Ammonia Market Report

Published Date: 02 February 2026 | Report Code: ammonia

Ammonia Market Size, Share, Industry Trends and Forecast to 2033

This report presents in-depth insights into the ammonia market from 2023 to 2033. It covers current market dynamics, size estimation, segmentation, regional analysis, technological trends, and forecasts, providing a comprehensive overview for stakeholders interested in this critical chemical commodity.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

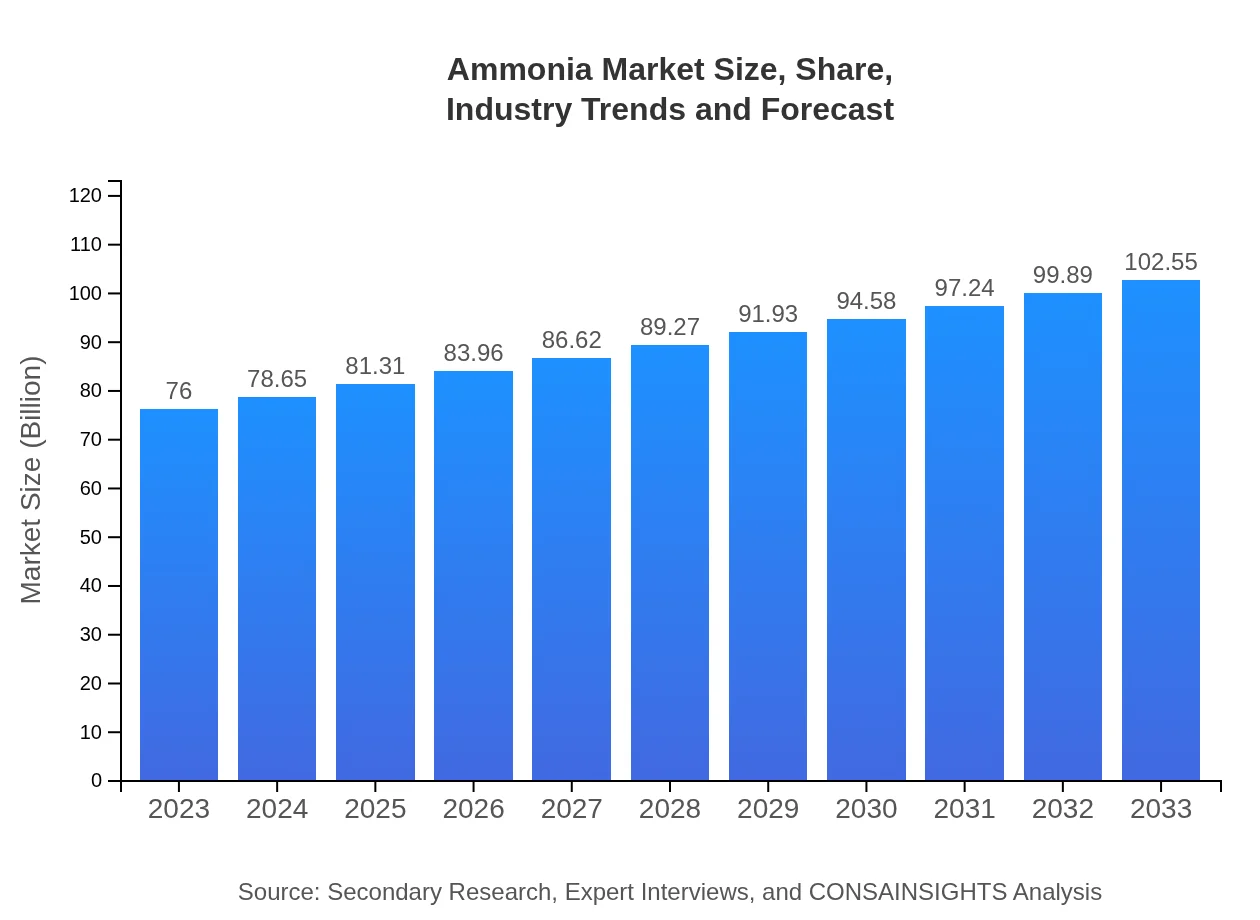

| 2023 Market Size | $76.00 Billion |

| CAGR (2023-2033) | 3.0% |

| 2033 Market Size | $102.55 Billion |

| Top Companies | Yara International, CF Industries Holdings, Inc., Nutrien Ltd., BASF SE |

| Last Modified Date | 02 February 2026 |

Ammonia Market Overview

Customize Ammonia Market Report market research report

- ✔ Get in-depth analysis of Ammonia market size, growth, and forecasts.

- ✔ Understand Ammonia's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ammonia

What is the Market Size & CAGR of Ammonia market in 2023?

Ammonia Industry Analysis

Ammonia Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ammonia Market Analysis Report by Region

Europe Ammonia Market Report:

Europe's ammonia market stood at USD 23.77 billion in 2023, projected to reach USD 32.08 billion by 2033. The region emphasizes regulatory compliance and sustainability, with several countries investing in green ammonia technologies, aligning with climate goals.Asia Pacific Ammonia Market Report:

The Asia Pacific region dominated the ammonia market in 2023, valued at USD 14.45 billion, with projections to reach USD 19.49 billion by 2033. Growth is fueled by the increasing agricultural output and expanding industrial sectors. Countries such as China and India are leading the charge in ammonia consumption, driven by substantial investments in agriculture and chemical manufacturing.North America Ammonia Market Report:

The North American ammonia market, valued at USD 24.94 billion in 2023, is expected to expand to USD 33.65 billion by 2033. The U.S. leads in ammonia production and consumption, driven by the agricultural sector's growth and innovations in sustainable ammonia production technologies.South America Ammonia Market Report:

In South America, the ammonia market was valued at USD 5.09 billion in 2023 and is expected to grow to USD 6.87 billion by 2033. Brazil and Argentina are key markets focusing on improving agricultural productivity and adopting nitrogen-based fertilizers, thereby showing steady demand for ammonia.Middle East & Africa Ammonia Market Report:

The Middle East and Africa market was valued at USD 7.75 billion in 2023 and is projected to grow to USD 10.46 billion by 2033. Increased production capacity and growing industrial sectors in the UAE and South Africa are key drivers in the region.Tell us your focus area and get a customized research report.

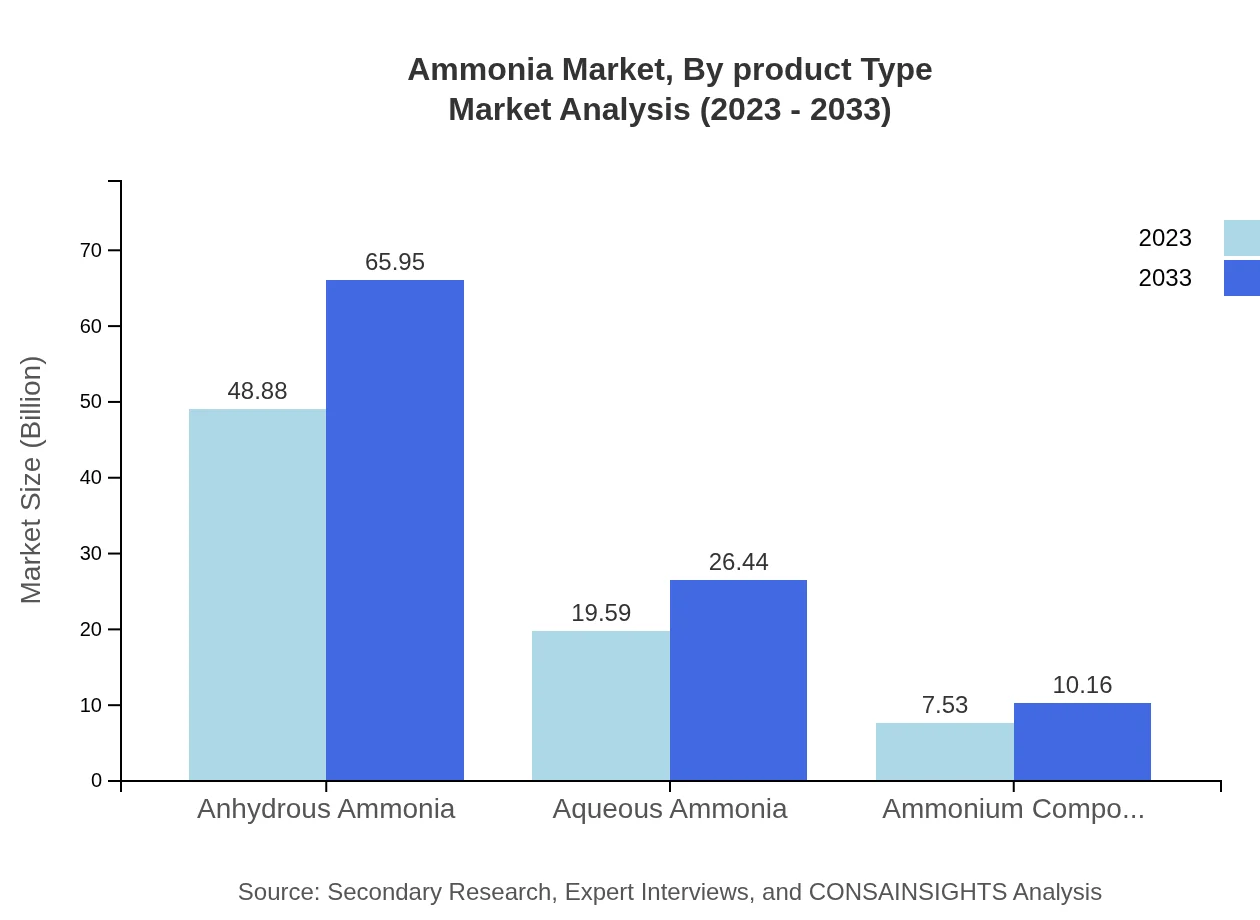

Ammonia Market Analysis By Product Type

The ammonia market, by product type, includes segments such as anhydrous ammonia, aqueous ammonia, and ammonium compounds. Anhydrous ammonia leads the market with a size of USD 48.88 billion in 2023 and is expected to grow to USD 65.95 billion by 2033, holding a 64.31% market share. Aqueous ammonia follows with a market size of USD 19.59 billion in 2023, anticipated to reach USD 26.44 billion by 2033.

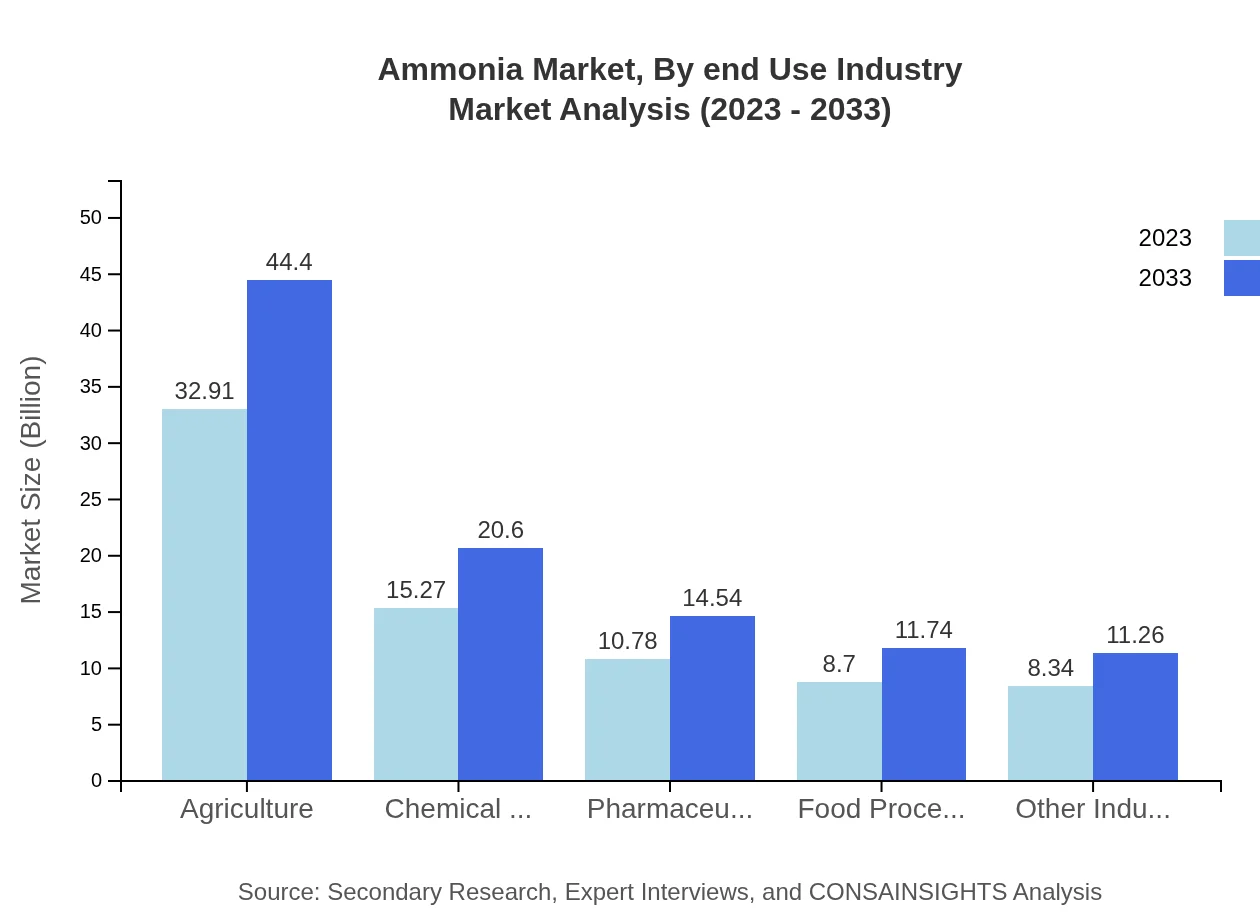

Ammonia Market Analysis By End Use Industry

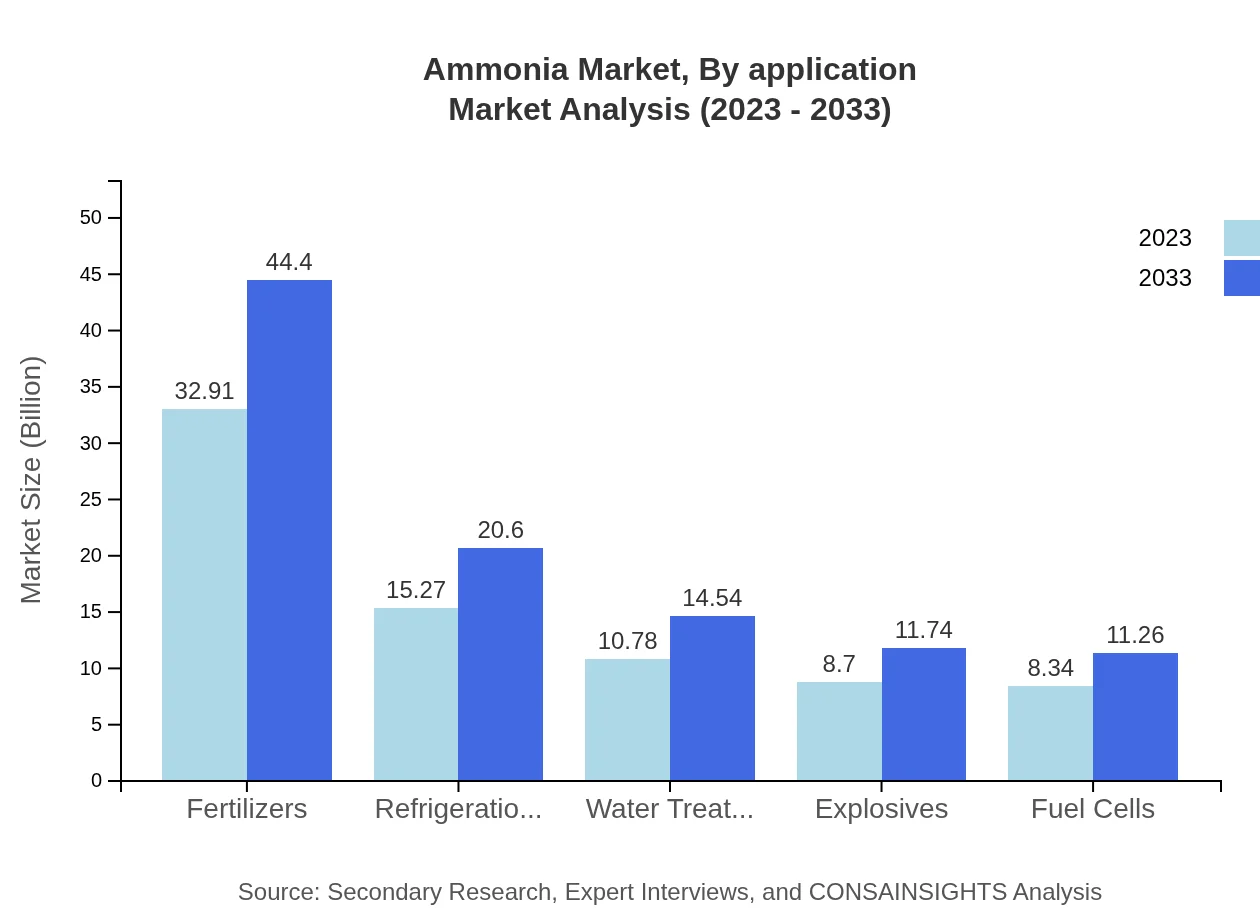

In the end-use perspective, the fertilizer sector dominates with a size of USD 32.91 billion in 2023, expected to reach USD 44.40 billion by 2033 (drawing a 43.3% market share). Other significant industries include refrigeration systems with a market size of USD 15.27 billion in 2023 and pharmaceuticals at USD 10.78 billion in the same year.

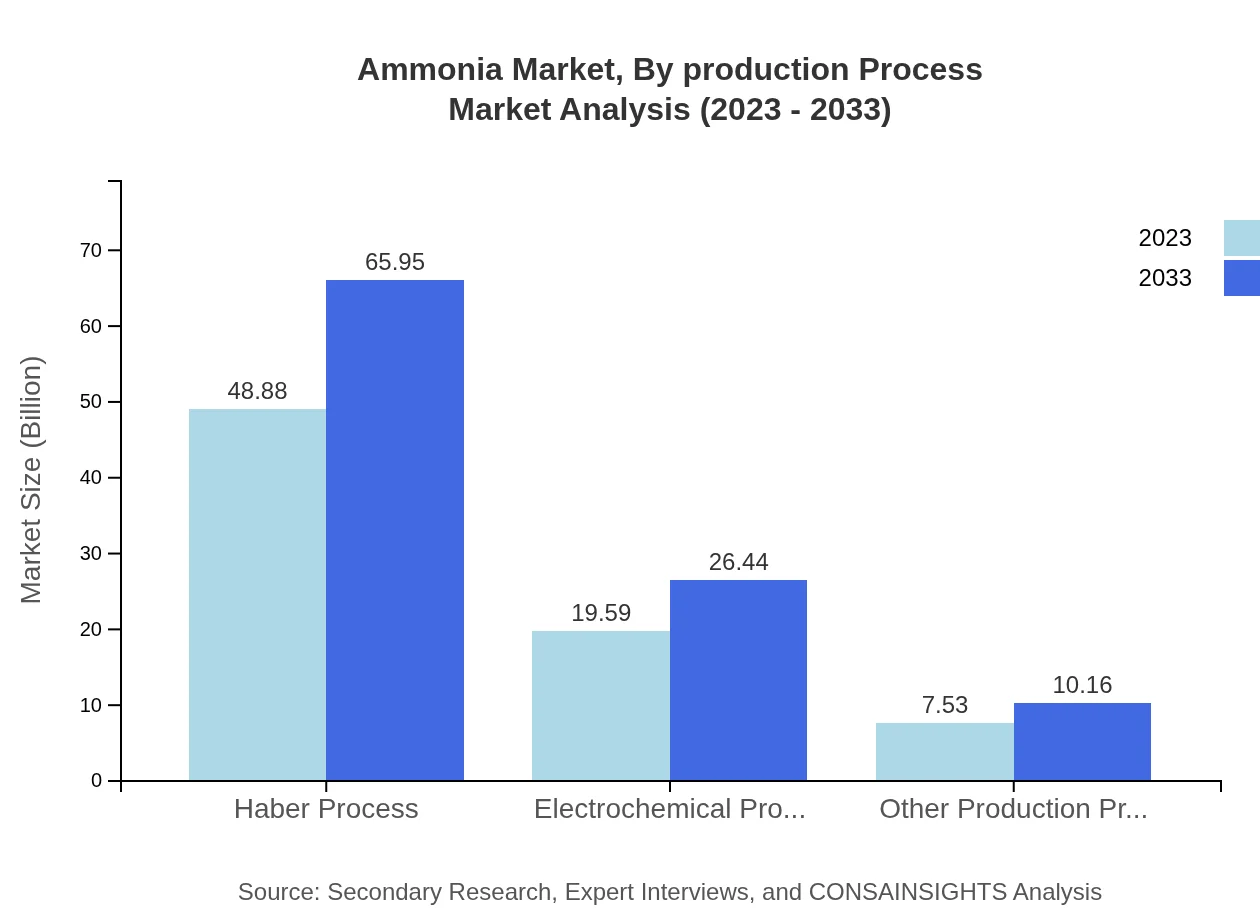

Ammonia Market Analysis By Production Process

Production processes such as the Haber process are critical, with an estimated market share of 64.31%, reflecting a size of USD 48.88 billion in 2023. New methods such as electrochemical production processes are also gaining traction, projected to grow from USD 19.59 billion in 2023 to USD 26.44 billion by 2033.

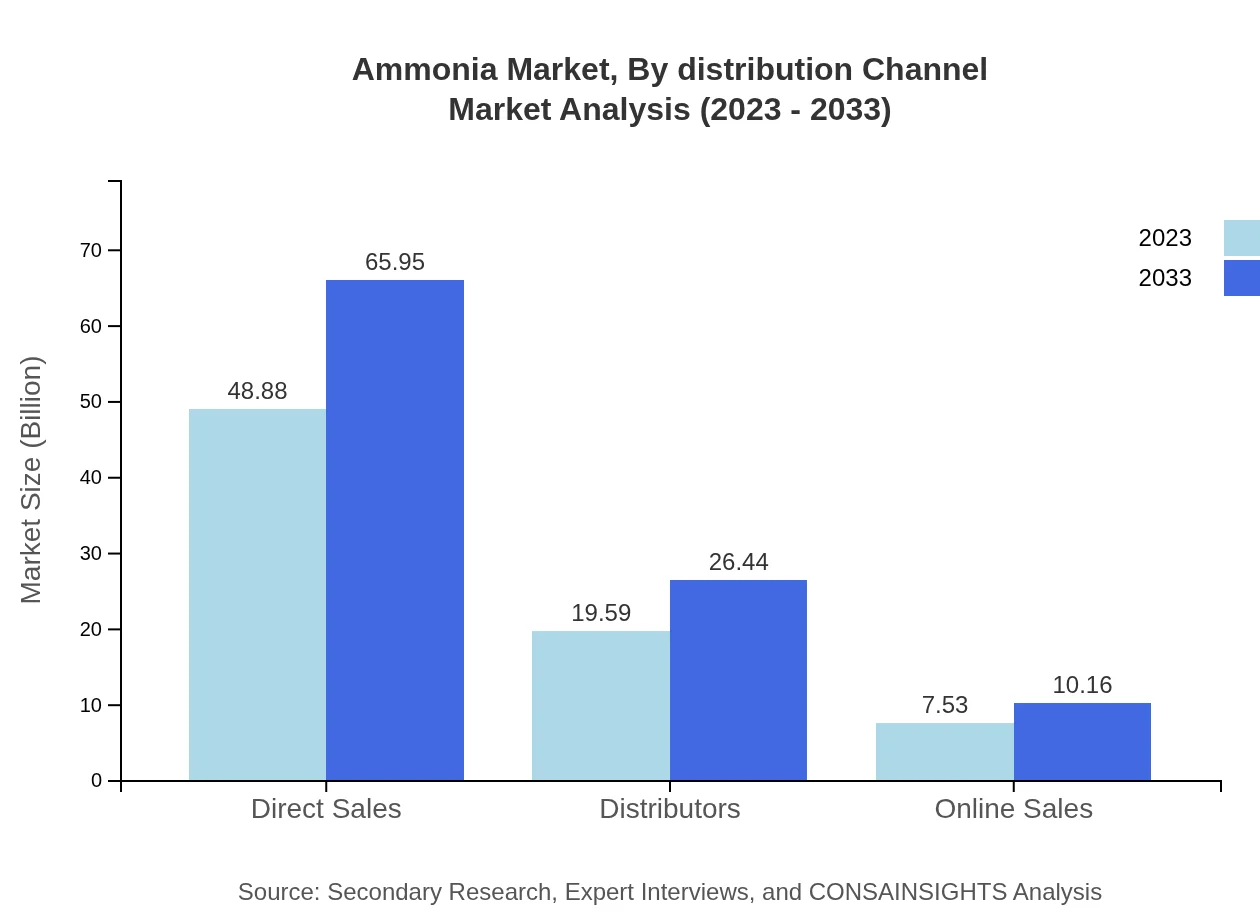

Ammonia Market Analysis By Distribution Channel

Distribution channels include direct sales, distributors, and online sales. Direct sales dominate with a market size of USD 48.88 billion in 2023. The rise of e-commerce will influence future distribution dynamics, although traditional models remain strong.

Ammonia Market Analysis By Application

Applications span various sectors including agriculture, chemical manufacturing, and food processing. Agriculture's share remains dominant, reflecting a market size of USD 32.91 billion in 2023, while segments like chemical manufacturing show significant growth potential.

Ammonia Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ammonia Industry

Yara International:

One of the largest producers of nitrogen fertilizers, Yara International operates globally and focuses on sustainable practices in ammonia production and distribution.CF Industries Holdings, Inc.:

A leading manufacturer of nitrogen fertilizers, CF Industries plays a crucial role in the ammonia market, leveraging advanced production technologies to meet global demand.Nutrien Ltd.:

Nutrien is significant in the agriculture sector, producing and supplying ammonia and its derivatives while emphasizing sustainable farming practices.BASF SE:

BASF engages in various sectors with a strong emphasis on agricultural solutions, including ammonia production for fertilizers, contributing to improved crop yields.We're grateful to work with incredible clients.

FAQs

What is the market size of ammonia?

The global ammonia market is valued at approximately $76 billion in 2023, with a projected CAGR of 3.0% through 2033. As demand for fertilizers and industrial applications grow, this market is expected to expand significantly.

What are the key market players or companies in the ammonia industry?

Leading players in the ammonia market include Yara International, CF Industries, Nutrien, and OCI Nitrogen. These companies dominate due to their advanced production processes and extensive distribution networks, driving innovation in the ammonia sector.

What are the primary factors driving the growth in the ammonia industry?

Key growth drivers in the ammonia market include the rising demand for fertilizers in agriculture, advancements in ammonia production technologies, and increasing applications in industrial sectors such as water treatment and refrigeration.

Which region is the fastest Growing in the ammonia market?

The Asia Pacific region is the fastest-growing market for ammonia, projected to grow from $14.45 billion in 2023 to $19.49 billion by 2033. This growth is fueled by expanding agricultural activities and demand for fertilizers.

Does ConsaInsights provide customized market report data for the ammonia industry?

Yes, ConsaInsights offers customizable market report data tailored to the ammonia industry. Clients can request specific insights, regional analyses, and detailed segment data to meet their unique research needs.

What deliverables can I expect from this ammonia market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, segmentation insights, competitive landscape assessments, and strategic recommendations tailored to the ammonia market for informed decision-making.

What are the market trends of ammonia?

Current trends in the ammonia market include the shift toward sustainable production methods, increased usage in renewable energy, especially hydrogen production, and the growing importance of ammonia in circular economy initiatives.