Ammonium Phosphate Market Report

Published Date: 31 January 2026 | Report Code: ammonium-phosphate

Ammonium Phosphate Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report covers the global Ammonium Phosphate industry from 2023 to 2033, providing detailed insights into market size, growth trends, regional analysis, and competitive landscape, along with technological advancements and product performance evaluations.

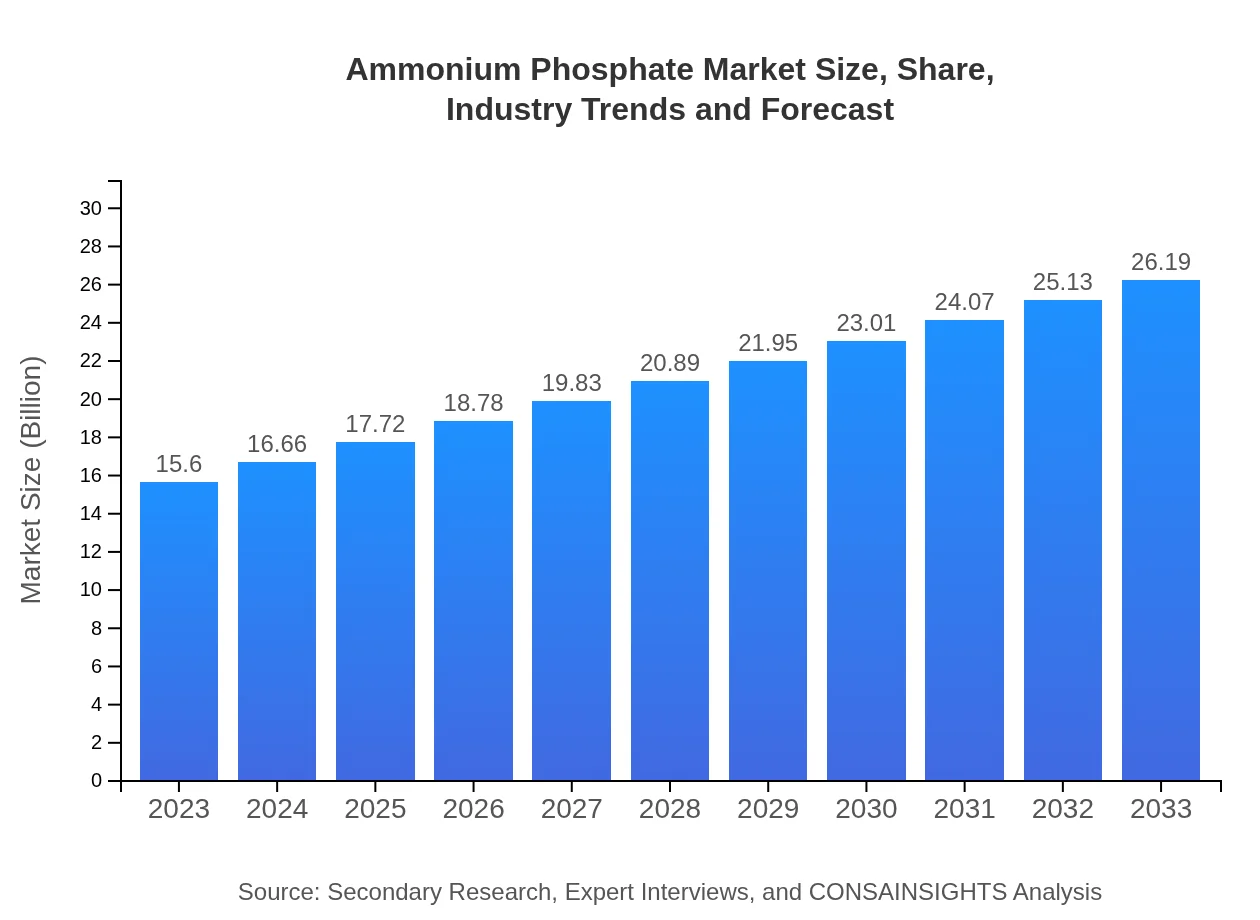

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | Nutrien Ltd., The Mosaic Company, Yara International, OCI Nitrogen |

| Last Modified Date | 31 January 2026 |

Ammonium Phosphate Market Overview

Customize Ammonium Phosphate Market Report market research report

- ✔ Get in-depth analysis of Ammonium Phosphate market size, growth, and forecasts.

- ✔ Understand Ammonium Phosphate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ammonium Phosphate

What is the Market Size & CAGR of Ammonium Phosphate market in 2023?

Ammonium Phosphate Industry Analysis

Ammonium Phosphate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ammonium Phosphate Market Analysis Report by Region

Europe Ammonium Phosphate Market Report:

The European market for Ammonium Phosphate will grow from USD 3.83 billion in 2023 to USD 6.44 billion by 2033. European countries are pushing for stringent regulations on fertilizers, transforming the market landscape towards ecological fertilizers and innovative application methods.Asia Pacific Ammonium Phosphate Market Report:

In the Asia Pacific region, the Ammonium Phosphate market size is projected to grow from USD 3.42 billion in 2023 to USD 5.75 billion by 2033, driven by increasing agricultural activities and a focus on improving crop yields through effective fertility solutions. Countries like China and India are undergoing agricultural modernization, significantly impacting demand dynamics.North America Ammonium Phosphate Market Report:

In North America, the market is expected to rise from USD 5.40 billion in 2023 to USD 9.07 billion by 2033. The U.S. remains a key player due to advanced technological adoption in agriculture and a strong focus on sustainable farming practices, which are boosting the consumption of both MAP and DAP.South America Ammonium Phosphate Market Report:

The South American Ammonium Phosphate market is anticipated to expand from USD 0.79 billion in 2023 to USD 1.33 billion by 2033, spurred by the demand for enhanced fertilizer solutions to improve production in the agriculture-dominant economies like Brazil and Argentina.Middle East & Africa Ammonium Phosphate Market Report:

In the Middle East and Africa, the market will increase from USD 2.15 billion in 2023 to USD 3.61 billion by 2033. This growth is attributed to a heightened focus on food security and the development of agricultural sectors in various countries, promoting the usage of Ammonium Phosphate.Tell us your focus area and get a customized research report.

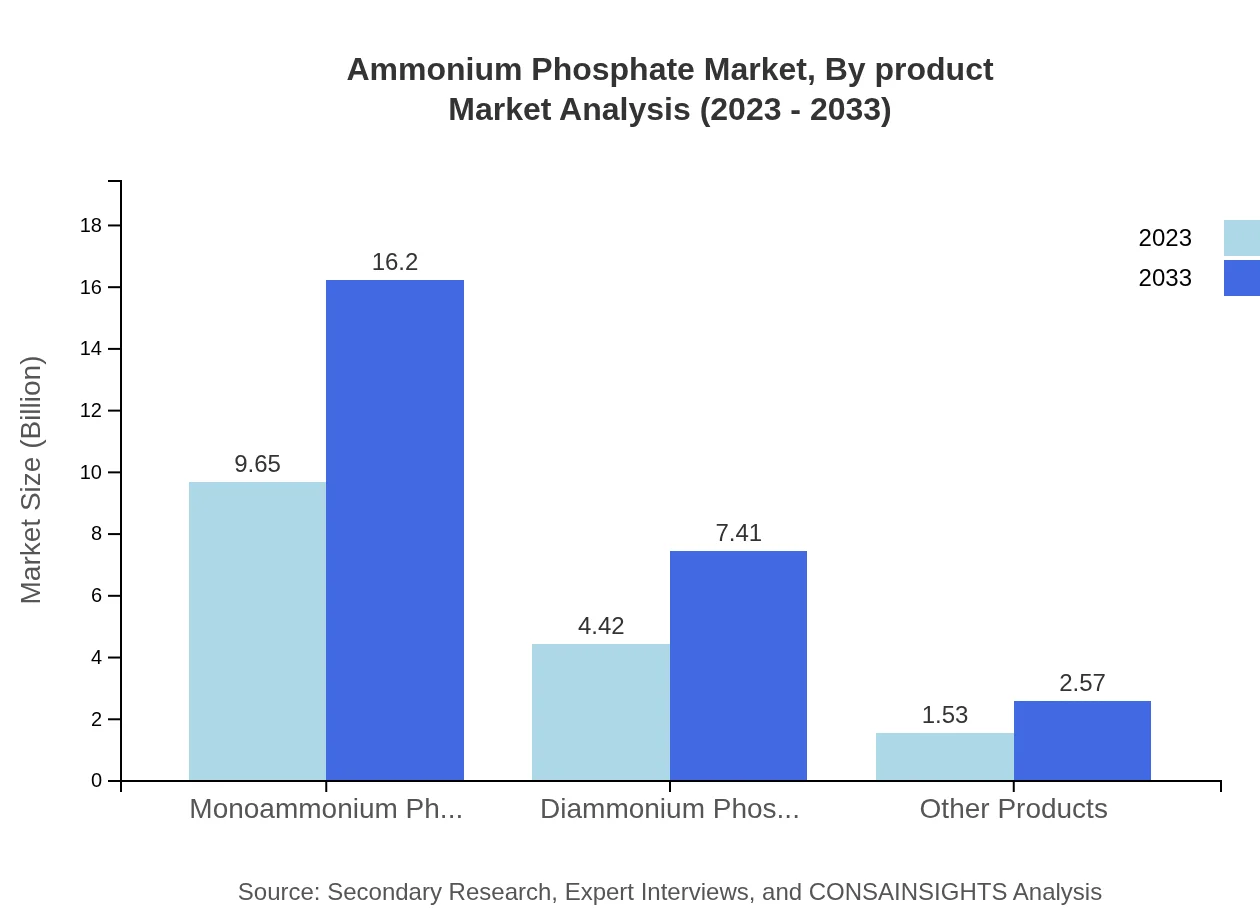

Ammonium Phosphate Market Analysis By Product

The product segment of Ammonium Phosphate is primarily divided into Monoammonium Phosphate (MAP) and Diammonium Phosphate (DAP). In 2023, MAP accounts for USD 9.65 billion and is projected to reach USD 16.20 billion by 2033, maintaining a market share of 61.86%. On the other hand, DAP generates USD 4.42 billion in 2023 and is expected to grow to USD 7.41 billion, with a 28.31% share. Other products in this category earn USD 1.53 billion currently, with a forecasted increase to USD 2.57 billion.

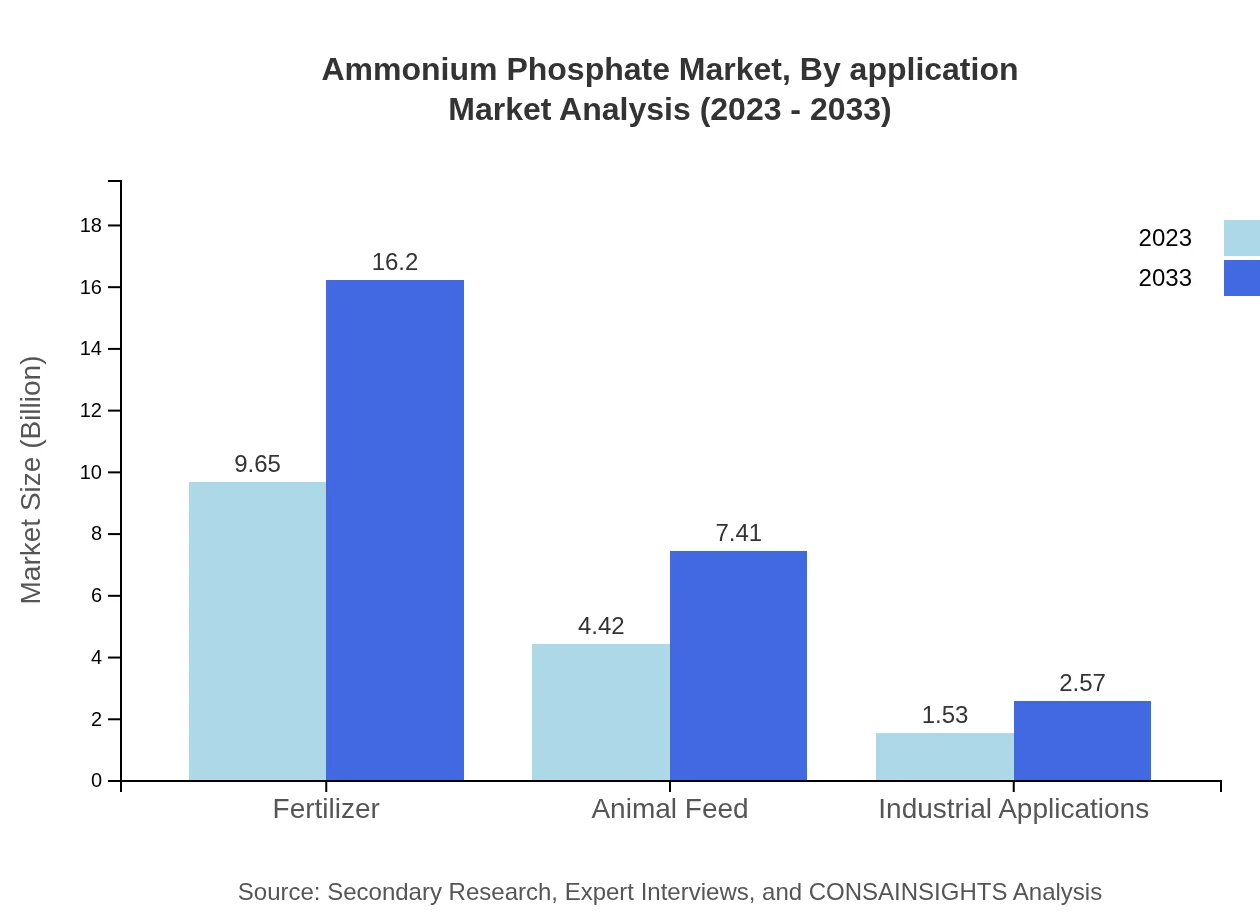

Ammonium Phosphate Market Analysis By Application

The application of Ammonium Phosphate encompasses various segments such as agriculture, livestock, and industrial applications. In agriculture, it leads the market with USD 9.65 billion in 2023 and is anticipated to maintain its dominance by targeting USD 16.20 billion. Livestock application segments will grow from USD 4.42 billion to USD 7.41 billion, while industrial applications will rise from USD 1.53 billion to USD 2.57 billion, showing steady demand.

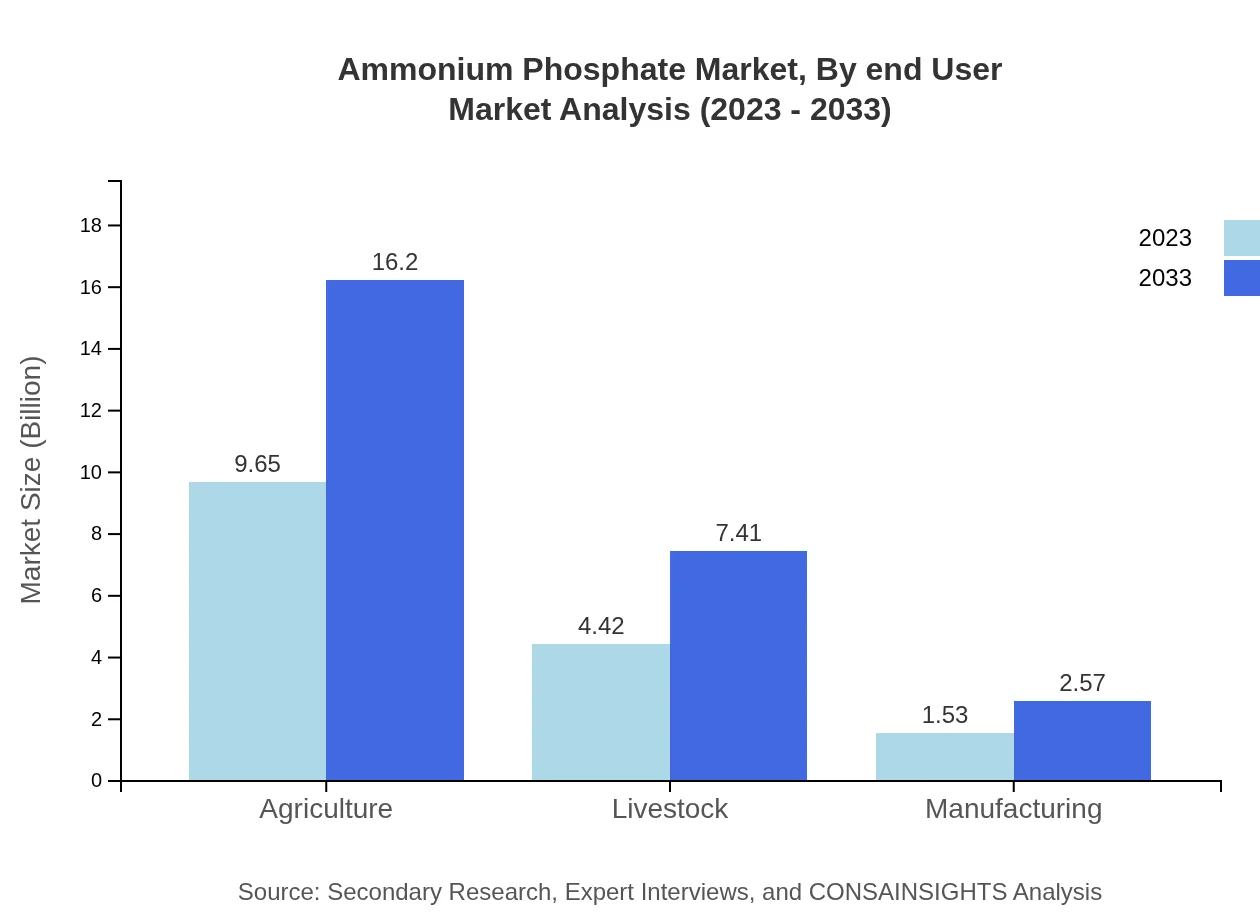

Ammonium Phosphate Market Analysis By End User

Analyzing the end-user sectors, agriculture remains the largest consumer segment of Ammonium Phosphate with a size of USD 9.65 billion currently, growing to USD 16.20 billion by 2033. Livestock feed and animal nutrition account for USD 4.42 billion and are expected to reach USD 7.41 billion, showcasing robust growth driven by the demands for quality feed. Meanwhile, industrial applications will contribute USD 1.53 billion moving to USD 2.57 billion.

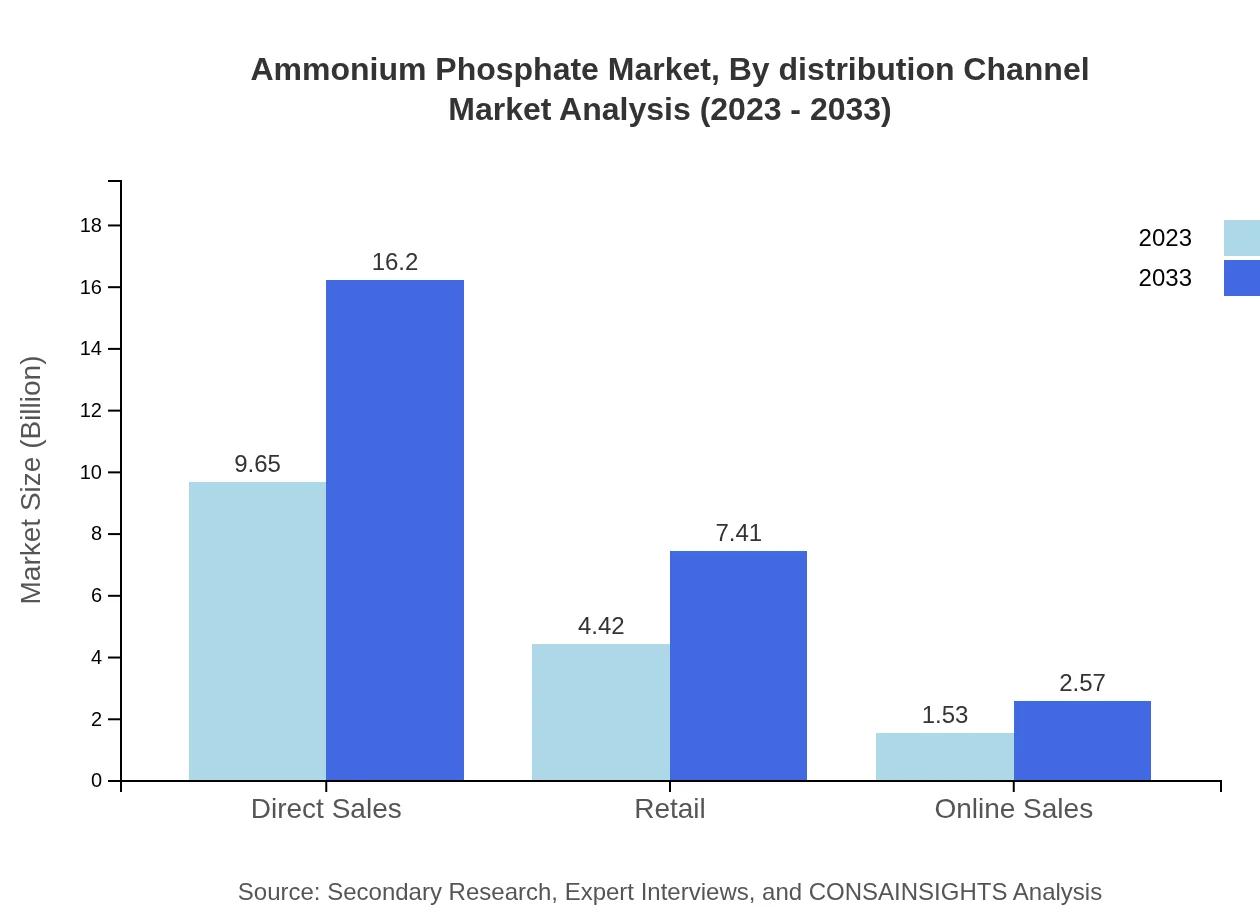

Ammonium Phosphate Market Analysis By Distribution Channel

Distribution channels for Ammonium Phosphate sales include direct sales, retail, and online sales. Direct sales dominate with USD 9.65 billion in 2023 and a forecasted increase to USD 16.20 billion, while retail channels will grow from USD 4.42 billion to USD 7.41 billion. Online sales, although a smaller segment currently at USD 1.53 billion, are showing promising growth trends aligning with e-commerce expansion.

Ammonium Phosphate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ammonium Phosphate Industry

Nutrien Ltd.:

Nutrien is one of the largest providers of crop inputs and services globally, significantly contributing to the Ammonium Phosphate market through innovative solutions and sustainable practices in agriculture.The Mosaic Company:

Mosaic is a leading producer of concentrated phosphate and potash crop nutrition products, including Ammonium Phosphate, enhancing agricultural productivity through efficiency and technology.Yara International:

Yara is a global leader in crop nutrition and a key supplier of Ammonium Phosphate, focusing on sustainable agricultural practices and innovative product development.OCI Nitrogen:

OCI Nitrogen specializes in the production of fertilizers including Ammonium Phosphate and is known for its commitment to sustainable production techniques.We're grateful to work with incredible clients.

FAQs

What is the market size of ammonium Phosphate?

The ammonium-phosphate market is valued at approximately $15.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.2%, expected to rise significantly over the next decade.

What are the key market players or companies in the ammonium Phosphate industry?

Key players in the ammonium-phosphate market include major fertilizer manufacturers and agricultural companies that focus on nitrogen and phosphate fertilizers, contributing to both regional and global markets significantly.

What are the primary factors driving the growth in the ammonium Phosphate industry?

The growth of the ammonium-phosphate market is driven by rising agricultural demand, advancements in fertilizer technology, and increasing global food production requirements, alongside sustainable farming practices.

Which region is the fastest Growing in the ammonium Phosphate?

The North America region is projected to be the fastest-growing for ammonium-phosphate, increasing from $5.40 billion in 2023 to $9.07 billion by 2033, driven by strong agricultural demand.

Does ConsaInsights provide customized market report data for the ammonium Phosphate industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the ammonium-phosphate industry, helping clients gather insights relevant to their strategic decisions.

What deliverables can I expect from this ammonium Phosphate market research project?

Deliverables from the ammonium-phosphate market research project typically include comprehensive reports detailing market analysis, trends, forecasts, and competitive landscape assessments relevant to your interests.

What are the market trends of ammonium Phosphate?

Market trends for ammonium-phosphate include an increasing shift towards sustainable fertilizers, the expansion of precision agriculture, and the growing use of ammonium-phosphate in various agricultural applications, all aimed at enhancing productivity.