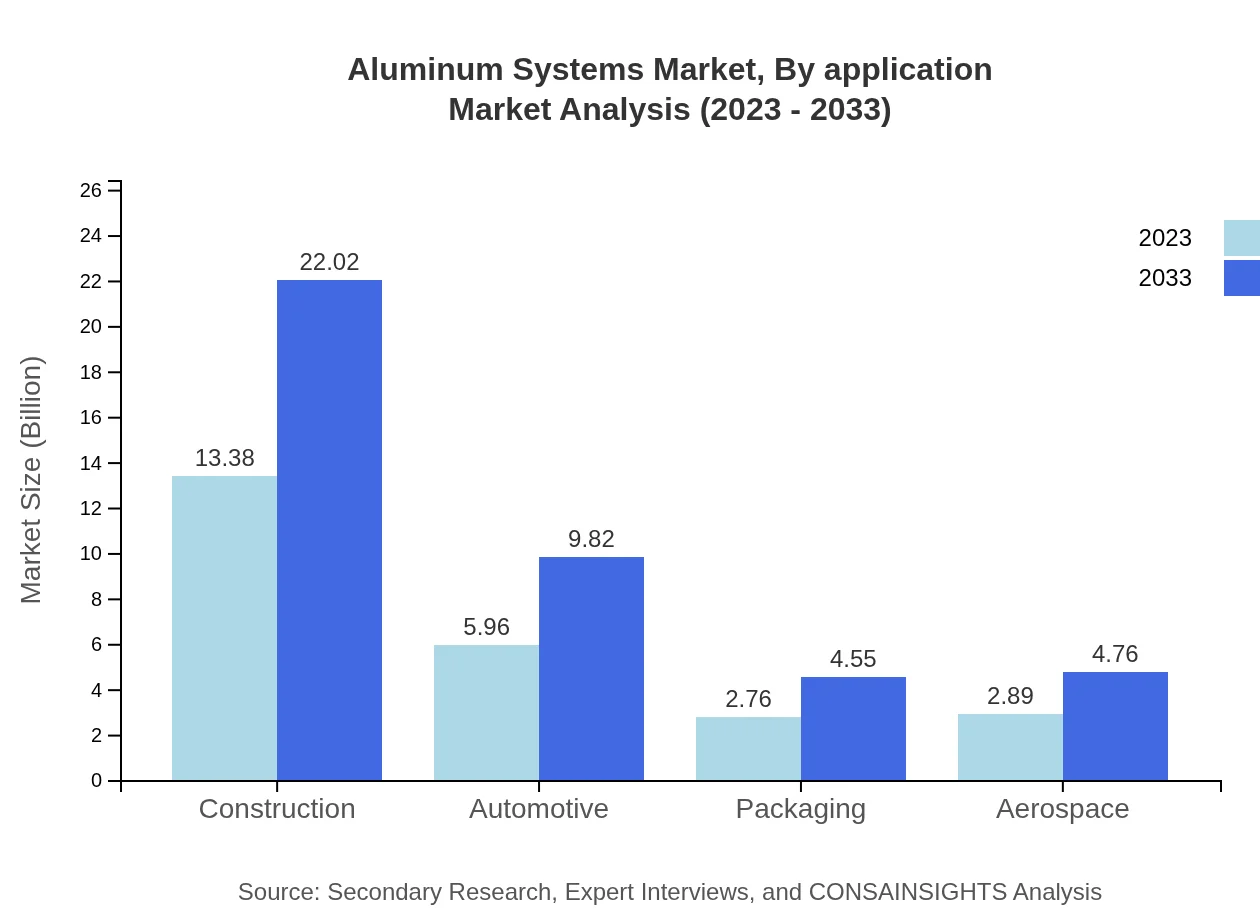

Aluminum Systems Market Analysis By Application

The market is divided primarily into construction, automotive, packaging, aerospace, and consumer goods applications. The construction application dominates the revenue share, accounting for $13.38 billion in 2023 and projected to reach $22.02 billion by 2033. The automotive sector follows, with a valuation of $5.96 billion expected to rise to $9.82 billion as the industry transitions to lighter materials. Packaging applications are also significant, showing steady growth driven by eco-friendly trends.

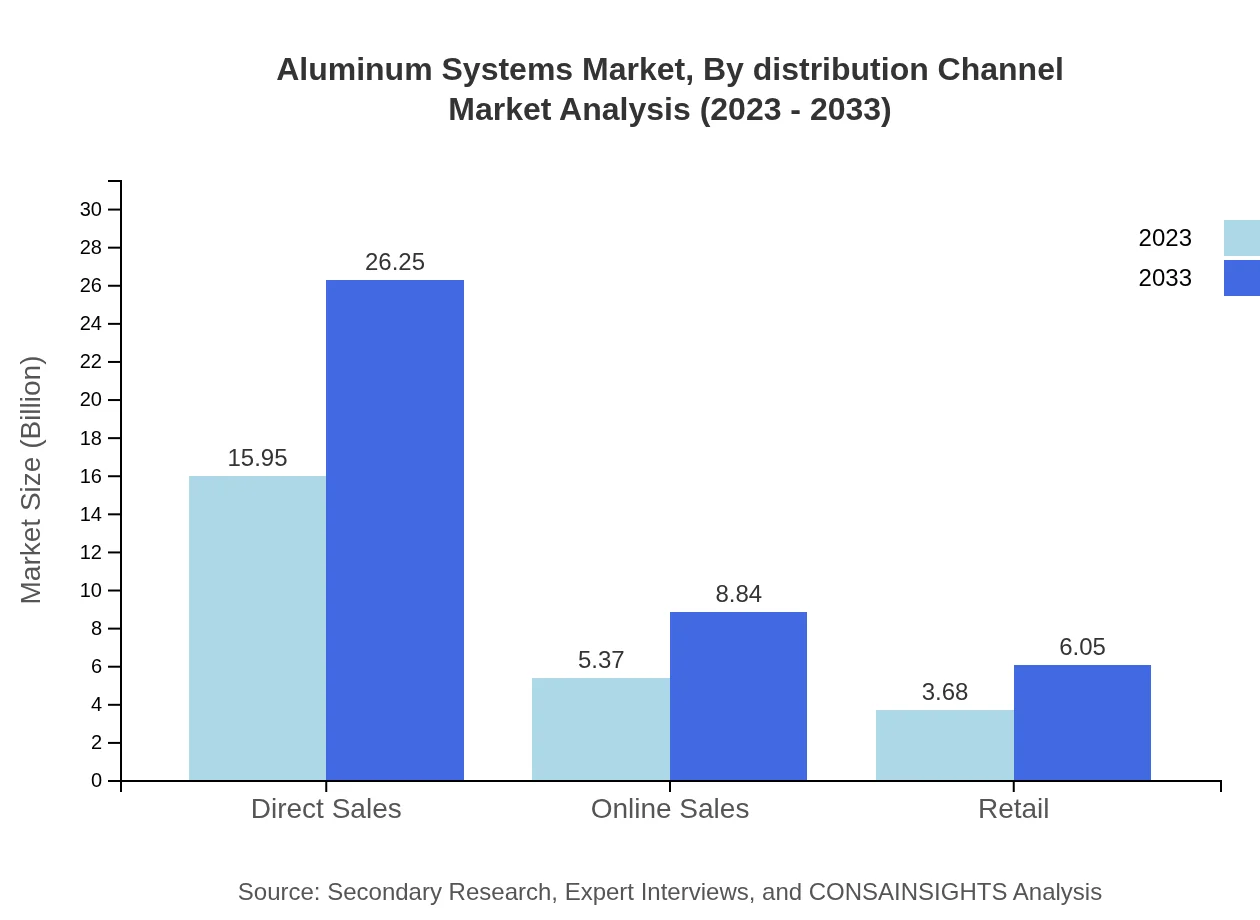

Aluminum Systems Market Analysis By Distribution Channel

Distribution channels include direct sales, online sales, and retail. Direct sales are significant, representing a size of $15.95 billion in 2023, projected to maintain a steady share as companies leverage direct customer relationships. Online sales are anticipated to grow from $5.37 billion to $8.84 billion, as digital platforms become more essential in reaching consumers. Retail channels maintain a stable contribution to market dynamics, adapting to evolving consumer buying habits.

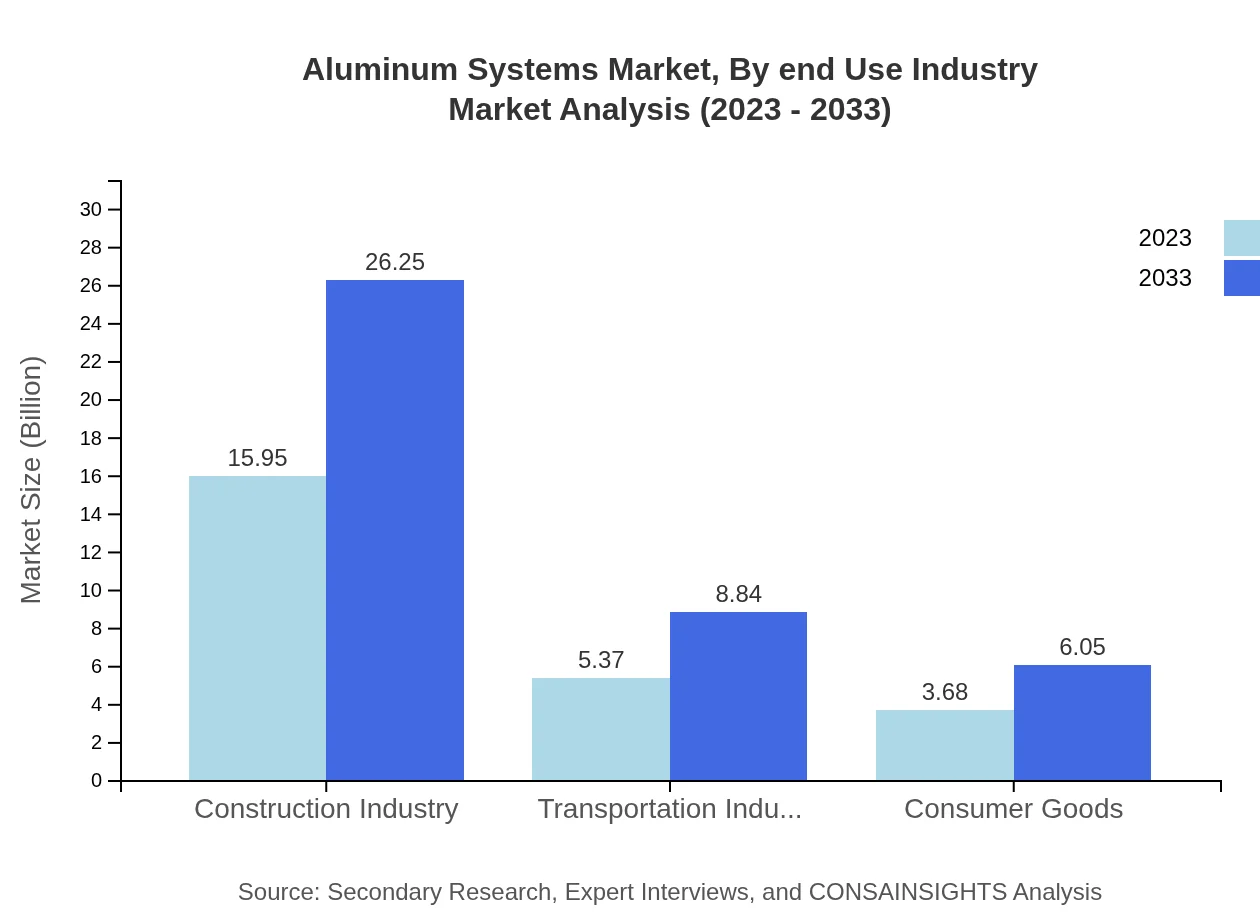

Aluminum Systems Market Analysis By End Use Industry

Key end-use industries include construction, automotive, transportation, and consumer goods. The construction industry leads the market with a share of 63.81% in 2023 and is expected to continue its growth through 2033. The transportation sector, particularly with rising sustainable transport solutions, contributes significantly, showing a steady increase towards meeting environmental regulations.

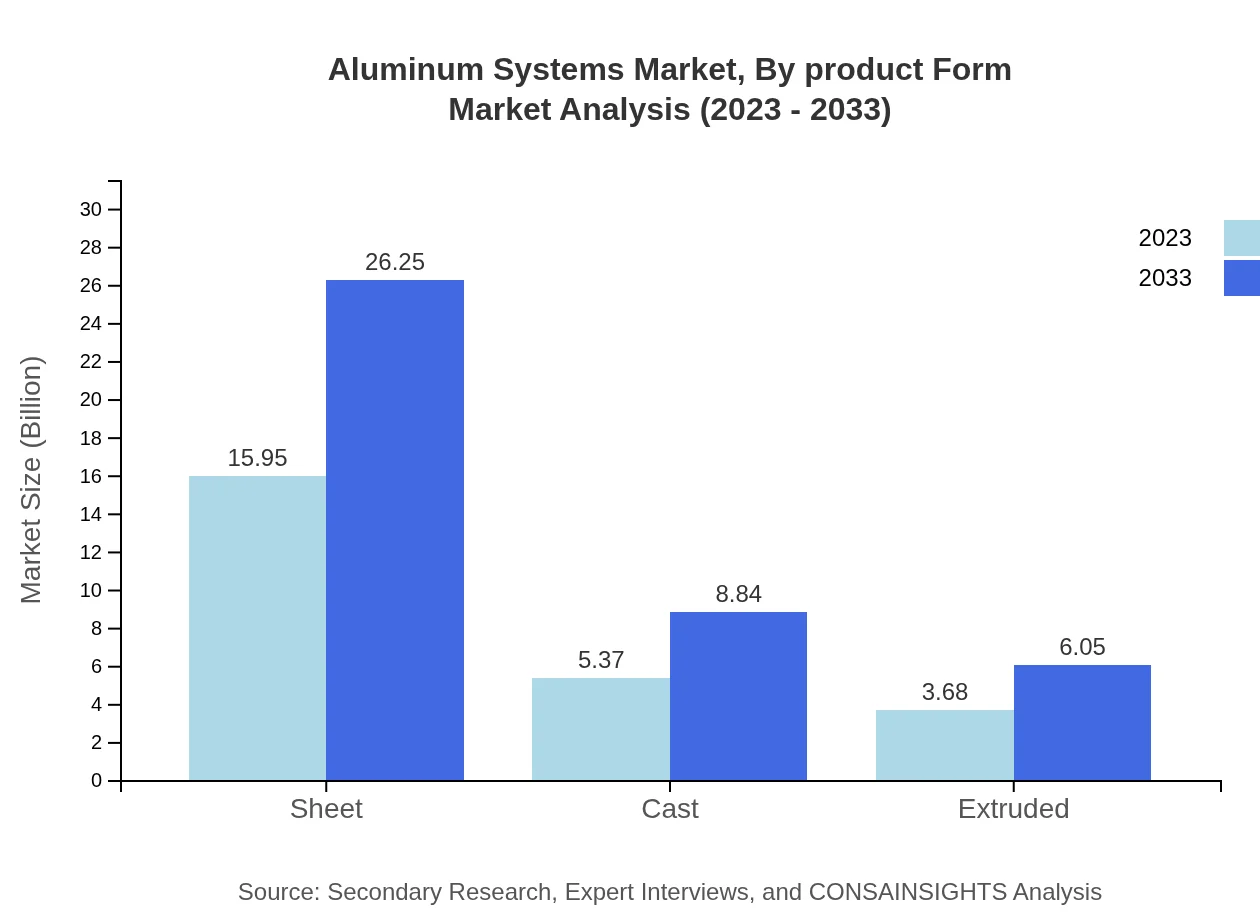

Aluminum Systems Market Analysis By Product Form

This market segment explores various product forms, including sheet, cast, and extruded aluminum. In 2023, sheet aluminum is dominant with $15.95 billion in revenue. Cast products followed at $5.37 billion and extruded forms at $3.68 billion, indicating diverse applications across industries—constructing portable structures, machinery, and frameworks.

Aluminum Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aluminum Systems Industry

Alcoa Corporation:

Alcoa is a leader in the aluminum production industry, known for its commitment to sustainability and innovation in aluminum alloys and recycling practices.Rio Tinto Aluminum:

Rio Tinto Aluminum is a global player, focusing on miner operations and environmental responsibility with an emphasis on producing low-carbon aluminum solutions.Constellium:

Constellium specializes in high-value-added aluminum products, primarily for the aerospace, automotive, and packaging sectors.Novelis:

Novelis is an industry leader in aluminum rolling and recycling, committed to sustainable practices and continuous improvements in manufacturing processes.We're grateful to work with incredible clients.

FAQs

What is the market size of aluminum Systems?

The aluminum-systems market is valued at approximately $25 billion in 2023, with an expected CAGR of 5% over the forecast period. This growth indicates a robust industry that is increasingly important in various sectors such as construction and automotive.

What are the key market players or companies in this aluminum Systems industry?

Key players in the aluminum-systems market include prominent manufacturers and suppliers who significantly influence industry standards. They encompass major global corporations and innovative small firms focused on efficiency and sustainability in aluminum production.

What are the primary factors driving the growth in the aluminum Systems industry?

Growth drivers in the aluminum-systems industry include increased construction activity, a rising automotive sector emphasizing lightweight materials, and a broader push for sustainable solutions in manufacturing and production processes, all contributing to heightened demand.

Which region is the fastest Growing in the aluminum Systems?

Currently, North America represents the fastest-growing region in the aluminum-systems market, projected to grow from $8.61 billion in 2023 to $14.17 billion by 2033, driven by infrastructure development and increased manufacturing activities.

Does ConsaInsights provide customized market report data for the aluminum Systems industry?

Yes, ConsaInsights offers tailored market report data for the aluminum-systems industry, allowing clients to obtain specific insights and analyses that cater to their unique business needs and strategic objectives.

What deliverables can I expect from this aluminum Systems market research project?

Expect comprehensive deliverables including detailed market analysis reports, growth forecasts, segment breakdowns, competitive landscape assessments, and regional insights, all structured to support informed business decisions.

What are the market trends of aluminum Systems?

Current trends in the aluminum-systems market include advancements in lightweight materials, innovative recycling techniques, and increased adoption of aluminum in various applications, particularly in renewable energy and automotive sectors.