Amorphous Polyethylene Terephthalate Market Report

Published Date: 02 February 2026 | Report Code: amorphous-polyethylene-terephthalate

Amorphous Polyethylene Terephthalate Market Size, Share, Industry Trends and Forecast to 2033

This market report provides comprehensive insights into the Amorphous Polyethylene Terephthalate industry, including market size, growth potential, segmentation, and regional performance. Forecasting from 2023 to 2033, it also highlights key players and emerging trends shaping the market's future.

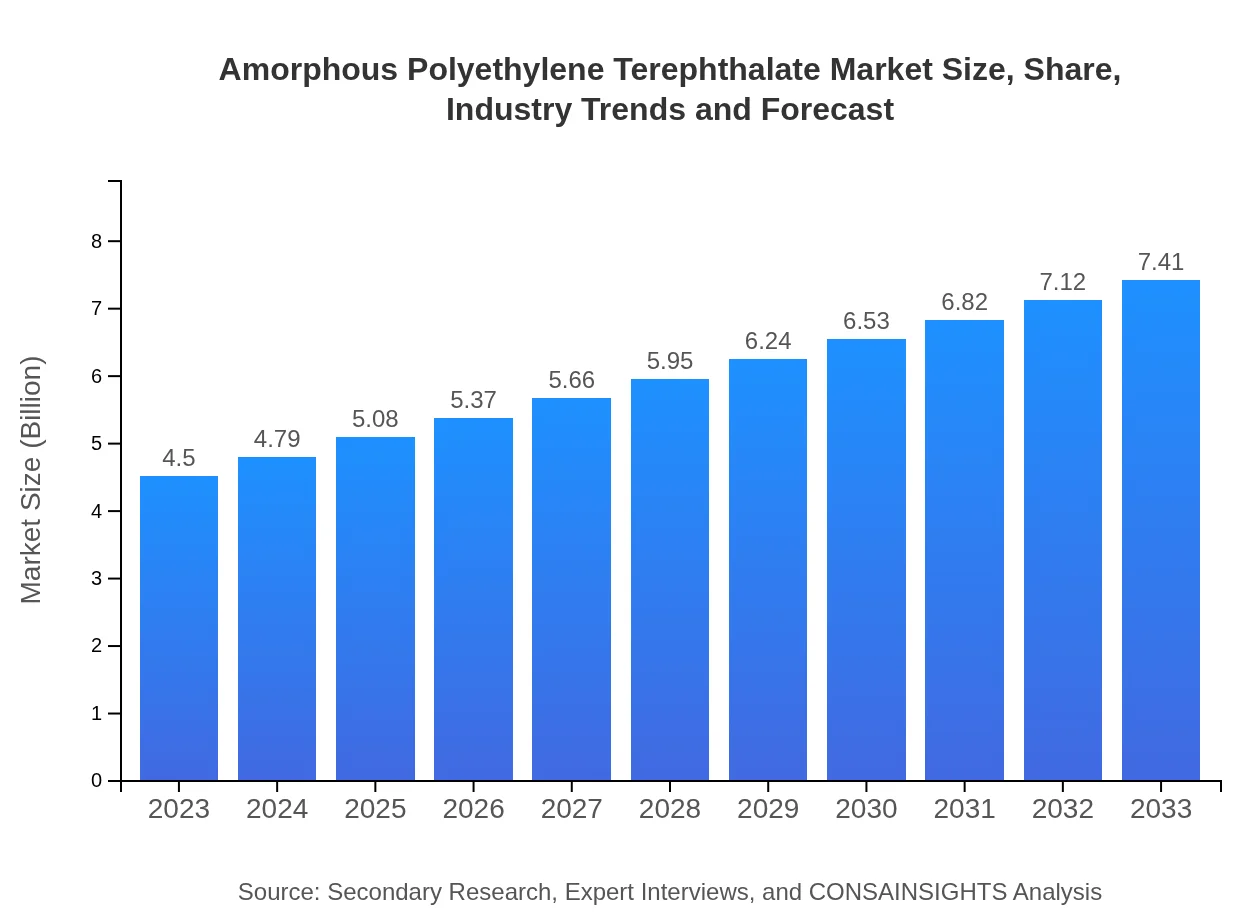

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $7.41 Billion |

| Top Companies | Indorama Ventures Public Company Limited, M&G Chemicals, BASF SE |

| Last Modified Date | 02 February 2026 |

Amorphous Polyethylene Terephthalate Market Overview

Customize Amorphous Polyethylene Terephthalate Market Report market research report

- ✔ Get in-depth analysis of Amorphous Polyethylene Terephthalate market size, growth, and forecasts.

- ✔ Understand Amorphous Polyethylene Terephthalate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Amorphous Polyethylene Terephthalate

What is the Market Size & CAGR of Amorphous Polyethylene Terephthalate market in 2023?

Amorphous Polyethylene Terephthalate Industry Analysis

Amorphous Polyethylene Terephthalate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Amorphous Polyethylene Terephthalate Market Analysis Report by Region

Europe Amorphous Polyethylene Terephthalate Market Report:

Europe is anticipated to increase its market from $1.42 billion in 2023 to $2.34 billion by 2033. The region's focus on recycling and sustainable packaging solutions is supporting growth in this market segment.Asia Pacific Amorphous Polyethylene Terephthalate Market Report:

In the Asia Pacific region, the APET market is projected to grow significantly from $0.85 billion in 2023 to $1.40 billion by 2033, driven by increasing urbanization, disposable incomes, and a burgeoning packaging sector.North America Amorphous Polyethylene Terephthalate Market Report:

North America leads in the APET market, with values increasing from $1.66 billion in 2023 to $2.73 billion in 2033, thanks to strict regulations on packaging materials and a strong emphasis on sustainability.South America Amorphous Polyethylene Terephthalate Market Report:

The South American market is expected to grow from $0.32 billion in 2023 to $0.53 billion by 2033, with growing demand for packaged food and beverages aiding market expansion.Middle East & Africa Amorphous Polyethylene Terephthalate Market Report:

The Middle East and Africa market is projected to grow from $0.25 billion in 2023 to $0.41 billion by 2033, spurred by the increasing uptake of modern retailing and rising consumer demand for convenience products.Tell us your focus area and get a customized research report.

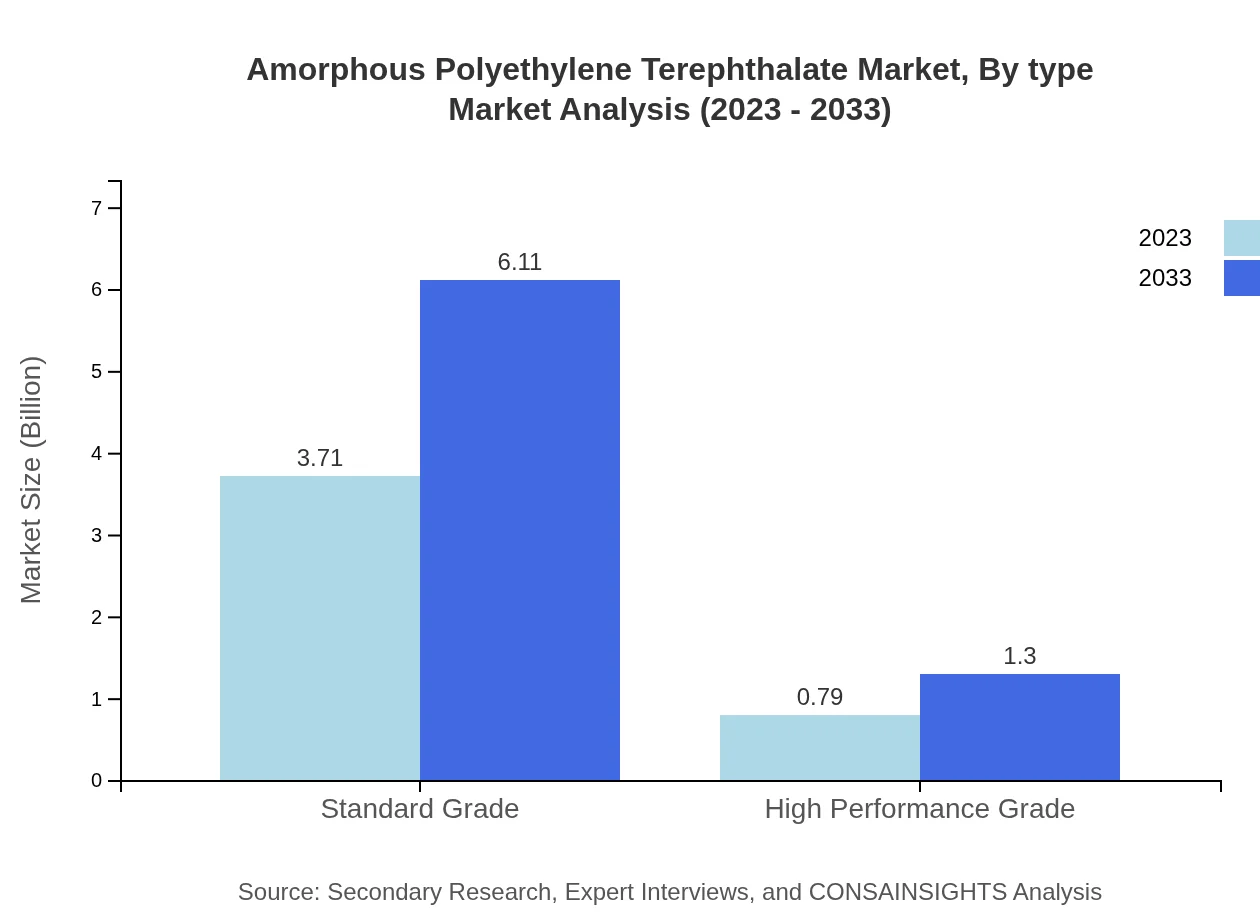

Amorphous Polyethylene Terephthalate Market Analysis By Type

The APET market is segmented into Standard Grade and High Performance Grade. The Standard Grade dominates the market, sized at approximately $3.71 billion in 2023, growing to $6.11 billion by 2033. It accounts for about 82.44% of the overall market share. High Performance Grade, though smaller at $0.79 billion in 2023, is expected to reach $1.30 billion by 2033, representing 17.56% market share, driven by specialized applications requiring superior properties.

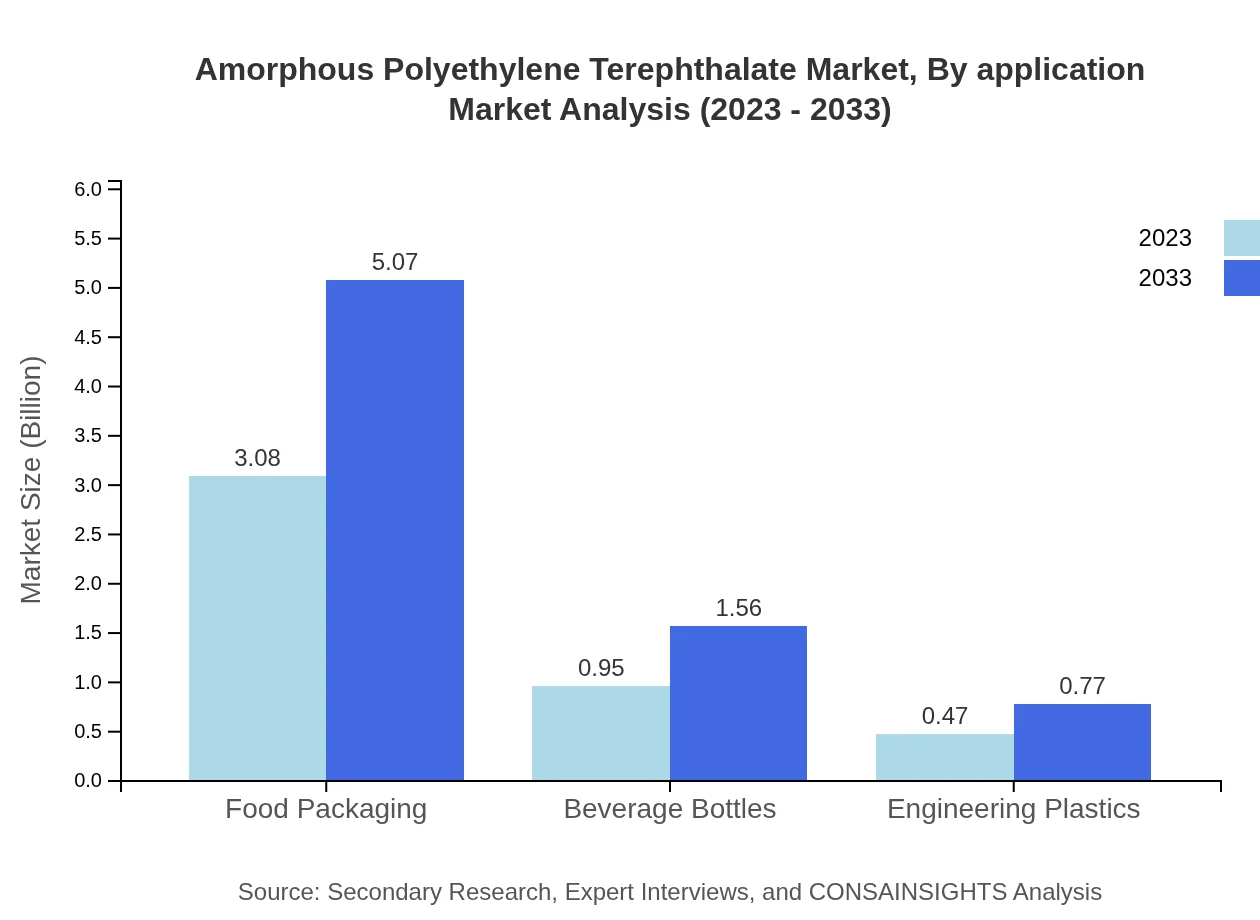

Amorphous Polyethylene Terephthalate Market Analysis By Application

The application segment highlights the diverse use of APET across industries. The packaging sector, including food packaging and beverage bottles, is particularly noteworthy, commanding a market size of $3.08 billion in 2023 and expected to grow to $5.07 billion by 2033, maintaining a market share of 68.52%. The automotive and electronics sectors also present growth opportunities with sizes of $0.95 billion and $0.47 billion respectively in 2023.

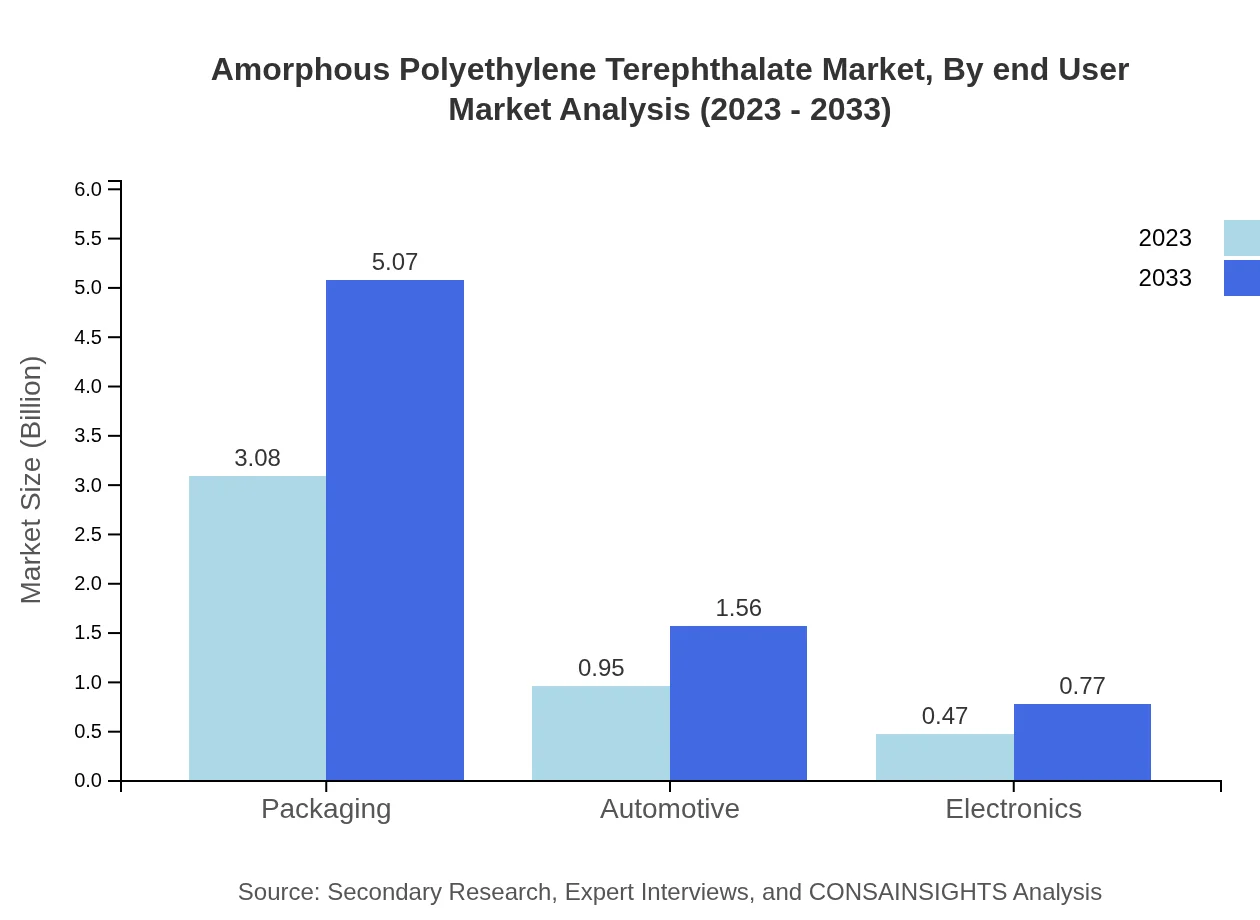

Amorphous Polyethylene Terephthalate Market Analysis By End User

End-user segmentation reveals that the packaging industry remains the largest consumer of APET, influenced by increasing demand for sustainable solutions. Automotive and electronics are also notable sectors, with sizes projected at $0.95 billion and $0.47 billion for 2023.

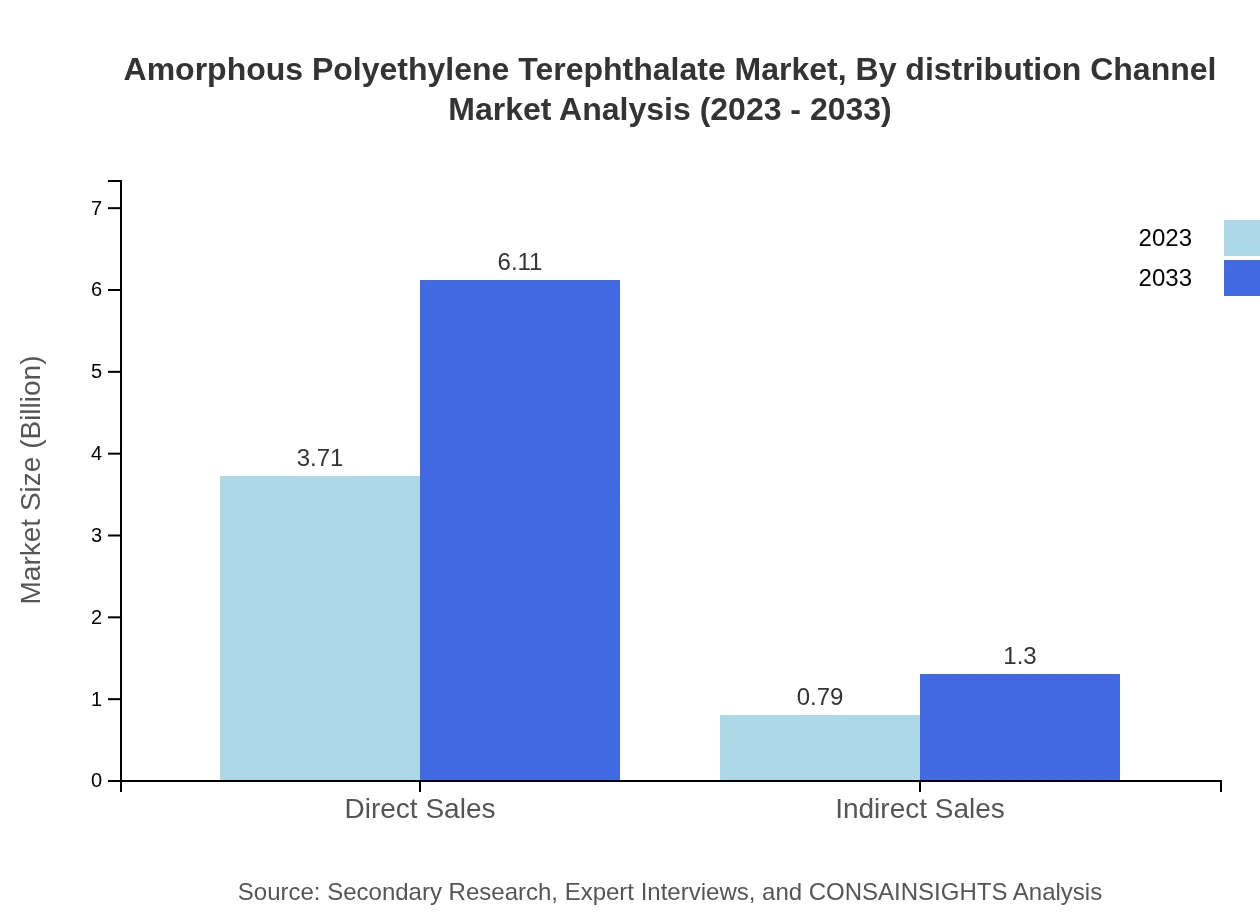

Amorphous Polyethylene Terephthalate Market Analysis By Distribution Channel

The distribution channel for APET encompasses both direct and indirect sales. Direct sales dominate, holding a market size of $3.71 billion in 2023 with a market share of 82.44%, whereas indirect sales represent $0.79 billion and 17.56% market share, showing significant growth opportunities in reaching wider markets.

Amorphous Polyethylene Terephthalate Market Analysis By Region

Global Amorphous Polyethylene Terephthalate Market, By Region Market Analysis (2023 - 2033)

Regional analysis outlines distinct growth patterns across different geographic areas. North America leads the APET market, followed closely by Europe and Asia Pacific, each presenting unique market dynamics and growth prospects.

Amorphous Polyethylene Terephthalate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Amorphous Polyethylene Terephthalate Industry

Indorama Ventures Public Company Limited:

A leading global producer of polyethylene terephthalate, Indorama is known for its sustainable practices and innovations across APET applications.M&G Chemicals:

M&G Chemicals is recognized for its extensive production of PET and APET products, focusing on creating sustainable and innovative packaging solutions.BASF SE:

BASF is a key player in the chemical industry, providing advanced solutions with APET technology tailored for various applications including automotive and packaging.We're grateful to work with incredible clients.

FAQs

What is the market size of amorphous polyethylene terephthalate?

The market size of amorphous polyethylene terephthalate is projected to reach approximately $4.5 billion by 2033, growing at a CAGR of 5% from 2023.

What are the key market players or companies in this amorphous polyethylene terephthalate industry?

Key players in the amorphous polyethylene terephthalate market include several global corporations, major chemical manufacturers, and specialized polymer suppliers that contribute to the industry's dynamic competitive landscape.

What are the primary factors driving the growth in the amorphous polyethylene terephthalate industry?

Growth drivers for the amorphous polyethylene terephthalate industry include rising demand in packaging applications, technological advancements, and its favorable properties for automotive and electronics industries, enhancing overall market expansion.

Which region is the fastest Growing in the amorphous polyethylene terephthalate market?

The Asia Pacific region is projected to be the fastest-growing, with market size increasing from $0.85 billion in 2023 to $1.40 billion by 2033, reflecting significant demand for PET applications.

Does ConsaInsights provide customized market report data for the amorphous polyethylene terephthalate industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the amorphous polyethylene terephthalate industry, providing insights based on client needs.

What deliverables can I expect from this amorphous polyethylene terephthalate market research project?

Deliverables include comprehensive market analysis, segments data, regional insights, trends forecasting, and actionable recommendations tailored to each client's strategic objectives.

What are the market trends of amorphous polyethylene terephthalate?

Current trends include sustainability initiatives within the industry, increasing utilization in food packaging, and innovations in high-performance grades of amorphous polyethylene terephthalate to meet diverse application demands.