Ammonium Nitrate Market Report

Published Date: 02 February 2026 | Report Code: ammonium-nitrate

Ammonium Nitrate Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Ammonium Nitrate market, providing insights into current trends, market size, and forecasts for the period 2023-2033. It covers market segmentation, regional analysis, and identifies key players in the industry.

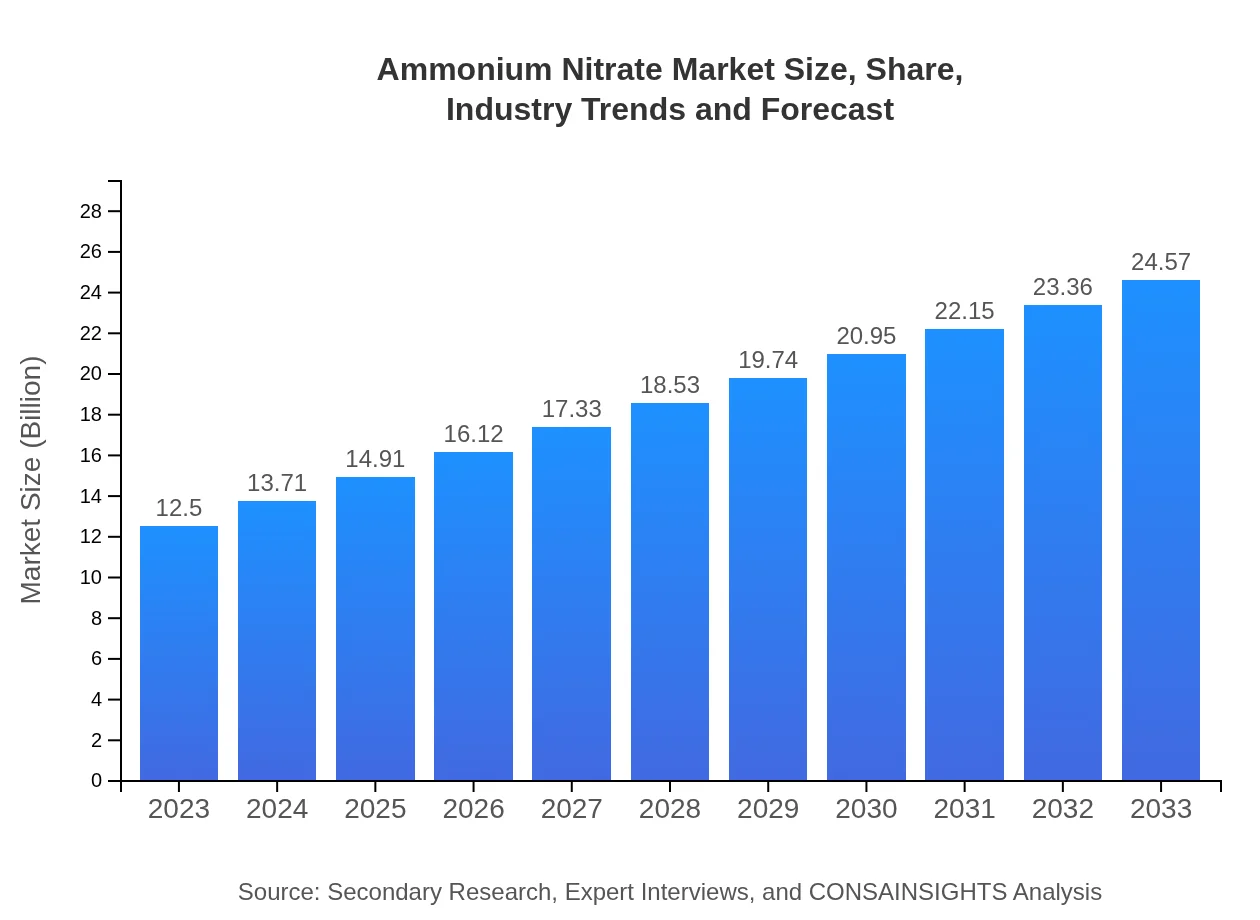

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Yara International, Nutrien Ltd., CF Industries, Orica, Acron Group |

| Last Modified Date | 02 February 2026 |

Ammonium Nitrate Market Overview

Customize Ammonium Nitrate Market Report market research report

- ✔ Get in-depth analysis of Ammonium Nitrate market size, growth, and forecasts.

- ✔ Understand Ammonium Nitrate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ammonium Nitrate

What is the Market Size & CAGR of Ammonium Nitrate market in 2023?

Ammonium Nitrate Industry Analysis

Ammonium Nitrate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ammonium Nitrate Market Analysis Report by Region

Europe Ammonium Nitrate Market Report:

Europe's market for ammonium nitrate is projected to rise from $4.00 billion in 2023 to $7.86 billion in 2033. Stringent regulations and a push for sustainable agriculture practices in countries like Germany and France are influencing market dynamics.Asia Pacific Ammonium Nitrate Market Report:

In the Asia-Pacific region, the ammonium nitrate market is projected to grow from $2.34 billion in 2023 to $4.59 billion in 2033. The increasing agricultural activities and rising food demand in countries like India and China significantly contribute to this growth.North America Ammonium Nitrate Market Report:

North America is forecasted to grow from $4.33 billion in 2023 to $8.52 billion in 2033. The presence of established agricultural practices and mining activities in the United States and Canada supports this expansion.South America Ammonium Nitrate Market Report:

The South American market, starting at $0.39 billion in 2023, is expected to reach $0.77 billion by 2033. Brazil and Argentina are leading the demand due to their extensive agricultural sectors.Middle East & Africa Ammonium Nitrate Market Report:

In the Middle East and Africa, the market size is expected to increase from $1.44 billion in 2023 to $2.82 billion in 2033. The demand for fertilizers and the growth in construction activities across the region are key contributors.Tell us your focus area and get a customized research report.

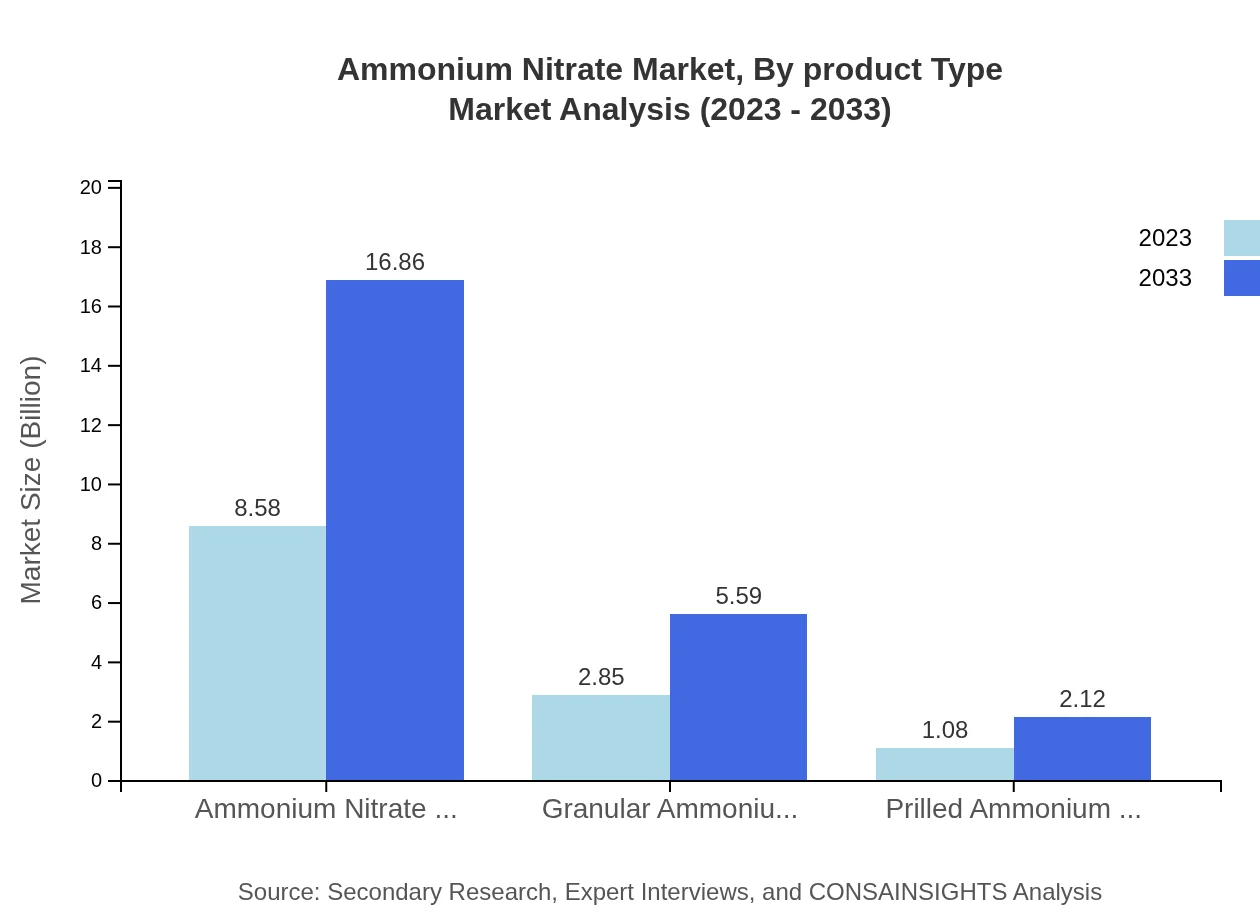

Ammonium Nitrate Market Analysis By Product Type

The two primary product types in the ammonium nitrate market are Granular Ammonium Nitrate and Prilled Ammonium Nitrate. Granular ammonium nitrate, with a market size of $2.85 billion in 2023, is primarily used for agricultural applications and is projected to reach $5.59 billion by 2033. In contrast, Prilled Ammonium Nitrate, starting at $1.08 billion in 2023, is anticipated to grow to $2.12 billion by 2033. The choice between the two often depends on specific application requirements.

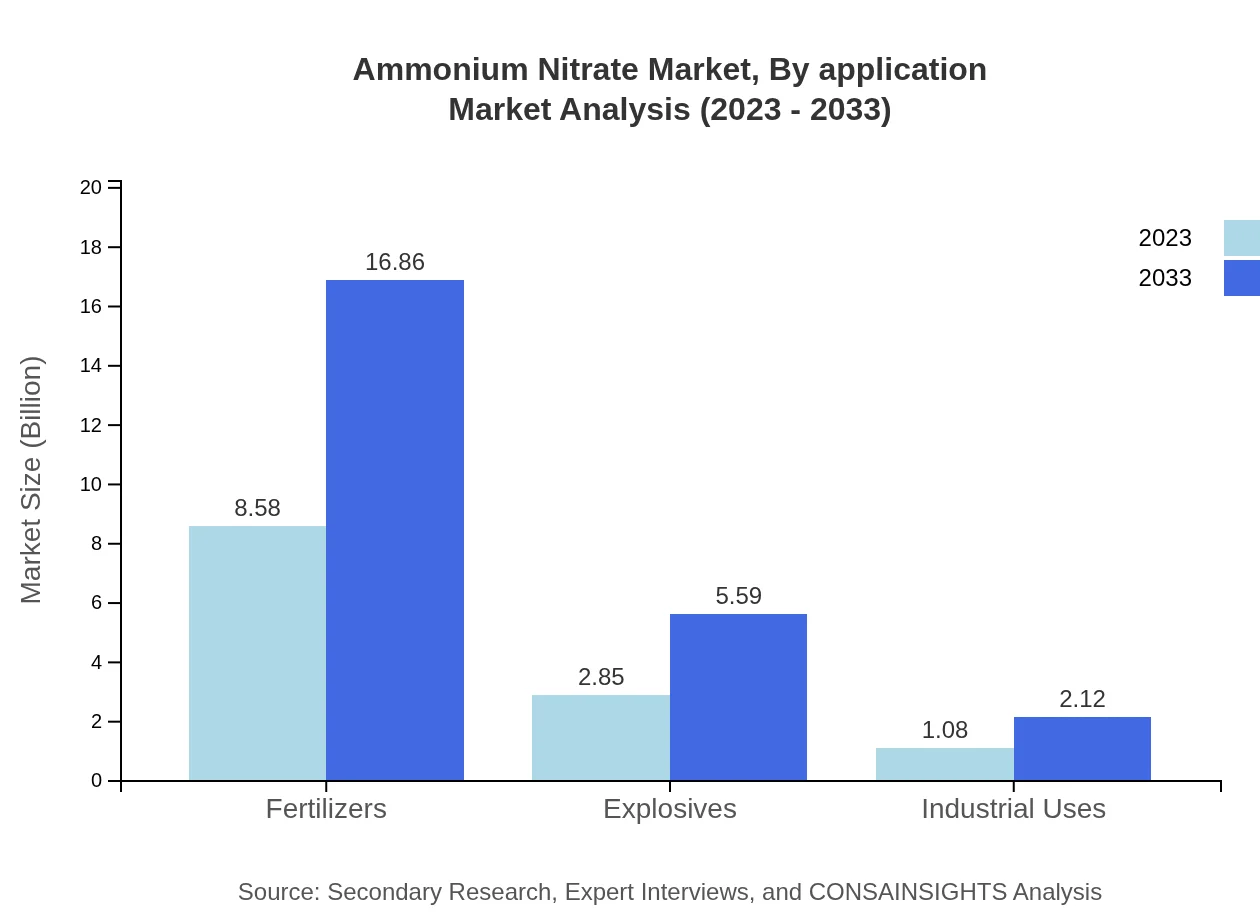

Ammonium Nitrate Market Analysis By Application

The major applications of ammonium nitrate fall within Fertilizers, Explosives, and Chemical Processing. Fertilizers dominate the market, with a size of $8.58 billion in 2023 and expected growth to $16.86 billion in 2033. Explosives accounted for $2.85 billion in 2023, expected to reach $5.59 billion, driven by increased mining activities. Chemical Processing, on the other hand, starts at $1.31 billion, expected to double by 2033.

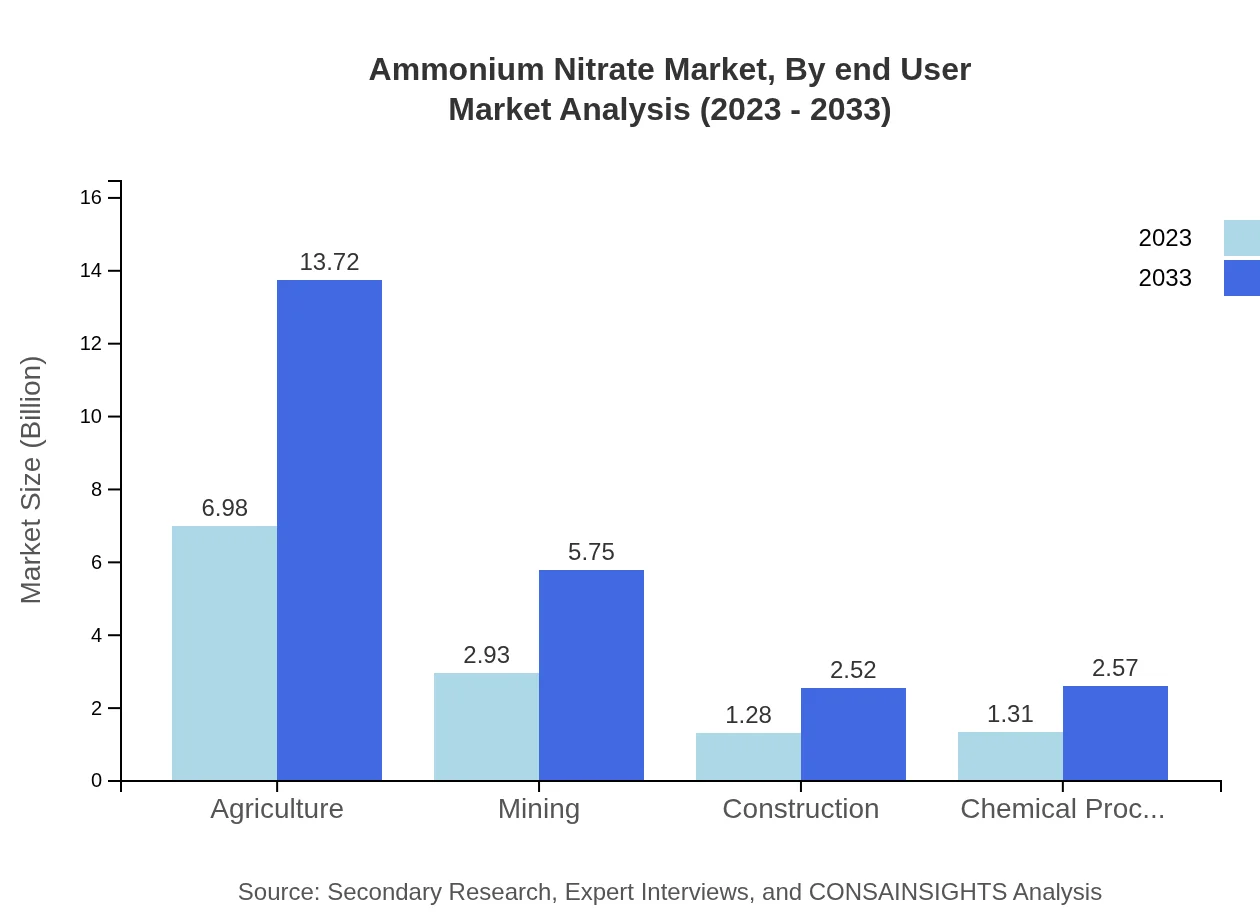

Ammonium Nitrate Market Analysis By End User

Key end-user industries for ammonium nitrate include Agriculture, Mining, and Construction. With agriculture taking a dominant share of approximately 55.85% in 2023 and projected to maintain this share through 2033. The mining sector shows robust potential with a current market of $2.93 billion expected to grow steadily as global mining activities expand. Construction accounts for a smaller segment but shows promise, suggesting future growth linked to infrastructure projects.

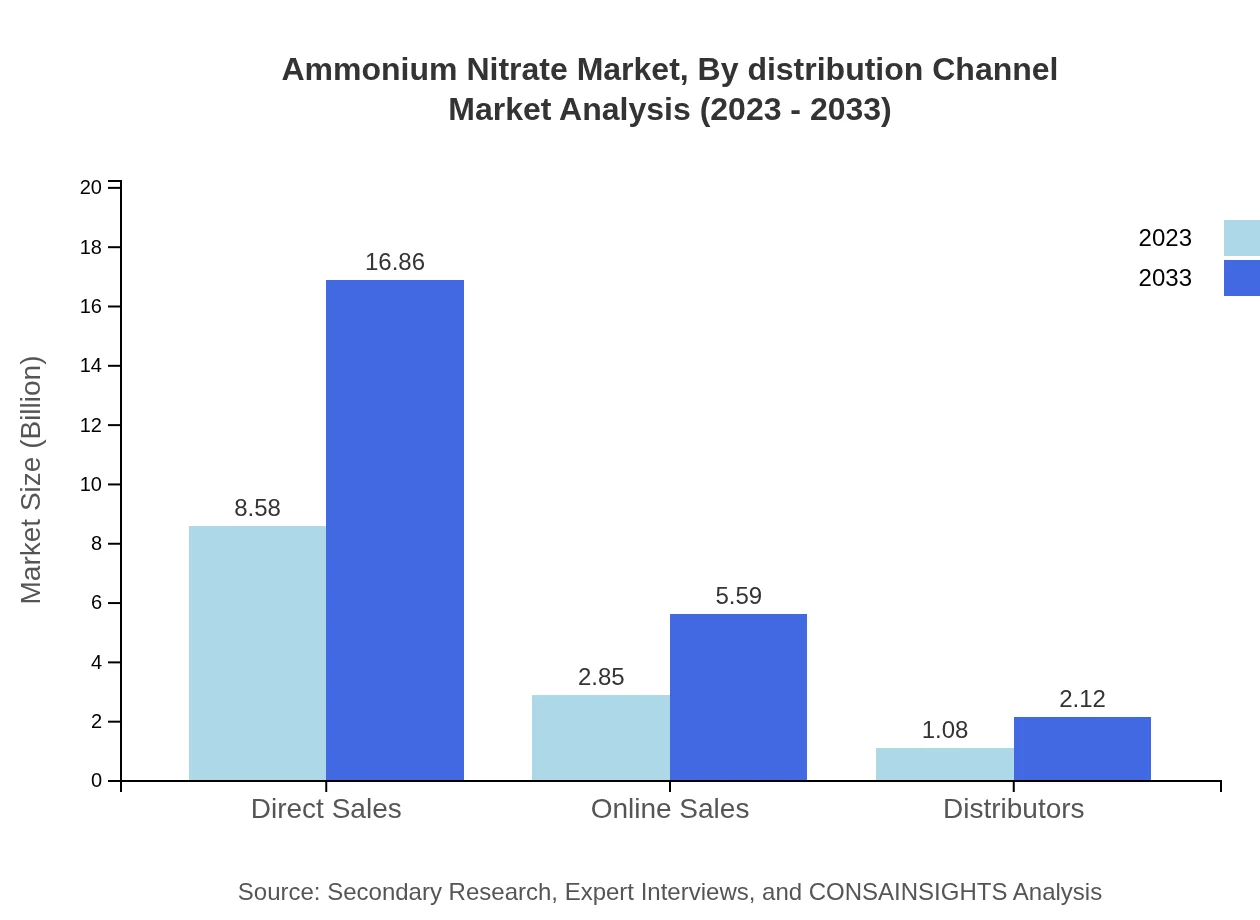

Ammonium Nitrate Market Analysis By Distribution Channel

The ammonium nitrate market can be segmented by distribution channels into Direct Sales, Online Sales, and Distributors. Direct Sales remains the largest channel, achieving $8.58 billion in 2023 and expected to double by 2033. Online Sales, while currently smaller at $2.85 billion, demonstrate rapid growth potential driven by the increasing digitization of supply chains. Distributors also play a role, currently standing at $1.08 billion but may face challenges from direct and online sales channels.

Ammonium Nitrate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ammonium Nitrate Industry

Yara International:

A leading global fertilizer company, Yara specializes in the production of nitrogen-based fertilizers. Their innovations in sustainable fertilizer solutions are making significant contributions to the ammonium nitrate market.Nutrien Ltd.:

As one of the largest agricultural solutions providers globally, Nutrien's diverse portfolio includes ammonium nitrate. Their strategic positioning and distribution capabilities enhance market reach and customer service.CF Industries:

CF Industries is a key player in the nitrogen fertilizer industry, with a strong focus on ammonia and ammonium nitrate production. Their advanced technological processes allow for high-quality product offerings.Orica:

Orica is a global leader in mining services and is a vital supplier of ammonium nitrate for mining applications. Their innovations in explosives technology positively impact market dynamics.Acron Group:

Acron Group is a prominent manufacturer of nitrogen fertilizers, providing ammonium nitrate to various markets. Their commitment to sustainability aligns with global trends in the fertilizers segment.We're grateful to work with incredible clients.

FAQs

What is the market size of ammonium Nitrate?

The global ammonium nitrate market is valued at approximately $12.5 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033. This growth indicates a robust demand in agricultural and industrial applications.

What are the key market players or companies in the ammonium Nitrate industry?

Key players in the ammonium nitrate market include major companies such as Nutrien Ltd, CF Industries Holdings, and Yara International. These companies lead due to their extensive product offerings and global distribution networks.

What are the primary factors driving the growth in the ammonium nitrate industry?

The ammonium nitrate industry is primarily driven by increased agricultural activities and the rising demand for fertilizers. Additionally, the mining and construction sectors are expanding, further fueling the market growth.

Which region is the fastest Growing in the ammonium nitrate market?

The fastest-growing region in the ammonium nitrate market is Europe, with the market projected to grow from $4.00 billion in 2023 to $7.86 billion by 2033, showcasing a significant increase in agricultural investments.

Does ConsaInsights provide customized market report data for the ammonium nitrate industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the ammonium nitrate industry, enabling detailed insights and analysis based on particular interests or regional focuses.

What deliverables can I expect from this ammonium nitrate market research project?

In this ammonium nitrate market research project, you can expect comprehensive reports including market size, segmentation analysis, growth projections, competitive landscape, and regional market insights.

What are the market trends of ammonium nitrate?

Current trends in the ammonium nitrate market include a shift towards more sustainable agricultural practices, increasing use in explosives for mining, and rising e-commerce for fertilizer sales, ensuring broader market outreach and accessibility.