Ammunition Market Report

Published Date: 03 February 2026 | Report Code: ammunition

Ammunition Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the ammunition market from 2023 to 2033, covering market size, growth trends, regional insights, and technological advancements, alongside competitive dynamics and future forecasts.

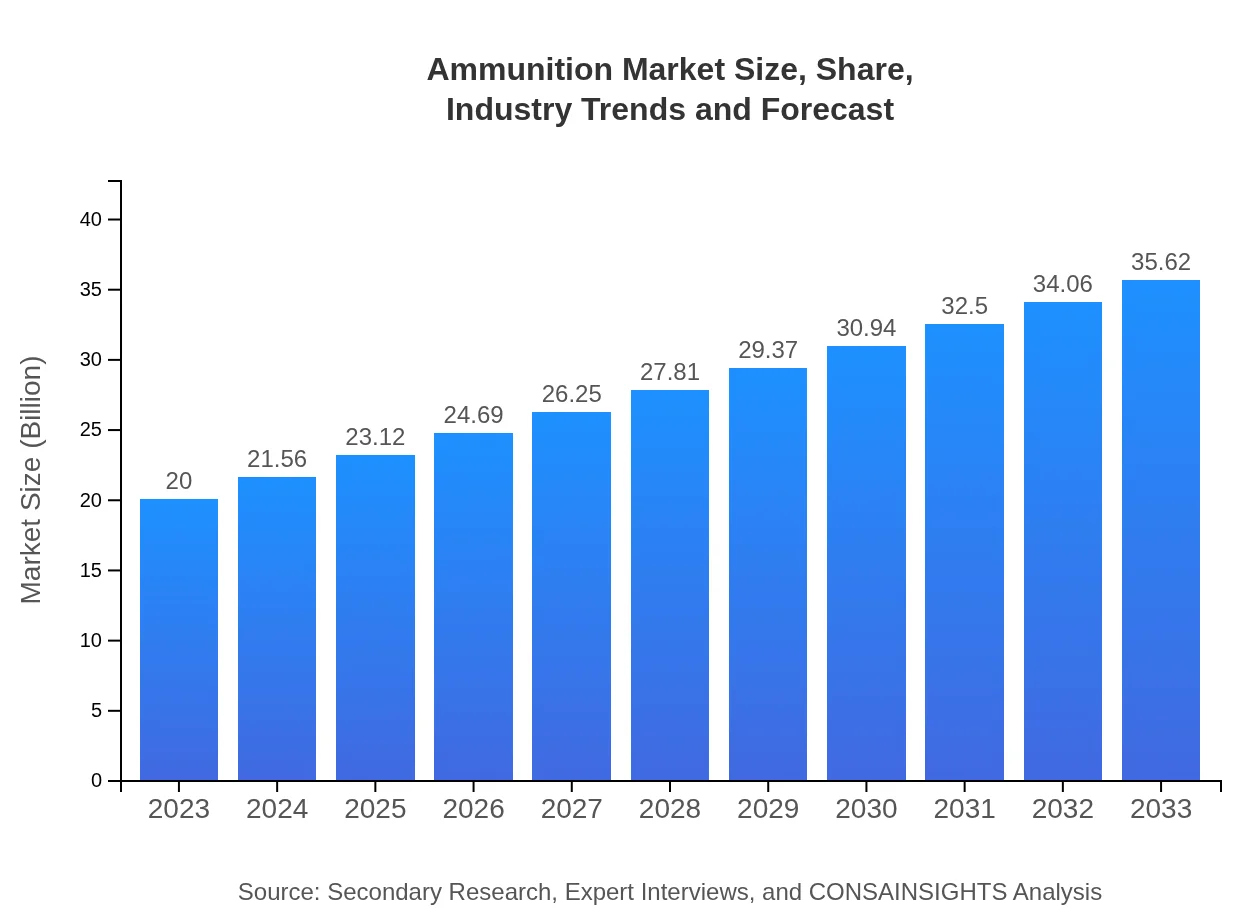

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $35.62 Billion |

| Top Companies | General Dynamics Ordnance and Tactical Systems, BAE Systems, Northrop Grumman, Rheinmetall AG, Olin Corporation |

| Last Modified Date | 03 February 2026 |

Ammunition Market Overview

Customize Ammunition Market Report market research report

- ✔ Get in-depth analysis of Ammunition market size, growth, and forecasts.

- ✔ Understand Ammunition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ammunition

What is the Market Size & CAGR of Ammunition market in 2023?

Ammunition Industry Analysis

Ammunition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ammunition Market Analysis Report by Region

Europe Ammunition Market Report:

Europe's ammunition market, currently at $6.00 billion in 2023, is projected to expand to $10.69 billion by 2033. Factors driving growth include increasing defense budgets in response to regional security challenges and higher investments in military technologies.Asia Pacific Ammunition Market Report:

The Asia Pacific region, valued at $3.77 billion in 2023, is expected to grow to $6.71 billion by 2033, propelled by significant military modernization efforts and defense procurement activities of nations like China and India. Rising geopolitical tensions in the South China Sea further contribute to this growth.North America Ammunition Market Report:

North America dominates the market with a valuation of $7.32 billion in 2023, anticipated to grow to $13.04 billion by 2033. The United States and Canada are heavily investing in defense modernization, contributing to robust military spending and subsequently generating higher demand for ammunition.South America Ammunition Market Report:

South America shows a market size of $1.90 billion in 2023, projected to reach $3.38 billion by 2033, supported by increasing investments in internal security and law enforcement. Brazil and Colombia are likely to lead the regional growth through augmentation of law enforcement capabilities.Middle East & Africa Ammunition Market Report:

This region's market size of $1.02 billion in 2023 is expected to increase to $1.81 billion by 2033. Defense spending remains elevated due to ongoing conflicts and political instability, particularly in the Middle East, driving demand for various ammunition types.Tell us your focus area and get a customized research report.

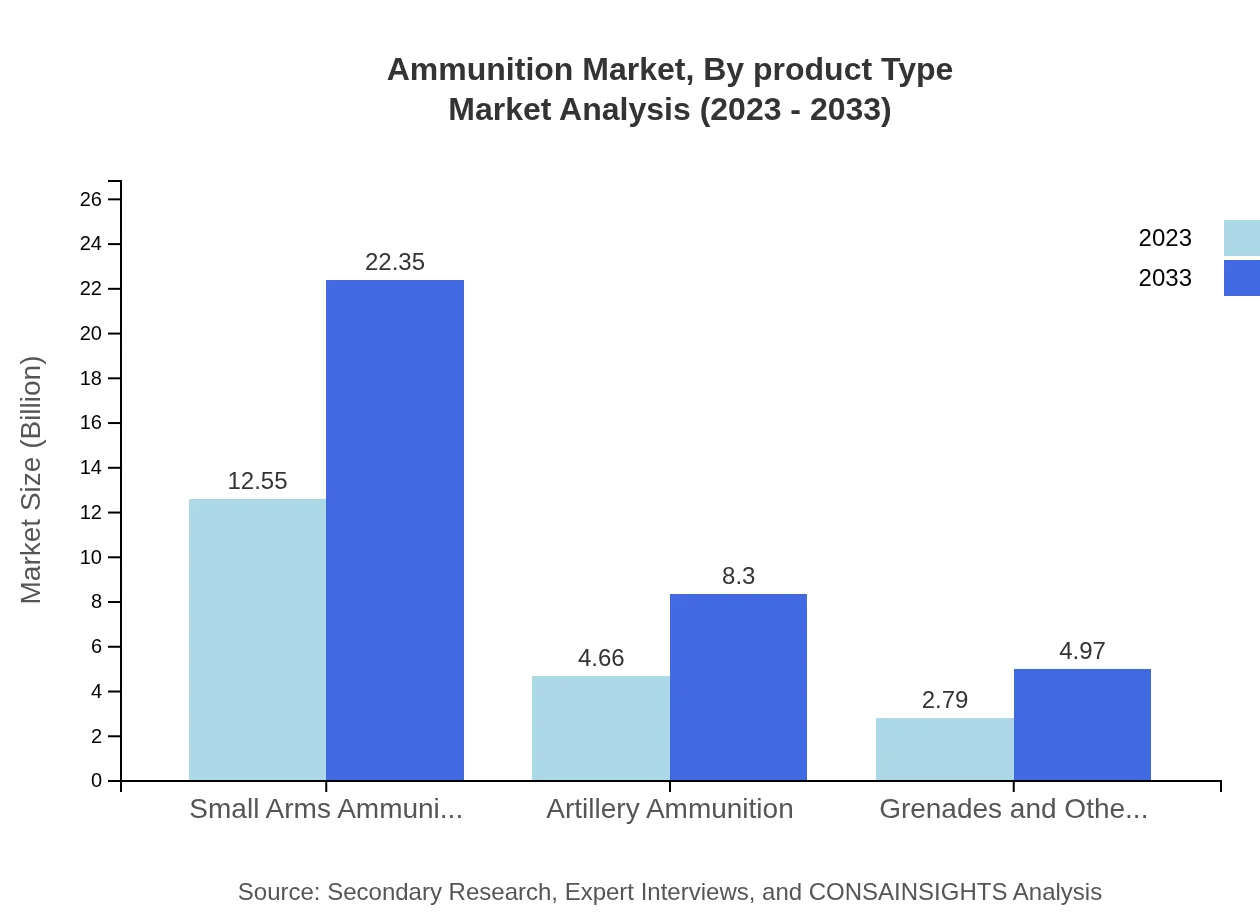

Ammunition Market Analysis By Product Type

Looking at product type, Small Arms Ammunition leads the market, projected from $12.55 billion in 2023 to $22.35 billion by 2033, driven by military and civilian demands. Artillery Ammunition is estimated to grow from $4.66 billion to $8.30 billion in the same timeframe, following increased usage in military operations, while Grenades and Other Ammunition will rise from $2.79 billion to $4.97 billion, highlighting their niche yet growing demand.

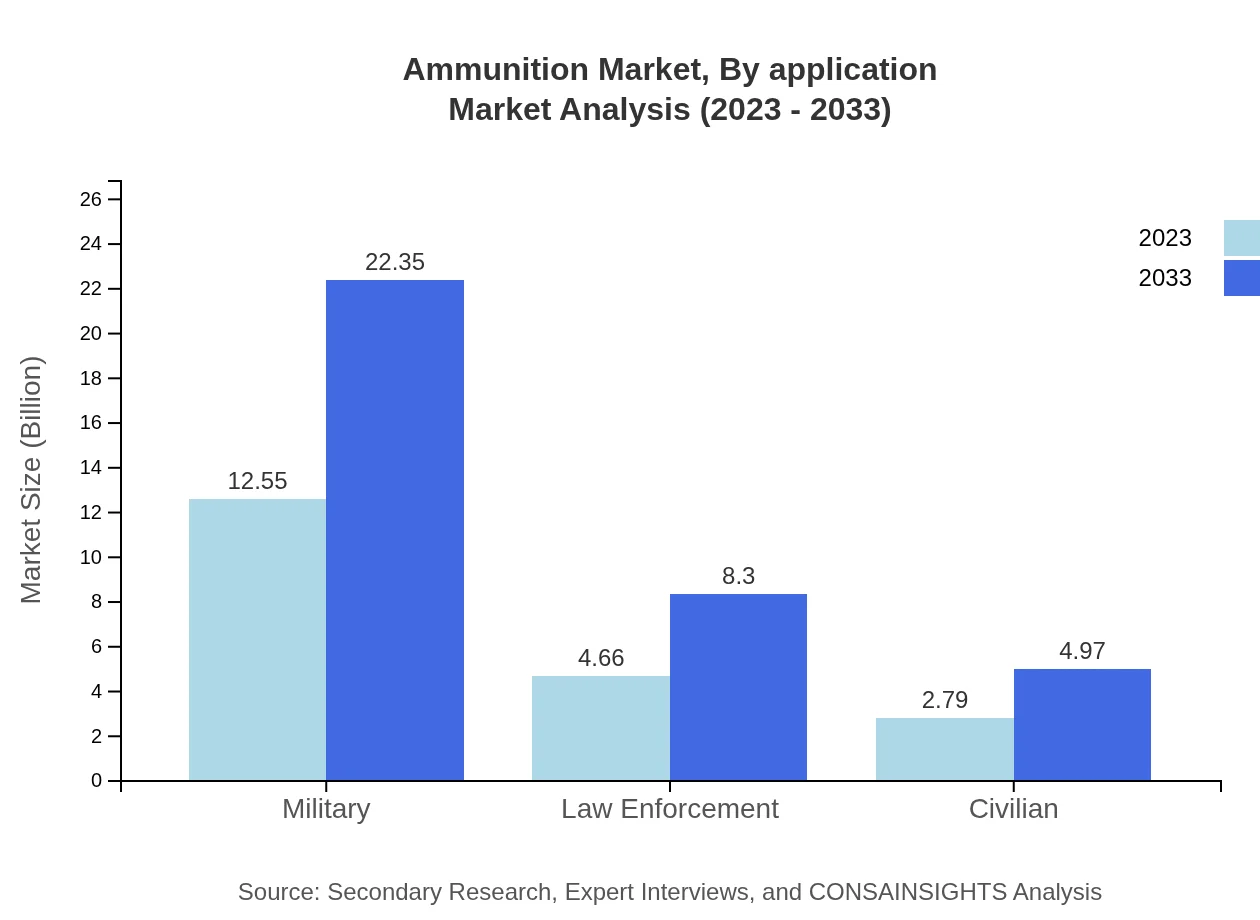

Ammunition Market Analysis By Application

In terms of application, the Military segment is the strongest, holding a size of $12.55 billion in 2023, moving to $22.35 billion by 2033. Law Enforcement also represents a significant sector with growth projected from $4.66 billion to $8.30 billion, driven by urban security initiatives. The Civilian market, while smaller, is expected to grow from $2.79 billion to $4.97 billion as recreational shooting gains popularity.

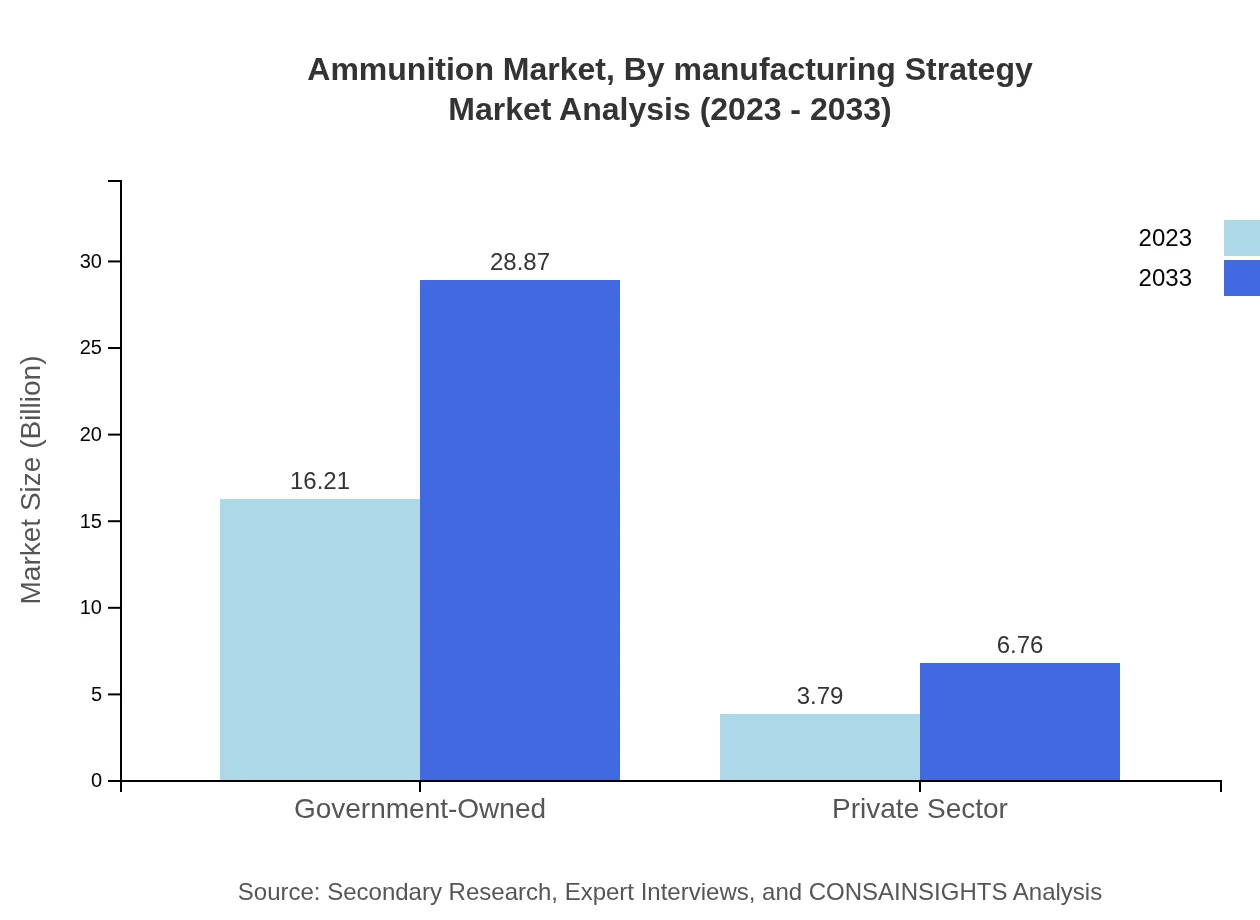

Ammunition Market Analysis By Manufacturing Strategy

Manufacturers are increasingly adopting strategies that focus on sustainable practices, adopting advanced technologies to enhance production efficiency, and developing customized ammunition solutions to meet specific defense and civilian needs. Recent moves towards automation and lean manufacturing processes are essential for maintaining competitive advantages.

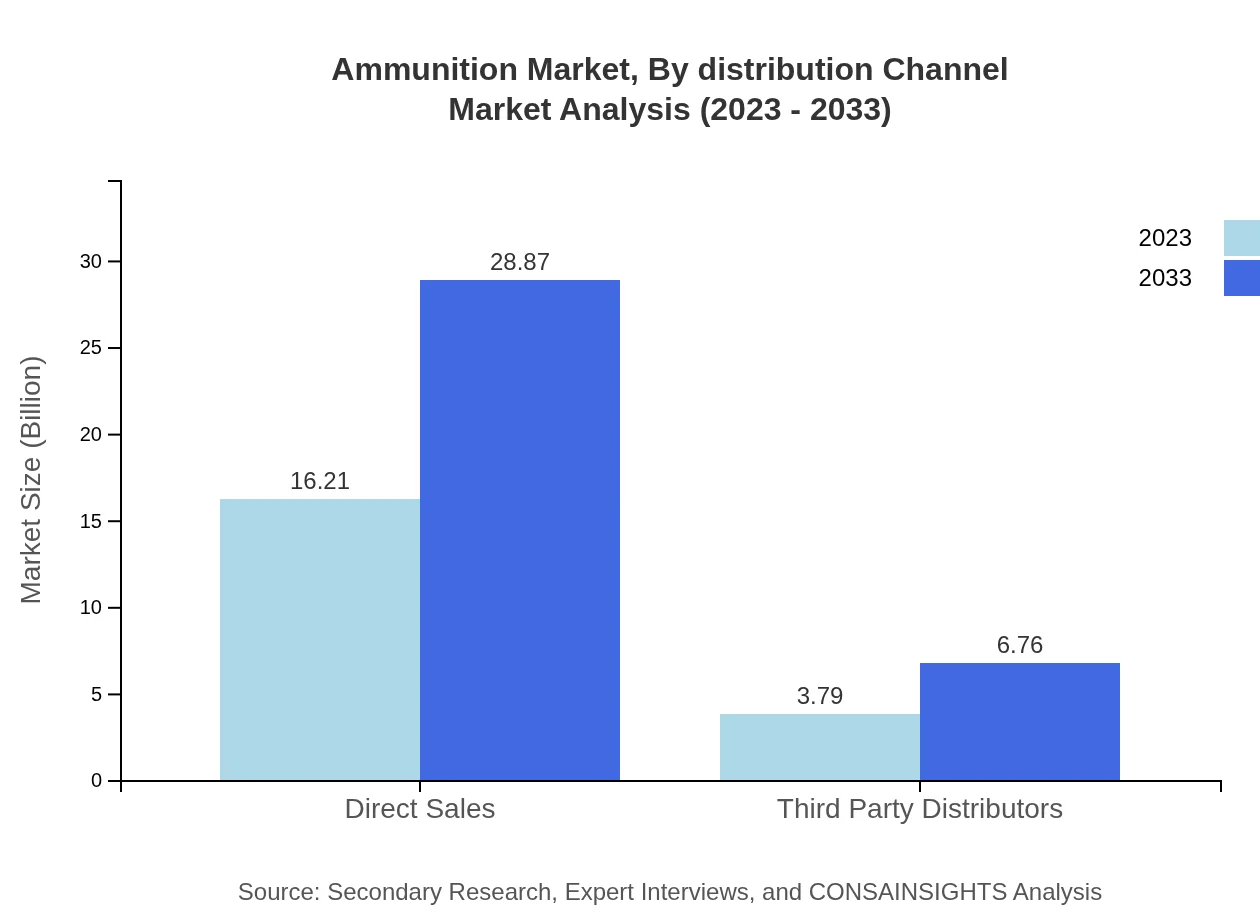

Ammunition Market Analysis By Distribution Channel

The distribution channels for ammunition include Direct Sales and Third-Party Distributors. Direct Sales dominate with a market size of $16.21 billion in 2023, expanding to $28.87 billion by 2033, reflecting the direct engagement strategies companies employ. Third-Party Distributors will follow, growing from $3.79 billion to $6.76 billion, as they offer expansive reach in civilian markets.

Ammunition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ammunition Industry

General Dynamics Ordnance and Tactical Systems:

A leading player in the ammunition sector, known for its advanced munitions solutions for military applications.BAE Systems:

Engaged in the design and manufacture of ammunition, BAE Systems adapts cutting-edge technologies for enhanced product offerings.Northrop Grumman:

Focuses on developing precision weapons and ammunition for defense applications while innovating in missile and ammunition systems.Rheinmetall AG:

A German defense company committed to supplying integrated ammunition solutions in military platforms.Olin Corporation:

Specializes in small caliber ammunition for civilian and law enforcement markets and is a prominent player in the sporting sector.We're grateful to work with incredible clients.

FAQs

What is the market size of ammunition?

The global ammunition market is projected to reach $20 billion by 2033, growing at a CAGR of 5.8%. This growth is attributed to increased military spending and rising global insecurity, impacting overall demand.

What are the key market players or companies in the ammunition industry?

Key players in the ammunition market include major defense contractors and manufacturers, such as Lockheed Martin, Northrop Grumman, and General Dynamics. These companies dominate through innovation, capacity, and extensive supply chains.

What are the primary factors driving the growth in the ammunition industry?

Growth in the ammunition industry is predominantly driven by factors like rising defense budgets, ongoing regional conflicts, and an increasing focus on homeland security, prompting governments to enhance their military capabilities.

Which region is the fastest Growing in the ammunition market?

North America is the fastest-growing region in the ammunition market, expected to expand from $7.32 billion in 2023 to $13.04 billion by 2033. This growth is fueled by high military budgets and significant law enforcement needs.

Does ConsaInsights provide customized market report data for the ammunition industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the ammunition industry. This includes detailed analysis on market size, trends, and forecasts across various segments.

What deliverables can I expect from this ammunition market research project?

Expect a comprehensive report detailing market size, segment analysis, regional insights, competitive landscape, and future growth projections, all designed to inform strategic decision-making in the ammunition sector.

What are the market trends of ammunition?

Current market trends include an increase in military modernization programs, growing civil defense initiatives, and the shift towards advanced ammunition technologies, which enhance effectiveness and reduce logistical footprints.