Ammunition Handling System Market Report

Published Date: 03 February 2026 | Report Code: ammunition-handling-system

Ammunition Handling System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ammunition Handling System market, highlighting current trends, market size, growth forecasts, and key players from 2023 to 2033.

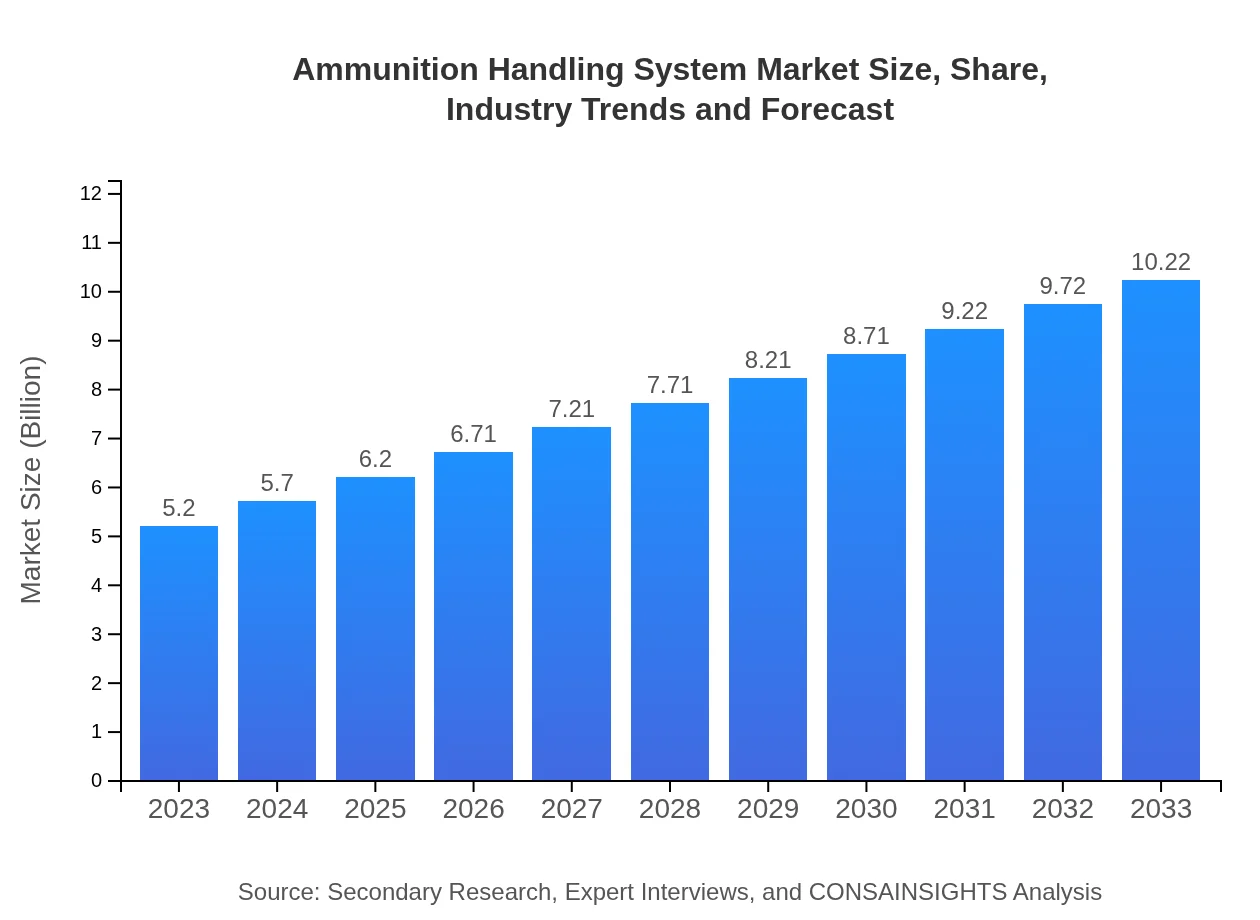

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | General Dynamics, BAE Systems, Northrop Grumman, Thales Group |

| Last Modified Date | 03 February 2026 |

Ammunition Handling System Market Overview

Customize Ammunition Handling System Market Report market research report

- ✔ Get in-depth analysis of Ammunition Handling System market size, growth, and forecasts.

- ✔ Understand Ammunition Handling System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ammunition Handling System

What is the Market Size & CAGR of Ammunition Handling System market in 2023?

Ammunition Handling System Industry Analysis

Ammunition Handling System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ammunition Handling System Market Analysis Report by Region

Europe Ammunition Handling System Market Report:

Europe's ammunition handling system market is forecasted to expand from USD 1.64 billion in 2023 to USD 3.23 billion by 2033. With ongoing geopolitical uncertainties, nations are intensifying defense preparedness, contributing significantly to market expansion.Asia Pacific Ammunition Handling System Market Report:

The Asia-Pacific region is expected to witness significant growth, with the market size projected to increase from USD 1.03 billion in 2023 to USD 2.02 billion by 2033. The region's growth is driven by rising military budgets in countries like India, China, and Japan, and the increasing complexity of defense operations necessitating advanced ammunition handling solutions.North America Ammunition Handling System Market Report:

The North American market, with a size of USD 1.72 billion in 2023, is projected to reach USD 3.37 billion by 2033. This growth is fueled by the U.S. Department of Defense's investments in advanced defense technologies and heightened military readiness amid global security challenges.South America Ammunition Handling System Market Report:

In South America, the ammunition handling system market is anticipated to grow from USD 0.24 billion in 2023 to USD 0.47 billion by 2033. This growth is primarily driven by government focus on internal security and modernization of defense forces, enhancing the need for efficient ammunition supply and management.Middle East & Africa Ammunition Handling System Market Report:

The Middle East and Africa region will experience growth from USD 0.58 billion in 2023 to USD 1.13 billion by 2033. Increased military spending and demand for improved ammunition management among defense forces in this region are key growth drivers.Tell us your focus area and get a customized research report.

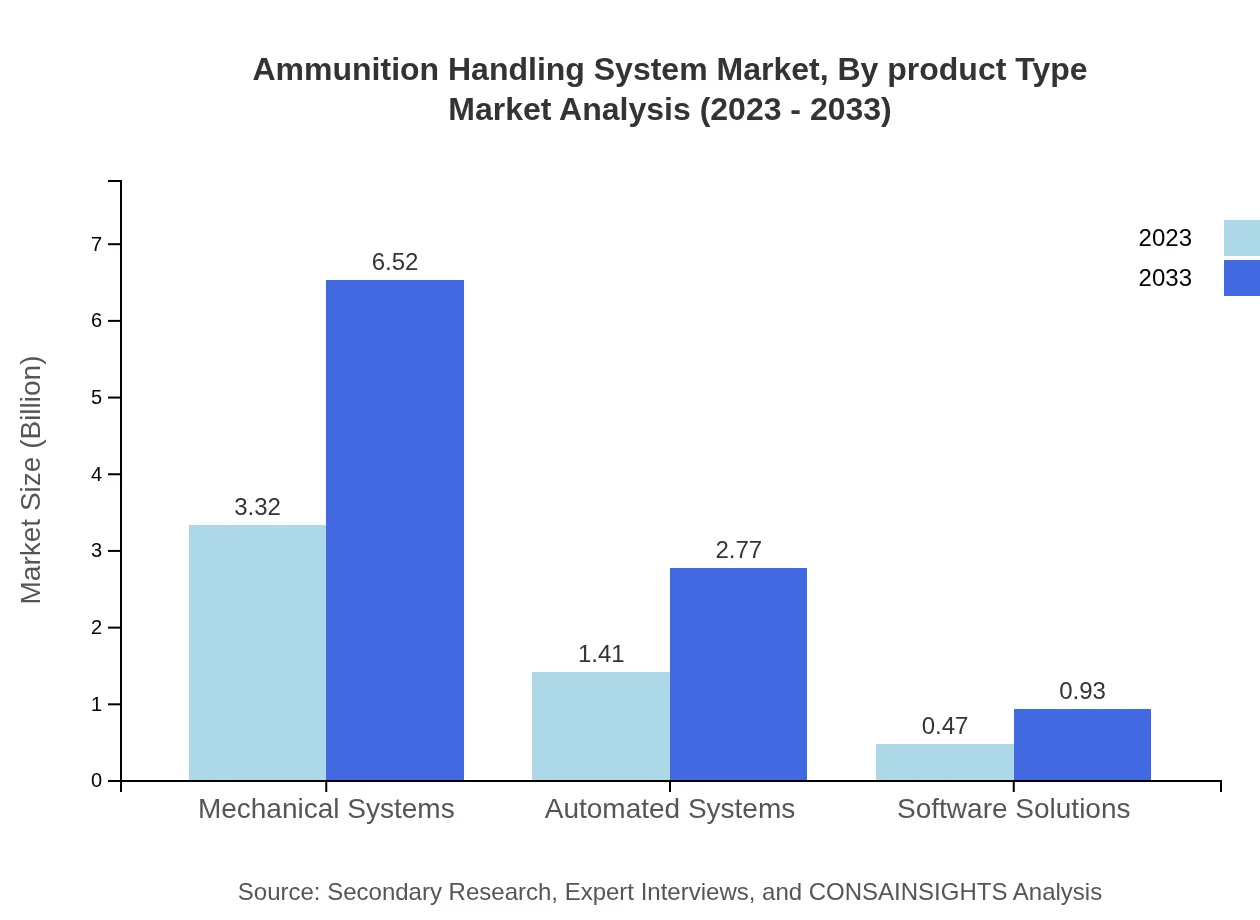

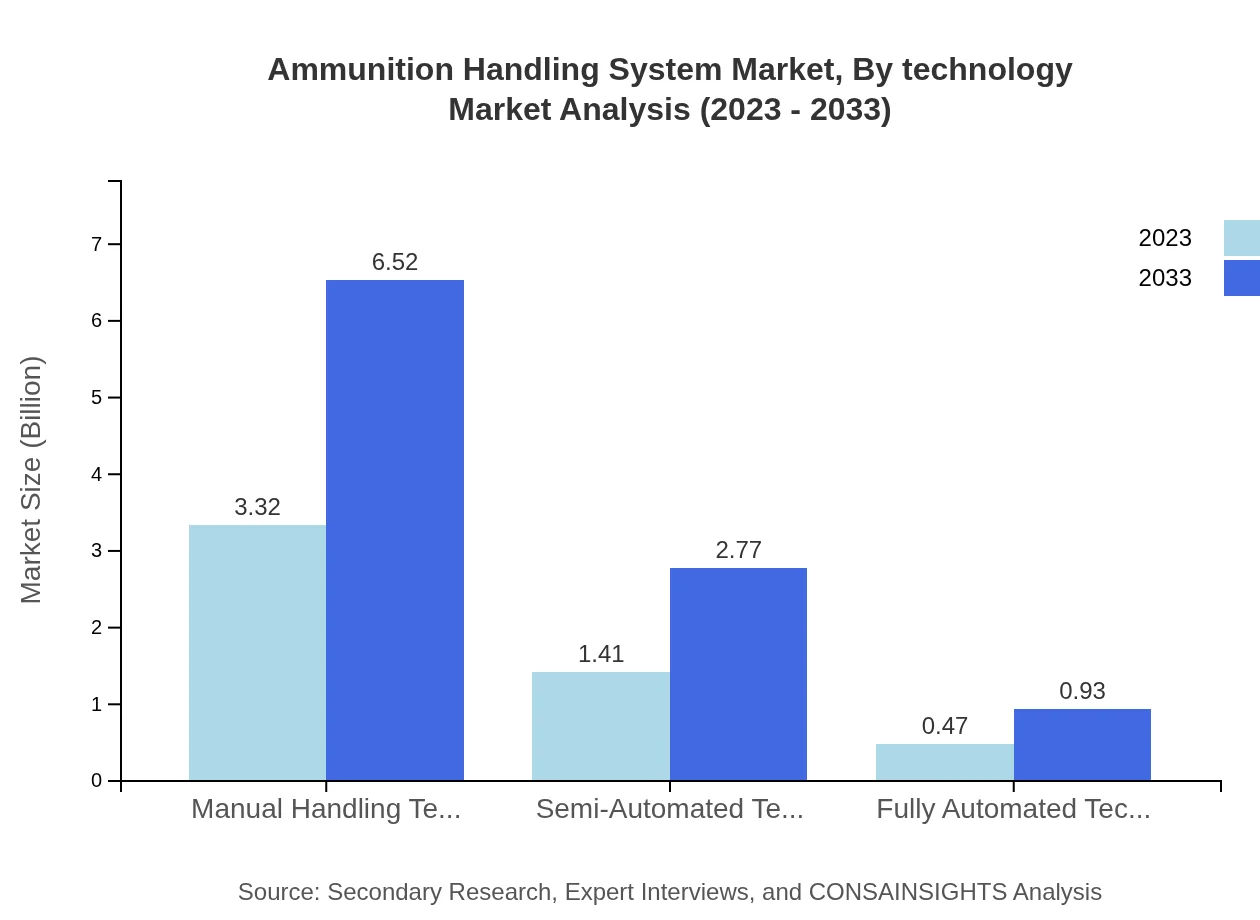

Ammunition Handling System Market Analysis By Product Type

The market is predominantly driven by manual handling technologies, which account for a market size of USD 3.32 billion in 2023, projected to grow to USD 6.52 billion by 2033. Semi-automated technologies, with a share of 27.11%, are also rapidly gaining traction, expanding from USD 1.41 billion in 2023 to USD 2.77 billion in 2033. Fully automated systems, although smaller in market share, are projected to double in size, highlighting a significant trend towards automation.

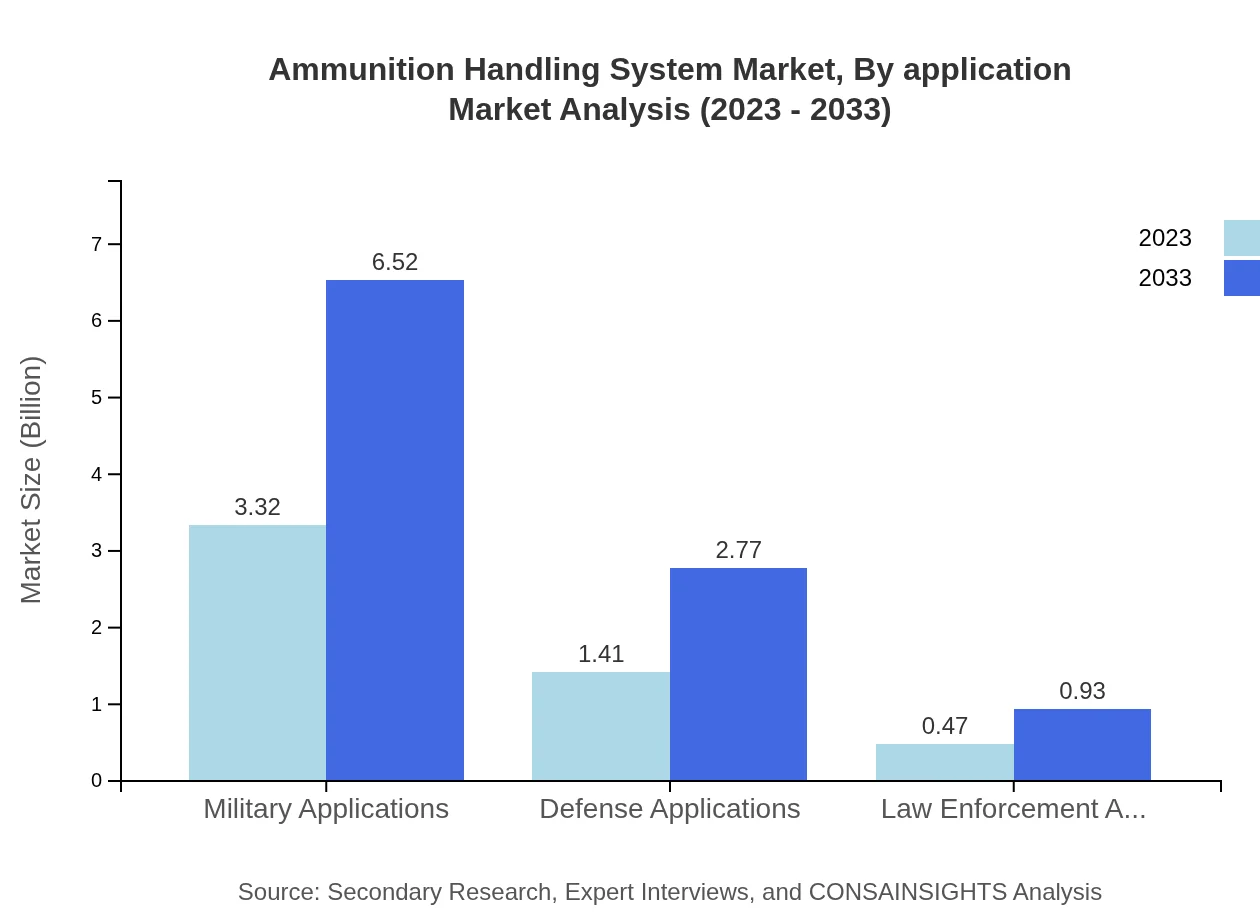

Ammunition Handling System Market Analysis By Application

In terms of application, the military sector dominates, representing 63.81% of the market share. The market size for military applications is expected to grow from USD 3.32 billion in 2023 to USD 6.52 billion by 2033. Defense contractors hold a significant share of 27.11%, while commercial applications account for 9.08%, illustrating the overall trend of increasing militarization and consequent demand for advanced ammunition handling systems.

Ammunition Handling System Market Analysis By Technology

The market's technological landscape includes mechanical systems, which dominate with a 63.81% share, valued at USD 3.32 billion in 2023, and expected to grow to USD 6.52 billion by 2033. Automated systems, holding 27.11% of the market, show significant growth potential, whereas software solutions play a niche role with a 9.08% share, reflecting the increasing integration of software technologies in ammunition handling.

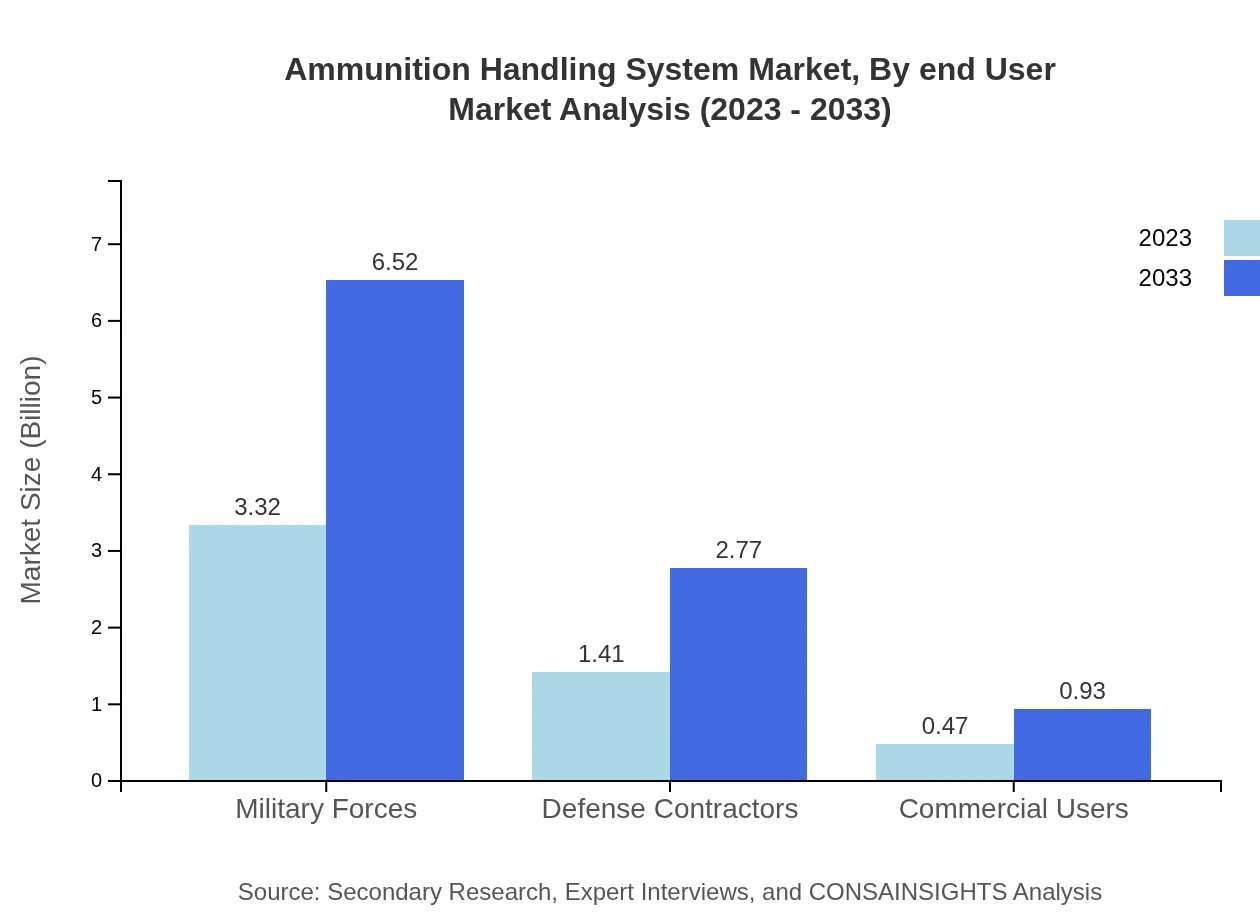

Ammunition Handling System Market Analysis By End User

The end-user segmentation is heavily represented by military forces, accounting for 63.81% of the market share, with sizes growing from USD 3.32 billion in 2023 to USD 6.52 billion by 2033. Defense applications follow at 27.11%, while law enforcement applications comprise 9.08%. This distribution highlights the primary focus of ammunition handling systems in military effectiveness and security operations.

Ammunition Handling System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ammunition Handling System Industry

General Dynamics:

A leading defense contractor, General Dynamics provides advanced ammunition handling solutions that enhance military operations worldwide.BAE Systems:

BAE Systems specializes in various defense sectors, including ammunition handling systems, focusing on innovative technology integration.Northrop Grumman:

Northrop Grumman develops advanced ammunition handling solutions tailored for modern military applications, emphasizing automation and efficiency.Thales Group:

Thales Group is known for its high-tech systems in defense, offering leading-edge ammunition handling technologies that improve operational readiness.We're grateful to work with incredible clients.

FAQs

What is the market size of ammunition handling system?

The global ammunition handling system market is currently valued at approximately $5.2 billion, with an expected compound annual growth rate (CAGR) of 6.8% from 2023 to 2033. This growth is driven by rising defense expenditures and advancements in technology.

What are the key market players or companies in this ammunition handling system industry?

Key players in the ammunition handling system industry include General Dynamics, BAE Systems, Northrop Grumman, and AeroVironment, along with various regional manufacturers and defense contractors, each contributing to innovative solutions and system enhancements.

What are the primary factors driving the growth in the ammunition handling system industry?

Growth in the ammunition handling system industry is driven by increasing military budgets, a rising focus on modern warfare technologies, and an emphasis on enhancing operational efficiency and safety in military logistics.

Which region is the fastest Growing in the ammunition handling system?

The fastest-growing region for the ammunition handling system market is the Asia Pacific, projected to grow from $1.03 billion in 2023 to $2.02 billion by 2033, driven by heightened defense activities and regional conflicts.

Does ConsaInsights provide customized market report data for the ammunition handling system industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, covering unique aspects of the ammunition handling system industry and providing insights for strategic decision-making.

What deliverables can I expect from this ammunition handling system market research project?

You can expect comprehensive market analysis reports, segmented data by region and market share, growth forecasts, key player profiles, and insights into upcoming trends in the ammunition handling system market.

What are the market trends of ammunition handling system?

Current trends in the ammunition handling system market include a shift towards automation, increased integration of software solutions, and a growing emphasis on multi-functional systems to enhance operational capabilities.